- Hopes of a trade deal and lukewarm data led to rebalancing from US, benefiting EM assets.

- Oil price increased due to positioning and better macro, despite higher OPEC+ expected output.

- The Central Bank of India delivered a 50bps policy rate cut, supporting Indian equities.

- South Korea’s political stabilisation boosted asset prices.

- OECD expects Vietnam growth of +6% over 2025 and 2026.

- Brazil’s government looks for alternatives to rein in fiscal deficits.

- Colombian Senator and presidential candidate Miguel Uribe Turbay shot.

- Political uncertainty in Poland likely to weigh on Eastern Europe’s relative value.

- Ghana’s gold reserves surge as Ivory Coast aims to boost offshore oil production.

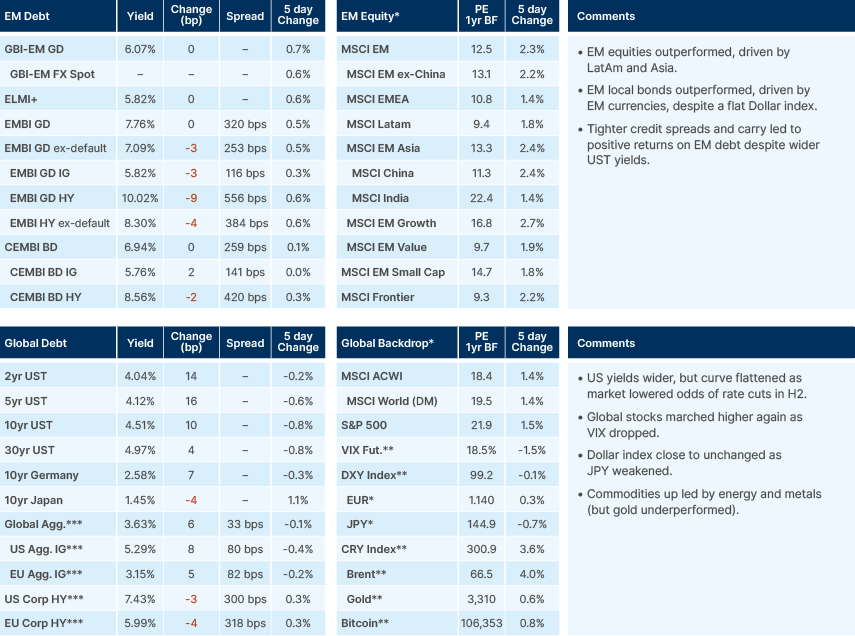

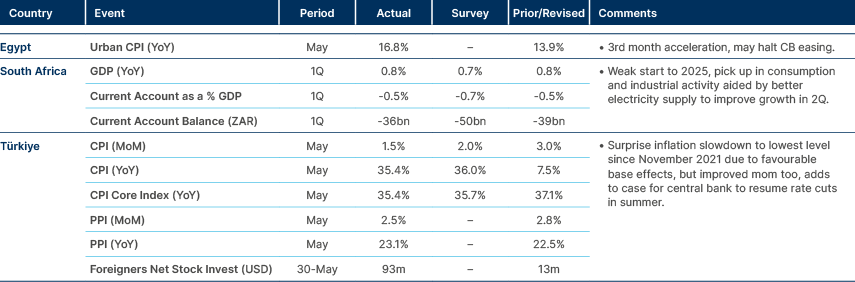

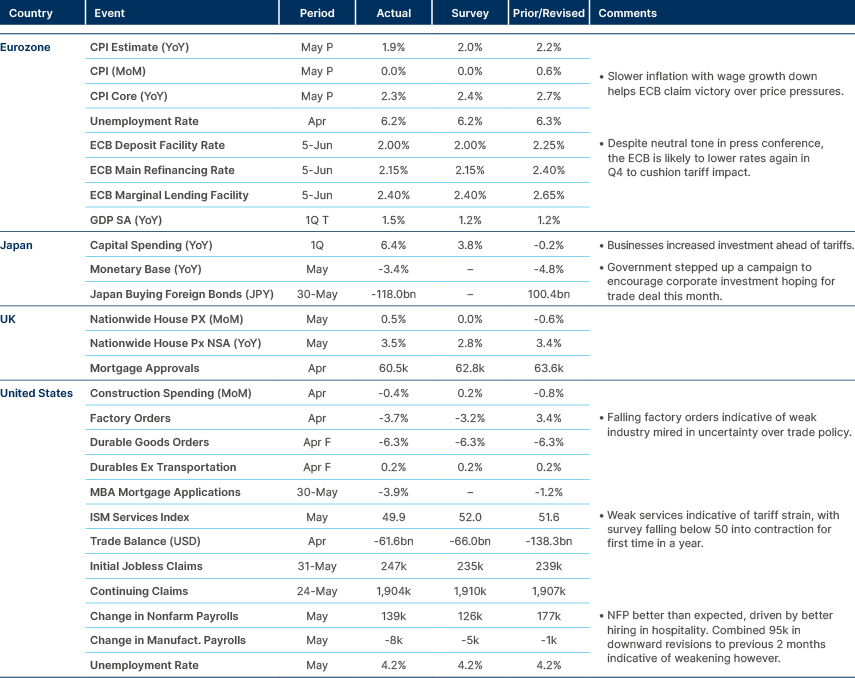

Last week performance and comments

Global Macro

US Treasury yields rose, but the curve flattened as the market repriced the odds of interest rate cuts from the Federal Reserve (Fed) over the coming months. US economic data, in particular labour market, appears not weak enough to convince the Fed to ease monetary policy. Nevertheless, there is evidence of an emerging discretionary service sector slowdown as the labour market continues to soften while the housing market remains very weak given high mortgage rates and house price levels.

Against this backdrop, US administration officials, including Scott Bessent, Howard Lutnick and Jamieson Greer, are reportedly meeting with the Chinese Vice Premier He Lifeng in London today to iron out the US-China trade deal after a 90-minute call between Donald Trump and Xi Jinping. The US kept announcing micro sanctions across sectors, and China kept several restrictions on rare earth mineral exports to US, despite the first détente after Trump cut tariffs from 145% to 45% with reciprocal de-escalation. But the big disruption to the first détente came when Lutnick, who was not part of the deal, publicly criticised China. Sources from the Japanese delegation, who are also discussing a trade deal with the US, said there is considerable infighting between the three main US negotiators, some of it about politics.

