Russia's Vladimir Putin took an unpopular decision and mobilised 300k new conscripts to the army as Donbass holds a referendum on whether to become part of the Russian territory. Developed countries have been through a full-blown currency crisis which accelerated after the United Kingdom cut taxes in a heterodox mini budget last week. EM local currencies outperformed as most EM countries have been hiking policy rates since 2021. Brazil kept its policy rate unchanged at 13.75%, Indonesia hiked 50bps to 4.25% and Turkey cut rates by 100bps to 12.00%. China increased the reserve requirement for US dollar buyers. Ghana announced a potential local debt restructuring.

Geopolitics

Russia announced the mobilisation of 300k “reservists” to the army as President Vladimir Putin pronounced Russia is “at war with NATO and the collective West” and pledged to take the “necessary steps to defend sovereignty” after saying the West is seeking to “weaken and destroy Russia”. The Russians estimate their losses at “almost 6k people killed” with “more than 90% of those wounded able to return to service and continue serving.”

Up until now, Putin has been trying hard to avoid unpopular mass conscriptions and was relying on professional soldiers and the Wagner Group’s ability to recruit prisoners. Flights to countries accepting Russians without passports were fully booked in hours as Russians try to escape the country despite up to 10-years imprisonment for desertion. Several videos of people protesting being drafted were posted on social media alongside suggestions that reservists will receive only two weeks of training before being sent to the front line – a very short time, particularly for unmotivated individuals. Russian forces reportedly took control of the Zaporozhskaya nuclear power plant.

Russia is holding a referendum in the occupied regions of Donetsk and Luhansk which entered its fourth day on 26 September. The referendum is aimed at providing legitimacy for Russia to defend its current territorial gains across Ukraine.

Overall, the latest actions suggest Russia is running out of alternatives after losing significant territory in Ukraine. The key question is whether Ukraine (and the West) will provide Vladimir Putin a “golden bridge”, allowing for a cease-fire that would be considered a victory for Russia or if they will keep adding pressure on Russia, which risks further escalation.

Emerging markets

Brazil: The Brazilian Central Bank (BCB) kept the policy rate unchanged at 13.75%, in line with consensus, but with two directors voting for a 25bps hike. The BCB was one of the first global central banks to start hiking policy rates in Q1 2021 and has harvested the resulting macroeconomic stability with the BRL rising against the USD in 2022 and local assets outperforming.

China: The People’s Bank of China (PBoC) imposed a 20% risk reserve requirement on banks’ foreign exchange forward sales to clients, a measure designed to curb long USD speculative positions, and adopted for the first time in August 2015 and repeated in August 2018. The measure is unlikely to backstop the RMB depreciation against the greenback in the current environment but is another signal the PBoC is not willing to see the RMB much weaker.

Ghana: The ratings agency Fitch downgraded Ghana’s sovereign rating to ‘CC’ from ‘CCC’ as the local media suggested Ghana may restructure its USD 19bn local government debt to fit debt sustainability metrics ahead of a programme with the IMF. The IMF is expected to visit Accra over the next weeks after President Nana Akufo-Addo requested its finance minister to engage with the fund on another programme. A local debt restructuring would most likely involve no principal haircuts, but a reduction in coupons and lengthening of maturities, to avoid any systemic banking sector risks. If implemented effectively, a local default could lead to an IMF agreement and better value on Eurobonds.

Indonesia: The Bank Indonesia hiked its policy rate by 50bps to 4.25%, against consensus expectations for a 25bps hike. Governor Perry Warjiyo said the hike was a "front-loading, pre-emptive and forward-looking measure to lower inflation expectations and ensure core inflation returns to the target of 3% +/- 1% in the second half of 2023”, thus leaving the door open for further outsized hikes.

Turkey: The Central Bank of Turkey cut its policy rate by 100bps to 12.0% despite core CPI inflation running at 66%. President Erdogan seems to be hoping to engineer a mini-economic boost ahead of presidential elections in 2023. The opposition parties remain fragmented, giving the incumbent president some hope despite the dismal economic performance and horrible purchasing power erosion by a weaker TRY. The next government will have to deal with a very challenging economic and financial situation as the Central Bank now has negative foreign exchange reserves.

Snippets

- Argentina: The yoy rate of real GDP growth improved to 6.9% in Q2 2022 from 6.0% in Q1 2022, 40bps above consensus and the unemployment rate declined by 10bps to 6.9% over the same period. The trade deficit narrowed to USD 300m in August from USD 437m in July as exports declined marginally to USD 7.5bn and imports declined by USD 0.4bn to USD 7.8bn while the fiscal deficit widened to ARS 210bn in August from ARS 2.0bn in July – the worse result for the month in five years.

