EM Purchasing Managers’ Index outperformed DM’s as China’s economic activity remained lukewarm due to the zero covid-19 policy. EM stocks outperformed led by China as hopes of a Chinese reopening increased. Brazilian assets outperformed the most as President Bolsonaro asked protesters to clear the streets.

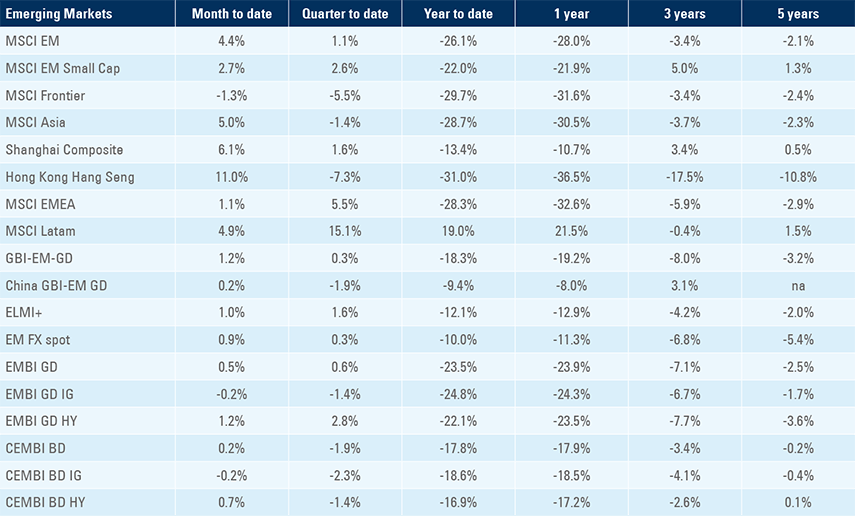

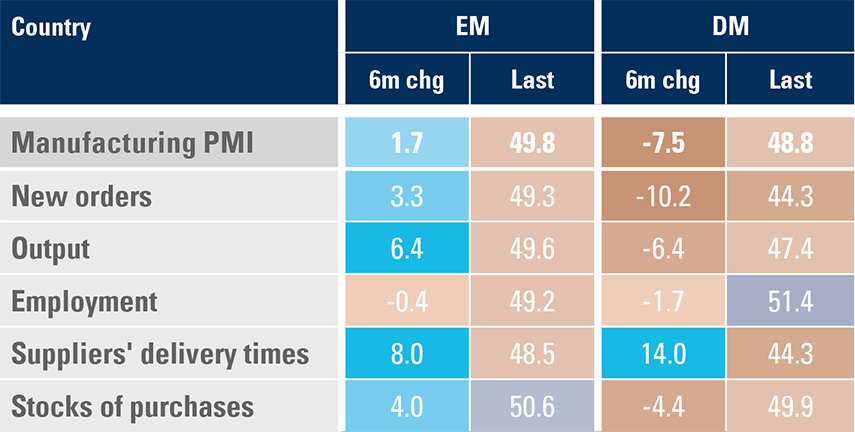

S&P Global Markit Purchasing Managers Index

The leading indicator survey with purchasing managers across the largest countries in the world showed the global economy continued to slow led by developed markets (DM) as emerging markets (EM) outperformed. Global Manufacturing PMIs declined 0.4 in October to 49.4 with DM PMIs down 1.3 to 48.8, but EM PMIs rose 0.4 to 49.8. The EM outperformance is even more pronounced over the last six months when EM Manufacturing PMIs improved 1.7 points, while DM PMIs dropped 7.5 points. Most notably, the new orders and output sub-index advanced sharply in EM but moved in the opposite direction in DM as per Figure 1:

