- US Treasuries rally despite ‘Trump premium’ post-debate.

- In the UK, Labour won a ‘loveless’ landslide.

- Far-right tide stemmed in France as left-wing coalition won most votes.

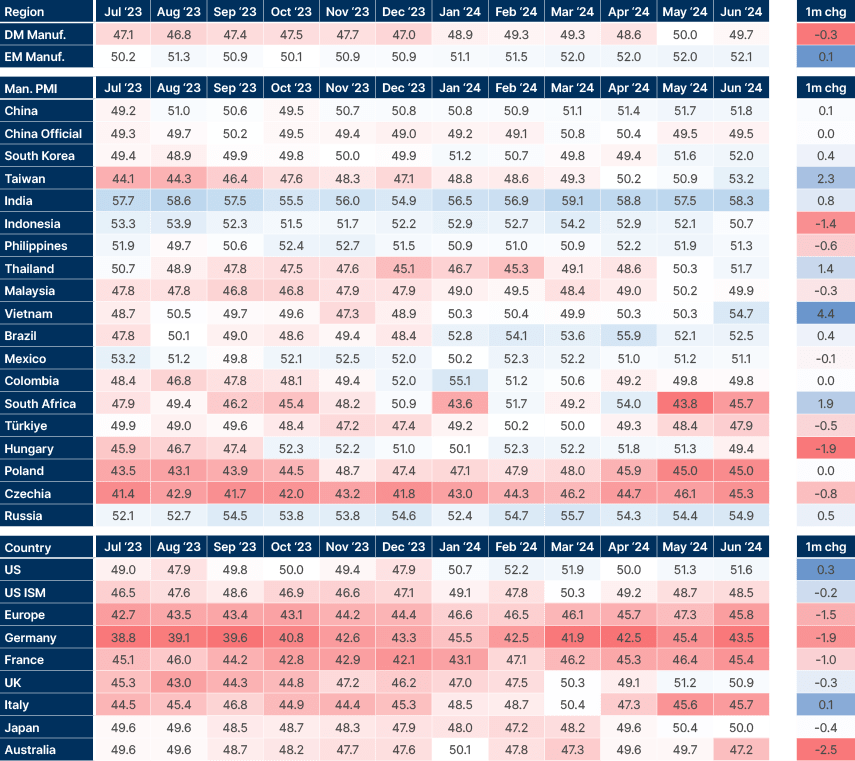

- Purchasing Managers Indices softened further in Europe, resilient in EM Asia.

- Sri Lanka announced novel terms of its debt restructuring.

- Brazil took steps to close the primary fiscal deficit and comply with its fiscal framework.

- Panama’s new president struck a market-friendly tone but faces a challenging political environment.

- Venezuelan government to resume talks with US over sanction relief.

- Romania elections.

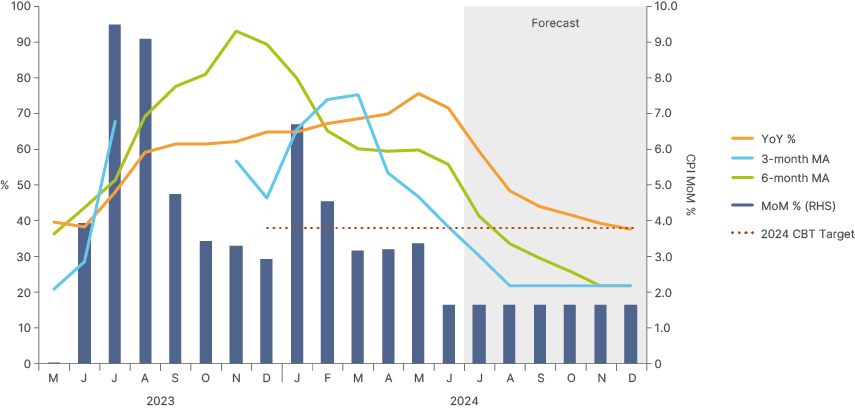

- Türkiye’s low inflation.

