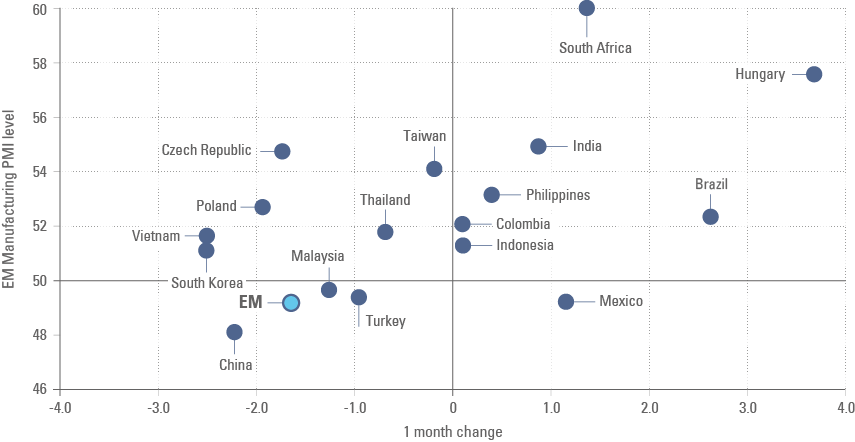

Global Markit Manufacturing PMI indicators softened, as China underperformed due to targeted lockdowns in Shanghai, notably. The increase in ISM prices paid and the depressed level of supplier delivery times in the US Markit PMI provide further evidence that supply chain disruptions are not over, yet. Against this backdrop, the central banks of Colombia and Chile hiked their policy rates by less than expected. In general, EM central banks already hiked policy rates to a level that will inhibit the secondary impact of higher commodity prices in inflation, and may now be turning their focus to the risk of lower economic growth following the supply shock resulting from the Ukrainian War. In Brazil, Bolsonaro replaced the CEO of Petrobras again, while Peruvian President Castillo survived another impeachment attempt. In Hungary Victor Orban won a fifth term as Prime Minister. Qatar and Saudi Arabia announced significant financial support to Egypt.

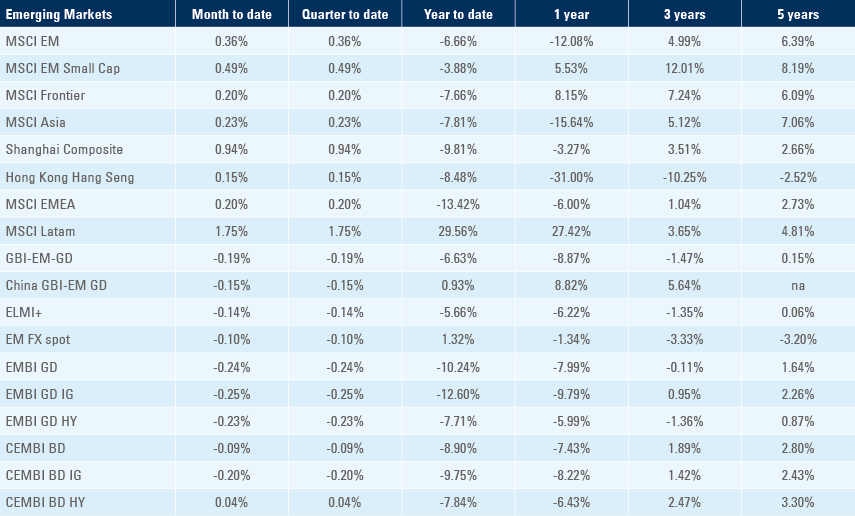

Manufacturing PMI Survey

The global manufacturing PMI dropped 0.7 to 53.0 in March, as DM PMI was unchanged at 56.5 and EM PMI dropped 1.7 to 49.2. In DM, the Eurozone manufacturing PMI dropped 1.7 to 56.5 while Japan rose 1.4 to 54.1 and the United States rose 1.5 to 58.8. DM supply delivery times remained extremely depressed at 30.6, reflecting supply chain disruptions, but current output rose 0.5 to 53.7. In contrast to the strong PMI in the US, the ISM manufacturing index, a survey focusing on large corporations, dropped 1.5 to 57.1, as prices paid rose 4.4 to 80.0, new orders plunged 7.9 to 53.8 and employment rose 3.4 to 56.3. This suggests large companies are seeing a more challenging environment for new orders in the face of elevated price pressures.

