As Artificial Intelligence (AI) evolves, it has the potential to be transformational for Emerging Markets (EM) through the advancement of economic development, by disrupting industries and, in some EM companies’ cases, by leading the global AI revolution itself.

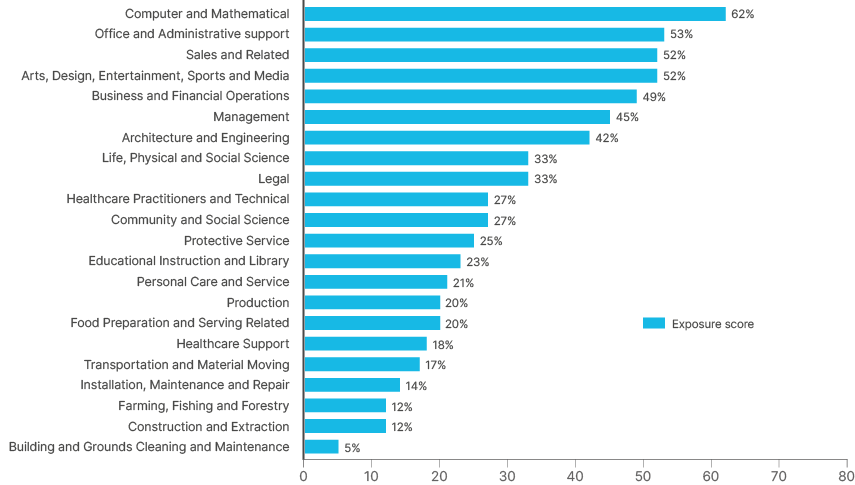

Historically, developing countries that embrace technological change have been able to bypass intermediary stages of technology adoption and ‘leapfrog’ to more advanced solutions. AI presents a similar opportunity and can accelerate and modernise economic development. However, it can also create challenges of adaptation and inequality. The impact on EM will be heterogeneous based on factors such as their respective digital infrastructure, regulatory support, industry exposure, labour skills and scope to retrain, among a host of other factors. Several EMs are well placed given their digital infrastructure, such as India, Brazil and China. China’s ability to develop a successful dual technological AI ecosystem away from the US will likely have multiple ramifications, not least for shaping future global geopolitics. AI’s impact on different industries will also vary considerably with white-collar labour-intensive jobs – including in skilled areas such as data analysis and coding – most likely to be impacted, while basic industries and manufacturing should be more insulated from change.

So far, as investors seek to interpret the impact of AI, they have focused narrowly on the initial beneficiaries. This is likely to metamorphosise this year and beyond, with each phase presenting its own investment opportunities and challenges. Ashmore expects the impact from AI to be over three key phases, and in this paper the Sub-IC assesses potential industries and companies in each phase likely to disrupt, as well as those vulnerable to being disrupted.

Fig 1: Future impact of AI

Phase 1

AI Enablers: The ‘picks and shovels’

Semiconductor building blocks

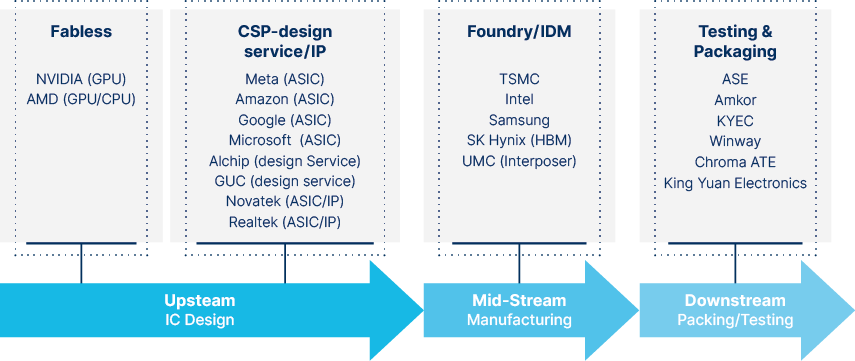

The AI chips value chain can be segmented into design, manufacture, testing and packaging. Initially, the most visible and sizable opportunity sits within ‘AI enablers’, which are primarily linked to the direct supply of AI semiconductor chips (see Fig 2).

