Flashing red PMIs already signalling a US recession in early 2023

Flashing red Purchasing Managers Indices (PMIs) are signalling a US recession in early 2023. China protesters took to the streets as local government restrictions conflicted with 20 new guidelines issued early in the month. The Peruvian president reshuffled the cabinet for the fifth time in less than 18 months. Colombia pledged not to issue Eurobonds within the next few quarters. External accounts improved in Argentina and Brazil while inflation remained unchanged in Mexico. Turkey was reported to be close to an agreement with Qatar to receive USD 10bn in funding. Ghana’s deputy finance minister suggested that haircuts of up to 30% are under discussion on principal payments to Eurobond holders.

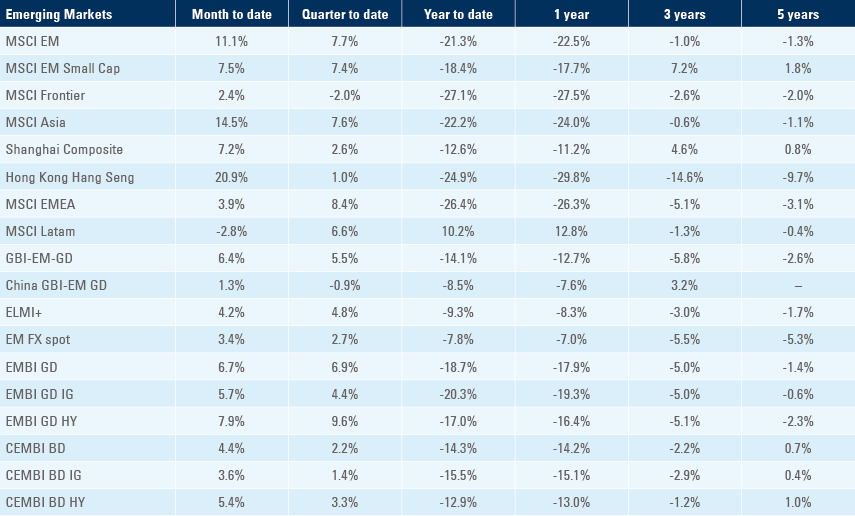

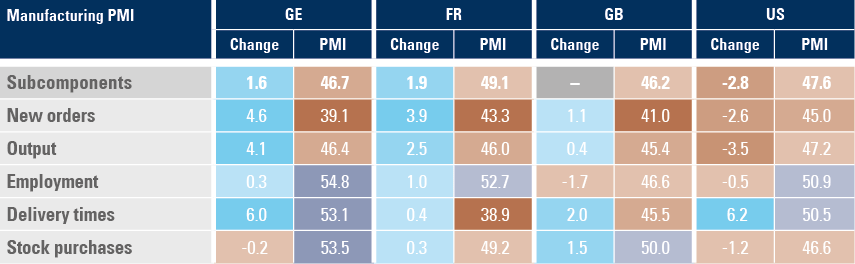

Flash Purchasing Managers’ Index (PMIs)

The flash PMIs for November, as per Figure 1, showed a continuous and faster than expected deterioration on the manufacturing sector for the United States (US) economy. Euro Area manufacturing recovered somewhat from October’s levels, led by improved new orders from Germany and France, but remain overall very much at recessionary levels. UK manufacturing was stable.

Figure 1: Germany, France, Britain and United States Manufacturing PMIs, November and 1m change

The key surprises were the sharp drop in US manufacturing new orders and output, bringing the level of manufacturing activity already to recessionary levels in November. The employment sector also softened but remained above 50, suggesting the US Federal Reserve (Fed) has more “wood to chop” as its ultimate objective of tighter monetary conditions is to slow wage inflation to stop inflation becoming structurally entrenched. Delivery times improved in the US and Germany, but remained at low levels in France and the UK.

