The situation on the ground continues to escalate. The United States Secretary of State Antony Blinken said the US may backfill aircrafts to Poland as the latter sends theirs to Ukraine. Blinken also said the US is considering a full oil embargo on Russian exports, leading to the risk of a full-blown energy crisis. Food prices were under significant pressure as Russia and Ukraine grains exports representing 25% of world’s total come into question. Inflation was already under severe pressure before the war, with the producer price index hitting 31% in Europe and 105% in Turkey in February. Against this tense backdrop, South Korea will hold presidential elections on the 9th of March.

Emerging markets

Ukraine: The situation in Mariupol turned desperate after evacuation plans via a humanitarian corridor failed twice as Ukrainian officials claimed Russia violated a temporary cease-fire. Civilians fled from Irpin, a city next to Kyiv, which was shelled by rocket attacks. On Sunday the UN said over 1.5m Ukrainians had fled the country, mostly to Poland and other European countries.

There are no signs that the situation will de-escalate, especially after US Secretary of State Antony Blinken said his country is working to backfill anything Poland provides to Ukraine, including MiG’s, Sus and other planes. His statement provides clear evidence of NATO supporting Ukraine, increasing the risk of an escalation of the conflict beyond Ukraine. Blinken also said the US was in active discussions to ban Russian oil imports.

Any comprehensive sanctions blocking Russia’s oil exports to the West would have a significant impact on oil prices as Russia exports 5m barrels of crude oil and 2.8m barrels of oil products per day. Brent prices rose by 27% last week to USD 128 per barrel this morning, a 65% increase year-to-date, but a retracement from the USD 139 intraday high print. Several analysts are already requesting the US and other countries to release strategic oil reserves to ease pressure in the spot market. Nevertheless, a ban on Russia’s exports could trigger a true shortage in a few months, suggesting the strategic oil reserves should be spared for now, despite the sharp price increase. Wheat prices rose 38.5% last week, up 67% year-to-date while the Dutch TTF Natural Gas Future has surged 240% year-to-date.

A continuous rise in oil prices represents a massive supply shock concomitantly increasing inflation and lowering economic growth with severe ramifications for other commodity prices (via logistic costs) and global economic activity. More central banks across the world may be forced to follow in the Central Bank of Russia’s (CBR) footsteps by hiking interest rates and providing liquidity to the financial system to avoid rampant inflation and a financial crisis. As we mentioned last week, an important unintended consequence of the sanctions is a risk of liquidity meltdown in the financial system due to the freezing of collateral and payment failure.

In other news, the International Monetary Fund approved a USD 1.4bn emergency loan to Ukraine as early as next week and warned about the severe impact of the war on the global economy.

Russia: President Vladimir Putin dangled a carrot to foreign creditors last Saturday as he signed a decree allowing Russian companies to pay foreign debt in RUB. The Finance Ministry clarified the sanctions and “exemptions established by relevant licences and permits” will determine whether foreign investors are paid. Ordering companies to service their debt may also help to avoid excess liquidity building up in RUB markets. The CBR hiked its policy rate by 1050bps to 20.0%, citing the sudden change in economic conditions due to sanctions imposed following Russia’s invasion of Ukraine.

A resolution by the United Nations (UN) General Assembly had 141 countries condemning Russia’s invasion to Ukraine (including all GCC members and Israel). Only four countries voted against the motion (Belarus, Eritrea, North Korea and Syria), while another 35 countries abstained (including China, Vietnam, India, Pakistan, Kazakhstan, Iran, South Africa, Angola, Senegal, Cuba, El Salvador and Nicaragua) and 12 countries did not vote (including Venezuela).1

Afghanistan: As the media focuses on the much more relatable Ukrainian war, it totally overlooks the humanitarian disaster in Afghanistan, where 23m people could suffer from acute food insecurity according to the UN. Last week the World Bank agreed to release more than USD 1bn from the Afghanistan Reconstruction Trust Fund, which was frozen since August when the Taliban took power.

