The IMF has kept its global economic growth forecast for 2022 unchanged at 3.2% but highlighted better EM growth. Russia aims at Ukraine infrastructure. Brazil had the third consecutive month of deflation. China’s 20th Party Congress started Sunday as Xi Jinping’s speech highlighted quality economic development, security concerns and reunification. Hungary hiked its effective policy rate to 18%. India CPI came slightly lower than expected.

International Monetary Fund (IMF) World Economic Outlook

The IMF WEO report acknowledged the challenges faced by the world’s largest economies today, including the cost-of-living crisis and the global slowdown in 2H 2022 and 2023 because of the ongoing monetary policy tightening and the supply shock in energy and food prices from the Ukrainian war.

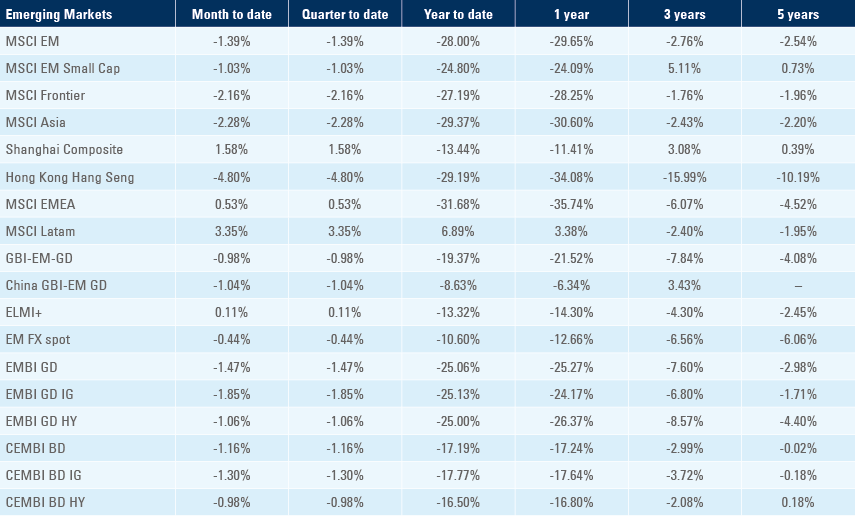

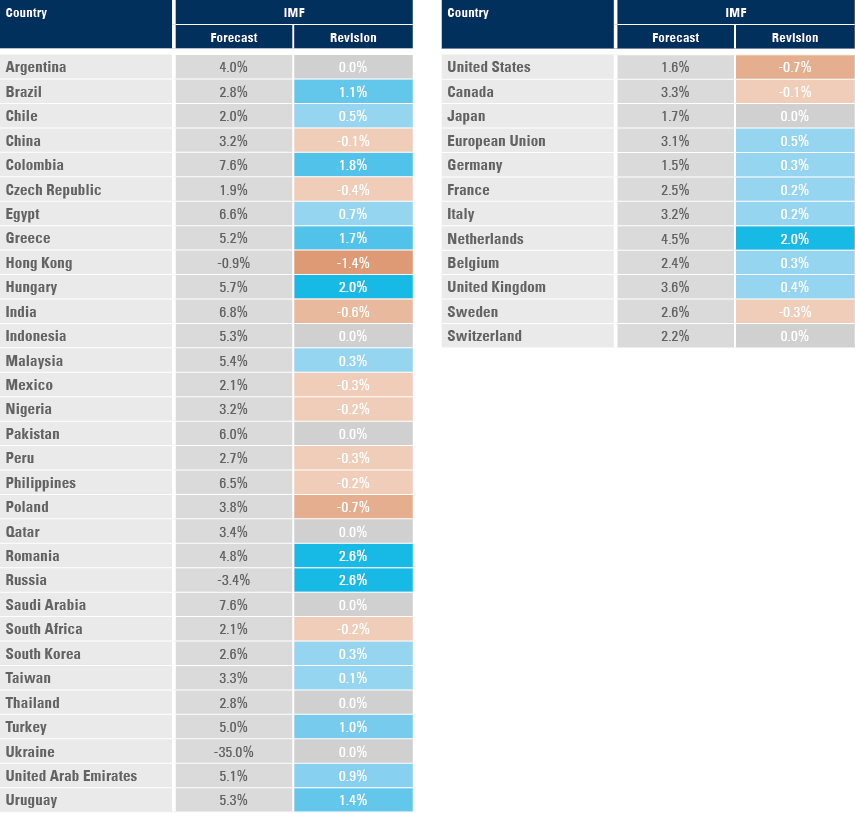

The outlook for global growth in 2022 was unchanged at 3.2%, but the IMF revised developed world (DM) GDP growth down by 10bps to 2.4% (led by the US) and Emerging Markets (EM) up 10bps to 3.7%. The global economy is expected to slow by 50bps to 2.7% in 2023 as DM growth declines to 1.1% (-30bps vs July) and EM remains unchanged at 3.7% (-20bps vs. July). The comparison of Q4 2022 over Q4 2021 on table 1.1 of the main document highlights the large upward revisions to EM growth (+0.4% to 2.5%yoy) and downward revisions to DM growth (-0.4% to 0.9% yoy).1

In EM, the IMF GDP growth forecast rose the most in Latin America, Middle East, and some Eastern European countries with the largest upside reviews from Romania, Russia, Hungary, Colombia, Greece, Uruguay, Brazil and Turkey and key downside reviews from Hong Kong, Poland, and India. More than one-third of a group of 31 key economies in Emerging Markets is expected to grow more than 5.0% in 2022 while only three economies (Hong Kong, Russia, and Ukraine) are likely to see negative GDP growth as per figure 1. Furthermore, GDP growth was revised significantly lower in the United States, but higher across most European countries. The better growth scenario for large Latin American countries explains the good performance across regional assets as the MSCI Latin America is up 6.9% year-to-date. Latin America benefits from neutral status to current geopolitical conflicts, positive terms of trade and sound macroeconomic policies as most central banks in the region started to adjust their monetary policy in H1 2021 while their fiscal numbers have outperformed most expectations due to a combination of higher inflation, better economic growth and efforts to consolidate the deficits.

Figure 1: IMF 2022 Growth forecast

