The IMF upgraded the 2021 growth projections to EM and downgraded DM’s

The IMF upgraded its 2021 growth forecast for Emerging Market (EM) economies and downgraded Developed Markets (DM). JP Morgan announced Egypt and Ukraine are joining the main local currency bond index in Q1-2022. The risk of energy rationing declined in Brazil, thanks to rains in October and lower consumption. China signaled it can backstop systemic risks from property sector deleverage. Chile hiked its policy rate by 125bps. The Ecuadorian president said it would re-submit its economic reform in

three separate bills. India’s inflation surprised to the downside as industrial production (IP) rose. Mexico’s IP surprised to the upside. Romania prime minister questioned the central bank’s inflation policies. Russia pledged to supply as much gas as Europe needs. Saudi may increase taxes on logistics platforms. The Bank of Korea kept policy rates unchanged. Thailand eased quarantine restrictions for foreign travelers. Turkey’s president sacked another two central bank directors.

Emerging Markets

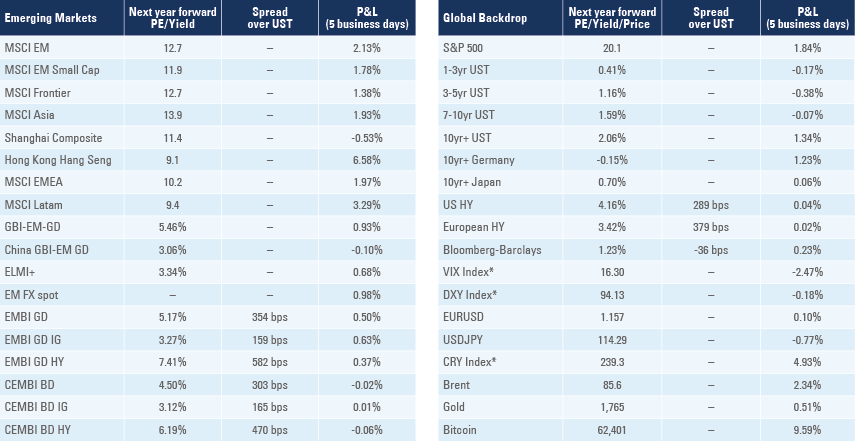

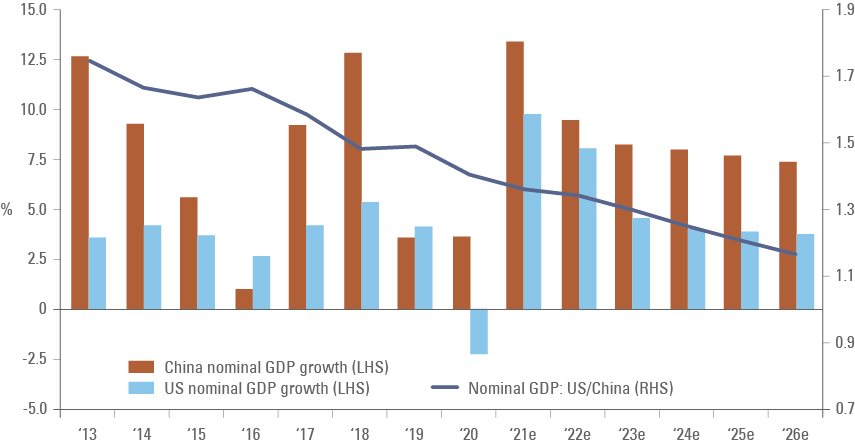

IMF World Economic Outlook: The gap between the IMF and Wall Street 2021 GDP growth forecasts has converged, with the IMF upgrading Emerging Markets (EM) and downgrading developed markets (DM), whilst Wall Street continued to downgrade DM 2021 growth as per Figure 1, in line with our expectations.1 The IMF is slightly more optimistic than Wall Street for 2022 GDP growth across EM and DM but has similar numbers for 2023 growth.

Fig 1: Real GDP growth forecasts: IMF vs. Wall Street

Source: IHS Markit, Ashmore as at 1 October 2021. *EM: GDP weighted average of 31 large Emerging and Frontier Markets. **DM: GDP weighted average of 11 large developed markets.

