The disruption in global shipping from Houthi attacks in the Strait of Bab al-Mandeb may have a larger than expected impact, if continued. In the United States, the “less dovish” tone of Federal Open Market Committee members led rates wider, but US stocks hit record levels, buoyed by the mega-caps. China kept its policy rates unchanged despite soft economic data and depressed sentiment in its equity market. Indonesia also kept its policy rates unchanged. Malaysian GDP growth was weaker than expected. Taiwan Semiconductor Manufacturing Company reported solid results, but shared a sombre outlook message. The Argentine government intensified negotiations with Congress to approve its sweeping reforms. Brazilian economic data upside surprises continued. Colombian data was mixed. The Egyptian currency plunged in the parallel market as Suez Canal volumes halved and Moody’s moved its rating outlook to negative. Ghana reached an agreement with official creditors and the International Monetary Fund approved the sixth review of Kenya’s programmes. Türkiye’s inflation expectations declined further as its central bank moved the real policy rate to positive for the first time since 2021.

Global Macro

Houthi attacks in the Strait of Bab al-Mandeb are having a big impact on global shipping. Volumes of cargo moving through the Suez Canal are down to 2.65m metric tons (from 5.5m) on a seven-day moving average basis. This may already be impacting economic activity in Asia – the region most impacted by the logistics disruptions. This morning, South Korea reported lower than expected exports in the first 20 days of January. Most macro analysts and policymakers are saying the impact of the geopolitical situation so far is marginal. Nevertheless, the longer the situation persists, the larger the risks of weak links in fragile supply chains breaking, which could lead to a sharper than expected increase in inflation.

In other geopolitical news, there was increased momentum in Davos on the proposal to expropriate Russian foreign exchange (FX) reserves to deploy it in aiding Ukraine. The US Senate will hold a hearing this Wednesday on the matter. The intention of expropriating Russian reserves increased after the Biden administration struggled to secure congressional approval for further aid to Ukraine. However, most Russian frozen reserves are within the European Union. Last year the central security depositories (i.e. Euroclear and others) was asked to earmark the “windfall” of Russian reserves (interest) to Ukraine. This is fundamentally different, from a contractual point of view according to BNE.1

In other global macro news, stronger economic data alongside more hawkish statements from Fed Board Members Christopher Waller, Atlanta’s Raphael Bostic, and Chicago’s Austan Goolsbee, led interest rates higher with two-year US Treasuries (USTs) up 26 basis points (bps) to 4.4% and ten-year USTs up 24bps to 4.18%. Early last week, US stocks were rattled by higher interest rates. However, stocks decoupled later in the week with the ‘Magnificent Seven’ rising 2.5% despite the equal-weighted S&P500 down 0.2%. The expectation that fiscal policy will remain friendly in an election year, plus the “good AI vibes” from the Davos World Economic Forum may keep up the momentum for high quality (albeit overvalued) US mega-caps. Last Friday, President Biden signed yet another stop-gap measure to fund the government through to early May.2

In political news, Ron DeSantis dropped out of the race for the Republican nomination after failing to gather enough support. He gave his endorsement to Donald Trump. Although centrist Republicans hope that Nikki Haley can pick up his votes, the reality is that DeSantis’ proposals and rhetoric were much more like Trump than Haley’s. The polls for the New Hampshire primaries before the DeSantis news showed Trump ahead with 49.8%, Haley gaining momentum at 36.1%, and a declining DeSantis receiving only 5.8% of vote intentions.