- Chile: PPI inflation dropped 0.5% mom in August after rising 1.1% in July as the yoy rate declined 380bps to 17.2% over the same period.

- Colombia: The soft-landing of the Colombian economy continues to take place as the yoy rate of economic activity slowed to 6.4% in July from 8.6% in June, in line with consensus.

- Egypt: The trade deficit narrowed to USD 2.7bn in July from USD 3.2bn in June, better than consensus.

- Hungary: The current account deficit widened to EUR 2.63bn in Q2 2022 from EUR 2.47bn in Q1 2022, EUR 0.65bn wider than consensus. The unemployment rate rose 10bps to 3.6% as average gross wages kept increasing by a yoy rate of 15.3% in July – in line with CPI inflation.

- India: Apple announced it has started manufacturing the new iPhone 14 in India, albeit most components for the manufacturing of the smartphone are still likely to be imported from China.

- Malaysia: The trade surplus rose to MYR 16.9bn in August from MYR 15.6bn in July, higher than consensus as both exports and imports rose by more than expected. The yoy rate of CPI inflation rose 30bps to 4.7% in August, in line with consensus as foreign exchange reserves dropped USD 1.9bn to USD 106.3bn on the week of the 15 September.

- Mexico: Retail sales rose by 0.9% mom in July, 60bps higher than consensus, after declining 0.3% in June. The GDP proxy from INEGI rose by a yoy rate of 4.8% in Q2 2022 from 2.9% yoy in Q1 2022, 110bps above consensus. CPI inflation was unchanged at 8.8% in the first week of September, but core CPI inflation rose 20bps to 8.3% yoy.

- Poland: The yoy rate of PPI inflation rose 0.8% mom in August from 1.3% in July (revised from 0.9%) as the yoy rate was unchanged at 25.5%, 100bps above consensus. Retail sales rose by 1.0% mom in August from 1.2% in July, significantly better than consensus at 0.0%. Construction output and sales declined marginally but remained very elevated, particularly considering consumer confidence remained at -44, the worse levels since the beginning of the survey in 1997.

- Philippines: The central bank hiked its overnight deposit and borrowing policy rates by 50bps to 3.75% and 4.25% respectively, in line with consensus.

- South Africa: CPI inflation rose 0.2% mom in August, significantly lower than 1.5% in July as the yoy rate declined 20bps to 7.6%, in line with consensus as core CPI declined to 0.2% mom from 0.7% over the same period, bringing the yoy rate to 4.4% (20bps below consensus).

- South Korea: The yoy rate of PPI inflation dropped 80bps to 8.4% in August.

- Taiwan: The central bank hiked its policy rate by 0.125% to 1.625%, in line with consensus as the unemployment rate was unchanged at 3.7%. Industrial production rose by a yoy rate of 3.7% in August from 1.63% in July, 330bps above consensus.

