Large divergence in favour of EM on PMI surveys as Pelosi’s visit to Taiwan elevates tensions with China

Visit to Taiwan by US Speaker of the House Pelosi triggers saber-rattling by China. Vienna negotiations over Iran nuclear deal resume. Energy concerns renewed in Europe as France reduces nuclear production and Norway threatens cutback in electricity distribution. Grain shipments from Ukraine finally resume. Global manufacturing PMIs decline but EM supplier delivery times back to normal levels. Zambia debt restructuring one step closer to completion.

Geopolitics

Speaker of the House of Representatives Nancy Pelosi led a US Congressional delegation to Taiwan with a message of support for the democratic island. The Chinese population demanded a response from its government as Beijing interpreted the visit as a violation of sovereignty and retaliated with powerful military exercises around the island, including firing missiles from mainland China over Taiwan, landing in Japanese territorial waters. Chinese jets and warships circled the island imposing a de-facto blockade in the world’s busiest sea lane from 4-7 August.

The military exercises only took place after Pelosi left the island and the military exercise areas were flagged in advance to avoid any accidents. A phone call between Presidents Joe Biden and Xi Jinping and the agreement to meet in Bali in November allowed for a measured price action despite the escalation in this key geopolitical fault line. Importantly, however, China entered Taiwanese territorial waters with warships several times while 66 airplanes entered Taiwan’s air defence zone on Saturday. If China becomes more comfortable crossing the line with military equipment, the odds of an accident and the readiness to a conflict from both parties will increase, which traditionally has been the catalyst for a conflict. Japan and other Asian democracies condemned the exercises.

After Pelosi’s visit, the US faces the uncomfortable choice of either accelerating support for Taiwan's military, which would increase the likelihood of a military response from Beijing, or avoiding support for Taiwan's mobilisation, thus leaving the island exposed to Beijing attack. In our view, Beijing would prefer not to invade Taiwan in the short-term, but a mobilization in Taiwan with the support of the US could precipitate a different answer from China. The White House is lobbying Democratic senators to halt a bill that would alter US policy toward Taiwan. If approved, the bill would include designating the island nation as a major non-NATO ally, according to sources interviewed by Bloomberg.

In other news, EU and US diplomats resumed talks in Vienna for a nuclear deal with Iran after months of deadlock. The deal is more important than ever as several OPEC+ are currently struggling to increase production. The energy crisis in Europe deteriorated as France was forced to lower nuclear energy production due to elevated water temperatures in its rivers, while Norway threatened to limit electricity exports to western Europe due to low hydro reserves. Furthermore, Germany, Austria and Switzerland are struggling to transport diesel from major refineries due to low water levels in the Rhine River, a vital conduit for deliveries of fuel as two refineries operate well below capacity. The cost of transporting a barge of gasoline from Rotterdam to Germany surged from EUR 33 per metric tonne on 30 June to more than EUR 240 last Friday – a 7-fold increase in 5-weeks.

In Ukraine, a second caravan of ships transporting grain via the Black Sea sailed yesterday. After successfully mediating the grain transportation agreement, Turkish President Recep Tayyip Erdogan is trying to mediate a ceasefire between the countries. Turkey is also deepening trade links with Russia as five Turkish banks have adopted the Russia payment system. Ukraine said the area around the Zaporizhzhia nuclear plant was again under shelling on Saturday, raising the risk of “potentially catastrophic consequences” according to the head of the United Nations atomic agency. Russia has denied involvement.