Emerging Markets

EM Asia

China: The People’s Bank of China (PBoC) kept its one and five-year Loan Prime Rates unchanged at 3.45% and 4.20%, respectively, in line with consensus, but with some investors calling for a ‘big cut’. The stock market is in full capitulation mode. Over the last 12 weeks there were USD 8bn of outflows from local stocks via the Hong Kong Connect, the largest outflows since 2016. Economic data continues to surprise to the downside despite the strength of the renewable, electric vehicles and technology industries. The PBoC left the medium-term lending rate unchanged at 2.5%. The market had expected a 10bps cut, however, a weakening yen currently limits the scope of monetary easing in the near term. Real GDP grew 5.2% year-on-year (yoy) in the fourth quarter of 2023, 10bps faster than expectations, from 4.9% in November. Nevertheless, the economy was in deflation, which means that nominal GDP growth was 4.2%, the lowest level since 1976, except for 2020. Industrial production rose 6.8% yoy, from 6.6% in November, while retail sales growth slowed 100bps more than expected, from 10.1% to 7.2% yoy. Lastly, property investment declined by a yoy rate of 9.6% in December and residential property sales declined by 6.0% in yoy terms. The poor economic growth and geopolitical disputes with the US led foreign investment to drop 8% in 2023 to RMB 1.1 trn (USD 153bn), according to the Ministry of Commerce. In other news, the Chinese mainland population declined by 2.1m to 1.41bn at the end of 2023, the second consecutive year of population decline. It is noteworthy that Xi Jinping mentioned China’s economic troubles in his New Year’s Eve speech, saying: “Some enterprises had a tough time. Some people had difficulty finding jobs and meeting basic needs. All these remain at the forefront of my mind”.3

India: The yoy rate of wholesale price index rose by 50bps to 0.7% in December, 50bps below consensus. The trade deficit narrowed to USD 19.8bn, from USD 20.5bn in November as imports fell 4.8% yoy in December, from -4.3% prior, while exports grew 1.0% yoy, from -2.3% in November.

Indonesia: The trade surplus improved by USD 0.9bn to USD 3.3bn as exports fell 5.8% yoy in December after -8.6% in November, but imports declined 3.8% after rising 3.3% in yoy terms. Bank Indonesia (BI) kept rates at 6.0%, in line with expectations. BI Governor Perry Warjiyo stressed it will be “patient” on rate cuts, highlighting that uncertainty over US rate cut expectations was driving some near-term volatility in the IDR.

Malaysia: The yoy rate of real GDP growth increased from 3.3% in Q3 2023 to 3.4% in Q4 2023, below consensus at 4.1%, leaving 2023 calendar-year GDP growth at 3.8% (4.0% est. and 8.7% in 2022). Weak demand from China and a softer construction market were the main causes for the weaker than expected economic performance. In this regard, the trade surplus was virtually unchanged at MYR 11.8bn in December, below consensus at MYR 17.6bn, as the yoy rate of exports declined 10% (-5.0% est. and -6.1% prior) and imports rose 2.9% yoy (+4.2% est. and +1.5% prior).

Philippines: Overseas remittances slowed to USD 2.7bn in November from 3.0bn in October, in line with consensus as the overall balance of payments moved to a USD 0.6bn surplus in December after a 0.2bn deficit in November.

South Korea: The first 20 days of exports were reported at -1.0% yoy (+13% prior); +2.2% yoy on a business days-adjusted basis (+13% prior). Imports -18.2% yoy.

Taiwan: TSMC reported solid results for Q4 2024. Revenues rose 14% in qoq terms and were unchanged in yoy terms, slightly better than consensus. Commenting on the outlook, TSMC expects consumer electronics demand to remain “subdued” in 2024, “weighed down by macroeconomic weakness and geopolitical uncertainties". For TSMC, it will be a “healthy growth year”, driven by strong demand for high-performance 3 and 5-nanometer (i.e., AI-related) chips. TSMC is the world’s main manufacturer of independently-designed semiconductors and is very unlikely to have its leadership challenged for many years after investing heavily in lithography machines which are supplied by a single company – ASML in the Netherlands. In economic news, export orders dropped 16.0% in yoy terms in December, significantly lower than consensus (-1.0%) and the +1.0% yoy in November.

Latin America

Argentina: On Friday, there were media reports that the government was close to securing the support of the three other parties in its incipient Congressional alliance to approve the Omnibus Law. According to Clarín, the government is supposedly pledging to lower duration of the delegation of emergency powers, reverse the 15% increase for export tax for regional economies, and modify the article of the retirement reform. Other newspapers speculate that YPF will be out of the privatisation list and that political reforms in the Omnibus bill will be postponed. The Argentine government seems to be focusing on sweeping deregulation of the economy to undo decades of red tape, betting on the ability to implement further fiscal measures while attracting investments to the country. The good news for the Government is that, after appointing members from other parties – notably Macri’s Juntos por el Cambio – to its cabinet, Milei seems to understand the importance of negotiating its sweeping changes in Congress, increasing the likelihood of its reform programme to be successful. The negotiation over the Omnibus bill may help the Emergency Decree with more than 300 rules which issued on 20 December and valid since the end of 2023 (except the labour chapter, which was successfully challenged in court). The decree may still be voted down if both Congress and the Senate repeal it until the end of the month or if the Supreme Court rules it unconstitutional. In economic news, the trade balance moved to a USD 1.0bn surplus in December after a USD 0.6bn deficit in November, as exports rose by USD 0.4bn to USD 5.3bn and imports declined by 1.2bn to USD 4.3bn.

