- US Treasury Secretary announced a 90-day reduction on China tariffs to 30%

- Steep tariff de-escalation leads to risk-on pricing in markets and a Dollar rebound

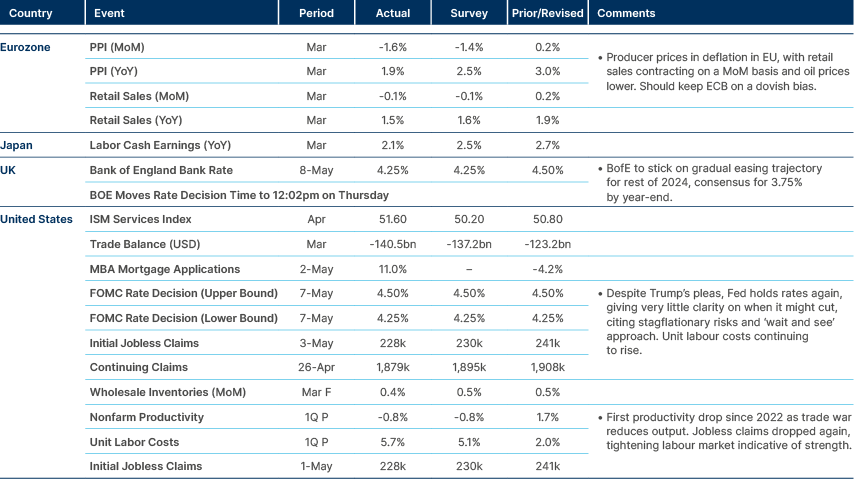

- FOMC kept Fed Funds rate on hold again, no clarity on timing of next cut

- China loosened monetary policy further, via a cut in both policy and reserve requirement rates

- Potential meeting between Zelenskyy and Putin in Türkiye this week

- India and Pakistan agreed a ceasefire after aerial dogfights last week

- IMF approved a new USD1.4bn loan to Pakistan

- Lee Jae-myung of the Democratic Party set to win elections on 3 June elections, as opposition implodes in South Korea.

- Peru’s central bank surprised analysts by cutting policy rate by 25bps.

- Ghana rating upgraded and positive news from Morocco and Zambia.