Venezuela: With the US contemplating an oil embargo to the largest exporting country in the world, the odds of a deal to lift sanctions in Venezuela, as well as Iran, increased significantly. Venezuela has dollarized its oil and gas industry, which allowed them to increase oil production from 310k barrels per day in Q3 2020 to 620k barrels in February 2022. At its peak the country pumped 3.7m barrels of oil per day in 1970 and 3.4m in 1999, but production declined gradually during the Hugo Chavez administration, and stabilised around 2.3m bpd before collapsing from 2015. It will take years to ramp up oil production to its previous levels, but every little increase will help depending on the length of the Ukraine War.

South Korea: Presidential elections will take place on 9 March as polls show a close race between People Power Party opposition candidate Yoon Seok-youl and the ruling Democratic Party Lee Jae-myung. The presidential race is a first-past-the-post system with the winner decided by a simple majority. Both candidates pledged to keep fiscal deficit elevated in the short term, but Yoon favours fiscal consolidation over the medium term while Lee is calling for enhanced social safety nets, including a KRW 1m (USD 858) yearly universal basic income. Foreign policy may be the key swing factor in the election as Lee suggests “setting up a peace regime that eliminates war itself,” while Yoon held a more hawkish stance, suggesting the opposite solution, “deterrence of provocation by force”. The war may provide a tailwind to Yoon’s hawkish stance, in our view.

In economic news, the yoy rate of real GDP growth rose 0.1% to 4.2% in Q4 2021. The yoy rate of CPI inflation rose 0.1% to 3.7% in February while export growth rose to 20.6% yoy, from 15.2% yoy in January.

Turkey: The yoy rate of CPI inflation rose to 54.4% in February from 48.7% in January, while PPI inflation rose 11.5% to 105% over the same period, both 2% above consensus. Real GDP growth rose by 9.1% in Q4 2020 from 7.5% in Q3 2020. The trade deficit widened to USD 10.3bn in January from USD 6.8bn in December, in line with consensus. The Central Bank of Turkey kept intervening in the TRY to avoid a disorderly currency depreciation. Turkey is a large net-importer of energy and wheat from Russia and Ukraine.

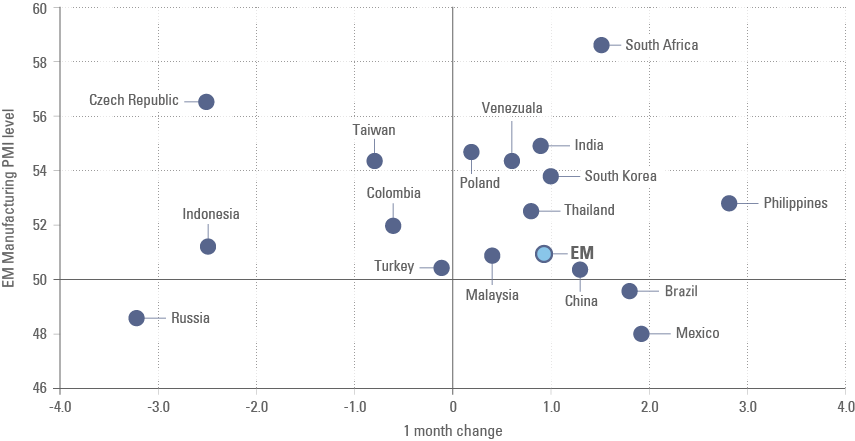

Markit Purchasing Managers Index (PMI) Survey

The global manufacturing PMI went up 0.4 to 53.6 in February as developed markets (DM) rose 0.2 to 56.6 and EM increased 0.9 to 50.9. The EM manufacturing PMI improved across all but one of the sub-components as new orders (30%) rose 2.2 to 51.6, output (25%) increased 1.3 to 51.0, employment (20%) was 0.5 higher to 48.9, delivery times (15%) went up 0.8 to 47.3, but stock purchases (10%) declined 0.6 to 49.8.

