EM stocks outperformed on the back of a weaker US Dollar, reflecting the soft price action in US stocks and in spite of higher US Treasury yields. China’s real GDP growth rose +8.1% in 2021 despite mixed activity in December. CPI inflation was lower than consensus in China and India and seems to be peaking in other EM economies, in contrast with DM where inflation is still rising. The Bank of Korea hiked its policy rate by 25bps to 1.25% and kept a hawkish stance. There was no break-thought in Russian-US discussions over strategic geopolitical objectives. Turkey’s current account moved back to a deficit. Ethiopia’s prime minister held a constructive phone call with US president. Tunisia foreign exchange reserves dropped less than expected in 2021.

Emerging Markets

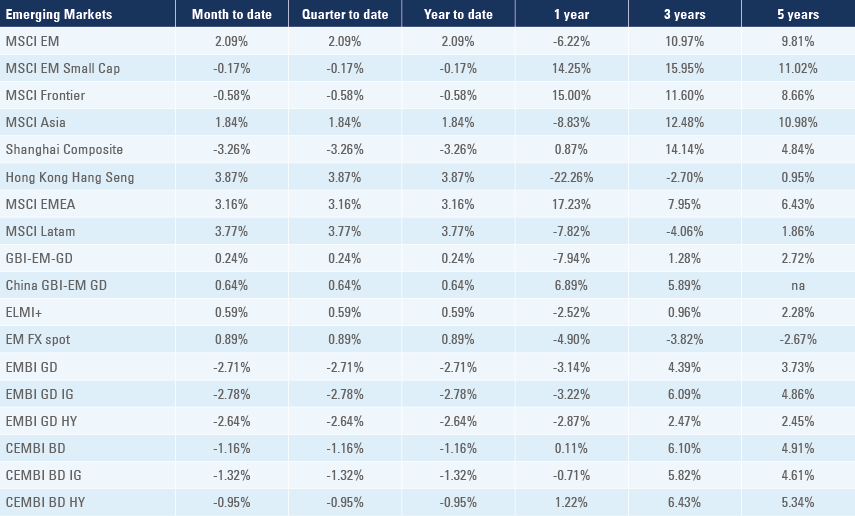

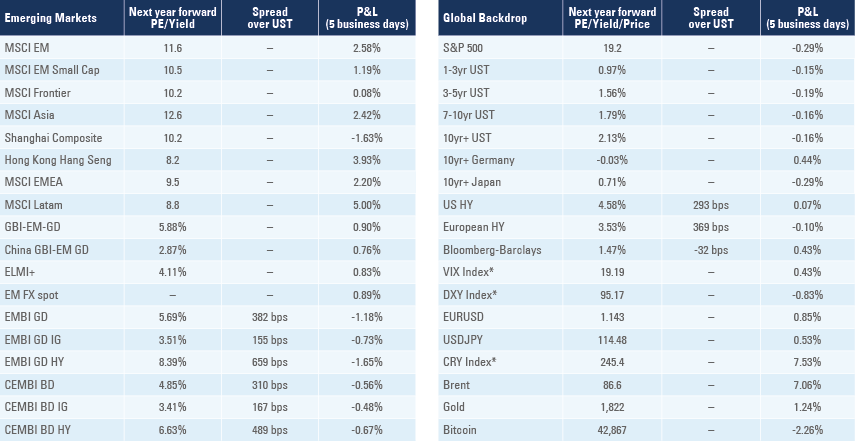

Emerging Market equities rose 2.1% year-to-date, outperforming both the MSCI World, down 1.8%, and the S&P500, down 2.1% so far in 2022. The EM outperformance is also reflected in currencies with the Dollar Index down 0.5% while EM currencies are up 0.9% year-to-date. The weaker Dollar is at odds with the higher (nominal and real) yields on US Treasuries, highlighting how dependent the Dollar performance has become on US equities inflows. Traditionally bond flows dominate the current account flows, but today foreign investors hold USD 12trn of US equities (>50% of US GDP) and only USD 6trn of US bonds (> 25% of UD GDP), hence, US stocks underperformance is likely to keep the US currency under pressure. Of course, this could change if the market moves to price a global recession and adds significant exposure to US Treasuries – but that would tilt the flows in favor of the US only temporarily, in our view.

