The minutes of the most recent Federal Open Market Committee (FOMC) meeting were more hawkish than initially expected. Artificial Intelligence (AI) exuberance has brought Nvidia valuations to extreme levels, but value may yet be found across its Asian supply chain. Flash purchasing manager indices (PMIs) showed softer manufacturing but resilient service sectors. China started to draft new property right laws and environmental, social and governance (ESG) regulations boosted private sector confidence. The International Monetary Fund (IMF) held positive meetings in Argentina, Egypt, and Pakistan. JP Morgan announced it will re-weight Venezuela into its flagship Emerging Market (EM) bond funds from April. Angola’s oil production ticked up post OPEC+ exit. The United Arab Emirates (UAE) announced a massive USD 35bn tourism development investment in Egypt.

Global Macro

The FOMC minutes from its January meeting were marginally hawkish. The staff of economists at the US Federal Reserve (Fed) see financial conditions as tight. They are worried about financial stability risks, in particular, the impact of high Fed Fund Rates and an inverted yield curve on banks, having noticed rising delinquency rates showing pressures on some households and banks’ exposure to commercial real estate. This contrasts with the view of several FOMC committee members who are worried that financial conditions have become less restrictive post the Q4 2023 rates and stocks rally in an environment where the economy remained strong.1

"Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent. A couple of participants, however, pointed to downside risks to the economy associated with maintaining an overly restrictive stance for too long"

FOMC Minutes , February 2024

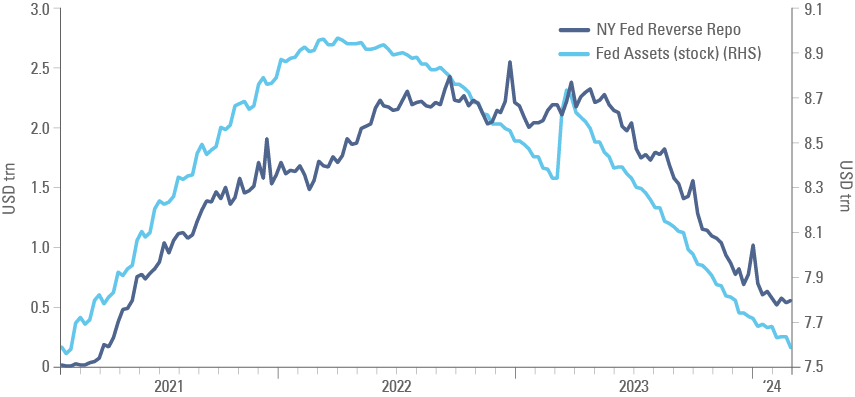

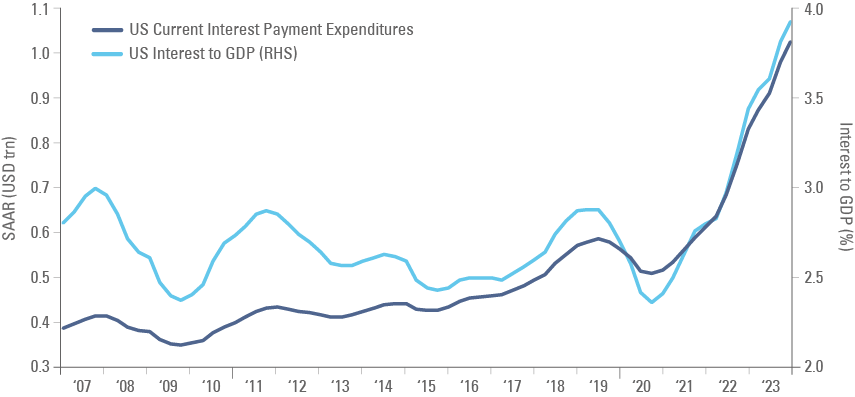

The minutes unveiled plans to begin "in-depth balance sheet discussions at the March meeting", meaning quantitative tightening (QT) remains in place in its current shape for the foreseeable future. The second element may be more concerning, considering the current pace of depletion of reverse repos, a measure of excess cash in the banking system, depicted in Fig. 1. The slow pace of ‘QT tapering’ will bring to the fore the fiscal debate between Democrats and Republicans. With interest payments ballooning (Fig. 2), a continuously large fiscal deficit will bring more issuance, putting pressure on long-term rates via the term premium. On the other hand, if the Republican Party drives a hard bargain and a fiscal consolidation amid tight monetary policy, the risk for economic activity increases significantly. Key FOMC participants corroborated the willingness to be patient and see inflation declining further before easing monetary policy. That included Fed Governor Christopher Waller’s speech last week titled “What’s the rush?”2

