EM Asia regulators acting to boost cheap equity market valuations

Stock markets and bond yields rose last week, led by strong economic activity numbers. Israel rebuffed a ceasefire proposal and attacked Gaza’s southernmost city of Rafah. China replaced its securities regulator, a sign that measures to boost the stock market were afoot. Ali Baba published good results and a very large share buyback programme. South Korea announced several measures to improve feeble stock market valuations two weeks ago. A reputable polling survey pointed towards a first-round victory for Prabowo in Indonesia’s elections this Wednesday. In Pakistan, Imran Khan’s allies gained 38% of seats in parliament last week, more than any other party, but Nawaz Sharif announced the intention to get a coalition government. The Bank of Thailand kept its policy rate unchanged. In Argentina, Milei recalled his Omnibus Bill from Congress, after pressure for more compromises. In Africa, Benin issued its first dollar-denominated Eurobond, and Kenya announced its own transaction in a bid to refinance its large April 2024 maturity.

Global Macro

On Friday morning, December's US consumer prices index (CPI) monthly inflation rate was revised to 0.2%, down from a 0.3% preliminary reading. This translates to a 3.3% annualised rate over the last three months, which was indicated by preliminary reports. Stronger employment data pushed US Treasury (UST) yields to their highest level since 13 December (10-yr UST +15 basis points (bps) to 4.18%). As of Friday afternoon, despite the reassuring data revision, markets were pricing in just a 15% odds of a rate cut in March, and a 59% chance of a cut by May. Despite the move upwards for UST yields over the week, the SP500 rose 1.4% to close above 5,000 for the first time last Friday. The MSCI All Country World Index (ACWI) rose 1.0% with Emerging Market (EM) stocks up 0.8% The main culprit for higher rates was stronger than expected economic activity, while US stocks are still driven by a very narrow leadership from artificial intelligence (AI) stocks and some of the top seven companies that delivered stronger-than-expected results. However, this narrow leadership is increasingly reliant on stocks that discount extraordinary growth over the next years, reflected in the elevated multiples. Last Friday, Nvidia’s market capitalisation exceeded all Hong Kong stocks, for example. The pace of growth of AI appears in bubble territory, with several companies likely to experience a significant de-rating over the next quarters, in our view, as it becomes clearer that such growth expectations are unrealistic.

After a stronger-than-expected manufacturing purchasing managers’ index (PMI) survey, the service sector also surprised to the upside across most countries. In the US, the ISM services PMI rose to 53.4 in January from 50.5 in December, 1.4 points above consensus. New orders increased 2.2 points to 55.0, and inflationary signs abounded as prices paid surged to 64.0 from 56.7 and the employment sub-reading rose to 50.5 from 43.8. However, the S&P Global services PMI slowed by 0.4 points to 52.5. Elsewhere, in Brazil, the Services PMI rose by 2.6 points to 53.1, and by 0.5 to 54.3 in the UK. The exceptions were the Eurozone, where the diffusion index was unchanged at 48.4, and in China where the services PMI declined 0.2 points to 52.7 – still in expansionary territory.

