Purchasing Managers’ Indices (PMIs) for Emerging Markets (EM) declined very slightly, contrasting with the deterioration on developed world PMIs. Europe agreed on capping the price of Russian oil. Large Chinese cities eased mobility restrictions. Vietnam data still weak, but asset prices rebounded strongly. The Bank of Thailand hiked policy rate by 25 basis points (bps) and economic data surprised to the upside. Better economic data was also observed in Mexico, Brazil, and Chile. The President of South Africa faced calls to resign after being accused of serious misconduct. The International Monetary Fund (IMF) approved a third review of its programme to Argentina, allowing for a USD 6bn disbursement needed to repay another IMF programme. Colombia issued USD 1.6bn in Eurobonds to buy back existing debt.

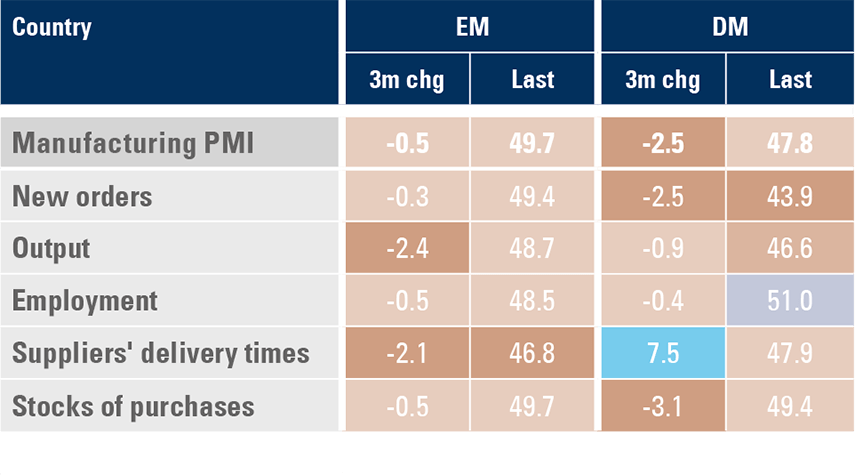

Purchasing Managers’ Index (PMIs)

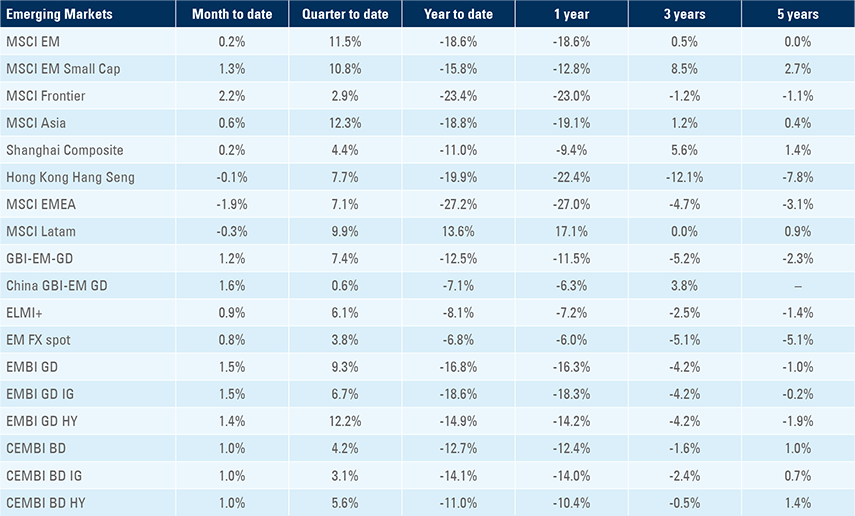

As highlighted last week, PMIs continued to decline at an accelerated pace in Developed Markets (DM) but remained much more stable in Emerging Markets (EM). EM PMIs slipped by just 0.1 to 49.7 in November, with new orders increasing 0.2 to 49.4 and output declining 0.9 to 48.7. Both the level and the cumulative decline over the last three months compares well with DM as depicted by the subcomponents on Figure 1.

