Israel declared war on Hamas following an organised attack on the country, 50 years after the Yom Kippur War. A Bank of International Settlements (BIS) paper published last week suggests the global supply chain has lengthened since the Covid-19 pandemic. No increase in supply chain density suggests global trade is more, rather than less, resilient to future shocks. Non-farm payrolls in the US were dramatically above expectations at 336k in September, furthering the case for continued rate hikes by the US Federal Reserve. The US House of Representatives voted to remove Speaker Kevin McCarthy following a motion to vacate submitted by Florida Republican Matt Gaetz. Consumer price index (CPI) inflation in Colombia continued its sequential decrease. Poland continued its cutting cycle, decreasing their base rate to 5.75%. Korea trade data showed further evidence of an improvement in global manufacturing as semiconductor exports continued to recover.

Geopolitics

On Saturday morning, Palestinian Islamist militant group Hamas launched a large-scale, coordinated offensive on Israel, attacking across the Gaza Strip through sea, air, and land. During the attack, at least 3,000 rockets were fired from the Gaza Strip as Hamas militants penetrated the border of Israel in the south, killing at least 700, including an estimated 260 people at an outdoor festival. Furthermore, at least 100 Israelis have been taken hostage, many taken across the border into Gaza. Directly following the attack, Israeli Prime Minister Benjamin Netanyahu declared a state of emergency, and declared war against Hamas, exactly 50 years after the 1973 Yom Kippur War. The Israeli military have since likened the attacks to the 9/11 attacks on the US.

Israel in turn has been air striking targets in Gaza, where more than 400 people have died. The Israeli Defence Force (IDF) has been attempting to secure the territory, deploying the military to retake control of the area. A spokesperson confirmed that most breach points have been closed, primarily with tanks, but could not deny that more militants could be entering the territory.

The attacks exposed shocking Israeli vulnerabilities at a time that it has been in political turmoil. Nevertheless, Israel is likely to galvanise against a historical existential threat. It also happens at a time where the hardliner Iranian regime has been isolated after the Abraham Accord between Israel and Morrocco supported by Egypt, the Gulf Cooperation Council and the approximation with Saudi Arabia.

The key question is whether the war spreads with Iran supporting the Hamas directly or via Lebanon. A conflict between Iran and Israel could make energy assets in the region vulnerable to attacks, potentially increasing the risks of much larger supply shocks than faced so far.

Following the attack, there has been strong verbal support from Iran, with Foreign Minister Hossein Amir-Abdollahian describing the violence as a “legitimate response” to the historic actions of Israel. The Wall Street Journal published an article claiming Iran was heavily involved in what was a carefully planned operation by the Hamas and Hezbollah in Lebanon. The US has deployed an aircraft carrier, accompanied with war planes, cruisers, destroyers, and additional munitions.

Oil sold off across the week, down around 8.5% until last Friday, following its bullish run during Q3 2023. This morning, Brent rallied as much as 5.5%, before settling at USD 85 per barrel (+2.8%) at the time of writing, following news of the extent of the Israeli conflict over the weekend.

Global Macro

The global pandemic highlighted the strain that single-source supply chains are placed under during periods of elevated geopolitical stress. A clear example of the shock to the global value chain (GVC) established across industries is the impact Covid-19 lockdown measures had on Ford Motor Company’s vehicle production in the US. Malaysia’s infection rate, and the impact it had on the countries semiconductor industry, sent shockwaves down the vehicle GVC, with shortages resulting in the suspension of vehicle production, impacting a very large supply chain. Severe strains like these, as well as the disruption from the Russian-Ukraine war, further pushed attention towards building “shorter, more resilient supplier relationships”, according to a recent BIS paper.1 Diversifying and building resilience (China +1 policies) have been on the minds and nations of legislators and CEOs alike, but are supply chains more resilient? The BIS paper compares GVCs in September 2023 to December 2021. The study shows connection between suppliers has not markedly altered, but rather there are greater “indirect cross-country links”. Goods previously made in China to be shipped to the US now have greater stops in between, elongating the production chain, especially in other Asian countries. The network firm distance between “suppliers from China and customers in the United States, increasing from 9.2 to 10.1” since December 2021.

This elongation of supply chains came together with an increase in density over the same period, with the “average number of suppliers for each customer” seeing a “slight decline from 2.25 in 2021, to 2.23 in 2023”. Intuitively, the study suggests that despite all the investment and attention to the topic, supply chains are more vulnerable today than they were three years ago.

Emerging Markets

EM Asia

China: The Caixin Manufacturing purchasing managers’ index (PMI) declined to 50.6 in September, from 51.0 in August, below a consensus of 51.2. The Caixin Services PMI declined to 50.2 in September, from 51.8 in August, below a consensus of 52.0. Foreign reserves decreased in September to USD 3,115bn, from USD 3,160bn in August, below a consensus of USD 3,160bn.