Fig 2: AI semiconductor supply chain

Despite strong near-term growth opportunities, not all parts of the value chain are attractive over the medium term, in our view. Some segments are fiercely competitive and quickly commoditised. While companies in these areas may have transitory moments ‘in the sun’, they will ultimately likely see their profits eroded, in our opinion. Instead, the opportunity appears to be greatest and most enduring for technology leaders and those operating in attractive industry structures where long-term profit growth can accrue.

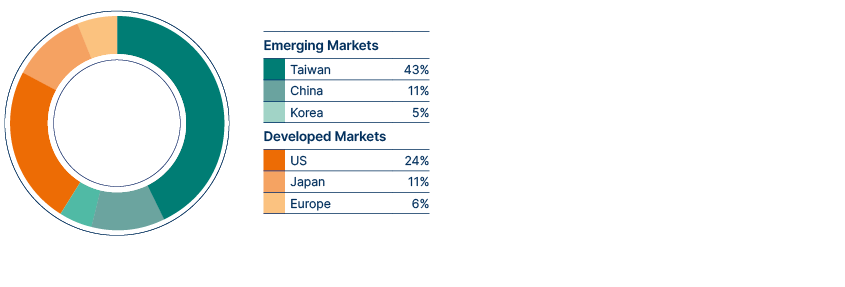

NVIDIA has captured much of the market’s attention so far and has taken an early lead in deep learning computer systems, or ‘AI accelerators’. The industry, though, is set to evolve and diversify, for example, through Application Specific Chips (ASICs) designed by companies such as Meta, Amazon and Google, as well as graphics processing units (GPUs) from AMD and Intel. While these competitor companies could eventually disrupt NVIDIA, each one will likely utilise a very similar supply chain and be dependent on a number of EM companies, particularly those from Taiwan. Taiwan’s technology strength reinforces its indispensable role in the global development of AI. We believe, this is not a product of chance but a testament to decades of strategic planning, investment and innovation, and hence not something easily replicable. Taiwanese companies dominate global advanced nodes where precision and complexity significantly increase, creating enduring barriers to entry.

Fig 3: EM dominance of AI Supply chain

AI chipmaking is particularly lucrative as AI chips involve complex requirements which differ significantly from traditional semiconductor processes. This typically means higher selling prices, reduced competition and therefore higher margins. Some of the most attractive investment opportunities include:

- Design: Taiwanese companies have significant expertise in design and dominant chip manufacturing. Taiwan design houses excel in creating sophisticated integrated circuits (ICs) that are optimised for AI tasks.

- Packaging: AI chips often require advanced packaging techniques to accommodate their higher performance requirements. Taiwan leads in deploying innovative packaging solutions, such as ‘2.5/3D’.

- Testing: An essential part of AI chip development as complexity and selling prices increase.

- Power supply: AI is notoriously energy-intensive, necessitating power supply solutions that maximise performance and deliver the necessary computational power efficiently and sustainably.

- Cooling: The intensive processing capabilities required by AI generate significant heat, making advanced cooling necessary.

Consequently, we see that the opportunities extend beyond industry titans such as Taiwan Semiconductor Manufacturing Company (TSMC) and even beyond Taiwan. Take high bandwidth memory (HBM) manufacturers in South Korea, for example. HBM is essential to high performance computing and these memory chips are specialised for use in AI, with the associated high complexity and pricing premia. Historically, Samsung has been the technology leader, yet local competitor SK Hynix has been able to leverage its packaging technology and disrupt the market by taking 50% of HBM global market share.