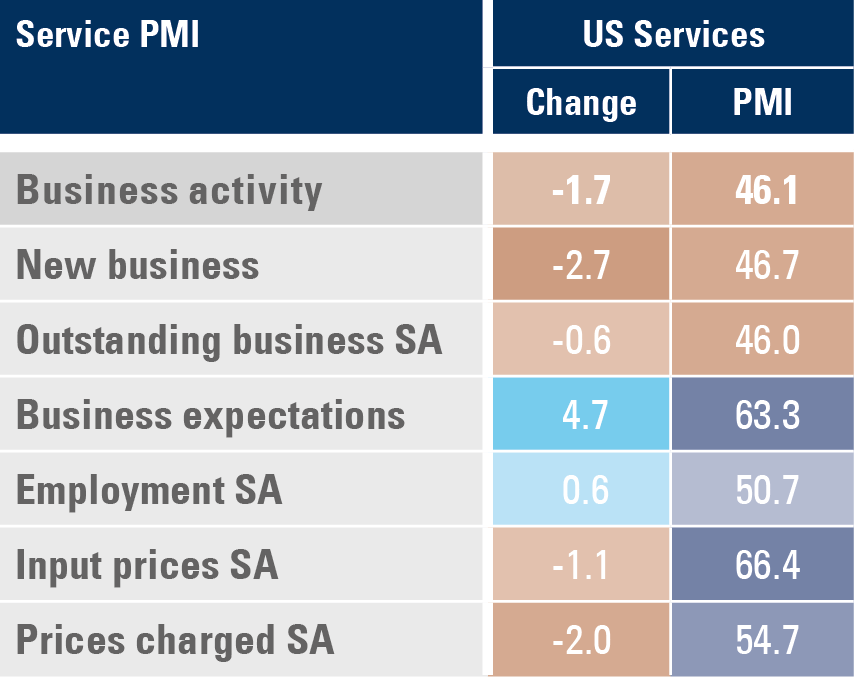

Figure 2 shows the US services sector PMI also came in much weaker than expected, declining 1.7 points to 46.1 in November as new business dropped 2.7 points. Strangely, business expectations jumped 4.7 points to an elevated 63.3. Service sector inflation is likely to remain elevated as input prices remained 1.4 standard deviations above its median, declining only 1.1 points to 66.4, while prices charged dropped 2.0 points to 54.7

Figure 2: US services PMIs, November and one-month change

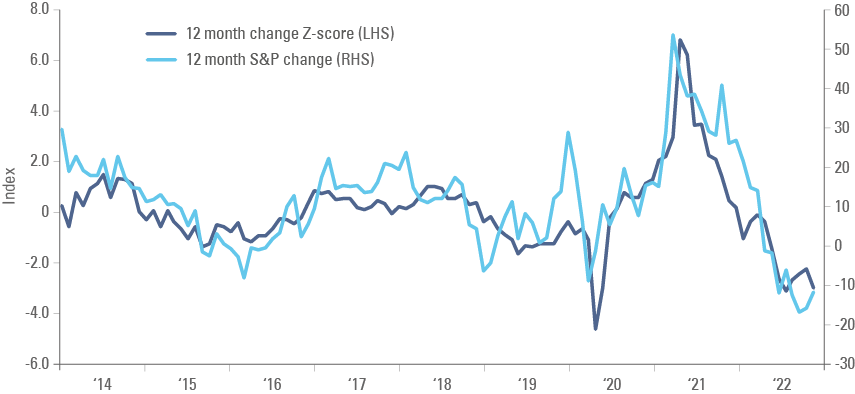

The declining trend for the manufacturing PMI suggests US equities are likely to start 2023 under pressure (Figure 3), particularly considering the recent rebound in global equities played out largely due to technical reasons. After all, the Fed is almost certain to slow its pace of hikes in December, but will keep the door open to bring policy rates to 5.0% and beyond as the resilience of the labour market and the elevated level of inflation demand higher policy rates for longer.

Figure 3: US flash PMI z-score vs. 12-month change in S&P500

Geopolitics

The decision on capping Russian oil prices was postponed to this week after Poland and the Baltic nations disagreed on a proposal to cap Russian oil prices at USD 65 per barrel. This level was judged too generous for Russia as it is above the rates at which Moscow sells crude today. Bloomberg reported a senior Polish diplomat says Poland wants new sanctions, a review mechanism, and a cap on oil prices below the current market level. The market dynamics and game theory suggest that the lower the oil price cap, the larger the risk of Russia lowering overall output, leading to an increase in non-Russian oil prices. Oil prices dropped to USD 81 per barrel today after covid-19 cases increased and a wave of unrest hit China.