Developed markets

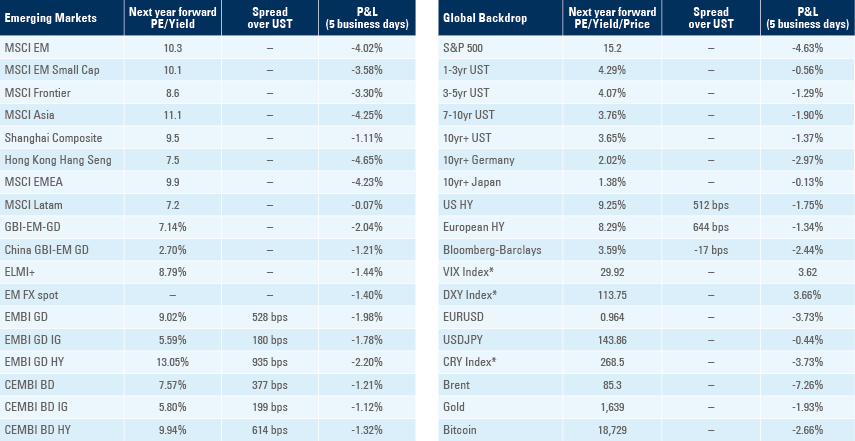

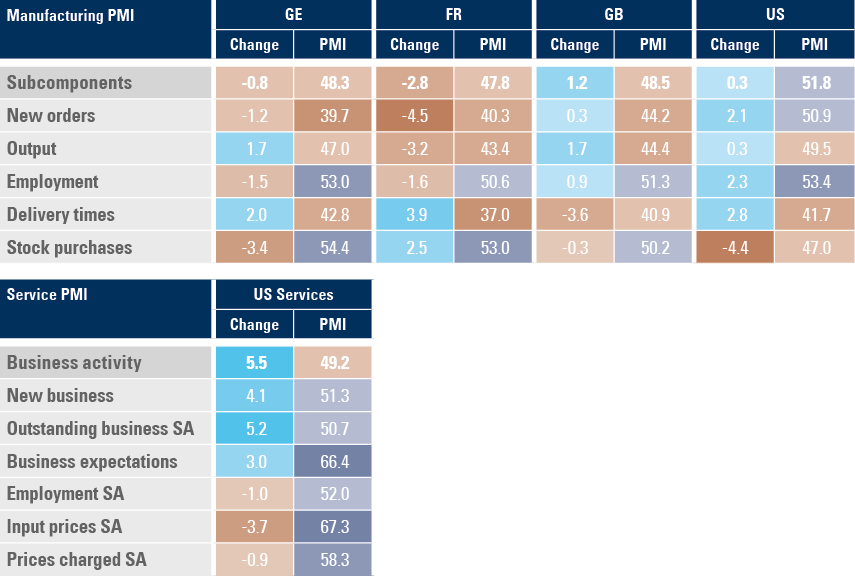

United States: The Federal Open Market Committee (FOMC) hiked its policy rate by 75bps to 3.25%, in line with consensus, and Chairman Jay Powell pledged to keep hiking policy rates until the hawkish stance is reflected in inflation. Powell repeated the FOMC wants to see the yield curve structure at positive levels despite on a forward-looking basis markets have already been at positive levels across the curve for nearly two months. The real yield on two-year inflation linked bonds rose from -3.02% on 11 March to 2.09% on 26 September. In economic news, existing home sales were unchanged at 4.8m and housing starts rose to 1.57m in August from 1.40m in July, but building permits declined to 1.52m from 1.69m over the same period, suggesting the housing market is likely to slow down. Initial jobless claims rose only 5k to 213k in the week ending on 17 September and continuing claims declined 22k to 1.38m in the week ending on 10 September. The manufacturing and services PMI were better than expected in September with business expectations particularly elevated in the service sector, which is still experiencing significant price pressures as per Figure 1.

Figure 1: Manufacturing PMI: Selected DM countries

Europe: The German PPI inflation surged to 7.9% mom in August from 5.3% in July, significantly above the 2.4% mom consensus estimates, taking the yoy rate of PPI inflation up 860bps to 45.8%. The level of producer price inflation is consistent with consumer prices accelerating towards double-digit levels in the Eurozone. Since most price pressures are a result of energy shortages, there is little the ECB can do to control inflation, except for policies that would be so tough to the point of destroying aggregate demand by a meaningful amount. Subsidising energy cost will compound the energy issues by limiting the amount of market-led demand destruction. In other news, the Euro Area current account moved to a EUR 19.9bn deficit in July from EUR 4.2bn surplus in June. Consumer confidence dropped to -28.8 in September from -25.0 in August, the lowest level in the series. The Euro Area manufacturing PMI dropped 1.1 points to 48.5 in September and the service PMI dropped by 0.9 to 48.5. New orders for France and Germany declined further to 39.7 and 40.3 as per Figure 1, suggesting further weakness ahead.

In political news, provisional results suggest far-right party Brothers of Italy got 26% of the votes, or 43-44% when combined with Silvio Berlusconi’s Forza Italia and Matto Savini’s League, which would be enough to give the coalition more than 50% of seats in both Houses of Congress.1 The main question is whether Giorgia Melloni will cave into Salvini’s pressure to increase energy subsidies by another EUR 30bn, on top of the EUR 63bn package by Mario Draghi, which would increase the budget deficit by 1.6% of GDP to 7.2% of GDP from 5.6%.

United Kingdom: Chancellor Kwarteng announced drastic fiscal measures aimed at increasing GDP growth. The measures include keeping corporation taxes at 19% (was scheduled to increase to 25%), lowering tax to individuals (basic rate declines to 19% in 2023 – one year prior to estimate) and abolishing the 45% income tax for individuals earning more than GBP 150k per year, at a GBP 45bn cost per year alongside an energy bailout plan with an estimated cost of GBP 60bn over six months. Bloomberg opinion columnist Javier Blas estimated a total of GBP 153bn for the 2022-2024 period if prices stay at current wholesale levels. The measures are extremely regressive and a gamble on boosting growth at a time when the world economy suffers from supply shortages and rising borrowing costs. The UK Institute for Fiscal Studies said previous tax cuts on similar scale in 1972 “ended in disaster”. The GBP collapsed 4.9% last week to 1.086 and traded at 1.033 today in Asia after Kwartengs said over the weekend that he would double down on tax cuts. The key issue for the current government is the lack of credibility. Before the budget the Bank of England had hiked the policy rate by 50bps to 2.25%, in line with consensus, but it is now under pressure to hike policy rates much more aggressively (possibly in an emergency meeting this week) to backstop the currency crisis, taking yields on 2-year UK gilts up 126bps in five days to 4.40% - the highest level across G-10 economies.