***Revisions: IMF WEO October 2021 vs. April 2021/Street: Last vs. 3 months change.

Geopolitics

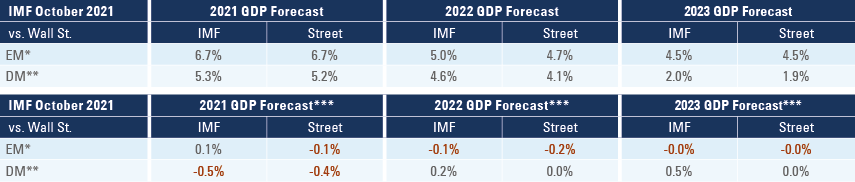

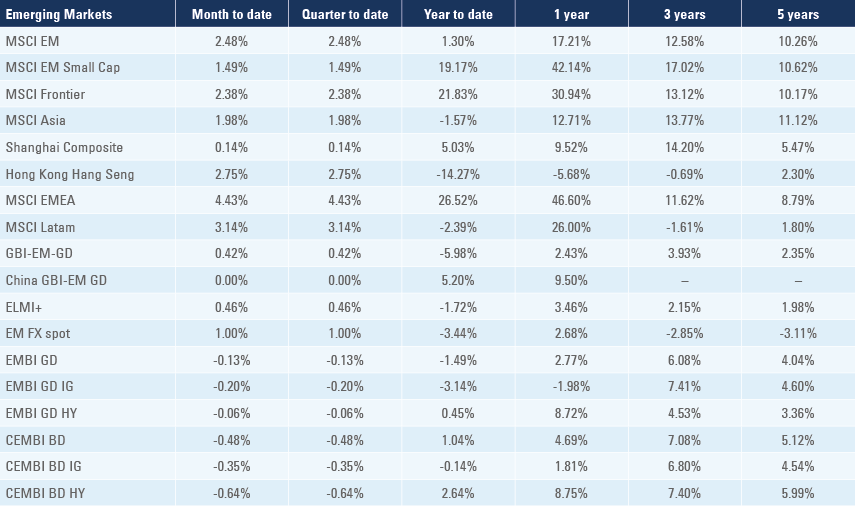

The long-term big picture remains the same. The pandemic apparently did not slow the real GDP convergence between EM and DM. Figure 2 shows EM economies had similar contribution to Global GDP in current Dollar terms as DM economies in 2018. EM will be 51% of the global economy by the end of 2021 and 54% in 5-years, according to IMF forecasts.

Fig 2: Gross Domestic Product (current USD), % world

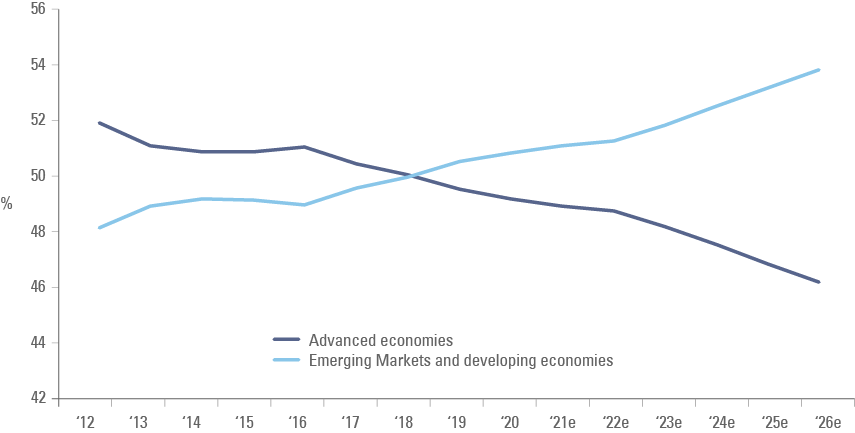

After adjusting for purchasing-power parity (PPP), EM will represent 58% of the global economy at the end of 2021 and 60% in 5-years as per Figure 3. The breakdown by region shows Latin America, Middle East & Central Asia GDP share declining whilst China and Asia ex-China gained market share. The year of 2012 was also the beginning of a bear market in commodity prices. Therefore, the declining trend for these regions could reverse, should commodity prices remain elevated for longer.

