Kazakhstan protests and looting controlled as President Tokayev consolidated power

Protesters took to the street in Kazakhstan in the first week of the year, but the government has regained control of the situation after accepting support from its neighbours. Emerging Markets (EM) manufacturing PMI improved in December. China keeps its zero tolerance to Covid-19 as Hong Kong went into lockdown. Argentina continued to haggle with the IMF. Brazil trade balance moved back to a surplus in December. Chile’s economic activity surprised to the upside again. Peru and Poland hiked policy rate by 50bps to 3.0% and 2.25% respectively. Turkey’s CPI inflation soared above 30% yoy. In Developed Markets (DM) news, the minutes of the Federal Open Market Committee (FOMC) showed most US policy makers are advocating reducing the Central Bank balance sheet in 2022. The more hawkish FOMC and further signs of a tight labour market in the United States (US) lead investors to anticipate a swifter tightening in monetary conditions, which affected asset prices last week, mostly in markets with inflated valuations such as US stocks and crypto markets.

Emerging markets

Kazakhstan: Protesters took to the street, initially in Almaty and then across the nation after the government increased the price of liquefied petroleum gas from KZT 60 per litre (c. USD 0.14) to KZT 120 in 2 January. Protesters demanded the reversal of the fuel hike as well as a reduction of former President Nazarbaev’s influence in politics.

Nazarbayev stepped down as president in 2020, but kept key roles such as head of the Security Council and was the head of the ruling party until November 2021. President Kassym-Jomart Tokayev took sweeping measures to control the situation, accepting the government resignation, removing Nazarbayev from the Security Council and arrested former intelligence chief Karim Massimov (Nazarbayev’s ally) and reversed most of the fuel price increase. His measures came in too late as protesters had already taken over the airport, set fire to important government buildings and started a process of indiscriminate looting (similar to the protest in South Africa last year). The situation stabilised only after President Tokayev accepted support from the Collective Security Treaty Organisation (CSTO) – Russia’s answer to the North Atlantic Treaty Organisation (NATO) – composed of Russia, Belarus, Kazakhstan, Armenia, Kyrgyzstan, Tajikistan, and Uzbekistan.

The CTSO agreed to send “peacekeeping troops” to support the government after Tokayev claimed foreign agents were amongst the protesters. This morning, Tokayev said the country escaped an attempted coup d’etat as militants from a coordinated single centre planned to attack the capital Nur Sultan (former Astana). Tokayev claimed order was restored but military forces were hunting for “terrorists”.

The situation in Kazakhstan is likely to stabilise. The CTSO intervention (and Belarus President’s public comments) confirms Kazakhstan is an important country for CSTO sphere of influence. However, differently from Belarus, Kazakhstan did not have a big breakdown in relations with western powers prior to the protests. Furthermore, the protests did not come after an illegitimate election (like in Belarus), but on the back of dissatisfaction with higher living costs after the fuel price increase (similar to the Gilles Jaune protests in France). Therefore, NATO will struggle to build a narrative for sanctions if all the CTSO is doing is to control looting. At the same time, Tokayer took the opportunity to consolidate power in his own hands while nodding to Russia (by accepting CTSO intervention) that its regime will remain loyal. His main challenge will be to keep an independent trade policy with China and Europe.

Kazakhstan is an energy powerhouse, one of the main producers of uranium, oil and natural gas as well as a key country responsible for bitcoin mining. Hence, oil prices are high despite the sell-off in global equity markets after the FOMC minutes. There is no risk of spill over to other EM countries (except for Russian assets) as Kazakhstan is a small part of the EM asset class and has a strong balance sheet.