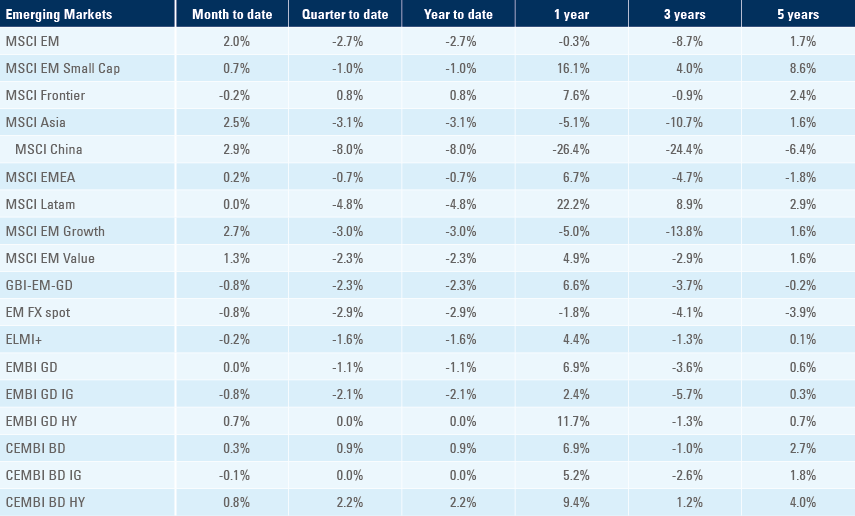

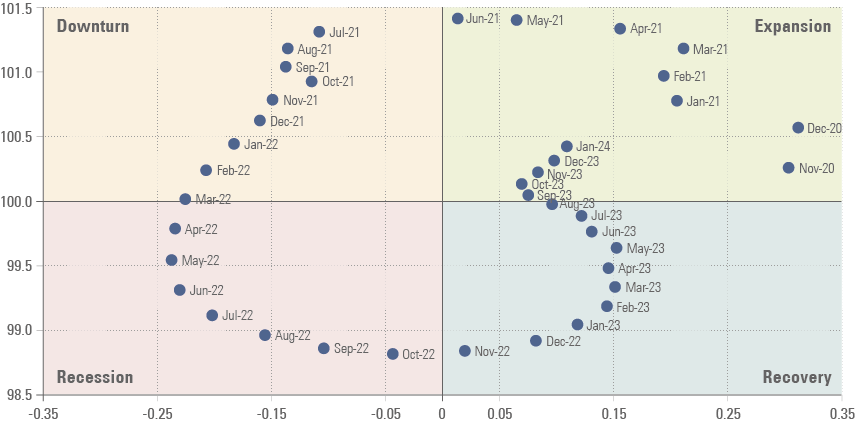

The OECD G-20 leading indicator for both services and manufacturing increased for the third consecutive month to 100.4, a clear picture that the global economy moved from a path towards downturn into a firmer expansion.

Fig 1: OECD G-20 Leading Indicator

Geopolitics

US General Election

Despite months of strong growth, a survey published by the University of Michigan Ross School of Business and the Financial Times showed 42% of Americans felt Donald Trump would be the best steward of the US economy, while only 31% chose Biden. Trump remains the favourite to win the Republican Party nomination. His main risk comes from court challenges in Colorado and Maine. While a Colorado District Court denied an attempt to bar Trump from the election, the Colorado Supreme Court, on appeal, decided in December that Trump had indeed violated Section 3 of the Amendment – the first ruling of its kind. Electoral officers in Maine also made a similar ruling. Trump’s team appealed to the US Supreme Court in Washington, DC, following Colorado’s decision. The Colorado Supreme Court, and the state of Maine, have stayed their rulings until the Supreme Court decides on the case.

Israel/Hamas

Conditions offered by Hamas last week for releasing the 130 remaining hostages included a 135-day ceasefire, the withdrawal of Israel's military from Gaza and the release of 1,500 Palestinian prisoners from Israeli jails. The US Secretary of State Anthony Blinken, who was in Israel at the time, said the proposal “offered space for agreement to be reached”. However, Israel’s Prime Minister Benjamin Netanyahu dismissed it as “delusional”, reaffirming that the only way forward was pushing for “total victory” over Hamas.

Despite pleas from the US and United Nations (UN) not to mount an offensive into Rafah, Israel attacked the area after asking for an evacuation of its civilian population. More than 1 million people are currently sheltering in the densely-populated city next to the border with the Sinai Peninsula in Egypt after being displaced from other parts of Palestine. Netanyahu believes Israel cannot eliminate Hamas without taking out the four Hamas battalions based there.

Commentary from the White House surrounding the conflict is turning increasingly blunt. President Biden stated last week that the offensive is “over the top”, and the death toll of innocents “has got to stop”. Riyadh also released a statement last week that there would be “no diplomatic relations with Israel unless an independent Palestinian state is recognised on the 1967 borders”.