The fact that Trump remains keen on a trade deal should support a better process and has supported investor sentiment. Helpfully, on the budget front, some Congressional checks and balances have emerged, as the Financial Times reported on the lobbying effort from corporate executives to eliminate or at least water down section 899, while the Wall Street Journal highlights that Republican Senators are struggling to find agreement on the trade-offs inherent in getting the bill passed.1 The CEO of Global Business Alliance was quoted as saying “I think there is growing momentum to get rid of this provision (Sec. 899). Senators recognise that it’s counter-productive to the economic vision for the administration, which has made a big point about trying to get more investment to the US.”

Nevertheless, investors observe the notable deterioration in US institutions and have started voting with their feet.

Bank of America reported that European asset managers rotated their portfolios from US to Europe in April. Flows have been supported by European Central Bank (ECB) comments last week. ECB President Christine Lagarde said there is an window of opportunity opening to strengthen the role of the EUR as a reserve currency of choice. Influential ECB board members, such as Fabio Panetta and Isabel Schnabel, are on the same page, as the trio encouraged member states, the EU commission, and the European Council to take substantive reforms to consolidate Europe’s economic and geopolitical roles. This includes to simplify, streamline and develop the capital market union, which could unlock significant capital flows and productivity gains. Above all, Europe should sustain respect for the rule of law and remain a reliable place for business, a status it already largely enjoys.

Emerging markets (EM) are also benefiting from this diversification momentum. Bank of America reported the strongest inflows into EM equities and debt in eight weeks, with USD 2.3bn inflows into equities and USD 2.5bn into EM debt. Local currency bonds mutual funds have had USD 10bn inflows year-to-date (YTD), the largest over the last five years, as flows initially tracked the poor 2022-2024 years, but have now surpassed inflows in 2021. In equity markets, the largest beneficiaries from inflows included India (USD 2.3bn), Taiwan (USD 7.6bn), and Brazil (USD 2bn).

Commodities

Saudi Arabia supported OPEC+ to hike another 411k barrels a day in both August and September this year, with hikes already scheduled for May, June and July. This would take overall hikes to 2.5 million barrels overall, which is likely to push the market into surplus by end of the summer, with demand growth currently tepid. Nevertheless, oil prices have been increasing, mostly due to covering of prior heavy short positions amidst the improved macro environment discussed above.