Fig 3: Gross Domestic Product (purchasing power parity), % world

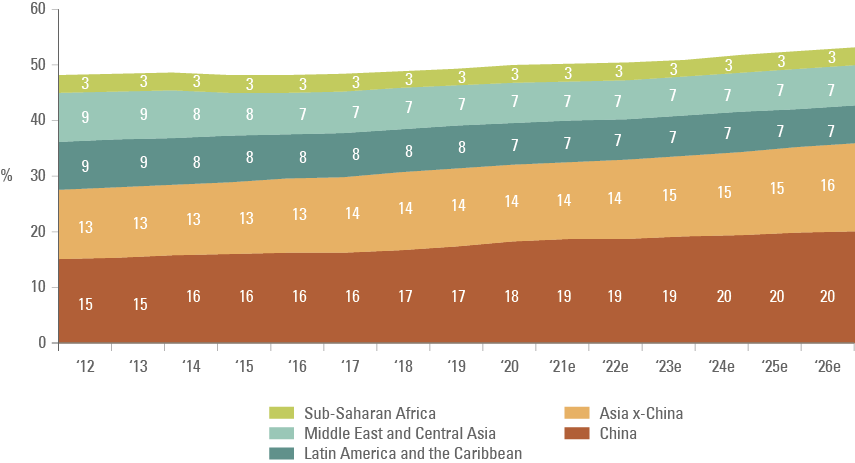

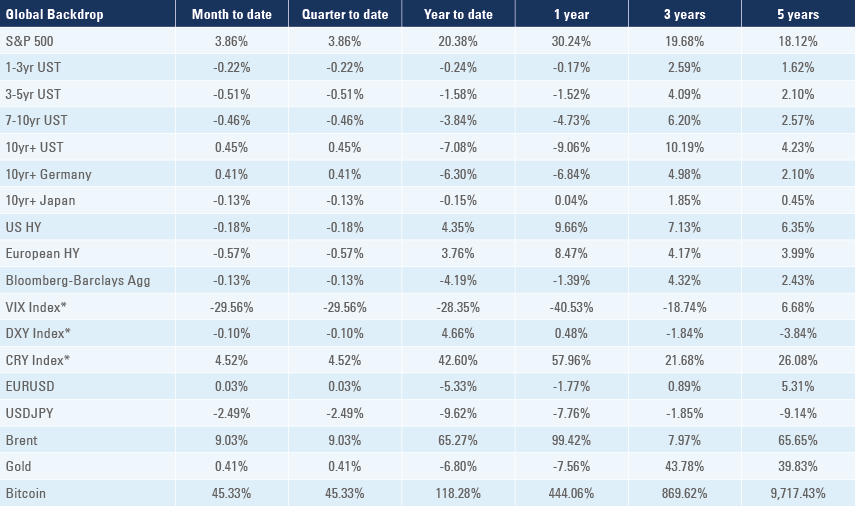

Finally, the IMF forecast both the US and Chinese economy will slow down from 2022 onwards (Figure 4). In spite of the downward adjustment, the pace of nominal GDP growth for both the US and China from 2022 remains elevated vis-à-vis their potential, in our view. Despite the fact that the convergence path is likely to remain unchanged, both countries could be subject to downward revisions in their GDP growth, in our view.

Fig 4: Nominal GDP growth (USD) US vs. China

Emerging Markets

The bull-case for EM assets remains in place, in our view. EM will benefit from a virtuous cycle of stronger GDP growth led by capex. Asia is already experiencing some capex pickup after strong export numbers while commodity exporters should also benefit from higher capex following the last 18m price performance. EM capex is likely to be buoyed by portfolio flows with the backdrop of a weaker USD, as Dollar-based investors seek diversification and inflation protection in EM local assets. In this scenario, the EM share of GDP in Dollar terms (51% of world) may converge to its share of GDP in PPP terms (58% of world).

Index matters: JP Morgan will include both Egypt and Ukraine on its local currency index, the Global Bond Index Emerging Markets Global Diversified (GBI EM GD). The number of countries in the GBI EM GD will rise to 22 after inclusion. Egypt will join the index in 31 Jan 2022 with an estimated 1.85% weight while Ukraine will join in 31 March 2022 with 0.12% (single global denominated in UAH added). JP Morgan also has Indian local currency bonds in the outlook for a potential inclusion in H2 2022.

Brazil: In climate matters, an improvement in the rains and the reduction of electricity consumption is helping to improve water levels in the reservoirs as the national electric agency (ONS) affirmed the current situation remains critical, but the risks of electricity rationing have substantially diminished. The Brazilian Central Bank (BCB) sold USD 3.4bn via foreign exchange (FX) swaps last week to support the BRL. The BCB said it would sell USD 18.2bn until the end of the year to support the seasonal FX hedging activity of banks. In other news, the Lower House of Congress passed a bill changing the calculation on the state-level fuel tax levied. The new formula would fix a value per liter of fuel, whereas the current formula is a percentage on the sale price, resulting in progressively higher taxation as gasoline and diesel price increases. If approved by the Senate, the new model will lower gasoline prices by c. 8% and diesel prices by c. 4% with no impact to Petrobras.

