Tensions between Russia and Ukraine increased, but a diplomatic solution is still possible. Iran nears a deal with the West for the removal of sanctions. China’s inflation was lower than expected as the RMB role for foreign transactions increased. Argentina hiked its policy rate by 250bps, bringing policy rates to positive ex-post real levels as agreed with the IMF. In Brazil, the gap between Lula and other candidates narrowed in a recent poll. Colombia’s GDP surprised to the upside. Czech inflation surged after an expected end in utility subsidies. Ecuador’s fiscal deficit was narrower than expected. Ethiopia started the operation of the first turbine in the Blue Nile hydroelectric dam. Turkey kept policy rate unchanged.

Emerging markets

Geopolitics

Tensions between Ukraine and Russia escalated further with separatist leaders of the occupied Donbass region in eastern Ukraine asking woman and children to leave the area last week. Over the weekend, Russia carried out long-range missile tests from Belarus and announced it will keep military personnel and equipment in the county on a permanent basis, entrenching its military position in the region. Since Friday, shelling was reported in Donbass with the separatists accusing Ukraine, while Ukrainian President Volodymyr Zelenskyy said Ukraine has been restrained on its response and will not respond to provocations.

The US has maintained its stance of repeatedly saying that Russia is very close to invading Ukraine. This has been seen both as a containment strategy (the thesis being that Russia does not want to confirm the US intelligence warnings) and to avoid being wrong-footed like in the recent botched exit of Afghanistan. This morning, the Ukraine Defence Minister Alexei Reznikov said a Russian invasion is unlikely in the early part of the week, as there are no strike groups ready near the border. Reznikov said, “In general, it can take weeks to deploy a strike group - from a week to a month”.

Yesterday, after a number of calls, the French President Emmanuel Macron agreed with Russia’s Vladimir Putin to negotiate a ceasefire, highlighting a diplomatic solution for the conflict remains possible, albeit the chance of a more meaningful conflict has increased significantly. The White House spokesperson said President Biden agreed “in principle” to meet if Russia does not invade Ukraine. Russian Finance Minister Lavrov will meet with his counterparty Blinken on Thursday.1

At the same time, it is clear that Russia has decided to further interfere with the sovereignty of Ukraine. President Putin’s request for Zelenskyy to speak with the separatists in Donbass is another attempt to get Ukraine to acknowledge the special status of the region, de-facto losing sovereignty over that territory. Furthermore, Russia insists the US has to deliver written guarantees that Ukraine will never join the North Atlantic Treaty Organisation (NATO), the most important request made last December. Beyond the public requests for non-NATO interference, an independent and successful Ukraine represents a threat to the Russian and Belarussian autocratic regimes.

In other geopolitical news, Iran has been inching closer to the revival of the 2015 nuclear deal with the US, Germany, France and Russia after the sixth round of negotiations between the parties led to a more refined draft document. Iran requests the immediate removal of sanctions imposed during the administration of Donald Trump after the US unilaterally withdrew from the deal in May 2018. Over the weekend, the Iranian parliament passed legislation demanding the US not to walk back from the treaty unilaterally.2

