Inflation surprised to the upside in the United States (US) and Europe but remains subdued across Asia and seems to have peaked in South America. Central banks will soon realise that the current level of interest rates and tightening of financial conditions amidst a supply shock from higher commodity prices could bring the world dangerously close to recession, and they could back track from hiking, but we are not yet at this stage. Argentina, Brazil, and South Africa had better economic data than expected. Chinese markets outperforming despite Covid-19 reopening challenges. Chile, Peru, Poland, and India hiked policy rates. Nigeria’s 2023 presidential elections shape up and Pakistan cut subsidies further while Turkey persists in making policy mistakes.

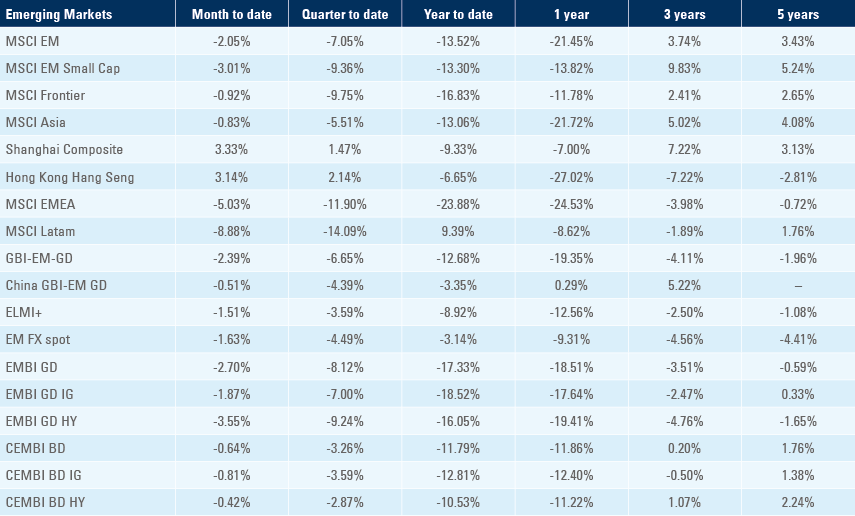

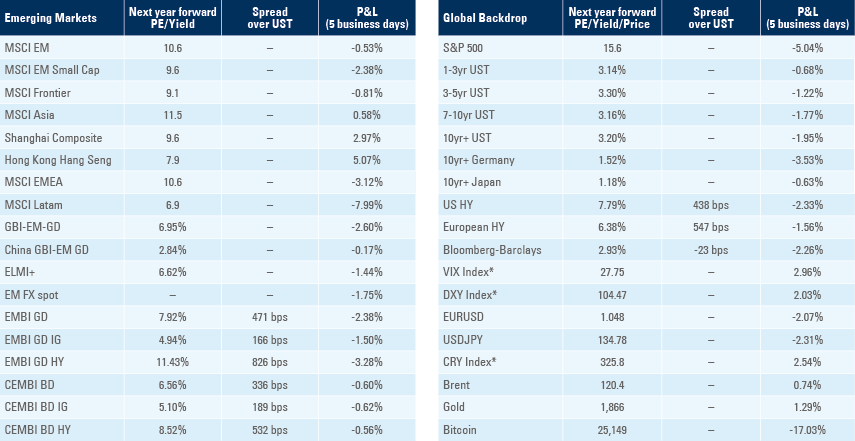

Emerging markets

Russia-Ukraine: The Ukrainian defences in Donbas are still overwhelmed by the larger artillery capacity from Russia as 200 casualties a day are demoralising Ukrainian troops.

