Emerging Market (EM) stocks and local bonds outperformed last week due to a weaker US dollar, better-than-expected economic data from China, and lower inflation in Brazil and India. Argentina’s inflation increased further, partially due to the drought, but bad news in the economy is likely to increase the odds of a transition of power to a market-friendly opposition.

Global Macro

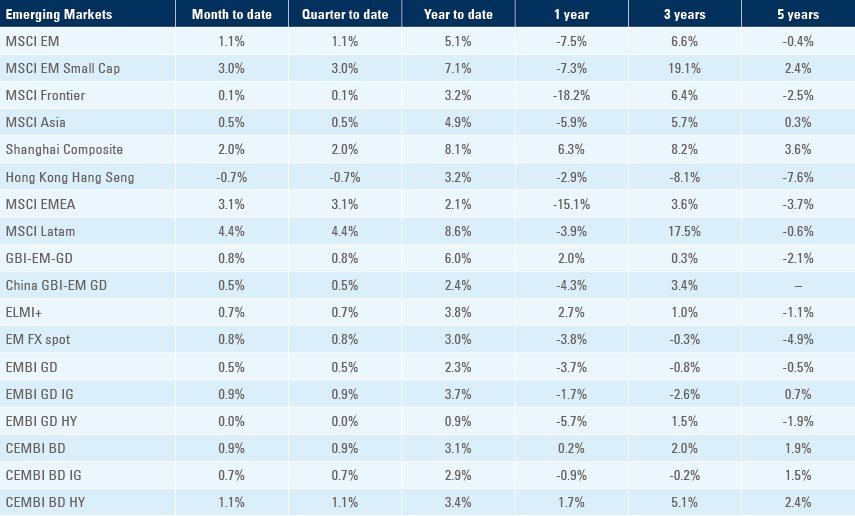

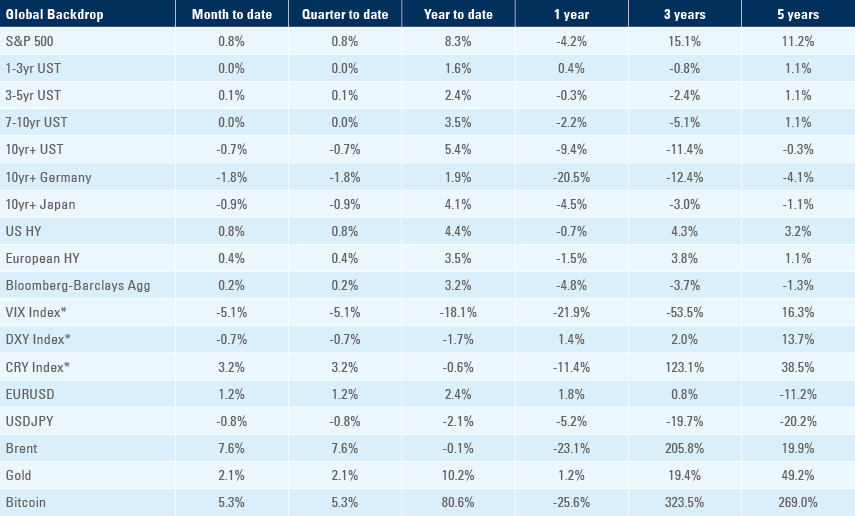

EM stocks outperformed last week, led by Latin America and small cap stocks. USD sold off another 0.8% as investors increased exposure to EUR and EM currencies, allowing local currency bonds to rally another 0.8% last week and 6.0% year-to-date. The VIX declined below 18%, the lowest levels since January 2022, as deposits stabilised both in small and large United States (US) banks, and the first banks reported positive Q1 2023 earnings last week. Nevertheless, the US stock market recovery has been extremely narrow, and stocks of regional banks are still down nearly 30% year-to-date, lingering at the lowest level since the 2020 Covid shock. The US National Federation of Independent Business (NFIB) reported last week that the availability of loans for small business had the largest monthly drop in 20 years as credit conditions declined to the tightest level since 2012 with interest costs rising to a 15-year high. Chinese credit and new home sales rebounded as new home sales improved, particularly in Tier 1 and 2 cities.