Brazil: Retail sales rose 2.2% yoy, 20bps more than expected after +0.2% in October, while broad retail sales (including construction materials and vehicles) rose by a yoy rate of 4.3%, up from +2.6% over the same period. The economic activity index rose by 90bps to 2.2% yoy in November, 20bps above consensus.

Chile: A pension reform was approved by the Lower House Labour Committee and is now heading to the Finance Committee. The Lower House is likely to approve the bill, which may face more scrutiny in the Senate.

Colombia: The yoy rate of industrial production declined 3.0% in November after -2.2% yoy in the prior month. Manufacturing production declined 6.4% yoy from -5.9%, both below consensus. The rate of decline of retail sales improved to -3.4% yoy in November from -11.0% in October, significantly better than consensus, and economic activity rose 2.3% from -0.5% yoy over the same period. Inflation expectations one-year ahead dropped to 5.2% in January from 5.70% in December, while two-year inflation expectations dropped by 20bps to 3.6%.

Ecuador: Industrial production fell 6.8% yoy in December (-6% consensus), from -6.6% in November. The trade balance, seasonally adjusted, rose to USD 14.8bn, from USD 11.1bn prior.

Peru: Economic activity rose 0.3% yoy in November, after having declined -0.8% in October.

Central and Eastern Europe

Poland: CPI inflation rose 6.2% yoy in December, from 6.1% prior as core inflation rose 0.3% month-on-month (mom), a 6.9% increase in yoy terms, in line with expectations.

Central Asia, Middle East, and Africa

Egypt: Real GDP growth improved to 5.1% in yoy terms in Q3 2023 after 4.4% yoy in Q2 2023. The EGP depreciated another 10.8% on the parallel market to 66.67, more than 100% above the 31.9 quoted in the official market and at a much wider gap than the 50% gap prior to the 2022 and 2023 devaluations that saw the currency going from 15.8 in Q1 2022 to 30.9 currently. Despite progress in an ambitious privatisation programme and more commitments from its Gulf Cooperation Council (GCC) allies, the currency is under pressure due to higher geopolitical risks from Gaza and the Houthi attacks on Shipping in the Bab al-Mandab Strait which led to a 40% decline in Suez Canal revenues year-to-date. In other news, Moody's affirms Egypt's Caa1 sovereign rating, but changed its outlook to negative despite reiterating its expectation of financial support from the IMF.4> The IMF has a mission in Cairo this week to negotiate a potential USD 3bn deal.

Ghana: The government has reached a deal with the official creditor committee, which should allow the first review of the country’s IMF programme to be approved opening the door for the release of USD 600m. The focus will now be on securing a deal with Eurobond holders.

Kenya: The IMF board Monday approved the sixth review under the country's programmes, allowing the immediate disbursement of USD 685mn tranche.5 According to the IMF Deputy Managing Director Antoinette Saye, "Kenya's growth remained resilient in the face of increasing external and domestic challenges.”

Ivory Coast: President Ouattara said the country plans to issue a Eurobond as early as next week. Ivory Coast has one of the most solid macroeconomic foundations in Africa. Over the last years has been focusing on issuing bonds denominated in Euros to reduce its currency exposure, since it operates within the West Africa Economic and Monetary Union (WAEMU) which has a currency that is pegged to the EUR. Thus, a Dollar denominated debt is likely to be well subscribed.

Saudi Arabia: CPI inflation yoy slowed to 1.5%, from 1.7% in December.