Figure 1: EM vs DM PMIs: November and last three-month change

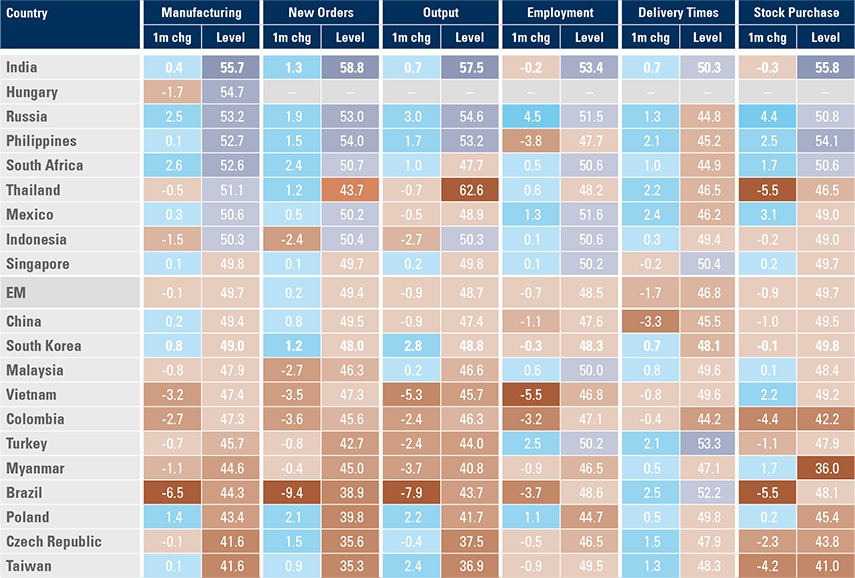

Figure 2 shows the cross-country breakdown of subcomponents in November versus the October survey. New orders improved most in South Africa, Poland, Russia, Czechia, the Philippines, and India. Employment remains softer in EM, with noble deterioration in Vietnam, Brazil, Philippines, and Colombia, while Russia, Turkey, Poland, and Mexico have improved. Supplier delivery times have deteriorated in EM, but improved in DM, suggesting fresh supply chain disruptions are hitting the leading assembly countries in Asia such as China and Vietnam, but have improved in most other countries, including Mexico, Philippines, Thailand, Turkey, and Brazil.

Figure 2: EM PMIs: November and one-month change

Geopolitics: The European Union (EU) agreed on capping the price of oil exported from Russia at USD 60 per barrel, which was exactly the level of prices on Russian Ural oil contracts at the end of last week – a 28% discount to Brent prices. Russia rejected the price cap and said it was preparing a workaround. It is very likely Russia will retaliate by cutting oil production within the next few weeks. The Indian energy minister already said they will not comply with the price cap and will act in accordance with India’s economy needs. The US had granted a waiver for India to keep importing oil from Russia. As with any sanctions, the unintended consequences of the measures may not be fully appreciated and could bring structural breaks in the energy and oil production markets.

In related news, the Organisation of the Petroleum Exporting Countries + Russia (OPEC+) met on Sunday. They did not announce any further cuts in oil production beyond the 2 million barrels of oil per day agreed in its previous meeting. Weak demand brought Saudi Aramco to cut the premium of its Arab Light grade by USD 2.2 to USD 3.25 per barrel. After declining for several quarters, energy market prices seem to now have more upside than downside, particularly considering the improved outlook for fewer mobility restrictions in China, which could add significant demand regardless of what happens in the global economy. At the same time, natural gas prices rose steeply last week with the Dutch natural gas first future contract up circa 16% and British first future up circa 22% over the last five days, after a strong cold snap hit Europe last week, leading to higher demand for heating. We are due to see temperatures hitting negative levels in London this week, so gas prices are likely to remain under pressure.

