EM Local bond markets weather US inflation surprise as policy-makers deliver on their mandate

US inflation rises higher and the policy response may come faster. Pressure regarding Ukraine increases, and oil prices continue to a boil. Local bonds out-perform dollar bonds for more reasons than one. EM inflation continues to warrant attention, and EM policy-makers give it just that: six central banks hiked rates last week, including 100 bps by the Central Bank of Russia. India’s RBI passes, however, and China’s credit data shows an overall easing in financial conditions.

Emerging markets

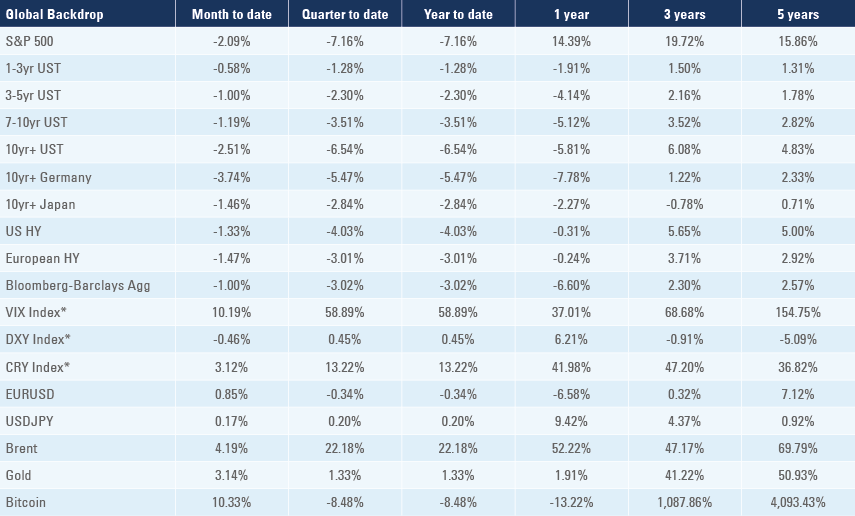

In a consequential week for global macro, the first highlight was the higher-than-expected 7.5% yoy inflation print in the US, and the resulting move higher in US dollar front-end yields. US 2-year Treasury yields jumped by 21 basis points on February 10th on the combination of the inflation report and very hawkish comments by Governor Bullard. In the relatively sedate environment for Treasuries post the global financial crisis, where low standard deviation has been the norm, this was a 7-sigma event. This echoes the 13 basis point jump in 2-year (EUR) Bund yields that took place just a week before on February 3rd, also a 7-sigma event, triggered when Governing Council president Lagarde gave in and no longer ruled out an ECB rate hike this year.

The second highlight was the heightened risk of escalation in the simmering conflict that opposes Russia to Western democracies about Ukraine. Although diplomatic efforts continue and German Chancellor Scholz is scheduled to meet with president Putin in Moscow this week, the US State department has resumed its pointed warnings that military action is imminent. A growing number of embassies in Kyiv, including the US and British ones, have sent non-essential staff home and have warned their citizens to leave the country. Although the Ukrainian government continues to play down the probability of armed conflict, investors are fast re-positioning for one, particularly in the oil and gas markets, where the first Brent futures rose by 3.3% last Friday to USD 94.5 per barrel, their highest level since 2014. The implications for inflation are not trivial, as some of the most effective avenues to limit oil price pressure, notably an increase in supply by the OPEC+ countries require Russia’s cooperation.

