- Softer US labour data contrasted with higher inflation, consumption and wider UK budget deficit, which kept yields under pressure last week.

- A surprising poll in Iowa showed Harris leading in a perceived ‘red’ state.

- China expected to unveil large support for local governments in this week’s NPC.

- Indonesia considers an 8-10% increase in minimum wages.

- Argentina’s central bank cut policy rates. Mexico signed a reform to restructure PEMEX.

- Brazil considers measures to consolidate its fiscal accounts.

- Egypt and Türkiye upgraded, Republic of Congo downgraded.

Last week performance and comments

Global Macro

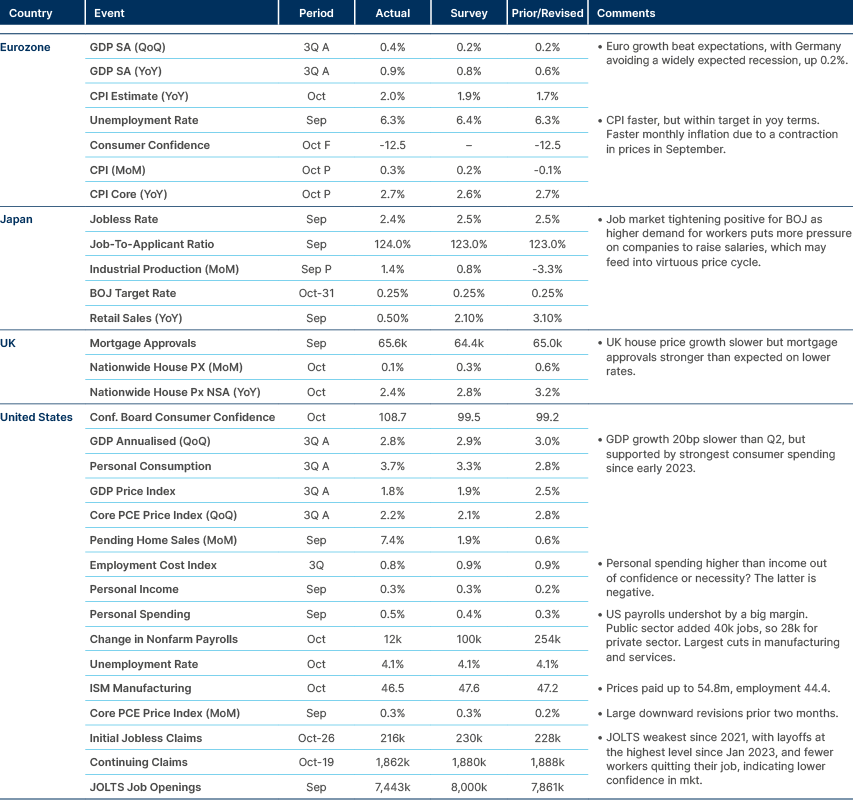

A sequence of surprisingly weak US labour market datapoints reestablished the softening trend which seemed to have subsided in October. Non-farm payrolls were the headline of the week, growing just 12k. This was propped up by public sector hiring, with private payrolls down 28k. Temporary effects from strikes and hurricanes are likely to have contributed to c. 100k job losses. Nevertheless, the Job Openings and Labor Turnover Survey (JOLTS) showed job openings fell to their lowest since early 2021, and layoffs rose to their highest since January 2023, while fewer workers voluntarily quit their jobs. US Treasury (UST) yields moved higher most of last week, led by expectations of Donald Trump winning the election, higher inflation readings and the larger than expected budget deficit in the UK.

World stock markets were down over the week, with the S&P 500 wiping out most of its October gains after earnings reports from five of the ‘Magnificent Seven’ indicated softening growth outlooks, and bigger artificial intelligence (AI) spending plans.

With the US election results days away, a pool by Selzer & Co is now pointing to a Kamala Harris win in Iowa – previously a firm Republican state – with a 3% margin.1 This pollster has in the past shown results that are different than most other pollsters and which proved correct. Statisticians and poll aggregators have been highlighting the risk that all polls had similar adjustment to compensate for under-weighting Trump votes both in 2016 and 2020. There is also the possibility that polls adjustments are purposefully moving towards a 50/50 scenario to avoid being exposed to mistakes. Reports of a stronger-than-expected female turnout can shift the dial towards Harris. This is important as polls in Iowa have shown a strong correlation with crucial swing states like Wisconsin. UST yields and the US dollar are lower this morning, reflecting a tighter race after the Iowa poll.