South Africa: Retail sales rose 0.4% mom in November, less than the 1.1% rise expected from -1.4% mom in October as the yoy rate improved to -0.9% from -2.3% over the period. Mining production increased by 6.8% yoy in November from 3.6% in October led by platinum.

Türkiye: Inflation expectations for the next 12-months declined to 39.1% in January from 41.2% in December and 45.3% in October. The Central Bank is likely to announce its final rate hike next week (consensus at +250bps to 45.0%), thus consolidating the ex-ante real interest rate in positive level for the first time since 2021, when Naci Ağbal was removed from the Central Bank.

Developed Markets

United States: Initial jobless claims declined to 187k in 13 Jan from 203k prior and 205k consensus and continuing claims declined to 1,806k in 6 Jan from 1,832 prior and 1,840k consensus. The University of Michigan sentiment survey improved with expectations up to 75.9 in January, from 56.8 in November and current conditions up 10pts to 83.3 from 68.3 over the same period, while inflation expectations dropped below 3.0% both for 1-year and 5-10 years. Retail sales rose 0.6% mom in December after 0.3% in November and 0.4% consensus as the control group (that guides GDP) rose to 0.8% mom from 0.5% prior and 0.2% consensus. Industrial production rose 0.1% mom in December, slightly better than consensus. On the other hand, the Empire Manufacturing (New York State) survey fell 29.2 points in January, more than expected, to -43.7. New orders fell to their weakest level since April 2020. The ISM manufacturing index, a broader gauge of nationwide manufacturing, has been in contraction for 14 months. Existing home sales declined by 0.04m to 3.78m in December. According to Bloomberg, “For all 2023, sales slipped back to the lowest level since 1995… when there were 74m fewer people in the country and the median home price was about USD 114k, less than a third of what it is now”. According to Bloomberg, a lack of inventory is keeping prices elevated as the median selling price rose to USD 383k in December after hitting a record of USD390k in 2023.6

Eurozone: European stocks and bonds fell after ECB president Christine Lagarde signalled that interest rates would be cut in summer, rather than spring. "We have to stay restrictive for as long as necessary" she said, to negate the risk that "we go too fast (on rate cuts) and have to come back and do more (rate hikes)." The Eurozone CPI inflation rose by 50bps to 2.9% in December, in line with expectations, while core inflation was unchanged at 3.4%. The ECB Inflation expectations for 1 and 3-years dropped by 80bps to 3.2% and 30bps to 2.2% respectively. The ZEW Survey of finance professions was virtually unchanged at 22.7. In other news, the trade surplus rose to EUR 14.8bn in November from EUR 11.1bn in October in seasonally adjusted terms.

Japan: PPI in December was flat yoy, from +0.3% in December. In mom terms, PPI rose 0.3%, the same as in November, 30bp more than consensus estimates.

United Kingdom: House prices rose 1.3% mom, following a 1.9% decline in December. Jobless Claims rose to 11.7k, from 0.6k the month before. CPI inflation rose 4.0% yoy, 20bp faster than expected, as prices rose 0.4% mom, from -0.2% in November. CPI core inflation rose 5.1% yoy, 20bp faster than expected, while RPI rose 5.2% yoy, a 0.5% increase mom following a 10bp retail price decline in November.

1. See – https://www.intellinews.com/bruegel-the-european-union-should-do-better-than-confiscate-russia-s-reserve-money-306134/?source=ukraine

