- US 10-year Treasury yield 75bps higher since start of rate cuts.

- Israel continued to strike Syrian air defences and weapon depots, as Turkish-backed opposition assumed control.

- China’s Central Economic Work Conference signalled ongoing commitment to reforms

- South Korean President impeached and the People Power Party leader resigns.

- Vietnam’s Politburo issued warnings to former prime minister and state president for violations of party regulations during his tenure, as anti-corruption campaign scaled-up.

- Brazil hiked rates 100bps and pledged to keep this pace in January and March 2025.

- Petrobras and Ecopetrol announced Colombia’s biggest-ever offshore natural gas discovery.

- S&P affirmed Mexico’s credit rating at BBB, with a stable outlook.

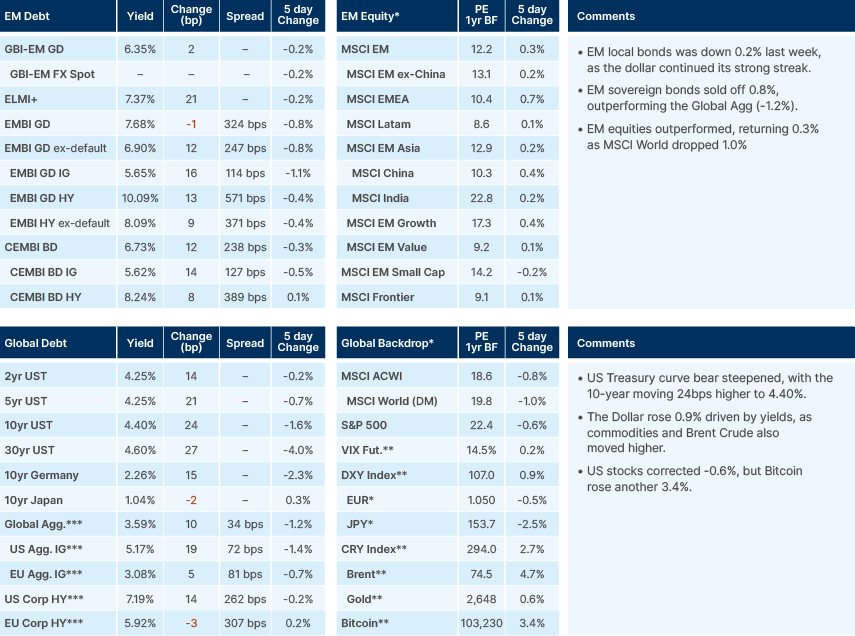

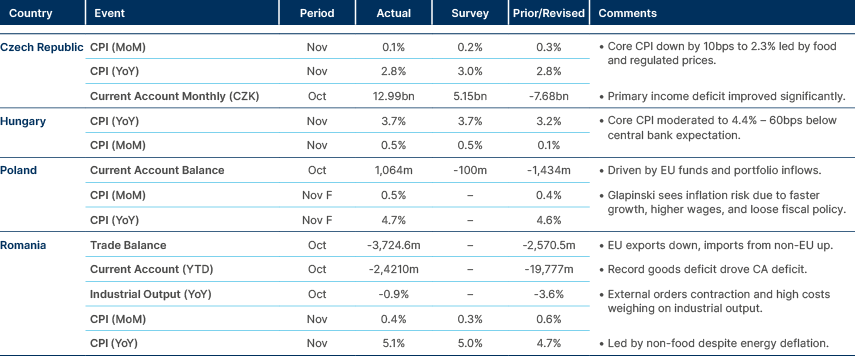

