Leading indicators in February suggested global manufacturing slowed but services advanced after inflation was higher than expected in January – a confusing read for global macro dynamics. China called for a ceasefire and peace process in Ukraine but announced further public support for Russia. Abu Dhabi announced the listing of Adnoc Gas. Argentina returned to the market to buy back its own bonds last week and is seeking ways of funding new purchases. Mexicans took to the street to protest reforms to the national electoral agency. Nigerian elections took place last week, with results likely to be announced this week. South Africa’s 2023 budget contained a large bailout package to battered national electricity company Eskom, but the company’s CEO resigned earlier than planned after accusing senior politicians of corruption.

Global macro

Purchasing Managers’ Index (PMI) data for France and Germany’s manufacturing sector were down 3.1 points and 1.6 points to 47.9 and 46.5 respectively in the February ‘flash’ preview, while the services sector survey rose 2.0 and 0.3 to 52.8 and 51.3, respectively. US leading indicators showed a similar picture to Europe as US manufacturing PMI rose 0.9 but remained soft at 47.8, while services jumped 3.7 points to 50.5. The PMI readings do a good job of explaining the current global economic situation.

The services sector, which had to cope with lockdowns and labour shortages, continues to outperform as global tourism activity has kept recovering, buoyed by income redistribution effects from government programmes. Manufacturing, on the other hand, is still going through a cyclical slowdown which started in Q1 2021 (with few exceptions). What reading is dominant? The services sector is the largest portion of the global economy, and is more relevant for jobs, but the manufacturing sector has a much better track records at anticipating recessions.

Other leading indicators corroborate the picture of a broad slowdown in the global economy. Bloomberg reported congestion levels declined in Asia Pacific (APAC) ex-China by -5.3%, in Europe by -4.8%, and in North America -1.0% in the week ending 18 February, while congestion levels in China’s largest 15 cities rose by 12.0%. On a four-week moving average basis, APAC ex-China dropped -1.8%, Europe -3.0%, but North America rose +0.9%.

The stronger inflation and activity data in January and February is leading to a risky scenario. After the broadest and most aggressive global hiking cycle since 1980s, Developed Market (DM) central banks have turned hawkish again, despite the feeble manufacturing picture. This appears concerning to us as the monetary policy actions have long and variable lags (Milton Friedman) while the labour market (as a lagging indicator) has a terrible track record at anticipating marked economic downturns and recessions.

On the bigger picture, the evolution of car prices in Europe and the US is stark. New vehicle price increase rose faster than Consumer Price Index (CPI) inflation and used car prices rose again in January and February, despite the strong increase in prices registered over the previous two years. Higher car prices may be a symptom of an inflationary mindset settling in for DM consumers. Once people realise they live in a world with scarcities, then holding cash will lead to lower purchasing power in the future, anticipating consumption decisions and adding to the inflationary pressures. This may explain why auto inventories are running low. Anyone living or investing in Emerging Markets (EM) over past decades will likely be very familiar with the mechanisms of an inflationary mindset.

High inflation and a downturn in manufacturing have central banks caught between a rock and a hard place. They can either turn very hawkish (say Fed Funds Rate at 6.0%) to avoid an inflationary spiral, risk a deeper or protracted recession or pause to evaluate the impact of the hikes and risk inflationary dynamics becoming entrenched.

Structural vs. cyclical

In our view, central banks are already way over their skis in the hiking cycle. The structural inflationary pressures hitting the economy are supply related (energy transition, onshoring of production, supply chain redundancies, and reversal of inequality). Monetary policy is too blunt of an instrument to be politically palatable.

Nevertheless, in cyclical terms, the softness in manufacturing and real estate is still likely to bring disinflation during 2023, notwithstanding the high CPI inflation print in January. Inventories have increased in durable goods (except for autos and trucks) and the monetary aggregate M2 is down 2.5% in nominal terms over the last three quarters, the first decline in nominal terms since 1960 and a similar degree of decline in real terms than Volcker’s adjustment. If this view is right, asset allocators should take advantage of weak bond prices to buy investment grade bonds, particularly in EMs, where yields are elevated and fundamentals have improved significantly more than in DMs.