The biggest drops came from Russia (-3.2 to 48.6), Czech (-2.5 to 56.5) and Indonesia (-2.5 to 51.2) while Philippines (+2.8 to 52.8), Mexico (+1.9 to 48.0), Brazil (+1.8 to 49.6) and China (+1.3 to 50.4) increased the most. Figure 1 shows the manufacturing PMI improved across most EM countries and only three out of 20 EM countries had readings below 50.

Figure 1: EM Manufacturing PMI: Feb 2022 vs. 1m change

In DM, Denmark (-8.7 to 50.7), Austria (-3.1 to 58.4) and Japan (-2.7 to 52.7) dropped the most while Australia (+2.8 to 61.5), US (+1.8 to 57.3) and France (+1.7 to 57.2) rose the most.

The global services PMI rose 2.9 to 53.9 as DM services PMI increased 4.2 to 55.0 while EM services dropped 0.1 to 51.5 in February. The normalisation of mobility following the omicron wave in the previous months explains the rebound on the DM service PMI survey.

Snippets

- Argentina: The International Monetary Fund (IMF) confirmed it has reached a staff-level agreement with Argentina.

- Brazil: The yoy rate of real GDP growth declined to 1.6% in Q4 2021 (1.1% consensus) from 4.0% yoy in the previous quarter. The trade balance improved to a USD 4.1bn surplus in February from a USD 0.2bn deficit in January as exports rose USD 3.3bn to USD 22.9bn and imports declined USD 1.0bn to USD 18.9bn.

- Chile: The unemployment rate rose 0.1% to 7.3% in January as the yoy rate of economic activity dropped 1.1% to 9.0% and retail sales declined 1.1% to 14.2% over the same period. Copper production dropped to 493k tons in January from 504k in December, the lowest production level for the period in 10-years.

- Colombia: The yoy rate of CPI inflation rose to 8.0% in February from 6.9% in January, 0.4% above consensus and core CPI rose 0.6% to 5.1% yoy. The urban unemployment rate rose 3.2% to 14.8% in January due to seasonal effects, slightly below consensus.

- Czech Republic: The yoy rate of real GDP growth was unchanged at 3.6% in Q4 2021, in line with consensus.

- Indonesia: The yoy rate of CPI inflation was down 0.1% to 2.1% (0.1% below consensus), while core CPI rose 0.2% to 2.0% (0.1% above consensus).

- Hungary: The National Bank of Hungary hiked its one-week repo policy rate by 75bps to 5.35%, 25bps above consensus, as the war in Ukraine hit the Central European currencies, which alongside higher commodity prices increases the risk for higher inflation. In other news, the yoy rate of real GDP growth declined 0.1% to 7.1% in Q4 2021, retail sales dropped 2.2% to 4.1% yoy in January and PPI inflation was unchanged at 22.3% yoy over the same period.

- Malaysia: Bank Negara Malaysia kept its policy rate unchanged at 1.75%, in line with consensus, and reiterated its monetary policy stance is appropriate and accommodative

- Mexico: The unemployment rate rose 0.2% to 3.7% in January, 0.5% below consensus mostly due to seasonal patterns. Foreign exchange remittances from abroad declined USD 0.9bn to USD 3.9bn in January. Vehicle exports declined 16k to 202k in February.

- Philippines: The yoy rate of CPI inflation was unchanged at 3.0% in February, in line with consensus.

- Poland: The yoy rate of real GDP growth was unchanged at 7.3% in Q4 2021.

- Romania: The yoy rate of retail sales rose 2.5% to 9.5% in January as PPI inflation rose 9.7% to 43.0% yoy and the unemployment rate declined 0.3% to 5.4 over the same period.

- South Africa: The trade surplus narrowed to ZAR 3.6bn in January from ZAR 29.0bn in December.