Global PMIs

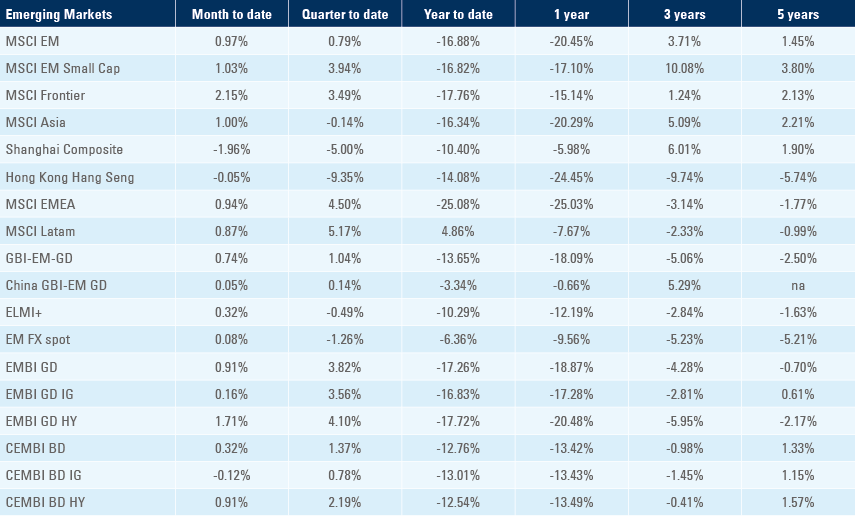

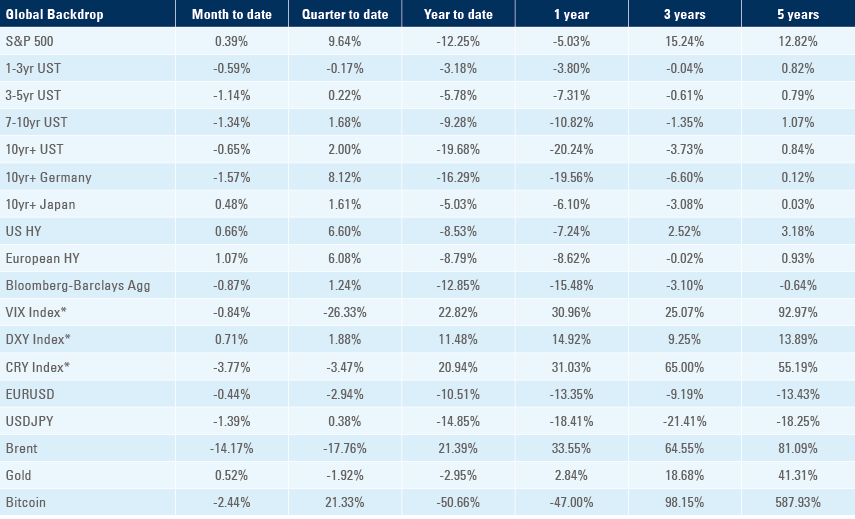

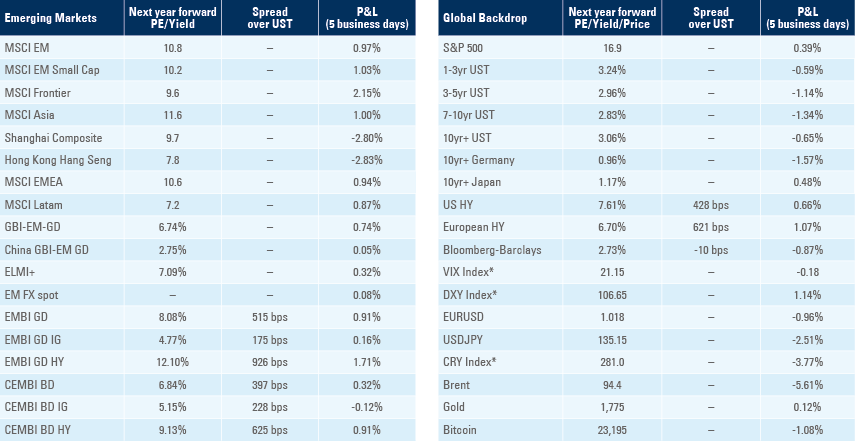

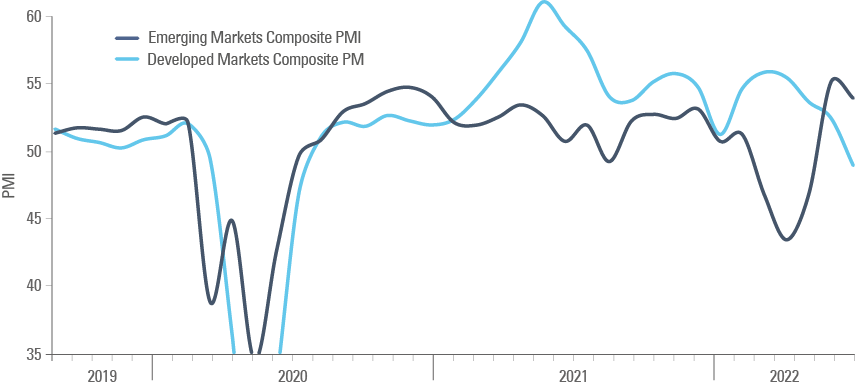

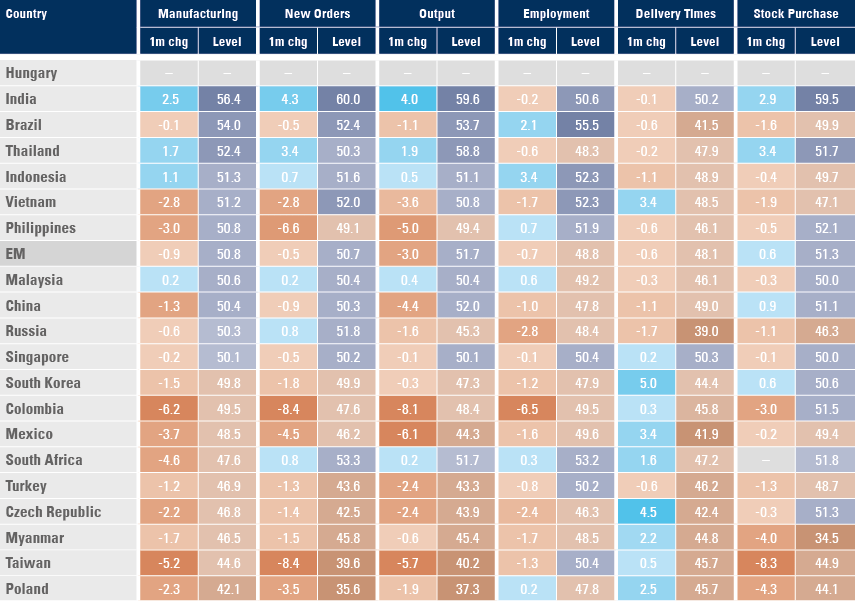

The global manufacturing PMI declined 1.1 points to 51.3 in July with DM PMI down 1.2 to 51.3, while EM PMI declined 0.9 to 50.8. The breakdown of the manufacturing survey (Figure 1) shows DM economies already in a shallow recession as new orders and output slowed 7.5 and 5.4 points over the last three months to 47.0 and 48.4, while EM new orders and output improved 4.7 and 8.5 points to 50.7 and 51.7, respectively. Suppliers’ delivery times improved across the board, reaching levels close to normal in EM, but remaining very low in DM. Employment deteriorated in both EM and DM.

Figure 1: Manufacturing PMI and breakdown in EM and DM

The service PMI saw a larger 2.8 points decline to 50.8 on the global level with DM services dropping 3.9 points to 49.2, while EM service activity was unchanged at robust 55.5. The large divergence (Figure 2) reflects developed world economies slowly moving to a recessionary