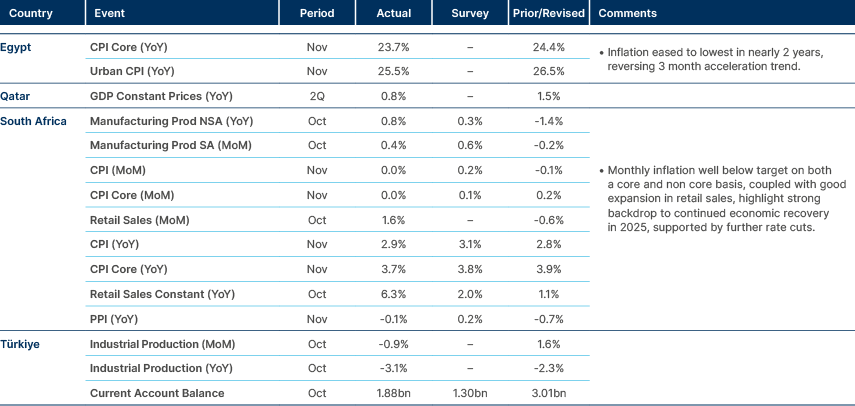

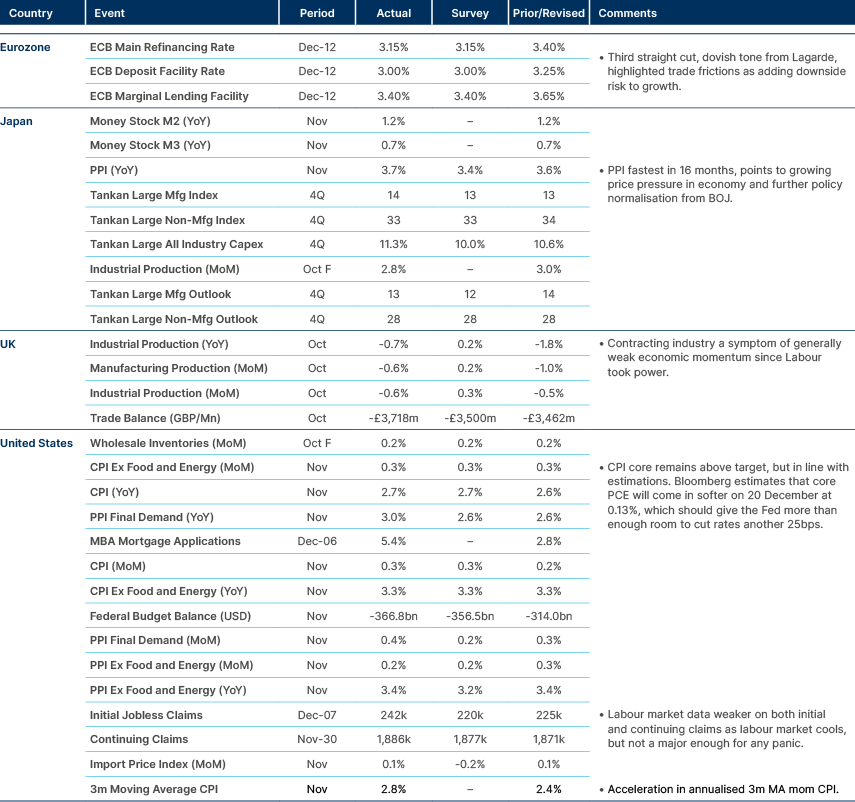

Last week performance and comments

Global Macro

The US Treasury market experienced a bear steepening last week, with the 10-year yield rising by 24 basis points (bps) to 4.4% following stronger-than-expected consumer price index (CPI) and producer price index (PPI) data. This movement coincided with stronger sentiment surveys and higher stock prices, which is not what the Federal Reserve (Fed) needed to justify easing monetary policy.

Since the first 50bps federal fund (FF) rate cut in this cycle, the 10-year yield has increased by 75 bps. This kind of movement is quite rare and has historically occurred mostly at the end of easing cycles, including the following instances:

- Q1 2008: FF rate from 5.25% to 2.25%.

- Q1 2003: FF rate from 1.75% to 1.00%.

- Q4 2001: FF rate from 6.50% to 1.75%.