“I have to say that I see predominately upside risks to my general expectation that inflation will continue to move toward the FOMC's 2 percent goal. On the flip side, I see little reason to expect that inflation will run below 2 percent for an extended period given the strong economic fundamentals we are observing in GDP and employment.”

C. Waller

The rates market reaction was muted, with the two-year flat at 4.65% (after rising 5bps the day before) and the 10-year down 2bps to 4.30% (after rising 5bps the day before). A few hours later, Nvidia’s results again surprised to the upside. The stock rose 10% post-results, wiping out almost all of the price correction from previous days. S&P500 futures are again close to all-time highs. Large ongoing US Treasury (UST) auctions and the government shutdown debate will be key for risk assets from here.

Fig. 1: Fed Total Assets and Reverse Repos

Fig. 2: Annualised interest payments

AI impact on EM

Aside from the FOMC minutes, a key development last week was the unprecedented results from chipmaker Nvidia. It’s Q4 2023 earnings rose by 490% in yoy terms as revenues increased by 265% yoy to USD 22.1bn (USD 60.9bn in 2023). Theparabolic acceleration of earnings – almost twice as fast as revenues – took place as margins expanded to 74% in Q4 2023, from 54% in Q4 2022 when the semiconductor industry was going through the post-covid and crypto cycle downturns. Nvidia's CEO Jensen Huang said AI was hitting a “tipping point”. It is well-known that Moore’s Law is hitting a physical limit with the miniaturisation of semiconductors approaching at 2-3nm. The main hope to maintain Moore’s Law into the future is with parallel computing, where Nvidia graphics processing units (GPUs) excel, particularly for gaming applications and AI powered servers. This is a very powerful narrative for growth, which may well materialise. Nvidia’s challenge is whether it can become the behemoth monopolistic power in a super-cyclical industry that has made many victims in the past.

Last year, the semiconductor industry was valued at USD 550bn globally. Without specifying its time horizon, Nvidia mentioned a total addressable market (TAM) for semiconductors that could reach USD 1.0tn. It is difficult to understand how a company with USD 61bn revenues (c. 11% market share) can achieve a USD 2tn valuation in a USD 1tn TAM for, say, 2027 to 2030. Other companies that reached trillion-dollar valuations did so by building strong ‘moats’ and with big advantages on Porter’s Five Forces, in particular, creating excellent scalable distribution platforms that led to very little concentration.3 In the case of Nvidia, however, 40% of its revenues come from these very same trillion-dollar companies that make no secret in trying to create a substitute product to Nvidia's GPUs, which currently trade at a premium.

Furthermore, Nvidia has a very concentrated group of suppliers it depends on. Nvidia chips are predominantly manufactured by Taiwan Semiconductor Manufacturing Company (TSMC), and most of its memory chips come from South Korea. These companies trade at much less demanding valuations. TSMC has built a truly remarkable moat in the ability to manufacture customised chips at an unparalleled scale. Therefore, in our view, the best way of positioning for the AI mega-trend, regardless of Nvidia or other individual companies’ valuation discussion, is across the Southeast Asia supply chain.

In macro terms, there is an unavoidable comparison between the current AI era and the late 1990s internet bubble.4 Like the internet frenzy in the late 1990s, the AI surge in valuations was fuelled by a temporary easing of monetary conditions. Back then, the collapse of LTCM and the Russian default in 1998 led 10-year USTs down from 5.8% in April 1998 to 4.2% in October 1998. It may not feel like that, but the same benchmark moved from 5.0% in October 2023 to 3.8% in December 2023. Perhaps, as in the late 1990s, an eventual spike in USTs (the 10-year surged back to 6.8% in January 2000) will be the catalyst for a correction of valuations.