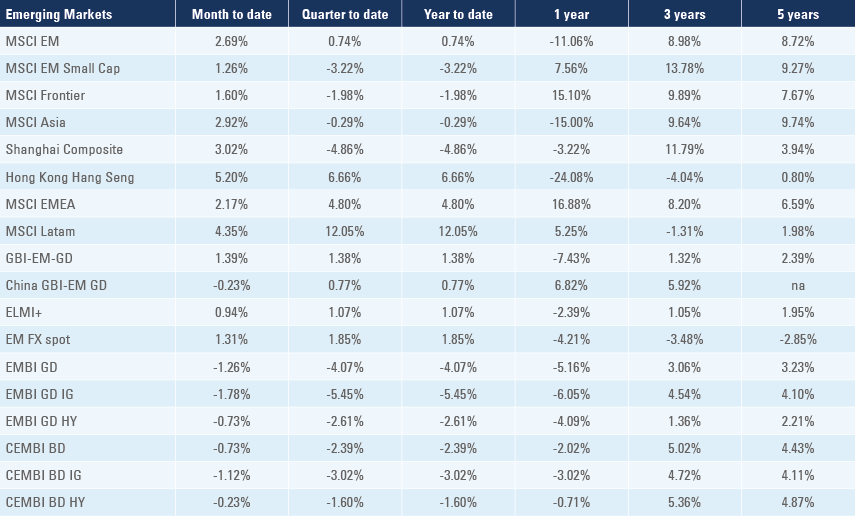

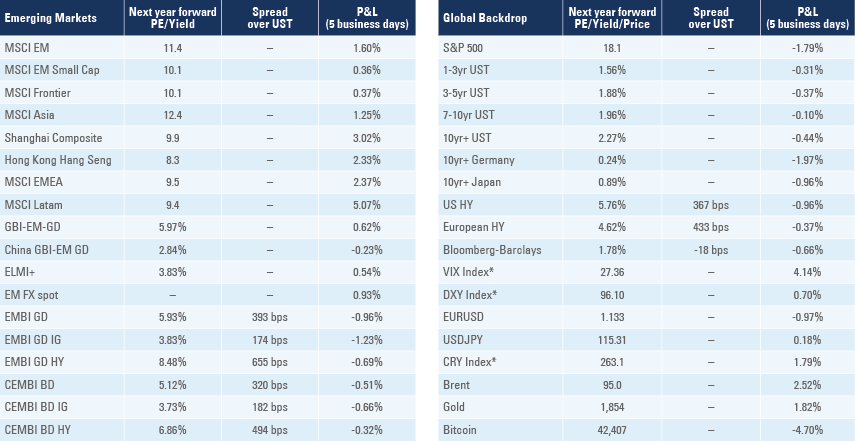

The third highlight, from our point of view, was the resilient performance of EM local debt and equity markets in the face of a sudden rise in interest rates volatility, and particularly the relative performance of EM local currency government debt vs. hard currency bonds. The reference JP Morgan EM local currency bond index (GBI-EM GD) is up 1.4% year-to-date vs. -4.1% for the index of USD-denominated EM sovereign bonds. A simple ratio of these two indices is up 5.7% YTD, a bout of out-performance that is commensurate in magnitude with the out-performance observed in Q1 2012, Q1 2016 and Q1 2018 notably. Although portfolio flows have remained too modest to talk of a ‘rotation’ into local debt products, and investors’ positioning is still very light, it is noteworthy that EM local currency debt funds and ETF have seen positive net flows for seven consecutive weeks.

Local markets’ out-performance comes partly form the strong performance of EM FX vs. USD (+1.85% YTD), helped by the 4% YTD return in Latin American currencies boosted by positive terms of trade effects. Importantly, it also comes from the much smaller widening in EM local bond yields in comparison to DM yields: (index weighted) local bond yields are only up 25 basis points ytd, vs. 60 basis points for the US 5-year treasury yield, for instance. This could be considered as just reward for EM central banks’ decisiveness in dealing with inflation and tightening monetary conditions to limit the risk of financial instability - this week’s ‘snippets’ below once again read like a litany of monetary policy committee rate hikes. These efforts will continue, and will probably extend to Asia. We will report on EM inflation data in more detail next week, when most of the local debt market index member countries have reported, but it already seems assured that the weighted average inflation for EM countries has continued to increase and will be close to the 6 percent level, equal to the bond index average yield to maturity.

Snippets

Brazil: The minutes of the latest monetary policy committee confirmed the intention of reducing the pace of policy rate hikes, but raised concerns about the inflation outlook and the risk of excessive fiscal stimulus affecting long-term inflation expectations requiring a higher terminal policy rate. CPI inflation dropped to 0.5% mom in January from 0.7% mom in December, as the yoy rate rose 0.3% to 10.4% from 10.1% yoy in December. Retail sales declined 0.1% mom in December after rising 0.4% in November, slightly better than consensus. The auto industry granted collective vacations for its employees due to a shortage of chips, leading vehicle production down to 145k in January from 211k in December, as sales dropped from 207k to 127k over the same period.