The key challenge within EM is on the Frontier countries that have grown dependent on Eurobond and other foreign creditors to finance their debt and have not undertaken structural reforms or fiscal consolidation. The IMF has been advocating for larger haircuts on debt restructuring after neither Argentina nor Ecuador were successful at regaining market access post their 2020 debt restructuring processes with virtually no principal haircut. This is largely priced with Zambian sovereign bonds trading at close to USD 40c and Ghana Eurobonds around USD 35c of their face value. Kenya and Nigeria need sound structural reforms to achieve the same status, while better managed countries such as Ivory Coast, or countries that did implement a solid fiscal consolidation – Angola – stand a better chance of regaining market access once risk premium recedes in global assets. The contrast between Frontier economies allows for significant opportunities to capture relative value across the asset class, but the levels of distress in asset prices already makes for an interesting opportunity for long term investors, in our view.

Geopolitics

The Russian military increased the attacks on civilians and key infrastructure in Ukraine, targeting as much as one-third of the country’s electricity generation to undermine the population’s morale ahead of the winter. President Zelensky continuously requested anti-aircraft weapons to deal with the challenge. Several attacks have been conducted by hundreds of Iranian-produced drones. The new strategy suggests Russia is likely to extend the war through the winter, and the damages will make it more challenging and costly to rebuild Ukraine.

Emerging markets

Brazil: CPI inflation declined by 0.3% mom in September, the third consecutive month of deflation, in line with consensus as the yoy declined 150bps to 7.2%. Communication, transportation, and food prices were the main contributors to deflation, but all core metrics decelerated on a seasonally adjusted monthly basis as inflation is likely to decline below 6.0% until year-end, almost half the consensus until a few quarters ago.

China: The 20th Party Congress started on the 16 October in Beijing. Xi Jinping’s opening remarks highlighted economic development based on common prosperity remained a priority but added emphasis on security and reunification with Hong Kong and Taiwan. Xi defended the zero covid-19 policies, giving no signs of a faster reopening. On security, the speech mentioned China would “strive for peaceful reunification” (of China, Hong Kong, and Taiwan) but pledged “never promise to renounce the use of force and reserve the option of taking all measures necessary”. Xi added that “the wheels of history are rolling on towards China’s reunification and the rejuvenation of the Chinese nation. Complete reunification of our country must be realised.”