In our view, however, the comparison with the dot-com bubble is tenuous, for several reasons. From a business perspective, AI adoption is set to be swifter and more seamless than the rollout of the internet in the 1990s, where part of the problem was the inflated valuations of unsustainable business models. And while multiples on the US stock market are stretched, they are not yet at late 1990s levels. On a company specific basis, loftier valuations are concentrated amongst industry leaders with proven profitability. Indeed, the current US stock market rally has been tremendously concentrated in the top-10 companies – an even narrower rally than the late 1990s. So, whilst this makes the market rally unbalanced, it also reflects that the AI hype has remained somewhat contained to the key players, at least in public markets. It is also important to remember that the increasing skew of the US stock market can be partially attributed to the distorting influence of passive flows, much more a driver today than it was in the 1990s. As passive funds buy the SP 500 at a market-cap-weighted rate, high valuations of the biggest companies in the index could become a self-fulfilling prophecy.

Some also seek to equate the current cycle with that of 1994 – one of the few cycles when the Fed was successful at hiking policy rates temporarily without generating a bubble. Alas, the macro comparisons with the mid-90s are unfounded, in our view. Back then, the boom in globalisation was accelerating after the fall of the Berlin Wall and in the run-up to China joining the World Trade Organization. The US was promoting counter-cyclical fiscal policies, running a very rare fiscal surplus, allowing for the private sector to take a larger slice of the economy. Globalisation allowed for outsourcing, which was a margin boon. That’s why inflation was declining fast – from 4.0% p.a. on average in the previous five years to 2.4% up to 1999. Today, the US is at the end of an era of massive pro-cyclical fiscal deficits, which has bloated the size of its government, as inflation measured by the consumer price index (CPI) rose from 1.5% on average from 2014 to 2019 to an average of 4.0% from 2019 to date. Lastly, the US – home of the trillion-dollar behemoths – is enacting protectionist policies. Pressure for more government spending and protectionist policies is likely to remain elevated, regardless of the result of November’s Presidential election.

Leading Indicators

February’s ‘flash’ PMI estimates were softer across the manufacturing sector, having dropped by 1.0 to 47.2 in Japan and by 0.5 to 46.1 in the Eurozone as Germany declined three points to 42.3 and France rose three points to 46.8. The UK was unchanged at 47.1, while the US rose one point to 51.5.

The services sector held up better: Japan declined 0.5 to 52.5, the US declined one point to 51.3. The UK was unchanged at 54.3, and Europe +1.5 to 50.0 (Germany +0.5 to 48.2 and France +2.5 to 48). In India, the HSBC Flash Manufacturing and Services PMI were virtually unchanged at 56.7 and 62.0, respectively.

Emerging Markets

EM Asia

China: The People’s Bank of China (PBoC) kept its one-year medium-term lending policy rate unchanged at 2.5%, in line with consensus, but one day later cut its five-year loan prime rate (LPR) by 25bps to 3.95%, while keeping the one-year rate unchanged at 3.45%, surprising consensus for a 10bps cut on the first and 5bps cut on the latter. The five-year LPR is the benchmark for mortgage rates and resets annually, so the impact of the policy ease will only be felt in 2025, when bank margins will decline by circa RMB 95bn per year. Perhaps more important were the policy announcements. Bloomberg reported China was drafting laws to be approved this year aiming to protect private firms’ core concerns, including property rights, guaranteeing the interests of entrepreneurs, and managing missed payments for small- and medium-sized enterprises.<5 China also proposed new ESG rules for its largest companies, which will have to publish sustainability reports by 2026, bringing regulations in line with those for European companies.<6

Indonesia: The central bank kept its policy rate unchanged at 6.0%, in line with consensus. The current account deficit increased to USD 1.3bn in Q4 2023 from USD 1.0bn in Q3 2023, worse than consensus at USD 0.2bn. Automobile sales declined to 70k in January from 85k in December, below the moving average for both December and January over the last ten years.