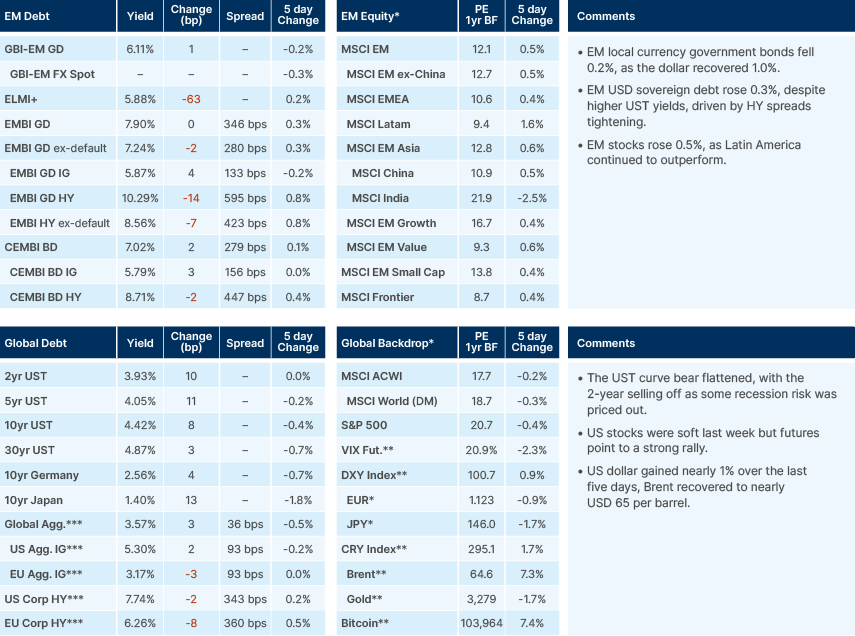

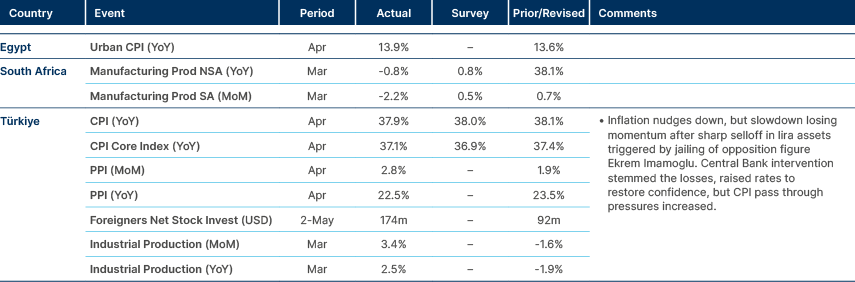

Last week performance and comments

Global Macro

The Hang Seng index rose 3.0% and US stock futures are up at the same magnitude this morning, pointing to a very strong opening after the US cut China’s new tariffs to 30% for 90 days. China cut its additional tariffs on the US to 10%, in a steep de-escalation of the trade war after US Treasury Secretary Scott Bessent and trade representative Jamieson Greer had meetings with Chinese representatives over the weekend in Geneva. Bessent said this morning that neither party was interested in a “decoupling” and that the meeting focused primarily on “terms of trade,” rather than currency.

This is only the beginning of negotiations with China and does not include sector-specific tariffs. However, it is fair to say this is a far more benign outcome than most expected, especially after Donald Trump had said an 80% tariff on China “seems fair” on Friday. The delegation of authority on the matter is also an important signal.

The UK made an official trade deal with the US last week, which included a reduction of the 25% auto tariff to 10% for 100k cars a year, and dropping the steel and aluminium tariff to 0%, in exchange for committing to opening the market for USD 5.0bn worth of American agricultural machinery. Trump also gave a concession on tariffs to Rolls Royce, in exchange for the UK buying Boeing aircraft. The most important takeaway here is that the 10% tariff is the baseline, even for America’s ‘oldest ally.’

As expected, the timing of the de-escalation against China is broadly in line with the 1-2 months of imports from China front-load we’ve seen earlier this year. It also suggests that effective US tariff rates will increase by less than 15%, making it less likely that we’ll have a significant recessionary impact on the economy.

The Federal Open Market Committee (FOMC) kept the Fed Funds rate on hold for a third meeting last week, citing risks to “both sides of the mandate,” in other words, stagflation. Since the announcements on China trade this morning, US Treasury (UST) yields have moved higher, with markets pricing out two rate cuts by the end of the year.

To make sense of what the US rate moves mean in practice, we can consider a simple scenario analysis of two outcomes. In the first scenario, a US recession, the Fed would cut rates by 150bps to 3.0% by the end of the year, and then the second scenario has no cuts keeping the Fed Funds rate at 4.5%. On 8 April, the market was pricing c. 80% odds of the first scenario and 20% odds of the second. Today, after the tariff announcement, we are very close to 50/50 odds on both scenarios.

This seems about right, for now, given the balance of risks. With inflation likely to remain above the Fed's target for the foreseeable future, it would take a meaningful rise in the unemployment rate for the Fed to cut rates much, in our view, even though the risk to inflation has declined with the worst case scenario on tariffs behind us and oil prices to remain lower with excess capacity form OPEC coming online in June. With initial jobless claims falling again last week, there is no sign of a weak jobs market yet.