Geopolitics

After meeting with French President Emmanuel Macron, China’s Xi Jinping met with Brazilian President Luiz Inácio Lula da Silva one month after meeting with US President Joe Biden. In the past, the relationship between Brazil and China was mostly trade-related, as South America’s largest country held little diplomatic clout with Beijing. But the bilateral meeting suggests this is changing as China becomes more assertive on its pursuit of a multilateral world. Lula visited Huawei’s factory and called for the end of the Dollar dominance in global trade: “Every night I ask myself why all countries must base their trade on the Dollar… Why can’t we do trade based on our own currencies? Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”. Lula also highlighted the need for a return of diplomacy between the US, Germany, France and China to find a solution for the war in Ukraine, echoing Macron’s more balanced approach following his meeting with Xi Jinping.

Lula’s off-the-cuff comments sounded biased and anti-American, much like Macron’s centrist arguments. Both were viewed as diplomatic blunders which may prove unhelpful in achieving their objectives and garnered criticism from the press in Brazil, France and further afield. Nevertheless, Macron’s pledge to re-establish a broader dialogue was echoed by several figures that understand the political-economic struggle between US and China, including former US Treasury Secretary Henry Paulson and former US Secretary Henry Kissinger.1 Lula’s comments are a reflection a broad sentiment of frustration with the incumbent superpower by EM and Frontier Market (FM) economies that consider the US as having not been a fair broker in the geopolitical and economic sense since the invasion of Iraq. At the same time, the population from several EM and FM countries have struggled with lower purchasing power due to a stronger USD over the last decade.

Emerging Markets

Argentina: Consumer Price Index (CPI) inflation rose to 7.7% month-on-month (mom) in March from 6.6% in February, as the year-on-year (yoy) rate rose by 180 basis points (bps) to 104.30%. This was the highest rate of the 30 largest economies in the world. Finance Minister Sergio Massa is negotiating another adjustment to the International Monetary Fund (IMF) programme due to the drought’s impact on the Argentine economy. The stagflation scenario caused by the monetary imbalance and the drought is very likely to play into the hands of the opposition on elections on 22 October, a scenario that will be very clear from the primary elections on 13 August. The primary is likely to be disputed between the current Mayor of Buenos Aires, Horacio Rodríguez Larreta, and the former Minister of Defence Patricia Bullrich, who took a licence from the presidency of the opposition Republican Proposal Party, a clear signal she will announce her candidacy. Patricia proposes a “shock therapy” in both economics and politics, advocating for a sharp fiscal consolidation via aggressive expenditure cuts and the immediate unification of the various ARS rates, while keeping a very confrontational rhetoric against the Peronist Party. Larreta also advocates a frontloaded fiscal consolidation, reducing the deficit to zero potentially in the first year of government, but having a more conciliatory language with Peronism.

Brazil: CPI inflation dropped to 0.7% mom in March from 0.8% in February and consensus, bringing the yoy rate down 90bps to 4.7%, thus falling within the 3.25% +/- 1.5% target band for the first time in two years. Core CPI measures also declined to 0.4% mom from 0.5% in February, the lowest mom reading since March 2021, as the yoy rate declined by 70bps to 7.5%. The three-month moving average yoy rate of core CPI declined to 5.5% from 6.0% over the same period. Inflation upward pressures were concentrated in fuel prices (due to tax increases) and downward pressures on education. Lower inflation figures will add pressure on the Brazilian Central Bank to at least signal the likelihood of lowering policy rates, particularly if inflation expectations start declining after stabilising over the last two weeks. Retail sales were better than consensus, led by fuel, food, and apparel sales. In political news, more details of the new fiscal framework were released, clarifying that the 70% cap on real spending growth will be linked to ordinary revenues growth, as opposed to total revenues, and investments are also subject to the cap on spending growth. Low inflation and good news on the fiscal front meant government bonds dropped 39bps last week and the BRL rallied 3.0% to 4.9%. Brazilian stocks rose by 7.3% in USD terms last week, the best week of the year, led by domestic stocks with high leverage (and therefore high sensitivity to interest rates).