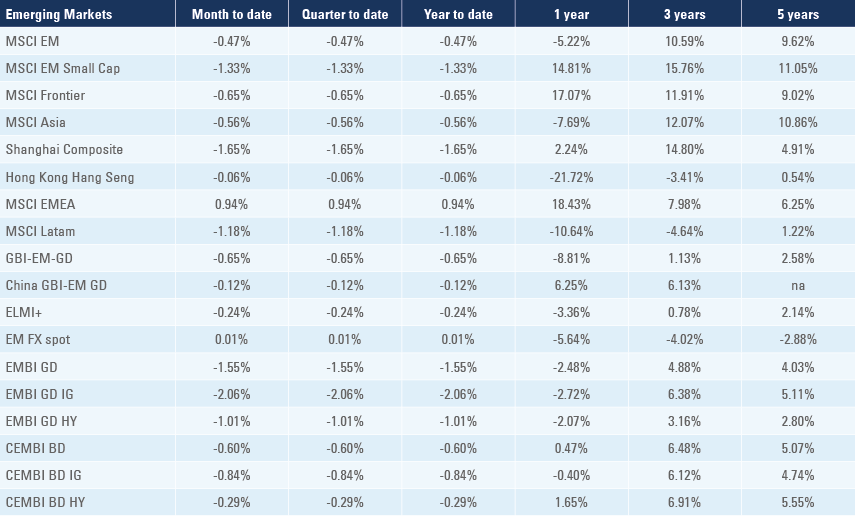

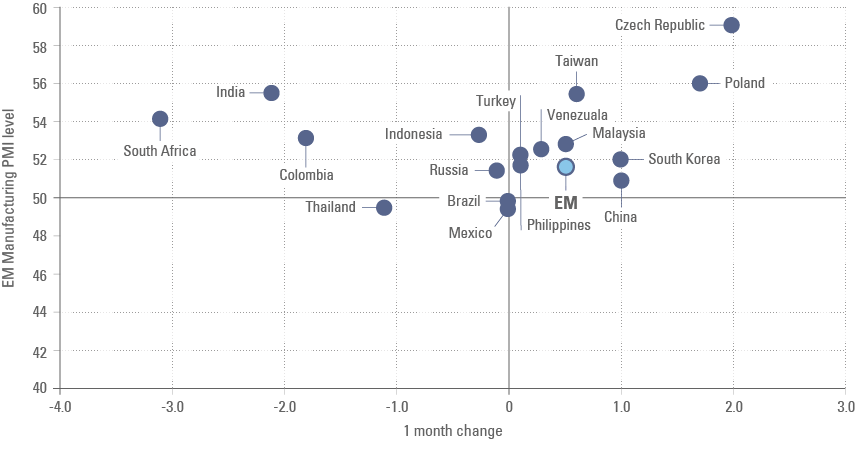

Global Purchasing Manufacturing Index (PMIs): The IHS Markit global manufacturing PMI was unchanged at 54.2 in December with EM manufacturing PMI rising 0.5 to 51.7 and DM down 0.3 to 56.6. In EM countries, the subcomponents with best performance were new orders and current output, rising 0.6 to 51.4 and 1.4 to 53.1 respectively. At the country level, Czech Republic and Poland rose 2.0 and 1.7 points to 59.1 and 56.1 respectively while South Africa, India and Colombia declined 3.1, 2.1 and 1.8 to 54.1, 55.5 and 53.1 respectively, as per Figure 1. Most large EM countries have PMI readings consistent with GDP expansion (above 50) as only Mexico, Brazil and Thailand have manufacturing PMIs between 49 and 50.

Fig 1: EM Manufacturing PMI: Last vs. 1 month change

Delivery times were flat in EM at 46.6 and improved 2.7 points to 28.5 in DM, levels that still suggests plenty of disruption within DM supply chains. The global services PMI declined 1.0 to 54.6 as EM rose 0.3 to 53.4 and DM declined 1.5 to 55.1. Service PMIs rose in China (+1.0 to 53.1) and Russia (+2.4 to 49.5), was stable in Brazil (at 53.6) and declined in India (-2.6 to 55.5).

China: China maintained its zero tolerance Covid-19 policy despite rising cases in both mainland China and Hong Kong, driven by the much more contagious omicron variant. The director of China’s National Center of Infectious Diseases, Zhang Wenhong, warned omicron is more than an “enhanced influenza” as he said only when a strong immunological barrier is built and the fatality rate is very low, will the world be re-opened again. China’s vaccination rate reached 86%, but a study from Sinopharm and Hong Kong University research team indicated a poor protection of current vaccines to the omicron variant, which may push China to rely on its strict policies for longer. In regulatory news, new rules prohibiting algorithm-controlled price discrimination and demanding technology companies to disclose (and allow user control of) the mechanisms of recommendation algorithms were unveiled. The rules are a mere formalisation of a thoughtful policy draft released in August 2021, and includes stopping practices causing internet addiction for minors and outlining requirements on algorithms targeting the elderly. Several companies have already updated their privacy policies in order to comply with recommendations. In real estate news, China Real Estates Information Corporation reported home sales by the one hundred largest developers dropped 3.5% to CNY 11.1trn in 2020 as several developers are struggling to find a balance between maintaining cash for ongoing constructions and serving obligations. The Guandong province is promoting meetings between developers incentivising mergers and acquisitions as well as asset sales across the industry.