We remain of the view that the budget deficit will be consolidated, whoever wins. Scott Bessent, rumoured to be Trump’s choice for Treasury Secretary, has laid out his vision for a 3% budget deficit by 2028. A split Congress would make it more difficult for Trump or Harris to pass more fiscal expansion. This weekend, Robert Lighthizer wrote an editorial piece for the FT highlighting his vision on how to reverse the large trade deficits. On top of tariffs, Lighthizer mentions administrative measures on imports and a possible inflow tax on capital investments in the US. The latter policy would most likely have a negative impact on the Dollar.2

Geopolitics

Donald Trump said that he would impose additional tariffs on China if they were to “go into” Taiwan. A Wall Street Journal interview published on Friday quoted Trump: “I would say: If you go into Taiwan, I’m sorry to do this, I’m going to tax you, at 150 percent to 200 percent.” When asked if he would use military force against a potential blockade in Taiwan by China, Trump responded that it would not come to that because Chinese President Xi Jinping respected him.

OPEC+ kept the 2.2m reduction in oil production until the end of the year due to softer-than-expected demand. The organisation was aiming to increase oil production by 180k in December.

Emerging Markets

Asia

Benign inflation in Indonesia. Cooling retail sales and exports in Korea.

China

Reuters reported Chinese policymakers are considering announcing additional support measures at the National People’s Congress (NPC) this week; RMB 6trn to address local government debt risks and an additional RMB 4trn in bonds to acquire idle land and reduce property infrastructure, totalling approximately USD 1.4trn. Expectations suggest further fiscal stimulus if Donald Trump wins the US election, due to the potential negative impact of his tariffs on the Chinese economy.

The primary aim of this stimulus is to strengthen balance sheets rather than drive consumption-led gross domestic product (GDP) growth, which would likely require measures like consumption cheques. China’s household spending remains below 40% of GDP, around 20% lower than the world average.

Indonesia

The government will consider trade union demands for an 8-10% minimum wage increase next year, according to Labor Minister Yassierli. He added that if the increase is deemed feasible, the government will work towards its implementation. Trade unions are encouraged by strong economic growth and a recent Constitutional Court ruling supporting some of their demands for amendments to the job creation law.

In other news, prosecutors arrested Thomas Lembong, a former trade minister from 2015/16 and a high-profile opposition figure to President Prabowo. The arrest was based on practices when Lembong was a minister, but the timing suggests a politically-driven decision, setting bad optics early in the Prabowo administration.

Pakistan

After committing USD 2.2bn in investments across various sectors earlier this month, Saudi Arabia will now invest an additional USD 600m, including in copper and gold mining projects.

Unprecedented air pollution in Lahore forced authorities to close all primary schools for a week and call 50% of office workers to work from home, as part of a ‘green lockdown plan’. The air quality index, which measures a range of pollutants, exceeded 1,000 on Saturday, well above the benchmark of 300 considered "dangerous" by the World Health Organization, according to data from IQAir.

Latin America

Stronger growth in Chile and Mexico. A 50bps “hawkish cut” in Colombia

Argentina

The central bank recently reduced its benchmark interest rate from 40% to 35%, marking the first cut in nearly six months. This decision follows a cooling of inflation under President Javier Milei, with monthly consumer price gains now down to 3.5%, from 25% at the beginning of 2024. The rate cut should go some way to assuaging Argentina’s tight liquidity conditions, while the government's continued commitment to a fiscal anchor will help to provide room for monetary easing without risking restoking inflationary pressures. Additionally, the central bank lowered rates on short-term financial instruments, known as ‘pases’, from 45% to 40%, signalling a broader effort to stimulate economic activity. Lower local market rates suggest capital controls are likely to remain in place as nominal rates remain below the running inflation rate. The government reported it raised USD 18bn through a tax amnesty law.

Brazil

Brazil's Finance Minister Fernando Haddad recently met with President Lula’s Chief of Staff, Rui Costa, to discuss proposed spending cuts aimed at meeting fiscal targets. Costa expressed support for the measures, which will be presented to Lula for approval and subsequently made public. Following Costa’s comments, the Brazilian real trimmed some of its earlier losses, reflecting a market response to the government's commitment to fiscal discipline. Haddad is keen to eliminate Brazil’s primary fiscal deficit by 2025, underscoring the administration’s efforts to balance social spending with fiscal responsibility.

Mexico

The Lower House passed a reform previously approved by the Senate to protect constitutional amendments from Supreme Court vetoes, with 340 votes in favour and 133 against. This measure solidifies the judiciary reforms enacted by Congress in September but has also raised concerns over the erosion of judicial independence. Eight Supreme Court judges resigned on Tuesday and Wednesday, as part of a political gesture rejecting the judicial reform. The fact eight judges resigned shows there is a wide enough consensus in the Supreme Court to rebuke parts of the reform, which has the potential to ignite a political crisis, in our view, given the MORENA regime insists it will not recognise the Court’s capacity to deem reforms unconstitutional. Opposition senator Emilio Suarez Licona criticised the reform during a debate, accusing lawmakers of undermining the country’s democratic system of checks and balances.