Citibank estimated the value of commodities consumed will double to USD 12.5trn in 2022 (13.5% of GDP) from USD 6.2trn in 2019 (7.1% of GDP). Even though the current increase in energy and commodity prices are inferior to the 1970s, lower nominal GDP growth means the global spending on commodities as percentage of GDP is already above the levels after the first commodity shock in 1973 and approaching the c. 15.5% of GDP peak in 1980. Russia is likely to use the current energy and food crisis to undermine the West’s ability to unite the world against the country in retaliation for the aggression in Ukraine. The Pakistani Finance Minister said his country will start conversations with Russia to import wheat. With the risk of a multi-year energy and food crisis looming, Niall Ferguson’s case for a détente policy (not appeasement) with Russia makes sense, in our view.1

The Central Bank of Russia cut its policy rate by 150bps to 9.5% (consensus 100bps) and updated its CPI forecast range to between 14% and 17% in 2022 and 5% to 7% in 2023. The yoy rate of CPI inflation dropped 70bps to 17.1% in May and core CPI dropped 50bps to 19.9% yoy. Russian foreign exchange (FX) reserves dropped to USD 587.4bn in May from USD593.1bn in April and USD 630.6bn in December, while Ukraine FX reserves dropped to USD 25.1bn in May from USD26.9bn in April and USD 30.9bn in December.

Argentina: The IMF reached a staff-level agreement on the first review of Argentina’s programme after all quantitative targets were met in Q1 2022 and initial progress was observed on growth-enhancing reforms envisaged by the programme. Argentina will have access to c. USD 4.0bn upon completion of the review. In testament to better economic performance, the World Bank increased Argentina’s 2022 real GDP growth estimates to 4.5% from 3.6%. In political news, President Alberto Fernandez’s approval rating dropped to 35.4% from 38.5% a month ago. The poll also found that 70% of the respondents disapproved of his economic policies. The yoy rate of industrial production rose 110bps to 4.7% in April as construction activity rose 690bps to 8.8% yoy.

Brazil: CPI inflation dropped to 0.5% mom in May from 1.1% mom in April and 1.6% mom in March, taking the yoy rate of inflation to 11.7%, 20bps below consensus and 40bps below April levels. President Bolsonaro said it would present a constitutional amendment to increase the tax cuts on energy items, zeroing government tax on fuel and electricity and compensating states for revenue loss on diesel and cooking gas. If all measures are approved, the economic team at Itaú, a bank, estimate the annual fiscal cost around BRL 168bn (1.7% of GDP) and a one-off decline in 2022 CPI inflation of approximately 3.1%. Economic activity surprised to the upside. Retail sales rose 0.9% mom in April after increasing 1.4% mom in March, taking the yoy growth rate to 4.5% while vehicle production rose to 206k in May from 186k in April, almost back to the average production over the last 10 years and exports were unchanged at 46k vehicles. In the labour market, 197k formal jobs were created in April, 23k more than consensus expectations, after 136k in March. In political news, a poll by Poder360 shows former President Luiz Inácio Lula da Silva leading an eventual run-off against incumbent President Jair Bolsonaro by a 10% margin (50% vs. 40%).

China: The yoy rate of CPI inflation was unchanged at 2.1% in May while PPI dropped 160bps to 6.4% yoy. Aggregate financing rose to RMB 2.8trn in May from RMB 0.9trn in April (consensus RMB 2.0trn), but most of the increase was related to short term loans by corporates and government bonds as long-term credit demand from households and corporates remained weak. Exports recovered to a yoy rate of 16.9% (from 1.9% yoy in April) while imports rose 4.1% yoy in May (from 0.0% yoy) leading to a USD 78.8bn trade surplus (USD 57.7bn consensus and 51.1bn prior). The number of Covid-19 cases increased over the weekend with 196 cases recorded Saturday and 143 on Sunday, forcing the city of Beijing to delay the reopening of most schools that was originally planned on 13 June, while Shanghai introduced a weekend lockdown for mass testing. Chinese stocks outperformed last week mostly due to the ongoing relaxation of internet regulations. In geopolitical news, China and the US accused each other of escalating the Taiwan situation and urged the other side to take measures to lower tensions.2

Chile: The central bank hiked its policy rate by 75bps to 9.0%, in line with consensus as CPI inflation declined to 1.2% mom in May from 1.4% mom in April and 1.9% mom in March, lifting the yoy CPI rate by 100bps to 11.5%. The trade surplus narrowed to USD 851m in May from USD 1,071m in April as exports rose to USD 9.29bn from USD 8.43bn (despite copper exports dropping to USD 3.76bn from USD 4.04bn) and imports increased to USD 8.44bn from USD7.36bn over the same period. Nominal wages grew at a yoy rate of 8.0% in April from 7.4% yoy in March.

