- Trump said the 25% tariffs on steel and aluminium will apply to imports from all countries.

- The Treasury is serious about cutting costs, including US Aid. MAG 7 results positive but share prices down.

- US to present its Russia-Ukraine peace plan at the upcoming (Feb 14-16) Munich Security Conference.

- The Reserve Bank of India's (RBI) has cut the repo rate by 25bps to 6.25%; the first reduction in nearly five years.

- Philippines Vice President has been impeached by the House of Representatives.

- Fitch Ratings has affirmed South Korea’s AA- long-term credit rating with a stable outlook.

- President Milei said Argentina's FX controls will be terminated by Jan 2026, even if the country gets no help from the IMF.

- Kenya central bank lowered the benchmark rate by 50bps to 10.75%.

- Fitch Downgraded Mozambique to CCC.

- Japanese nominal wages surged by 4.8% year-on-year in December, the fastest since 1997.

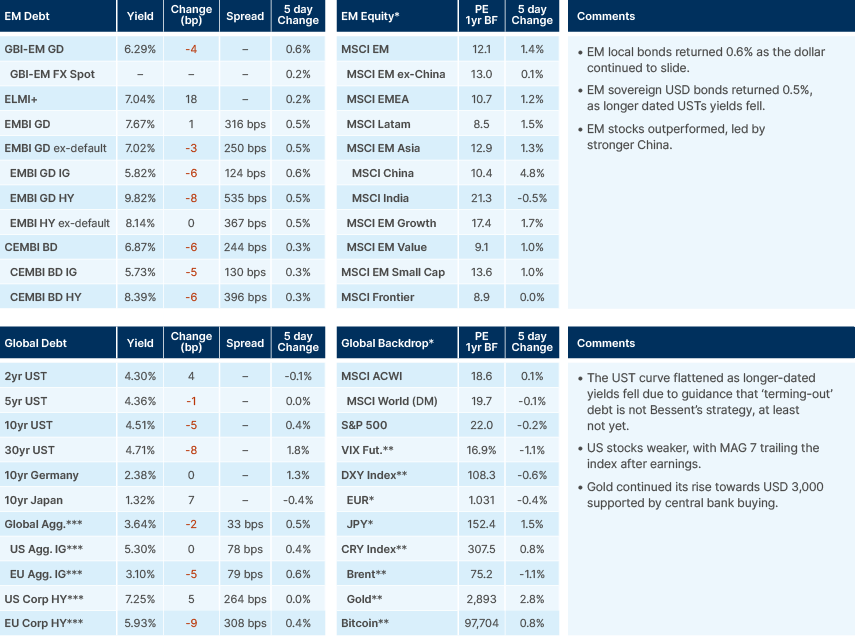

Last week performance and comments

Global Macro

In his latest weekend tariff announcement, US President Donald Trump, speaking to reporters Sunday on Air Force One, said 25% tariffs on steel and aluminium will apply to imports from all countries. He didn’t specify when the duties would take effect. The US imports around USD 30bn of steel and 11bn of aluminium per year. The largest exporters of the two metals are Canada (USD 12bn) and Mexico (USD 5bn). A few countries like Brazil, Russia, South Korea, and Japan have USD 1.5bn-2.5bn of annual exports of the two metals.

Unlike the Mexico and Canada tariffs, which were threatened to achieve a non-trade-related goal, tariffs aimed at protecting specific American industries are likely to stick. Reciprocal tariffs, details of which are likely to be announced this week, will also probably be implemented for the longer term, unless opposing countries make deals with the US to remove tariffs on American goods altogether, or significantly lower them. The tariffs would support native American industry in lieu of foreign industries, resulting in an overall increase of the cost base of a long supply chain that is likely to be partially absorbed by the long supply chain. However, it will have specific sector imports. For example, an industry expert pointed out to us that a 20% tariff on steel would increase the break-even on shale oil by up to c.$10 to c. $80 per barrel. Whilst we emphasise that this is an uncertain and complex calculation, the order of magnitude is noteworthy.

As tariffs dominate market discourse and sentiment on future inflation, Fedspeak over the last week has remained relatively dovish, given the circumstances. Rhetoric from US Federal Reserve (Fed)Governors is that they remain focused on cuts as long as trade and fiscal policies do not make them impossible. Phillip Jefferson, Vice President of the Fed, said in a statement last week: “Over the medium term, I continue to see a gradual reduction in the level of monetary policy restraint placed on the economy as we move toward a more neutral stance as the most likely outcome. That said, I do not think we need to be in a hurry to change our stance.”

