- EM equities extended their winning streak to a 10th consecutive month.

- US and China reached a truce, as China delayed rare earth export controls for a year.

- US also reached trade agreements with Thailand, Cambodia, and Malaysia, but tariffs continue.

- The Fed cut its benchmark policy rate by 25bps, but with a dual-direction dissent.

- India announced capital market reforms and strategic metals investment.

- South Korea boosted as Nvidia plans to sell 260k GPUs to the government and domestic tech firms.

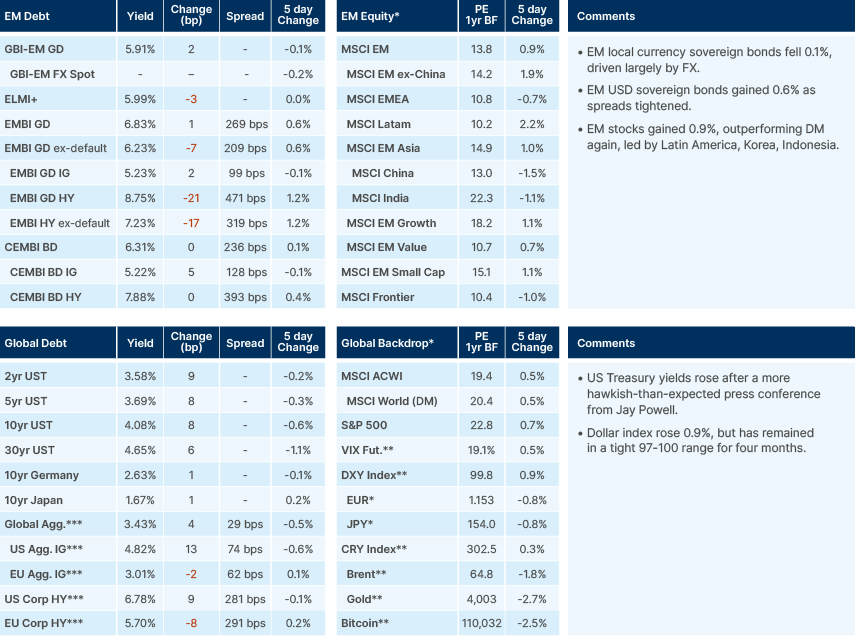

Last week performance and comments

Global Macro

October performance review

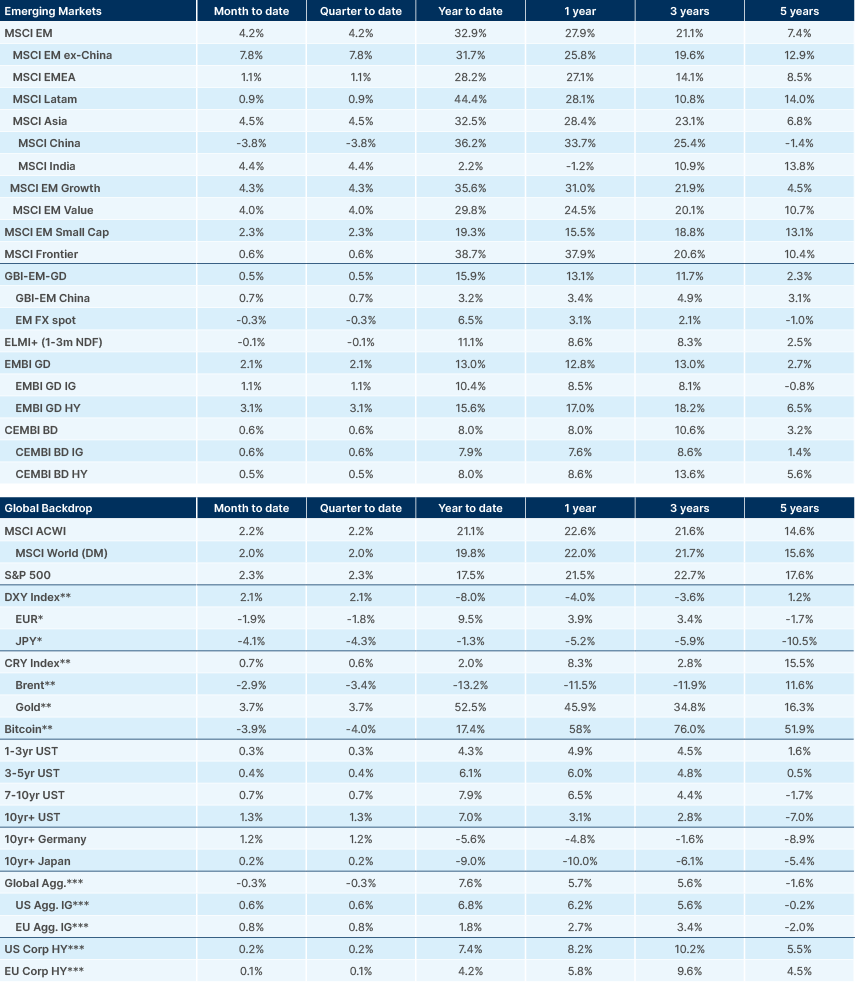

Emerging market (EM) equities (MSCI EM index) extended their winning streak to a 10th consecutive month, bringing cumulative year-to-date total returns to 33.5%. This is well ahead of developed market (DM) peers at 20.2% (MSCI World index). October’s positive performance was led by North Asian heavyweights South Korea and Taiwan but supported by strength across most of the EM universe, including Hungary, Colombia, Chile, Poland and Brazil. Russia and Hong Kong were the main drags. Due to a combination of valuation, earnings and currency returns most EM equity markets have posted double-digit gains year-to-date.

In fixed income, EM hard currency bonds continued to climb steadily, marking six straight months of positive performance. The EMBI GD index is outpacing US investment grade and high yield benchmarks year-to-date as well as over the last three years. EM local bonds (GBI-EM GD index) delivered a modest positive return in October, holding up despite a meaningful 2.1% rebound in the Dollar index. Performance trends have become increasingly differentiated and localised. Latin America and Central and Eastern Europe remain largest contributors to year-to-date gains.

Trade truce

Communications following Trump and Xi Jinping’s meeting in South Korea last week suggest a measured thawing in trade relations between the US and China, with several incremental steps indicating progress toward a broader agreement.