Malaysia: The trade surplus declined to MYR 10.1bn in January after MYR 11.8bn in December, as exports rose by a yoy rate of 8.7% and imports by 18.8%, respectively.

Philippines: The balance of payments moved to a USD 0.7bn deficit in January from a USD 0.6bn surplus in December. The decline was in line with the seasonal pattern over the last 10 years.

South Korea: 20-day exports dropped 19.2% yoy on an unadjusted basis, but daily exports rose 9.9% yoy as chip exports surged 39.1% yoy (unadjusted). Semiconductors are now 17.2% of total exports from Korea. The Bank of Korea kept its policy rate unchanged at 3.5%, in line with consensus.

Thailand: Real GDP contracted 0.6% in qoq terms (but rose 1.7% yoy) in Q4 2023, from +0.6% qoq (+1.4% yoy) in Q3 2023, below consensus for a 2.6% yoy increase. Thai Prime Minister Srettha Thavisin renewed calls for the central bank to cut rates to boost consumption. However, the Bank of Thailand has – rightly in our view – been conservative in loosening monetary policy due to the rise in fiscal spending. The government is pushing for USD14bn (2.7% of GDP) in handouts to citizens via a digital wallet scheme, which may increase inflation pressures, particularly if met with easing monetary policy.

Vietnam: Vehicle sales rose by a yoy rate of 19.3% in January from 20.0% yoy in December.

Latin America

Argentina: The government increased pensions by 27.2% in March, according to the Official Gazette. Inflation rose 20.6% in January, but is likely to rise by “closer to 10% than 20%” in February, according to Finance Minister Luis Caputo, meaning pensioners’ purchasing power is likely to decline. To compensate, the government introduced an ARS 70k bonus. IMF Chief Economist Gita Gopinath visited Buenos Aires to meet with authorities, and the meetings had a cordial tone. If anything, the IMF is worried about the social impact of the impressive front-loaded fiscal consolidation underway in Argentina. In economic data news, the trade surplus slowed to USD 0.8bn in January from USD 1.0bn in December as exports rose by USD 0.1bn to USD 5.4bn and imports increased by USD 0.3bn to USD 4.6bn over the same period.

Brazil: The economic activity proxy index improved to 0.8% mom in December from 0.1% in November (revised from 0%), as the yoy rate slowed by 100bps to 1.40% over the same period, 90bps above consensus. January tax collections rose by BRL 50bn to BRL 281bn in December, marginally above consensus, increasing by 11.5% yoy in nominal terms or 6.7% yoy in real terms.

Colombia: Industrial confidence increased by 4.5 points to 0.2 in January and retail confidence declined by two points to 14.5 in January.

Mexico: Retail sales dropped by 0.9% in mom terms in December as the yoy rate dropped to -0.2% from 2.7% yoy in November. Real GDP growth increased by 0.1% qoq (2.5% yoy in non-seasonally adjusted (NSA) terms) in Q4 2023, bringing the full-year growth to 3.2%, in line with consensus. CPI inflation declined by 0.1% mom in the first two weeks of February after rising 0.3% mom in the same period of January, bringing the yoy rate down by 40bps to 4.5% as core CPI declined by 10bps to 4.6%, both within striking distance from the 3% (+/-1%) target by the central bank. However, nominal wages remained elevated, as it increased by a yoy rate of 9.3% in January, down from 9.5% in December (which was revised from 9.0%).

Venezuela: JP Morgan announced it would re-weight Venezuela’s defaulted Eurobonds in its flagship EM indices. The rebalancing will be staggered over three months, starting on 30 April. Using bond prices as of close-of-business on 20 February, JP Morgan estimated Venezuela’s country weight to be 0.58% in its Emerging Market Bond Index – Global Diversified (EMBI GD) and 0.69% in the EMBI Global (EMBI G). The country weight is driven by the market value of the bonds and the total market cap of the index; hence market price oscillation is likely to change the final index weight of Venezuela. JP Morgan strategists estimate that index inclusion would lead to USD 2bn of potential purchases, but legacy positions would bring net USD 1bn inflows. However, the bonds will not enter the EMBI G Core, the preferred benchmark for exchange-traded funds.

