Emerging Markets Equity: Catalysts for stock market leadership transition

Plague, War, Famine & the Fed

The world is in a very different macroeconomic position today compared to the prior forty years. From 1980 to 2020, investors benefited from a benign ‘Goldilocks’ environment where GDP growth was above trend while inflation was below trend. In future, the macroeconomic environment will be more challenging, in our view, given structurally higher inflation triggered by a combination of:

- Elevated debt levels that will make positive real rates challenging.

- Structural underinvestment in energy that will constrain the supply response.

- The inflationary impact of policies to reverse inequality; and

- Increased regulation for technology and consumer companies erodes their deflationary qualities.

In our view, this new macroeconomic paradigm will lead to a leadership transition in equity markets with a significant rotation to Emerging Markets. The asset classes’ advantage will be triggered by four catalysts, namely: Plague, War, Famine and the Fed.

This paper is based on a webinar discussion between Fernando Assad, Chairman of the EM Active Equity Strategy, and Gustavo Medeiros, Head of Research.1

Stock market leadership transition

CATALYST 1

Covid risk premia reversal (plague)

Since the onset of the pandemic in 2020, the market has waited for EM to ‘blow up.’ Initially, concerns focused on China’s ability to shut the door on Covid in early 2020. Once that test was passed, investor caution shifted its attention to Brazil and its handling of the Gamma variant, followed by India and the Delta variant, and finally South Africa and the Omicron variant. In each case, the market narrative obsessed over the potential for overwhelmed healthcare systems and ineffective policy responses, neither of which materialised.

The mind-set ‘what is bad for developed economies must be worse for Emerging Markets’ has, in our opinion, quickly been disproved and the virus has now moved from a state of pandemic to endemic. Emerging Markets have demonstrated an ability to proactively respond and to recover. In EM countries primary fiscal deficits have moved from approximately -3% pre-Covid to -7% mid-Covid and we expected to return towards -3% by the end of 2022. It is a similar picture for EM GDP growth, which was 3.7% pre-Covid and is anticipated to be comparable in 2022.

Figure 1: Real GDP growth

However, what has not recovered is the Emerging Markets Covid discount. US equities trade at broadly comparable levels pre and post the pandemic, at around 17x forward price-to-earnings. In contrast, the MSCI Emerging Markets index traded around 12x prior to Covid in comparison to around 10x post. It is a similar picture for the MSCI EM ex China index, while it is even starker in the case of China. The MSCI China index traded over 12x prior Covid and is currently trading below 10x. Consequently, there remains significant risk premia to be harvested, and much more so than compared to developed markets.

A key potential catalyst for this discount to close will be how China’s current zero-Covid policy evolves. There has been increased evidence of a more nuanced approach to containing the virus. Steps to incrementally reopen have so far included localised lockdowns and closed loop production, as well as progress towards mRNA vaccines. Should this continue, which is our expectation, it would buoy domestic economic growth expectations, where consensus 2022 expectations have fallen from 5.5% to around 3.0%. It would also be a strong positive for Emerging Markets more broadly given China’s importance from both an economic and wider sentiment perspective. The low visibility of a timeline to reopen means this is likely to remain a source of market volatility, although the passing of the National Congress of the Chinese Communist Party in October is one potential catalyst. Positive traction in efforts to remobilise the population, from current subdued investor expectations, would be strongly positive.

CATALYST 2

An increasing multi-polar world (war)

Russia’s invasion of the Ukraine in February 2022 is symptomatic of a broader trend towards an increased multi-polar world. China is a central leader for change and since 2013 and the establishment of the ‘One Belt, One Road’ initiative, China has sought to defy US political and economic hegemony. This has triggered a series of confrontations, including over technology and trade, which are likely to continue and remain a source of market volatility.

In a backdrop of greater multi-polarity and potential geopolitical risk, investors are encouraged to diversify their portfolios and to identify ‘neutral’ countries that are well placed to benefit from economic arbitrage. Given Emerging Markets heterogeneous nature, and geographical span, EM invariably comprises ‘winners’ from every geopolitical situation.

One current example is India. The country has benefitted from increased foreign direct investment from US corporates that want to diversify their supply chains away from China. An example is Apple which recently announced it will start producing iPhones in India. Meanwhile, the country can also buy discounted energy from Russia. Another example is Mexico, whose proximity and close trading ties to the US is advantageous given the trend towards ‘nearshoring’. The domestic economy is benefitting from wage increases and record high remittances. Publicly traded companies have seen revenues grow at around two times inflation. Despite this constructive backdrop, meaningful risk premia surrounding Covid-19 and former President Trump’s policies has yet to dissipate. The Mexican stock market has historically traded broadly at par with US equities yet currently trades at an approximate 30% discount.

