- Trump’s big win delivered the expected macro reaction; for one day.

- Geopolitical discussions begin with Trump and Zelensky, and (probably) Trump and Putin.

- Qatar request Hamas leaders leave Doha.

- China deliver RMB10tn in fiscal support for local governments at NPC, no consumption cheques yet.

- Brazil Central Bank quicken pace of hikes, Selic rate raised 50bps to 11.25%.

- Germany coalition collapse brings earlier election into view.

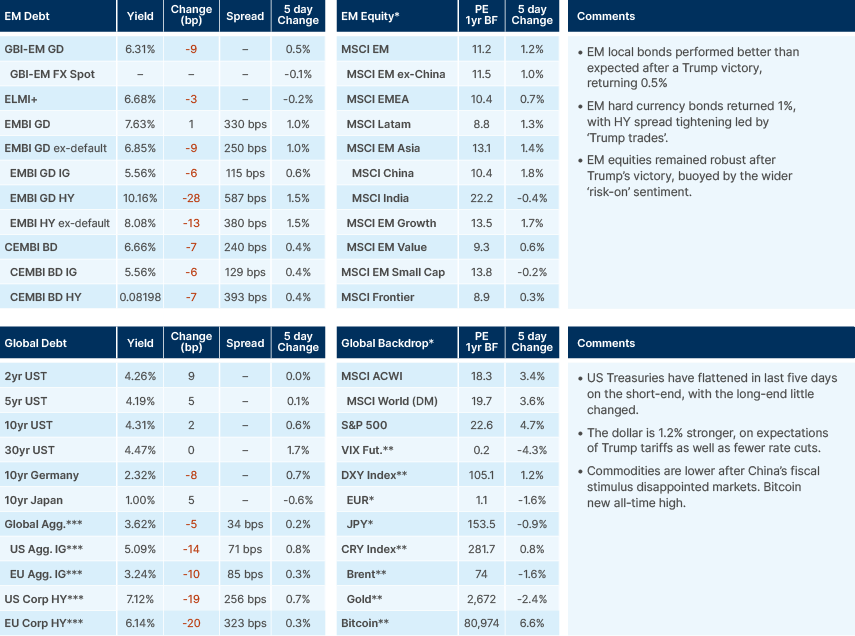

Last week performance and comments

Global Macro

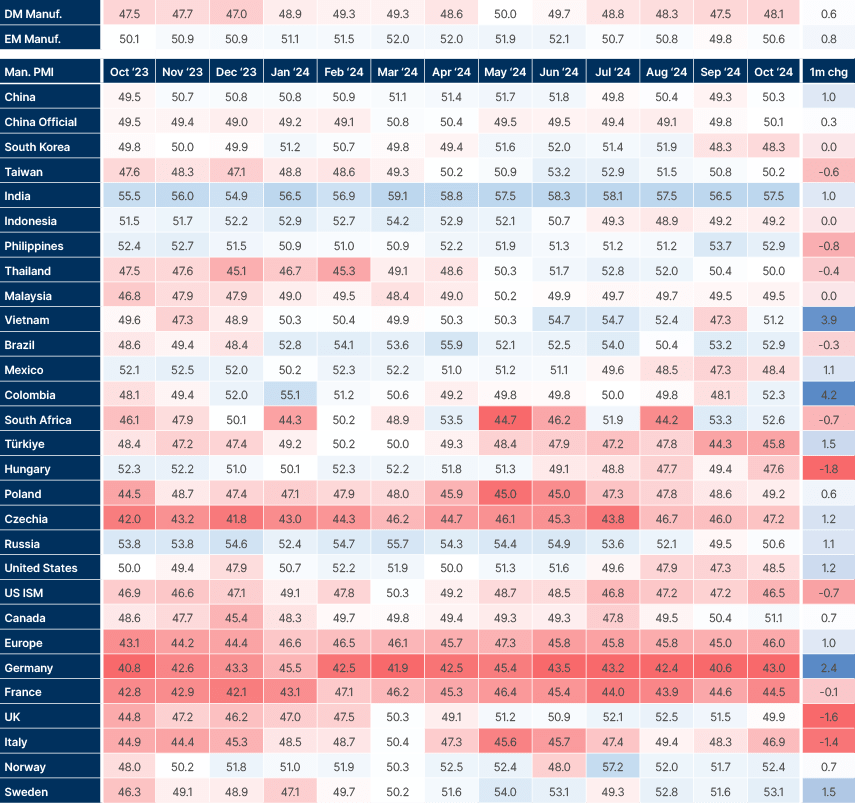

Fig 1: PMI: Monthly recovery in manufacturing led by China, Vietnam, India, US and Europe