- Q1 1996: FF rate from 6.00% to 5.25%.

- Q4 1991: FF rate from 8.25% to 4.00%.

- Q4 1989: FF rate from 9.75% to 8.00%.

- Q3 1986: FF rate from 6.37% to 5.87%.

Conversely, a similar pattern emerged when the Fed cut rates, but economic activity improved, forcing it to reverse course and hike rates:

- Q4 1998: Federal Funds rate decreased from 5.5% to 4.75% (LTCM crisis).

- Q1 1988: Federal Funds rate decreased from 6.87% to 6.5%.

In other cases, this occurred during early cycles under in the 1970s and 1980s, when the Fed targeted liquidity and interest rates were more volatile.

It would be even more unusual if US Treasuries would move higher from here. When the 10-year sold off after the first three months, rates continued to rise on the following three months only in the following cycles:

- Q1-1996: The economy re-accelerated, forcing the Fed to hike in early 1997 and 10-year settled at a higher level.

- Q4-2001: 10yr rates resumed the downward path after rising for c. 5 months following the penultimate cut of the cycle.

Notwithstanding the fact that this historical analysis took place during a secular bull market in bonds, our view is that higher yields from here are likely weight on asset prices, which would circle back to the economy. Therefore, the historical analysis and current asset price levels suggests receiving rates into weakness to be the right strategy.

Given recent data, the Federal Open Market Committee (FOMC) summary of economic projections (SEP) this Wednesday is likely to show revisions to the 2024 economic forecasts, with growth and inflation revised up and the unemployment rate down. The dot-plot is likely to show an additional two or three cuts in 2025, close to current expectations of two cuts.

Geopolitics

Israel’s heavy bombardment of Syria’s air defences and weapon depots leaves the path clear for more direct attacks on Iran and its nuclear facilities via Syria and Iraq. Iran is in disarray. The powerful Hezbollah network in Lebanon and Syria built over decades is now significantly weaker, after the last three-month war in Lebanon and the regime change in Syria. This means the balance of power in the Middle East is changing rapidly. It may be a welcome situation in the medium term, particularly if the end game is regime change in Iran, but very dangerous in the short term, raising the potential of Iran lashing out if backed into a corner. Within Syria, Türkiye seems to be in a good position to take advantage of the return of Syrian emigrants and the reconstruction of the country. The new rebel leader, Ahmed al-Sharaa, said that he is not interested in engaging with any new conflicts with Israel, as the country focuses on rebuilding.

Emerging Markets

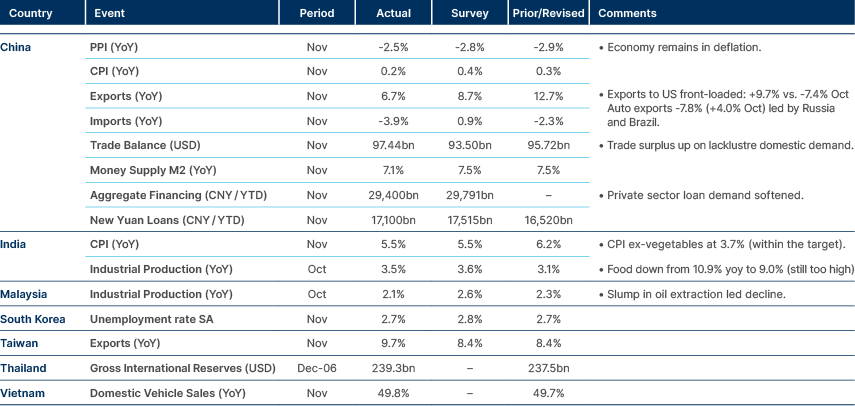

Asia

Chinese economy remains in deflation.

China

The annual Central Economic Work Conference (CEWC) was held on 11-12 December, and a memo was released.