As a start, the US announced that they would delay Trump’s 24% reciprocal tariff on China for another year and the current 20% tariff on Chinese goods linked to their export of fentanyl-related products will be halved to 10%. According to estimates from UBS, this means the average US tariff on Chinese imports is expected to decline from 45% to around 35%, bringing the overall weighted tariff in the US down from 14.9% to 13.6%.

US President Donald Trump also signalled that a more comprehensive trade deal could materialise “soon” and revealed plans for reciprocal leader visits: a US delegation is set to visit China in April, followed by a visit from President Xi Jinping to Washington thereafter. These exchanges suggest a renewed diplomatic channel that could pave the way for further negotiation and coordination.

On the Chinese side, Beijing agreed to delay the implementation of rare earth export controls by one year. US Treasury Secretary Scott Bessent indicated that a formal agreement could be signed as early as next week. Nonetheless, China’s rare earth policy framework continues to serve as a strategic lever, maintaining pressure on US manufacturers reliant on these critical inputs. Beijing also committed to purchasing 12m tons of US soybeans immediately, with an additional 25m tons to be acquired over the following three years. The move underscores China’s continued engagement in agricultural trade and signals an intent to stabilise commercial ties amid broader geopolitical uncertainty.

Beyond US-China relations, several parallel trade agreements, reached last week, highlight Washington’s broader strategy to deepen economic engagement across Asia.

Reciprocal tariffs remain unchanged for several Southeast Asian partners; set at 19% for Thailand, Cambodia, and Malaysia, and 20% for Vietnam. However, additional exemptions could follow as negotiations evolve, suggesting scope for gradual liberalisation. The new trade arrangements with Southeast Asian economies also underscore the US administration’s intent to counter the spread of digital services taxes (DSTs). Cambodia, Thailand, and Malaysia have agreed not to impose DSTs or any comparable measures that would disadvantage US technology and digital firms. The countries also pledged to expand purchases of US energy, aircraft, and agricultural products, further reinforcing trade linkages across multiple sectors.