In economic news, aggregate financing rose to RMB 3.5trn in September from RMB 2.4tn in August as new yuan loans doubled to RMB 2.5trn over the same period. The yoy rate of PPI inflation dropped by 140bps to 0.9% in September while CPI inflation rose 30bps to 2.5% yoy, both 10bps below consensus.

Hungary: CPI inflation jumped to 4.1% mom in September from 1.8% in August, taking the yoy rate up 450bps to 20.1% over the same period, 30bps above consensus. The central bank offered 18% deposit rates on 1-day deposits – an effective 500bps hike – to anchor the HUF amidst a sharp deterioration in inflation, fiscal balance, and the external accounts.

India: The yoy rate of CPI inflation rose 40bps to 7.4% in September, in line with consensus, but wholesale prices declined by 170bps to 10.7% yoy in September, significantly better than 11.3% consensus. The trade deficit narrowed to USD 25.7bn in September from USD 28.0bn in August, slightly better than consensus.

Snippets

- Argentina: CPI inflation rose 6.2% mom in September from 7.0% in August, 50bps below consensus, but the yoy rate still rose by 450bps to 83.0%

- Chile: The Central Bank of Chile hiked its policy rate by 50bps to 11.25% and signalled the end of the hiking cycle after a cumulative 10.75% increase in policy rate.

- Colombia: The yoy rate of industrial production rose by 280bps to 7.1% in August and manufacturing production rose by 390bps to 9.1% over the same period.

- Czechia: CPI inflation rose 0.8% mom in September from 0.4% mom in August and 0.2% consensus, taking the yoy rate up 80bps to 18.0%.

- Egypt: The yoy rate of CPI inflation rose 40bps to 15.0% in September as core CPI rose 130bps to 18.0% over the same period.

- Indonesia: Consumer confidence declined 7.5 points to 117.2, but local auto sales improved 3k to 100k in September.

- Malaysia: The yoy rate of industrial production rose 110bps to 13.6% in August, significantly better than consensus at 10.2% yoy as the value of manufacturing sales rose 60bps to 24.4% yoy over the same period.

- Mexico: Nominal wages rose by a yoy rate of 8.2% in September form 5.0% yoy in August. Industrial production rose to a yoy rate of 3.9% in August from 2.6% yoy in July as manufacturing production improved to 8.1% from 5.1% over the same period, both significantly above consensus.

- Philippines: The trade deficit was unchanged at USD 6.0bn in August, slightly better than consensus.

- Poland: The trade deficit widened to EUR 2.9bn in August from EUR 1.9bn in July, more than twice the level of consensus expectations.

- Romania: CPI inflation rose to 1.3% mom in September from 0.6% in August, taking the yoy rate up 60bps to 15.9%, 50bps above consensus. GDP growth slowed to 1.8% qoq in Q2 2022 from 2.1% in Q1 2022, taking the yoy rate down 20bps to 5.1%.

- South Africa: Manufacturing production rose 2.1% mom in August from -0.1% in July, significantly better than consensus.

- South Korea: The Bank of Korea hiked its policy rate by 50bps to 3.0%, in line with consensus.

Developed markets

United States: Higher than expected inflation led to a sharp increase in US stocks volatility last Thursday and Friday. CPI inflation rose to 0.4% mom (0.2% consensus) in September after rising 0.1% mom in August as the yoy rate declined by only 10bps to 8.2%. The main culprits were food prices and shelter. Gasoline prices and used cars declined. US CPI inflation remains buoyed by food and shelter prices. PPI inflation rose 0.4% mom (0.2% consensus) and 8.5% yoy while core CPI rose 0.6% mom in September, the same level as August, taking the yoy rate up 30bps to 6.6%.