Geopolitics

US President-elect Donald Trump reportedly held discussions with Russian President Vladimir Putin on Thursday, advising against further escalation in the war with Ukraine and expressing a desire for ongoing dialogue aimed at ending the conflict quickly. Trump has articulated a preference for a “just end to the war.” The Kremlin denied this conversation took place.

A conversation certainly took place between Trump, Ukrainian President Volodymyr Zelenskyy and Elon Musk. Zelenskyy responded with caution to Trump’s talk of a quick end to the war, suggesting any swift resolution could involve losses, likely referring to potential territorial concessions by Ukraine. Zelenskyy also noted that he has not engaged in direct discussions with Trump regarding his plans to resolve the war, creating uncertainty about the specifics of Trump’s proposed solution. We think this would probably involve a freezing of the front line where it stands, as well as commitments from Ukraine not to attempt to join NATO for an extended period. Meanwhile, the Russian military continues to advance in eastern Ukraine, particularly west of Donetsk toward the industrial city of Pokrovsk. Facing a substantial disadvantage in numbers and firepower, the Ukrainian forces are currently struggling to halt the Russian offensive in these areas. Russian and North Korean troops are also preparing to launch an incursion into the Kursk region currently occupied by the Ukrainians. It is likely Russia will continue to push hard for more territorial gains in anticipation of a ceasefire agreement.

Roughly ten days ago, Qatar requested that leaders of Hamas vacate the country, a shift attributed to significant pressure from the US. This marks a substantial policy change for Qatar, which has hosted Hamas’s political office in Doha since 2012. Hamas initially relocated to Qatar from Damascus, driven out by the onset of the Syrian civil war. Qatar originally agreed to host Hamas at the request of the US, who wanted to maintain a communication channel with the organisation.

US Election and Market Reactions

Donald Trump achieved a landslide election victory with 312 electoral votes to 226 and secured 50.5% of the popular vote. The Senate now consists of 53 Republicans and 46 Democrats, with Arizona likely leaning Democratic. In the House of Representatives, the Republicans hold 213 seats against the Democrats’ 202. The projected final tally stands at 222 Republicans versus 213 Democrats. This surprising result suggests that issues like inflation, inequality, and immigration were particularly significant to voters, who believe that Trump’s administration has a better chance of solving these problems than Harris, who represented a continuation of the status quo.

Following the election news, the dollar and bond yields initially spiked on Wednesday but later retraced these moves, as traders took profits, and a sequence of articles were published reflecting a growing market consensus that inflation will remain a key constraint on policy. The post-election period saw a rally in the S&P 500, which has risen by 3.8% since Wednesday, alongside a USD 20bn inflow into US markets—the largest inflow in five months. Additionally, Bitcoin reached a record high of USD 80,000, buoyed by market optimism around supportive regulatory measures.

From here, we anticipate a policy timeline in which adjustments to the Inflation Reduction Act (IRA) and tariffs may occur in 2025, followed by the renewal of the Tax Cuts and Jobs Act (TCJA) and potential corporate tax cuts in 2026. The Federal Reserve (Fed) is anticipated to have the capacity for rate cuts if credible fiscal consolidation brings the deficit down to 3% by 2028. Jerome Powell is expected to serve out his current term as Fed Chair, with a governor appointee next year possibly succeeding him as chair in 2026.