Emerging markets

China: The People’s Bank of China cut the reserve requirement ratio for major banks by 25 basis points (bps) to 11.0%. The measure represents a liquidity adjustment rather than any significant easing. The number of covid-19 cases increased as a larger share of the population remained indoors in Beijing and other cities in China. Police clashed with workers from Foxconn (Hon Hai Precision Industry) factory in Zhengzhou, capital of the Henan Province, leading to significant disruptions in iPhone production. Thousands of protesters took to the street across several cities, including Shanghai and Beijing, after covid-19 restrictions were blamed for hampering rescue efforts in an apartment building that caught fire in Urumqi, Xinjiang, killing 10 people. The Central Government said counties or local governments have the authority to impose localised lockdowns, which are only allowed in high-risk areas (narrowed down to each building). It also clarified no authority can lock down or seal fire exits at any time and stated any mobility restrictions should be lifted once no new infections were observed for five consecutive days. Protests are now having an impact on local authorities’ controls. In Beijing, several residential compounds lifted control measures in low-risk areas buildings after residents voiced complaints on excessive curbs to officials. Guangzhou said there was no plan for a broad lockdown, while several districts fine-tuned local controls. Shenzhen said it will limit restaurants and indoor venues at 50% capacity and bar new arrivals from entering public venues for three days; residents are being asked to stay at home from 28 November to 2 December.

Peru: The Constitutional Tribunal ruled the treason accusation against President Pedro Castillo as “groundless”. The accusation was based on a television interview where Castillo suggested Peru could hold a referendum and cede some territory to Bolivia, giving its landlocked neighbour access to the Pacific Ocean. A second accusation against Castillo on corruption grounds is still pending with the Constitutional Tribunal. Last week, the ministerial cabinet resigned after President of the Council of Ministers (a prime minister-like post) Anibal Torres quit the government after clashing with the executive branch. The resignation came after Torres denied President Castillo demanded to repeal a law that restricts the power of the executive to present a vote of confidence. Castillo interpreted the decision as an outright denial of a vote of confidence on government policy. A second denial would constitutionally entitle (but not require) the executive to dissolve Peru’s Congress, triggering early elections. Members of parliament would like to avoid an early election, but so far do not have enough power to impeach the president. Castillo appointed Betssy Chaves as premier, the fifth government head since Castillo took office in July 2021. Chaves was censured by Congress when serving as Labour Minister. In economic news, the yoy rate of real GDP growth slowed to 1.7% in Q3 2022 from 3.3% in Q2 2022, in line with consensus. The current account deficit widened to 6.0% of GDP in 3Q 2022 from 3.5% in Q2 2022, increasing to 4.4% of GDP over the last 12 months.

Colombia: Finance Minister Jose Antonio Ocampo said Colombia would abstain from issuing Eurobonds over the next few quarters and is, instead, looking into a possible debt swap supported by private banks. Ocampo also said the Interamerican Development Bank (IDB) and the World Bank have offered to guarantee the issuance of foreign debt as Colombia studies measures to lower the country risk premium. Tax collection increased by a yoy rate of 35% from January to October, reaching USD 191.7bn, 8.4% above the target, of which USD 152.2bn was tax collected from local activity and USD 39.5bn tax from foreign trade.

Argentina: The trade surplus increased to USD 1.8bn in October from USD 0.4bn in September as exports rose by USD 0.4bn to USD 7.9bn and imports declined USD 1.0bn to USD 6.1bn. Foreign exchange reserves declined USD 0.5bn to USD32.9bn in October, still significantly above the USD 28.9bn levels in August. The good trade data followed USD 7.7bn inflows after the Argentine government allowed agriculture exports to be converted to ARS at 200, halfway between the official exchange rate and the parallel rate in September. Finance Minister Sergio Massa said he would open a second window for agriculture exports to be converted a preferential rate of ARS 230 between 28 November and 31 December, but rural producers said they would like to see a full liberalisation on foreign exchange markets. Argentina’s fiscal balance moved to an ARS 103bn deficit in October from an ARS 80bn surplus in September.

Brazil: Consumer price index (CPI) inflation rose 0.5% mom in the first fortnight of November from 0.2% in October, as the yoy rate declined 60bps to 6.2% and average core metrics declined 40bps to 9.4%, according to Morgan Stanley. The current account deficit narrowed to USD 4.6bn in October from USD 7.1bn in September, in line with consensus, as foreign direct investment declined to USD 5.5bn from USD 9.2bn over the same period.

Mexico: CPI inflation rose to 0.6% mom in the first fortnight of November, up from 0.2% over the same period in October, but the yoy rate declined 20bps to 8.1% as core CPI was unchanged at 0.3% mom and the yoy rate rose 20bps to 8.7%, broadly in line with consensus. The yoy rate of real GDP growth accelerated to 4.3% in Q3 2022 from 4.2% in Q2 2022 and the current account deficit increased to USD 5.5bn from USD 0.5bn over the same period. Retail sales declined 0.2% mom in September following a 0.4% drop in August, taking the yoy rate down 140bps to 3.3%.

