EM inflation still subdued as food prices likely to decline into year-end

Emerging Markets consumer prices index (CPI) inflation remains subdued as food prices are likely to decline into year-end. Primary issuance of Eurobonds increased last week. China announced further capital account liberalisation. India’s CPI inflation declined more than expected and Indonesian exports surprised to the upside. The Bank of Korea revealed a bias to hike its policy rate further to curb financial stability risks. Two large Brazilian political parties are negotiating to merge. The Argentinian government is in disarray after the poor result in the primary elections. The Chilean Central Bank minutes signalled further 50-75bps hikes over the next meetings.

Emerging Markets

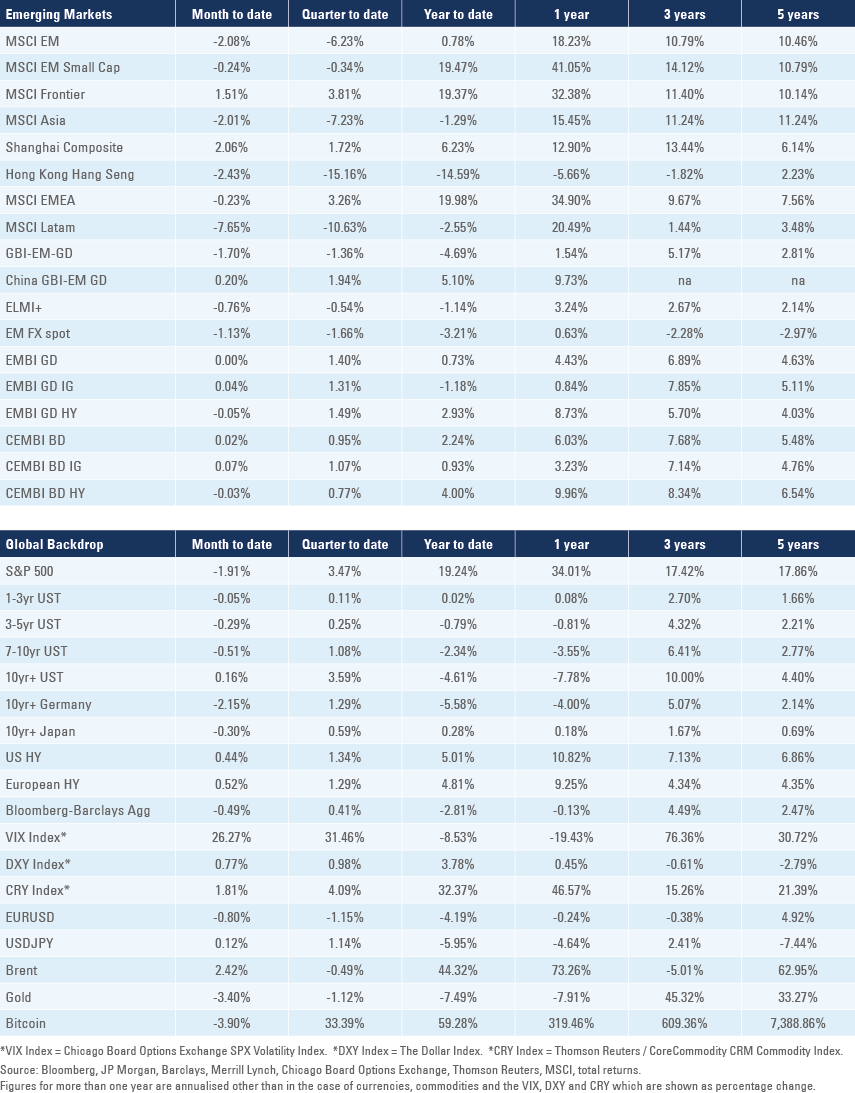

Inflation: August CPI inflation was released in 82% of the JP Morgan GBI EM GD Index (17 out of 20 countries) and 94% of the MSCI EM Index (25 out of 28 countries). The GBI-weighted yoy rate of CPI inflation rose 0.1% to 4.3%, which is 0.1% below the highest year-to-date (YTD) levels in May 2021, while MSCI-weighted CPI inflation was stable at 2.9% yoy (0.2% below the YTD highs in June 2021) as depicted by Figure 1. In contrast, the yoy rate of CPI inflation in the US remained at the most elevated level since 2008 at 5.3% and hit the highest level since 1994 at 3.9% yoy in Germany.