Czech Republic: CPI inflation was unchanged at 1.8% mom in May, 40bps above consensus, lifting the yoy rate by 180bps to 16.0%. Higher inflation across Central and Eastern Europe contrasts with inflation in Latin America that seems to have peaked and still subdued inflation in Asia, suggesting policy divergence. The yoy rate of export and import price increase rose by 12.6% and 18.4% respectively in April, both slightly below from March. Industrial output dropped by a yoy rate of 6.4% in April (-1.4% yoy in March) as construction rose by 4.0% yoy, down from 8.8% yoy in March, but retail sales ex-auto rose 50bps to 6.2% yoy over the same period.

India: The Reserve Bank of India (RBI) hiked the repurchase (policy) rate by 50bps to 4.9% (consensus +40bps), as it raised its 2023 CPI inflation projection by 100bps 6.7%. The RBI changed the words “remain accommodative” to “to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth”, an ambivalent message aimed at anchoring inflation expectations and aiming to control terminal rates. The yoy rate of industrial production accelerated to 7.1% in April from 2.2% in March, significantly better than 5.0% yoy consensus.

Nigeria: The ruling APC party picked former Lagos state Governor Bola Tinubu as its candidate for 2023 presidential election. He will dispute the election against former Vice President Atiku Abubakar. Both candidates are businessmen close to the traditional political powers in Nigeria and are likely to implement economic reforms, but also viewed as unlikely to fight corruption.

Pakistan: Finance Minister Miftah Ismail said the country would increase fuel prices further to end subsidies after increasing fuel prices by 40% over the past weeks, to meet a key condition to resume the country’s lending programme with the IMF. The new budget envisages narrowing the fiscal deficit from 8.6% of GDP in 2022 (after a large slippage from the 6.3% GDP target due to higher subsidies) to 4.9% of GDP in 2023. On Saturday, Ismail said Pakistan would need to address IMF concerns, particularly increasing direct taxes and lowering fuel subsidies further to reduce the current account deficit before a deal is reached.

Peru: The Central Reserve bank of Peru (CBRP) hiked the policy rate by 50bps to 5.5% in line with consensus. The policy rate remains at a much lower level, both in nominal and ex-post real terms than most Latin American countries, as the CBRP expects inflation to peak in May or June this year and return to the 1.0% - 3.0% target range by around Q2/Q3 2023.

Poland: The National Bank of Poland (NBP) hiked its policy rate by 75bps to 6.0%, in line with consensus. Governor Glapinski said the NBP sees inflation declining towards 6.0% next year and signalled the end of the cycle is near, albeit more hikes are possible should inflation rise more than expected. Polish banks are under pressure to write off in a single quarter the costs of government-proposed mortgage payment holidays until Q4 2023. The central bank estimates banks face close to PLN 20bn (USD 4.7bn) of provisions if all mortgage borrowers decide to request aid, equivalent to slightly more than one year of Polish banks’ profits.

Philippines: The yoy rate of CPI inflation rose 50bps to 5.4% in May, in line with consensus as the unemployment rate declined 10bps to 5.7% in April. In the external sector, the yoy rate of export growth was unchanged at 6.0% in April while imports declined 5% to 22.8% yoy, leading to small decline in the trade deficit to USD 4.8bn from USD 5.0bn in the previous month as foreign exchange reserves declined USD 1.9bn to USD 103.5bn in May.