India: The Reserve Bank of India held its cash reserves ratio and repurchase rate unchanged and in line with consensus at 4.50% and 6.50%, respectively.

Indonesia: CPI inflation increased 2.3% yoy in September, down from 3.3% in August, 5bps below expectations. Core CPI inflation declined by 20bps to 2.0% yoy in September, 6bps below consensus. Foreign reserves fell to USD 134.9bn in September, from USD 137.1bn in August.

Malaysia:S&P Global Manufacturing PMI decreased to 46.8 in September, from 47.8 in August. Foreign reserves decreased to USD 110.1bn in September, from USD 111.5bn in August.

Philippines: CPI inflation rose by 1.1% mom in September, the same rate as August in sequential terms, 80bps above consensus as the yoy rate of increased by 80bps to 6.1% over the same period.

South Korea: The trade surplus increased to USD 3.7bn in September from USD 0.9bn in August, significantly above consensus at USD 1.1bn. Alongside a reduction in energy imports (down 16.5% yoy), part of the trade surplus was related to semi-conductors. Chip inventories declined in 2022 as fears of an economic slowdown led to lower purchases by final assemblers, but have been recovering over the last few months. Exports of semiconductors fell 13.6% yoy, the slowest in a year, but are improving sequentially from -20.6% yoy in August, and -33.6% yoy in July. Exports over the same period fell less than expected at -4.4% yoy, compared to an expected -9.3% yoy – this was the 12th consecutive fall in exports, but the softest of the sequence. In other economic news, CPI inflation declined in sequential terms to +0.6% mom in September, lower than 1.0% mom in August, but the yoy rate increased by 30bps to 3.7%, 20bps above consensus, while CPI ex-food and energy was unchanged at 3.3%, in line with expectations. Industrial production decreased 0.5% yoy in August, up from a revised decline of 8.1% yoy in July, beating a consensus figure of -5.8% yoy.

Taiwan: CPI inflation rose 2.9% in September, up from a rise of 2.5% in August, 40bps above consensus. S&P Global Manufacturing PMI increased to 46.6 in September, from 44.3 in August.

Thailand: Consumer prices declined by 0.4% mom in September, following a 0.6% mom increase in August, bringing the yoy rate of CPI inflation down by 60bps to 0.3% over the same period as core CPI was down 20bps to 0.6% yoy. The lower-than-expected inflation remains well below the 2.0% inflation target by the Bank of Thailand, and justifies its decision to end its hiking cycle after bringing its policy rate to 2.5%. S&P Global Manufacturing PMI decreased to 47.8 in September, from 48.9 in August. Foreign reserves decreased to USD 211.8bn in September, from USD 213.6b in August.

Latin America

Brazil: S&P Global Manufacturing PMI decreased to 49.0 in September, down from 50.1 in August. Industrial production increased 0.5% yoy in August, up from the decrease of 1.1% in July, but below the consensus figure of a 1.0% rise. The monthly trade balance declined to USD 8904m in September, from USD 9545m in August, below the consensus figure of USD 9250m.

Chile: Economic activity decreased by 0.9% yoy in August, down from an increase of 1.8% yoy in July, below a consensus of a decrease of 0.1%. CPI inflation increased 5.1% yoy in September, down from an increase of 5.3% in August, 10bps above consensus.

Colombia: CPI inflation increased by 11.0% yoy in September, down from 11.4% in August, in line with the consensus.

Ecuador: CPI inflation increased 2.23% in September, down from an increase of 2.56% in August.

Mexico: Manufacturing PMI decreased to 49.8 in September, from 51.2 in August.

Peru: Lima CPI inflation decreased to 5.04% yoy in August, from 5.58% in August, below consensus by 27bps. The reference rate was cut by 25bps to 7.25%, in line with consensus.

Central and Eastern Europe

Czechia: Retail sales (excluding automobiles) declined 2.8% yoy in August, from a decline of 1.8% yoy in July, 90bps below consensus.

Hungary: Manufacturing PMI increased to 47.4 in September, from a revised figure of 46.7 in August, above a consensus of 43.7. Industrial production WDA decreased 6.1% yoy in August, greater than the decrease of 2.6% in July, below consensus of a decrease of 2.9%.

Poland: The base rate was cut by 25bps to 5.75%, in line with consensus.

Romania: International reserves rose to USD 65.1bn in September, from USD 59.9bn in August. Retail sales rose 1.1% yoy in August, down from a revised increase of 1.4% yoy in July. The key policy rate was held at 7.0%, in line with consensus.