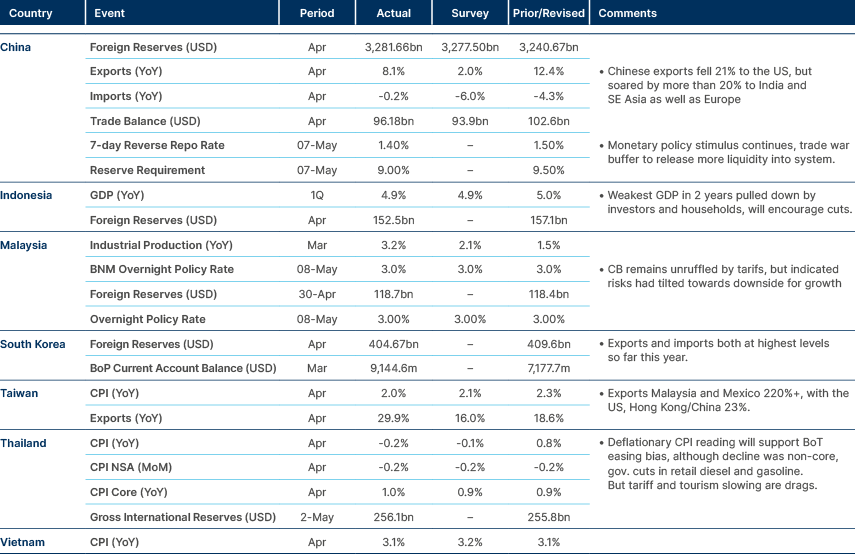

China’s policymakers last week unveiled several monetary policy easing measures that marginally exceeded market expectations ahead of the trade negotiations, including a 10bps policy rate cut, a 50bps reduction in the reserve requirement ratio and a 25bps cut in mortgage rates for first-time home buyers. The 50bps reduction to the reserve requirement ratio will be particularly powerful and likely free up RMB 1trn (USD 130bn) in liquidity.

Geopolitics

Russia/Ukraine

Over the weekend, the prime ministers of the United Kingdom, Germany, France and Poland travelled to Kyiv to demonstrate their support for President Volodymyr Zelenskyy. During the visit, they declared that no negotiations with Moscow would take place unless Russia first observed a 30‑day ceasefire and warned that fresh sanctions would follow if that condition were ignored. President Vladimir Putin suggested talks must precede any suspension of hostilities. From the US, Donald Trump seemed to back Putin’s position and urged Zelenskyy to meet the Russian leader in Istanbul on Thursday (15 May). This highlights the pivotal part Türkiye could be asked to play and raises expectations in Kyiv and European capitals that Ankara will ultimately side with Ukraine.

Also in Türkiye, the Kurdistan Workers’ Party (PKK) announced it will disband, formally ending its 40‑year armed struggle against the Turkish state.

India/Pakistan

India and Pakistan stepped back from the brink after a US‑brokered ceasefire agreement. Pakistani equities, which had fallen more than 10% in the immediate aftermath of an Indian strike and Islamabad’s threat of retaliation, recovered to levels above those seen before the flare‑up. Because each side claimed victory after a brief exchange of fire, analysts now judge a protracted confrontation unlikely. During the skirmish, Chinese‑built J‑10 fighters reportedly shot down at least two Indian aircraft, an episode that some observers interpreted as evidence of China’s edge in modern air combat capability.

Emerging Markets

Asia

Chinese exports surprisingly resilient, suggests softer impact of US-China trade war.

Pakistan: The IMF approved a new USD 1.4 billion loan under its climate‑resilience fund together with the first review of the USD 7.0 billion Extended Fund Facility, enabling the immediate release of about USD 1.0 billion; Pakistan remains one of the country’s most vulnerable to climate change.

South Korea: Lee Jae‑myung of the Democratic Party is set to win the 3 June presidential election as the People Power Party (PPP) implodes. After a tumultuous search, the PPP has finally chosen former labour minister Kim Moon‑soo as its candidate, and the chaotic process has undermined prospects for a broad anti‑Lee coalition. Lee maintains a lead of about 20 percentage points over Kim in polls. His legal risk has eased because the Seoul High Court postponed the hearing in his election law violation case until after 3 June, although the fate of the trials if he is elected remains unclear. Compared with 2022, when he lost to Yoon Suk‑yeol, Lee is running a more openly pro‑business campaign.