China: The PBoC cut its policy rates by 10bps, taking the 7-day reverse-repo rate to 2.1% and the 1-year medium lending facility (MLF) to 2.85% as it increased its MLF size by CNY 200bn to CNY 700bn. Real GDP rose 4.0% yoy in Q4 2021 (3.1% yoy consensus) taking real GDP growth 8.1% higher in 2021. December economic data was mixed, with net exports and industrial production stronger than expected, buoyed by auto and smartphones production, whereas retail sales and property market remained weak, partially compensated by higher infrastructure investment. The yoy rate of CPI inflation dropped 0.8% to 1.5% in December (1.7% yoy consensus) as PPI inflation dropped 2.6% to 10.3% yoy (11.3% consensus) over the same period. The trade surplus rose to a record USD 94.5bn in December from USD 71.7bn in November as imports slowed more than expected and exports remained resilient, leading to a cumulative trade surplus of USD 676bn in 2021. Exports to G3 countries (US, EU and Japan) stagnated while exports ex-G3 rose by 31% yoy.

India: The yoy rate of industrial production declined to 1.4% in November (2.8% consensus) from 4.0% yoy in October. The yoy rate of CPI inflation rose 0.7% to 5.6% in December, but was 0.2% below consensus. The trade deficit declined to USD 21.7bn in December from USD 22.9bn in November, broadly in line with consensus.

South Korea: The Bank of Korea (BoK) hiked its policy rate by 25bps to 1.25%, back to pre-pandemic level. The BoK revised its inflation outlook stating CPI inflation “will continue to run in the 3% range for a considerable time”. The BoK expects real GDP growth in 2022 of around 3.0% as the economy “is likely to sustain its sound ground, as the recovery of private consumption is forecast to pick up again while exports are expected to continue their solid trend of increase”. At the press conference, Governor Lee Ju-yeol said it is now time to observe the effect of the past three hikes in the economy. In economic news, the unemployment rate rose 0.7% to 3.8% in December while the current account surplus rose to USD 7.2bn in November from USD 7.0bn in October.

Russia: There was no breakthrough on strategic disagreements during meetings between the United States, NATO and Russia. Foreign Minister Sergei Lavrov said escalation was not imminent, but the deputy foreign minister suggested dispatching military infrastructure to Venezuela and Cuba is a possibility to retaliate against US sending weapons to Ukraine and NATO expansion closer to the Russian borders. There were reports of increased mobilisation of military equipment towards the Ukraine borders last week, but little signs of an increase in troops. The risk of sanctions overhang is keeping deeply undervalued Russian assets from rallying. Official FX reserve assets rose to USD 630.6bn in December from USD 622.5bn in November.

Turkey: The current account moved to a USD 2.7bn deficit in November from a USD 3.1bn surplus in October, slightly wider than consensus as industrial production rose 3.3% mom from 0.7% mom over the same period. Inflation expectations for the next 12 months surged to 25.4% in January from 21.4% in December, the highest level since the beginning of the survey in 2006 (average 8.3%).

Ethiopia: Prime Minister Abiy Ahmed had a phone call with US President Joe Biden. The US is calling for Ethiopia to cease hostilities between Amhara and Tigrayans in order to end the civil war, release aid and improve political dialogue. Statements from both parties acknowledge the importance and the intention to strengthen bilateral relations.1

Tunisia: The central bank noted the fiscal deficit improved to 8.3% of GDP in 2021 from 9.6% GDP in 2020 as inflation rose to 6.6% yoy from 4.9% yoy over the same period. FX reserves declined by only 0.5bn during the year to USD 8.0bn (136 days of imports) despite tourism revenues remaining EUR 1.2bn below pre-pandemic levels.

Snippets

- Argentina: CPI inflation rose 3.8% mom in December from 2.5% mom in November taking the yoy rate down 0.3% to 50.9%.

- Brazil: The yoy rate of CPI inflation dropped 0.6% to 10.1% in December, 0.1% above consensus. Retail sales rose to 0.6% in November from 0.2% mom in October, higher than consensus.

- Colombia: Consumer confidence dropped to -7.0 in December from -1.4 in November

- Czech Republic: The yoy rate of CPI inflation rose 0.6% to 6.6% in December. November retail sales rose to 9.9% yoy from 0.7% yoy in October and the current account deficit widened to CZK 6.0bn in from CZK 3.7bn over the same period.

- Egypt: The yoy rate of CPI rose by 0.3% to 5.9% in December and core CPI inflation rose 0.2% to 6.0% yoy over the same period.

- Hungary: The yoy rate of CPI inflation was unchanged at 7.4% in December, 0.2% above consensus. The trade balance moved to a EUR 81m surplus in November from a EUR 302m deficit in October.

- Indonesia: Consumer confidence was unchanged at 118.3 in December. Local auto sales rose to 97k in December from 87k November, the best level for auto sales in December in 10 years and back to pre-pandemic levels.

- Malaysia: The yoy rate of industrial production surged 3.9% to 9.4% in November, 2.1% above consensus.

- Mexico: The yoy rate of industrial production rose 0.9% to 1.6% in November, 0.8% below consensus. Nominal wages increased at a yoy rate of 5.5% in December, 0.3% above the previous month, despite 313k formal jobs destruction in December after 165k jobs created in November.