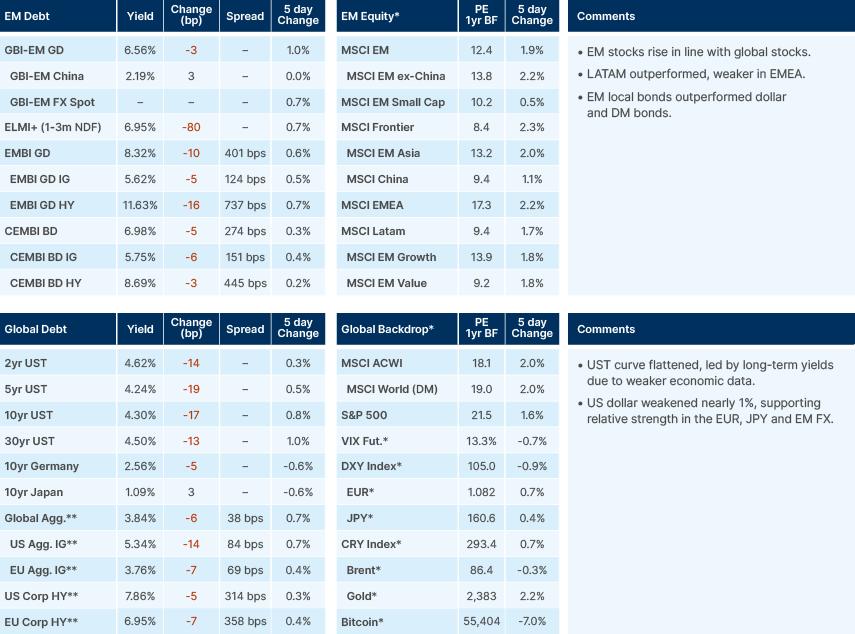

Last week performance and comments

Global Macro

US

Markets are expecting spending to rise and tax cuts to stay in place under a re-elected President Trump, which will lead to a wider fiscal deficit, more borrowing and higher inflation, and so likely higher bond yields. Therefore, selling long-dated bonds and buying short-dated bonds, or ‘the bear steepener’, has been labelled ‘the Trump trade’ since the first Presidential debate. However, economic activity and labour market data came in softer once again, increasing chances of the US Federal Reserve (Fed) cutting rates in September, which is the base case, or sooner, which is far from priced. The US 10-year Treasury recouped 20bps of its post-debate sell-off this week, rallying back from nearly 4.50% to 4.30%.

The election outcome that could lead to the most drastic policy change would be Trump winning with the Republicans taking both Houses of Congress. This is also the most potentially disruptive scenario for American institutions, as Trump has repeatedly shown disdain for following the rules. This became particularly important after the Supreme Court ruling that presidents are immune from the law when carrying out ‘official acts,’, which may embolden Trump in a future presidency.1 This is reason why several Democrats are now pressuring Biden harder to step aside, allowing for Kamala Harris, Gavin Newsom, or Gretchen Whitmer to take his place, which has also been Treasury supportive in the last few days. All three alternatives have better polling numbers than Biden, albeit all are still behind Trump. Michelle Obama is a theoretical alternative, as she polls better than all other candidates, but the former First Lady has expressed unwillingness to run several times in the past.

UK election

Sir Keir Starmer and the Labour Party won the UK General Election in a landslide, winning 412 seats, 211 more than in 2019. The Conservatives lost 250 seats, holding on to just 121.

Although at first glance this sweeping victory seems powerful, this was a loveless landslide. Last week’s polls had indicated Labour might win 45% of all votes. They won just 34% on the day. To put this number into perspective, former Labour leader Jeremy Corbyn won 32% in 2019. In fact, due to one of the lowest turnouts in history (60%), Starmer won fewer votes than Corbyn in 2019. The Starmer victory was thanks to excellent strategy under the UK’s first-past-the-post system. So, under the hood, the Labour mandate is much weaker than its majority suggests, and the landscape of British politics is now more fragmented than it has been in recent memory. Nigel Farage’s Reform UK won just five constituencies but took 14% of the vote, as Farage himself won a seat in Parliament for the first time. The Green Party recorded its best performance yet, winning 7% of the vote. Independent parties took 4%. But perhaps the most telling statistic is that 48% of those who intended to vote for Labour said the main reason was to get rid of the Tories rather than because of Labour’s policies.

If Starmer is to keep this fragile coalition of support together, he will have to walk a political tightrope and deliver tangible improvements quickly. The main low-hanging fruit is closer integration with Europe. On the other hand, the Government has minimal fiscal wiggle room, and the immigration issue has no resolution that will not anger large groups within the electorate, Parliament, and even the Labour Party itself.