CATALYST 3

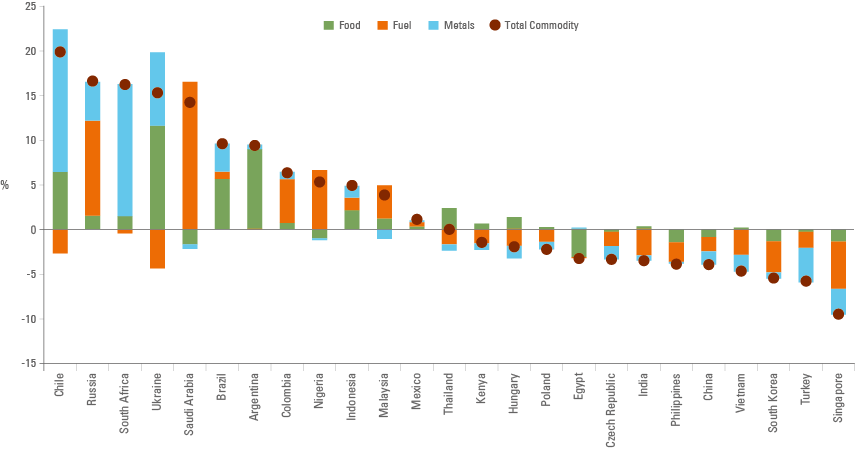

Commodity constraints (famine)

Russia’s invasion of the Ukraine exacerbated already constrained commodity markets including energy, fertilizers, food, and some industrial metals. JP Morgan estimates a current global commodity inventory of 64 days. This compares to 70 days a year ago and 76 days five years ago. According to Citibank, the value of commodities consumed globally has increased from $6.3 trillion in 2019 to $12.5 trillion, or from 6% to 13% of the world’s GDP. This is triggering a positive terms of trade shock and a transfer of wealth in favour of commodity exporters, many of which are in Emerging Markets.

In several countries these positive dynamics are leading economic growth expectations to be revised upwards, they are buoying companies’ operating environments and supporting domestic currencies. We think there remains considerable further opportunity for positive revisions. These dynamics have also improved Emerging Markets resilience in the face of record US dollar strength. The JPM GB EM index, a basket of EM currencies has fallen -8% year to date which compares to Euro -14%, Pound -17% and the Yen -26%. Meanwhile, the Brazilian Real and Mexican Peso have strengthened against the US dollar, no mean feat considering the USD dollar index is up 17%.2

On this basis, the attractiveness for investment in the Middle East has become more compelling. The Gulf States’ economies and underpinned by large commodity reserves which enhances their economic resilience. The countries are also seeing their capital markets broaden and deepen. Many businesses are large cash generators that offer good dividend yields in a credible US dollar-pegged currency.

Conversely, this backdrop is negative to more vulnerable energy importers, especially those reliant on Russia; for example, certain central European countries who have close trade ties with the EU, where sustainable energy supplies remain uncertain.

Figure 2: Commodity trade balance % of GDP

CATALYST 4

Divergent policy paths (the Fed)