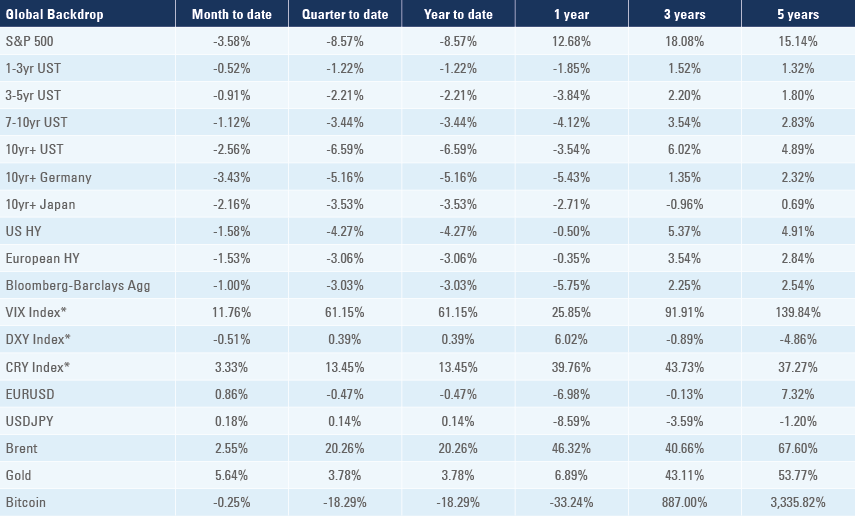

Last week oil prices hit a high of USD 96.0 per barrel on Monday on fears of escalation and low inventory data from the US, but declined to USD 90 per barrel by Friday after the Iran deal headlines before spiking to USD 93.5 on the first headlines of shelling in Eastern Ukraine. Commodity prices rose 0.5%, supported by precious and industrial metals. Gold rose 1.4% last week and 5.7% month to date as the yellow metal historically benefits from bellicose conflicts. EM local assets (local bonds +0.5% and equities -0.7%) outperformed risky assets again as the S&P500 sold-off 1.5% during the week.

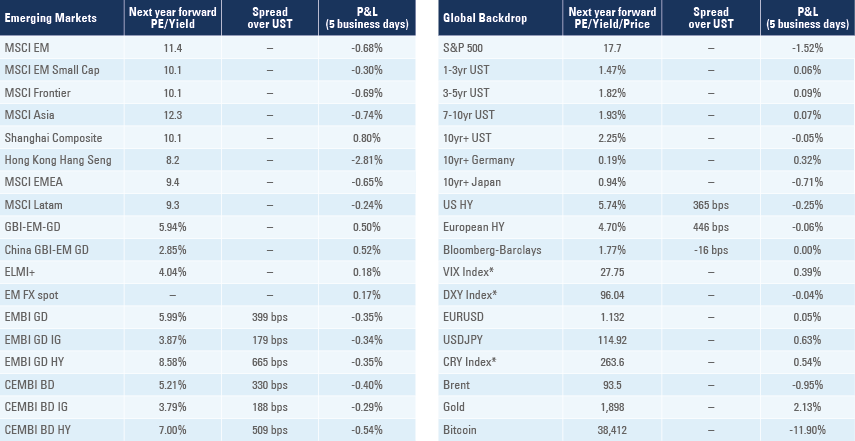

China: The yoy rate of CPI inflation declined to 0.9% in January from 1.5% in December, slightly lower than consensus while PPI inflation dropped 1.2% to 9.1% yoy (consensus 9.5%) driven by softer food prices. The share of swift payments in CNY jumped to 3.2% in January from 2.7% in December, the highest level in history and 0.4% above the JPY as per Figure 1. The low RMB volatility makes it more attractive for the adoption of the Chinese currency as a means of settling commercial transactions at the same time that the opening of Chinese capital accounts encourages foreign traders to convert their settlement to the Yuan. In other news, the city of Heze in Shandong cut the mortgage down payment ratio to 20% (from 30%) for first homebuyers and lowered mortgage rates by 35bps to 5.6% for first and second home buyers.

Figure 1: Currencies between 1% and 10% of market share on Swift:

Argentina: The central bank hiked its 7-day Leliq policy rate by 250bps to 42.5%, taking the annualised effective policy rate to 51.9%. The policy rate now stands above the last 12 months inflation as the yoy rate of CPI inflation declined 0.2% to 50.7%, in line with consensus. The 180-day Leliq rate was increased by 300bps to 47.0% (or 52.6% in annual terms)

Brazil: A poll by Poderdata showed former president Luis Inacio Lula da Silva’s vote intention dropping 1% to 40%, incumbent president Jair Bolsonaro’s +1% to 31%, and former Judge Sergio Moro’s +2% to 9%. There has been an intense surge in negotiations for alternatives to the polarisation between Lula and Bolsonaro with Joao Doria’s party PSDB gaining support from Cidadania (9 seats of 513 in the Lower House and 3 of 81 in the Senate).