The memo called for more specific measures to support consumption, including increasing basic pension payments, raising fiscal subsidies for basic medical insurance, and developing policies to boost fertility. In detail, the memo mentioned that the fiscal deficit ratio will be raised, more special government bonds will be issued and cuts to interest rates and the reserve requirement ratio (RRR) should be implemented at the proper time. The National People’s Congress meeting in March next year is expected to give more specific numbers for these policy measures. The CEWC also referenced improved incentives for entrepreneurship to flourish in order to support employment.

The offshore yuan (CNH) dropped 0.5% to 7.29 per dollar after Reuters reported policymakers were mulling letting the currency depreciate, possibly to around RMB 7.5 per dollar. That is roughly a 3.5% depreciation from current levels of around 7.25. In Trump's first term as president, the yuan weakened more than 12% against the dollar during a series of tit-for-tat tariff announcements between March 2018 and May 2020. However, the RMB was trading at 6.4 before the beginning of the first trade war, a very different, much stronger level than it is now. Weaker levels and the risk of financial instability means that is unlikely, in our view, that China will let its currency depreciate as much over the incoming period.

In the seven days leading up to 11 December, road congestion in the 15 Chinese cities with the highest number of vehicle registrations increased by 9.7 percentage points week-on-week, reaching 151% of January 2021 levels, according to Bloomberg NEF analysis of Baidu data.

India

The Reserve Bank of India has a new governor, Sanjay Malhotra, who has taken charge for a three-year term. Markets had expected the former Governor to be handed another extension to his term and his appointment contributed to the recent volatility in the INR. Malhotra is currently the revenue secretary for the ministry of Finance and is a technocratic, career bureaucrat who will take over at a time where Indian growth is beginning to slow, while headline inflation remains above the RBI target, a challenging backdrop for monetary policy.

South Korea

Parliament voted to impeach President Yoon Suk Yeol, almost two weeks after his short-lived declaration of martial law. Han Duck-soo has taken over as acting President. Han has worked in various high-ranking government leadership positions for more than 30 years, including as Prime Minister from 2007-2008, and is perceived as a steady, technocratic hand. Han’s role in leadership is expected to last for months until the Constitutional Court decides whether to remove Yoon or restore his powers within the next 6-months. If Yoon is removed, a presidential election must be held in 60 days, until which Han will stay at the helm.1

People Power Party leader Han Dong-hoon resigned after Yoon’s impeachment. He said he couldn't fulfil his duties after all five Supreme Council members of the party resigned. He took responsibility for failing to find an “orderly” exit for President Yoon and reaffirmed his support for impeachment.

Vietnam

The Politburo recently issued warnings to former prime minister and state president Nguyen Xuan Phuc for violations of party and state regulations during his tenure, citing significant consequences and a notable erosion of public trust. Nguyen Xuan Phuc resigned in January 2023 from all his positions, including President, Politburo member, and Central Committee member. His resignation was framed as an acknowledgment of political responsibility for misconduct among senior officials under his leadership.

Former Politburo members Truong Hoa Binh and Truong Thi Mai also faced disciplinary actions for violations committed during their tenures in high-ranking roles. These measures underscore the Party's strong commitment to accountability as part of its ongoing anti-corruption campaign and governance reforms led by General Secretary To Lam. The actions serve as a clear message that violations of Party ethics and governance standards will not be tolerated, regardless of the rank or status of the officials involved.