In EM, the decline was led by China (-2.3 to 48.1), South Korea (-2.6 to 51.2), Vietnam (-2.6 to 51.7) and Russia (-4.5 to 44.1), while Hungary (+3.8 to 57.6), Brazil (+2.7 to 52.3), South Africa (+1.4 to 60.0)

and Mexico (+1.2 to 49.2) outperformed as per Figure 1. The EM employment subcomponent rose 1.2 to 50.1, but new orders dropped 4.4 to 47.2 and output declined 3.1 to 47.9. The supplier delivery times declined 1.3 to 46.0, suggesting the supply chain remains problematic, but to a much lesser extent than in DM.

Figure 1: EM Manufacturing PMIs

Emerging markets

Chile: The central bank hiked its policy rate by 150bps to 7.0%, 50bps below consensus expectations and kept the door open for further hikes, albeit mentioning that the pace of hikes is likely to be slower as the focus shifts to economic activity from currently de-anchored inflation expectations. The unemployment rate rose 0.2% to 7.5% in February, while economic activity declined 0.7% mom in February after 0% in January.

Colombia: The central bank hiked its policy rate by 100bps to 5.0%, 50bps below consensus, but acknowledged that inflation risks remain skewed to the upside, particularly owing to food prices. The central bank increased its 2022 GDP growth forecast by 40bps to 4.7% after a 10.6% expansion in 2021 and a 7.0% contraction in 2020. The urban unemployment rate dropped 2.1% to 12.7% in February and continued to decline from its 24.9% peak in June 2020.

Brazil: President Jair Bolsonaro fired the Petrobras CEO General Silva e Luna and nominated Adriano Pires as his replacement. The new appointee has ample experience in the oil and gas sector and is likely to keep the current pricing policy in place, whereby the company adjusts prices in line with international parity. Pires supports the establishment of a special fund endowed with dividend payments and royalties, designed to subsidise fuel prices for a period of time to smooth the price increase. In economic news, 328k jobs were created in February, more than 100k above consensus expectations, mostly due to higher employment in the service sector as the unemployment rate was stable at 11.2%. Industrial production rose 0.7% mom in February after declining 2.2% in January and the trade surplus rose to USD 7.4bn in March from USD 4.1bn in February. In political news, there were signs of further consolidation in the political ‘centre’ after Social Democrat candidate Joao Doria threatened to drop out of the presidential race and former judge Sergio Moro gave up on his presidential bid to run for the lower house for the Brazil Union party instead.

Peru: President Pedro Castillo survived the second impeachment attempt against him in four months with 55 votes out of 128 lawmakers voting for the impeachment, 32 short of the number needed for impeachment, as 54 parliamentarians voted against impeachment and 19 abstained. Truck drivers started a strike over fuel prices and blocked two out of three road arteries connecting Lima to the rest of the country, threatening the supply of food and commodities to Lima. The yoy rate of CPI inflation rose 60bps to 6.8% in March in the city of Lima.

Hungary: Victor Orban won his fourth consecutive victory as leader of the Fidesz Party, allowing him a fifth consecutive term in power, despite the opposition parties uniting around a single opposition candidate. Orban’s Fidesz party was leading with 53.1% of votes counted versus 35% for the opposition alliance; preliminary results indicate Fidesz would have a two-thirds majority in Parliament. Victor Orban becomes the longest running political leader in Europe, and the EU leader most opposed to harsh energy sanctions against Russia. Hungary has built strong political and economic ties with Putin’s Russia, which has led to a rift with its ideological cousins in Poland’s Law and Justice Party. Hungary’s dependence on Russian natural gas has been modest at c. 40% of its gas imports in 2020 (mainly via gas pipelines through Ukraine) and was balanced out by LNG imports from Croatia. But Victor Orban signed a deal with Gazprom in 2021 expected to increase the share of Russia gas to 55% and to reduce imports via Ukraine.