South Africa: The yoy rate of real GDP growth rose 3.0% in Q1 2022 from 1.7% yoy in Q4 2021, 110bps above consensus. The Q2 GDP is likely to decline after floods in Kwa-Zulu Natal and lower energy supply due to Eskom operational issues. The current account surplus rose 10bps to 2.2% of GDP in Q1 2022 (70bps above consensus) as Q4 2021 surplus was revised higher by 20bps to 2.1% of GDP. Mining production declined 4.3% mom in April after rising 3.2% mom in March, taking the yoy rate down 740bps to -14.9%.

Turkey: Despite inflation running around three-digits, President Recep Tayyip Erdogan said Turkey would continue cutting interest rates claiming the objective is to bring Turkey to have a current account surplus. Erdogan could achieve the objective alongside financial stability by increasing the saving rates across the economy, demanding the Central Bank to do its job independently while the government runs a large fiscal surplus. Alas, despite all evidence that “Erdo-nomics” don’t work, the president shows no signs of capitulation from poor policies and instead is destroying more institutions in the country as the national statistical agency is no longer producing the inflation breakdown per product as inflation spirals out of control. At the same time, instead of using the current crisis to consolidate its key position in the North Atlantic Treaty Organisation (NATO), Erdogan said he cannot let NATO expand saying Sweden is a “nation swarmed by terrorist organisations” and snapping about the “real objective” of NATO’s US bases in Greece.

Snippets

- Colombia: Most polls released over the last week, including the daily poll from FM/GAD3 pollster on 11 June, showed a technical tie in next Sunday’s run-off between Gustavo Petro (47.1% of vote intentions) and Rodolfo Hernandez (47.7%).

- Egypt: CPI inflation declined to 1.1% mom in May from 3.3% mom in April, nevertheless driving the yoy rate up 40bps to 13.5% as core CPI rose 140bps to 13.3% yoy.

- Hungary: The yoy rate of CPI inflation rose by 90bps to 10.4%. Hungary issued USD 2.0bn and EUR 1.0bn in Eurobonds at

- Hungary: The yoy rate of CPI inflation rose 120bps to 10.7% in May, 30bps above consensus.

- Indonesia: The consumer confidence index rose to 128.9 in May from 113.1 in April

- Malaysia: The yoy rate of industrial production declined 50bps to 4.6% in April, 90bps below consensus, as manufacturing sales value declined 70bps to 13.2% yoy over the same period.

- Mexico: The yoy rate of CPI inflation was unchanged at 7.7% in May while core CPI rose 10bps to 7.3%, both broadly in line with consensus. Manufacturing and industrial production data rose more than expected in April as leading indicators point to more acceleration: Vehicle production rose 25k to 275k in May and exports increased 4k to 245k over the same period, both rising above the average of the last 5 and 10-years for the period.

- Romania: The yoy rate of real GDP growth was unchanged at 6.5% in Q1 2022, in line with consensus while CPI inflation declined to 1.2% mom in May from 3.7% mom in April but the yoy rate increased 70bps to 14.5% yoy. Wage inflation increased by 11.4% yoy

- South Korea: The yoy rate of real GDP growth expanded by 3.0% in Q1 22, broadly in line with Q4 21. The current account moved to a balanced position in April after a USD 7.1bn surplus in March, but the balance of goods remained a solid USD 5.3bn surplus (down USD 0.3bn from March)

- Taiwan: The yoy rate of export growth moderated to 12.5% in May (down 630bps) and imports were unchanged at 26.7% yoy. CPI inflation was unchanged at a yoy rate of 3.4% and core CPI rose 10bps to 2.6% yoy in May, in line with consensus, as wholesale price inflation (WPI) rose by 100bps to 16.6%.

- Thailand: The Bank of Thailand kept its policy rate unchanged at 0.5% despite CPI inflation accelerating to 1.4% mom (7.1% yoy) in May from 0.3% mom in April as the yoy rate of core CPI remained subdued, rising only 30bps to 2.3% in May.