The food component of the GBI-weighted EM CPI inflation rose 0.4% to 4.7% yoy in August, the highest level in 2021, driving the increase in GBI-weighted inflation. However, the yoy change in agriculture commodity prices peaked in April at 59.5% before declining to 45.1% yoy in August and is likely to decline further (to 17.8% yoy assuming stable agriculture prices), suggesting the food component of CPI inflation should decline over the coming months. This is important because food represents a larger share of EM CPI baskets due to its largest weight in the population total expenditure.

Reflecting more benign future inflationary dynamics, the full-year 2021 consensus expectation for GBI-weighted inflation rose 0.2% to 4.3%, thus fully converging to current yoy inflation, while the 2022 consensus was unchanged for the third month at 3.1%, implying a convergence with the low inflation profile experienced since 2008 across EM.

Fig 1: EM CPI inflation weighted by GBI EM GD and MSCI EM vs. US and German inflation

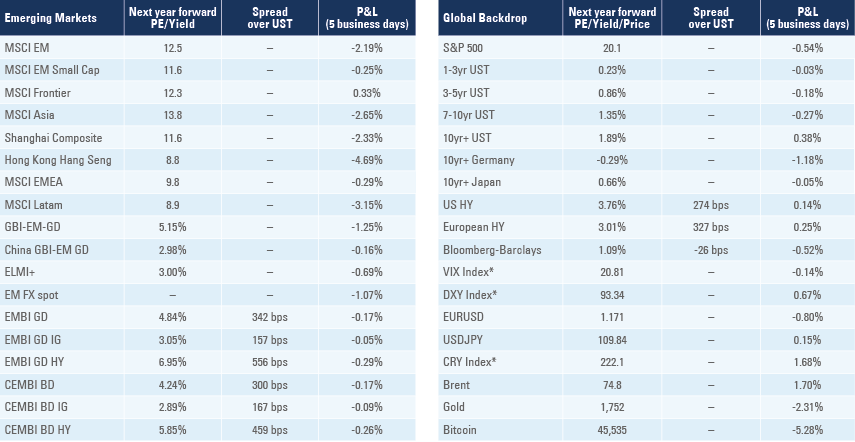

The yield on the GBI EM GD rose 0.1% to 5.0% in August, allowing the ex-post real interest rates on the GBI EM GD index to remain unchanged at 0.7%. EM real yields remain significantly above the ex-post real rates in the United States (US), which rose 0.2% to -4.5% and Germany (+0.1% to -4.6%) as per Figure 2.

Fig 2: Ex-post real yields: GBI EM GD, United States (US) and Germany

The recent increase in GBI EM GD yields to 5.2% (17 September) and the fact that inflation is likely to roll over suggests the real interest rates differential between EM and DM is likely to remain unusually elevated, even after the US eventually tapers its quantitative easing (QE) programme. At this week’s FOMC meeting, the Fed is likely to signal QE tapering is likely to be announced over the coming two meetings.