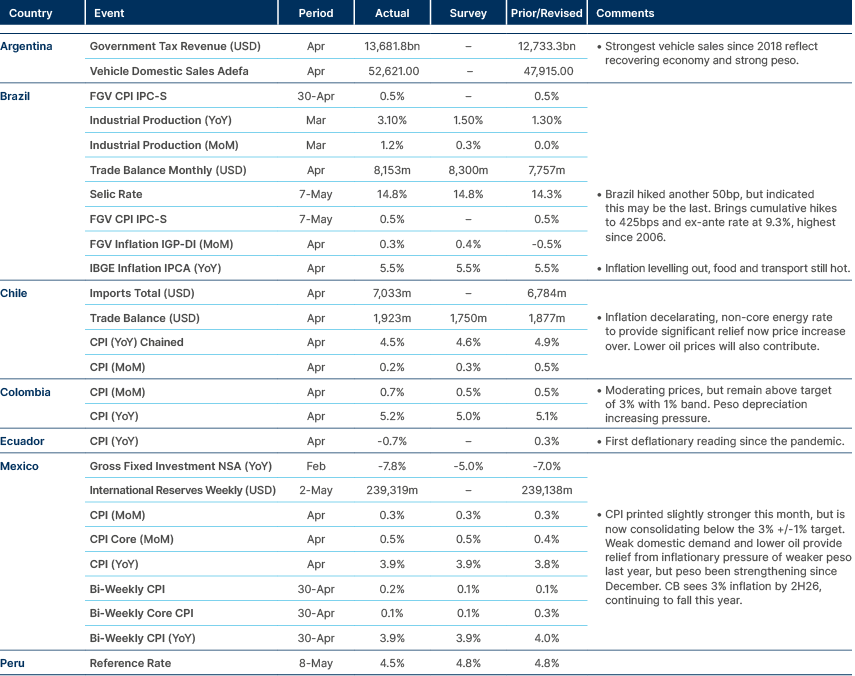

Latin America

Inflation moderating in Latin America. Resilient activity in Brazil. Peru cut.

Argentina: Market analysts have lifted their end‑2025 inflation forecast to 32% and increased the 2025 GDP growth projection to 5.1%, most likely reflecting the expected impact of exchange‑rate policy changes. The consensus now puts inflation at 18% by the end of 2026 and 10% by the end of 2027.

Peru: Peru’s central bank (BCRP) surprised markets by cutting its policy rate by 25bp to 4.50% at its May meeting, stating that the reference rate is close to the estimated neutral level and predicting that year‑on‑year inflation will move toward the midpoint of the 1% to 3% target range in coming months. This may be the terminal rate, but further easing remains possible if inflation expectations keep falling.

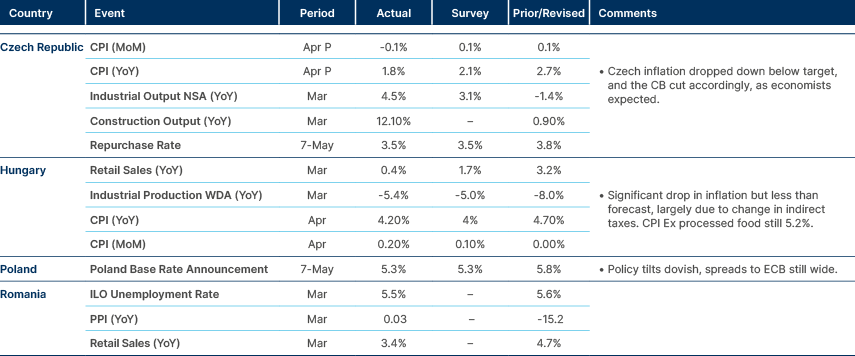

Central and Eastern Europe

Inflation and activity softening across the countries.

Czechia: The weekly poll from STEM pollster, shows the opposition ANO party at 30.7%, narrowing its gap with Spolu to 10.5%, the tightest margin since last August. Six parties are projected to enter parliament, forcing ANO to look toward a partnership with SPD and foreshadowing a more fragile government than the previous 12 years. In other news, the CNB’s latest forecast sees core inflation at 2.7% in 2025, 20bps higher than previously estimated, and expects it to converge with headline inflation only in the second quarter of 2026, after remaining elevated through the first quarter of that year.

Poland: The first round of the presidential election takes place on Sunday 18 May, with results expected early on Monday and a possible second round on 1 June. On the policy front, Monetary Policy Council (MPC) member Przemysław Litwiniuk believes there is room for a 50bps cut in September or October and does not rule out an earlier move in July, allowing space for about 125bps of cuts in 2025. Two other members publicly advocated to a more moderate stance. MPC member Henryk Wnorowski said the nearest realistic cut is 25bps in July and cautions that fiscal policy and energy prices still pose inflation risks, aiming to bring the key rate into the 4.0% area this year. Member Ludwik Kotecki favours two further 25bps reductions, possibly in July and September. Indeed, Governor Adam Glapiński reported last Thursday that opinions within the council are split between a July cut and waiting until autumn.

Romania: The INSCOP pollster, announced a significant shift in polling numbers ahead of the Romanian presidential run-off scheduled for May 18. The gap between George Simion, leader of the far-right AUR party, and the current mayor of Bucharest and independent candidate Nicușor Dan has narrowed from 17% to just 4%. The pollster representatives attribute this rapid change to recent economic turmoil, describing it as an "economic firestorm" that has influenced voter sentiment.

Ukraine: The National Bank has announced some relaxation of capital controls but linked it to new foreign direct investment.

Central Asia, Middle East, and Africa

Softer inflation in Türkiye.