The Trump administration announced Susan Wiles as Chief of Staff, a veteran campaign strategist active in Republican politics since the Reagan era. Robert F. Kennedy Jr. was named Health Secretary and is expected to play a prominent role. Rumours about further appointments include Marco Rubio as Secretary of State and either Scott Bessent or John Paulson as Treasury Secretary. Trump has reportedly approached Robert Lighthizer to be the US Trade Representative, though there is some uncertainty over whether this is true. Former special forces officer Christopher Miller, known for his work on Project 2025, is speculated to be the next Secretary of Defense. Elon Musk has indicated interest in contributing to significant federal budget cuts, while it appears Mike Pompeo and Nikki Haley will not be part of the cabinet.

Monetary Policy

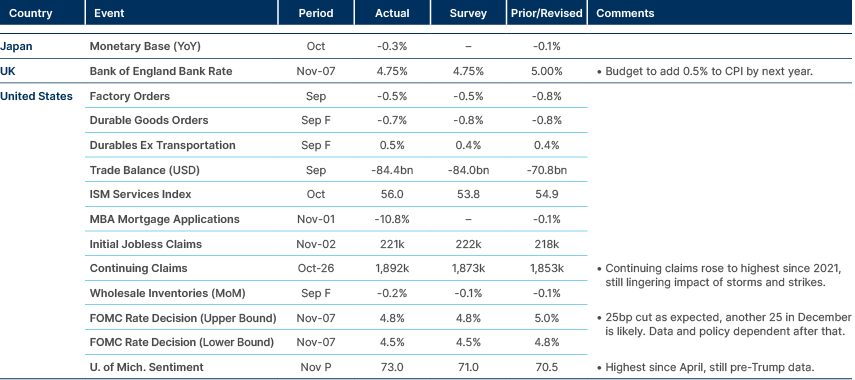

Last Thursday, the Fed announced a unanimous 25 basis points (bps) rate cut, with another similar cut likely in December. Powell emphasised that future policies remain both data- and policy-dependent, making the exact timing and specifics of further changes uncertain. In the UK, Bank of England (BoE) forecast suggests the Budget impact will peak with a 50bps effect on consumer price inflation (CPI). The BoE opted against a rate cut at its next meeting, with a terminal rate set at 3.25%.

China’s Economic Stimulus Package

China recently announced a RMB 10trn (USD 1.4trn) fiscal package aimed at stabilising the economy through local government bailouts. The package, however, was met with muted responses, as it focused on debt restructuring rather than immediate stimulus. Local governments will be authorised to issue RMB 6trn in bonds over the next three to five years, targeting the restructuring of approximately RMB 14trn in sour debts, primarily linked to infrastructure and property investments. Additionally, RMB 4trn in central government bonds will be reallocated over the next five years for debt management.

This restructuring effort is projected to save RMB 600bn over five years and will help bring off-balance sheet debt onto local government balance sheets, reducing ‘hidden debt’ to around RMB 2.3trn. The restructuring will free resources for local governments to redirect spending toward development and public welfare initiatives. Although further stimulus measures are under consideration, particularly to recapitalise banks and support unfinished property projects, the package left markets underwhelmed. The yuan fell slightly to 7.16, while commodity prices, including crude oil and iron ore, also declined, reflecting reduced growth expectations. Beijing is likely conserving additional measures for potential US tariff increases of up to 60%, which could substantially impact China’s gross domestic product (GDP).

German Political Developments

In Germany, a fiscal policy dispute between Chancellor Olaf Scholz and his Finance Minister from a junior coalition partner has triggered the possibility of an early election. The timeline suggests a potential vote of no confidence in January 2025, with the election likely to occur in March 2025. However, if the opposition Christian Democratic Union (CDU) Party supports Scholz’s budget, the election could happen sooner. Currently, projections indicate the CDU will secure the largest share of seats, approximately 25%, although the far right could emerge as the largest party.