French Election

The National Rally came third in the second round of voting in France's parliamentary election, according to exit polls. Marine Le Pen's far-right party was tipped to emerge as the dominant force in French politics following President Emmanuel Macron's decision to hold a snap poll. However, the left-wing New Popular Front coalition (NPF) is expected to win the most seats (182) in the second voting round. President Emmanuel Macron's centrist group, Ensemble, is predicted to win 163 seats with National Rally (RN) in third with an estimated 143 seats. Turnout, at 66.6%, was the highest in a parliamentary second round since 1997. Even if RN's vote held up, this time it had to contend with more non-RN votes often being used tactically to block them.

Iranian Election

Reformist candidate Masoud Pezeshkian was elected Iran’s new president, beating his hardline conservative rival, Saeed Jalili. Pezeshkian secured 53.3% of the votes, with Jalili polling at 44.3%. The election was called after the previous President, Ebrahim Raisi, was killed in a helicopter crash in May. The new President has called for “constructive negotiations” with Western powers, and an end to Iran’s “isolation”. However, under Iran's dual system of clerical and republican rule, the President cannot enforce any major policy shift on Iran's nuclear programme or support for militia groups across the Middle East, since Supreme Leader Ayatollah Ali Khamenei maintains responsibility for top state matters, including foreign policy.

Commodities

Brent oil futures rose to USD 87 last week, the highest level in two months, driven by expectations of high demand during the US driving season, and the disruptive impact a very early start to the Atlantic hurricane season could bring to supply. The hurricane currently blowing in the Gulf of Mexico is one of the strongest-ever storms recorded at this time of year. Shell, BP, and Exxon evacuated personnel and shut down key oil platforms in the Gulf of Mexico to ensure safety and protect operations. Geopolitical tensions threaten to add risk premium to prices, as skirmishes between Hezbollah and Israel, as well as Russian and Ukrainian strikes on energy plants and oil refineries, keep the possibility of further supply disruptions in play.

Geopolitics

Hezbollah said it had fired more than 200 rockets at several military bases in northern Israel in retaliation for an Israeli air strike that killed one of its senior commanders. Media outlets continue to report that most sources in the region insist Hezbollah, Iran and Syria do not want a war with Israel and Hezbollah's attacks will stop when a ceasefire is reached in Gaza.

Leading Indicators: S&P Global Manufacturing Purchasing Managers Index (PMIs)

The Developed Market (DM) manufacturing Purchasing Managers’ Index (PMI) retraced from 50 to 49.7, while the Emerging Market (EM) PMI grew slightly, from 52.0 to 52.1. In Asia, positive PMI activity was widespread, with Vietnam, Taiwan, and Thailand seeing significant improvement and India remaining very elevated. Manufacturing PMIs retraced sharply in Europe, led by Germany, France, and Italy. Some of the softening is most likely related to increased political uncertainty after President Macron called the parliamentary election in France.

Fig 1: Global Manufacturing PMI data

Emerging Markets

Asia

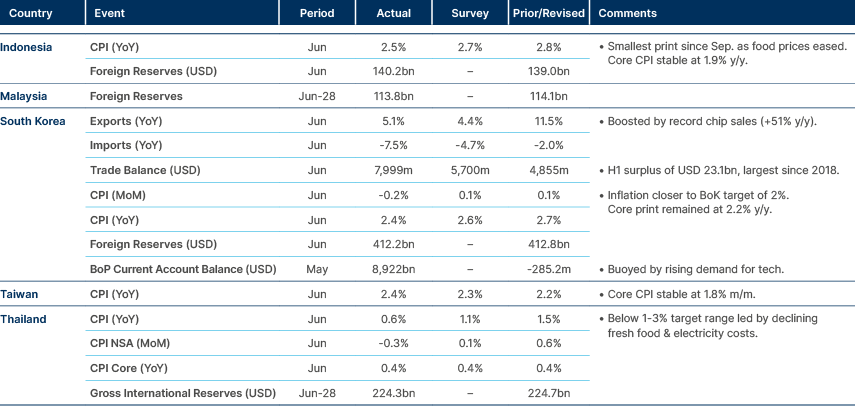

Weak CPI in Indonesia, South Korea, and Thailand.

