Hopes of a peace deal for Ukraine and a policy response in China push equities sharply higher from over-sold levels

The Chinese leadership addressed financial stability concerns as economic activity surprised to the upside. South Korean exports remained solid in the 20 days of March. Brazil hiked its policy rate by 100bps to 11.75%. Russia paid the coupon on its USD-denominated debt, despite economic sanctions. The war in Ukraine deteriorated as Russia utilises hypersonic missiles and regroups to attack Kyiv. Egypt devalued the EGP by c. 10% and announced it is willing to freeze bread prices amidst a sharp increase in wheat prices. The Gulf Cooperation Council (GCC) central banks hiked policy rates by 25bps, in line with the Fed. Sri Lanka’s president said it would pursue a deal with the IMF. S&P cut Peruvian sovereign rating to BBB and Turkey kept its policy rate unchanged at 14.0%.

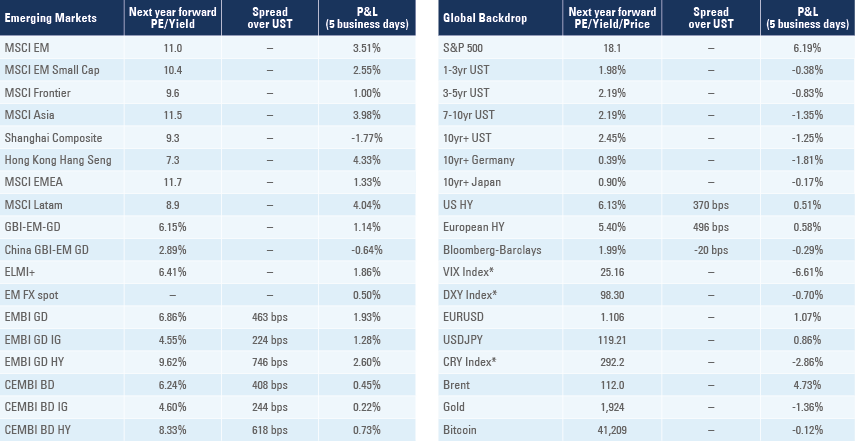

Emerging markets

China: Premier Liu He addressed financial stability concerns, saying monetary policy should be actively used to boost Q1 2022 economic growth and maintain steady growth in new loans adding that government agencies should coordinate with financial regulators on policies impacting capital markets and be “very cautious” on contractionary policies. The verbal intervention is important as it signals investors that China’s policymakers are wary of causing any further damage to Chinese assets. Equities responded with a sharp rebound from oversold levels taking the MSCI China up 13.7% last week, outperforming the MSCI World, which rose 6.5%. In the property sector, China announced the property tax pilot programme is will not be rolled-out in 2022 and said they would crack down on malicious short-selling activities. Economic data was significantly better than consensus in February as the yoy rate of industrial production declined 2.1% to 7.5%, fixed asset investments surged to 12.2% yoy from 4.9% yoy. Retail sales declined 5.8% to 6.7% yoy, however. In other news, President Xi Jinping said China should adopt more targeted and precise tools to prevent covid-19 infections while minimising the economic costs. Despite high level of infections, Shenzhen reopened multiple districts last Friday, 3 days earlier than planned, and allowed many companies, including Foxconn, to restart production.

South Korea: Exports rose by a yoy rate of 26.4% in the first 20-days of March after adjusting for business days, from 17.0% yoy in February as imports rose to 36.5% yoy from 17.0% yoy over the same period. The unemployment rate plunged 0.9% to 2.7% in February, the lowest level since the start of the series in 1999. The massive increase in employment was due to the resumption of the government elderly job program which is budgeted to provide 845k jobs in 2022 (2.9% of the labour force)

Brazil: The Brazilian Central Bank (BCB) hiked its “Selic” policy rate by 100bps to 11.75%, in line with consensus, but less than was priced in for by the market. The BCB highlighted that the higher inflationary pressures coming from commodity shocks are likely to demand tighter monetary policy ahead, which effectively extends the cycle. Economic activity declined 1.0% in January after rising 0.3% in December, surprising consensus to the downside.

Russia: On March 16th Russia paid a US dollar 117 million coupon due on two Eurobond issues to its correspondent bank, and the paying agent was able to process the payment into bondholders’ bank accounts. The Central Bank of Russia granted Sberbank a licence to issue and exchange digital financial assets, likely a step designed either to evade sanctions or to allow trade settlement between sanctioned companies and parties willing to trade with Russia, but afraid of secondary sanctions. The Central Bank kept its policy rate unchanged at 20%, in line with consensus. In economic news, the trade surplus declined to USD 21.2bn in January from USD 26.7bn in December, slightly below consensus. Australia imposed sanctions on exports of alumina and aluminium. Russia imported 20% of its alumina from Australia, and the sanction limits its ability to manufacture and export aluminium.