Egypt: Saudi Arabia said it had deposited USD 5bn with the Central Bank of Egypt to support the country’s balance of payment, in addition to a USD 10bn financial commitment by Saudi Arabia’s PIF to make investments in Egypt. The UAE invested USD 2bn into Egyptian government-owned companies, and the Qatar Investment Authority pledged to invest USD 5bn into Egypt. France pledged to help Egypt to secure wheat supplies in the coming months. In economic news, real GDP rose by 4.6% qoq in Q4 2021 from -2.4% qoq in Q3 2021.

Kenya: The central bank kept its policy rate unchanged at 7.0%, justifying the decision on anchored inflation expectations. The policy rate at 7.0% remains in positive real terms as the yoy rate of CPI inflation rose 50bps to 5.6%. The government is discussing another 15% cut to electricity bills for homes and businesses during Q2 2022 as the country seek to review the power purchase agreements signed over the last years.

Pakistan: In a surprising twist of events, a long-awaited vote of no-confidence in Prime Minister Imran Khan, which was due to take place on Sunday, was cancelled at the last minute with the deputy Speaker of the house citing alleged ‘foreign interference’; The country’s president, at Khan’s urging, then dissolved the National Assembly and asked PM Khan to stay on as PM until a caretaker government is appointed. The Army was quick to distance itself from Khan’s move with its spokesperson saying “the army has absolutely nothing to do with what happened in the National Assembly today”. The Supreme Court is looking in the constitutionality of PM Khan’s power move, and will determine if the non-confidence vote needs to be reinstated. Just last month, the Executive Board of the IMF had concluded the sixth review of an Extended Fund Facility (EFF) for Pakistan, allowing the authorities to draw the equivalent of of SDR 750m (about USD 1bn) from the IMF.

Snippets

- China: The Markit manufacturing PMI dropped 0.7 to 49.5, while non-manufacturing PMI dropped by 3.2 to 48.4, both slightly below consensus due to the impact of the rolling lockdowns across China.

- Czech Republic The central bank hiked its policy rate by 50bps to 5.0%, in line with consensus.

- Dominican Republic: The central bank hiked its policy rate by 50bps to 5.0% as inflation rose to a yoy rate of 9.0% in February.

- Ecuador: The state-owned oil company Petroecuador said it plans to increase oil production by 100k to 495k barrels per day in 2022 by reactivating 1k closed wells.

- El Salvador: President Nayib Bukele declared a state of emergency after dozens of killings over the weekend.

- Ghana: Parliament approved a 1.5% electronic transaction tax, seeking to raise USD 0.9bn in revenues.

- Hungary: The trade deficit increased to USD 244m in January from USD 196m in December.

- Indonesia: The yoy rate of CPI inflation rose 60bps to 2.6% in March while core CPI rose 30bps to 2.4% yoy, both broadly in line with consensus.

- Mexico: The unemployment rate was unchanged at 3.7% in February, while the trade balance moved to a USD 1.3bn surplus in February from a USD 6.3bn deficit in January. The rebound was stronger than expected even after considering seasonal patterns. Commercial bank loans dropped 0.3% in February to MXN 4.85bn in February after rising 0.3% in January.

- Mozambique: The central bank hiked the policy rate by 200bps to 15.25%.

- Poland: The yoy rate of CPI inflation rose by 240bps to 10.9% in March or 110bps above consensus.

- Russia: The unemployment rate dropped 30bps to 4.1% in February, 50bps below consensus while retail sales rose by a yoy rate of 5.9% in February from 3.6% yoy in January.

- South Africa: The unemployment rate rose 40bp to 35.3% in Q4 2021, the highest level on record as the number of economically active people rose by 397k. The trade surplus rose to ZAR 10.6bn in February from ZAR 4.1bn in January and the yoy rate of PPI rose 40bps to 10.5% in February.

- South Korea: The trade balance moved to a USD 140m deficit in March from a USD 831m surplus in February as imports rose at a yoy rate of 27.9% (led by energy) and exports increased by 18.2% yoy. Industrial production rose to a yoy rate of 6.5% in February from 4.2% yoy in January, 200bps above consensus, while retail sales dropped to 4.7% yoy in February from 13.9% yoy in January.

- Thailand: The Bank of Thailand kept its benchmark rate unchanged at 0.5% in line with consensus while the yoy rate of export growth rose to 16.0% in February from 7.9% yoy in January taking the trade surplus to USD 3.4bn from USD 0.6bn over the same period.