Colombia: The 2021 full year GDP rose 11.8%, significantly above 9.1% consensus, after declining 7.0% in 2020. The yoy rate of retail sales rose to 15.9% in December from 6.1% in November, significantly higher than consensus while industrial production declined 2.0% to 10.5% yoy. The trade deficit narrowed to USD 1.3bn in December from USD 2.0bn in November.

Czech Republic: The yoy rate of CPI inflation surged 3.3% to 9.9% in January, 0.6% above consensus expectations. The main drivers of the acceleration were the increase in electricity and gas prices after the VAT cut expired, but also food, core goods and hospitality sector. The current account deficit widened to CZK 18.3bn in December from CZK 6.0bn in November.

Ecuador: The fiscal deficit narrowed to 3.2% of GDP in 2021 from 7.2% in 2020, significantly better than the IMF target. The government targets a 2.0% deficit in 2022, but based on very conservative GDP growth and oil prices assumptions. Foreign exchange reserves rose USD 0.1bn to USD 8.0bn in January, the highest level in 20 years.

Ethiopia: The state media reported the first turbine of the Grand Ethiopian Renaissance Dam (GERD) on the Blue Nile River has started generating 375 megawatts of electricity on Sunday. The controversial USD 5.0bn project will have 16 turbines and with c. 6 gigawatts of capacity when completed. The largest hydroelectric power plant in Africa will more than double Ethiopia’s energy output. Sudan hopes the project will regulate annual flooding, but fears its own dams could be harmed if not coordinated with the GERD while Egypt is extremely concerned about its existential dependence on the Nile river for irrigation.

Turkey: The central bank kept its policy rate unchanged at 14.0%, in line with consensus. House prices rose 7.9% mom in December from 9.0% mom in November, taking the yoy rate of growth 9.0% higher to 59.6% as individuals seek assets to protect themselves from inflation. Home sales declined to 88.3k in January (in line with 10-year average) from 227k in December, which was the highest level of sales for December in 10 years.

Snippets

- Hungary: The yoy rate of real GDP growth rose 7.2% in Q4 2021 from 6.1% yoy in Q3 2021, significantly above consensus.

- Indonesia: The trade surplus declined to USD 0.9bn in January from USD 1.0bn in December and the Q4 current account surplus narrowed to USD 1.4bn in Q4 2021 from USD 5.0bn in Q3 2021, both better than consensus.

- Malaysia: The trade surplus narrowed to MYR 18.4bn in January from MYR 31.0bn in December as imports grew faster than exports.

- Nigeria: Real GDP growth rose 3.4% in 2021, the highest level in nine years. In other news, the yoy rate of CPI inflation was unchanged at 15.6% in January.

- Philippines: The central bank kept its policy rate unchanged at 2.0%, in line with consensus. Remittances from overseas workers rose to USD 3.0bn in December from USD 2.5bn in November.

- Poland: The current account deficit widened to EUR 4.0bn in December from EUR 0.6bn in November, as the trade deficit widened to EUR 2.5bn from EUR 0.2bn over the same period. The yoy rate of real GDP growth accelerated to 7.3% in Q4 2021 from 5.3% yoy in the previous quarter. The yoy rate of CPI inflation rose 0.6% to 9.2% in January, slightly below consensus while PPI inflation rose 0.4% to 14.8% yoy over the same period.

- Romania: The yoy rate of real GDP growth declined to 2.2% in Q4 2021 from 7.4% yoy in Q3 2021, 3.0% lower than consensus. The yoy rate of CPI inflation rose to 8.4% in January from 8.2% yoy in December (consensus 8.0%). Industrial production rose 1.2% in December after rising 3.0% in November, but industrial sales dropped 8.4% after rising 12.5% over the same period.

- Russia: The yoy rate of PPI inflation dropped 5.4% to 23.1% in January

- Saudi Arabia: The yoy rate of CPI inflation was unchanged at 1.2% in January.

- Senegal: The yoy rate of CPI inflation rose to 5.5% in January from 3.8% yoy in December, mostly led by food, while services inflation remained subdued.

- South Africa: The yoy rate of CPI inflation dropped 0.2% to 5.7% as core CPI rose 0.1% to 3.5%, both in line with consensus. Retail sales rose 1.5% mom in December after rising 1.6% in November.