Would synchronised weakness in real estate and manufacturing lead to much wider credit spreads? Unlikely, in our view. We are not in a 2008 environment. Global financial institutions are unlevered, while the largest companies in the private sector have extended the duration of their liabilities. If that’s true, the mini blow-ups caused by monetary policy tightening will come, but in non-systemic places, such as EM countries with poor balance sheets and dependency on Eurobonds (Sri Lanka, Ghana) and in developed world, pockets of overvalued assets where leverage is key and has been much shorter term (residential real estate in Australia, Scandinavia, or global office real estate).

Low systemic risks mean the risks for a long and enduring recession are lower. This parameter is in line with our highly stylised base-case scenario in our 2023 outlook, where the S&P500 would bottom to around 3,300 by mid-year, but close the year unchanged as markets anticipate central banks moving to ease monetary policy and rush to ‘buy the dip’. We called this a ‘soft landing’ scenario. While this can still play out, the risks of more aggressive monetary policy in H1 2023 leading to a bigger problem ahead are increasing.

Geopolitics

Russian President Vladimir Putin’s state of the nation speech did not contain any big surprises, including the suspension of Russia’s participation in the Start Treaty that agrees on the non-proliferation of nuclear weapons. After visiting Moscow, China’s top diplomat Wang Yi confirmed China is willing to deepen its ties with Russia and won’t be pressure by any third party on its resolve. Wang also laid the groundwork for a meeting between Putin and Xi Jinping “in the coming months” according to the Wall Street Journal.

Last Friday, China released a document calling for a ceasefire and peace talks in Ukraine, largely repeating statements made by Chinese officials previously, positioning China as a strategic power broker for diplomacy and political settlements. The ambiguous support for Russia, including potential military aid, and ceasefire calls suggests China is increasingly wary of a long and protracted war that could leave Russia crippled and open the door for political instability in a key Asian military power that is tactically allied with Beijing.

In other news, the US announced it was increasing troop numbers stationed in Taiwan for training purposes, from 30 currently to 100-200 troops in the coming months.

The Finance Ministers of the G-20 countries met in Bengaluru, India, with most countries condemning Moscow for the invasion of Ukraine. Meanwhile, China and Russia declined to sign the joint statement, a similar outcome to the summit in Bali last November. The International Monetary Fund (IMF) and the World Bank held a meeting with China, India, Saudi Arabia, and the G-7 countries to discuss the debt restructuring of countries with distressed balance of payments and fiscal accounts. However, there were too many disagreements among members according to IMF Managing Director Kristalina Georgieva. Chinese Finance Minister Liu Kun reiterated Beijing's position that the World Bank and other multilateral banks should also participate in debt relief by taking haircuts.

Emerging Markets

Abu Dhabi: Adnoc Gas, a mid-stream gas processing subsidiary providing the link between the upstream business and the marketing and trading arm of Adnoc Group is listing shares in the Abu Dhabi stock exchange. The company plans to raise USD 2.4bn to 2.5bn (upsized from USD 2.0bn due to an oversubscribed book), valuing the company at USD 48bn to 50bn. This valuation would entail an attractive 6.5% dividend yield for incoming shareholders and a stable business with healthy margins that can benefit from higher energy costs.

Argentina: News agency Reuters reported the government is seeking to lower the foreign exchange (FX) reserves target agreed with the IMF due to the country’s continued drought. Argentina is reportedly studying the possibility of using the IMF special drawing rights (SDRs) as collateral for bank loans destined to buy back debt. Last week, the Central Bank of the Republic of Argentina returned to the market to buy back bonds. In political news, Mayor of Buenos Aires Horacio Larreta announced his candidacy for president. Larreta is a competitive candidate at the national level, but has lost some support from the ruling opposition coalition Juntos por el Cambio for being perceived as ‘soft’ with the opposition. He has advocated for a front-loaded fiscal consolidation alongside an ambitious investment programme to reopen the Argentinian economy.1 2 In economic news, the trade balance moved to a USD 500m deficit in January from a USD 1.1bn surplus in December, as exports dropped USD 1.2bn to USD 4.9bn and imports rose USD 0.35m to USD 5.4bn over the same period. Consumer confidence dropped two points to 36.2 in February. In other news, the long drought is leading to significant revisions from agriculture exports, with soybean production estimates down to 33.5m metric tons in the 2023 harvest (the lowest in 14 years), down from 38.0m metric tons in the previous week.