Emerging markets

China: Chinese stocks and high yield bonds continued to rebound last week, fuelled by the expectation of a gradual reopening of the economy. Early last week, social media was speculating Beijing would officially announce the policy to end zero-covid by emphasising the low fatality rate of new variants and the historic success achieved by the policy in protecting people’s lives. China released a detailed action plan for boosting vaccination in the elderly, shortening the time between complete vaccination and booster shot to three months. Shanghai and Hangzhou dropped testing requirements to enter public venues, including offices and supermarkets, as well as for public transport. The central government has effectively ‘passed the baton’ to local authorities following widespread public protests a few weeks ago. Local governments are likely to favour an earlier reopening, given they are more accountable to the population. In economic news, the Federation of Logistics and Purchasing manufacturing PMI declined 1.2 points to 48.0 and the non-manufacturing PMI dropped 2.0 to 46.7, both below consensus.

Vietnam: Exports dropped by a yoy rate of 8.4% in November after rising 4.5% yoy in October (back to Q1-2020 levels), as imports declined 7.3% yoy (from +7.1% yoy). The trade surplus narrowed to USD 0.8bn from USD 2.3bn over the same period. The yoy growth rate of industrial production (IP) slowed by 100bps to 5.3%, but exports as leading indicator suggests IP will decline towards 0%. Consumer price index (CPI) inflation increased 10bps to 4.4% and retail sales increased 40bps to 17.5% in November. The slowdown in the external sector and industrial production is either due to China's lockdowns or global recession. Despite the relatively weak macro data, Vietnam assets recovered in sympathy with China’s reopening, but also on the expectation of more easing of liquidity onshore.

Thailand: The Bank of Thailand (BoT) hiked its policy rate by 25bps to 1.25%, in line with consensus. The BoT also increased its 2023 CPI forecast by 40bps to 3.0% due to higher electricity rates and lowered its 2023 GDP growth estimate by 10bps to 3.7%. In economic news, the trade deficit narrowed to USD 596m in October from USD 853m in September, as exports declined 4.4% yoy in October after rising by 7.8% yoy in September. Imports dropped 2.1% yoy from +15.6% yoy over the same period. The economy shrank -0.1% qoq in Q3 2022, better than -0.5% qoq consensus, from +1.9% in Q2 2023.

South Africa: Cyril Ramaphosa faced calls to resign as the leader of the governing African National Congress (ANC) Party after a panel led by a former chief of justice told lawmakers Ramaphosa may have been guilty of serious misconduct in a 2020 theft case where at least USD 580k was hidden in his Phala Phala farm. In our view, Ramaphosa is likely to fight back as he remains widely popular. The ANC is the front-runner for party leadership elections on 16th December and has no alternatives to replace him at such short notice. On Tuesday, lawmakers will vote on whether to accept the report and launch an impeachment proceeding. South Africa’s unemployment rate declined by 1.0% to 32.9% in Q3 2022 from 33.9% in Q2 2022, better than consensus. The trade balance moved to a ZAR 4.3bn deficit in October from ZAR 26.2bn in September.