growth environment, but EM growth remaining at positive levels, thanks to better economic momentum in China after the end of radical lockdowns in Shanghai and Beijing and fewer strict mobility restrictions across other parts of the country, as well as strong economic activity in other large EM countries.

Figure 2: Composite PMI: EM vs DM

EM PMIs

Last month, the manufacturing PMI slowdown was apparent across most economies in EM, but rose in India, Thailand and Indonesia and remained above 50 in more than half the countries surveyed by S&P Global Markit. New orders accelerated in India and Thailand but declined significantly in Vietnam, Philippines, Colombia, Mexico, Taiwan and Poland.

Figure 3: EM manufacturing PMI by country and 1-month change

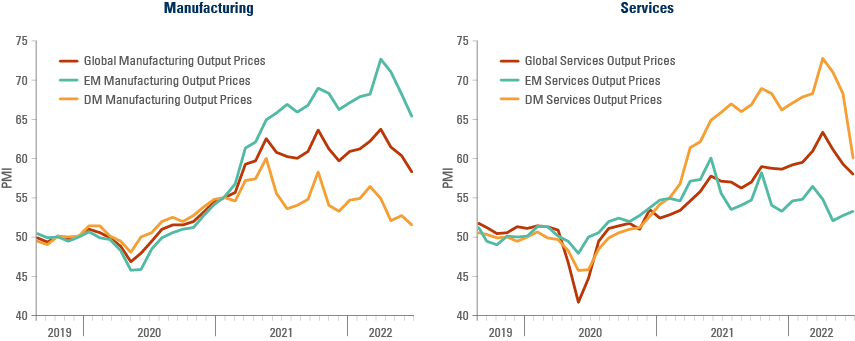

Another highlight of the survey was output prices, which declined globally in both the manufacturing and service sectors as per figures 4 and 5. Output costs deflation has been most notable in EM economies while DM service prices seemed to have dropped precipitously over the last 3 months with the PMI moving from 72.8 to 60.1.