Mexico: Hundreds of thousands took to the streets in Mexico City and other cities on Sunday to protest legal changes that slash the budget for the electoral agency (INE). President Andrés Manuel López Obrador championed the bill, alleging the INE was corrupt and captured by conservatives. CPI inflation came in 5 basis points (bps) better than consensus at 0.3% month-on-month (mom) and 7.8% year-on-year (yoy) in the first half of February, with core CPI down 8bps at 8.4% yoy. The yoy rate of real gross domestic product (GDP) growth rose 10bps to 3.6% in Q4 2022, as full-year 2022 real GDP grew by 3.1%, down from 4.7% in 2021. The current account moved to a USD 4.6bn surplus in Q4 2022 from a USD 5.5bn deficit in Q3 2022.

Nigeria: Presidential elections took place on 25 February. Several states reported glitches in the electronic voting system and at the time of writing, only five states have been called. The former governor of Lagos, Bola Tinubu, from the incumbent All Progressives Congress Party (APC) won three states while Atiku Abubakar from the People’s Democratic Party (PDP) won one state. Interestingly, Peter Obi from the Labour Party won the state of Lagos by a narrow 10k votes, the first defeat for the APC in Lagos since 1999. A presidential candidate needs to win 24 out of 36 states with more than 45% of the valid votes per state to win the election without a run-off. At the current pace of counting the results are unlikely to be published until Wednesday. Presidential elections are usually polarised between the PDP and APC, but the relatively young Peter Obi is trying to break the polarisation with a call for change and renovation. While Nigeria’s debt stock is relatively low compared to the size of its economy, the country’s ability to repay its debt is impaired by mismanagement and corruption. We believe Nigeria needs simple but painful economic reforms, lowering subsidies in fuel prices, allowing the Naira to depreciate and float freely, and increasing tax as a percentage of GDP to avoid having to restructure its debt. After stabilising its monetary and fiscal policies, Nigeria should focus on creating appropriate conditions for the private sector to invest in infrastructure and energy. Oil production has dropped from over 2.6m barrels per day (bpd) in September 2011 to 1.2 m bpd in October 2022.

South Africa: The National Treasury (NT) released its fiscal year budget including a ZAR 254bn in debt relief for Eskom, or approximately two-thirds of the company’s debt burden (the higher end of the range) and covering the company’s debt service for three years. The NT revised its fiscal deficit to 3.9% of GDP in 2023/24, 3.6% in 2024/25 and 3.3% in 2025/26 from 4.5%, implying a primary surplus more than 1.5% of GDP by 2025/26. However, the fiscal deficit would be at least 1% of GDP wider after including the Eskom bailout, which was re-classified as “investment” from “cost”, leading to a better fiscal result in accounting terms. In other news, André de Ruyter resigned from his position as Eskom CEO one month earlier than planned, after saying corruption was entrenched in the Africa National Congress (ANC). De Ruyter expressed concerns around the watering down of governance around the USD 8.5bn granted to Eskom for energy transition at COP26. Eskom became a structural problem for South African growth as the company’s operational problems have forced locals to ration energy since 2019. The amount of energy rationing has also deteriorated since the biggening of the crisis. On the data front, Producer Price Index (PPI) inflation declined 0.6% mom in January as the yoy rate dropped 80bps to 12.7%.

Snippets

- Brazil: CPI inflation rose 0.8% mom in the first half of February and by 5.6% in yoy terms, down from 5.9% yoy in January. The current account deficit declined to USD 8.8bn in January (slightly higher than USD 8.2bn consensus) from USD 11.1bn in December, while foreign direct investments rose to USD 6.9bn, which was USD 0.7bn below consensus but 1.3bn above December. January tax collections came in slightly better than consensus, but declined in real terms.

- China: Mainland China investors bought HKD 8.23bn in Hong Kong shares (H-shares) via the Southbound Connect on Thursday. Southbound Connect inflows accelerated last year before the massive rebound in H-shares. Foreign direct investment rose to RMB 127.7bn in January from RMB 76.6bn in December, the best result for the month of January on record. The People’s Bank of China (PBoC) kept its one-year and five-year loan prime rates unchanged at 3.65% and 4.30%, respectively

- Chile: PPI inflation was unchanged in January (0.0% mom) after a 6.6% mom deflation in December.