Separately, the US and South Korea finalised the USD 350bn investment framework. The deal allocates approximately USD 150bn toward shipbuilding, with the remainder to be deployed in annual tranches of around USD 20bn. Meanwhile, Japan reaffirmed its USD 550bn investment commitment to the US unveiled in July. Additional details are expected to clarify Japan’s planned capital expenditures across infrastructure, industry, critical minerals, and energy, reinforcing the depth of bilateral economic cooperation between the two nations.

Lastly, the first round of trade negotiations between the US and Brazil were limited in scope, largely due to the absence of US Secretary of State Marco Rubio. As a result, discussions were confined primarily to tariff-related issues, with both sides agreeing to defer broader conversations on economic cooperation to subsequent rounds.

Supreme Court decision

The US Supreme Court has agreed to hear arguments concerning the scope of presidential authority under the International Emergency Economic Powers Act (IEEPA), with the case scheduled for 5 November. The Court has granted an expedited timeline, and the administration has requested a ruling by year end, reflecting the significant policy and market implications of the outcome.

At issue is whether the administration’s use of IEEPA to justify certain tariffs under a ‘national emergency’ framework is legally valid. Potential outcomes include a full or partial invalidation of tariffs imposed on this basis. However, even if the Court limits the use of IEEPA, the executive branch could still rely on alternative statutory authorities such as Sections 232, 301, 122, and 338, preserving substantial flexibility to maintain or adjust tariff measures. A more targeted ruling is also possible, in which the Court might determine that only specific tariffs don’t match the action taken and are unlawful.

Central bank decisions

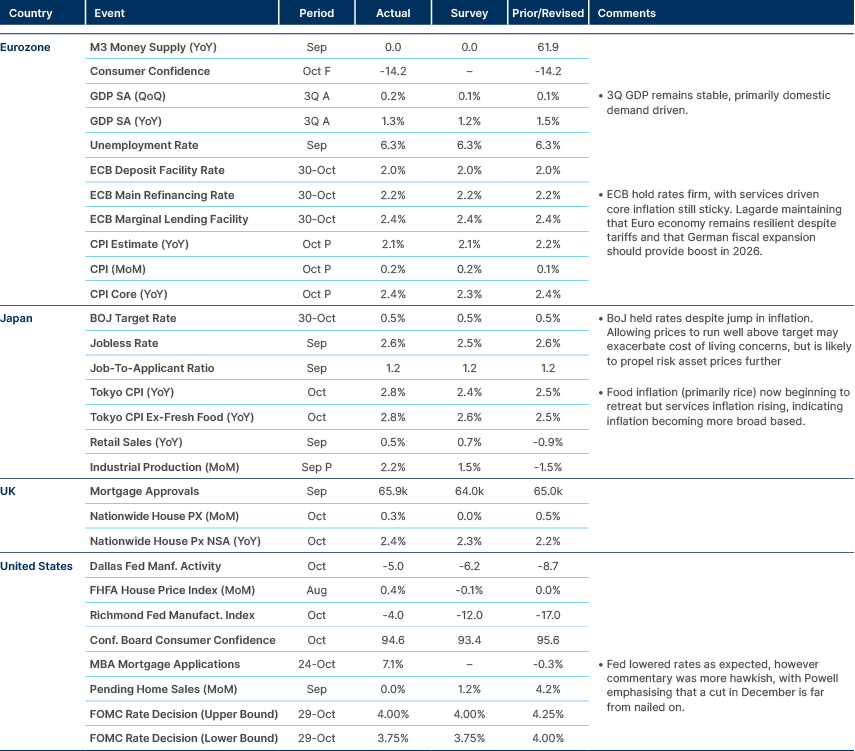

The Federal Reserve (Fed) reduced its benchmark policy rate by 25 basis points (bps), bringing the target range to 3.75-4.00%, in a widely anticipated move aimed at cushioning a softening labour market. However, two-year US Treasury yields posted their largest single-day increase in four months after Fed Chair Jerome Powell remarked that “another cut in December is not a foregone conclusion - far from it” underscoring uncertainty around the policy trajectory heading into year end and beyond.