Treasury Secretary Scott Bessent said in an interview on Fox news that while President Trump wanted lower rates, they were both focused on the 10-year yield, not the Fed policy rate, adding that policies to boost energy supply and reduce the budget deficit would help achieve this. He implied that the “jumbo rate cut”, referring to last September’s 50 basis points (bps) cut, helped create the bond sell-off. Both led to the flattening of US Treasuries (USTs) last week. In other fiscal news, the Treasury is serious about cutting costs, including USAID, the United States Agency for International Development. The biggest tickets to go after, however, will be in healthcare and military procurement. Trump has said he would cut billions of dollars from the Pentagon budget, which currently is USD 800bn a year. The public healthcare budget is far larger, however, with Medicare and Medicaid spending growing to nearly USD 2trn in 2023.

Magnificent Seven (MAG 7) results were positive, but details (cloud results and guidance) were mixed. Five out of six companies were down post-earnings, despite five beating earnings-per-share (EPS) and four out of six beating on revenues. Forward guidance for artificial intelligence (AI)-related capital expenditure (capex) was strong, but markets were more concerned of risk related to large capex post-DeepSeek. Nvidia reports on 22 February.

Geopolitics

Russia-Ukraine Deal

Hopes for a peace deal between Russia and Ukraine are rising again, amid reports that the US would present its Russia-Ukraine peace plan at the upcoming (14-16 February) Munich Security Conference. Trump and Russian President Vladimir Putin have also reportedly been in contact various times. Though the US Special Envoy on Russia-Ukraine may not present at the conference, most remain optimistic that the endgame is approaching, even if negotiations are likely to be drawn out. Ukrainian USD bonds rose +4 points last week, as well as some interest to sell EURHUF and EURPLN last week.

Australia banned DeepSeek on government devices for security reasons, and Panama is considering cancelling it deal with CK Hutchinson, the Hong Kong firm which operates the Panama Canal port. The renewal of the concession is believed to have been fraudulent.

Emerging Markets

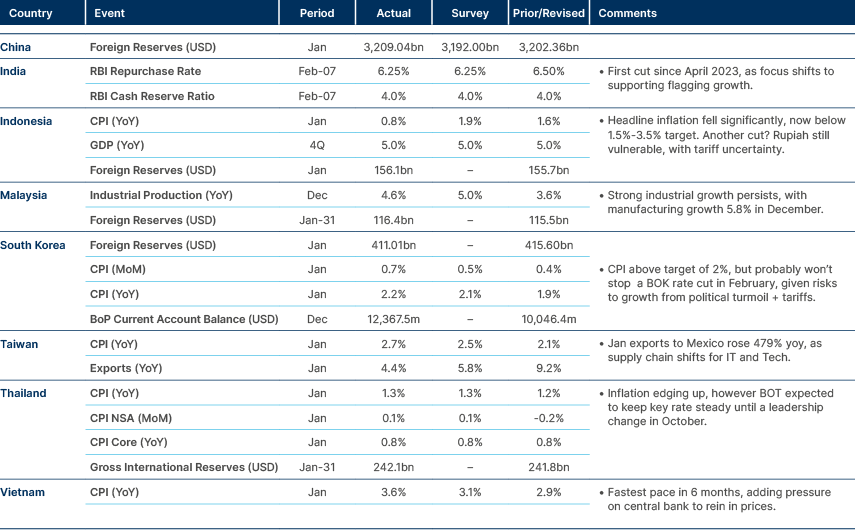

Asia

India cuts policy rates after Indo’s cut last week – more cuts likely to come from both countries.

India: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) has cut the repo rate by 25bps to 6.25%, marking the first reduction in two years, in a unanimous decision, on the first meeting under Governor Sanjay Malhotra. The cut is intended to boost growth, as GDP growth forecast for FY26 has been set at 6.7% the slowest pace for four years. The inflation projection for FY25 remains unchanged at 4.8%, above the 4% target, but within the 2% tolerance band. The inflation forecast was also unchanged for FY26 is 4.2% y/y. Despite the unanimous cut, the committee were careful not to send overly dovish signals to keep the policy stance ‘neutral’ rather than change it to ‘accommodative’ which would have signalled more rate cuts. Because this cut was expected, the lack of liquidity steps given by new Governor Malhotra, caused bonds to fall, along with stocks, who were hoping for more substantial growth-oriented measures. However, given external inflation risk, and the Rupee under pressure the central bank remains tentative. Malhotra reiterated Friday that the foreign exchange intervention is aimed at controlling excessive volatility, but that there was no specific level or band the RBI aim for. The INR has fallen 2.2% against the dollar year-to-date.