Emerging Markets

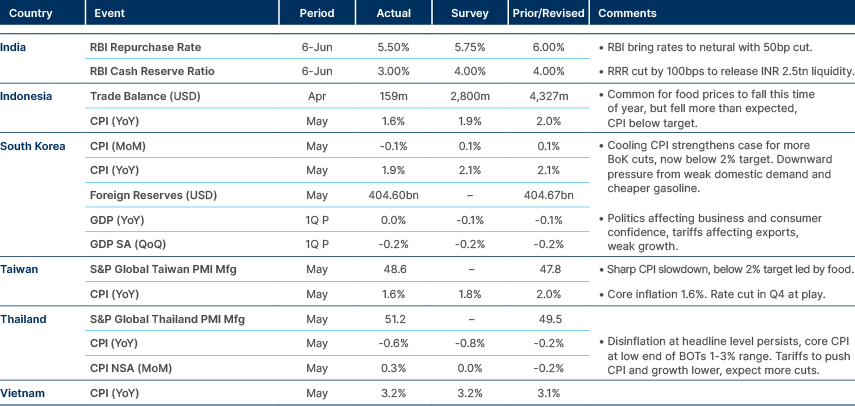

Asia

Inflation sliding further across Asia and RBI 50bps cuts suggests more easing ahead.

China: May consumer price index (CPI) inflation declined by 0.1% in yoy terms (-0.2% est.), while producer price index (PPI) deflation deepened 3.3% yoy (-3.2% est), largely due to a significant drop in energy costs. Prices for goods leaving the factory gate also continued to fall, signalling that demand remains weak in the face of excessive production capacity across a few large sectors. However, the services sector is showing signs of life, with prices of hotel stays and tourism increasing. On the trade front, China's export engine generated another USD 100bn surplus in May, despite both exports and imports growing less than expected due to softer US demand. China is likely to keep pivoting away from the US towards emerging economies in Asia and beyond.

India: Economic activity picked up in April, building on a recovery that began the previous month. Indian households are spending more thanks to lower inflation, which increases their purchasing power, and improved liquidity conditions from the Reserve Bank of India (RBI), which made borrowing cheaper. Favourable monsoons have been also supportive as the economic recovery is also being felt in rural areas.

India’s growth is likely to remain solid in the coming fiscal year. Last week, the RBI cut its policy rate by 50 basis points (bps) to 5.5% and injected further liquidity in the system. RBI Governor Sanjay Malhotra said the monetary policy stance moved from accommodative to neutral. The frontloading of policy rate cuts is positive for Indian stocks, in our view, consolidating India as a key engine for Asia's overall economic growth.

Malaysia: State-owned oil and gas giant Petronas is taking significant steps to cut costs in the face of persistently low global oil prices. The company announced it will lay off over 5,000 employees, roughly 10% of its workforce, by the end of 2025. It will also freeze all new hiring and promotions until late 2026 to rein in spending. Petronas leadership warned shrinking profit margins will make it difficult to pay its usual dividend to the government.2 A lower-than-expected payout could force the government to cut its own spending or find new sources of revenue. While exports may face headwinds, Malaysia's economy is expected to see healthy growth driven by strong domestic demand and investment flows, including from Chinese firms in the tech and auto sectors.

South Korea: Newly-elected President Lee Jae-myung moved quickly to establish his government, nominating a former campaign aide as prime minister. With his party holding a strong majority in parliament, the confirmation is expected to be swift, ensuring a smooth transition of power. The unified government brought increased hopes of measures to support Korean assets such as the equity value up scheme, and reviewing commercial law to enhance corporate governance. The KRW rallied 2% on the back of USD 1.8bn inflows into local stocks last week and another USD 0.3bn this morning. Koreans retain a large exposure into foreign assets, particularly in speculative assets including single stock leveraged ETFs and cryptocurrencies.

President Lee has already engaged with President Trump, and the two leaders have agreed to start trade negotiations quickly. However, the US Treasury has kept South Korea on its ‘watch list’ for currency manipulation. The US is concerned about South Korea's large trade surplus and believes it may be keeping its currency artificially low to make its exports cheaper. This issue is likely to be a key topic in the upcoming trade talks and substantiates our view that the Trump administration will seek to adjust currency levels as part of its overall trade rebalancing strategy.