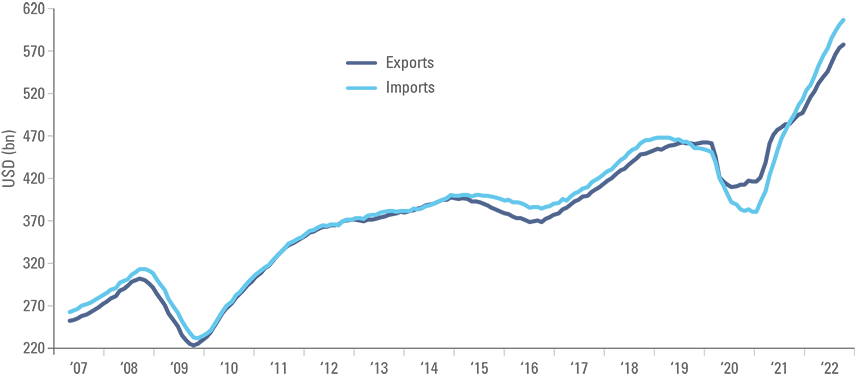

Mexico: Jesus Carmona, the CEO of Schneider Electric in Mexico, said the company is growing at “high double digit” levels due to nearshoring. This nearshoring was already visible in the trade data, as the volumes of imports and exports increased significantly as per Figure 1, while Chinese exports to the US peaked in Q3 2021. On that note, the trade deficit widened to USD 2.0bn in October from USD 0.9bn in September as exports declined USD 3bn to USD 49.3bn and imports dropped 2.0bn to USD 51.3bn. Remittances from Mexicans working abroad rose from USD 5.0bn in September to USD 5.4bn in October, a new historic high. Mexico’s unemployment rate was unchanged at 3.3%, in line with consensus, and domestic sales rose 4.5k to 95.6k in November.

Figure 3: Mexican Trade: 12m moving average (USD bn)

Brazil: President Luis Inácio Lula da Silva is likely to appoint his economic cabinet within the next weeks. Lula is expected to appoint former mayor of Sao Paulo Fernando Haddad, who was involved in the 2023 budget discussions with Congress. Economic indicators and fiscal numbers were better than expected as inflation surprised to the downside and tax collections and external accounts improved. Producer price index (PPI) inflation declined 0.6% mom in November, after dropping 1.0% in October, bringing the yoy rate of inflation down 60bps to 5.9%, 20bps below consensus. Tax collections rose to BRL 205.5bn in October from BRL 166.3bn in September, the best level for the month both in nominal and inflation-adjusted terms. The ratio of net debt to GDP was unchanged at 58.3% in October as the primary balance improved to BRL 27.1bn from BRL 10.7bn in September. The central government surplus reached BRL 30.8bn, the third-largest surplus since 1997. Brazil’s unemployment rate dropped by 40bps to 8.3%, 20bps below consensus. The trade surplus rose to USD 6.7bn in November from USD 3.9bn in October as exports increased by USD 0.9bn to 28.6bn and imports declined by USD 1.9bn to USD 21.5bn. Total outstanding loans grew 1.0% mom in October after increasing 1.8% mom in September, bringing the yoy rate down to 15.8% from 16.4% in September and 17.8% yoy in June. Lastly, vehicle sales rose to 204k in November from 181k in October, still 13.6% below the average sales for the month over the last ten years.

Chile: Economic activity improved 0.5% mom in October, a faster pace than 0.2% mom in September and significantly better than consensus, but the yoy rate declined 1.2% from -0.4% yoy in September due to base effects. The unemployment rate was unchanged at 8.0%, 10bps below consensus. Manufacturing production declined by a yoy rate of 9.2% in October from 3.4% in September while industrial production deteriorated to -4.2% yoy from -1.6% over the same period. Copper production increased to 485.5 metric tons in October from 439.3 metric tons in September, bringing production close to the average of the last ten years. Vehicle sales rose to 31.7k in November from 28.6k in October.

Argentina: The IMF said it reached a staff-level agreement on the third review of its current programme. It had to relax some of its quantitative targets, considering the multiple-tiered foreign exchange market creating monetary and economic distortions which the IMF should not vouch for, in our view. The agreement allows for a USD 6bn disbursement which will fully compensate for the repayments from Argentina to the IMF due in January. The agreement also allows for loans from other multilateral institutions to be approved.

Colombia: Colombia issued USD 1.6bn of Eurobonds at 8.125% yield to buy back debt maturing in 2023 and 2024. The treasury repurchased USD 319m due in March 2023, USD 381m in February 2024 and USD 218m in May 2024. The remaining USD 706m will be used to repay the remaining outstanding amount of the March 2023 bond. After the transaction, Colombia has no debt to repay in 2023 and only USD 2bn of principal repayment on Eurobonds in the next three years. In economic news, the national unemployment rate declined 100bps to 9.7% in October as the urban unemployment rate dropped 50bps to 9.9%, both better than consensus. The current account deficit widened to USD 6.2bn in Q3 2022 from USD 4.9bn in Q2 2022, a slightly larger deficit than consensus.