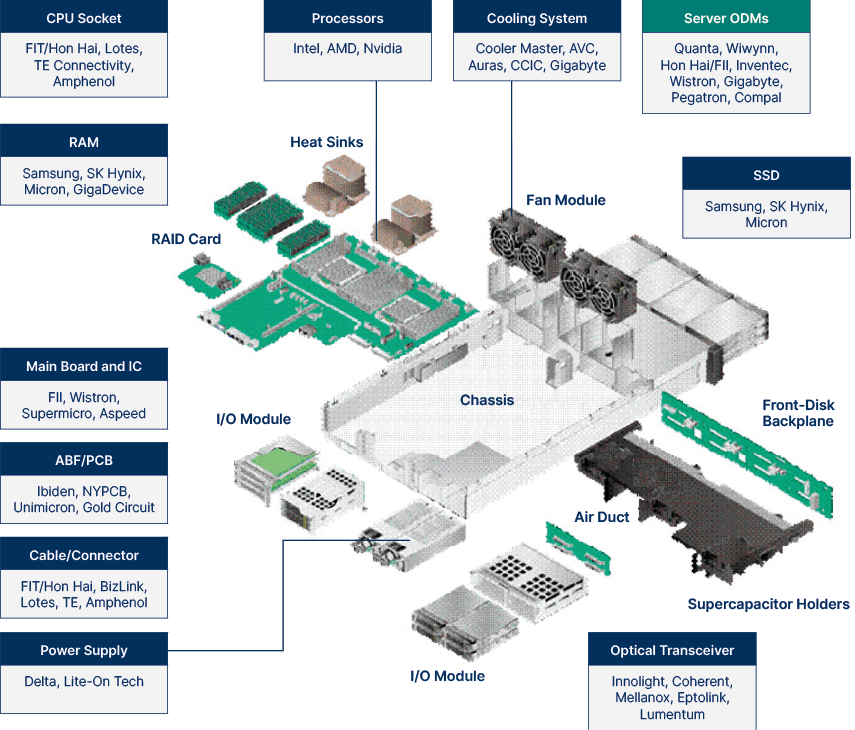

Fig 4: Semiconductor/hardware server guide

Case study 1

Areas to exploit: Semiconductor testing

The early identification of faulty chips before they are packaged with other high-value semiconductors and assembled into systems worth millions of dollars can drive substantial cost savings. This is leading to increased intensity of testing in AI servers. Given the ‘mission critical’ nature of testing equipment, only a few companies globally are trusted as part of the value chain, and barriers to entry are extremely high.

Several Taiwanese companies are particularly well positioned in the manufacturing of both tester machines and testing consumables. These components represent an extremely low part of total production cost which helps these manufacturers show pricing power and deliver over 50% gross profit margins.

For example, the total cost of a co-axial GPU test socket is typically less than 0.005% of the overall production cost, yet the socket is a critical component manufactured by just two companies globally, including one of our Taiwanese holdings.

Case study 2

Areas to avoid: The unsustainable margins of server ODMs

In 2023, supply chains were not prepared for the rapid scale-up in AI server demand that occurred after the release of ChatGPT. This led many parts of the immediate value chain to ‘overearn’ in the short term, as customers paid premium prices to secure capacity. This does not look sustainable to us.

Original Device Manufacturers (or ODMs) help assemble the various components of an AI server into a complete system before shipping to end customers. This is typically a low value-add assembly business with limited intellectual property or differentiation between vendors, and hence low barriers to entry. Consequently, it is a fiercely competitive industry with companies typically operating at single-digit gross profit margins. While many ODM stocks have performed well in the short run, a mean reversion in margin and valuation multiples looks likely driven by competitive forces.

Phase 2

Democratisation of AI

In due course, AI-enabled products and services will be rolled out to consumers and businesses. This will benefit a different set of companies that deliver AI products, such as AI smartphones, AI-enabled personal computers, as well as enterprise software.

The proliferation of AI products among corporations and consumers will require hardware upgrades, prompting a product replacement cycle in consumer devices. AI may also help unlock longer-term new demand drivers such as robotics and augmented reality functions.

Enterprise Resource Planning (ERP) systems are the backbone of business operations, which should migrate from storage repositories into sophisticated ecosystems capable of analytics and insights. These will likely enable more sophisticated business decisions as well as the automation of tasks, and consequently we believe this will be a highly monetisable product offering. A current portfolio holding in Brazil is a good case in point. It already has a 50% market share in its target SME market segment and the strength of its franchise and the future demands of AI should see its dominance and monetisation of services only expand.