Vietnam: The OECD forecasts GDP growth of over 6.0% for both 2025 and 2026, fuelled by consumption and government investing in public projects. Furthermore, the country remains a very attractive destination for foreign companies looking to invest. However, the OECD warns Vietnam's success is still tied to the health of the global economy. A significant global slowdown or an increase in trade tensions could negatively affect its vital export sector and slow down investment. Sources suggest the country is on the third round of trade negotiations with the US. The Vietnamese government has been very upfront about the US concerns, granting it a good position in the pecking order of negotiations, but risks remain.

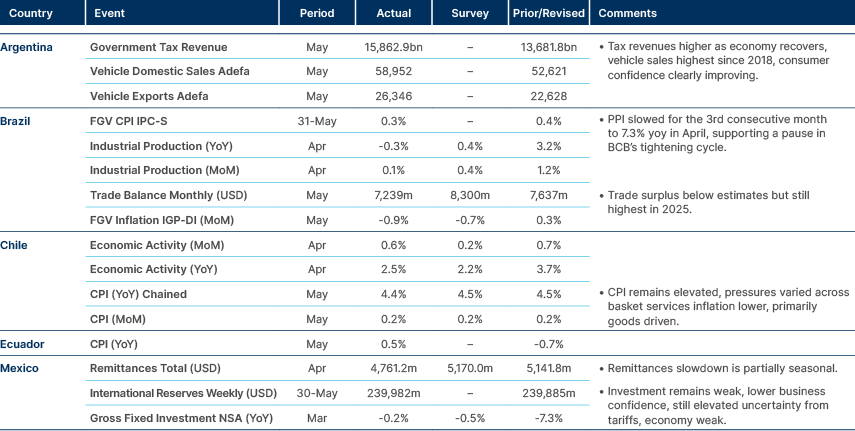

Latin America

Higher tax revenues in Argentina; Activity softened in Chile.

Argentina: President Javier Milei has seen his approval ratings rise after he took the bold step of removing long-standing controls on the foreign currency exchange market. Former President Cristina Fernández de Kirchner (CFK) announced she will run for a legislative seat in the powerful province of Buenos Aires. With a pending court ruling in place, CFK is unable to run for elections. If she is allowed to run, it is likely she will split the Peronist Party in Buenos Aires. Meanwhile, former President Mauricio Macri's party is exploring an alliance with President Milei's party to consolidate the non-Peronist vote.

On the policy front, the Lower House passed a bill to significantly increase pension payments. Milei vowed to veto the bill, as per prior populist moves by Congress, and the opposition does not have enough votes to override him. The government remains focused on attracting large-scale foreign investment through a new incentive programme, particularly in the mining and energy sectors.

Brazil: The government is looking for ways to shore up its finances and is considering measures to raise significant new revenue from its oil and gas sector. This comes as it seeks alternatives to a politically unpopular tax hike on financial transactions (IOF) which has been vetoed by Congress many times in the past. Meanwhile, the Central Bank of Brazil has signalled it plans to keep interest rates high for an extended period to combat persistent inflation. In politics, a recent poll showed a majority of voters are not keen on seeing either President Lula da Silva or former President Jair Bolsonaro run again in 2026. While this bodes well for the centre-right opposition, if Bolsonaro agrees to support one of its leaders, it also increases the risk of another polarised election, should Bolsonaro support one of his family members and Lula decides to run regardless of his poor approval rating. In other news, S&P recently affirmed Brazil's 'BB' rating, stating the country's strong external position helps to balance out its high level of government debt.

Colombia: Security concerns are growing ahead of the 2026 elections after right-wing senator and presidential hopeful Miguel Uribe Turbay was shot and gravely wounded at a campaign event. The country is struggling with public finance concerns. Last week, the Finance Minister suggested the government might deviate from its fiscal rule law, designed to limit government borrowing. He argued that sticking to the rule would harm the economy. Breaking with the rule would lead to a marked deterioration in the debt/GDP trajectory. At the same time, President Gustavo Petro is in a standoff with Congress, pushing for a national referendum on his labour reform after it was rejected by the Senate. In other news, state-owned oil company Ecopetrol had its credit outlook downgraded by S&P due to concerns about high dividend payouts and governance risks.