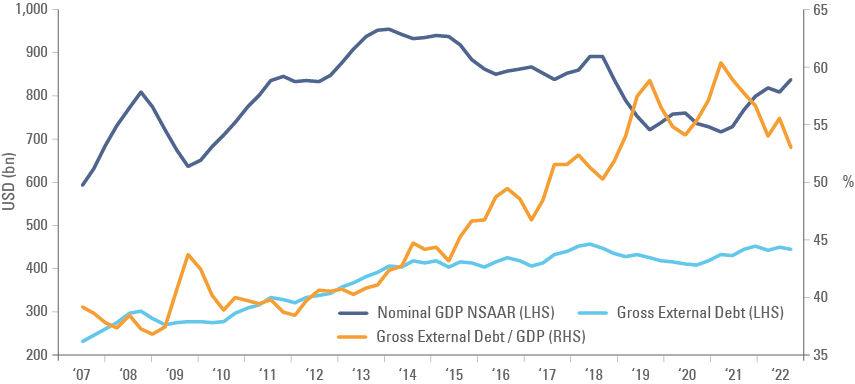

Turkey: News agency Reuters reported two senior Turkish officials said they are close to an agreement with Qatar for USD 10.0bn in sovereign debt funding, including up to USD 3.0bn by the end of this year. It was also reported that Saudi Arabia was considering a USD 5.0bn deposit at the Central Bank of Turkey (CBT). The CBT kept its heterodox policy framework last week when it cut its policy rate by 150bps to 9.0%, resulting in continuous underperformance of the Lira, which has depreciated 0.1% in November and 28.6% year-to-date, making it the second-worst performing G-20 currency (after Argentina). It is worrisome that Turkish External Debt increased by c. 9% to USD 444bn over the last two years. Over the same period, debt/GDP remained unchanged due to an increase in nominal GDP. Should nominal GDP decline in the future – either due to further depreciation of the TRY or otherwise – the country’s debt/GDP could increase quickly to unsustainable levels, in our view.

Figure 4: Turkey External Debt

Ghana: In a radio interview, deputy finance minister John Kumah said Ghana could propose as much as 30% principal haircuts for Eurobond holders and a three-year suspension on interest payments suspension. Later last week, the finance minister issued a press release that said the details of the debt operations were still under discussion and its terms would be announced in due course.1

Snippets

- Hungary: The central bank kept its policy rate at 13.0%, in line with consensus. The labour market remains strong as the unemployment rate dropped 20bps to 3.6% and average gross wages rose by 1.2% to a yoy rate of 17.8%.

- Malaysia: The yoy rate of CPI inflation declined 50bps to 4.0%, broadly in line with consensus.

- Nigeria: The central bank hiked its policy rate by 100bps to 16.5%, 25bps more than consensus. The yoy rate of real GDP growth decelerated faster than consensus to 2.3% in Q3 2022 from 3.5% in Q2 2022.

- Pakistan: The central bank hiked its policy rate by 100bps to 16.0% last Friday, after an increase in headline inflation and a deterioration on external accounts after higher imports.

- Poland: Some signs of disinflation were evident in October as producer price inflation (PPI) rose to 0.7% mom from 0.2% in September, but the yoy rate dropped 170bps to 22.9%, 60bps below consensus. Gross wages were unchanged in October after rising 1.6% mom in September, bringing the yoy rate down 150bps to 13.0%. The yoy rate of retail sales declined to 18.3% in October from 21.9% in September as consumer confidence remained depressed at -44.0 (up 1.5 points only)

- Russia: The yoy rate of PPI inflation dropped 300bps to 0.8% in October. Foreign exchange reserves rose to USD 569bn in the week of 18 November from USD 552bn in the previous week.

- South Africa: CPI inflation rose 0.4% mom and 7.6% yoy as core CPI rose 0.5% mom in October and 5.0% yoy, both 20bps above consensus, while PPI inflation declined 30pbs to 16.0% yoy. The South African Reserve Bank (SARB) hiked its policy rate by 75bps to 7.0%, in line with consensus. The Rand strengthen by 6.8% in November as the higher policy rates improves carry while the SARB signalled the possibility of less aggressive hikes over the next months.

- South Korea: The Bank of Korea hiked its policy rate by 25bps to 3.25%, in line with consensus as the yoy rate of PPI inflation dropped 60bps to 7.3% in October.

- Thailand: Real GDP growth rose 1.2% qoq in Q3 2022 after increasing 0.7% qoq in Q2 2022, lifting the yoy rate by 200bps to 4.5% over the same period.