Emerging Markets

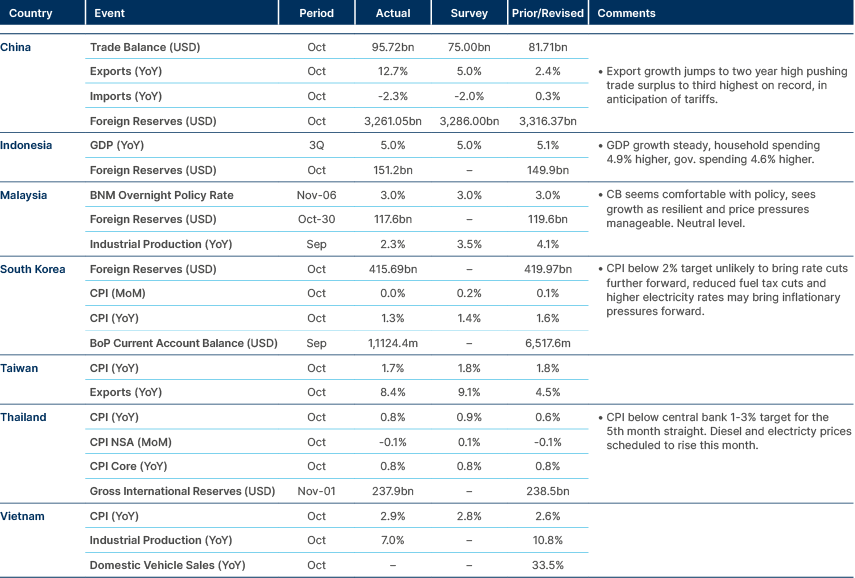

Asia

Third-highest trade surplus on record for China, CPI inflation under control in Malaysia and Korea.

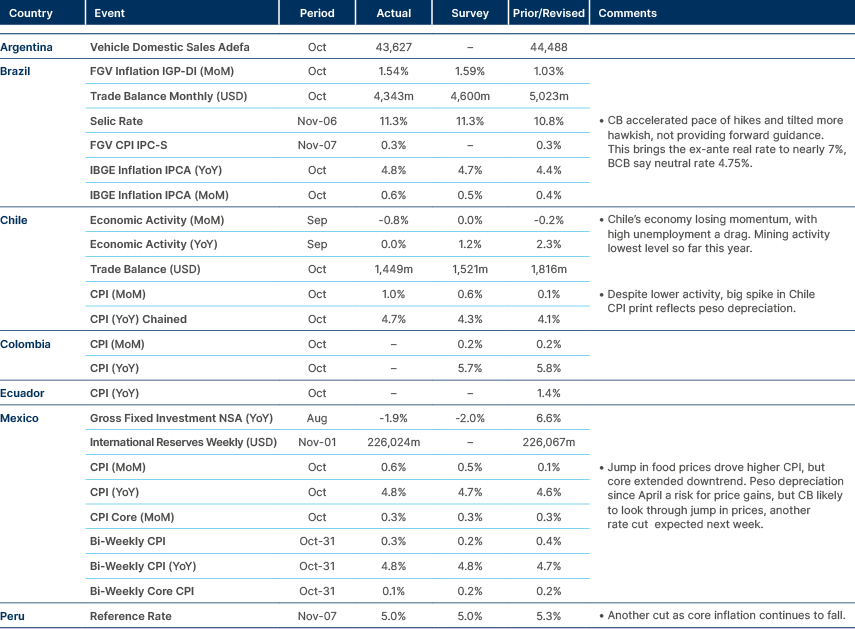

Latin America

Brazil hikes faster, Chile economy flagging.

Barbados

Upgraded by S&P to B, and Fitch to B+.

Brazil

The central bank raised the pace of hikes of the Selic rate to 11.25%, as inflation expectations continue to rise. JPMorgan analysts project the central bank will continue tightening in 50bps increases until March 2025, followed by a final 25bps hike taking rates to 13%.

Mexico

Mexico's Congress will probably pass a constitutional reform abolishing certain autonomous institutions by mid-November, the Lower House's leader said on Monday. The reform “will probably come out some time between 11 and 14 of November", Ricardo Monreal, the Lower House leader for the ruling Morena Party, said in a press conference.