The decision marked the first dual-direction dissent within the Federal Open Market Committee (FOMC) since 2019. Fed Governor Stephen Miran advocated for a larger 50bps reduction, while Jeffrey Schmid preferred to hold rates steady, highlighting divergent views on the balance between inflation risks and employment conditions.

Powell’s post-meeting press conference drew little attention to the Fed’s independence – a notable shift from prior months. Bloomberg published no related stories referencing Governor Liza Cook, the first such absence in six months. The Supreme Court is scheduled to hold oral arguments in January 2026 concerning broader questions around administrative authority, which could indirectly affect the Fed’s institutional autonomy. Powell’s term concludes in May, with the next Fed Chair announcement expected by Christmas.

In parallel, the Fed’s top banking supervisor Michelle Bowman outlined plans to reduce the supervision and regulation division by roughly 30%, bringing headcount to about 350 by end-2026. The restructuring reflects an ongoing shift toward more targeted oversight and operational streamlining amid a changing regulatory landscape.

Lastly, this week the US Treasury will announce its quarterly refunding announcement (QRA). The consensus is for Treasury (T-bill) issuance to remain unchanged, but the Treasury may formally increase the share of issuance of T-bills to 25%. The higher issuance of T-bills would cut the equivalent of USD 1trn of 10-year equivalent risk. If confirmed, it would represent a significant push to cut duration risk.

The Bank of Japan (BoJ) left its policy rate unchanged at 0.50%, maintaining its cautiously accommodative stance amid persistent global and domestic uncertainties. As in the previous meeting, there were two dissenting votes in favour of a 25bps rate increase, highlighting a gradual rise in internal pressure to normalise policy. Governor Kazuo Ueda emphasised the need for additional data on domestic wage growth and the broader impact of global trade conditions before committing to further tightening.

Commodities

Copper prices retreated 1.8% after briefly touching a record high of USD 11,200 per ton on the London Metal Exchange. The pullback followed profit taking that coincided with the conclusion of the Trump-Xi summit and a subsequent strengthening of the US dollar. The earlier rally had been driven by optimism surrounding the meeting and expectations of renewed global policy coordination.

On the supply side, a bullish signal emerged as China’s Metals Group called for a ceiling on copper production capacity, reinforcing the view that structural constraints could tighten medium-term supply and support prices once near-term volatility subsides.

In oil markets, OPEC+ confirmed plans to raise output by 137k barrels per day in December, aligning with the group’s schedule of incremental increases in October and November. However, the alliance also announced a pause in additional production hikes between January and March, signalling a more cautious approach amid uneven demand recovery and ongoing uncertainty around global inventories.

Geopolitics

President Trump authorised nuclear weapons trials in response to Russia’s recent tests of nuclear-powered underwater drones and cruise missiles. This marks a significant development, as the US has not conducted a nuclear explosive test since 1992. The decision reflects ongoing strategic signalling between Washington and Moscow amid elevated security tensions. The situation in Ukraine was also discussed during talks between Trump and President Xi, indicating that the conflict remains a central topic in broader geopolitical discussions between the US and China.

In a parallel development, both countries agreed to establish direct military communication channels aimed at preventing miscalculation and mitigating escalation risks. According to US Defense Secretary Pete Hegseth, the initiative is designed to “deconflict and deescalate any problems that arise.” Both sides affirmed a shared commitment to maintaining peace, stability, and constructive bilateral relations, signalling a pragmatic step toward restoring trust between the two militaries amid elevated global geopolitical uncertainty.