Developed markets

United States: The publication of the minutes of November’s Federal Open Market Committee meeting anchored market expectations for a 50bps hike in the Fed Funds rate in December, bringing the upper target of policy rates to 4.5%. In economic news, durable goods orders rose 1.0% mom in October from 0.3% in September and capital goods increased 0.7% mom after declining 0.8% over the same period. Initial jobless claims increased by 17k to 240k, and continuing claims rose 48k to 1.551 million, both higher than consensus. The University of Michigan consumer sentiment survey rose to 56.8, but down from 59.9 in October as one-year inflation expectations declined by 20bps to 4.9%, while long-term expectations were unchanged at 3.0%. New home sales were surprisingly strong at 632k in October, up from 599k in September.

Europe: The German IFO business climate survey increased 1.8 points to 86.3 as the current assessment declined 1.1 points to 93.1, but expectations rose 4.1 points to 80.0, all remaining at very depressed levels.

New Zealand: The Reserve Bank of New Zealand hiked its policy rate by 75bp to 4.25%, in line with consensus, as its Committee considered a 100bp move, and projected the cash rate will peak at 5.5% in Q3 2023. The central bank increased its peak inflation forecast to 7.5% in Q1 2023, from 7.3% in Q2 2022, and sees the economy contracting for four consecutive quarters from Q2 2023, bringing annual GDP growth to 1.2% in 2023 (revised from 1.4%) and -0.3% in 2024 (previously 0.8%). Unemployment is expected to increase from 3.3% today to 4.8% by end-2023 and 5.6% by end-2024 (revised from 4.5% and 4.9%, respectively).

1. See https://mofep.gov.gh/sites/default/files/news/Possible-Debt-Operations.pdf

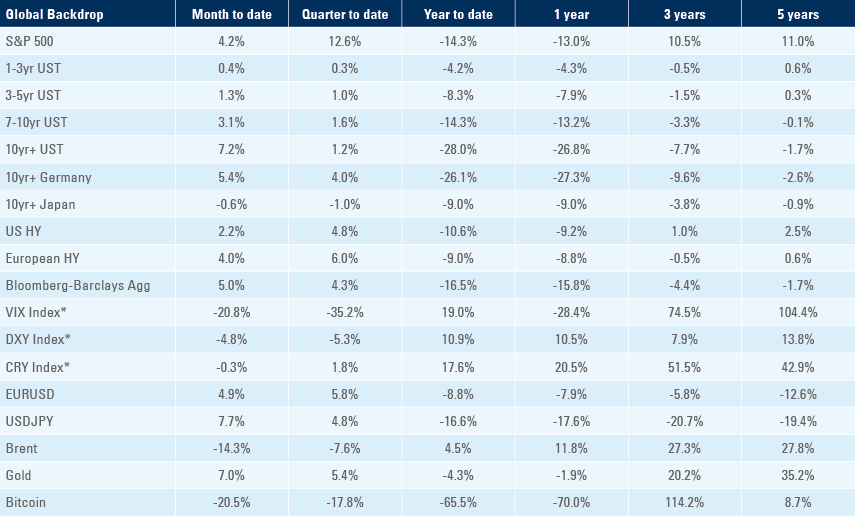

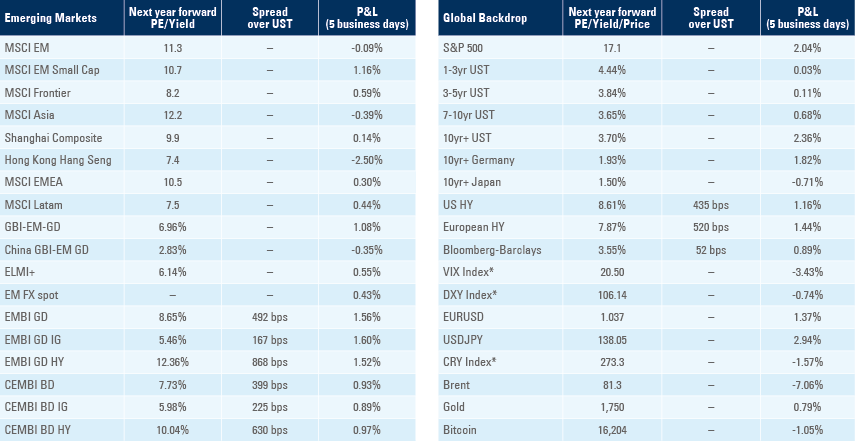

Benchmark performance