The central bank's rate reduction follows a range of monetary measures previously announced, including an injection of $18bn (£14.48bn) into the domestic banking system, to ease a cash shortage in the economy. The banking system liquidity has been in deficit for eight weeks, with a deficit now of INR1.3 tn, or USD14bn. The RBI had also cut the cash reserve ratio by half a percent in December.

The RBI's moves to begin loosening financial conditions come after the Union Budget's $12bn tax cut for the struggling middle class last week. The budget as a whole however focuses on fiscal consolidation in the next two years, as part of a plan to bring down government debt from 57% of GDP in 2025 to 50% of GDP over the next five years. According to Fitch, this would require fiscal deficits to be sustained at or just below the 4.4% GDP deficit target in FY26 on average.

Ratings agency S&P reaffirmed the budget aligns with India's gradual fiscal consolidation, reinforcing its positive outlook on India's BBB- sovereign rating. Fitch, on the other hand, says an upgrade to the country’s BBB- rating is unlikely, given the ratio of debt/GDP is above 80%, higher than the mid-50% average for similarly rated peers.

Malaysia: Industrial production accelerated to 4.6% yoy in December. Electrical and electronic product output was up 9.4% yoy. Manufacturing sales rose by 5.7% yoy. Credit growth to the private sector eased to a one-year low of 5.5% yoy in December, while bank deposit growth slowed to 3.0% yoy. The loan-to-deposit ratio was maintained at a modest 87.8%.

The government denied allegations that Malaysia helped smuggle Nvidia AI chips to China and said it firmly adheres to export control restrictions under the Strategic Trade Act, local media reported, citing Trade and Industry Minister Tengku Zafrul.

Pakistan: Consumer price index (CPI) inflation increased by 2.4% yoy in January, the slowest growth in over nine years, from 4.1% yoy in December.

Philippines: Vice President Sara Duterte was impeached by the House of Representatives with 215 members supporting the motion, surpassing the required one-third threshold. The case will now move to the Senate, where a two-thirds majority is needed for conviction. There are several allegations against Duterte, such as misuse of public funds and threats to have President Ferdinand Marcos Jr., his wife, and the House Speaker assassinated. Duterte denies any wrongdoing.

This impeachment is unprecedented for a Philippines Vice President and comes amid rising tensions between the Duterte and Marcos political clans. Their alliance, which secured a landslide victory in the 2022 elections, has since deteriorated over policy disagreements.

The net trust ratings of both President Marcos and Duterte dropped further, according to a Stratbase-SWS survey conducted in late January.

- Trust ratings for Marcos decreased to +24 in January from +29 in December, +33 in September and +42 in July.

- Duterte’s ratings declined to +19 in January from +23 in December, +29 in September and +45 in July.

South Korea: Fitch kept Korea’s credit rating at AA- with a stable outlook. Strong macroeconomic performance, dynamic exports and robust external finances underpin the rating. Political turmoil does not threaten governance, for now. Fitch revised GDP growth sharply to 1.7% in 2025 and expects a 10% global tariff from the US.

Thailand: International reserves rose by USD 5.0bn mom to USD 242.1bn at end-January. Gold prices (+6.7% to USD 21.1bn) and lower net USD forward position (down 4.7% to USD 24.0bn) explain most of the reserve increase. Cabinet approved the second phase of the Thai-Chinese high-speed rail project. The 357km extension is estimated to cost THB 340bn. This will allow fast travel from Bangkok to Yunnan in China via Laos. The construction of the link is to be completed by 2030.

South Korea: Fitch affirmed South Korea’s AA- long-term foreign-currency issuer default rating with a stable outlook. This decision reflects the country's strong external finances, stable macroeconomic position, and robust export sector. However, geopolitical risks from North Korea, an aging population, and recent political instability pose challenges. Fitch lowered its 2025 GDP growth forecast to 1.7% due to political uncertainties and weak economic data, with a gradual recovery expected later. Medium-term growth is projected at 2.1%, constrained by demographic factors and global competition. The government’s deficit is expected to narrow to 1% of GDP, with debt rising to 48.4%.