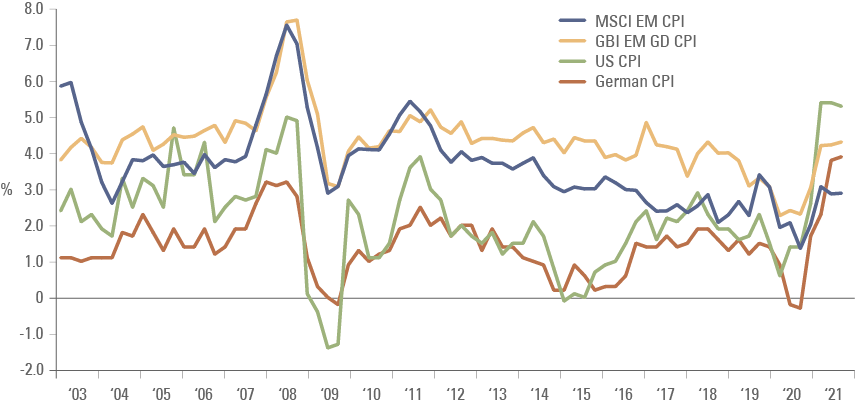

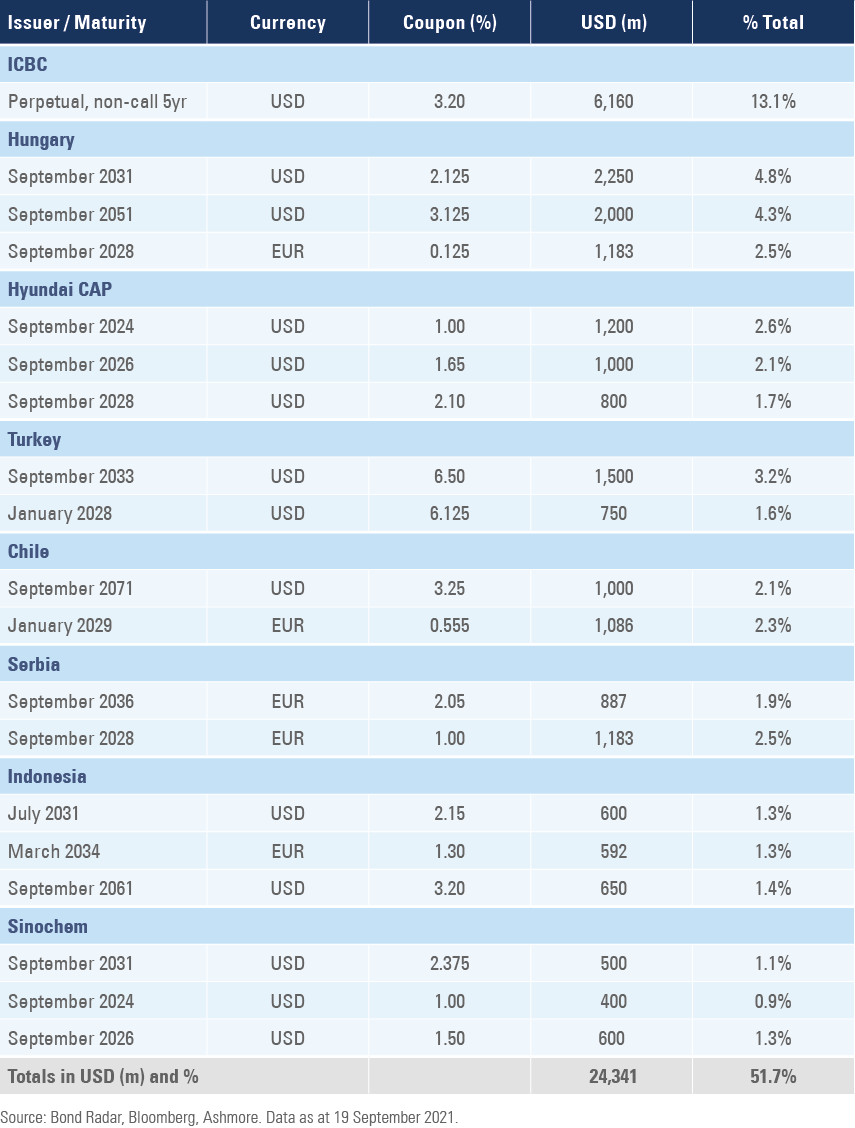

New issuances: Activity in the Eurobond market accelerated following the end of the summer holiday period in the northern hemisphere. Last week 57 EM Sovereign and Corporate issuers borrowed the equivalent of USD 47bn across 72 bonds. Dollar-denominated bonds were 87% of the total and Euro-denominated was 11%. More than half of the issuance was concentrated across 8 issuers: 2 Chinese quasi-Sovereigns, 5 Sovereigns and one Corporate as per Figure 3.