Ukraine: Although the discussions between Russia and Ukraine allegedly made progress during the week, the situation on the ground deteriorated further as Russia used its Kinzhal hypersonic missile (which travels 5 times faster than the speed of sound) for the first time to hit an underground ammunition storage facility. President Zelensky invoked Pearl Harbour in a live broadcast to the US parliament and accused Germany of doing too little to hold the Russians away from Europe. Ukraine approved a crypto bill to deploy digital donations that have been made to the country.

Egypt: The Egyptian central Bank announced a surprise 100 basis points increase in its EGP deposit and lending rates to 9.25% and 10.25% respectively, citing global inflationary pressures. This was the central bank’s first hike since 2017. At the same time, the central bank’s statement also stressed “the importance of the exchange rate flexibility to act as a shock absorber to preserve Egypt’s competitiveness”, and EGP FX rates were quoted c. 11% weaker overnight. President Abdel Fattah El-Sisi announced the intention to freeze bread prices to avoid social unrest amidst the sharp increase in wheat prices. Egypt imports as much as 80% of wheat from Russia and Ukraine. The country is working to secure alternative sources and boost local production.1 The government agreed to increase direct flights between Tel Aviv and Sharm el-Sheikh to compensate for the loss of Russian tourists.2 The increased proximity between Egypt and Israel is a long-term development for the country and the region.

Gulf Cooperation Council (GCC): Five out of six GCC countries hiked their policy rates by 25bps to 0.5%, in line with the Fed. Oman often lags on its policy decision, but is likely to follow the Fed. The GCC imports their monetary policy due to the currency peg and are likely to tighten monetary policy by a lesser extent than if monetary policy was independent, considering the low levels of inflation across the region (Saudi Arabia’s inflation is only 1.6% yoy).

Sri Lanka: President Gotabaya Rajapaksa said the government started negotiations with the International Monetary Fund to resolve the current external crisis. In the example of Ecuador, the programme was finalised only after 6-months and a suspension on external debt repayments was agreed with bondholders. Sri Lanka’s debt to GDP is likely to exceed 130% after the recent currency devaluation, as a significant share of the debt, USD 51bn or c. 60% GDP, is comprised of external debt. The government is running a sizeable 4-5% primary fiscal deficit, which is likely to demand a significant and challenging adjustment.

Peru: The rating agency S&P cut Peru’s sovereign debt rating by one notch to BBB with a stable outlook, citing political instability undermining investor’s confidence and growth outlook. The opposition-led Congress voted 76-41 to start proceedings on a second impeachment trial of president Castillo in eight months. Lawmakers will eventually need 87 votes to dismiss the president. In economic news, the yoy rate of economic activity for January rose 1.2% to 2.9% yoy, in line with consensus.

Turkey: The Central Bank of Turkey (CBT) kept its policy rate unchanged at 14.0%, in line with expectations. The CBT mentioned the “lira-lisation” will be strengthened, which probably means they will encourage more FX-hedged TRY deposits in the system. Finance Minister Nureddin Nebati raised the idea of issuing FX-hedged TRY deposits to foreign investors, which de-facto increases the country’s foreign exchange liabilities at a time when the economy has to cope with a significant exogenous shock from higher imported energy costs and lower tourism revenues (8 million tourists from Russia and Ukraine were expected in 2022). Turkey continues to issue Eurobonds and using its proceeds to defend the TRY. Last week Turkey issued a USD 2bn Sep-2027 bond at 8.625% yield, paying a higher credit risk premium than Nigeria that issued a USD 1.25bn Mar-2029 bond at 8.375% on the same day.

Snippets

- Argentina: CPI inflation rose 4.7% mom in February from 3.9% mom in January, reaching 52.3% yoy

- Czech Republic: The yoy rate of retail sales rose to 4.8% in January from 1.4% yoy in December, significantly below consensus.

- Colombia: The yoy rate of retail sales rose to 20.9% in January from 16.0% yoy in December, 180bps above consensus as manufacturing production rose 2.0% to 15.1% over the same period. The trade deficit widened to USD 1.7bn in January from USD 1.3bn in December.

- Hungary: The National Bank of Hungary kept its 1-week repo rate unchanged at 5.85% last week as oil prices declined and the HUF stabilised.

- India: The yoy rate of CPI inflation rose 0.1% to 6.1% in February broadly in line with consensus, while wholesale price index rose 0.1% to 13.1%.

- Indonesia: Bank Indonesia kept its policy rate unchanged at 3.5%, in line with consensus, and vowed not to overreact to higher energy prices, until second-round effects become clearer. The trade balance for February improved to USD 3.82 from 0.93 in January.

- Kenya: The World Bank approved a USD 750m loan to accelerate the post-pandemic economic recovery.

- Malaysia: The trade surplus widened to MYR 19.8bn in January, in line with consensus.

- Nigeria: The yoy rate of CPI inflation rose 0.1% to 15.7% in February, in line with consensus.