Snippets

- Czechia: The economy contracted 0.2% qoq in Q3 2022 after -0.4% qoq in the previous quarter, and base effects led to an 0.1% increase in the yoy rate of GDP growth to 1.7%.

- Hungary: The economy contracted 0.4% in Q3 2022, a similar pace to the previous quarter with the yoy rate of GDP growth unchanged at 4.0%. PPI inflation rose 3.7% mom in October after increasing 1.8% in September, but base effects brought the yoy rate down 100bps to 41.7%. The trade deficit widened to EUR 745m in September from EUR 652m in August.

- India: The yoy rate of real GDP growth slowed to 6.3% in Q3 2022, 10bps above consensus, from 13.5% yoy in Q2 2022.

- Indonesia: CPI inflation increased 0.1% in November after declining 0.1% in October, bringing the yoy rate down another 30bps to 5.4%. Core CPI was unchanged at 3.3% yoy.

- Peru: CPI inflation rose to 0.5% mom in November from 0.4% mom in October, lifting the yoy rate by 20bps to 8.5%.

- Poland: Real GDP growth reached 1.0% in Q3 2022 from 0.9% in Q2 2022, bringing the yoy rate up 10bps to 3.6% over the same period. CPI inflation declined to 0.7% mom in November from 1.8% in October bringing the yoy rate down 50bps to 17.4%.

- Romania: PPI inflation rose 2.2% mom in October after declining 1.0% mom in September as base effects brought the yoy rate down 560bps to 41.1% over the same period.

- South Korea: Industrial production dropped 3.5% mom in October after declining 1.9% mom in September. GDP growth rose 0.3% qoq and 3.1% yoy in Q3 2022, unchanged from the previous quarter in both periods. The trade deficit widened to USD 7bn in November from USD 6.7bn in October as exports declined by a yoy rate of 14.0% and imports rose 2.7% yoy. CPI inflation was -0.1% mom in November after rising 0.3% in October, bringing the yoy rate down 70bps to 5.0%. Core CPI was unchanged at 4.8% yoy.

- Taiwan: The yoy rate of real GDP growth slowed 10bps to 4.0% in Q3 2022.

- Turkey: The trade deficit narrowed to USD 7.9bn in October from USD 9.6bn in September. The economy contracted 0.1% qoq in Q3 2022 after growing 1.9% qoq in Q2 2022, bringing the yoy rate of GDP growth down to 3.9% from 7.7% over the same period.

Developed markets

United States: The Bureau of Labor Statistics establishment survey showed a stronger labour market than expected. The net between jobs created and destroyed added +263k new jobs in November, a similar number to the 284k in October and significantly higher than the 200k consensus, but keeping the 3-month, 6-month and 12-month moving averages on a downward trend. The unemployment rate was unchanged at 3.7%, as the labour force participation rate declined 10bps to 62.1% (30bps below August’s levels) and average hourly earnings rose 0.6% mom after 0.5% in October, bringing the yoy rate up 20bps to 5.1%. The strength of the labour market should be taken with a pinch of salt, in our view. Anecdotal evidence of layoffs in the technology sector and the strong slowdown in the housing market suggests the labour market should be flatlining and turning weak soon. In terms of coincident indicators, the household job survey shows no jobs were added over the last eight months, contrasting with 2.7m jobs on the establishment survey responsible for the payroll report. This may be down to double counting as many Americans work in more than one job, counting as two positions in the establishment payroll report, but only one in the household survey. On average hourly numbers, the number may have been inflated by severance payments from the technology sector, which are incorporated in the establishment survey. The Conference Board consumer confidence index declined 20bps to 100.2, still above the average since the inception of the series in 1967 (low 26.9; high 142.5), but significantly below the 128.9 levels from June 2021. The Chicago PMI plunged 8.0 points to 37.2, almost ten points below consensus, at 47.0.