Fig 3: New issuance highlights (13 September 2021 to 17 September 2021)

China: Further capital account reforms announced with the southbound bond connect allowing mainland institutional investors to invest in Hong Kong bond markets to be launched on 26 September with a daily cap on net capital flows of RMB 20bn (c. USD 3bn). Hong Kong Prime Minister Carrie Lam announced the construction of a rail link connecting the northern New Territories and Shenzhen Qianhai economic zone. In corporate news, the beleaguered construction company Evergrande hired financial advisers to assess its capital structure while the government also hired advisers to examine the company’s numbers, suggesting both sides are preparing for a debt restructuring, potentially involving a government bailout alongside a broad debt restructuring exercise. Economic data was weaker than consensus expectations as the yoy rate of industrial production dropped 1.3% to 13.1%, retail sales declined 6.0% to 2.5% yoy and fixed asset investment was down 1.4% to 8.9% yoy. In regulatory news, the food delivery company Meituan pledged to alter algorithms to improve riders’ conditions – a known concern for food delivery businesses alongside informal job conditions.

India: The yoy rate of CPI inflation declined 0.3% to 5.3% in August on the back of lower food prices, while wholesale price index (WPI) inflation rose 0.2% to 11.4% yoy, 0.6% above consensus. The trade deficit widened to USD 14bn in August from USD 11bn in July, in line with consensus as the yoy growth of both imports and exports remain above 45%.

Indonesia: The yoy rate of export growth rose 64.1% while imports rose 55.3%, both significantly above consensus, resulting in a USD 4.7bn trade surplus in August, the largest on record for the month. Local auto sales improved to 83k vehicles in August from 67k in July, which is in line with the average of the previous five and ten years.

South Korea: The minutes of the latest Bank of Korea meeting showed policymakers are biased to increase policy rates further (after a first 25bps hike on 26 August) to curb financial stability risks. The seasonally adjusted unemployment rate declined 0.5% to a record low at 2.8% in August as the participation rate dropped 0.2% to 62.5%. The yoy rate of export prices rose 1.2% to 18.6%, while import prices rose 2.1% to 21.6% yoy.

Argentina: The crisis within the ruling coalition deepened after Vice President Cristina Fernandez de Kirchner published a public letter blaming President Alberto Fernandez for the poor result in primary elections.1 Alberto Fernandez reshuffled his cabinet replacing his cabinet chief Santiago Cariero – a personal ally – with the governor of Tucumán Province Juan Manzur, a name suggested by Kirchner. Economy Minister Martin Guzmán, who was criticised by Kirchner’s allies for trying to reduce the fiscal deficit, kept his post. In economic news, the current account balance improved to USD 2.7bn in Q2 2021 from USD 0.7bn in Q1 2021.

Brazil: The centre-right Democrats (DEM) and Social Liberal (PSL) parties are in discussions over a possible merger, which would create the largest party in the Lower House of Parliament with 81 seats. The combined party would have the largest amount of electoral resources and television advertisement time, building a solid base for an alternative coalition to the polarisation between President Jair Bolsonaro and former President Luis Ignacio Lula da Silva. If confirmed, it would motivate other small parties to merge, which could pave the way to a more stable system in the parliament. Economic activity rose 0.6% in July from 0.9% in June revised from 1.1%), higher than consensus.

Chile: The Banco Central de Chile (BCCh) released the minutes from the latest monetary policy committee when they hiked the policy rate by 75bps to 1.5%. The minutes signalled a normalisation of policy rate by H1 22 (latest estimate from 3.25% to 3.75%), while market prices imply 275bps hikes over the next 12 months.

Snippets:

- Angola: The rating agency Moody’s raised Angola’s credit rating to B3 from Caa1 with a stable outlook, after an improvement in the country’s credit profile and slightly improved governance.

- Bahamas: The opposition PLP Party candidate Philip Davis defeated the incumbent FNM Party represented by Prime Minister Hubert Minnis in a snap election last week. Minnis was driving a fiscal consolidation policy before his defeat while Davis pledged to cut the VAT by 2% to 10%

- Colombia: The yoy rate of manufacturing production declined 0.7% to 20.1% in July and retail sales rose 2.2% to 26.9% over the same period, both significantly higher than consensus. The trade deficit narrowed to USD 1.2bn in July from USD 1.6bn in June, in line with consensus.