Emerging Markets

EM Asia

China: Last Wednesday, Xi Jinping replaced the head of its securities regulator, appointing Wu Qing, a banking and regulator veteran who previously headed the Shanghai Stock Exchange and has a reported zero tolerance for wrongdoing. On the same day, consumer company Yum China posted a 19% yoy increase in revenues and 98% yoy increase in net income. In macroeconomic news, CPI inflation declined 0.8% yoy in January, 30bps more than expected from a 0.3% drop in December. New yuan loans jumped to RMB 4,920bn in January from RMB 1,171bn in December, above the consensus at RMB 4,500bn, as the People’s Bank of China’s easing policies started getting some traction. Among the measures so far, it has injected RMB 500bn into the banking sector via a targeted loan scheme and lowered the reserve requirement ratio (RRR) by 50bps to 10%.

Ali Baba

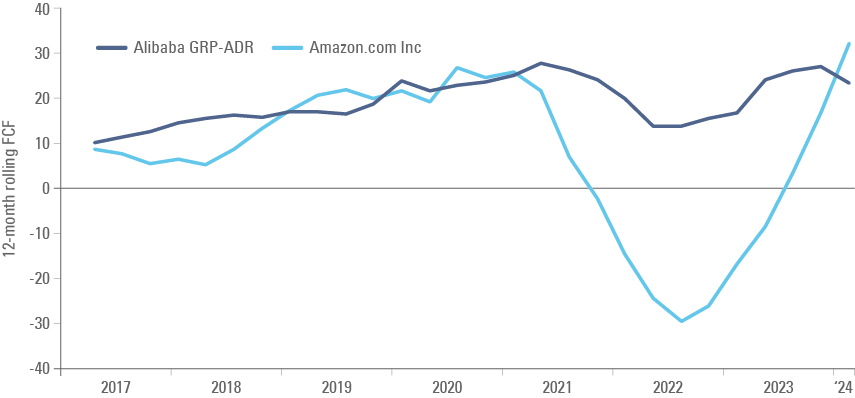

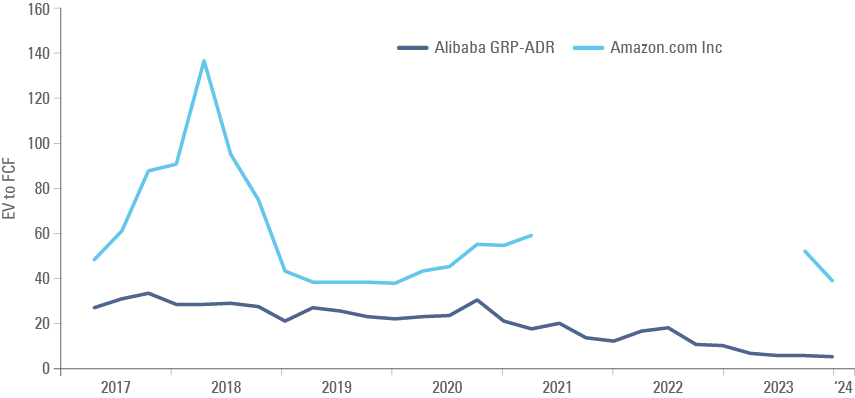

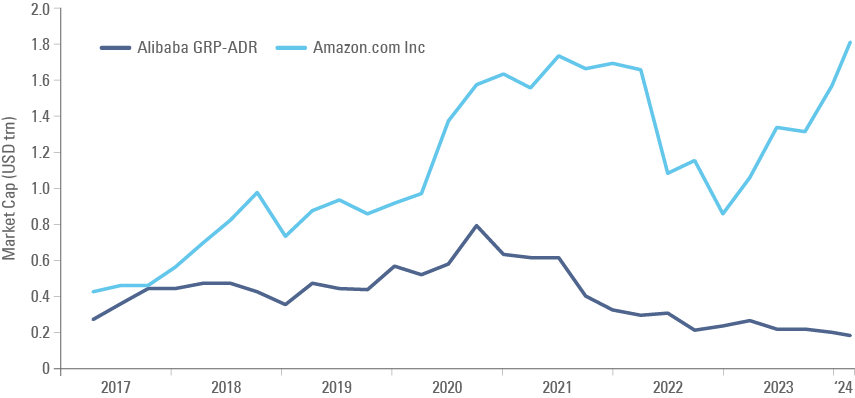

The Chinese multinational’s revenues increased 5% yoy, led by its e-commerce division, in line with estimates, albeit the company’s cloud division grew only 3%. It announced a USD 25bn increase in its share buyback to USD 35.3bn over the next three years, equivalent to 18% of its market cap and 23% of its free float. Investors fear the company will struggle to rekindle growth, albeit Ali Baba seemed to be punished by investors despite managing the Covid-19 cycle in a better fashion than its large US peers, as per Fig 2. In December, the company held USD 117bn in cash and equivalents and USD 75.9bn after excluding preferred shares and debt. The net cash is equivalent to 41% of its total enterprise value. Ali Baba trades at 5.2x free cash flow, against 38.6x of Amazon, while remaining free cash flow positive during the post-pandemic period, as per Fig.3. Founder Jack Ma has also been buying shares, in contrast with Amazon founder Jeff Bezos, who sold shares recently. The last time Bezos sold shares was in 2021, when the company traded at similar market capitalisation as per Fig 4. The value gap between Ali Baba and Amazon is symptomatic of the broader Chinese stock market value opportunity, in our view. While it is hard to identify the precise timing of closing such gaps, in the medium-term, company values will reflect their fundamentals rather than the recent hype.