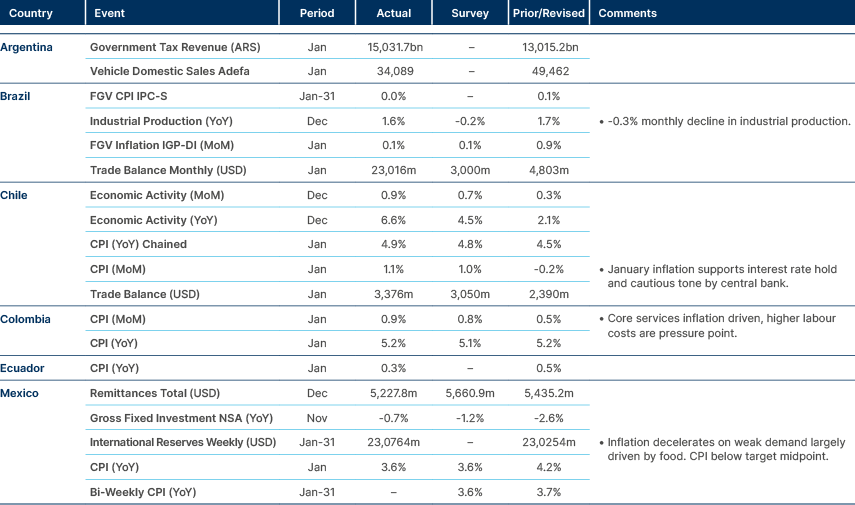

Latin America

Stick inflation keeping Colombia and Chile in hold, but benign in Mexico, with 50bps cut.

Argentina: Economy Minister Luis Caputo said an eventual agreement with the International Monetary Fund (IMF) will not require a devaluation or an immediate exit from foreign exchange (FX) controls. He forecasts the economy to grow more than 5% in 2025.

President Javier Milei said Argentina's FX controls will be terminated by January 2026, even if the country gets no help from the IMF. This reflects significant confidence in the stabilisation and reform drive supported by a zero-deficit fiscal policy approach, and tight monetary policy. Milei’s office also said he had taken the decision to ban gender change treatments and surgeries for minors.

Chile: President Gabriel Boric's approval rate returned to 31% in January, in line with the average for his presidential term, after dropping to 29% last year. Finance Minister Mario Marcel said 2025 fiscal numbers will be revised to ensure debt doesn’t rise. This came after the fiscal deficit ended 2024 at 2.9% of GDP, 1% above the target. Prices rose 1.1% in January, the fastest monthly pace in two years, driven by local electricity tariffs jumping and a weak peso. A 1% jump was expected, given the energy tariffs. Electricity costs rose 10.8% after the tariff hike.

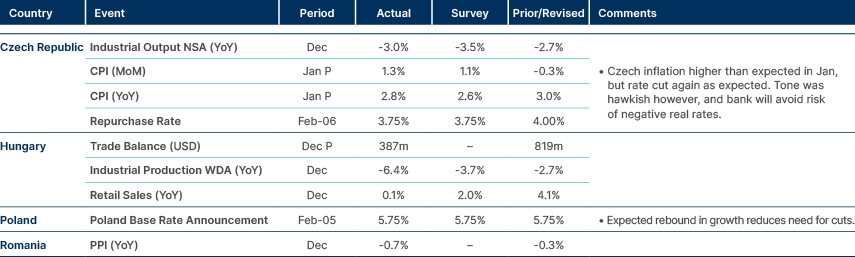

Central and Eastern Europe

Stronger GDP in Hungary.

Czechia: The Czech National Bank (CNB) lowered its policy rate by 25bps to 3.75%, as expected. The post-meeting statement was more hawkish than implied by the flash CPI print, at 2.8% yoy in January. CPI inflation was higher than the CNB's expectations of 2.5% yoy, but the deviation is likely primarily due to food prices, which the board emphasised are expected to be transitory. All seven board members voted for a 25bps cut. The staff cut the 2025 GDP growth projection to 2% (from 2.4%), and the inflation projection to 2.4% (from 2.6%)

Central Asia, Middle East, and Africa

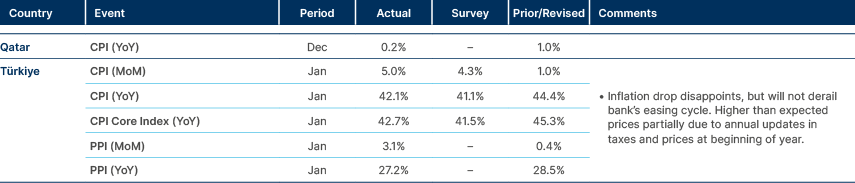

Inflation surprised to the upside in Türkiye.