Background

JP Morgan decided to keep the bonds in the index, but marked at zero weight, after the Office of Foreign Assets Control (OFAC) prohibited US persons from buying bonds in the secondary market. This secondary market trading sanction was lifted on 18 October 2023 via the issuance of a new general licence (without an expiry). Other general licences permitting US persons to conduct business and financial transactions with the Venezuelan government and certain state-owned entities – including in the oil and gas sector and in gold mining – were issued with an expiry date of 18 April 2024. The second set of general licences can be renewed if the US deems that Maduro’s government has kept its commitments in the Barbados Agreement reached with the opposition. This is a relatively subjective target, in our view. Since then, the US re-imposed sanctions on gold mining, after the Venezuelan Electoral Court maintained the ban on opposition candidates Maria Corina Machado and Henrique Capriles to run in upcoming presidential elections that must take place before the end of 2024. On Friday afternoon, Venezuela announced it was halting flights from US deportees as a retaliation against the reimposition of some of the sanctions, including the mining sector, after the US said Caracas failed to live up to the “loose pledges” it made to restore democratic order and evolve toward free and fair elections. The licence that matters for the economy, the oil and gas sector, remains in place. The US government confirmed it will wait until 28 April to decide whether to extend sanctions relief or let the general licenses expire.

Secondary market trading sanction relief, however, is not subject to the same level of uncertainty, in our view. Senior Biden administration officials went on the record in February confirming that the decision to lift secondary market trading sanctions was in the interest of the US, even at the same time as it threatens to reimpose oil and gas sanctions. Such statements may have contributed to JP Morgan announcing the index re-inclusion, despite the political uncertainties.

Central and Eastern Europe

Poland: Sold industrial output rose by 2.3% mom in January after dropping 9.5% in December as the yoy rate rose to +1.6% from -3.5% over the same period. The producer price index (PPI) came at 0.2% mom deflation in January after -1.4% mom in December, bringing the yoy rate of deflation to 9.0% from 6.9% over the same period. The yoy rate of retail sales rose 4.6% in January from 0.5% in December, more than 100bps above consensus.

Central Asia, Middle East, and Africa

Angola: The International Energy Agency (IEA) reported oil production increased by 60k barrels per day (bpd) to 1.18m bpd in January, after it exited OPEC last month. Oil production has been largely stable since 2020, oscillating between 1.04m and 1.2m bpd, after declining from 1.87m bpd at its highest level in 2015, as mature fields are replaced by new exploration ventures from large international oil companies such as Total. S&P Global kept Angola’s sovereign rating at ‘B-‘ with a ‘stable’ outlook. S&P mentioned close to half of external debt repayments in 2024 and 2025 are collateralised oil loans from Chinese lenders and that commercial external repayments add up to USD 4.4bn in 2024 (of which USD 0.8bn in Eurobonds, USD 1.3bn multilateral/bilateral) and USD 5.1bn in 2025 (USD 1.7bn Eurobonds, USD 1.3bn multilateral/bilateral). Foreign exchange (FX) reserves improved to USD 13bn in December 2023 from USD 11.6bn six months before.

Egypt: The UAE announced a USD 35bn investment in a tourist development in Ras El Hekma, approximately 2.5 hours’ drive west of Alexandria. The UAE will pay USD 24bn for the development rights and another USD 11bn in real estate and other projects. As much as USD 15bn will be paid to Egypt in a week and USD 20bn in two months. The UAE claims it will invest USD 150bn in Ras el Hekma, including residential, commercial assets and an international airport in a new free trade zone.7 To put this into perspective, Egypt’s FX reserves stood at USD 35bn (5.5 months of imports) at the end of January. In parallel, the IMF said it was close to announcing a fresh loan deal that would reach USD 6bn to USD 12bn. The sheer size of the transaction is likely to allow Egypt’s currency to depreciate and stabilise at a level far below the EGP 77 at the end of January. The trade deficit was unchanged at 3.0bn in December and the production index dropped by 2.6% in mom terms after declining 2.4% mom in November.