Fig 2: 12-months Rolling Free Cash Flow

Fig 3: EV to Free Cash Flow

Fig 4: Market Cap (USD Bn)

Indonesia: GDP grew 5.0% yoy in Q4 2023 from 4.9% in Q3, in line with expectations. In political news, pollster Indikator Politik published its latest survey based on sampling from 28 January 2024 to 4 February 2024. The coalition between Prabowo Subianto and Gibran Rakabuming had 51.8% of vote intentions, followed by Anies-Muhaimin at 24.1%, and Ganjar-Mahfud 19.6%, with 4.5% undecided. The survey result indicated Prabowo-Gibran winning in first round elections this Wednesday, 14 February.

India: The Reserve Bank of India (RBI) maintained its cash reserve ratio at 4.5% and its repurchase rate at 6.5%, as expected.

Pakistan: Independents linked to Imran Khan's Pakistan Tehreek-e-Insaf (PTI) Party won 93 out of 265 National Assembly seats in the Pakistan general election last Thursday. Other independent parties siding with Khan won another eight seats. This was a big surprise to the two other parties, considering Khan is in jail and could not run. The election was highly contentious, marred by accusations of poll rigging and violent protests, causing a delay in results. Former Prime Minister Nawaz Sharif's Pakistan Muslim League (PMLN) won 75 seats and Bilawal Bhutto Zardari’s Pakistan People's Party (PPP) gained 54 seats. As results came in stages over Friday and Saturday, due to delays in vote counting, both Imran Khan and Nawaz Sharif claimed victory. Sharif's PMLN and Bhutto’s PPP issued a statement saying they planned to work together to bring political stability. If no deal is reached, Pakistan's military will step in. Heightened uncertainty over the political transition does not bode well for implementing the economic reforms necessary to push on with a new bailout programme from the International Monetary Fund (IMF) expiring in April, which is the first item on the agenda for whichever coalition takes power.

Philippines: The yoy rate of CPI inflation dropped to 2.8% in January, 30bps below consensus, from 3.9% in December. Core CPI declined by 60bps to 3.8% yoy as both measures are now within the central bank’s 2%-4% inflation target. Rice prices increased by 22% yoy.