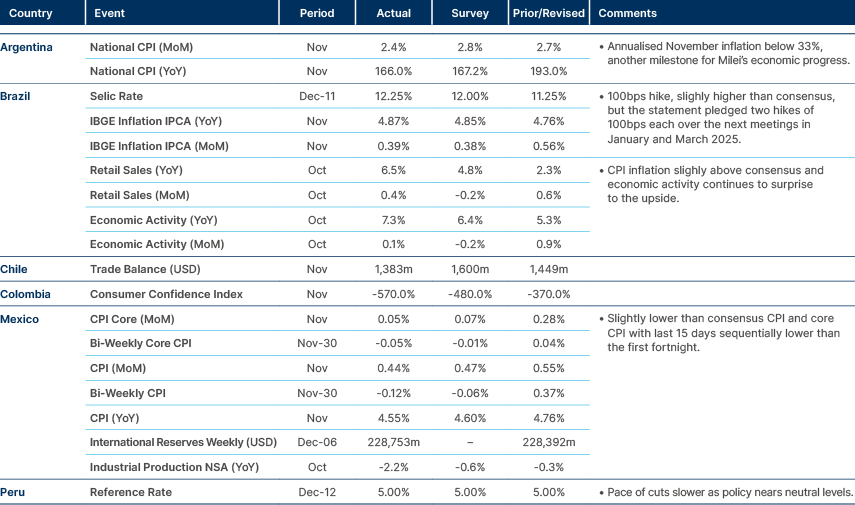

Latin America

Brazil more hawkish than expected.

Argentina

The government and the International Monetary Fund (IMF) are making progress in discussions toward a new USD 26bn loan arrangement that would have a high share of the principal disbursed at the start of the programme, according to a Friday report published in La Nación citing a “diplomatic source”.

Brazil

Brazilian assets oscillated as President Lula undertook two medical procedures to contain bleeding in his brain. He gave a press conference this weekend and is likely to be released from hospital this week but was asked not to travel and to avoid getting too stressed for 60-days.

The Brazilian Central Bank hiked its policy rate by 100bps to 12.25%, as anticipated, but pledged to hike it by another 200bps over the next two consecutive meetings on 30 January and 20 March 2025 to 14.25%. The forward guidance was more hawkish than market expectations and may have been a clever way of release any political pressure on the incoming Governor. Current Monetary Policy Director Gabriel Galipolo is due to assume the institution in January for a 4-year term, from Roberto Campos Neto, who oversaw the institution during the period it gained formal independence by Congress.

Colombia

Congress's rejected President Gustavo Petro's proposed tax reform, which sought to generate an additional COP 9.8 trillion ($2.24 billion) to fund the 2025 budget. As a result, the COP 523 trillion budget remains partially unfunded. Finance Minister Diego Guevara has pledged a responsible approach to reduce the fiscal deficit, targeting a reduction to 5.1% of GDP in 2025 from the projected 5.6% in 2024. In parallel, the Ministry of Finance addressed obligations to Ecopetrol, the state-owned oil company, by issuing COP 1.8 trillion in TES bonds maturing in August 2026 as part of efforts to manage the Fuel Price Stabilization Fund.

Petrobras and Ecopetrol announced Colombia’s biggest-ever offshore natural gas discovery. The Sirius-2 well was confirmed as having more 170 billion cubic metres of potential oil. This could triple the country’s reserves, should the deposit be commercially viable. Petrobras expects to confirm the commercial viability of the discovery by 2027, and it would then take three years to reach first production after getting the project licensed. This project aims to produce around 13m cubic meters a day for 10 years, which would represent nearly half of Colombia’s current domestic demand. There are no plans to export the gas.

Mexico

S&P affirmed the country’s credit rate at BBB, with a stable outlook, expecting Mexican President Claudia Sheinbaum to handle the relationship with US president-elect Donald Trump pragmatically.

Central and Eastern Europe

Inflation continues to fall in region.

Romania

Romania is preparing for presidential elections likely in Q1 2024, while its four-party coalition (PSD, PNL, USR, UDMR) faces immediate challenges. The coalition must nominate a new prime minister to stabilize governance and finalize a national budget amidst the EU’s largest deficit. So far, internal disagreements over fiscal policies, particularly USR’s demand for tax and spending clarity, have delayed progress and tested the coalition's unity.

Slovakia

Moody’s downgraded the sovereign rating to A3, bringing its rating in line with Fitch and two notches below S&P which holds Slovakia at A+.