- Poland: The yoy rate of CPI inflation declined 0.9% to 8.5% in February, 20bps above consensus, while core CPI inflation rose 0.6% to 6.7%, some 40bps above consensus.

- Romania: The yoy rate of CPI inflation rose 0.1% to 8.5% in February, 40bps below consensus. The yoy rate of industrial output rose to 1.1% in January from -1.1% yoy in December, significantly above consensus. The trade deficit narrowed to EUR 2.1bn in January from EUR 2.3bn in December.

- South Africa: The yoy rate of retail sales rose to 7.7% in January from 3.2% yoy in December, significantly above consensus.

- Taiwan: The Central Bank of Taiwan hiked its policy rate by 25bps to 1.375%, whilst consensus expectations was set at unchanged.

Global backdrop

United States: The Federal Reserve hiked its policy rates band by 25bps to 0.25% - 0.50%, in line with consensus, with one director voting for a 50bps hike. The median forecast implies 7 increases of 25bps in the Fed Funds rates in 2022 and 3 increases in 2023, implying a terminal rate of 2.75%, but more than half the participants favour more than 7 hikes this year, increasing the odds of a 50bp hike later in the year. Growth forecast declined 1.2% to 2.8% and inflation forecast (core PCE) rose 1.4% to 4.1% in 2022 while unemployment rate was unchanged at 3.5%. The statement also mentioned the Fed would start unwinding its balance sheet (QT) in the coming meetings, which probably means as early as May. Chairman Jerome Powell stroke a hawkish tone on the press conference following the meeting, while two voting members said they would consider 50bps for the following meetings as Bullard dissented as he would like to announce a QT path. Despite the hawkish tone, it is our opinion that the Fed remains woefully behind the curve and started to tighten policy when the global economy starts to slow down as reflected by declining purchasing manager’s surveys.

In economic news, the Empire Manufacturing survey dropped to -11.8 in March from 3.1 in February, the lowest level since March 2020, while the Philadelphia Fed business survey rose 11.4 points to 27.4 – neither indicators are reliable predictors of the nationwide manufacturing surveys. The yoy rate of PPI inflation was unchanged at 10.0% in February, while industrial production rose 0.5% mom in February, from +1.4% mom in January.

Europe: The ZEW survey of economic expectations for Germany plunged by 95 points to -39.3 in March from 54.3 in January, the biggest monthly drop in its 30-year history, sending the indicator to the lowest level since Mar-2020 as a result of the war in Ukraine. The survey is conducted among financial markets participants, so it historically reflects the mood in capital markets better (strong correlation with stocks) than the mood among real economy participants, where the IFO does a better job. The yoy rate of CPI inflation was revised higher by 0.1% to 5.9% in February

United Kingdom: The Bank of England (BoE) hiked its policy rate by 25bps to 0.75%, in line with consensus. The BoE said inflation may surpass 10% due to the situation in Ukraine. In economic news, the unemployment rate dropped 0.2% to 3.9% in January.

Japan: The Bank of Japan (BoJ) kept its policy rate unchanged at -0.1%, the 10-year bond yield target around 0%, and the size of its asset purchases unchanged. BoJ Governor Kuroda is comfortable about the recent increase in inflation as its mainly resulting from an exogenous shock leading to higher commodity prices. Industrial production dropped 0.8% mom in January after -1.3% in December.

Australia: The unemployment rate declined 0.2% to 4.0% in February, as 77k jobs were created in February after 28k in January.

Canada: The yoy rate of CPI inflation rose by 0.6% to 5.7% in February, 20bps above consensus.

Commodities: The London Metals Exchange (LME) re-established nickel trading last week with prices dropping to the initial daily limits of 5% and 8% on Thursday and revised to 12% Friday.

The bond prices of commodity trading companies have declined sharply and their credit default swap spreads widened over the last weeks. Trading companies are levered entities that transact in physical commodities with very tight margins; several of the transactions involve purchasing physical commodities and hedging it via futures prior to sales. A priori, this transaction has zero exposure to commodity price oscillations, but in practice, trading companies would have to deposit margin if the future contract moved against its position in the exchange. Reports of trading companies negotiating capital injection and loans from private equity funds are evidence of the liquidity stress. Last week the European Federation of Energy Traders formed by the largest trading houses, oil companies and utilities, wrote a letter pleading for emergency liquidity support from central banks, a sign that several entities are facing simultaneous liquidity stress.3

Commodity producers also often hedge their future sales in the exchange, and sharp increases in prices drive margin calls, hence the liquidity squeeze in the sector. The main risk lies in large positions that would match multi-year commodity production, or worse, short positions against the purchase of Russian cargo, which may no longer be “shippable”, forcing the trader to cover its short exposure in the market at a loss that is larger than the trader can absorb in its balance sheet. The failure of small trading company would not represent a systemic event, however, if a large or several trading companies fail, it would significantly disrupt the global commodity flows, with important implications for the global commodity markets.

3. See https://twitter.com/JavierBlas/status/1504182020649504775/photo/1