Chile: The yoy rate of CPI inflation rose to 7.7% in January (7.0% consensus) from 7.2% in December, amid widespread underlying pricing pressures. Core CPI inflation rose 0.7% to 7.1% yoy whilst nominal wages increased 1.0% to 6.8% yoy in December. The trade surplus increased to USD 800m in January from USD 520m in December as imports declined faster than exports.

China: China’s credit data for January sent a positive signal that policy easing is feeding through the economy. A broader measure of credit conditions called ‘total social financing’ (TSF) jumped c. RMB 1 trillion over the previous year to a record RMB 6.2 trillion. New loans totalled RMB 4.0 trillion in January, up 10% yoy. Economists however, note the high contribution from short-term loans and instruments, while medium and long-term loans increased at a more modest 3% yoy. The Q4 current accounts recorded a USD 119bn surplus, or 2.4% of GDP, up from 1.6% of GDP in Q3; thanks notably to an increase in the goods trade surplus to USD 180bn. The 2021 annual trade surplus contributed up to 1.8% of GDP, vs. 2.0% of GDP the prior year.

Czech Republic: The yoy rate of retail sales dropped to 2.1% in December (consensus 4.5%) from 9.9% yoy in November, while industrial output dropped to 0.4% yoy in December from 4.5% yoy in November.

Ecuador: Tax collection rose by a yoy rate of 19% in January to USD 1.6bn buoyed by a 31% increase in VAT revenues, partially due to tighter compliance to payments.

Ghana: The yoy rate of CPI inflation rose 1.3% to 13.9% in January, 0.9% above consensus. Ghana has disputed Moody’s macroeconomic numbers and analysis that led to the sovereign rating downgrade below Baa3.

Hungary: The yoy rate of CPI inflation was unchanged at 7.4% in January, in line with consensus.

India: The Reserve Bank of India policy rates were unchanged at 3.35% and 4.0%. The statement was more dovish than expected against a backdrop where most market participants expected a normalisation of the interest rate corridor and higher interest rates in the future.

Indonesia: The central bank kept its policy rate unchanged at 3.5% in line with consensus. The yoy rate of real GDP growth rose to 5.0% in Q4 2021 from 3.5% yoy in Q3 2021, 0.2% above consensus and bringing the overall 2021 real GDP growth up to 3.7% yoy.

Malaysia: The yoy rate of industrial production dropped to 5.8% in December from 9.4% yoy in November, while manufacturing sales dropped to 15.5% yoy from 18.8% yoy over the same period. The yoy rate of real GDP growth rebounded to 3.6% in Q4 2021 from -4.5% in Q3 2021, following the end of strict lockdown orders.

Mexico: The central bank (Banxico), under new governor Victoria Rodriguez, hiked its policy rate by 50bps to 6.0%, in line with consensus. One MPC member out of five voted for a more measured 25bps hike, and the MPC communiqué reiterated a balanced policy stance. CPI inflation rose 0.6% mom in January from 0.4% in December, taking the yoy rate to 7.1%, slightly above consensus. Banxico revised upwards its headline inflation forecast for end-2022 to 4.0% from 3.5%, consensus Street forecasts are already at 5.1%.

Peru: The central bank (BCRP) also hiked its policy rate by 50bps to 3.5%, in line with consensus. Policy guidance was unchanged and the central bank continues to expect inflation to come back into the target range by year-end. Lima CPI declined to 5.7% yoy from 6.4% in December.

Poland: The National Bank of Poland hiked its policy rate by 50bps to 2.75%, in line with consensus, and hiked the reserve requirement ratio by 150bps to 3.50%, draining liquidity from the financial system. Governor Glapinski reiterated he expects policy rate to increase to 4.0% or higher if needed. The NBP forward guidance also mentioned, “Zloty appreciation would be consistent with the direction of monetary policy conducted by the NBP”. This is further evidence that EM central banks have shifted from seeking currency depreciation to currency appreciation.

Romania: The central bank hiked its policy rate by 50bps to 2.5%, 25bps above consensus. The central bank sharply increased its inflation forecast for end-2022 to 9.6%, from 5.9% previously. Higher energy prices according to the central bank calculations are solely responsible for 6% of their new inflation forecast.