Figure 1: Manufacturing PMIs subcomponents

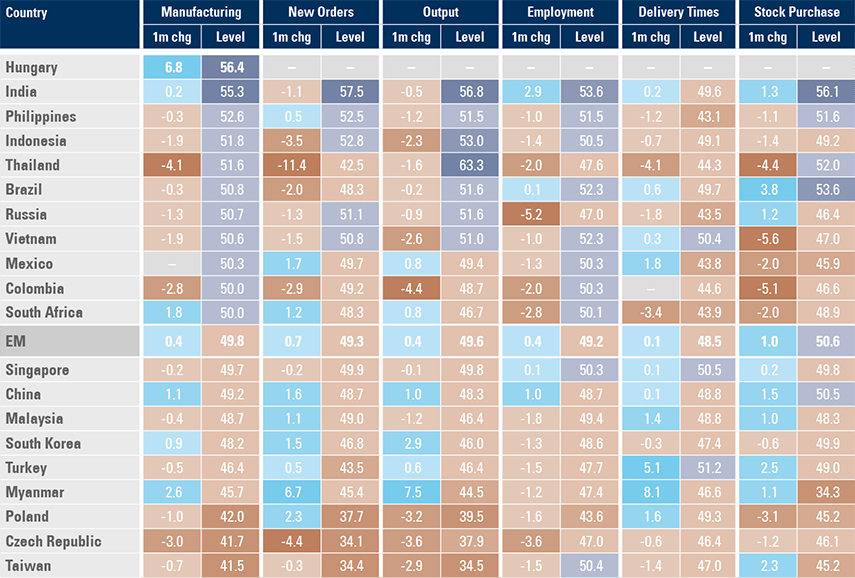

Activity declined the most in the Eurozone where the Manufacturing PMI dropped 2.0 to 46.4 while Australia PMI declined only 0.6 to 55.0. The US PMI declined 1.6 points to 50.4 as new orders declined 3.5 points to 47.6. Figure 2 shows the breakdown of the PMI by subcomponents across EM countries. Hungary, India, Philippines, and Indonesia had the highest manufacturing readings, albeit the volatility of the survey in Hungary and the lack of details brings the data into question, while the worst performing countries remained Taiwan, Czech Republic, Poland, and Malaysia. The 1.1-point improvement in the Chinese PMI to 49.2 was the main reason for the improvement of the indicator across EM. Half of EM countries showed an improvement in new orders with Malaysia and Mexico seeing the sharpest increases, but three-quarters of countries had new orders in negative territory. Output declined the most in Colombia, Czechia and Poland and remained at positive levels in seven out of twenty countries. Delivery times improved sharply in Malaysia, Turkey and Mexico, and deteriorated the most in Thailand, Russia, and Philippines.

Figure 2: Manufacturing PMI subcomponents across EM

Emerging markets

China: Chinese stocks outperformed last week as signs that the zero covid-19 strategy will become less stringent are increasing, including several cities reported they would start charging for PCR testing, which could lower the overall test numbers. At the same time, Beijing city vowed to stick to covid zero as local cases rise, one day after allowing the Beijing Marathon to take place.

Allowing the Beijing Marathon while vowing to keep zero covid policies is just another of China’s contradictions: the micro equivalent of the tensions of a Communist country with free markets. Exiting zero covid-19 policy is likely to be a multi-month tortuous process rather than a big-bang announcement, in our view. Progress in native vaccines will be an important milestone to monitor, but the politics will be equally, if not more important. We believe that the unpopularity of the zero covid-19 strategy will end up tipping the balance towards a gradual but continuous reopening. For capital markets, what matters is whether the private sector will be allowed to operate. China cannot try to encourage inbound travel to support foreign direct investment while having employees fleeing a mega-industrial complex, causing hundreds of billions of losses to the most valuable manufacturing company in the world, which concentrated almost 100% of its assembly in China. Chinese capital markets were so oversold that asset prices jumped at the slimmest sign that a reopening will take place. This is not another Chinese contradiction, but equity markets’ usual behaviour of moving ahead of likely events before the narrative for these events is ready (i.e., not yet priced).

In economic news, the trade surplus was unchanged at USD 85bn in October, but both exports and imports declined marginally in yoy terms. Despite trade weakness, commodity import volumes held up with iron ore + 3.7% yoy, oil +14.1%, copper +4.0% and coal +8.3%.

Brazil: President Jair Bolsonaro asked protesters to clear the streets, while president-elect Luiz Inacio Lula da Silva appointed his running mate Geraldo Alckmin to lead the transition team. Lula is already negotiating the 2023 budget with congress to keep the increase in social benefits granted by Bolsonaro unchanged in 2023. The market will carefully monitor his choice of Finance Minister, likely to be announced over the next weeks as an orthodox fiscal policy will be necessary to conciliate the challenging task of lowering the country’s deficit and debt/GDP while keeping elevated social programmes. In economic news, the budget deficit narrowed to BRL 60.6bn in September from BRL 65.9bn in August, slightly better than consensus and the trade surplus was unchanged at USD 3.9bn in October, slightly below consensus. Industrial production dropped 0.7% mom in for the second month in September, bringing the yoy rate down to 0.4% from 2.8% yoy in August. Vehicle sales slowed to 181k in October from 194k in September remaining close to the most depressed levels in 10 years.