Figures 4 and 5: Manufacturing and services output prices across EM and DM

Emerging markets

Argentina: Finance Minister Sergio Massa announced a package of measures to contain inflation and currency depreciation, including pledging to honour the terms of the agreement with the IMF, keeping a 2.5% of GDP primary deficit in 2022 despite disorderly spending so far by the Fernandez administration. Massa also pledged to freeze the hiring of public employees and to stop any monetary financing from the Central Bank until the end of the year, as well as a tiering of energy subsidies with 4m residences paying full tariffs. The subsidies for the 9m residences requesting it will be capped at 400kw per household with a similar mechanism to be implemented for natural gas and water. Massa claimed to have reached an agreement with the export sector to convert USD 5bn from exports in 2-months by granting incentives to exporters and pledged to work to close the gap between the official and parallel ARS. In other news, vehicle production dropped to 44k in July from 48k in June, while exports slowed to 23k from 32k over the same period.

Brazil: The Brazilian Central Bank hiked its policy rate by 50bps to 13.75%, in line with consensus, and mentioned the possibility of a smaller residual adjustment at the next meeting. The statement highlighted inflationary risks on both sides, with upside surprises possible from external supply shocks and higher spending in social programmes becoming permanent. The central bank may have ended its hiking cycle last week as inflation is already rolling over, led by lower fuel prices, as the producer prices declined 0.4% in July after rising 0.6% in June, taking the yoy rate down by 200bps to 9.1% and Petrobras cut wholesale diesel prices by 3.6% last week. In other economic news, industrial production declined 0.4% mom in June after rising 0.3% in May and vehicle production rose to 219k in July from 204k in June and exports increased by 4k units to 182k over the same period. The trade surplus narrowed to USD 5.4bn in July from USD 8.8bn in June, as exports declined USD 2.6bn to USD 30.0bn and imports increased USD 0.6bn to USD 24.5bn.

China: China's trade surplus reached a new record at USD 101.3bn as exports grew by a yoy rate of 18% in July (unchanged vs. June but 390bps above consensus) while imports expanded by 2.3% yoy, 170bps below consensus. The solid trade numbers on lower imports suggests economic activity remained subdued last month. The current account surplus narrowed to USD 80.2bn in Q2 2022 from USD 88.9bn in Q1 2022 while FX reserves increased to USD 3,104bn in July from USD 3,071bn in June.

India: The Reserve Bank of India (RBI) hiked its policy rate by 50bps to 5.4%, 15bps more than consensus and kept the message that further “withdrawal of accommodation” is coming but steering clear from any precise forward guidance. The RBI kept the fiscal year 2023 GDP and inflation

forecasts unchanged at 7.2% yoy and 6.7% yoy, respectively. Governor Das noted that INR has moved in a “relatively orderly fashion” and “fared much better than many other currencies.”

Indonesia: GDP growth increased 3.7% qoq in Q2 2022 from -1.0% qoq in Q1 2022, lifting the yoy rate by 40bps to 5.4%, 20bps ahead of consensus, buoyed by strong consumption and net exports. The yoy rate of core CPI rose 20bps to 2.9% in July, inside the comfort zone of Bank Indonesia (BI), as CPI inflation rose 50bps to 4.9% in July, in line with consensus. Loan growth accelerated to 10.7% yoy in June (from -3.0% in early 2021) as BI continues to encourage banks to lower lending rates. Foreign exchange reserves declined USD 4.2bn to USD 132.2bn in July.

Zambia: Bilateral creditors pledged to negotiate a restructuring of Zambia’s debt payments, clearing the way for a US$1.4bn IMF programme by September. The IMF reached a staff level agreement with Zambia in December 2021 contingent on financing assurances from creditors. The next step is to get private creditors to commit to comparable debt treatment in the spirit of the IMF’s G20 Common Framework.

Snippets

- Chile: The yoy rate of economic activity declined to 3.7% in June from 6.4% in May, in line with consensus, as nominal wage growth accelerated 40bps to 10.0% yoy over the same period. The vice president of the Central Bank of Chile Pablo Garcia said the institution will probably hike policy rates further to avoid compounding inflationary pressures from strong economic growth and supply disruptions over the last 12 months.