Russia: The central bank hiked its policy rate by 100bps to 9.5%, in line with consensus expectations and maintained its prior guidance that further rate hikes are possible. During the press conference, governor Nabiullina recognized that the economy risks over-heating and monetary policy needs to be tighter than expected. This pushed 1-year RUB government bond yields up 60 bps in the week to double digits. The policy statement said that the bank’s key rate could average 9-11% in 2022, up from a previous range of 7.3-8.3%. Although the central bank did not announce any decision on the resumption of FX purchases, the Russian rouble weakened before the weekend on renewed warnings of imminent attacks on the Ukraine from US diplomats.

The yoy rat of CPI inflation rose to 8.7% in January (consensus 8.9%) from 8.4% yoy in December, while core CPI rose 0.3% to 9.2% yoy, in line with consensus. The unemployment rate was unchanged at 4.3% in December, but real wages rose 3.4% yoy in November from 0.6% yoy in October. The trade surplus rose to USD26.7bn in December from USD 21.1bn in November.

South Africa: The month-on-month rate of manufacturing production fell to 2.3% in December (hit by Mining output, -5.3% mom) from 3.7% last November, which led to a flat yoy number.

Taiwan: The yoy rate of CPI inflation rose to 2.8% yoy in January from 2.6% in December. The trade surplus for January came in at USD4.9bn in January, from USD 5.8bn in December.

Thailand: The central bank (BOT) kept its policy rate unchanged at 0.5%, in line with consensus.

Turkey: The current account deficit widened to USD 3.8bn in December (USD 4.2bn consensus) from USD 2.7bn in November. This brought the full-year current account deficit to USD 14.9bn, or 2.0% of GDP, a narrower outturn than the 5.0% deficit recorded in 2020, despite a widening in the energy deficit to USD 18bn last year.

Global backdrop

United States (US): US CPI inflation rose 0.6% mom in January from 0.5% mom in December, taking the yoy rate up 0.5% to 7.5% (7.3% consensus) and core CPI rose 0.5% to 6.0% yoy, their highest levels in 40 years. The rise in used cars prices, gasoline, electricity and meat/fish/eggs prices remained high but are peaking on a yoy basis. It is the broadening in price increases and in particular the rise in core service and the shelter and rents components that raised highbrows.

The University of Michigan sentiment survey fell to 61.7 in February from 67.2 in January, its lowest level since 2011. When asked about their financial prospects, the impact of higher inflation on personal finances was spontaneously cited by one-third of survey respondents, with nearly half expecting declines in their inflation-adjusted incomes during the year ahead. The 1-year inflation expectation survey rose by a modest 0.1 points to 5.0%, and the 5-10 year inflation expectation survey was unchanged at 3.1%.

Initial jobless claims fell to 223k in the week ending in 11 February from 238k in the previous week. The trade deficit widened to USD 80.7bn in December (consensus USD 83.0bn) from USD 79.3bn in November.

The surprise blow out in inflationary expectations has shortened the odds of a 50 basis points hike by the fed at their next FOMC meeting scheduled March 16th, as opposed to a standard 25 bps hike. The scenario of a larger initial Fed hike in March has become almost entirely priced by the market since last Thursday and is now 50% ‘priced in’. There is a lot of economic data yet to be release ahead of this meeting, not least another jobs report and another employment report, so the market, much like the fed, is likely to be guided by the data. There has also been some speculation about a faster reduction in the fed’s balance sheet. However, the Fed did release their schedule of asset purchases (for the coming month) on Friday, any change in schedule now seems less likely – which put the change in Fed Funds rate squarely in play.

Europe: The ECB Governor Christine Lagarde downplayed concerns about wider spreads on indebted peripheral countries saying that the ECB would use any tools and instruments needed to make sure that monetary policy is transmitted throughout all member states when the conditions are satisfied. Lagarde also re-emphasised the ECB would only hike policy rates after unwinding its balance sheet.

Japan: The Bank of Japan (BoJ) Governor Kuroda said monetary easing will not abate, as he attributed a very low probability of Japan experiencing a large rise in inflation like other countries. In a response to rising pressure on government bonds yields, the BoJ bucked the global move towards quantitative tightening and offered to buy an unlimited amount of 10-year JGBs at 0.25%.