Argentina: Finance Minister Martin Guzman said the government disagrees with the IMF in the path of fiscal consolidation, but agrees with the multilateral institution on the need to speed up FX reserves accumulation. Considering how close the government is to the IMF’s fiscal consolidation objective, it seems unnecessary for Minister Guzman to continue haggling over fine margins, like he did with bondholders in 2020, when his focus may be better directed on getting the deal done. Instead of focusing on the big picture and working to take the underlying adjustment Guzman is haggling over details that may make little difference in the long term in an attempt at showing his party’s voter base that it is driving a hard bargain against international finance. Tax revenues rose to ARS 1,180bn in December from ARS 1,035bn in November.

Brazil: The trade balance moved to a USD 4.0bn surplus in December from a USD 1.3bn deficit in the previous month, broadly in line with expectations as exports rose USD 4.1bn to USD 24.4bn and imports declined USD 1.2bn to USD 20.4bn. Industrial production dropped 0.2% in November from -0.6% in October. Vehicle sales rose 34k to 207k in December as exports jumped 14k to 42k in November while vehicle production increased 5k to 211k over the same period.

Chile: The economic activity index declined 0.7% to a yoy rate of 14.3% in November, above consensus. The yoy rate of CPI inflation rose 0.5% to 7.2% in December, 0.2% above consensus. The trade surplus narrowed to USD 0.5bn in December from USD 0.8bn in the previous month. In political news, the Lower House of Congress approved a Universal Pension Bill from President Sebastian Pinera. The bill creates a universal pension of CLP 185k (c. USD 217) per month for individuals over 65 years and is expected to cost USD 3bn (c. 1% of GDP). The funding for the universal pension is still under discussion as the bill moved to the Senate.

Peru: The Central Bank of Peru hiked its policy rate by 50bps to 3.0%, in line with consensus.

Poland: The National Bank of Poland (NBP) hiked its policy rate by 50bps to 2.25%, keeping the same hiking pace as in November despite the 54% increase in gas and 24% hike in electricity prices for 2022. The NBP associated inflationary pressures with higher commodity prices as well as an increase in CO2 emission prices, factors that are beyond domestic monetary policy. The yoy rate of CPI inflation rose 0.8% to 8.6% yoy, the highest level in 22 years.

Turkey: The yoy rate of CPI inflation rose to 36.1% in December from 21.3% yoy in November, almost 10% ahead of consensus. Core CPI inflation, the index the central bank adopts for its target, jumped to 31.9% yoy from 17.6% yoy over the same period, almost 8% above consensus. President Erdogan said he was “sorry” for high inflation and pledged to look into its causes.

Snippets

- Colombia: A poll for presidential elections (disputed in 29 May 2022) conducted by Ivamer showed former Bogota Mayor Gustavo Petro with 42.1% of the intended votes followed by Medellin Mayor Sergio Fajardo with 18.9%. In economic news, CPI inflation rose to 0.7% mom in December from 0.5% in November, bringing the yoy rate up 0.3% to 5.6% in December, above consensus, while core CPI was stable at 3.4% yoy.

- Czech Republic: The trade balance moved to a CZK 5.7bn surplus in November from CZK 16.3bn deficit in October. The yoy rate of industrial output rose to 4.5% in November from -7.4% yoy in October as the yoy rate of real GDP growth rose 0.2% to 3.3% in Q3 2021.

- Hungary: The National Bank of Hungary kept the 1-week repo policy rate unchanged at 4.0% after seven consecutive hikes since 14 November. Industrial production rose 2.9% in November from 0.5% in October and unemployment rate dropped 0.2% to 3.9%.

- India: The Markit Composite PMI dropped 2.8 to 56.4 in December as services PMI dropped 2.6 to 55.5 over the same period.

- Indonesia: The yoy rate of CPI inflation rose 0.1% to 1.9% in December as core CPI rose 0.2% to 1.6% yoy over the same period, both 0.1% ahead of consensus.

- Malaysia: Industrial production doubled to 3.0% in November from 1.7% in October, driving the yoy rate up by 1.8% to 7.3% mostly due to surging mining output (+6.8% mom) and stable manufacturing at high levels (+2.9% mom).

- Mexico: The yoy rate of CPI inflation was unchanged at 7.4% in December, lower than expected as inflation declined sequentially in the second half of the month. Vehicle exports dropped 12k to 228k in December, but domestic vehicle sales rose 14k to 97k as production dropped 36k to 212k over the same period.

- Philippines: The yoy rate of CPI inflation declined 0.6% to 3.6% in December, below consensus as unemployment rate dropped 0.9% to 6.5% in November.

- Romania: The yoy rate of PPI inflation rose to 32.2% in November from 26.8% yoy in October.

- Thailand: The yoy rate of CPI inflation dropped 0.5% to 2.2% in December, 0.3% below consensus as core CPI remained unchanged at 0.3% yoy.