- Colombia: CPI inflation rose 0.8% mom in July from 0.5% in June, lifting the yoy rate 60bps higher to 10.2% as core CPI increased 0.7% mom after 0.5%, leading the yoy rate up 50bps to 7.3% over the same period. Fuel price increases that lowered subsidies as well as apparel were the main contributors to higher prices.

- Czechia: The Czech National Bank kept its policy rate unchanged at 7.0%, disappointing the consensus for a 25bps hike. The budget deficit widened to CZK 192.7bn in July from CZK 183bn in June.

- Ecuador: CPI inflation rose 0.2% mom in July after rising 0.7% mom in June, bringing the yoy rate down 30bps to 3.9% over the same period.

- Egypt: Foreign exchange reserves declined by USD 0.3bn to USD 33.1bn in July, equivalent to 5.14 months of imports, down from 6.70 months in December 2021 and 8.04 months in December 2020, thus approaching critical 3-4 months levels. The PMI rose 1.2 to 46.4 in July.

- Hungary: The trade balance moved to a EUR 95m deficit in May from a EUR 135m surplus in April. The yoy rate of retail sales slowed to 4.5% in June from 10.9% yoy in May while industrial production rose 140bps to 4.8% yoy over the same period

- Malaysia: FX reserves rose USD 2.2bn to USD 109.2bn as of 29-July as Malaysia benefited from better terms of trade.

- Mexico: Remittances from Mexican workers were unchanged at USD 5.2bn, a record monthly level, and FX reserves increased to USD 199.5bn in July from 198.9bn in the previous month. Vehicle production dropped by 25k to 260k while exports declined by 17k to 210k and consumer confidence declined 2.3 points to 41.3 in July, the lowest level since March 2021. The yoy rate of gross fixed investment slowed 80bps to 6.2% in May as private companies keep a cautious stance to investing.

- Peru: Congress barred President Pedro Castillo from travelling to the inauguration of Colombia`s president-elect, saying evidence of wrongdoing is accumulating in the current investigation against Castillo and the president should be in the country to address the question. CPI inflation declined to 0.9% mom in July from 1.2% mom in June in the city of Lima as the yoy rate declined 10bps to 8.7%, 30bps above consensus.

- Philippines: The yoy rate of CPI inflation rose 30bps to 6.4%, also 30bps above consensus and FX reserves declined USD 2.1bn to USD 98.8bn.

- Poland: FX reserves rose by USD 3.4bn to USD 157.6bn in July.

- Romania: The central bank hiked its policy rate by 75bps to 5.5%, 25bps below consensus. Policy rate does not seem to be elevated enough to contain inflationary pressures as PPI inflation surged 3.1% yoy in June from 1.5% in May, taking the yoy rate another 150bps higher to 48.1%. high inflation is taking the toll in the economy as retail sales declined 2.1% mom in June after rising 0.1% in May (revised from 0.9%).

- Saudi Arabia: The S&P Global Markit all-economy PMI slowed 0.7 point to 56.3.

- South Africa: The S&P Global all-economy PMI rose 0.2 to 52.7, better than the ABSA manufacturing PMI survey which declined 4.6 points to 47.6. Vehicle sales rose by a yoy rate of 30.9% in July from 7.6% yoy in June.

- South Korea: The trade deficit widened to USD 4.7bn in July from USD 2.6bn in June as imports rose 21.8% yoy and exports rose by 9.4% yoy, and the current account surplus increased to USD 5.6bn in June from USD 3.9bn in May. The yoy rate of core CPI rose 10bps to 4.5% yoy and CPI rose 30bps to 6.3%, both in line with consensus.

- Taiwan: The yoy rate of CPI inflation declined 20bps to 3.4% and core CPI was unchanged at 2.7% yoy, both broadly in line with consensus, but WPI inflation dropped 320bps to 13.1% yoy, more than 200bps below consensus.

- Thailand: The yoy rate of core CPI inflation rose 50bps to 3.0% in July, 40bps above consensus as CPI inflation was virtually unchanged at 7.6%, 40bs below consensus. The Thai Bhat outperformed as high core inflation is likely to motivate the Bank of Thailand to increase policy rates for the first time since December 2018.

- Turkey: CPI inflation rose 2.4% mom in July (20bps below consensus) from 5.0% mom in June, taking the yoy rate 100bps higher to 79.6%. Many locals feels that inflation is much more elevated as PPI inflation rose another 630bps to a whopping 144.6%.