Türkiye: Central Bank Governor Fatih Karahan said the central bank has taken proactive measures to address financial market volatility and sustain disinflation. Lira deposits now account for 58% of total deposits as FX deposit protected (KKM) accounts are gradually phased out, food inflation is moderating despite seasonal spikes, and broader cost pressures are easing.

Ghana: The ratings agency S&P upgraded Ghana to CCC+ from SD (Selective Default) after the country made progress in restructuring its debt.

Morocco: Consulting firm Oliver Wyman identified Morocco as the world’s lowest‑cost car manufacturer in 2024, with average labour costs of only USD 106 per vehicle compared with USD 273 in Romania, USD 305 in Mexico, USD 414 in Türkiye and USD 597 in China. This gives the country a meaningful competitive advantage, considering labour accounts for 65%–70%of total production cost. Commerce and Industry Minister Ryad Mezzour said Morocco plans to raise annual car production capacity from 700k to 1m vehicles by the end of 2025.

Nigeria: The International Monetary Fund (IMF) confirmed the country repaid in full the USD 3.4 bn rapid financing instrument loan disbursed in April 2020 to support the country during, under the COVID‑19 pandemic.

Zambia: President Hakainde Hichilema has commissioned the USD 450m Kafulafuta Dam, which will supply up to 300,000 litres of clean water per day to four districts, enhance food security through irrigation and support the 4m tonne maize output target. In other news, Mozambique and Zambia are also set to sign a USD 1.5 bn fuel pipeline agreement with capacity for 3.5m tonnes a year.

Developed markets

Economic data surprised to the upside in the US.

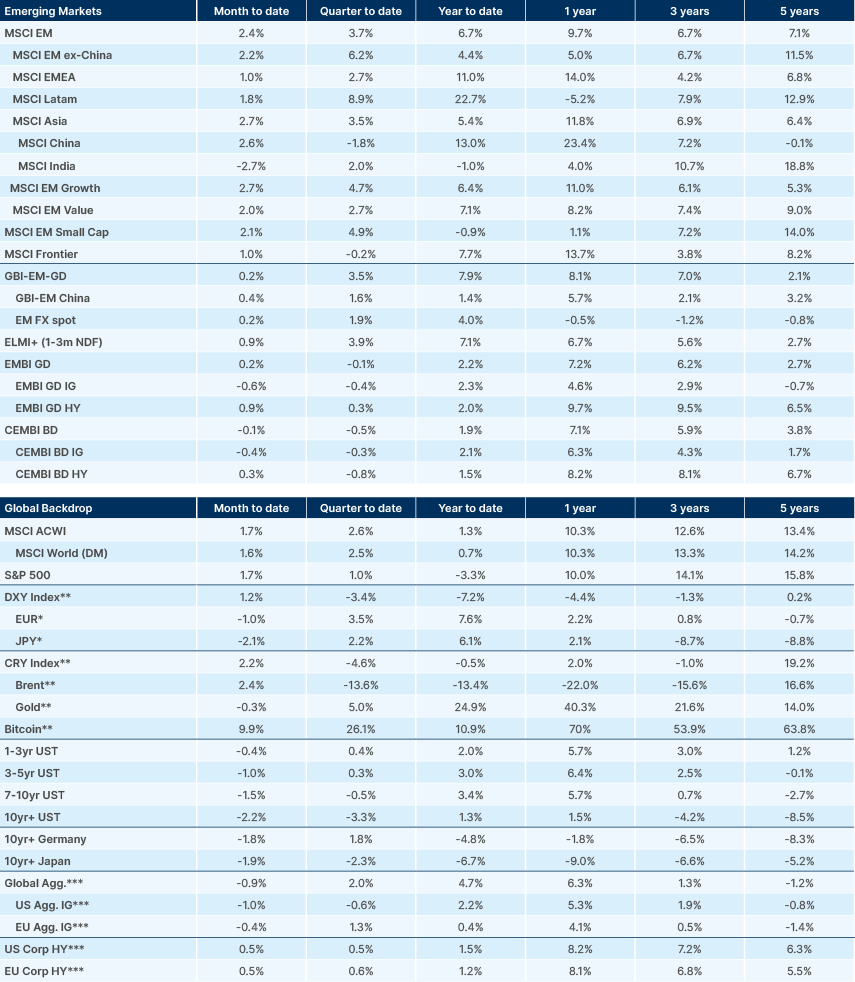

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.