Emerging Markets

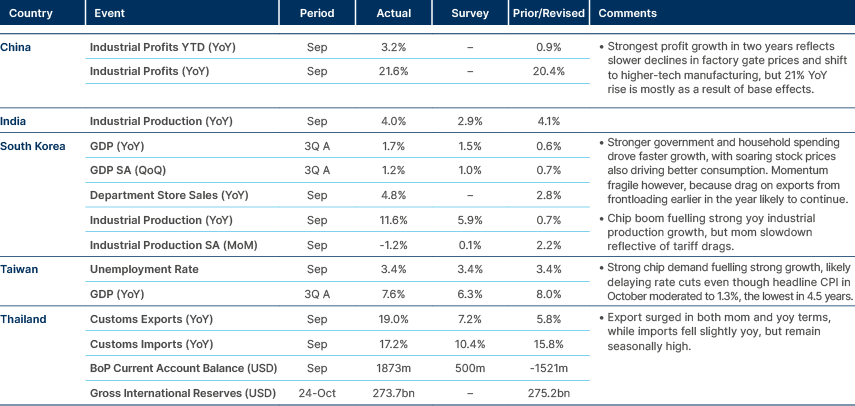

Asia

Positive data across the board, including Korean GDP, and India’s industrial production.

China: Sales among the top 100 property developers fell 41% yoy in October, compared with a 3% decline in the previous month. The sharper drop reflects both a high base of comparison from last year and the waning impact of policy easing measures introduced in Tier-1 cities during August and September.

China’s new Five-Year Plan outlines measures to boost household consumption and strengthen social welfare, signalling a continued shift toward more balanced, domestically driven growth. The government plans to “reasonably” increase spending on public services and social welfare, reduce barriers to service access, and ease restrictions on housing and automobile purchases. It also aims to raise household income shares, expand the middle-income group, “adjust” excessive high incomes, and improve redistribution through tax, fiscal transfers, and social insurance.

Additional initiatives include gradually increasing pension payouts, expanding education access, and raising social insurance participation among flexible and migrant workers. In our view, these measures move incrementally in the right direction to support consumption and income equality, but they fall short of a major fiscal push — indicating no “consumption bazooka,” but steady, measured progress toward rebalancing China’s growth model.

India: The government is set to accelerate financial sector reforms following USD 17bn in portfolio outflows so far this year, which has been partially reversed in October. Regulators are easing capital requirements, facilitating corporate borrowing, and simplifying foreign investor access in an effort to restore confidence and attract long-term investment. While economic growth remains resilient at 6.8%, the Reserve Bank of India (RBI) emphasised that structural reforms and tax simplification are essential to achieving India’s longer-term development objectives.

Separately, India plans to nearly triple its incentive programme for rare earth magnet manufacturing to over INR 70bn (USD 788m), according to Bloomberg reports citing unnamed sources. The initiative aims to build domestic capacity in a sector currently dominated by China and represents a major expansion from the previous USD 290m plan. The proposal, pending cabinet approval, is designed to strengthen supply chain resilience and secure critical materials vital to the electric vehicle, renewable energy, and defence industries.

Indonesia: Finance Minister Purbaya Sadewa outlined plans to narrow the fiscal deficit through a combination of targeted expenditure measures and enhanced revenue collection. Public debt currently stands at 39.9% of GDP, and the government aims to raise the tax-to-GDP ratio by 0.5-1.0%. The increase is expected to come from growth-linked initiatives and efforts to reduce tax leakage, reinforcing a commitment to fiscal discipline while supporting medium-term economic stability.

South Korea: Nvidia announced plans to supply 260k graphics processing units (GPUs) to South Korean technology firms and the government, a deal valued between USD 7.8-10.4bn. The agreement is expected to increase the country’s artificial intelligence (AI) computing capacity fivefold, underscoring South Korea’s ambition to become a regional leader in artificial intelligence infrastructure.

On the domestic front, President Lee Jae Myung described the housing market as a “ticking time bomb,” voicing support for the Bank of Korea’s decision to maintain its policy rate to temper price pressures.