South Korea: On 1 February, Finance Minister Choi Sang-mok highlighted the need to address the persistent undervaluation of the stock market. He spelt out three key policy goals: 1) improve shareholder value; 2) promote fair market rules; and 3) support investment demand. Choi added the government plans to release a detailed “Corporate Value Up Program” in March. The policies that have been implemented or being explored so far include: 1) an equity short sale ban; 2) narrowing the scope of ‘large shareholders’ to lower capital gains tax; 3) abolishing the scheduled/planned capital gains tax; 4) further lowering equity transaction tax; 5) discussing a potential cut in inheritance tax; 6) increasing the size of allowance for individual savings accounts (ISAs); 7) provide stronger protection for minority shareholders; 8) launching a program’ to address ‘Korea discount’ by boosting market valuation multiples; 9) providing dividend amount information; and 10) improving transaction convenience for investors. The Korea Financial Investment Association (KOFIA) has suggested two additional policies: 1) incentivise listed companies to raise dividend payout ratios, and 2) improve shareholder return policies via share buybacks and cancellations. The policy reforms are similar to those undertaken by Japan last year which, alongside its ultra easy monetary policy, was successful at revaluing Japanese stock markets. In another relevant market development, it is very likely, in our view, that Korean Treasury Bonds could be included in the Citibank World Global Bond Index as early as March or September 2024.

Thailand: Prices were flat in mom terms and contracted 1.1% yoy in January, 20bps more than expected from -0.8% yoy in December. Core CPI inflation was down 10bps to +0.5% yoy over the same period. Government measures to subsidise electricity tariffs and diesel costs, as well as falling vegetable prices, are driving downward pressure on prices. Prime Minister Srettha Thavisin pressed for the Bank of Thailand (BoT) to cut rates, saying a 25bps rate cut would help people and not stoke inflation. However, the BoT kept its policy rate at 2.5%, with two out of seven members of the committee voting for a 25bps cut. It is likely the BoT will cut policy rates in its next meetings for purely technical/fundamental reasons, in our view. Over the last three months, consensus expectations for GDP growth expectations declined by 50bps to 2.3% in 2023 and by 40bps to 3.2% in 2024. Lower tourism per capita, elevated inventory levels, and an unexpected decline in public investment were the main culprits.

Taiwan: CPI inflation fell to 1.8% in January, from 2.7% in December (est. 2.2%). This was its lowest point in seven months. However, a large factor here is the timing of the Lunar New Year Holidays, which were in January last year, but are in February this year. In January, exports rose 18.1% yoy, from 11.8% in December (a 19.5% increase was expected). Imports spiked at the beginning of the year, up 19% yoy from -6.5% in December. The consensus estimate was a 4.8% contraction.

Latin America

Argentina: In a surprise move, President Javier Milei pulled back the Omnibus Bill from Congress. Last Friday, the bill was approved, in general terms, by the Chamber of Deputies. However, in an article-by-article approval process on Tuesday in Congress, Governors rejected numerous articles of the bill. As a result, Milei chose to adjourn the session and freeze the bill until further notice. He then released a hearty attack on the “political elite” who pushed against his reforms, calling them part of “the caste against the people”. While Milei’s political pragmatism has been encouraging since he took office, his latest reaction shows the challenges of implementing radical changes in a country like Argentina. Vehicle sales dropped to 15.9k in January, the lowest level of the series except during the 2001-2002 depression and the Covid-19 shock. Vehicle production declined to 22.6k, from 37.0k, in line with its seasonal pattern over the last ten years.

Brazil: The current account deficit declined to USD 28.6bn in 2023, or 1.3% of GDP, as the trade surplus rose to 3.7% of GDP in 2023, from 2.3% in 2022, more than compensating for the increase in the primary income deficit to 3.3% of GDP from 2.9% over the same period. This was the narrowest deficit since 2017 (-1.2% of GDP). Foreign direct investment declined by USD 13bn to USD 62bn in 2023 (more than twice the current account deficit), mostly due to lower intercompany loans. The producer price index (PPI) moved to 0.3% deflation in mom terms in January after rising 0.6% mom in December, bringing the yoy rate of deflation down another 30bps to 3.6% over the period. Net debt rose from 59.5% of GDP to 60.8% in December.

Chile: Former President Sebastián Pinera died in a helicopter crash. President Gabriel Boric held a state funeral on Friday, saying Pinera had “genuinely sought what he believed was best for the county”.1 Pinera was known as one of the great Latin American statesmen, leading Chile from 2010 to 2014 and from 2018 to 2022.