Russia: S&P Global Manufacturing PMI increased to 54.5 in September, from 52.7 in August.

Central Asia, Middle East, and Africa

Kazakhstan: The key rate was cut by 50bps to 16.00%, 12.5bps below consensus expectations.

South Africa: Absa Manufacturing PMI fell to 45.4 in September, from an August figure of 49.7, below a consensus figure of 49.5.

Türkiye: CPI inflation increased by 61.5% yoy in September, up from an increase of 58.9% yoy in August, below a consensus figure of 61.6%. Price producer index (PPI) inflation increased by 47.4% yoy in September, below the August increase of 49.4% yoy.

Developed Markets

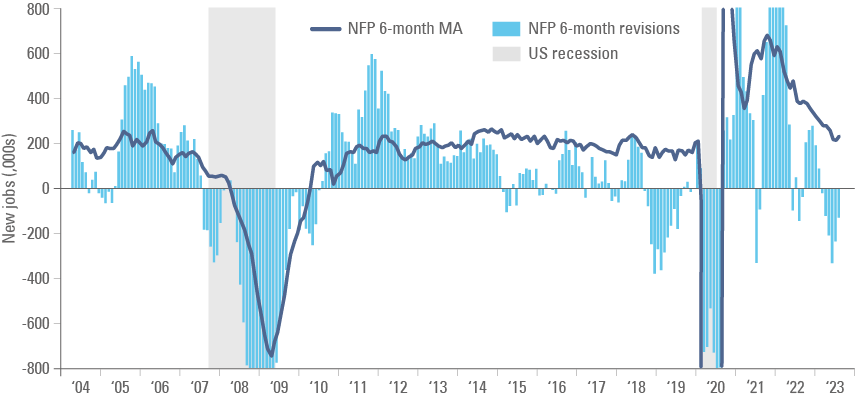

United States: Yields on US Treasuries (UST) widened, and stocks dropped after the change in non-farm payrolls came far above expectations, with 336k new jobs being added to the economy in September, significantly above the consensus figure of 170k. This came in addition to the 88k revisions to the previous two months, although revisions remain a negative 236k year-to-date. The unemployment rate stayed at a consistent 3.8%, 10bps above consensus, and average hourly earnings increased 4.2% yoy, 10bps below consensus. Lower earnings and the fact that payrolls remain on a downward path of payrolls on a three-month and six-month moving average basis led markets to retract the initial moves with UST yields declining and US stocks rising on the day. Despite the retracement of asset prices, the data poses the question on whether the Federal Reserve will opt to hike the policy rate again in November or December.

Fig1: US Non-Farm Payroll data with 6-monthly revisions

Overall, economic data surprised to the upside with the US Citibank Surprise index rising 15.6 points to 59.7 last week. The S&P Global Manufacturing PMI increased to 49.8 in September, up from 48.9 in August, the same as September’s consensus figure. ISM Manufacturing increased to 49.0 in September, from 47.6 in August, beating a consensus figure of 47.9. The JOLTS (Job Openings and Labor Turnover Survey) rose to 9,610k, from a revised figure of 8,920k in July, beating expectations of 8,815k. MBA Mortgage applications were down 6.0% wow as of 29 September, down from the decline of 1.3% wow as of 22 September. ADP employment change fell in September to 89k, down from 180k in August, lower than a consensus figure of 150k. Initial jobless claims increased to 207k as of 30 September, from 205k the week prior, below a consensus figure of 201k.

In political news, following the last-minute vote to avoid a government shutdown on 30 September, Florida Republican Matt Gaetz submitted a motion to vacate the Speakership of Kevin McCarthy, which passed with 208 Democrats and eight strident Republicans having voted to remove the Speaker against 210 Republicans in favour of keeping him. An election for Speaker maybe held as soon as next Wednesday, and several Republican representatives are candidates, including the hardline Jim Jordan, a staunch ally of former President Donald Trump, and Steve Scalise, who was a House majority leader this year. However, the process of finding a new leader is uncertain and maybe convoluted. McCarthy himself was elected only after 15 rounds of voting. Congress has until 17 November (when the short-term funding deal expires) to elect a new Speaker and pass a resolution to avoid a government shutdown. The direction of travel of politics in Washington suggests fiscal consolidation is more likely than not. Should Congress find a replacement in time, the successor would likely be under greater pressure to avoid deal-making with Democrats and increasing funding for Ukraine (a driver of Gaetz’s push for McCarthy’s removal), increasing the risk of no agreement being reached and a government shutdown happening.

Eurozone: The unemployment rate decreased to 6.4% in August, down from a revised July figure of 6.5%.

United Kingdom: Nationwide House PX (NSA) fell 5.3% yoy in September, in line with the decrease in August, 30bps above the consensus.