The trade account surplus exceeded USD 6bn, more than double the USD 3bn consensus estimate. Exports rose 3.5% yoy (or 14% when adjusted for the number of business days), while imports fell 1.5%, contributing to the stronger balance. The rebound was driven largely by continued strength in memory chip exports, which surged 25.4% yoy. In contrast, traditional industries remained under pressure due to high input costs and weak global demand: auto exports declined 10.5%, while petrochemical and steel shipments fell 22% and 21.5%, respectively.

Malaysia: The US reached a trade agreement granting US firms greater entry into Malaysia’s industrial and agricultural sectors, while Malaysia pledged not to impose export restrictions on critical minerals, ensuring supply chain stability in key strategic materials. In addition, Malaysia reaffirmed USD 70bn in US investment and procurement commitments, underscoring the deepening economic partnership between the two countries.

Thailand: The Finance Ministry raised its 2025 GDP growth forecast to 2.4%, up from 2.2% previously, citing strong export performance and the impact of fiscal stimulus measures. Growth is projected to moderate to 2.0% in 2026 as external demand stabilises and policy support tapers. Inflation is forecast to remain subdued, at 0.5% in 2026, reflecting persistent disinflationary pressures and a gradual normalisation in energy and commodity prices.

Vietnam: The State Bank of Vietnam (SBV) injected VND 70trn into the interbank market to ease liquidity pressures and stabilise short-term interest rates, which had been rising amid tighter funding conditions. In other news, Vietnam and the US announced a new trade framework granting preferential market access for US exports while maintaining 20% reciprocal tariffs on Vietnamese goods. Under the framework, select Vietnamese products could see tariffs reduced to zero, contingent upon compliance with US regulatory and quality standards.

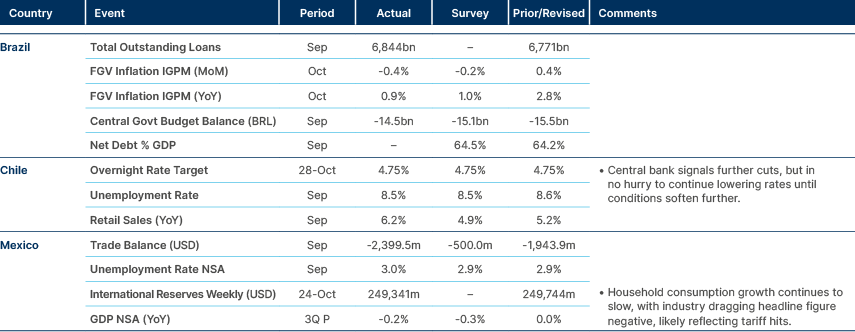

Latin America

Chile, Peru, and Colombia kept policy rates unchanged as expected.

Argentina: President Javier Milei pledged to engage opposition parties to build consensus around key tax, labour, and trade reforms, adding that cabinet adjustments will follow to facilitate political alignment and ensure the smooth implementation of his economic agenda. Meanwhile, central bank Vice President Vladimir Werning outlined plans for a “demand-driven re-monetisation” strategy, under which non-sterilised FX purchases would be used to support M2 (broad money) growth as domestic Peso demand gradually recovers.

Mexico: President Claudia Sheinbaum announced a postponement of US tariffs that had been scheduled to take effect on 1 November, stating that negotiations with President Trump are “close to a non-tariff agreement.” The delay signals ongoing diplomatic engagement aimed at preserving trade stability between the two countries. In other news, Pemex reported a third-quarter loss of MXN 61bn and outstanding supplier debt of MXN 517bn, underscoring liquidity pressures despite continued government support. The company’s total debt stands at approximately MXN 1.8trn (USD 100bn), with nearly half maturing by 2028, highlighting ongoing refinancing challenges with implications for the sovereign balance sheet.

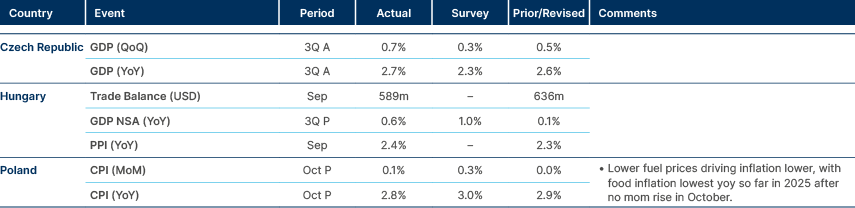

Central and Eastern Europe

Stronger Q3 GDP in Czechia, softer in Hungary.