Sri Lanka: Sri Lanka reached a provisional deal to restructure USD 12.6bn in bonds, with private creditors accepting a 28% reduction in bond principal, and an 11% reduction on past interest with payments on the interest component to start from September. Private bondholders hold about 50% of the country’s outstanding overseas bonds. The outline proposes to swap four existing dollar-denominated bonds for three new fixed income instruments. One is a standard ‘plain vanilla’ bond that has a coupon of 4% and matures in 2028. The second is a series of macro-linked bonds, where payouts and principal will be adjusted according to the country's economic performance, downwards if the economy fails to hit the baseline projections of the International Monetary Fund (IMF), and upwards should the economy outperform. A third instrument would be a so-called governance-linked bond.

Initial estimates suggest that the new recovery values will be around 60 cents on the dollar, with the 2030 bonds rising to 59 cents on the dollar on Thursday, following the announcement. Sri Lanka’s dollar bonds were among the best performers in EMs last year, delivering returns of almost 70%. The deal still awaits IMF and official creditor approval.

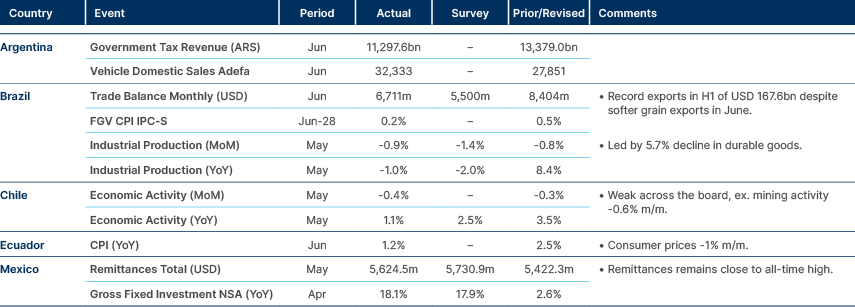

Latin America

Solid trade data in Brazil and remittances in Mexico.

Brazil: The government announced a cut of BRL 26bn (c. 0.2% of GDP) in public spending to be included in the 2025 Budget, which will likely be delivered to Congress’ approval by the end of August. Mandatory expenditures linked to social programmes are the focus of cuts. Finance Minister Fernando Haddad said he is determined to “preserve the fiscal framework at all costs” and indicated the potential to freeze or block spending on the third reassessment of the budget law on 22 July.

Panama: President José Raúl Mulino's first day in office produced positive headlines. In his public address, he emphasised fiscal adjustment and social security reform. He also committed to “attracting investment and restoring the confidence of international markets in Panama”. Without giving any concrete policy proposals, he highlighted a need to move away from “cosmetic” solutions to long-term problems. He criticised the previous administration's handling of the Cobre Panama copper mine debacle and said he would order a strict environmental audit of the mine, so that the country “knows the truth about the state of the place, its surroundings, rivers, fauna and flora and the possible dangers that the current situation represents for the environment, being open or closed.” Decisions on whether to reopen or close the mine will be based on the results of this audit. Cobre Panama, in full flow, contributed around 5% of Panama’s GDP and made up 75% of its exports.

Venezuela: Venezuela’s government will resume talks with the US on 28 July to negotiate guarantees for ensuring the legitimacy of the upcoming election for sanction relief, following stalled talks since April. Last year, President Nicolás Maduro entered into an agreement with the opposition coalition to work toward building conditions for a free and fair election. But Maduro changed course as the meteoric rise of opposition leader María Corina Machado turned into a real threat to his re-election prospects.2 Albeit the general licence to invest in oil, gas, and mining was revoked, any companies already willing to doing business in Venezuela were issued a “one-off” licence to operate. Maduro, despite trailing in polls to Edmundo Gonzáles, the candidate supported by Machado after she was banned from running, remains confident of victory. Venezuela has withdrawn EU election monitors and intensified repression, raising concerns about election legitimacy.

Central and Eastern Europe

Romania: Key elections are scheduled for later this year, with presidential elections set for 24 November and a potential second round on 8 December, while parliamentary elections will take place on 1 December, coinciding with Romania’s national ‘Great Union Day’ holiday. This decision follows weeks of disagreement between the ruling coalition parties, the Social Democrats and the National Liberal Party, exposing tensions within their two-year power-sharing arrangement. Both parties have yet to announce their presidential candidates, but NATO Deputy Secretary General Mircea Geoanǎ, a potential independent contender, is seen as a strong candidate, according to recent polls.3

Central Asia, Middle East, and Africa

Softer inflation in Türkiye positive for TRY via de-dollarisation

Turkyie: Monthly inflation increased by 1.6%, from an average of 3.2% mom, over the prior three months. Three-month annualised inflation dropped to 38.1%, in line with the central bank target for 2024. If monthly inflation remains at the same level across H2 2024, the yoy inflation rate will drop from the current 71.6% to 37.5% by year-end.