2. See – https://www.reuters.com/world/us/us-congress-scrambles-pass-stopgap-bill-avert-government-shutdown-2024-01-18/

3. See – https://www.mfa.gov.cn/eng/zxxx_662805/202312/t20231231_11215608.html

4. See – https://www.reuters.com/markets/commodities/egypts-suez-canal-revenues-down-40-due-houthi-attacks-2024-01-11/

5. See – https://www.theeastafrican.co.ke/tea/business/imf-approves-685m-new-funding-to-kenya-4495622

6. See – https://blinks.bloomberg.com/news/stories/S7IKCZT1UM0W

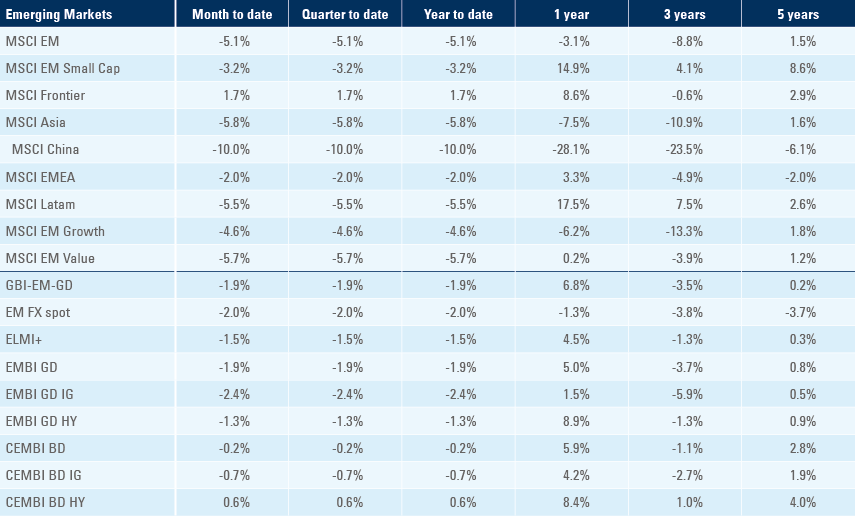

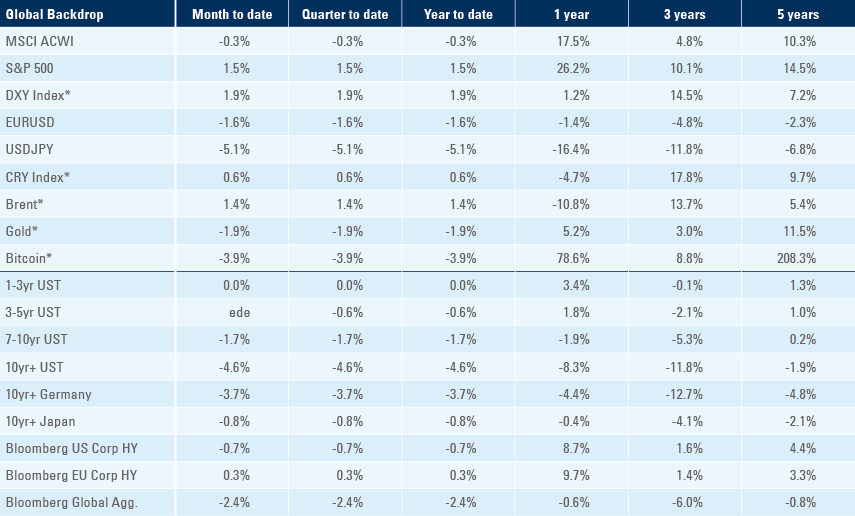

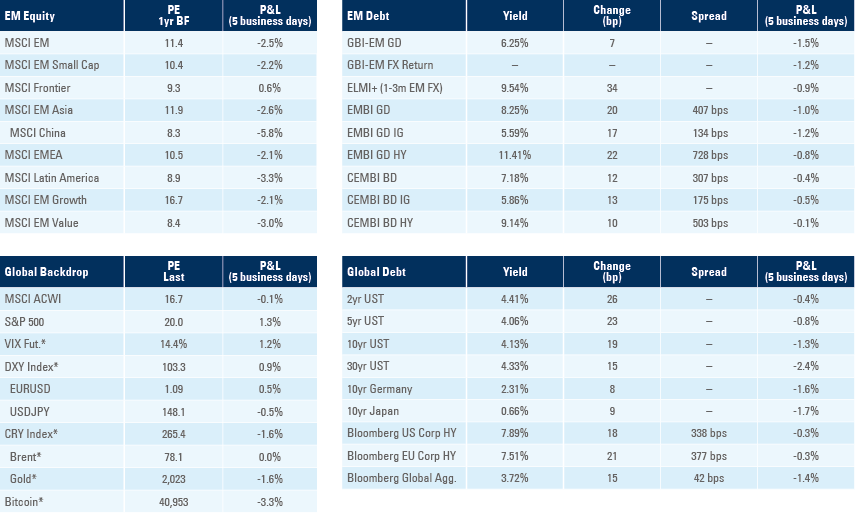

Benchmark performance