News of the US freezing foreign aid will impact several African nations. The largest recipients of US aid in 2024 were: Ethiopia, at USD 1.2bn, or 0.8% of GDP, followed by Nigeria (USD 780m, 0.4% of GDP), Kenya (USD 647m, 0.65% of GDP), Uganda (USD 440m, 0.8% of GDP) and Zambia (USD 380m, 1.5% of GDP).

Angola: The government published its 2025 annual debt plan. Gross borrowing requirement projects at USD 14.9bn, with a net requirement at USD 2.4bn in 2025. Debt service costs to amount to AOA 13.3trn (USD 13.6bn); down from AOA 14.3trn last year. External borrowing plans: USD 1.5bn in Eurobond, USD 1.2bn in World Bank (WB) and commercial, and USD 4.6bn in credit lines disbursement, of which 82% has already been contracted. Debt stock is expected to reach USD 60bn by the end of 2025, representing 63% of GDP, down from USD 62bn or 69% of GDP at end-2024. Oil production totalled 31.8m barrels for December 2024, with a daily average of 1.02m barrels per day (mbpd), slightly below the expected 1.03mbpd. The 2025 annual output target has been set at 1.1mbpd, up from the expected 1.09mbpd in 2024.

Kenya: The central bank lowered its benchmark rate by 50bps to 10.75%. Despite edging marginally up, inflation remained below the mid-point of the government's target range (5.0%) for an eighth consecutive month. The Kenyan government is considering listing Kenya Pipeline Company (KPC) on the Nairobi Securities Exchange through an initial public offering (IPO), which would mark the first new listing on the bourse in nearly a decade. The company has been a source of dividend payments to the Treasury.

As part of its growth strategy, KPC is said to be planning a petroleum trading hub in Mombasa to enhance fuel distribution in the region. The govt is also supporting efforts to wind down Kenya Petroleum Refinery Ltd and integrate its operations into KPC within the current fiscal year. The government is also readying public consultations on plan to toll five major highways to finance its infrastructure needs.

From last week

Moody's upgraded the sovereign outlook from negative to positive while affirming its long-term issuer ratings and foreign-currency senior unsecured debt ratings at Caa1. This revision reflects an increasing likelihood of improved debt affordability and reduced liquidity risks, driven by declining domestic financing costs and effective fiscal management, the agency said.

Mozambique: Fitch downgraded Mozambique debt to CCC. The downgrade was driven by domestic debt service risk and pressure on economic activity and fiscal deficit from unrest, and high government debt.

Qatar: Qatar's Prime Minister and Foreign Minister, Sheikh Mohammed bin Abdulrahman Al Thani, pledged support for the reconstruction efforts in southern Lebanon. He also said Qatar will keep providing Lebanon with energy supplies and gas as part of efforts to ease the country's energy crisis.

Lebanon has been facing almost 24-hour daily power outages due to acute fuel shortages in the past few years.

Developed Markets

ECB dovish tone. Fed waiting for policy impact.