Colombia: CPI inflation increased 8.3% yoy in January, from 9.3% in December. Core CPI decreased, however, to 9.7%, from 10.3% in December.

Mexico: In January, CPI inflation rose to 4.9% yoy from 4.7%, as expected. This was the third consecutive monthly increase in the headline inflation rate, but was mainly driven by a transitory spike in fresh food prices. Core CPI continued its downtrend, falling to 4.8% from 5.1% yoy. On Thursday, the overnight rate was kept at 11.25%, as expected. However, forward guidance at the meeting indicated Mexico may start cutting rates in March, should inflation stay under control.

Paraguay: The government issued a USD 500m 6.0% coupon 2036 bond and a PGY 3.64tn (c. USD 500m). The three major rating agencies rate Paraguay ‘BB+’, but it is a candidate for an upgrade to investment grade, owing to years of centre-right pragmatic governments implementing sound policies. The Euroclear local currency bonds are likely to be included in local currency bonds benchmark, with a small weight initially. We believe Paraguay will benefit from broadening access to foreign investors by making the local bonds Euroclearable.

Peru: Peru cut its reference rate by 25bps to 6.25%, as inflation has slowed more than forecast in recent months.

Central and Eastern Europe:

Hungary: Industrial production declined by 8.7% in working day adjusted (WDA) yoy terms in December from -5.3% prior, as retail sales contracted by a 0.2% yoy rate improving from -5.4% over the same period. CPI inflation rose 3.8% yoy in January, down from 5.5% in December and 50bps less than expected.

Poland: The base rate was kept at 5.75%, as expected. The National Bank of Poland will likely only be able to make its next move after the government decides how and when to lift the 0% VAT rate on food and the freeze on energy prices.

Romania: Retail sales growth slowed to 1.5% yoy, from 3% in December, falling 0.2% mom.

Central Asia, Middle East, and Africa

Benin: The Republic of Benin issued its debut Dollar Eurobond with a 14-year USD 750m issuance at 8.375%, which was more than 5x oversubscribed. Benin is a very well-managed country, from a macro perspective, and has benefited in the past from the large Nigerian consumer market on its western border, in our view. Benin had initially issued in the EUR market as it uses the West Africa CFA Franc pegged to the single European currency.

Egypt: Urban CPI inflation rose 29.8% yoy in January, slowing from 33.7% in December. This is the fourth consecutive month of lower CPI prints. Services and food inflation moderated most significantly in the month, dropping from 60.5% to 47.9%, and 40.6% to 32.8%, respectively.

Kenya: The Central Bank of Kenya hiked its policy rate by 50bps to 13.0%, the third hike since Kamau Thugge became Governor in June. Only two out of eight economists surveyed by Bloomberg expected a hike. The move was partially motivated to backstop the pressure on the Shilling, which has depreciated more than 35% since 2019 after remaining stable at KES 100 per dollar for nearly five years. Thugge said, “the Monetary policy Committee (MPC) noted the continued, albeit reduced, pressures on the exchange rate and therefore concluded that further action was needed to stabilise prices”. The yoy rate of CPI inflation declined to 6.9% in January 2024 from 9.2% in March 2023, within the central bank target of 5.0% +/- 2.5%. Nevertheless, the weaker KES brought PPI inflation up to 10.5% in yoy terms in December from 8.9% yoy in September 2023 (retracing after dropping from 16.7% yoy in June 2022). Foreign exchange reserves stood at USD 7.1bn, equivalent to 3.8 months of import cover. On the heels of the successful Ivory Coast and Benin offers, Kenya announced a Eurobond issuance for 7-year amortising in three instalments (six-year weighted average life) and a buyback of its USD 2.0bn April 2024 maturity. The Kenyan government is refinancing its debt at unsustainable levels, in our view, as the yield on the equivalent 2028 bullet Eurobond was above 10% at the close last Friday. Kenya will have to rely more on multilateral credit and implement a thorough fiscal consolidation to avoid a confidence crisis in the next recession, in our view.