- Czech Republic: The current account deficit widened to CZK 19.5bn in July from CZK 10.0bn in June, CZK 4.8bn wider than consensus. The yoy rate of PPI inflation widened 1.5% to 9.3% in August (0.6% above consensus).

- Egypt: The central bank kept its deposit and lending policy rates unchanged at 8.25% and 9.25% respectively. The trade deficit was unchanged at USD 2.9bn in July.

- Honduras: The IMF board approved the fourth review of the Stand-By Agreement ending in January 2022, despite reservations over reforming the state-owned utility company ENEE. Honduras general election takes place on 28 November

- Mexico: The Government bought foreign exchange (FX) reserves worth USD 7.0bn from the Central Bank, reducing FX reserves to USD198.5bn.

- Nigeria: The yoy rate of CPI inflation declined 0.4% to 17.0% and the Central Bank of Nigeria kept its policy rate unchanged at 11.5%, both in line with consensus.

- Peru: In a positive development for political stability, Congress approved a bill limiting the president’s power to call a vote of confidence. The yoy rate of economic activity growth slowed to 12.9% in July from 23.4% yoy in June, broadly in line with consensus, while the Lima unemployment rate rose 0.1% to 9.5%.

- Philippines: Foreign exchange (FX) remittances from overseas workers rose to USD 2.9bn in July from USD 2.6bn in June, higher than consensus and FX reserves increased USD 0.9bn to USD 108.1bn in August.

- Poland: The current account moved to a USD 1.8bn deficit in July from USD 0.3bn surplus in June. Average gross wages rose at a yoy rate of 9.5% in August from 8.7% yoy in July as employment rose 0.9% from 1.8% over the same period and core CPI inflation rose 0.2% to 3.9% yoy.

- Romania: The current account deficit rose to USD 9.1bn in the first seven months of 2021 from USD 7.0bn in 1H 2021. The yoy rate of industrial output declined to 5.9% in July from 12.5% yoy in June as industrial sales declined to 13.6% yoy from 28.7% yoy over the same period.

- Russia: Exit polls suggest the ruling United Russia party won a decisive victory in legislative elections on Sunday the 19 September despite low government popularity in recent surveys. Official results are likely to be announced soon.

- Saudi Arabia: The yoy rate of GDP growth rose to 1.8% in Q2 2021 from 1.5% in Q1 2021. CPI inflation declined to a yoy rate of 0.3% in August from 0.4% yoy in July.

- South Africa: Retail sales declined by 11.2% in July (consensus -2.7%) after rising 0.7% in June. Mining production rose at a yoy rate of 10.3% in July from 19.1% in June.

- Sri Lanka: The Central Bank Governor Ajith Nivard Cabraal said the FX reserves were sufficient to cover debt repayments for the “foreseeable future” and there was “absolutely no risk” debt of a default. Cabraal said Sri Lanka is working on non-debt inflows via government-to-government investment initiatives.

- Turkey: The Central Bank of Turkey (CBT) hiked the reserve requirement ratio for foreign exchange and precious metals deposits by 200bps to 20.6% (weighted average across the term structure), leading to an estimated increase in the CBT FX reserves of USD 7bn.

Global backdrop

Commodities: Commodity prices rose 1.7% last week driven by higher energy prices, but industrial metal prices declined last week led by a 17% decline in iron ore prices to USD 101 per ton – 50% below its peak in mid-July. China is targeting to keep full-year steel production flat to reduce pollution ahead of the Winter Olympics in February 2022, which implies meaningful cuts in 2H 2021. Property demand has also softened due to the Evergrande situation.

Covid-19: Cases in Israel stabilised at high levels after the country administered vaccine boosters to 34.5% of its population in 1.5 months. 63% of the population is vaccinated with two doses and 69% with one dose. An Israeli study also suggests that the third booster shot increases the efficacy of the vaccine. The United Kingdom started rolling out boosters to healthcare workers. In the United States, the FDA has not authorised the administration of boosters while Governors of 19 states claimed they would challenge the Federal government over the mandate for every company which employs more than 100 employees to vaccinate its workers.