- Thailand: The yoy rate of CPI inflation rose 2.0% to 5.3% in February, 1.2% above consensus while core CPI rose 1.3% to 1.8% yoy over the same period. Energy prices contributed around two-thirds of inflation, surging 10.0% to 29.2% yoy. The current account deficit widened to USD 2.2bn in January from USD 1.4bn in December.

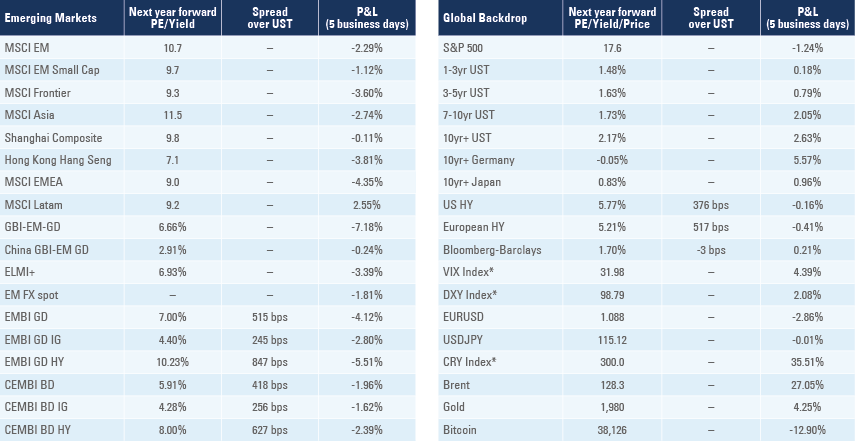

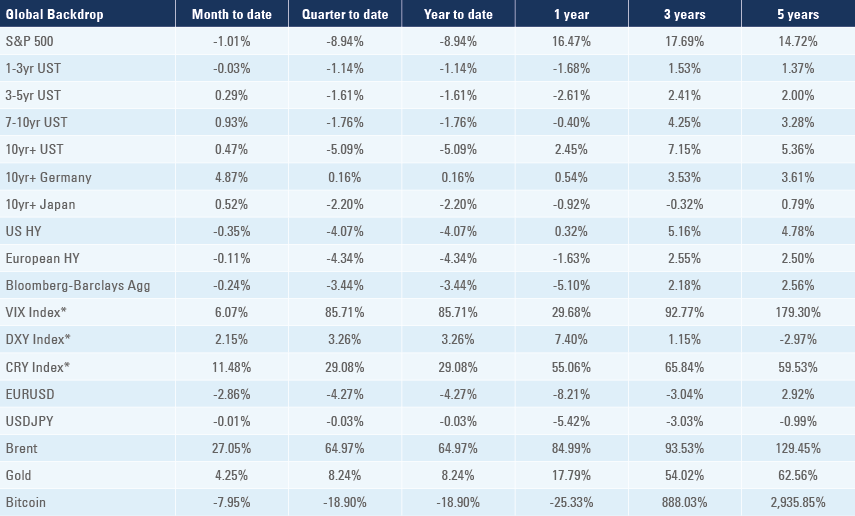

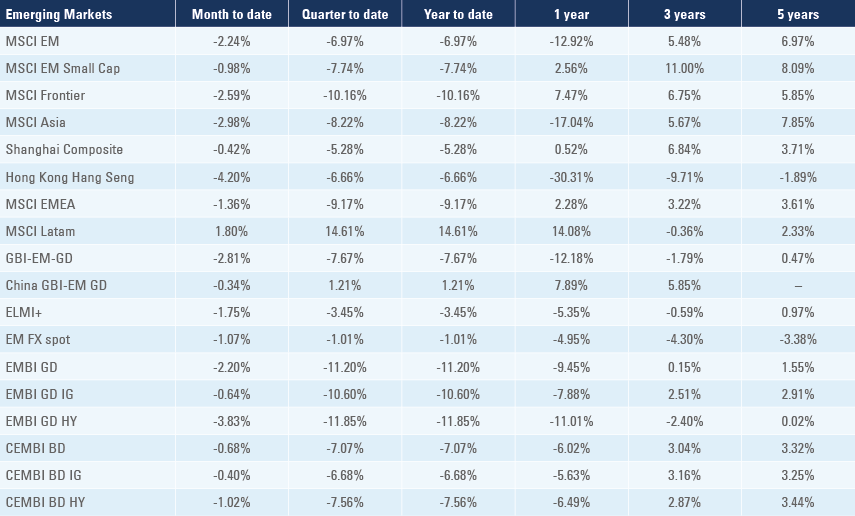

Global backdrop

United States (US): The Chairman of the Federal Reserve Jerome Powell gave a two-day testimony to Congress about the state of the economy. In a question from Senator Richard Shelby2 Powell stated that he favours a 25bps hike in March and reiterated his commitment to the price stability mandate even if it comes at the expense of lower economic growth. Powell’s main challenge will be to reconcile rampant inflation due to helicopter money with the supply shock resulting from the Ukrainian War that will increase inflation and lower economic growth. Indeed, the labour market is another reminder that the Fed is very much behind the curve. Non-farm payrolls increased by 678k in February, significantly above consensus of 423k and January’s 481k. The unemployment rate declined by 0.2% to 3.8%, but average hourly earnings declined to a yoy rate of 5.1% (consensus 5.8% yoy) from 5.5% yoy. The ISM manufacturing survey rose 1.0 in February to 58.6 and the IMS services declined 3.4 to 56.5. The ISM prices paid declined 0.5 to 75.6, ISM new orders rose 3.8 to 61.7, but employment dropped 1.6 to 52.9. Both Markit manufacturing and services PMIs declined 0.2 to 57.3 and 56.5 respectively.