Poland: Prime Minister Donald Tusk reaffirmed that public debt remains under control despite elevated defence spending linked to the ongoing war in Ukraine. He highlighted that Poland’s debt ratio remains well below that of major EU economies, noting that “fifteen EU countries have higher debt.” Tusk projected October inflation at slightly below 3.0% yoy, and reiterated his commitment to fiscal discipline, while defending temporary deficit expansion to support defence investments. He also pledged to accelerate investigations into alleged corruption scandals involving former Law and Justice (PiS) officials. The deepening of these investigations could further weaken the PiS, but may strengthen far-right alternatives, and reshape Poland’s political landscape, in our view.

Middle East, and Africa

Trade deficit widens in Türkiye as the holiday season draws to a close.

Angola: Social security contributions have increased sharply since 2017, rising 309% to AOA 67bn, supported by tighter collection mechanisms and digital payroll reforms. The number of insured workers has nearly doubled to 3.1m, while registered employer contributors rose 90% to 270k. Despite this progress, more work is due as an estimated 80% of all jobs remain informal.

Kenya: The International Monetary Fund (IMF) raised concerns over the stability of the Kenyan shilling, which has traded in a narrow KES 129-129.3 per USD band throughout 2025. The Central Bank of Kenya (CBK) maintains that the currency’s limited movement reflects robust inflows from remittances and exports, consistent with its flexible exchange rate framework. The debate over currency valuation is expected to resurface in upcoming IMF loan negotiations, following the early conclusion of the previous lending programme.

Nigeria: President Trump issued a stark warning to Nigeria, threatening to withdraw US aid over concerns regarding attacks on Christian communities. He stated that if such violence continued, the US would “immediately stop all aid and assistance” and potentially undertake military action against terrorist groups operating in the country. Nevertheless, USA Facts reports US aid to Nigeria totalled USD 903m in 2024, declining sharply to USD 84m in 2025, suggesting that further reductions would have limited direct economic impact.

Saudi Arabia: Investment Minister Khalid Al-Falih announced that Vision 2030 is approximately 85% complete, highlighting that the non-oil sector now accounts for 56% of GDP, up from 40% in 2016. He noted that GDP has doubled to USD 1.3trn, while female labour force participation has risen to 37%. The announcement came amid a slowdown on several giga-projects due to the decline in oil prices. In other news, Saudi equities recorded their sharpest decline since late September after the Capital Market Authority indicated that reforms allowing majority foreign ownership of domestic firms may take longer than expected to implement.

South Africa: A study by Rand Merchant Bank (RMB) estimated South Africa has USD 75bn in untapped export potential by 2029, surpassing that of Egypt, Morocco, and the Democratic Republic of Congo combined. However, rail and port infrastructure bottlenecks continue to constrain trade competitiveness. Reforms at Transnet and new public-private logistics initiatives are viewed as critical to unlocking this potential and sustaining export-led growth over the medium term.

Developed Markets

Benchmark Performance

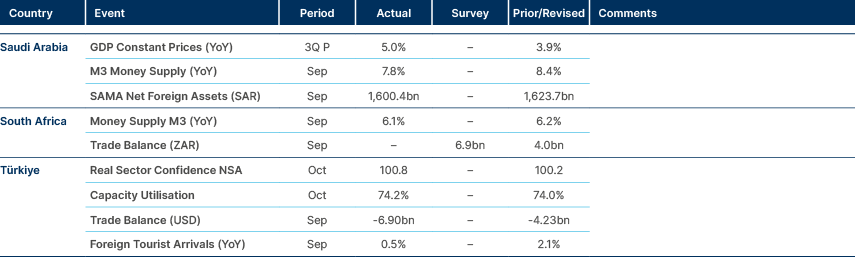

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.