United Kingdom: Prime Minister Liz Truss fired her friend and trusted ally Kwasi Kwarteng as Chancellor of the Exchequer and appointed Jeremy Hunt in his place. Hunt is seen as a “safe pair of hands” by the top echelon of the Conservative Party and has pledged to move towards a more orthodox fiscal policy and normalise the relationship with the Bank of England. His main challenge will be to approve policies to increase tax and cut expenditures to bring debt to a declining path over the next years. Members of Parliament of the Conservative Party spent the weekend debating alternatives to replace Liz Truss as Prime Minister within the coming weeks, breaking a key rule of the “1922 committee” that determines a minimum period of one year between party leadership elections. A scenario where the party becomes “ungovernable” cannot be discarded after Theresa May, Boris Johnson and now Liz Truss failed to find a new motto for Britain post-Brexit. The silver lining in the crisis is that Britain’s next governments are likely to return towards an orthodox fiscal path, an encouraging development for global financial stability, in our view.

Europe: The Euro area seasonally adjusted trade deficit widened to EUR 47.3bn in August from EUR 40.5bn in July, EUR 2.3bn more than consensus. Industrial production rose 1.5% mom in August after declining 2.3% in July.

Japan: The yoy rate of PPI inflation rose 70bps to 9.7% in August, 80bps above consensus. The Bank of Japan signalled it will keep its loose monetary policy despite the sharp 22.5% depreciation of the Yen year-to-date to 148.5 – the lowest level since July 1990 and the lowest historical level in real terms since the 1970s.

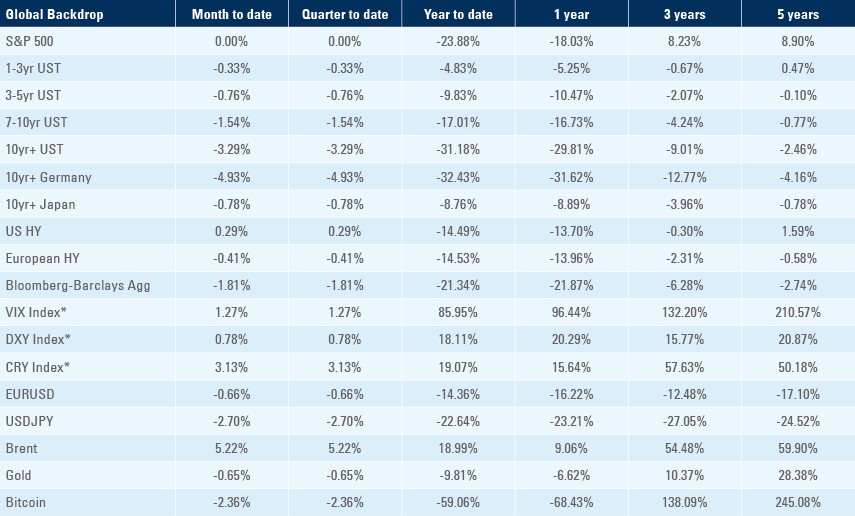

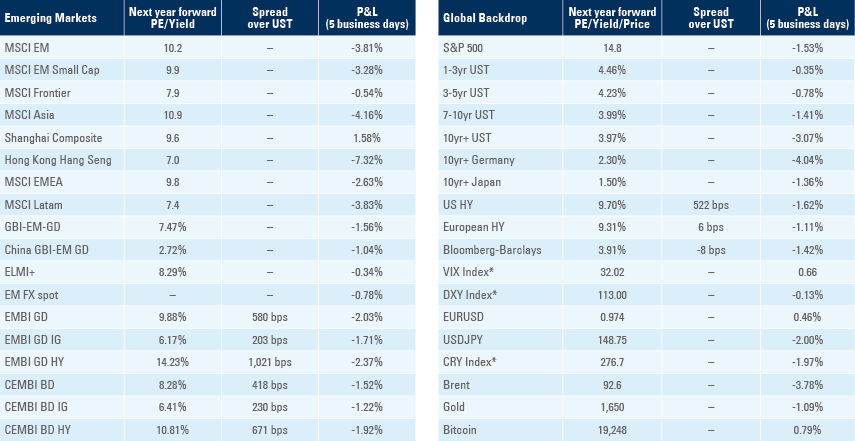

Benchmark performance