Colombia: Colombian markets underperformed despite the approval of the tax reform. The government is trying to reassure the market by saying they will keep oil and gas exploration and obeying the fiscal rules. The national unemployment rate rose 10bp to 10.7% in September, but the urban unemployment rate dropped 40bps to 10.4% over the same period. CPI inflation slowed to 0.7% mom in October from 0.9% in September, but the yoy rate rose by 80bps to 12.2%, in line with consensus, while core CPI increased 90bps to 9.2% yoy.

Snippets

- Argentina: Tax collection rose 2.4% yoy in real terms in October leading tax revenues up 5.9% yoy on a year-to-date basis. Vehicle production was unchanged at 52.4k in October but exports rose by 2k to 37.3k over the period, remaining at the best pace of production and exports since 2014.

- Chile: Economic activity improved 0.2% mom in September after 0.6% in August, or 60bps better than consensus, but vehicle sales declined 9k to 28.6k in October.

- Czechia: The Czech National Bank kept its policy rate unchanged at 7.0%, in line with consensus.

- Hungary: The trade deficit widened to EUR 1.6bn in August from EUR 1.3bn in July.

- Indonesia: CPI inflation dropped 0.1% mom in October from +1.2% in September taking the yoy rate down 30bps to 5.7%, which is 30bps better than consensus, while core CPI rose 10bps to 3.3% yoy over the same period, 10bps better than expected.

- Malaysia: Bank Negara Malaysia hiked its policy rate by 25bps to 2.75%, in line with consensus.

- Mexico: Real GDP increased 1.0% qoq in Q3 2022 from 0.9% qoq in Q2 2022, taking the yoy rate up 220bps to 4.2% over the same period. Foreign exchange remittances were USD 5.0bn in September after USD 5.1bn in August, remaining at very elevated levels. Domestic auto sales improved 5k to 91k in October.

- Nigeria: The ratings agency Moody’s downgraded Nigeria’s sovereign credit rating by one notch to ‘B3’ (equivalent to ‘B-‘), with a negative outlook, citing a deteriorating economic situation and a worsening of its external debt position.

- Pakistan: Former Prime Minister Imran Khan was shot in a leg during his ‘long march’ rally between Lahore and Islamabad and several other PTI party members were injured.

- Peru: The Lima CPI slowed to 0.4% mom in October from 0.5% mom in September, allowing the yoy rate to decline 20bps to 8.3% over the same period, 10bps below consensus.

- Philippines: The yoy rate of CPI inflation rose 80bps to 7.7% in October, 60bps above consensus, but the trade deficit narrowed by USD 1.2bn to USD 4.8bn in September as exports improved by USD 0.75bn to USD 7.2bn and imports slowed USD 0.4bn to USD 12.0bn.

- Poland: CPI inflation rose 1.8% mom in October from 1.6% mom in September as the yoy rate rose 70bps to 17.9% over the same period.

- Romania: PPI inflation declined 1.0% mom in September after increasing 1.8% mom in August, taking the yoy rate down by 630bps to 46.7%.

- South Africa: The trade surplus improved to ZAR 19.7bn in September from ZAR 6.2bn in August, significantly better than consensus. Electricity consumption dropped by a yoy rate of 7.5% in September as the utility company Eskom is struggling to increase production and keeps forcing the population and industry to ration energy.

- South Korea: Industrial production dropped 1.8% mom in September after declining 1.4% in August, bringing the yoy rate down by 70bps to 0.8%.The trade deficit widened to USD 6.7bn in October from USD 3.8bn in September as imports rose by a yoy rate of 10.0% (down from 18.6%), but exports declined by 5.7% yoy (from +2.7%) over the same period. CPI inflation rose 10bps to 5.7% yoy while core CPI rose 30bps to 4.8% yoy.

- Thailand: The current account moved to a USD 600m surplus in September from a USD 3.5bn deficit in August led by a sharp improvement in the trade accounts to a USD 1.9bn surplus from a USD 1.0bn deficit over the same period.

- Türkiye: The yoy rate of CPI inflation rose 200bps to 85.5% in October, in line with consensus as core CPI rose 240bps to 70.5% yoy over the same period and PPI jumped 620bps to 157.7% yoy.