- Philippines: the trade deficit widened to USD 4.7bn in November from USD 4.0bn in October as the yoy rate of import growth rose 11.7% to 36.8% and exports rose to 6.6% yoy. Overseas remittances remained strong at USD 2.5bn in November (from USD 2.8bn in October)

- Poland: The current account deficit widened to EUR 1.1bn in November from EUR 0.9bn in October (revised from EUR 1.8bn deficit), better than consensus.

- Romania: The central bank raised its policy rate by 25bps to 2.0%, below consensus expectations for a 50bps hike. The yoy rate of CPI inflation rose another 0.4% to 8.2% in December and the trade deficit improved to EUR 2.2bn in November from EUR 2.5bn in October.

- Saudi Arabia: The yoy rate of CPI inflation rose 0.1% to 1.2% in December.

- South Africa: Manufacturing production rose 3.7% mom in November after dropping 5.2% in October, slightly below consensus.

- Thailand: Consumer confidence improved 1.3 to 40.1 in December but remained at very depressed levels when compared with the average of the last 20 years at 71.1.

Global backdrop

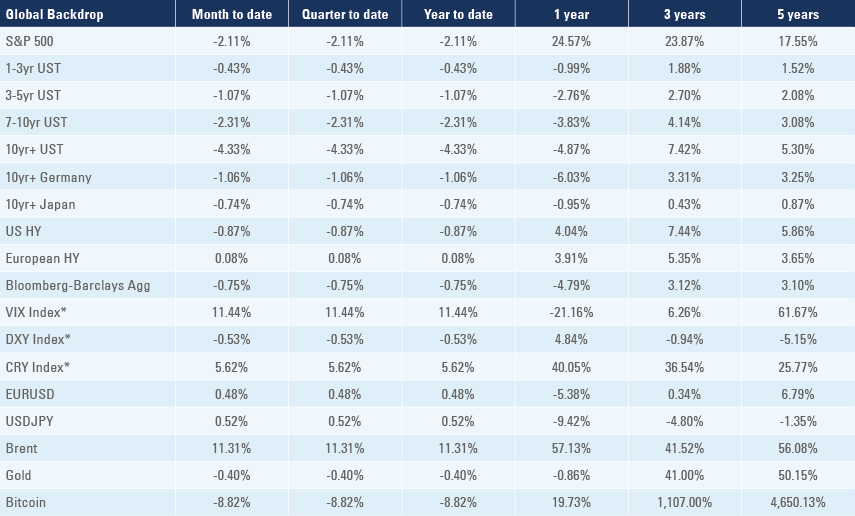

United States (US): Inflation rose in December roughly in line with consensus as the yoy rate of CPI inflation rose 0.2% to 7.0%; CPI ex-food and energy rose 0.6% to 5.5% yoy and PPI final demand declined 0.1% to 9.7% yoy. The long-term inflation expectation on the University of Michigan survey rose by 0.2% to 3.1% as 1-year expectations increased 0.1% to 4.9% in January. The same survey showed economic sentiment down 1.8 points to 68.8 and current conditions down 1.0 to 73.2. Retail sales plunged 1.9% mom in December from +0.2% mom in November as industrial production dropped 0.1% mom from +0.7% mom over the same period. There was more evidence of an ongoing tightening in the labour market as jobless claims rose to 230k in the first week of January from 207k in the previous week, and continuing claims dropped to 1.56m in the last week of December from 1.75m prior.

The Philadelphia Fed President Patrick Harker and Richmond Fed President Thomas Barkin said they favour a lift-off in March and expected 3-4 hikes this year. The more dovish Chicago Fed President Charles Evans also sees three or four hikes this year while hawkish Fed Governor Christopher Waller said 4-5 hikes may be necessary, and if inflation stayed 'stubbornly high' in the second half of this year that the Fed could start shrinking its balance sheet by summer.

Eurozone: The Eurozone trade balance moved to a EUR 1.5bn deficit in November from a EUR 3.3bn surplus in October. Industrial production jumped 2.3% mom in November after declining 1.3% in October (revised from 1.1%) and the unemployment rate dropped to 7.2% in November from 7.3% in October.

United Kingdom: Industrial production rose 1.0% mom in November from -0.5% in October as the trade surplus improved to GBP 0.6bn (significantly better than consensus for GBP 2.5bn deficit) from GBP 0.2bn over the same period.

Japan: The current account surplus declined to JPY 897bn in November (JPY 590bn consensus) from JPY 1,180bn in October. The yoy rate of PPI inflation dropped 0.7% to 8.5% in December.

Australia: The trade surplus narrowed to AUD 9.4bn (c. USD 6.7bn) in November from AUD 10.8bn in October, slightly below consensus, but remained at the highest seasonally adjusted levels in 20 years.