China: Aggregate financing totalled RMB 5.4tn in March from 3.2tn in February, almost RMB 1tn higher than consensus as new loans more than doubled to RMB 3.9tn from RMB 1.8tn over the same period. Exports surprised positively at USD 316bn in March, from USD 214bn in February, 14.8% higher on yoy terms, while imports rose to USD 227bn in March from USD 197bn in February, down 1.4% on yoy terms. The trade balance accumulated a USD 88bn surplus in March. The surge in exports was related to the end of the Chinese New Year period and was concentrated to ASEAN countries while exports to US and Taiwan declined in yoy terms. Since the Russian invasion of Ukraine, there has been a clear decline in monthly exports to competitor countries, while exports to friendly countries kept expanding. Oil imports rose to the highest levels since June 2020 after the end of the zero-Covid policy and the Chinese New Year. In other news, new home prices rose at the highest pace since June 2021, increasing in 64 of the top 70 cities, according to the National Bureau of Statistics. Developers started to build a land bank in Tier 1 and 2 cities in Q1 2023, as new home supply slumped below 2018 levels.

India: The yoy rate of industrial production rose by 40bps to 5.6% in February, significantly higher than consensus. CPI inflation declined by 80bps to 5.7% in March, in line with consensus and inside the Reserve Bank of India’s target band, which is likely to keep policy rates unchanged for now. The Wholesale Price Index (WPI) declined to a yoy rate of 1.3% in March from 3.9% in February, the lowest level since October 2020. The trade deficit widened to USD 19.7bn in March from USD 17.4bn in February as exports declined by a yoy rate of 13.9%, while imports were down by 7.9% yoy.

Indonesia: The trade surplus narrowed to USD 2.9bn in March from USD 5.5bn in February, but remained at the highest levels in ten years, except for 2022, as the yoy rate of exports and imports growth declined by 11.3% and 6.3% respectively, due to the decline in terms of trade during Q1 2023. Local auto sales rose to 101k units in March from 87k in February, the highest levels for the month of February in five years.

Snippets

- Colombia: Consumer confidence declined marginally to -28.5, the lowest level in the series except for June 2020. The yoy rate of manufacturing and industrial production were roughly unchanged at 0.4% and 0.8%, respectively, in February but retail sales slowed to 0.1% yoy from 1.2% in January.

- Czechia: CPI inflation declined to 0.1% mom in March from 0.6% mom in February, as the yoy rate dropped 170bps to 15.0%, in line with consensus. The current account surplus was unchanged at 600m in February, in line with the average over the last five years, but better than consensus.

- Hungary: CPI inflation rose 0.8% mom in March, unchanged from February, but higher than consensus, while the yoy rate dropped only 20bps to 25.2%.

- Mexico: The yoy rate of industrial production rose to 3.5% in February from 2.7% in January, while manufacturing production declined 230bps to 2.4% over the same period. Nominal wages accelerated to a yoy rate of 9.2% in March, 80bps above the yoy rate in February. The minutes of the Banxico meeting suggests the end of the hiking cycle at 11.25%.

- Peru: The central bank kept its policy rate unchanged at 7.75%, despite inflation slowing only at a moderated pace with CPI down 25bps to 8.4% and core CPI flat at 5.9% last month.

- Poland: The trade surplus increased to USD 2.2bn in February from USD 1.6bn in January as exports declined only marginally to USD 26.5bn. Imports declined by USD 1.3bn to USD 24.3bn and the current account surplus increased to USD 2.6bn in February from USD 2.1bn in January.

- Romania: CPI inflation rose 1.0% mom in March for the second consecutive month as the yoy rate was down 100bps to 14.5% due to base effects.

- South Africa: Manufacturing production declined 1.3% mom in February after rising 0.5% in January as the yoy rate declined 5.2%, from -4.1% over the same period. Mining production declined by 4.9% mom and 5.0% yoy in February, reflecting the ongoing challenges with energy production.

- South Korea: The unemployment rate increased 10bps to 2.7% in March, slightly less than consensus.

- Vietnam: Domestic vehicle sales increased to 26.3k in March from 20.8k in February, in line with the average of the last five years but representing a 25% drop in yoy terms and leaving the six-month moving average on a declining trend which started in May 2022. The cyclical slowdown explains why Vietnam was one of the first countries to start easing its policy rate.