- Turkey: The trade deficit narrowed to USD 7.9bn in February from USD 10.3bn in January, slightly better than consensus.

- Vietnam: The yoy rate of real GDP growth rose by 5.0% in Q1 2022 with a broad-based recovery centered in its external accounts. Vietnam reopened its borders from mid-March, a move that is likely to support further economic outperformance based on the revival of the tourism sector.

- Zambia: The yoy rate of CPI inflation declined 110bps to 13.1% in March, a sharp decline from the peak at 26.3% yoy in June-2021. The stronger ZMW due to lower risk premium, tight monetary conditions and lower energy prices after the end of the drought are bringing inflation back towards single-digit levels.

Global backdrop

United States: The Chicago PMI rebounded to 62.0 in March from 56.3 in February, more than 5.0 above consensus, but remained on a declining trend since peaking at 73.3 in May 2021. Personal consumption dropped to 2.5% qoq from 3.1% in Q3 2022 while the yoy rate of PCE deflator rose 40bps to 6.4% and core CPE deflator rose by 20bps to 5.4% in February. The labour market remains strong, with 431k jobs created in March after 750k in February, taking the unemployment rate down 20bps to 3.6% as average hourly earnings rose 40bps to a yoy rate of 5.6%. The 30-year mortgage rate increased to 4.78% last week, the highest level in 10-years at the same time that higher house prices brings affordability to the lowest levels since 2007.

Europe: The Eurozone CPI inflation rose by 160bps to 7.5% in March, 70bps ahead of consensus, led by a 220bps increase in Germany’s CPI to 7.3%, over 100bps above consensus, while France’s CPI rose 90bps to 5.1% yoy over the same period. The elevated level of inflation is likely to bring the ECB to end its asset-purchasing programme and start increasing policy rate to positive levels during 2022.

Commodities & RUB: The US federal government announced the release of 180m barrels of oil over the next six months from the US SPR (Strategic Petroleum Reserve). This is a significant drawdown from reserves that stood at 568m barrels as of 25 March. If fully implemented, the drawdown will take the strategic reserves to their lowest levels since 1984. Such low levels could make oil prices more sensitive to any further supply shocks in the future. Commodity prices (CRY) rose by 27% in Q1 2022, the largest increase for Q1 since 1915. Over the same period, broad energy prices rose 48% (oil was up 39%), industrial metals 23% and agriculture prices rose 20%. President Putin’s insistence that oil and gas buyers from ‘unfriendly’ countries should pay in Roubles (RUB) has gathered considerable attention. It has been used as an illustration of how the central role of the USD in international trade can be undermined by the ‘weaponisation’ of the dollar through US-led sanctions. These risks may be real, but Russia’s objectives are more mundane: Russia’s use of USD assets is significantly impaired by sanctions, the internationalisation of the RUB can help circumvent these sanctions. The Central Bank of Russia’s ability to monetise its USD 140bn in gold reserves has also been impaired by US sanctions, prompting the CBR to make a market for gold in RUB at a price equivalent to USD 1,00 per ounce as of Friday’s close. Already the value of the RUB has recovered to pre-war levels. The rebound in RUB is principally the result of domestic capital controls, but there is a view in the US and in Europe that the sanctions are not be tough enough, and need to include (partial) bans on oil imports from Russia, with cuts in gas imports next in line for curbs.

Monetary policy: Higher commodity prices and lower housing affordability amidst ongoing supply chain disruptions all feed into the stagflation narrative. This is a challenging background for the Fed, which may be moving from one mistake to another. After keeping loose monetary policy during the entire year 2021 when economic activity was overheating and inflation rising, the Fed is looking to tighten monetary policy via interest rates and quantitative tightening to fight inflation – the biggest concern of the US population ahead of midterm elections. However, whilst the Fed’s tools have the power to curb demand, it will do little to lower commodity price pressures incurring from the war – a supply disruption. In fact, the general increase in commodity prices and the disruption in the transport, storage and payments for commodities because of the war are demanding more capital for energy, food and metals. In this environment, we posit that central banks should be providing liquidity to upstream commodity producers and commodity traders to ensure the supply and transport commodities, while at the same time hiking interest rates to avoid higher commodity prices disseminating across the economy.