In general, the technology differentiation for the personal computer and mobile value chains are not as high when compared to AI semiconductors or ERP software. Therefore, investors will need to be even more selective when picking companies, since short-term winners may not necessarily endure.

There are plentiful direct and indirect beneficiaries of AI democratisation:

Case study 3

AI powers up

AI is highly energy intensive, and the anticipated exponential growth of AI training and inferencing (the process by which machine learning draws conclusions from brand-new data) means bottlenecks in the power network are expected.

Previously, electricity grids and the associated equipment value chain were a mature and low-growth industry. This is changing. Meaningful investment is underway to re-engineer electricity grids to connect with renewable energy sources. Long lead times within the industry, which has consolidated after a decade of low growth, present dominant companies with pricing power when demand spikes.

We expect investment will expand meaningfully over the coming decade, creating many opportunities for electrical equipment companies. This has the potential to benefit a wide range of companies in transmission lines, grid software and transformers. There will likely also be associated benefits to the value chains of solar and battery storage.

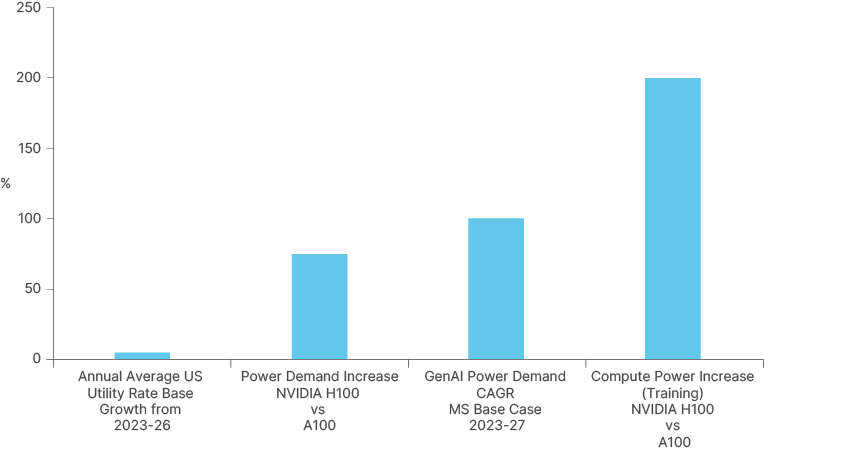

Fig 5: The increased power needs of AI

Case study 4

IT Services: AI ‘enablers’ or AI ‘disrupted’?

The implementation and integration of AI poses significant challenges for companies that will most probably require the assistance of IT service companies. The need to enhance data management and develop algorithms to integrate with existing systems and processes creates meaningful additional volume of IT service work. Consequently, this should be a significant revenue tailwind for IT service companies, many of which reside in EMs given low-cost labour.

However, this may not translate into meaningful medium-term revenue growth since the work itself can be largely automated or may be priced lower due to AI productivity gains. Consequently, the rising tide ‘will not lift all boats’. Companies with a greater focus on front end bespoke services, and less reliance on commoditised testing and programming, will be expected to be better placed to navigate these challenges.

Phase 3

AI Everywhere: Proliferation across industries

We believe AI will drive a bigger gap between corporate ‘winners’ and ‘losers’. Companies with forward thinking management teams and a focus on innovation will be able to reap significant advantages that include creating new business opportunities, boosting productivity and reducing costs, in our opinion.

Other companies risk falling behind due to operational inefficiencies and an inability to compete with AI-empowered rivals that are more efficient and operate at lower costs. Greater dispersion of corporate outcomes will therefore enhance the opportunity for alpha generation by active managers.

Companies poised to capitalise from the integration and enhancement of AI tend to share certain characteristics that not only enable them to leverage AI, but also to transform these capabilities into competitive advantages and substantial value creation. These attributes include:

- Data: Companies with access to large volumes of high-quality proprietary data and are able to collect and process data efficiently have a significant advantage.

- Corporate culture: A culture that is agile and open to adopting new technologies can help foster an environment where AI solutions can be rapidly deployed.

