Sell-side economists revised real GDP growth higher over the last three months across two-thirds of Emerging Markets (EM) and frontier markets (FM) countries,1 while lower revisions affected one-third of EM economies. This data stands in contrast with the latest revision of global GDP growth by the International Monetary Fund (IMF), which reduced its EM growth forecast for 2021 but increased DM growth forecasts.

However, the IMF also revised 2021 GDP higher in 58% of countries, and revised GDP lower in only 39%, which means the EM cuts are concentrated in a few large countries. Another Covid-19 wave recently hit a few countries in Asia, but economies suffered a much lower impact from the second and third waves than the first.

Furthermore, a surge in vaccination pace alongside mobility restrictions in 1H 2021 drove cases and deaths lower across most EM countries, supporting further upside growth surprises for EM countries against both expectations and DM.

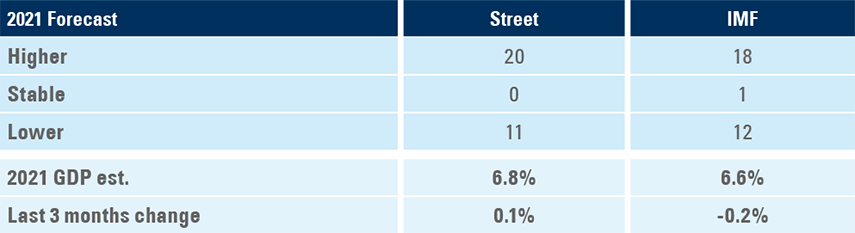

EM real GDP growth revisions

Sell-side economists (‘the Street’) recently increased their growth forecast for 20 out of 31 large EM and FM countries (65% of total) and cut only 11 countries (35%) as per Figure 1.2 The same figure shows that, on a GDP-weighted basis, the street modestly increased its 2021 real GDP growth forecast by 0.1% to 6.8% over the last 3 months.

Fig 1: Real GDP growth forecast revisions (last 3-months)

In comparison, the IMF raised or kept unchanged its real GDP growth forecasts for almost the same number of countries as the Street. The IMF GDP-weighted forecast for the same group of 31 countries was 0.2% lower at 6.6%.

Misleading headlines

However, the recent World Economic Outlook growth forecast had a very different headline. Last week the IMF kept its 2021 global real GDP growth expectation unchanged at 6.0% raising their DM real GDP growth forecast by 0.5% to 5.6% while reducing their EM forecast by 0.4% to 6.3%.3 The headline data is misleading in our view, considering the IMF increased its real GDP growth for most EM countries, broadly in line with the Street as per Figure 1. In fact, the bulk of the EM growth forecast reductions seem to be concentrated in a few large countries: China -0.3% to 8.1% and India -3.0% to 9.5%.

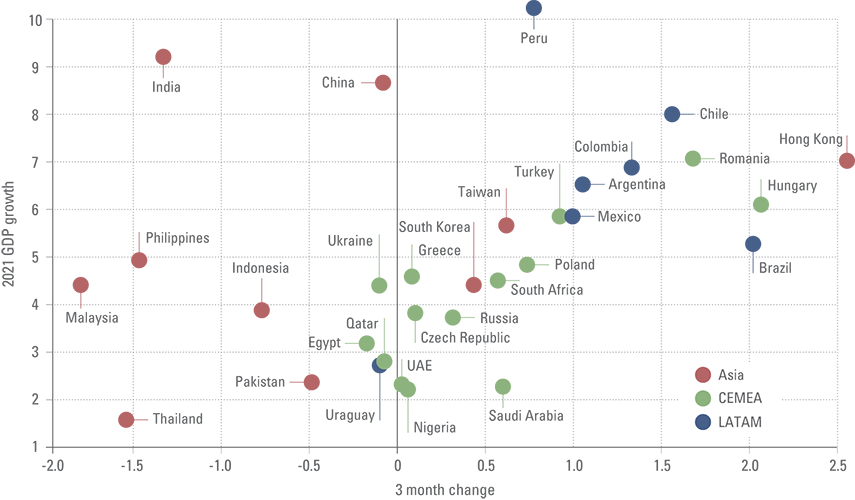

EM 2021 real GDP growth by country

Over the past three months, the Street only reduced real GDP growth meaningfully in Asian countries that suffered mobility restrictions owing to the coronavirus pandemic – Malaysia, Philippines, Thailand, India and Indonesia – as per Figure 2.