Developed markets

United States: The Federal Open Market Committee (FOMC) hiked the upper bound of its policy rate by 75bps to 4.0%, in line with consensus. The statement highlighted the FOMC intention of lowering the size of the hikes over the next meetings to assess the impact of the cumulative hikes on the economy. However, Chairman Jerome Powell struck a very hawkish tone in the press conference, conveying a message that inflation is the top priority for the institution. That may well be the case, after all, there are very few signs of an incoming recession in continuing and lagging indicators. In the labour market, non-farm payrolls rose by 261k in October after 315k in September, significantly higher than necessary to curb wage inflation. The unemployment rate increased by 20bps to 3.7%, and average hourly earnings rose by 0.4% mom and 4.7% yoy – down from 5.6% yoy in March 2022. The wage inflation decline in real terms is even more pronounced as CPI inflation remained above 8.0% over the last six months. The sharp sell-off in technology stocks is already leading to lay-offs across many companies, a trend that is likely to spread across other sectors as tighter liquidity forces companies to adjust. The all-important housing sector is already suffering as house prices have tipped and started a likely multi-year decline in real terms. Other leading indicators are also soft, including the Chicago PMI, which declined another 0.5 to 45.2 (consensus was 47.3) and the Dallas Fed of manufacturing activity survey which dropped to -19.4 from -17.2. The ISM Manufacturing declined 0.7 to 50.2, down from 64.0 at its last peak March 2021 as ISM prices paid dropped 5.1 points to 46.6 from 92.4 in June 2021 (which was the highest level since the 1970s).

United Kingdom: The Bank of England hiked its policy rate by 75bps, the largest hike since 1982, to 3.0%, in line with consensus. Two out of nine members dissented in favour of 50bps and 25bps hikes. Governor Andrew Bailey mentioned the UK is suffering from a larger energy shock than the US and that the 75bps pace is not the new norm as the economy is likely to endure an eight-quarter long recession. House prices declined by 0.9% in October, the sharpest decline since June 2020.

Europe: CPI inflation rose 1.5% mom in October from 1.2% in September, driving the yoy rate up 70bps to 10.7%, while core CPI rose only 20bps to 5.0% over the same period. Real GDP growth slowed to 0.2% qoq in Q3 2022 from 0.8% qoq in Q2 2022, in line with consensus, taking the yoy rate down 200bps to 2.1%.

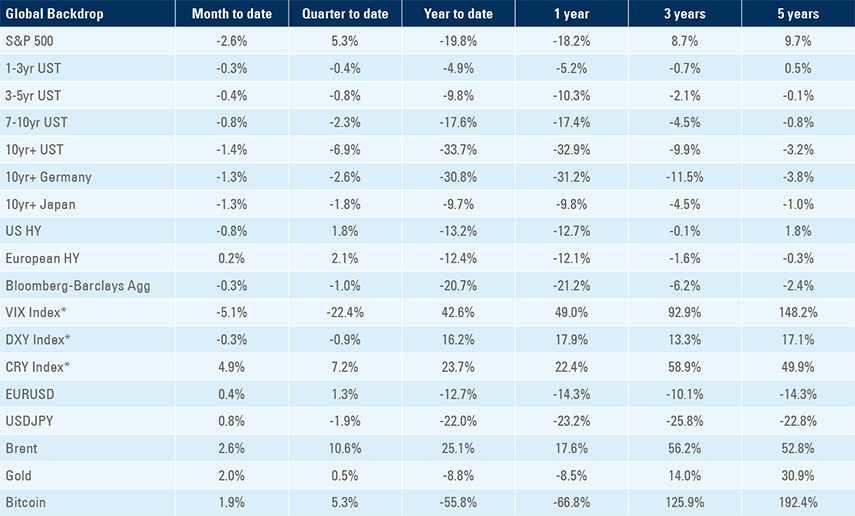

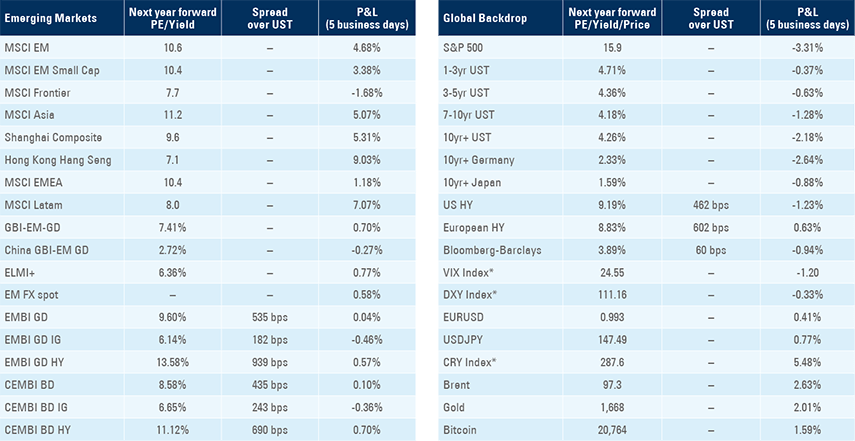

Benchmark performance