Global backdrop

United States: A much stronger than expected labour market report led yields on US Treasury notes 18bps wider to 2.83%, after trading at 2.52% on 2 August. The yield curve is now deeply inverted with 2-year UST at 3.22%, 40 basis points above 10-year rates. Yield curve inversions are one of the best leading indicators of a recession. The labour market is proving to be strong as highlighted by the Fed as non-farm payrolls rose to 528k in July from 398k in June (revised from 372k), significantly above consensus of 250k. The unemployment rate declined 10bps to 3.5% as labour force participation dropped 10bps to 62.1% and average hourly earnings was unchanged at 5.2% (30bps above consensus). However, the payroll report is at odds with initial jobless claims, which rose 6k to 260k in the week ending on 30 July and continuing claims rose 50k to 1.42m in the previous week, the highest level since November 2021.

Several Fed speakers, including Mary Daly and Michele Bowman, emphasised the committee bias is to tighten monetary policy further. The Fed is likely to hike policy rates by at least another 50bps, with 75bps possible depending on incoming inflationary data. The recent rebound of US stock market prices also goes in the opposite direction than desired by the Fed, since the committee needs financial conditions to tighten (wealth destruction) to generate lower underlying demand and a softer labour market via layoffs.

Leading indicators were soft with the ISM manufacturing slowing 0.2 points to 53.0 as prices paid collapsed 18.5 points to 60.0 and new orders slowed 1.2 point to 48.9, but employment rose 2.6 to 49.9. The ISM services increased 0.3 point to 47.3. Coincident data were positive as factory orders rose 2.0% mom in June from 1.8% in May, durable goods orders also rose 2.0% mom from 1.9% and capital goods orders were unchanged at 0.7% mom over the same period. Construction spending declined 1.1% mom in June after rising 0.1% mom in May.

In political news, the Inflation Reduction Act passed in the Senate with 51-votes against 50, with Vice President Kamala Harris providing the tie-break vote. The bill’s ability to lower inflation is questionable. The large subsidies provided to renewable energy and electric vehicles will be provided only to companies whose employee base is highly unionised. This will keep shifting the balance of power in wage negotiations to employees. The CBO calculated the original bill will cut federal spending by USD 14.5 bn and raise revenues by USD 87.0bn, reducing government deficits by approximately USD 102bn over 10 years, mostly through a new 15% minimum tax on large U.S. corporations, the revised tax treatment of carried interest, and savings from a pharmaceutical-pricing proposal.

United Kingdom: The Bank of England (BoE) hiked its policy rate by 50bps to 1.75% and warned that inflation was likely to reach 13.0% while the economy was expected to slow towards a recession in 2023. The BoE announced an active reduction of its balance sheet by selling securities while at the same time creating a short-term repo facility (SRF) in which it offers collateralised loans to banks at the same rate it pays on reserve balances. The BoE plan will replace reserve assets to SRF loans, allowing for a faster reduction on the balance sheet with less disruption to banking sector liquidity. In our view, the BoE remains the most realistic central bank, acknowledging the economy is challenged by elevated inflation even as growth declines to a standstill. We posit that a credible assessment of the economy is the first step needed for developed world central banks to regain their credibility, destroyed for misreading both supply and demand sides of the economy since 2021 when there were plenty of signs of rampant non-transitory inflation.

Europe: The unemployment rate was unchanged at 6.6% in June, but retail sales dropped 1.2% mom after rising 0.4% in May and the yoy rate of PPI inflation increased 1.1% mom in June from 0.5% in May, taking the yoy rate down 40bps to 35.8%. The German trade surplus increased to EUR 6.4bn in June from EUR 0.9bn in May (revised from -1.0bn).

Australia: The Reserve Bank of Australia hiked its policy rate by 50bps to 1.35%, in line with consensus. Retail sales rose 1.4% qoq in Q2 2022 from 1.0% in the previous quarter and the trade balance improved to AUD 17.7bn in June from AUD 15.0bn in May, as exports rose 5.0% mom and imports increased only 1.0%.

Canada: The unemployment rate was unchanged at 4.9% despite 31k jobs lost in July after 43k jobs destroyed in June as the participation rate dropped 0.2% to 64.7% and wages declined 20bps to 5.4% (50bps below consensus). Building permits declined 1.5% mom in June after rising 1.6% in May (revised from 2.3%).

Benchmark performance