Europe: The yoy rate of CPI inflation rose 0.7% to 5.8% across the Eurozone in the February, 0.2% above consensus, while PPI inflation rose 4.3% to 30.6%, 3.3% above consensus. Italian CPI inflation rose 1.1% to a yoy rate of 6.2% in February (consensus 5.5%) while German CPI rose 0.2% to 5.1% yoy (in line)

Japan: Industrial production dropped 1.3% mom in January (consensus -0.7%) from -1.0% in December.

Canada: The Bank of Canada (BoC) hiked its policy rate by 25bps to 0.5%, in line with consensus etstimates. Governor Tiff Macklem struck a hawkish tone saying a 50bps hike in the future is on the cards and that BoC primary target is to control inflation. Macklem said the BoC will not actively sell bonds, but the balance sheet may still shrink quickly as 40% of bond holdings matures within two years.3

Australia: The Reserve Bank of Australia (RBA) kept its policy rate unchanged at 0.1%, in line with consensus. The RBA expects inflation to briefly exceed the upper limit of the 2.0% to 3.0% target band, but decline inside the band during the year.

Benchmark performance

Abstainees: Algeria, Angola, Armenia, Bangladesh, Bolivia, Burundi, Central African Republic, China, Congo, Cuba, El Salvador, Equatorial Guinea, India, Iran, Iraq, Kazakhstan, Kyrgyzstan, Laos, Madagascar, Mali, Mongolia, Mozambique, Namibia, Nicaragua, Pakistan, Senegal, South Africa, South Sudan, Sri Lanka, Sudan, Tajikistan, Tanzania, Uganda, Vietnam and Zimbabwe.

Non-voters: Azerbaijan, Burkina Faso, Cameroon, Eswatini, Ethiopia, Guinea, Guinea-Bissau, Morocco, Togo, Turkmenistan, Uzbekistan and Venezuela

2. https://www.c-span.org/video/?c5004286/user-clip-shelbypowell-exchange

3. See https://blinks.bloomberg.com/news/stories/R86GI03T6SRG