- Colombia: Industrial and retail confidence improved to 3.6 (from -1.2) and 29.7 (from 22.6) respectively in January, both around the average of the last ten years for January.

- Hungary: The unemployment rate rose by 10bps to 3.9% in January, 20bps below consensus as average gross wages increased by 130bps to a yoy rate of 18.1% in December, significantly above consensus at 17.0%.

- Malaysia: The trade surplus declined to MYR 18.2bn in January from MYR 28.1bn in December, as the yoy rate of exports growth declined to 1.6% (from 5.9%) and imports fell to 2.3% yoy (from 11.5%). The yoy rate of CPI inflation dropped 10bps to 3.7%, in line with consensus.

- Pakistan: The government raised tax on electricity power to comply with an IMF request, but no IMF programme has been announced so far. At the same time, the China Development Bank’s board approved a USD 700m lending facility for Pakistan, according to Finance Minister Ishaq Dar.

- Peru: The yoy rate of real GDP growth rose 1.7% in Q4 2022 from 2.0% yoy in Q2 2022.

- Philippines: The current account surplus rose to USD 3.1bn in January from USD 0.6bn in December.

- Poland: PPI inflation rose 0.8% mom in January from 0.6% mom in December, but the yoy rate declined by 200bps to 18.5% due to base effects. Retail sales dropped 23.1% mom in real terms (consensus -20.8%) but rose 15.1% in yoy nominal terms (consensus +16.3%) or -0.3% yoy after adjusting for inflation. Construction output rose by a yoy rate of 2.4% (consensus -5.4%).

- South Korea: Exports declined by 2.3% yoy in the first 20 days of February, but average daily exports dropped by 14.9%, following an 8.8% decline in the same period of January. Exports to China were probably lower than usual due to seasonal effects, as the Chinese New Year happened in the last two weeks of January in 2022 but lasted until 5 February in 2023.

- Türkiye: The Central Bank of Türkiye (CBT) cut its policy rate by 50bps to 8.5% (consensus was for a 100bps cut). The CBT also slapped banks with nearly TRY 700m worth of fines for insufficient documentation of overseas money transfers , according to Bloomberg, a move designed to discourage foreign exchange purchases.

Developed Markets

United States: The main data moving rates and equity markets was higher than expected inflation as core personal consumption expenditures (PCE) inflation rose by 10bps to 4.7% in January, significantly higher than the 4.3% consensus. The yoy rate of real GDP growth was revised lower by 20bps to 2.7% in Q4 2022 and core PCE revised higher by 40bps to 4.3% yoy over the same period. Existing home sales dropped 0.7% mom in January to 4.0m houses, 0.1m below consensus and close to the lowest levels in the series achieved in March 2009 (3.9m) and September 2010 (3.8m). Meanwhile, new home sales rose 7.2% mom to 670k houses (down from 990k in September 2020, but significantly better than the 300k lows in the 2010-2011 period). Initial jobless claims was unchanged at 192k (200k consensus) and continuing claims declined by 35k to 1.65m (below 1.70m consensus). The University of Michigan Consumer Sentiment survey improved 0.6 points to 67.0, with current conditions dropping 1.9 points to 70.7 and expectations increasing 2.4 points to 64.7. The one-year inflation expectation declined by 10bps to 4.1% and long term inflation expectations were unchanged at 2.9%.

In monetary policy news, the minutes from the Federal Open Market Committee (FOMC) were as expected with only "a few" participants supporting a 50bps hike (non-voting members Bullard and Mester publicly defended a 50bps March hike). Participants were more concerned about the economy slowing down due to the lags in monetary policy and pushed against rate cuts in H2 2023 due to labour market strength and momentum. In other policy news, a paper by the Cleveland Federal Reserve suggested a deep recession would be necessary to bring PCE inflation to 2.1% projection levels by the end of 2025. The paper suggested that “if 2.8% inflation doesn’t result in an un-anchoring of inflation expectations” the optimal policy would be to allow inflation to remain above 2.0% for a longer period.