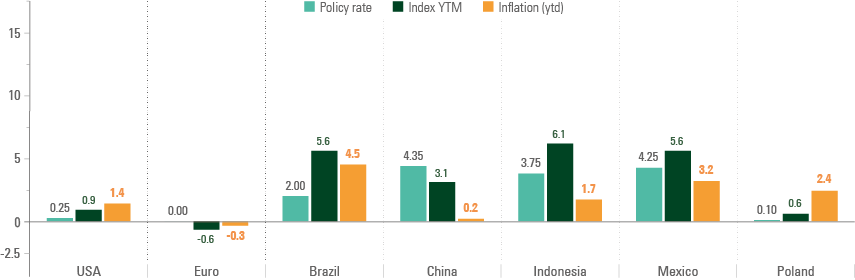

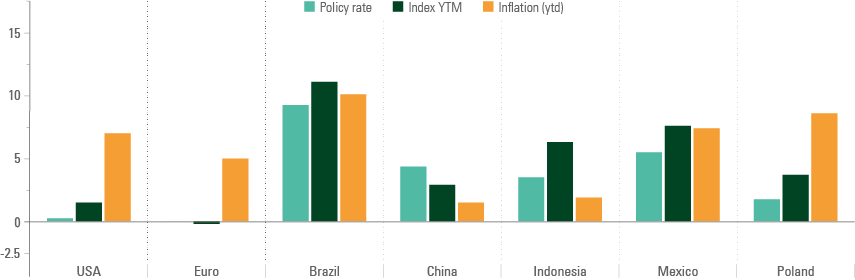

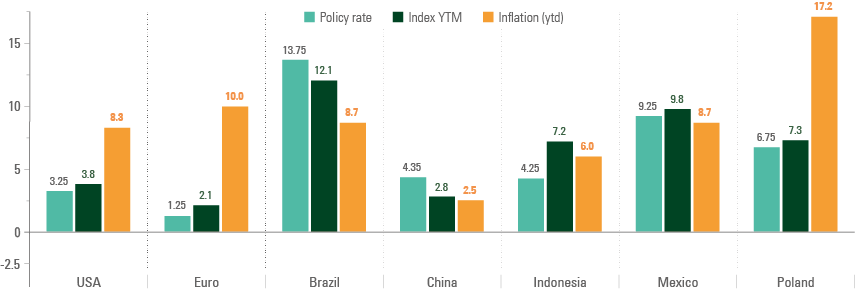

In a hyper-financialised world characterised by significant levels of debt, monetary policy has become a disproportionately important driver of market performance. It is our view that, after making a policy mistake in 2021, by not tightening policy rates in an economic boom (high growth and high inflation), developed markets have been guilty of being reactive to persistently high inflationary pressure. This has triggered investor uncertainty and market volatility at the expense of risk assets. Meanwhile, Emerging Markets have been largely orthodox and increased policy rates pre-emptively and predictably. This has helped anchor inflation expectations as per figure 3.

The unanimous tightening path from the Federal Reserve and the European Central Bank mean that we expect developed markets economic growth to continue to decelerate. The potential for a ‘positive policy pivot’ will likely have to wait for sustained evidence of more stable inflation dynamics unless a financial risk provokes a ‘policy panic’ beforehand. In contrast, Emerging Markets are approaching the end of restrictive monetary policy paths. We expect policy will incrementally become more expansionary as we move into 2023 to the benefit of domestic economic growth, earnings and stock market performance.

Figure 3: Policy rates, Yields and CPI inflation on selected countries

2020

2021

2022

At a portfolio level, we have been stress testing on this basis and have reduced exposure to certain stocks with high multiples and long duration characteristics. We have also steered away from external facing economies, for example South Korea. Meanwhile, we have been attracted to high quality resilient franchises that can maintain pricing power in countries such as Brazil.

Nowhere is the policy dynamic more differentiated than in China, where we expect an acceleration in policy stimulus. We have already seen several recent measures implemented, which include expansionary monetary policy and measures to support the property market. These have been well received after a prolonged period of policy disruption given the politics of enhanced regulation and zero-Covid initiatives. We believe the former has now normalised and it is hoped that the new economic leadership after the Party Congress will prioritise the support of the real estate market and the promotion of economic growth. This has been reflected in our portfolio by closing our earlier underweight position in China and focusing our research efforts on high returning companies that have continued to execute well and who trade at historical trough valuations.

The MSCI China index has lost over half its value since cycle peak in February 2021, a comparable percentage to the S&P500 during the Global Financial Crisis, and China has been a key reason for Emerging Markets witnessing their longest bear market in history. A positive shift in policy direction is not currently priced, and the return to Chinese domestic consumption from depressed levels would be a catalyst for strong market performance and welcome the world over.

Conclusion

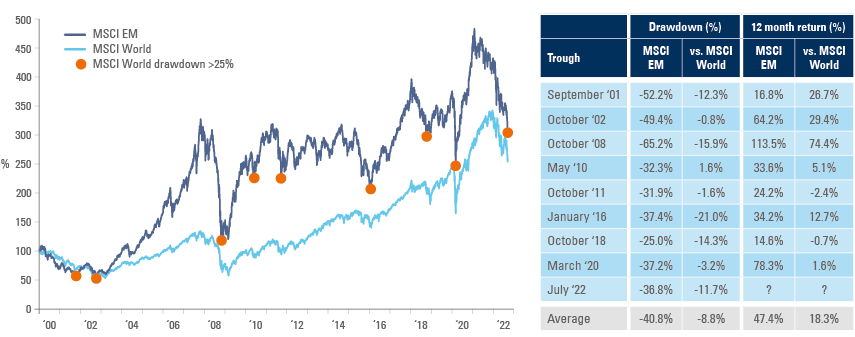

The unstable global macroeconomic backdrop has provoked indiscriminate selling pressure and attractive investment opportunities. In the past two decades, Emerging Markets have witnessed eight drawdowns over 25% and over the following 12 months the MSCI Emerging Markets index has returned over 47% on average, 18% ahead of the MSCI World index.

As we move towards the end of 2022 and into 2023, the prospect of Covid moving to the rear view mirror, commodity prices staying higher for longer and Emerging Markets policy stance becoming more expansionary are all positive omens for Emerging Markets, not least when valuations are at historical extremes.

Watch out US equities, there could be a new leader in town.

Figure 4: Buying the dip in the right asset class: 12m returns post drawdowns