Central Asia, Middle East, and Africa

Egypt inflation lowest in two years, South Africa macro strong.

Türkiye

The current account was in surplus for the fifth consecutive month in November, at USD 1.9bn dollars. These are very good numbers, and evidence that the TRY is not overvalued, despite a high real effective exchange rate (REER).

United Arab Emirates

Emaar Property PJSC announced changes to its dividend policy, declaring dividends at 100% of its share capital for 2024 (c. AED 7.7bn) and the following few years, doubling the dividend yield to c. 9.1% at current market prices. This led to the Dubai Financial Market General Index gaining 4.4%, to the highest level since October 2014, led by Emaar which rose by 15% the maximum price increase permitted by the exchange. Emirates Bank also rallied to a record high, with Aldar Properties in Abu Dhabi up 4.7%.

Developed Markets

EU has reason to be more dovish, US more hawkish.

United States

Small business optimism has surged following November’s presidential election, despite facing significant challenges from elevated inflation and higher interest rates that have squeezed profitability. For this optimism to be fully realised, an economic environment akin to a "goldilocks" scenario or a robust boom – where nominal growth far outpaces interest costs – would be necessary, just like with the stock market.

Trump has nominated Ronald Johnson as ambassador to Mexico. Johnson, an Army veteran and former CIA officer who previously served as US Ambassador to El Salvador during Trump’s first term, is expected to work with Secretary of State nominee Marco Rubio to advance strong “America First” foreign policies. Trump announced the nomination on his Truth Social platform Tuesday night.

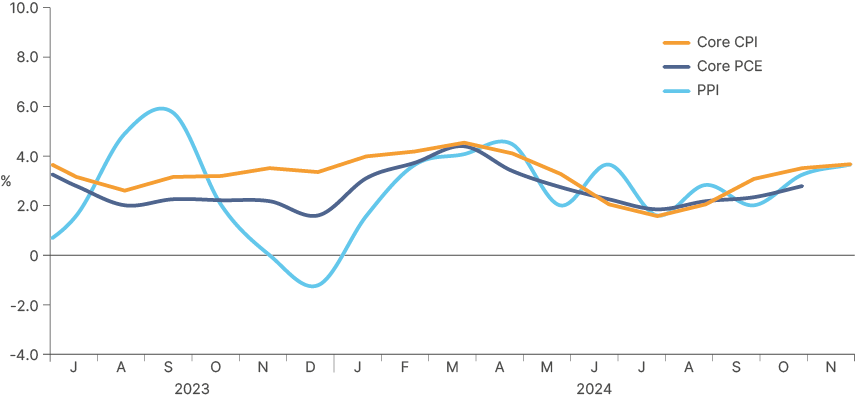

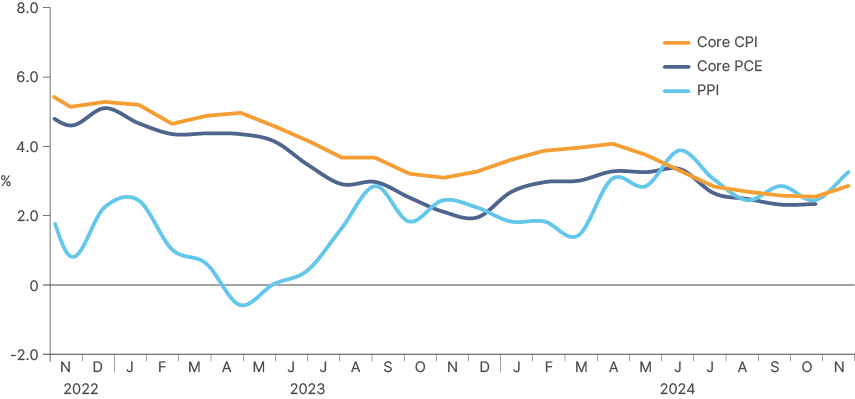

US inflation data has been surprising to the upside in recent readings driving the 3m moving average of CPI and PPI higher (Fig. 1). Now the 6m moving average is pointing upwards as well (Fig. 2). Looking at these moving averages is useful to remove noise from the data and examine longer-term trends, which now are moving in the wrong direction for the Fed, even before Trump’s inauguration, where he is expected to begin implementing policies that bring further upside risk to prices.