Global backdrop

United States (US): In economic news, non-farm payrolls rose 199k in December from 249k in November (lower than 450k consensus), but the unemployment rate dropped 0.3% to 3.9% (0.2% lower than consensus) and the yoy rate of average hourly earnings declined only 0.4% to 4.7% (higher than consensus). The strong drop in unemployment rate and elevated wage inflation corroborates the labour market tightness from other reports and suggests the Fed will be removing excessive liquidity from the system faster than expected. In fact, the minutes of the FOMC showed several participants are willing to start reducing the size of the balance sheet in 2022. US Treasury bonds rose sharply on the news with 2-year rates up 0.13% to 0.86%, 5yr up 0.24% to 1.50%, 10-yr higher by 0.25% to 1.76% and 30-yr +0.21% to 2.12% on the 7 January. These prices are consistent with 3.5 hikes of 25bps this year and with the first hike in March. However, a faster reduction in the size of the Fed balance sheet is likely to lead to fewer hikes than priced by the market, which should be negative for the US Dollar.

In other economic news, durable goods orders rose to 2.6% mom in November after 0.1% mom in October and factory orders rose to 1.6% mom from 1.2% mom over the same period. The trade deficit widened to USD 80.2bn in November from USD 67.2bn in October. The ISM Manufacturing survey slowed 2.4 points to 58.7 in December as prices paid dropped 14.2 points to 68.2 and new orders declined 1.1 to 60.4, while the ISM services declined 7.1 to 62.0 over the same period.

Europe: Inflation was higher than consensus in December as the yoy rate of CPI inflation rose 0.1% to 5.0% in December, core CPI was unchanged at 2.6% yoy and PPI inflation rose 1.8% to 23.7% yoy in November, 0.5% above consensus as retail sales rose 1.0% mom in November from 0.3% in October.

Economic confidence declined 2.3 to 115.3 in December.

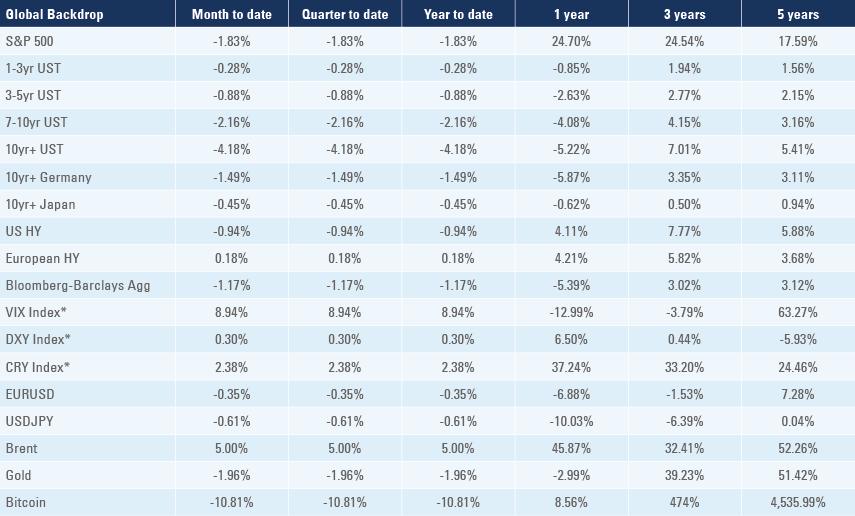

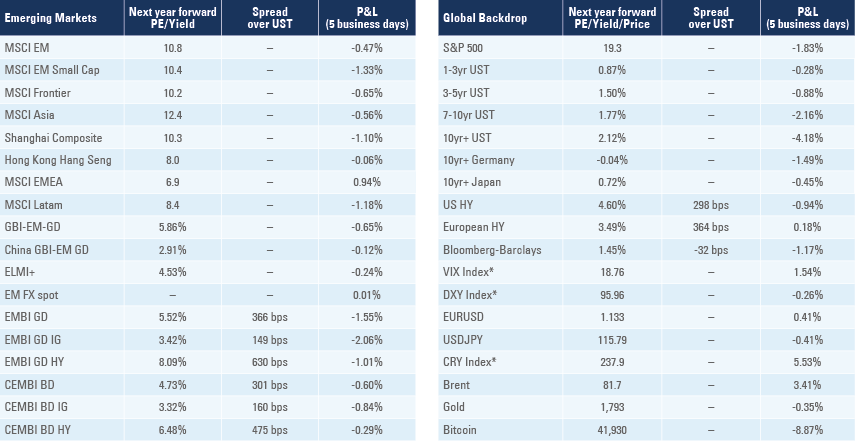

Benchmark performance