Japan: The Tankan Large Manufacturing Index increased to 9 in Q3, from 5 in Q2, beating a consensus figure of 6. The Large Non-Manufacturing Index increased to 27 in Q3, from 23 in Q2, beating a consensus figure of 24, with the outlook figure rising to 21, from 20, but below a consensus of 23.

1. See – https://www.bis.org/publ/bisbull78.htm

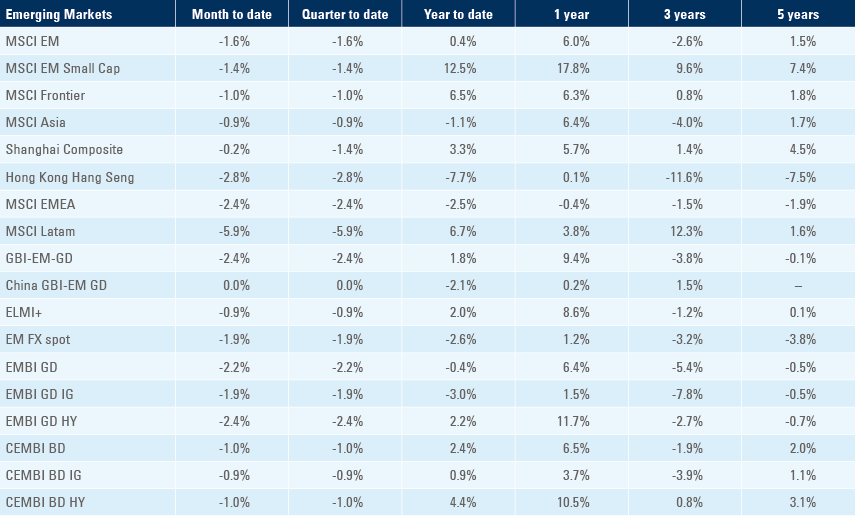

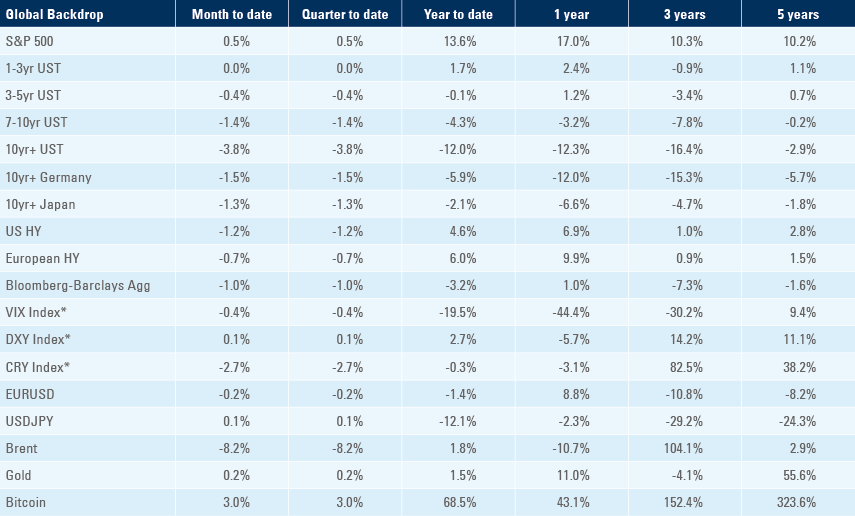

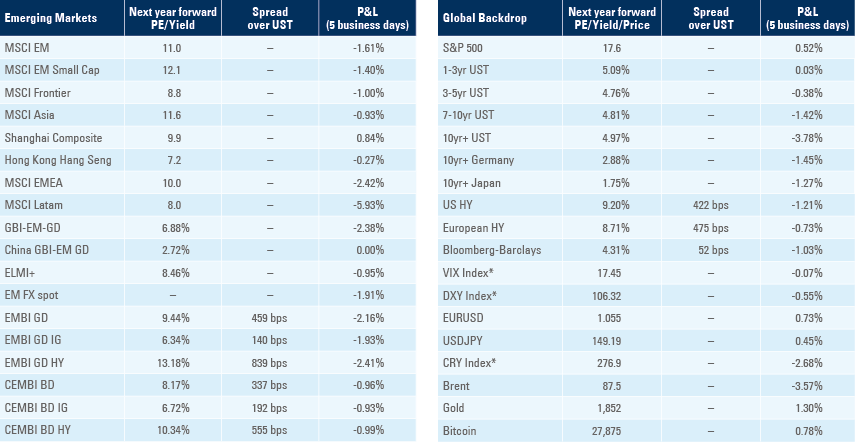

Benchmark performance