Developed Markets

United States: CPI inflation dropped to 0.1% mom in March from 0.4% mom in February as the yoy rate declined 100bps to 5.0%, both 10bps below consensus. Meanwhile, core CPI came in at 0.4% mom from 0.5% mom in February, but the yoy rose 10bps to 5.6%, in line with consensus. Core services ex-housing remained elevated at 5.8% yoy, still too high for the US Federal Reserve (Fed) to pause its rate hiking programme. However, the combination of softer labour market data last week and positive base effects is likely to allow the Fed to deliver its latest hike and then pause. In terms of base effects, Q2 2022 inflation was 0.8% mom on average (0.4%, 0.9% and 1.2% mom respectively). If mom inflation averages 0.5% mom in Q2-2023, the yoy rate would drop to 4.0%, but mom averages of 0.2% or -0.1% would bring yoy inflation to 3.0% and 2.1% respectively. The Producer Price Index (PPI) (final demand including services) declined 0.5% mom in March from 0% in February, bringing the yoy rate of PPI final demand 220bps lower to 2.7%, 30bps below consensus, driven by lower energy and food prices, while PPI ex-food and energy declined 240bps to 3.4%, in line with consensus. Import prices declined 0.6% mom in March after -0.2% in February, bringing yoy imported deflation to 4.6% from 1.1%. Retail sales were down 1.0% mom in March after -0.2% in February, while retail sales (ex-auto) declined 0.8% in March from -0.1%, soft across the board. Retail sales declined 1.0%, but the control group – which excludes auto dealers, building materials retailers, gas stations, office supply stores, mobile homes and tobacco stores – declined 0.3% mom against consensus for a 0.5% mom decline. The University of Michigan sentiment survey rose 1.5 points to 63.5, but one-year ahead inflation expectations jumped by 100bps to 4.6% while 5-10-year inflation was unchanged at 2.9%.

The Treasury General Account (TGA) dropped to USD 86bn, from USD 573bn in the week to 25 January, when the debt ceiling of USD 31.4tn was reached. Since the end of January, the US government is using extraordinary measures (not investing in savings and stabilisation funds) to keep running. If the debt ceiling is not raised or suspended, the Congressional Budget Office expects the US government to run out of money between July and September, but a negative surprise to tax receipts this month could lead it to run into arrears or default on its obligations sooner. Capital gain tax receipts in 2022 are likely to have been poor and the weakening economy in 2023 doesn't augur well for future tax receipts.

Running down the TGA more than compensated for the impact of quantitative tightening and the increase in reserve repo deposits (i.e., dead money parked in the Fed from banks or money market funds). Now the US Treasury appears to be between a rock and a hard place. If the debt ceiling is raised and the TGA is replenished, that would tighten liquidity in the system, which has been bad for asset prices over the last 15 months. If the debt ceiling is not raised, the government arrears will start impacting the US economy negatively at a time when the manufacturing sector is already in recession.

Eurozone: Retail sales declined 0.8% mom in February after expanding 0.8% in January, leading the yoy rate to a deeper contraction at -3.0% from -1.8% over the same period. Industrial production rose 1.5% mom in February after 1.0% in January. The yoy rate of wholesale prices declined by 690bps to 2.0% in March, signalling more disinflation ahead for consumer prices.

Japan: PPI inflation was unchanged in March, rising from a 0.3% deflation in February as the yoy rate declined 110bps to 7.2%.

Canada: The Bank of Canada kept its policy rate unchanged at 4.5%, in line with consensus.

1. See https://www.ft.com/content/a101d2c1-13b7-4a20-9e8e-38fb1d54723d

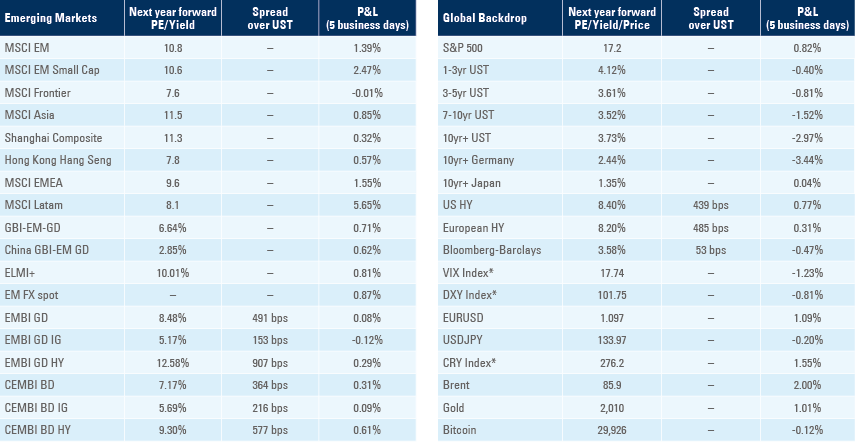

Benchmark performance