Japan: The Bank of Japan (BOJ) kept its policy rate unchanged at -0.1% and the yield curve control on 10-year bonds at 0.25% but announced a stealth intervention selling USD to defend the JPY, which depreciated above 145 following the meeting. It is hard to understand what the BOJ is trying to achieve by keeping its monetary policy so easy when inflationary pressures from abroad pile up.

Canada: CPI inflation dropped 0.3% mom in August (-0.1% consensus) after rising 0.1% in July, bringing the yoy rate down 60bps to 7.0%, 30bps below consensus. Core CPI measures declined more marginally hovering between 4.8% yoy (median) and 5.7% yoy (common).2

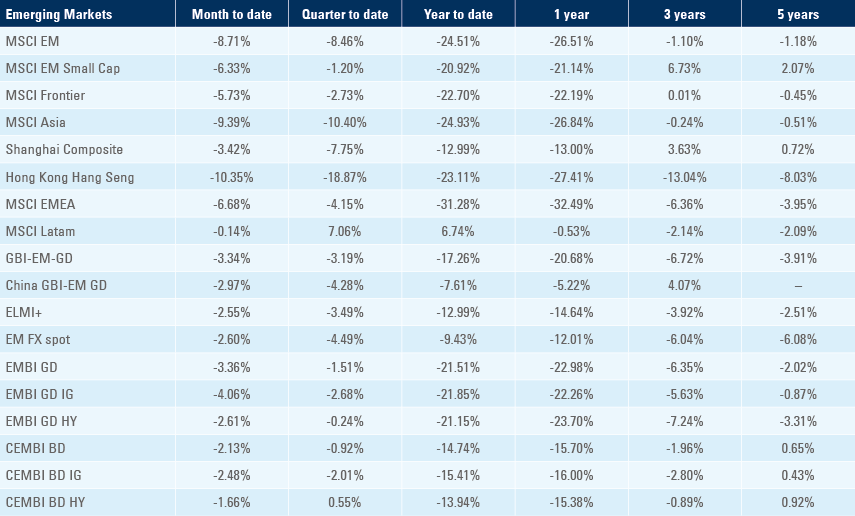

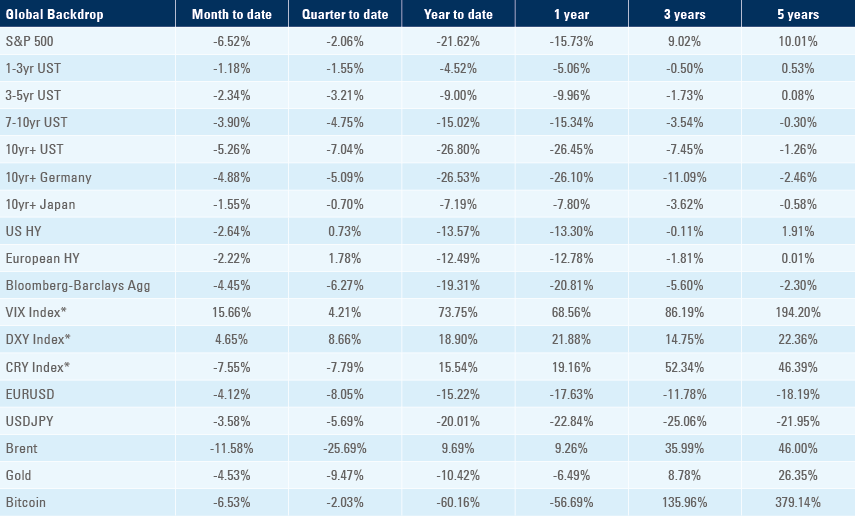

Benchmark performance

1. See https://www.bbc.co.uk/news/world-europe-63029909

2. For more detail about the Bank of Canada’s preferred core inflation metrics, see: https://www.bankofcanada.ca/wp-content/uploads/2016/10/background_nov11.pdf