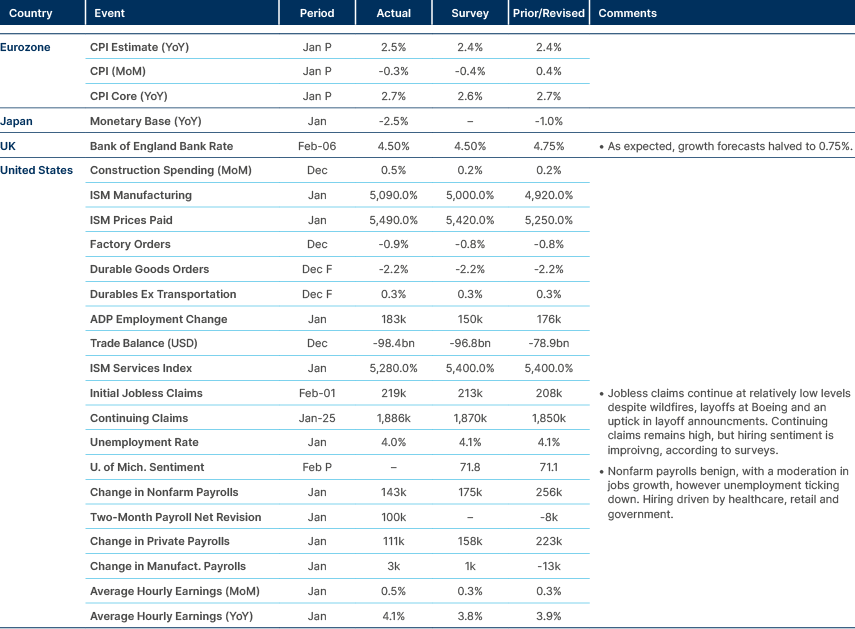

Japan: In December 2024, Japanese nominal wages surged 4.8% year-on-year, the fastest growth since 1997, largely driven by a sharp rise in bonuses. This strong wage growth supports the Bank of Japan’s case for continued monetary tightening, reinforcing its recent rate hike decision and signalling a 78% probability of another rate increase by July, according to market pricing.

The prospect of higher interest rates has also strengthened the yen, not just by attracting foreign capital, but by encouraging the repatriation of Japan’s substantial external assets as investors seek better returns domestically. The robust wage gains reflect growing domestic demand, potentially helping Japan break free from decades of deflationary pressures. Policymakers will closely monitor how sustained wage growth could influence inflation, consumer spending, and the yen’s trajectory, all of which will play a pivotal role in shaping Japan’s economic outlook for 2025.

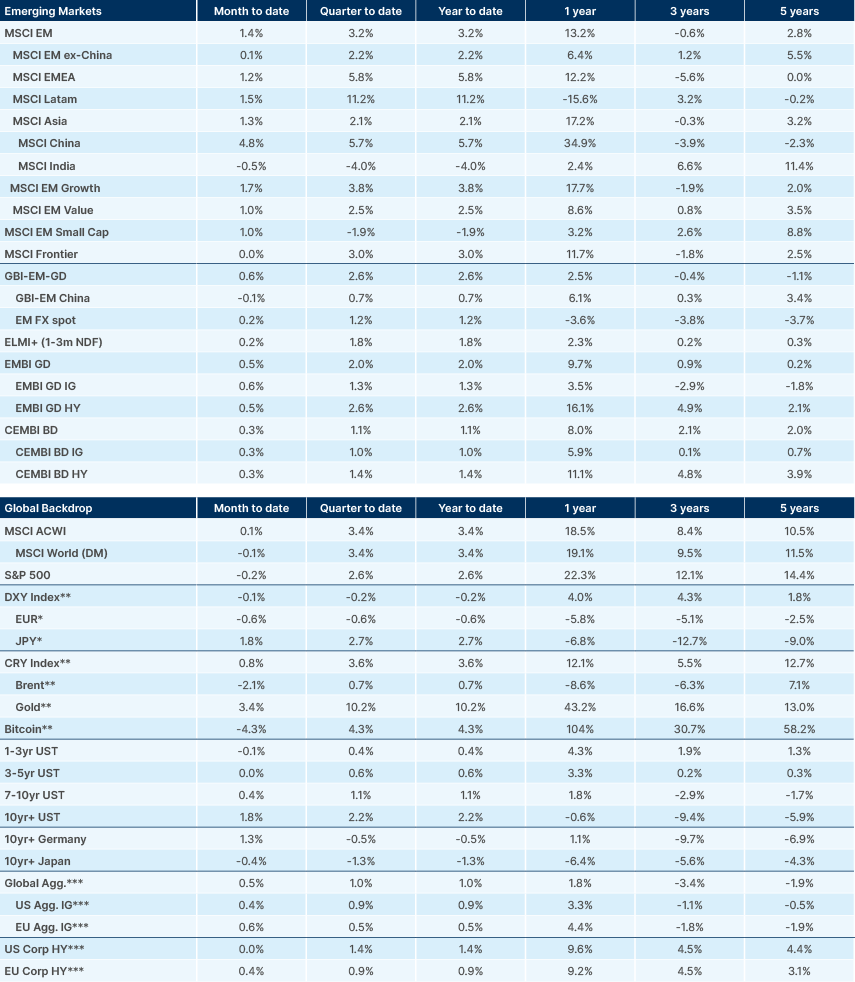

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.