Fig 2: Turkyie CPI inflation: MoM and 3m, 6m, YoY annualised

Developed Markets

Soft data patch remains, particularly the details within the labour market data.

United States: Labour market softness is now pronounced. The main trend on payrolls has been the ongoing downward revisions to prior surveys. The three-month moving average is now at 177k, much lower than all the previous headline indicators. The number of full-time employees is also down nearly 1.5m from its November 2023 high. The unemployment rate is now at 4.1%, very close to triggering the ‘Sahm Rule’, which calls for a recession when the three-month moving average of unemployment rate rises 0.5% above its 12-month low.

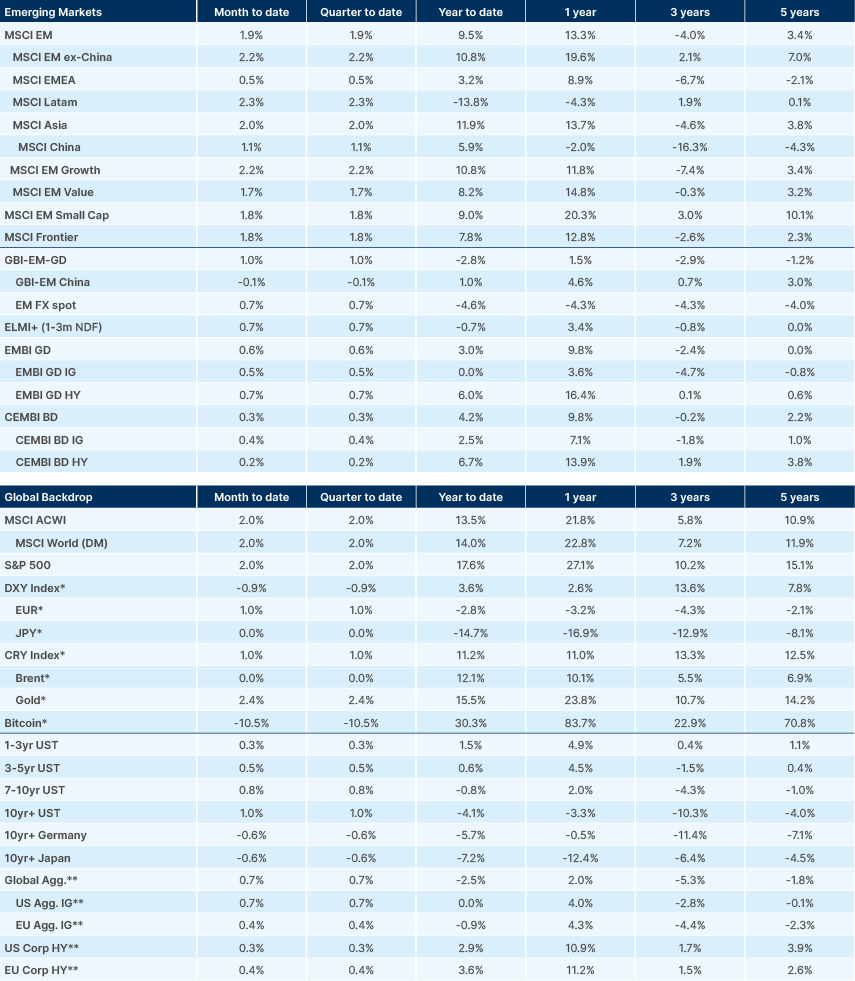

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – See – https://www.economist.com/united-states/2024/07/01/donald-trump-wins-a-big-victory-at-the-supreme-court

2. See – https://apnews.com/article/venezuela-opposition-primary-machado-winner-5d3c4c4b9a4cd42f52729fc0e798954f

3. See – https://www.inscop.ro/4-iulie-2024-news-ro-sondaj-inscop-la-comanda-news-ro-intentia-de-vot-la-alegerile-prezidentiale-geoana-267-ciolacu-178-lasconi-143-sosoaca-134-ciuca-119-simion-112-ca/