China: Xi Jinping softened its recent “communist stance” in an article published on the Qiushi magazine.2 In particular, Xi emphasised the importance of private sector and rewarding “honest, hard work” and protecting intellectual, wealth and property rights. Xi also clarified the “common prosperity” goal is a dynamic process, and not something that must be reached immediately (inalienable right for the “pursuit of happiness”, Chinese style). Xi suggested China should be cutting taxes on capex and business development while raising taxes on existing monopolistic sectors and wealthy population. In other policy news, PBoC Governor Yi Gang pledged to prevent any systemic risks from Evergrande saying, “The rights and interests of creditors and shareholders will be fully respected in strict accordance with the law”.

In economic news, the yoy rate of real GDP growth declined to 4.9% in Q3 2021 from 7.9% in Q2 2021, broadly in line with consensus. High-frequency economic data for September was mixed: On the one hand, retail sales declined to 4.9% yoy from 7.9% yoy in August and the jobless rate declined 0.2% to 4.9%, both better than consensus; on the other hand, IP declined to 3.1% yoy (from 5.3% yoy) and fixed asset investment declined to 7.3% yoy (from 8.9% yoy), both below consensus. The total aggregate financing (TAF) was broadly unchanged at CNY 2.9trn in September as new loans rose to CNY 1.7trn from CNY 1.2trn. The cumulative Jan-Sep TAF hit CNY 24.7trn, which is 16.5% lower than the same period in 2020, but 19.9% higher than the same period in 2019. The yoy rate of CPI inflation declined 0.1% to 0.7% in September, while PPI inflation rose 1.2% to 10.7% yoy, largely due to higher energy, and metal manufacturing prices. The widening gap between PPI and CPI inflation suggests global inflationary pressures remaining in place for longer than initially expected as well as further margin pressures for Chinese companies.

The trade surplus rose to USD 66.8bn in September, accumulating USD 630bn (c. 4% of GDP) over the last 12 months. The large trade surplus softens the impact of weaker real estate. Private investment usually increases substantially after large export increases. This time investors will find attractive opportunities in high value-add manufacturing, renewable energy and import substitution sectors where the Chinese government has increased incentives (or co-investments). Foreign investors purchased USD 11.9bn of Chinese bonds in September from USD 2.5bn in August.

In other news, China lifted the price ceiling on coal-fired electricity prices to boost generation. The International Energy Agency (IEA) estimates that, in order to achieve its net zero emissions goal by 2060, China needs to expand wind power capacity by 9x and solar energy by 7x, while reducing coal usage by 80%. After incorporating the needs for electricity infrastructure upgrade, HSBC estimates the annual investment required by the public and private sectors is close to RMB 5trn per year by 2060 (just under 5% of current GDP), or RMB 200trn over the next 40 years (2x current GDP).

Chile: The Central Bank of Chile (BCCh) hiked its policy rates by 125bps to 2.75%. Most economists surveyed by Bloomberg expected a 75 or 100bps hike. The BCCh sees a faster convergence of the policy rate towards the centre of its neutral range of 3.5%, implying another 75-100bps hike is likely in December. The approval of the fourth pension withdrawal and higher domestic policy uncertainty poses upside risks for inflation, demanding policy rate to be significantly above the neutral level. In political news, Congress presented an impeachment motion against President Sebástian Piñera after the president was cited in the Pandora Papers.

Ecuador: President Guillermo Lasso said the government would resubmit its “creating opportunities” bill via three separate pieces of legislation for labour regulations, tax reform and investment. The trade balance moved to a deficit of USD 4.2m in August from a USD 22.2bn surplus in July, in line with the average of the previous five years.

India: The yoy rate of CPI inflation declined 0.9% to 4.4% in September and wholesale price index inflation dropped 0.7% to 10.7% yoy over the same period. In other economic news, the yoy rate of IP rose 0.4% to 11.9%, higher than consensus while the trade deficit widened to USD 22.6bn in September from USD 13.8bn in August.

Mexico: The yoy rate of IP slowed to 5.5% in August from 7.3% yoy in July while manufacturing production rose 6.6% yoy from 6.2% yoy over the same period, both significantly above consensus. Strong performance from electronic equipment, chemicals and oil related products compensated for the weak auto sector performance, impacted by supply chain disruptions. Same store sales reported by ANTAD rose by a yoy rate of 10.1% in September from 4.5% yoy in August. Formal job creations rose to 174k in September from 129k in August, the best result for the month in 20-years.