Mexico: The Morena party is set to take control of the Electoral Court following a judicial election, a development that critics argue could undermine the independence of the judiciary. On the economic front, central bank director Galia Borja offered a dovish view on inflation, suggesting recent price increases are temporary and that a slowing economy will help bring them down. On the trade front, the US doubled its tariffs on Mexican steel and aluminium to 50%. The Mexican government is attempting to negotiate an exemption, but has not ruled out taking retaliatory measures if talks fail. The International Monetary Fund recently lowered its 2025 growth forecast for Mexico, citing the impact of US tariffs.

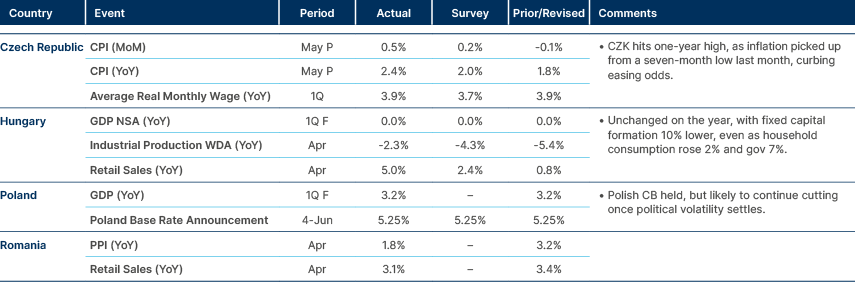

Central and Eastern Europe

Higher inflation in Czechia boosted the Koruna.

Czech Republic: The trade surplus fell in April and was lower than experts had predicted. Exports declined led by motor vehicles to Germany, the centre of the supply chain. YTD, the trade surplus is down 6% in yoy terms. High elevated real wages suggest the economy is adjusting to weaker demand from its trading partners, and the cyclical slowdown does not pose an immediate risk to economic stability.

Hungary: Ratings agency Fitch affirmed Hungary at 'BBB' with a stable outlook, backed by the country's solid financial situation. Hungary has become a major hub for Chinese investment in Europe, particularly in the electric vehicle sector, and has introduced thoughtful policies to support its small and medium sized companies. The main risk centres on presidential elections in 2026, but that is unlikely to materialise in the short term, in our view.

Poland: Prime Minister Donald Tusk called for a confidence vote on 11 June after his party's candidate lost the recent presidential election. The political gridlock has prompted warnings from credit rating agencies Moody's and Fitch, amid fears it could derail essential fiscal and judicial reforms and potentially jeopardise access to EU funds.

A party within the ruling coalition has proposed a new windfall tax on what it calls "excess profits" for banks, a move that sent Polish banking stocks lower. Amid uncertainty, the central bank is taking a cautious stance on monetary policy. Monetary Policy Council member Henryk Wnorowski suggested an interest rate cut is unlikely before September due to concerns about government spending. Nevertheless, soft inflation and activity may bring it to cut policy rates by more than its peers.

Ukraine: Russian President Vladimir Putin rejected calls for a ceasefire from Ukrainian President Volodymyr Zelenskyy. S&P affirmed Ukraine's sovereign rating at 'SD' (Selective Default) and downgraded its rating on a specific type of debt known as GDP warrants to 'D' (Default) after the government missed a payment.

Central Asia, Middle East, and Africa

Türkiye’s inflation drops to the lowest level since Nov 2021.

Egypt: The trade deficit narrowed by nearly 39% compared with the same month last year, driven by a 21% increase in exports, particularly of clothes and petroleum products, and a 10% decrease in imports of goods like wheat and pharmaceuticals. Egypt's trade position remains sensitive to global events, such as fluctuations in energy prices and agricultural products, which so far have been favourable.

Ghana: Ghana is actively using its significant gold resources to strengthen its national finances. The Bank of Ghana's gold reserves have risen by over 44% in the past year as part of a strategic programme to bolster the country's foreign currency reserves and support the value of the cedi. The government has established a new state-owned entity, Gold Board, which will act as the sole buyer and exporter of all gold produced within the country. Separately, Ghana's parliament approved an increase in the energy sector levy. The government aims to raise funds to pay down debt in the sector and claims the measure will not lead to higher fuel prices for consumers, citing the recent Cedi appreciation .