- Strategic vision: Executives need to understand clearly how AI fits into their overall business strategy, to articulate the vision and to allocate resources effectively.

- Technology infrastructure: AI requires a robust technology infrastructure including access to necessary computational power, highly digitalised processes, and a commitment to invest more.

- Customer-centric solutions: AI can significantly enhance and personalise the user experience. Businesses focused on improving the customer experience can help further differentiate themselves from peers.

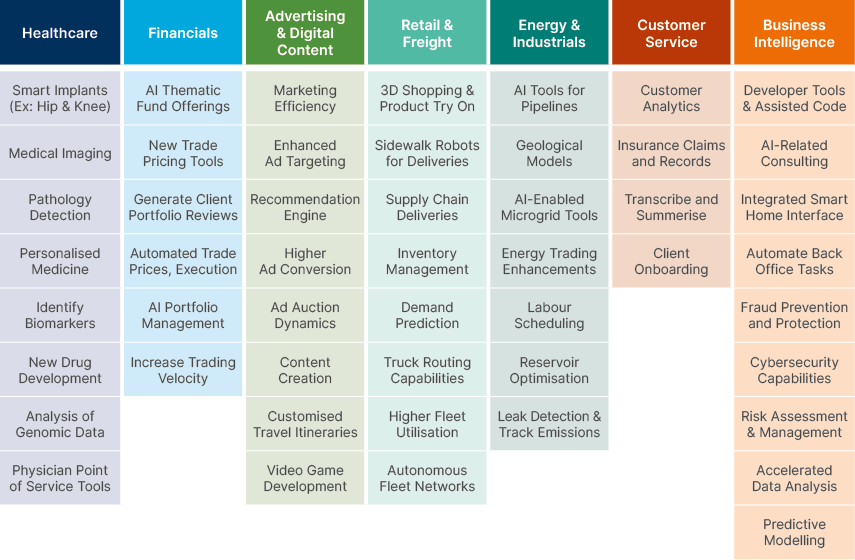

While we are still at the early stages of product development, and hence potential change, some of the possible impacts to industries can already be assessed. What immediately stands out is AI’s reach and potential magnitude of disruption. See Figure 5.

Fig 6: Emerging AI applications

Case study 5

Banks vs fintech: Advantage challengers

AI algorithms can assess creditworthiness using alternative data sources, enhancing underwriting as well as improving credit accessibility to the underserved parts of the economy. Consequently, incumbent banks need to contend with increased competition from digitally savvy fintech innovations like AI-powered lending platforms.

Traditional banks could face disruption if they do not embrace rapid digital change, which can often be difficult to instil. Hence, the list of incumbent winners may ultimately be small. Meanwhile, fintechs can have a long runway for growth. Moreover, we believe improved financial inclusion through mobile banking solutions can significantly increase the marketable audience.

Case study 6

Online insurance: Data is king

India’s largest online insurance aggregator has been an early adopter of AI across its sales and customer support function to improve the quality of the business it underwrites. The company has a 95% market share in the online insurance aggregator market which comprises over 70 million registered customers and 16 years of transaction data. This includes recorded audio calls from every policy sold (!) and the subsequent policy performance. The scale of the company’s proprietary database, and its potential monetisation, is vast.

So far, the data has been used to train a system that helps its agents to quickly identify suspicious behaviour on insurance declarations based on key terminology associated with fraud. The outcome is the company’s low claims ratio on health insurance which, at 35%, is approximately half that of offline insurance agents. Moreover, given the company’s two biggest expenses are online advertising and customer support via call centres, there is meaningful scope to streamline costs by employing AI to improve productivity.

Conclusion

AI looks set to transform the world and has the potential to create significant investment opportunities, as well as challenges. AI’s impact on EM could be outsized given EM’s dominance of the AI supply chain and the ability of EM countries and companies to be early adopters. The significant scope of implications for EM, from a top-down as well as industry and company perspective, mean a comprehensive and systematic investment approach could be a prerequisite to sustained alpha generation. Our conclusion is to enhance our research process in order to identify explicit AI risks and opportunities in our company analysis, and to perform deep-dive research on the impact of AI industries in which we invest.