Romania: The interim Prime Minister questioned the Romanian Central Bank policy on inflation. The yoy rate of CPI inflation hit the highest levels in 10-years in September at 6.3% (1.0% higher than August and 0.5% above consensus). The main culprit for higher global inflation was large fiscal stimulus, mostly in DM economies, boosting demand during 2021 while the global economy suffered from supply disruptions. In other news, the yoy rate of real GDP growth rose 0.9% to 13.9% in Q2 2021. Industrial output declined to a yoy rate of 0.5% in August from 5.9% yoy in July while the year-to-date current account deficit widened to USD 10.2bn in August, significantly higher than the USD 8.1bn average deficit from 2016 to 2020.

Russia: President Vladimir Putin said Russia is fulfilling its gas contract obligations, as usual, and is ready to increase production to supply “as much gas as Europe needs”. Putin touted the Nord Stream 2 gas pipeline as a cheaper and less carbon-intensive route than the existing pipeline via Ukraine, but also committed to increase gas transit via Ukraine, should there be additional demand. Russia can use the energy crisis as an opportunity to sign more long-term contracts with Europe, thereby guaranteeing market share and lowering the risk of trade and financial sanctions imposed on Russian companies and individuals. In geopolitical terms, the Nord Stream 2 pipeline allows Russia to gain further leverage over Ukraine, which derives large revenues from gas transiting from Russia to Europe and is dependent on natural gas. Finally, Putin said he was discussing a round of talks with President Joe Biden and that Russia will target zero net emissions by 2060, aligning Russia’s target with China. In economic news, the current account surplus rose to USD 40.8bn in Q3 2021 from USD 18.2bn in the previous quarter, significantly above consensus.

Saudi Arabia: Bloomberg reported car-hailing and sharing economy platform companies such as Uber and Careem will have to pay overdue value added tax (VAT). Most platforms pay VAT on the company’s commission, which is a smaller share of the total amount paid by customers. In other news, the yoy rate of CPI inflation rose to 0.6% in September from 0.3% yoy in August.

South Korea: The Bank of Korea kept its policy rate unchanged at 0.75%, in line with consensus. However, two policymakers dissenting in favor of a second consecutive 25bps hike. The unemployment rate rose 0.2% to 3.0%, mostly due an increase in the labour force, in line with consensus. The yoy rate of export and import prices rose 20.2% and 26.8% respectively. In corporate news, car manufacturer Hyundai plans to invest USD 7.4bn in electric vehicle plant in the US, but the project is pending approval of the infrastructure bill in US Congress.

Thailand: The government announced vaccinated travellers from 22 countries that represented 85% of all tourism revenue in 2019 would not have to quarantine when entering the country. The Phuket pilot project saw most tourists coming from the US, UK, Israel, Germany, France, the UAE and Switzerland. However, China still imposes quarantines to Chinese residents returning from other countries. Chinese tourists accounted for 28% of Thailand`s tourism revenues in 2019.

Turkey: Industrial production rose 5.4% in August from 3.4% in July, surprising consensus to the upside. The TRY was the worst performing currency across EM last week after President Recep Tayyip Erdogan dismissed three directors from the Central Bank of Turkey (CBT) and appointed two new members. The move consolidates power under current Governor Sahap Kavcioglu as one of the dismissed directors – Semih Tümen – was a contender to the post of governor of the CBT.

Snippets:

- Argentina: CPI inflation increased to 3.5% (mom) in September from 2.5% in August, above consensus as the Greater Buenos Aires inflation rose to 3.8% from 2.6% over the same period.

- Colombia: The yoy rate of retail sales, manufacturing production and industrial production (IP) rose to 32.0% (from 26.9% yoy), 22.9% (from 20.1% yoy) and 15.5% (from 13.5%) respectively.

- Czech Republic: The yoy rate of CPI inflation rose 0.8% to 4.9% in September, 0.3% above consensus. The current account deficit widened to CZK 37.8bn in August from CZK 19.5bn

- Egypt: The yoy rate of CPI inflation rose to 6.6% in September from 5.7% in August.

- Malaysia: The yoy rate of IP improved but remained negative at -0.7% in August from -5.1% yoy in July.