Europe: The Eurozone manufacturing PMI declined 0.3 points to 48.8 and the services sector PMI rose 2.2 points to 53.0. European car sales rose 11.3% yoy in December. Despite the large yoy growth, car sales had the third weakest December in ten years, behind only 2012 and 2020. Pent-up demand in the automobile sector, which suffered the most with supply chain disruptions, leads to an encouraging picture for global manufacturing. However, the duration and intensity of the rebound is likely to be challenged by much higher leasing rates and auto prices. CPI inflation dropped 0.2% mom in January, bringing the yoy rate down by 0.6% to 8.6%, but core CPI was unchanged at 5.3%, which was 0.1% above consensus. The IFO survey of economic expectations rose 1.0 point to 91.1, in line with consensus, but the current assessment was unchanged at 93.9 and expectations dropped 1.0 point to 88.5.

Japan: The yoy rate of CPI inflation rose by 30bps to 4.3% in January, as CPI ex-food and energy rose by 20bps to 3.2%, both in line with consensus.

1. See https://buenosairesherald.com/politics/larreta-officially-launches-presidential-bid

2. See https://www.batimes.com.ar/news/argentina/horacio-rodriguez-larreta-there-is-no-justification-political-legal-or-of-any-other-type-for-not-heeding-a-supreme-court-ruling.phtml

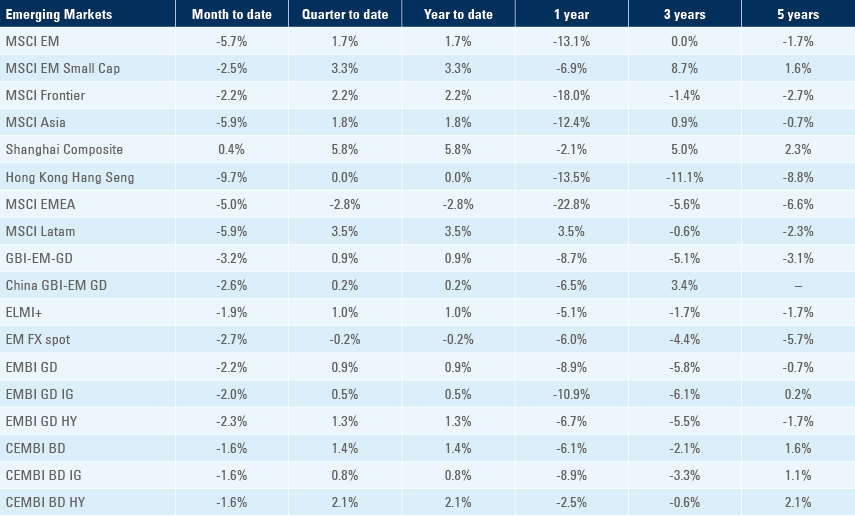

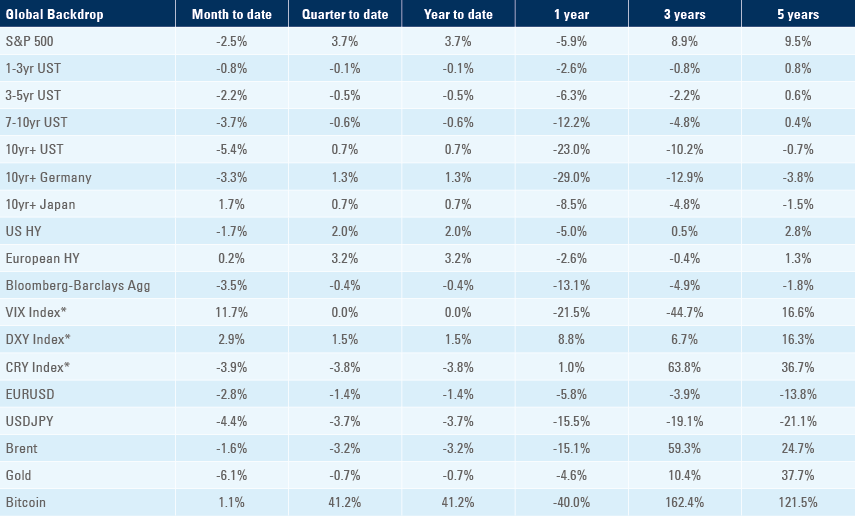

Benchmark performance