- South Korea: Exports expanded at a yoy rate of 13.1% in the first 20 days of February, or 17.2% yoy after adjusting for business days, which is unchanged from January. The unemployment rate dropped 0.2% to 3.6% (consensus 3.5%).

- Thailand: The yoy rate of real GDP growth rose 1.9% in Q4 2021 GDP, twice the level of consensus expectations, taking 2021 full year growth to 1.6% (1.2% consensus). Private consumption and investment positive surprises were the main contributors to stronger economic performance.

- Uruguay: The central bank hiked its policy rate by 75bps to 7.25%, in line with consensus, and pledged a similar hike in the next meeting as inflation expectations remain outside its target range as analysts expect 6.6% yoy inflation over the next two years and business expects 8.0%.

Global backdrop

United States (US): President of the Cleveland Fed Loretta Mester said she would support a faster pace of tightening if needed to tame inflation, but prefers to do it in 2H 2022, should inflation not slow down. President of the New York Fed John Williams said, “we clearly have opportunities to take policy actions over this year starting in March. Personally, I don’t see any compelling argument to take a big step at the beginning”, adding that the Fed could move to normal rates faster than in 2015-17. Most FOMC members have backed an initial 25bps hike in March, with the exception of non-voter Bullard who supported a 50bps hike. Initial jobless claims rose to 248k in the 12 February week from 225k in the previous week. Retail sales rose 3.8% mom in January from -2.5% in December as industrial production increased to 1.4% from -0.1% over the same period. The yoy rate of PPI inflation declined 0.1% to 9.7% (consensus 9.1% yoy). The housing market remained strong with housing starts declining a little, but building permits holding steady in January and existing home sales surging 6.7% in January from -3.8% in December and -1.3% consensus. A sharp increase in 30-year mortgage rates to 4.19% from 3.27% in December is likely to start affecting the housing market over the coming months, in our view. The empire manufacturing survey rose to 3.1 in February from -0.7 in January.

Europe: The ECB economist Philip Lane justified the hawkish shift at the latest meeting saying there is enough evidence to suggest the Eurozone may be in a higher inflationary regime from before the pandemic. Lane took some comfort from the fact that inflation expectations remain reasonably anchored, but pointed to the importance of (currently tight) labour market dynamics on medium term inflation trends.3 Lane’s speech reflects other ECB directors’ recent statements and solidifies our view that monetary policy shift seems to be decided as the question is not whether, but when and by how much interest rates should rise to zero or positive levels.

In economic news, the yoy rate of PPI inflation rose to 25.0% in January from 24.2% in December (consensus 24.4%). The French Markit PMIs surprised to the upside with manufacturing rising 57.6 (consensus 55.5) and services at 57.9 (consensus 54.0), while the German manufacturing PMI disappointed at 58.5 (consensus 59.8) but services was strong at 56.6 (consensus 53.1). The Euro Area trade deficit widened to EUR 9.7bn in December from EUR 1.8bn in November (EUR 4.7bn consensus), but the current account surplus declined only EUR 1.0bn to 22.6bn. Industrial production rose 1.6% mom in December from -1.4% mom in November.

Japan: The yoy rate of CPI inflation declined 0.3% to 0.5% in January as core inflation dropped 0.4% to -1.1% over the same period, both slightly lower than consensus. Real GDP growth rose 1.3% qoq in Q4 2021 from -0.7% in Q3 2021. Industrial production dropped 1.0% in December

United Kingdom: The yoy rate of CPI inflation rose 0.1% to 5.5% in January and core CPI rose 0.2% to 4.4% yoy, both slightly above consensus. The unemployment rate was unchanged at 4.1%.

Canada: the yoy rate of CPI inflation rose 0.3% to 5.1%.

1. See https://www.rt.com/russia/550045-putin-macron-call-ukraine/ and https://www.france24.com/en/europe/20220220-putin-macron-discuss-need-to-step-up-diplomacy-on-ukraine

2. See https://www.aljazeera.com/news/2022/2/20/irans-parliament-sets-conditions-for-return-to-nuclear-deal

3. See https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220217_1~592ac6ec12.en.html