Qatar: CPI inflation declined by 1.3% mom (+3.0% yoy) in January vs +1.6% mom (+1.7% yoy) in December.

Nigeria: Real GDP growth increased to 3.5% in yoy terms in Q4 2023 from 2.5% in Q3 2023, significantly above consensus at 2.4%

Pakistan: The Pakistani government formed a coalition and is discussing increasing its loan with the IMF to up to USD 8bn. Pakistan has SDR 5.66bn of outstanding debt with the IMF, equivalent to USD 7.5bn, or 279% of its quota. The outsized deal would bring it to 297% of the quota, which is still below the IMF limit of 600%.8 9 For comparison, Angola and Egypt have borrowed the equivalent of 540% and 567% of their quotas, while Ecuador and Argentina exceeded the upside limit at 849% and 954%, respectively.

South Africa: CPI inflation rose by 0.1% mom in January after being unchanged in December with the yoy rate increasing by 20bps to 5.3%, while core CPI rose by 10bps to 4.6% yoy. The headline number was 10bps below, but core was 10bps above consensus.

Turkey: The central bank kept its policy rate at 45%, in line with consensus.

Developed Markets

United States: Jobless claims declined by 12k to 201k in the week ending on 17 February, while continuing claims declined by 27k to 1,862k in the previous week. Existing home sales rose by 0.12m to 4.0m in January, in line with consensus.

Europe: The current account surplus rose to EUR 31.9bn in December from EUR 22.5bn in November. New car registrations rose by a yoy rate of 12.1% in January, from -3.3% yoy in December. Electric Vehicles (EV) accounted for 11.9% of the mix, up from 10.2% a year ago. Bloomberg said the European auto industry is realising that its EV industry is far behind the curve compared to Tesla and Chinese manufacturers, and it will have to join forces to compete with Chinese rivals. A slowdown in the pace of EV adoption drove auto executives to discuss ideas ranging from pooling development resources to bundling businesses across Europe, creating an “Airbus of autos”. EV sales are expected to grow at the slowest pace since 2019 this year. Headwinds for the sector include governments dropping incentives, higher prices than internal combustion engine cars, rental firms baulking at ballooning repair costs, and low second-hand values.10

United Kingdom: The Bank of England’s Governor Andrew Bailey had a few dovish remarks in a testimony to the Treasure Select Committee, including that: “We don’t need obviously inflation to come back to target before we cut interest rates. I must be very clear on that, that’s not necessary.” The overnight interest rate swap currently prices only 50% odds of a cut by the 20 June meeting, with one cut fully priced in for the 1 August meeting.

1. See – https://www.federalreserve.gov/monetarypolicy/files/monetary20240131a1.pdf

2. See – https://www.federalreserve.gov/newsevents/speech/waller20240222a.htm

3. See – https://www.isc.hbs.edu/strategy/business-strategy/Pages/the-five-forces.aspx

4. See – https://www.axios.com/2024/02/23/nvidia-valuation-chipmakers-trillion

5. See – https://blinks.bloomberg.com/news/stories/S978LCT1UM0W

6. See – https://blinks.bloomberg.com/news/stories/S97AGDDWRGG0

7. See – https://www.adq.ae/newsroom/adq-led-consortium-to-invest-usd-35-billion-in-egypt

8. See – https://www.thenews.com.pk/print/1161495-pakistan-looking-to-hike-imf-loan-to-up-to-8bn

9. See – https://www.imf.org/en/News/Articles/2023/12/15/pr23454-imf-pr-imf-executive-board-temporarily-increases-access-limits-under-prgt