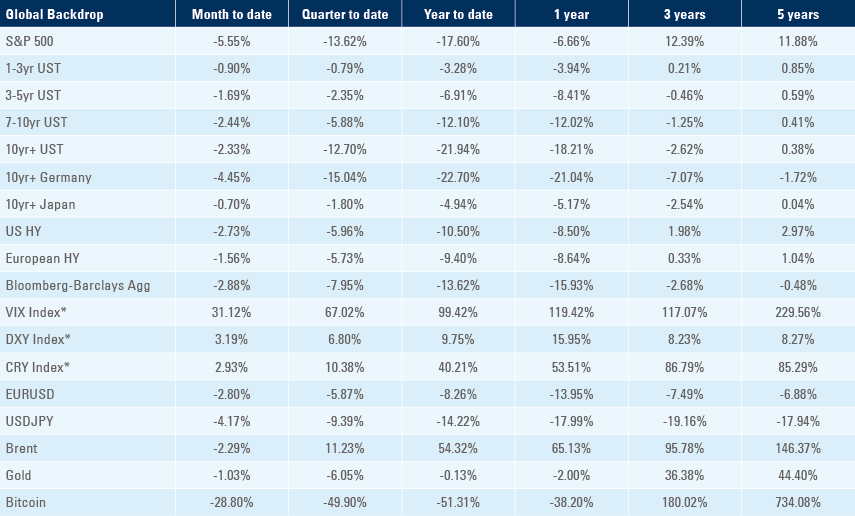

Global backdrop

United States: CPI inflation rose 1.0% mom in May from 0.3% mom in April, 30bps above consensus, bringing the yoy rate up 30bps to 8.6% as core CPI rose 0.6% mom in May (unchanged) and the yoy declined 20bps to 6.0% (5.9% yoy consensus). Real weekly earnings dropped 3.9% yoy in May from -3.4% yoy in April, the lowest level since the beginning of the survey in 2007. Higher inflation and a more hawkish RBA and ECB (see below) led to a strong sell-off in global rates with 2-year US Treasury bonds 41bps higher to 3.06%, the highest levels since 2007 as 10-year UST widened by 22bps to 3.16%, while 30-year mortgage rates widened 33bps to 5.78% - the widest level since 2008. The repo market now prices 262bps of hikes over the next seven meetings, including more than 50bps this week and in July. Despite high inflation, the level of Fed hikes expected by the market is exaggerated, in our view, as economic activity is already faltering due to the tightening of financial conditions. In our view, within the next months it will become clear that to lower inflation significantly amidst the current inertial inflation from the monetary and fiscal excesses of 2020 and 2021 and the food and energy shortage resulting from the war, the Fed would have to adopt interest rate levels that would take the economy to a bad recession just ahead of mid-term elections, which would be inconsistent with the institution’s dual mandate.