Fig 2: Street 2021 real GDP growth forecast

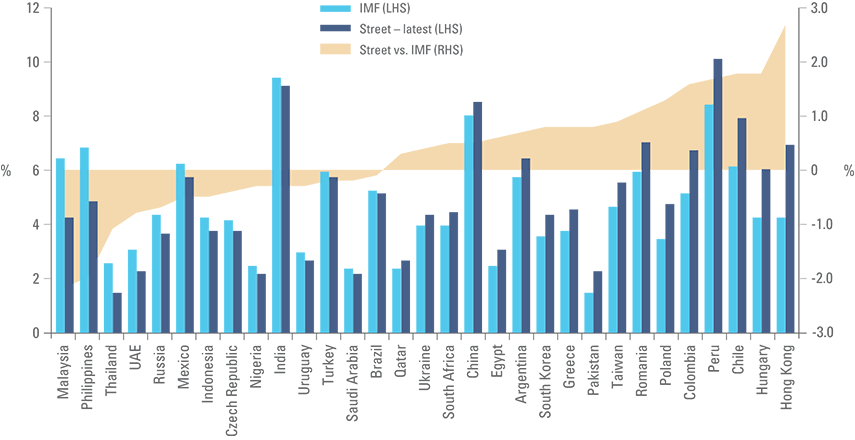

Curiously, the IMF growth forecasts remains much higher than the Street forecasts in these very same countries (Figure 3), suggesting either the IMF expects a lower impact from the Covid-19, or the IMF forecasts are lagging the Street’s adjustments.

Fig 3: 2021 real GDP growth forecasts major EM countries: IMF vs. Street

It is also noticeable that the Street has raised its 2021 real GDP growth forecast meaningfully for regions that experienced large waves of Covid-19 cases in 1H 2021 – Latin America, Eastern Europe as well as South Africa. Growth expectations are also higher in South Korea and Taiwan, despite some lockdowns imposed in both countries. This suggests that the impact of the current lockdowns on economic activity has been lower than originally expected, probably due to a combination of reasons: First, the current lockdowns are province-specific, which means countrywide industrial activity and consumption did not collapse like in the first Covid-19 wave last year. Second, many economies have ‘learned’ how to live with the pandemic with lockdowns confined to hotspots whilst essential activities, production and construction continued. Thirdly, the service sector has adapted well to working from home.