- Peru: The yoy rate of economic activity index softened 1.1% to 11.8% in August while the Lima unemployment rate rose 0.5% to 10.0% in September.

- Philippines: The trade deficit was unchanged at USD 3.6bn in August, slightly higher than consensus and foreign exchange remittances declined USD 0.25bn to USD 2.6bn (slightly below consensus)

- South Africa: Manufacturing production increased 0.5% in August from -0.6% in July, boosting the yoy rate to 1.8% from -4.8% yoy over the same period. Retail sales increased 4.9% in August after declining 11.1% in July as the yoy rate of mining production growth decelerated to 2.0% in August from 12.3% yoy in July.

- Uruguay: Finance Minister Azucena Arbeleche said multilateral financial institutions should offer cheaper loans for countries that implement strong environment policies. The yoy rate of IP softened 4.7% to 14.0%.

Global backdrop

Coronavirus: The number of Covid-19 cases declined to 51 cases per million on a global basis, from 84 at the peak of the third wave. Cases declined further in South America, North America and Asia. However, cases per million have been rising since 20th September in Europe due to higher mobility and low vaccination rates in a few Eastern European countries.

The world health organisation (WHO) said individuals over 60-years old vaccinated with the Sinovac or Sinopharm vaccines should receive a third dose ‘booster’ shot, moving away from its original position or discouraging third shots in lieu of providing vaccines to low income countries.3 The fact that low-income countries still have not vaccinated even front-line workers on healthcare and education represents a massive global failure, primarily due to the selfishness of high income economies that hoarded a much larger number of shots than needed to immunise their populations. China and Russia were the only countries that actually avoided hoarding vaccines and provided shots to medium-income countries at the same time that they vaccinated their populations.

United States (US): CPI inflation rose by 0.4% in September, increasing the yoy rate by 0.1% to 5.4% in September, while core CPI was unchanged at 4.0% yoy. The sub-components of inflation showed price pressures are spreading, with new cars (3.8% of the index), energy (7.3%), food (14.9%) and housing (41.6%), rising between 0.5% and 1.3% in September while used cars (3.4%) and apparel (2.7%) prices declined.

The minutes of the federal open market committee (FOMC) confirmed most participants agreed to lower the pace of the asset-purchasing program (QE) by USD 15bn (USD 10bn US treasuries and USD 5bn mortgage-backed securities) per meeting starting in November and ending QE by mid-2022. Atlanta Fed Raphael Bostic positioned himself as a strong contender to the Chairman position next year by shunning the ‘transitory’ thesis in a speech last week. Bostic said “data from multiple sources” suggests the intense and widespread supply chain disruptions will last longer than most thought.4 The overnight index swap (OIS) is now pricing the first interest rate increase by November 2022. The yield curve flattened last week as 2yr bonds rose 10bps to 0.41% and 10yr bonds declined 1bps to 1.59%. The real interest rates priced in the 5-year swap curve starting in 2026 declined 17bps to -0.29%.

In corporate news, Bloomberg reported Apple is likely to slash its projected iPhone 13 production targets for 2021 by as many as 10 million units (from 90m original estimated).5 Smartphones are a large and important supply chain, which so far have relatively avoided supply shortages.

Eurozone: The President of the ECB Christine Lagarde said inflation expectations remained anchored and she saw no evidence, so far, of second round effects through wages, signalling policy support will not be removed prematurely. On the other hand, Klass Knot (one of the most hawkish governing council member) said supply side problems and “stronger domestic wage-price dynamics” add short and medium term consumer inflation upside risks. Knot added it would not be “proportional to use asset purchases to actively strive for an overshoot” of the inflation target. In contrast to the Fed, the ECB signalled they might tolerate, but not pursue, an inflation overshoot.

Japan: Core machine orders declined 2.4% in August after rising 0.9% in July. The yoy rate of PPI inflation rose to 6.3% in September, 0.5% higher than both August levels and consensus.

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See ‘EM 2021 real GDP growth revised higher’, Market Commentary, 6 August 2021.

2. See http://www.qstheory.cn/dukan/qs/2021-10/15/c_1127959365.htm

3. See https://www.washingtonpost.com/world/2021/10/12/sinovac-sinopharm-third-dose/

4. See https://www.atlantafed.org/news/speeches/2021/10/12/bostic-the-current-inflation-episode.aspx

5. See https://www.bloomberg.com/news/articles/2021-10-12/apple-poised-to-slash-iphone-production-goals-due-to-chip-crunch?sref=QY7kFAuy