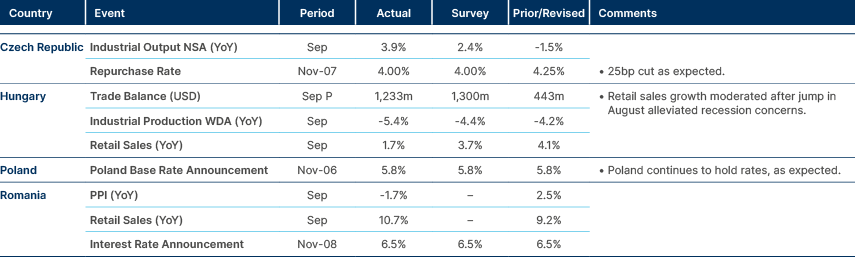

Central and Eastern Europe

Czech Republic cut again. Poland holds.

Central Asia, Middle East, and Africa

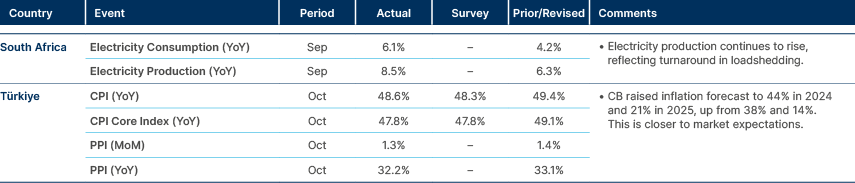

Türkiye’s central bank raises inflation forecast for 2025.

Developed Markets

25bps cut in US and UK, but higher risks to inflation for the latter.

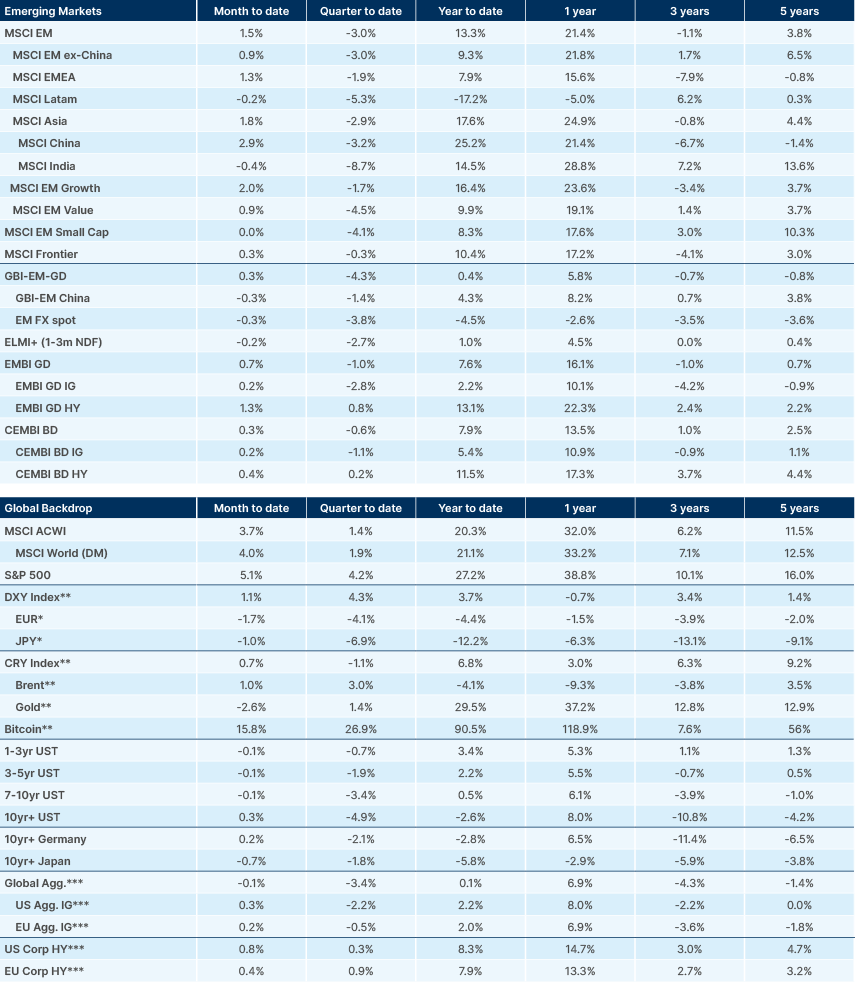

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.