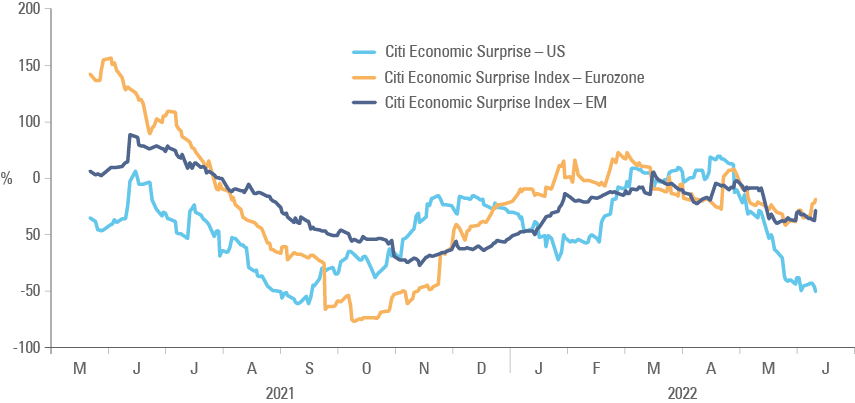

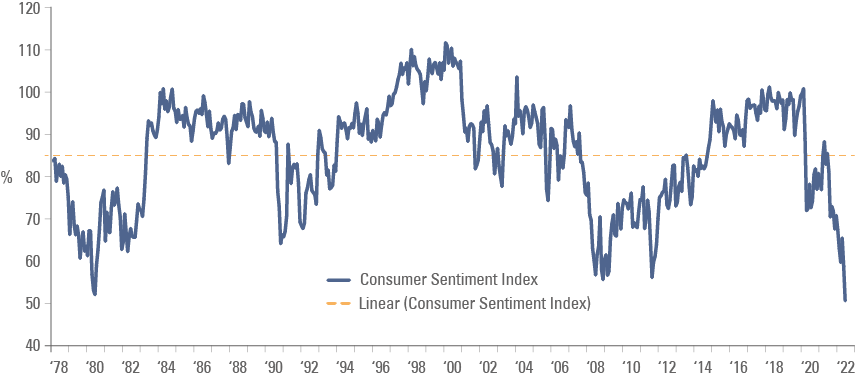

Economic data surprised to the downside for the 8th consecutive week as the Citibank Surprise index dropped another 4.7 to -50.3, in sharp contrast with more resilient economic data than expected across the Eurozone and Emerging Markets as per Figure 1. The University of Michigan consumer confidence sentiment dropped 8.2 to 50.2, the lowest level since the inception of the series in 1978, mostly due to a sharp decline in current economic conditions as per figure 2, while the 5-10 year inflation expectation rose 30bps to 3.3%, the highest level since June 2008. In other economic news, jobless claims rose to 229k in the week ending on the 4 June from 202k in the previous week and the trade deficit narrowed to USD 87.1bn in April from USD 107.7bn in March

Figure 1: Citibank Economic Surprise Index: US, EU, and EM

Figure 2: University of Michigan Consumer Sentiment Index

United Kingdom: Prime Minister Boris Johnson survived a no-confidence vote in parliament but remains in a precarious position as leader of the Conservative Party. A poll conducted by IPSOS on behalf of the Bank of England about the next 12 months inflation expectations found the median population expect 4.6% (from 4.3% in February and 3.2% in November 2021) while the percentage of respondents expecting inflation above 5.0% rose to 39% (from 35% in February and 21% in November 2021.3

Europe: The Governing Council of the European Central Bank (ECB) announced the end of its quantitative easing programmes and said it will hike policy rate by 25bps in July as well as signalling a potential 50bps in September, should inflation remain elevated. This is broadly in line with market pricing, but significantly more hawkish than expected just one month ago. Interestingly, the ECB increased 2022 and 2023 CPI expectations to 6.8% and 3.5%, respectively, upgrading its 2022 estimates in line with median consensus but 2023 90bps above the median, which suggests the bar to increase hikes to 50bps from September is low. At the same time, the ECB said it would reinvest the proceeds of QE to peripheral country bonds in case their spreads widen due to “factors related to the pandemic”, leaving some uncertainty about their ability to contain the widening in periphery spreads. Despite the more hawkish ECB, the EUR sold off 1.9% to 1.052 due to the risk of fragmentation as yields on 10-year Italian bonds widened 36bps last week to 3.76%, whilst 10-year Bunds were 24bps wider to only 1.52% - the widest spread since May 2020. In economic news, the Euro Area Q1 2022 GDP growth was revised up by 30bps to 0.6% qoq or 5.4% yoy, but German factory orders dropped another 2.7% mom in April (consensus +0.4% mom) after plunging 4.2% mom in March, bringing the yoy rate 330bps to -6.2%. Germany industrial production rose 0.7% mom in April (1.2% consensus) recovering from a 3.7% decline in March.

Australia: The Reserve Bank of Australia hiked tis policy rate by 50bps to 0.85%, above consensus expectations for a 25bps hike.

Benchmark performance