Europe: CPI inflation dropped 0.1% mom in November after rising 1.5% mom in October. This meant the yoy rate declined 60bps to 10.0% in November, 40bps below consensus. The decline in inflation was driven by non-core items as PPI inflation dropped 2.9% mom in November, as the yoy rate plunged by 1,110bps to 30.8%, 90bps below consensus, but core CPI was unchanged at 5.0% yoy, in line with consensus.

The European Central Bank (ECB) Governor Christine Lagarde posed a hawkish tone when addressing the EU parliament last Monday, saying the ECB would hike its policy rate by as much as necessary to lower inflation. Last week, Volkswagen agreed an 8.5% pay raise to around 125k German factory workers in a two-year deal comprising a 5.2% pay increase from June 2023, and 3.3% from May 2024, alongside a lump sum payment worth EUR 3k (after tax). The IG Metall union initially demanded an 8% wage rise over a 12-month period at six of the carmaker's German plants, along with subsidiaries, according to the report. The pay increase was below the cumulative 12-month inflation rate, but may have set a precedent.

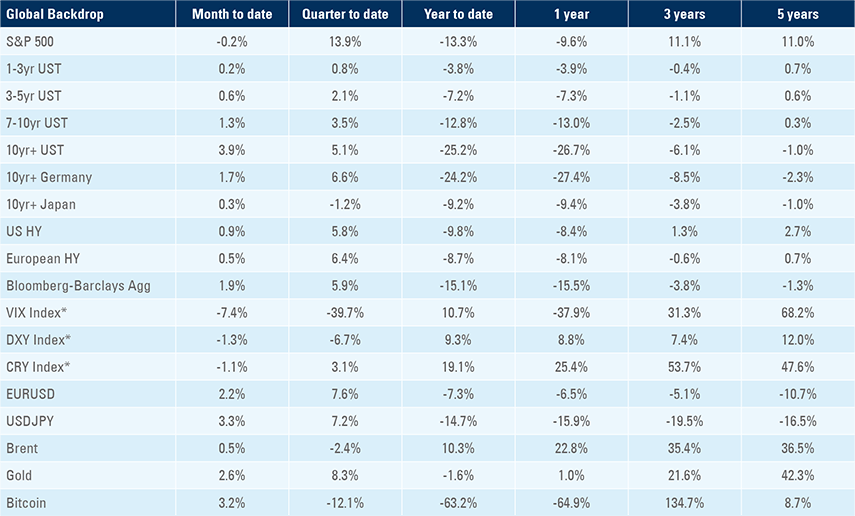

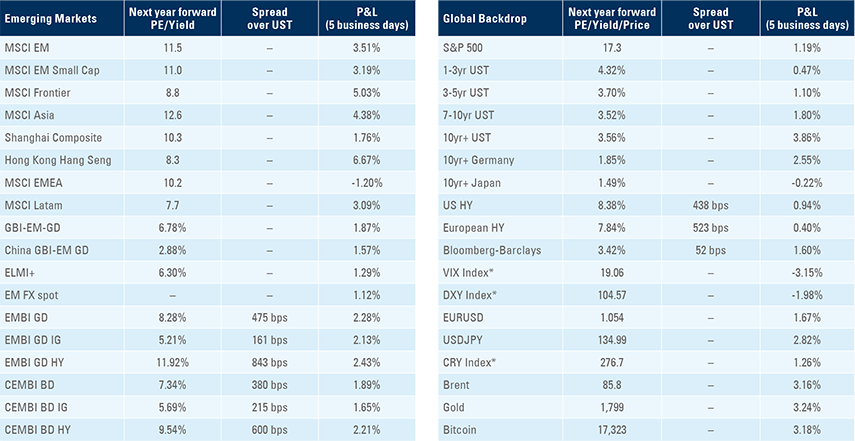

Benchmark performance