Turkey: CPI inflation mom rose to 6.7% in January, from 2.93% in December. This was 20bps higher than expected, and the largest monthly increase since August. This spike in inflation stems from a rise in the 2024 minimum wage, which the Turkish Government has set at TRY17k, a 100% increase from 2023.

Developed Markets

United States: December's trade deficit remained largely unchanged from the month before at USD 62bn. Initial jobless claims declined by 11k to 218k for the week ending on 3 February, and continuing claims were down 23k to 1,871k in the previous week.

Europe: PPI deflation accelerated to 0.8% mom in December from 0.3% in November, as the yoy rate declined by 180bps to -10.6% over the period. Deeper producing price deflation is a sign the European Central Bank may ease monetary policy before the US Federal Reserve. Retail sales declined by 1.1% in mom terms in December after rising 0.3% mom in November.

Australia: The Reserve Bank of Australia kept its policy rate unchanged at 4.35%, in line with consensus.

Japan: Japan's current account surplus narrowed to JPY 744bn in December, from JPY 1,925bn in November.

1. See – https://www.reuters.com/world/americas/chile-ex-president-sebastianpinera-dies-helicopter-crash-local-media-says-2024-02-06

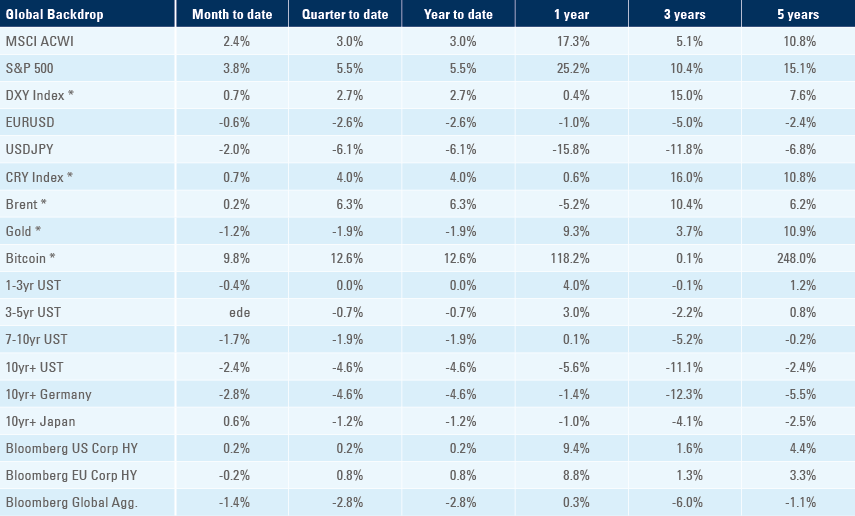

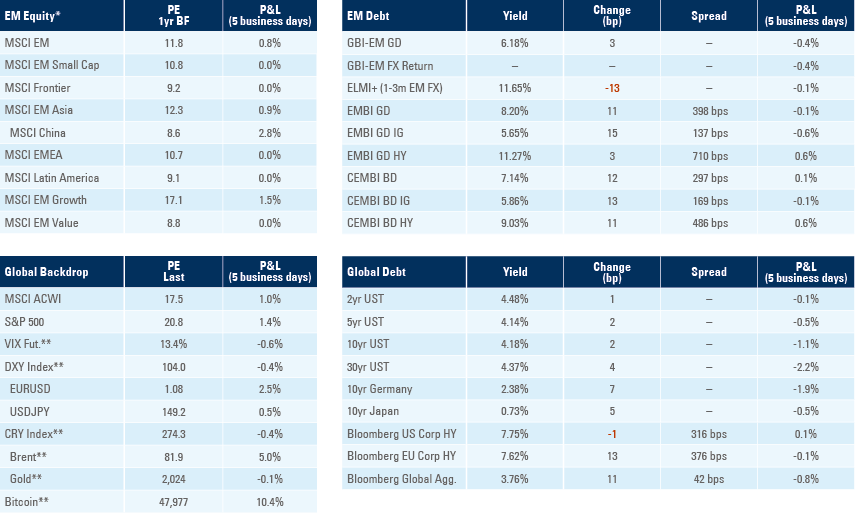

Benchmark performance