Fig 1: US CPI 3-month moving average

Fig 2: US CPI 6-month moving average

France

Moody’s downgraded France’s credit rating to Aa3 from Aa2, assigning a stable outlook. This unscheduled move late on Friday aligned Moody’s rating with those of S&P and Fitch. In response to the fiscal challenges, Prime Minister François Bayrou is set to meet with far-right leaders Marine Le Pen and Jordan Bardella on Monday morning to initiate discussions on reaching a budget agreement.

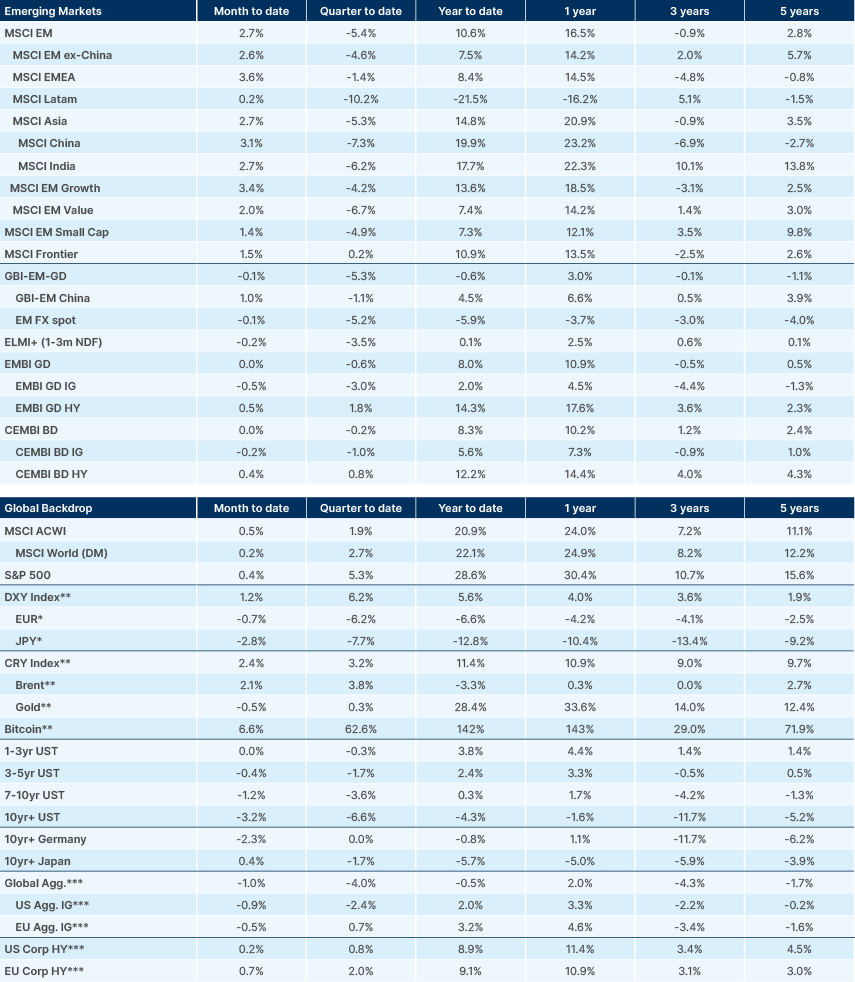

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – ‘Bashar al-Assad falls in two weeks after a 13-year Civil War in Syria’, Weekly Investor Research, 9 December 2024.