Ivory Coast: The government granted Brazil's state-owned energy giant Petrobras exclusive rights during the negotiation for the exploration licences in nine offshore blocks. This bodes well for oil production, in our view, considering Petrobras’s proven track record in offshore production, including challenging deepwater basins. Production from the Baleine field is anticipated to transform Ivory Coast into a significant oil producer by 2028.

Zambia: Former President Edgar Lungu died at age 68 in South Africa. His death creates a leadership vacuum within the main opposition Patriotic Front party and the broader Tonse Alliance coalition, which he chaired. The event is likely to trigger a succession contest and reshape the political landscape ahead of the 2026 general elections.

Developed Markets

Softer inflation in Europe. Softer housing and labour markets in US.

Austria: Fitch downgraded Austria to 'AA' and kept a stable outlook.

Japan: Bank of Japan Deputy Governor Shinichi Uchida said the central bank will not shift policy to help government financing: “In its future conduct of monetary policy, the bank should make it clear that it is not engaging in monetary financing”.3

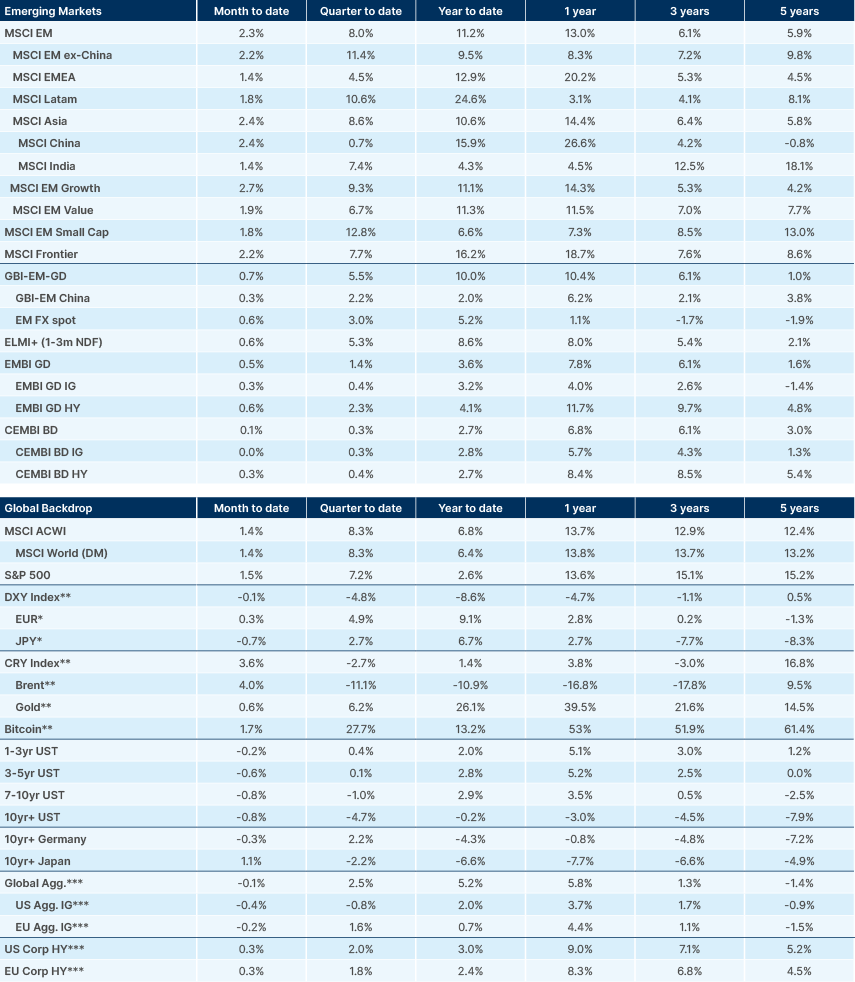

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.ft.com/content/e2525100-e432-4987-8b7d-e6fdb325145e?shareType=nongift and https://www.wsj.com/politics/policy/trump-tax-bill-senate-next-2cd9a63e?mod=hp_lead_pos1.

2. See – https://sg.finance.yahoo.com/news/malaysia-petronas-cut-10-workforce-040302987.html

3. See – See Uchida Says BOJ Won’t Shift Policy to Help Government Financing: https://blinks.bloomberg.com/news/stories/SXH5XADWLU68.