Additionally, Mexico City Mayor Claudia Sheinbaum signed into law a reform that will restructure PEMEX, the state oil company, turning it into a fully government-controlled entity. These legislative changes reflect a shift toward greater government influence over key institutions, sparking debate over the balance of power between the branches of government.

Central and Eastern Europe

Stronger core inflation supports Polish CB plan to hold rates till 2025.

Czech Republic

The Czech economy has lagged other European Union nations in its recovery from the pandemic and the regional energy crisis. Over the past year, the Czech National Bank has responded by reducing borrowing costs by a total of 275 basis points (bps), bringing the rate to 4.25%. However, inflationary pressures are now taking hold, prompting discussions within the Czech National Bank about possibly pausing interest rate cuts. Vice Governor Eva Zamrazilová has indicated she will consider keeping the benchmark rate unchanged at the upcoming meeting on 7 November. Although some board members, including Governor Aleš Michl, have expressed caution regarding further rate cuts, Zamrazilová is the first to openly consider maintaining the current rate this soon.

Central Asia, Middle East, and Africa

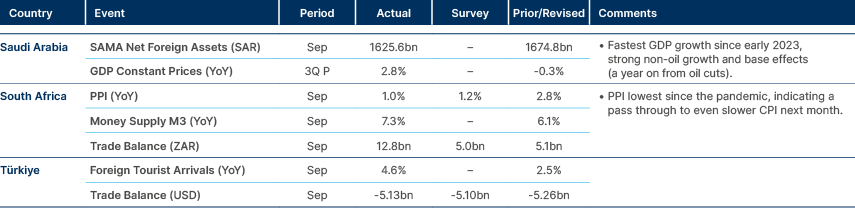

Strong growth in Saudi Arabia.

Republic of Congo

S&P downgraded the sovereign rating to CC+, reflecting significant liquidity pressures. According to S&P, the country’s net reserves are sufficient to cover only about 1.4 months of current account payments and less than 40% of short-term external debt based on remaining maturity. The rating outlook is negative, highlighting ongoing economic vulnerabilities and limited financial buffers.

Botswana

An opposition coalition has emerged as the unexpected winner of Botswana’s parliamentary elections, in the first power shift since independence nearly 60 years ago. Duma Boko, a Harvard-educated human rights lawyer, is expected to replace Mokgweetsi Masisi as President, with partial vote tallies showing Boko’s Umbrella for Democratic Change winning a majority in the 61-seat legislature. The Botswana Democratic Party (BDP), previously expected to retain its hold, came in fourth with just four seats. Masisi conceded the election before the results on Friday. The BDP’s poor performance in the election can be partially attributed to a recent economic downturn driven by a decline in the diamond market, Botswana's main source of revenue and exports. The downturn has contributed to a rise in the national unemployment rate to 28%, fuelling social discontent.

Egypt

Fitch upgraded Egypt to B, with a stable outlook. This takes Fitch one notch above S&P and two notches above Moody’s. The upgrade effects the boost in Egypt’s external finances thanks to the Ras El-Hekma foreign investment, as well as foreign inflows into the debt market, better exchange rate flexibility and tighter monetary conditions.

Türkiye

S&P upgraded Türkiye to BB-, outlook stable. This brings S&P in line with Fitch and one notch above Moody’s. The main reason for the upgrade is the central bank’s tight monetary stance allowing for stabilisation in the Lira, lower inflation and a rebuilding of reserves. An improvement in the current account has also been notable, with the deficit declining 4% of GDP since 2022. S&P Global stated: “The outlook is stable to reflect balanced risks over the next 12 months to authorities' ambitious plans to bring down still elevated inflation, manage workers' wage expectations, and rebalance the Turkish economy.”

Developed Markets

US jobs data returns to weakening trend.

United Kingdom

Yields on UK government bonds (gilts) surged to their highest level in 2024 following Chancellor Rachel Reeves’s Budget announcement, which outlined significantly increased borrowing over the next four years. The yield on the ten-year gilt rose by 16 basis points to 4.51%, while the two-year yield climbed 19bps to 4.50%. Meanwhile, the pound depreciated 0.7% against the Dollar, reaching USD 1.29, its lowest level in two months. The market response reflects concerns over rising government debt levels and potential implications for fiscal sustainability.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See https://www.economist.com/united-states/2024/11/03/a-much-watched-poll-from-iowa-points-to-a-harris-landslide

2. See https://www.ft.com/content/c72fac7b-4b0c-4981-8bc8-8999bde17900