10. See – https://blinks.bloomberg.com/news/stories/S95NP5T0AFB4

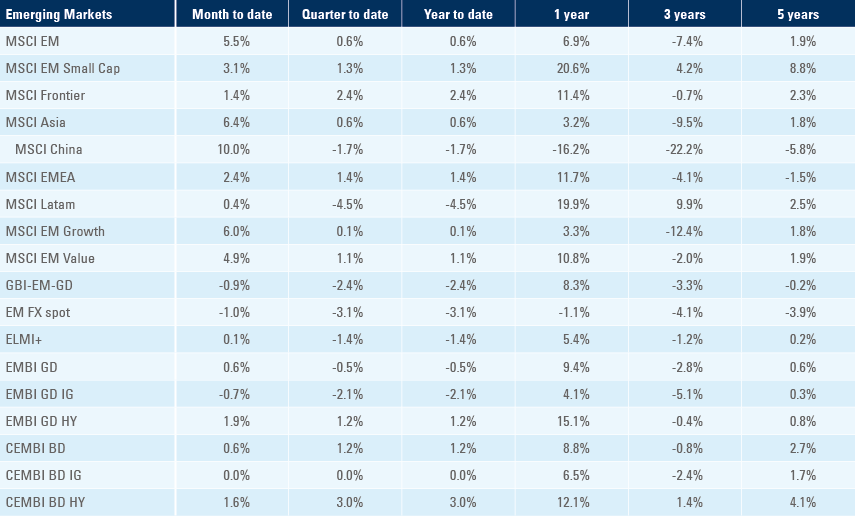

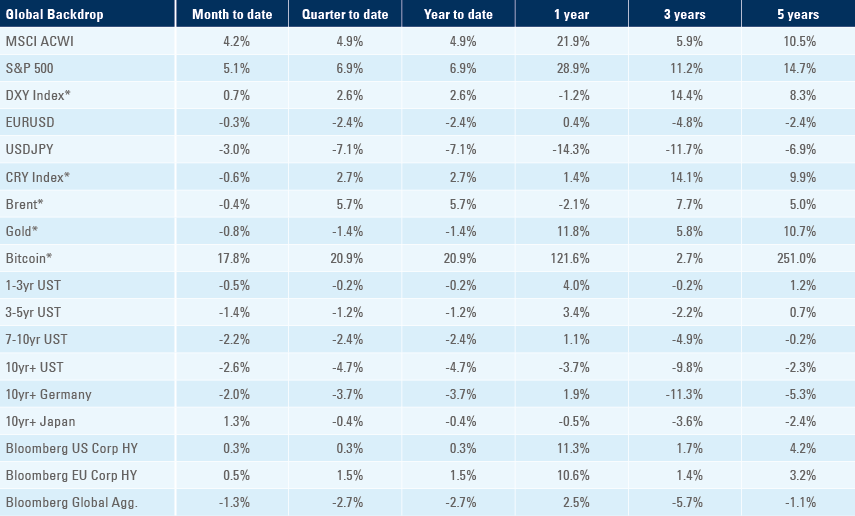

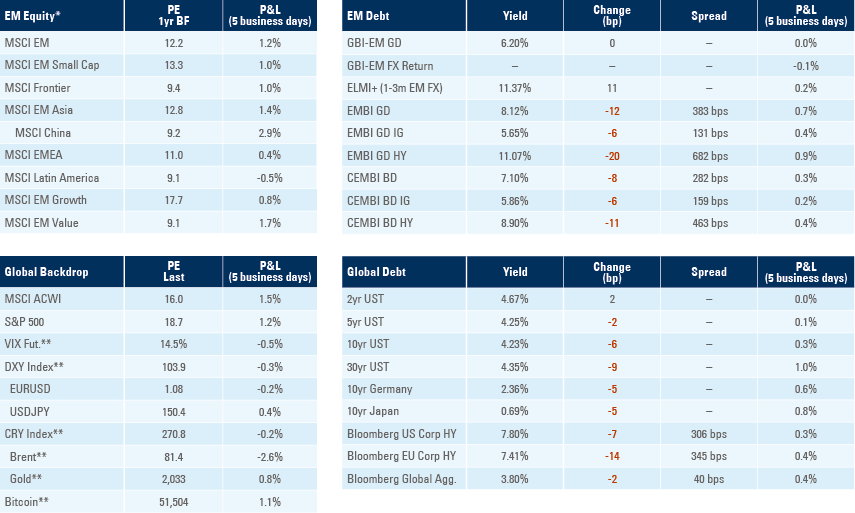

Benchmark performance