The pace of vaccination in EM ex-China remains strong as Vietnam continues to accelerate and is now tracking to inoculate more than 80% of its population by year-end. Other countries in the region with a zero Covid-19 tolerance policy such as South Korea, New Zealand and Australia are now vaccinating more than 1% of their population per day, a pace that should allow less draconian policies to be adopted over the next months.

United States: Treasury Secretary Janet Yellen renewed the call for Congress to raise or suspend the US debt ceiling to avoid “widespread economic catastrophe”. The yoy rate of CPI inflation declined 0.1% to 5.3%, in line with consensus while core CPI declined 0.3% to 4.0%, below consensus estimates. On the other hand, other core measures of inflation like the Cleveland Fed trimmed mean core CPI rose 0.2% to 3.2% yoy (from 2.4% in both Aug-2020 and Aug-2019). The University of Michigan sentiment rose 0.7 to 71.0 in September, slightly below consensus while inflation expectations 1-year rose 0.1% to a yoy rate of 4.7% and 5-10-years expectations was unchanged at 2.9% yoy. The Empire Manufacturing survey rose to 34.3 in September from 18.3 in August while Philadelphia Fed Business optimism rose to 30.7 from 19.4 over the same period. Retail sales rose 0.7% in August after declining 1.8% in July (revised from -1.1%) while IP rose 0.4% from +0.8% over the same period. The import price index declined to a yoy rate of 9.0% in August from 10.3% in July while export prices inched 0.2% lower to 16.8% yoy over the same period.

Eurozone: The Euro Area IP rose 1.5% in July from -0.1% in June, higher than consensus as the current account surplus declined to EUR 21.6bn from EUR 21.8bn over the same period.

United Kingdom: The yoy rate of CPI inflation rose 1.2% to 3.2% in August or 0.3% above consensus. In political news, Prime Minister Boris Johnson’s approval rate declined to 35% in September from 48% in May according to a poll by You Gov. Johnson reacted by reshuffling his cabinet as Trade Secretary Liz Truss replaced Foreign Secretary Dominic Raab after criticism of the UK’s chaotic withdrawal from Afghanistan. The Chancellor of the Exchequer Rishi Sunak and Home Secretary Priti Patel kept their positions.

Norway: The Labour Party led by Jonas Gahr Støre retained its position as Norway’s largest party leading incumbent Prime Minister Erna Solberg to concede defeat. Støre will seek a centre-left coalition between Labour, Centre Party and Socialist Left. The Green and Red Parties (who oppose oil and gas exploration) will not be necessary to form a coalition. Greens received 3.9% of the votes, 0.1% below the threshold to receive compensatory seats.

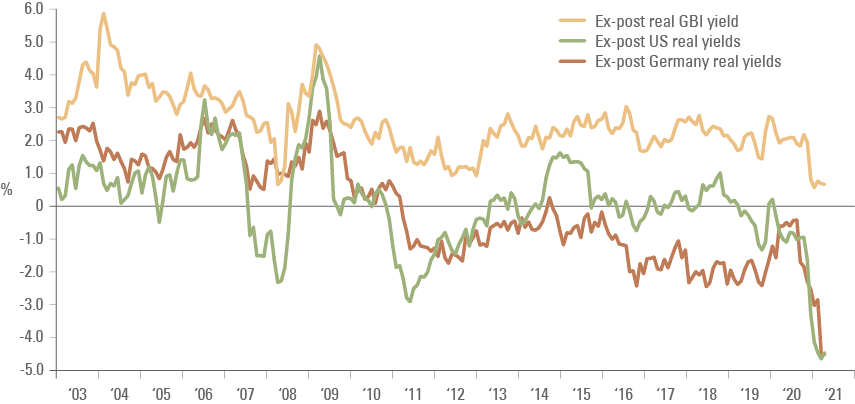

Benchmark performance