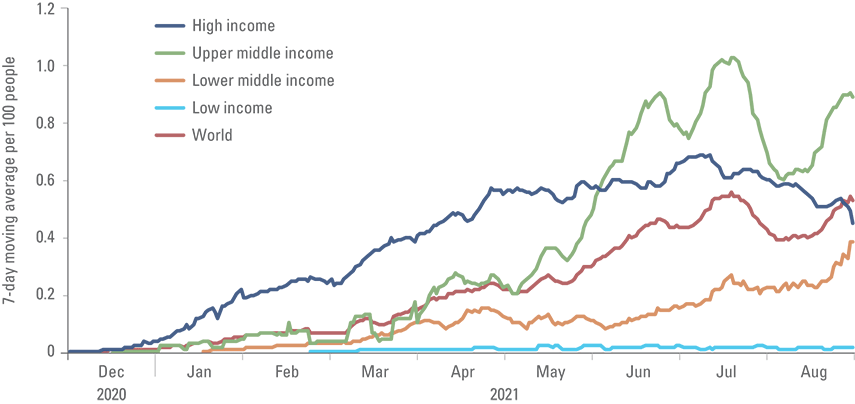

Furthermore, the pace of Covid-19 vaccinations has consistently improved across EM economies for a number of months as per Figure 4.4 Faster vaccination alongside mobility restrictions in selected countries led to a strong decline in cases and fatalities across Latin America and Eastern Europe.5 Only a few Asian countries, such as Malaysia, are experiencing a significant increase in Covid-19 cases, as cases are declining in Indonesia and have stabilised in most other Asian countries including Vietnam. China is now taking precautions against an increase in cases across provinces despite the fact that total daily cases remains below 100 at the time of writing, a very low number both in absolute and relative terms.

Fig 4: Vaccine doses administered daily (7-day moving average) per 100 people

Therefore, if the impact of the pandemics in Malaysia, Indonesia, the Philippines and Thailand is not as bad as priced, this may lead to upward revision in their growth forecasts over the next months. On that note, last week the Street revised its 2021 real GDP growth in India by 0.2% to 9.2%, as leading indicators point to better economic performance than originally expected, in spite of the pandemic. Malaysia’s surprisingly stronger than expected trade data also suggests its economy may have weathered the lockdown better than feared.

DM real GDP growth revisions

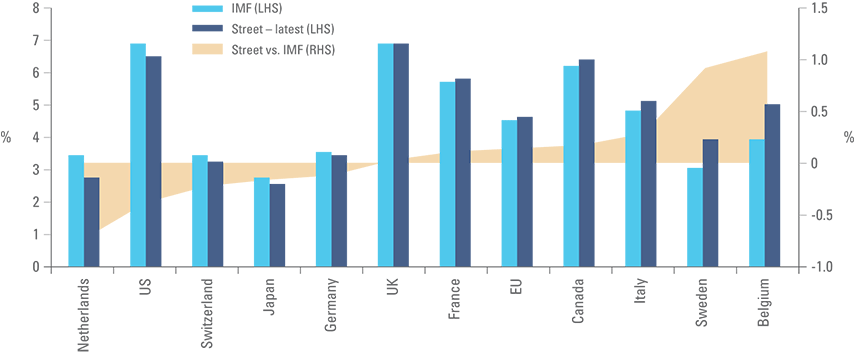

Lastly, the Street estimate of 2021 growth across major DM economies such as the US and Japan is lower than the IMF by 0.4% and 0.2% respectively, as per Figure 5. If the Street is right, a large part of the IMF growth revisions in DM may ultimately not take place, another factor that would meaningfully change last week’s headlines.

Fig 5: 2021 real GDP growth forecasts major DM countries: IMF vs. Street

Conclusion

In summary, investors should look beyond headlines when assessing short-term real GDP growth across EM. Investors should instead focus on factors impacting long-term growth potential, in our view.

The Street has been increasing its growth forecasts across two-thirds of EM countries, mostly due to a lower impact from the last Covid-19 waves. With the pace of vaccination accelerating across large EM countries, future growth revisions maybe biased to the upside, in our view.

1. A selected group of 31 large EM and FM countries comprised of: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hong Kong, Hungary, India, Indonesia, South Korea, Mexico, Malaysia, Nigeria, Peru, Philippines, Pakistan, Poland, Qatar, Romania, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, Ukraine, United Arab Emirates and Uruguay.

2. Sell-side analysts weighted by quality of research includes: Bank of America, Barclays, BNP, Citibank, Deutsche Bank, Fitch, Goldman Sachs, HSBC, Itau, JP Morgan, Morgan Stanley, Nomura, Scotiabank, ICBC Standard Bank, Standard Chartered and UBS.

3. See https://www.imf.org/en/Publications/WEO/Issues/2021/07/27/world-economic-outlook-update-july-2021

4. See ‘Another week of hawkish surprises and faster vaccinations in EM’, Weekly investor research, 28 June 2021.

5. See ‘Covid-19 casualties continue to decline across most EM’, Weekly investor research, 19 July 2021.