- A landslide victory in Mexico led to higher market volatility as it raised constitutional risks, while coalition governments in South Africa and India led to a more muted market response.

- The IMF struck deals with Zambia, Ukraine, and Ecuador.

- Zambia concluded its debt restructuring under the G-20 common framework.

- Far-right parties increased their share in the European Parliament, which motivated Macron to call for early French elections.

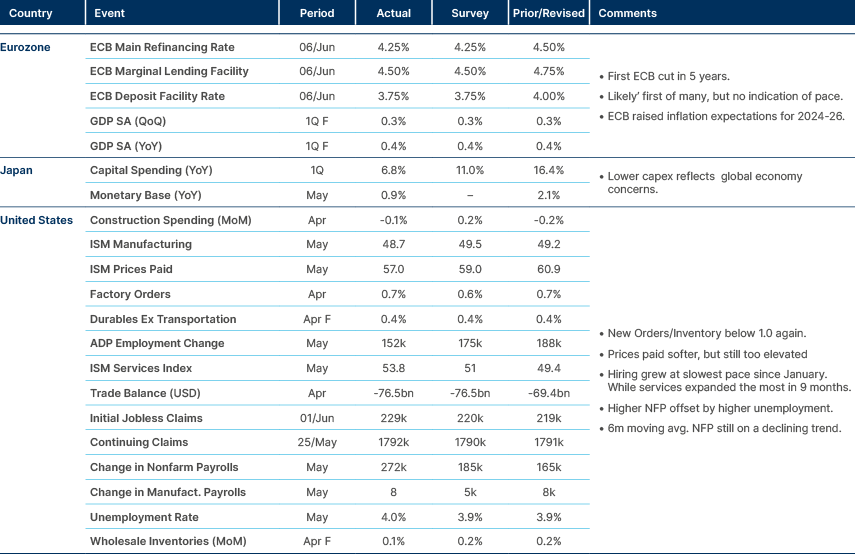

- The ECB cut rates for the first time in five years, with the BoC also initiating cuts.

- Manufacturing and service sector PMIs improved at the margin.

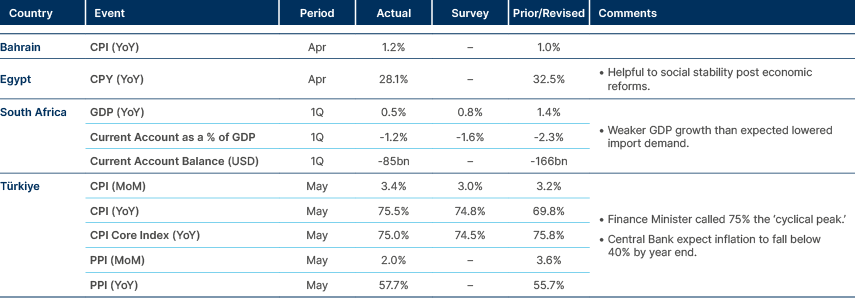

Last week performance and comments

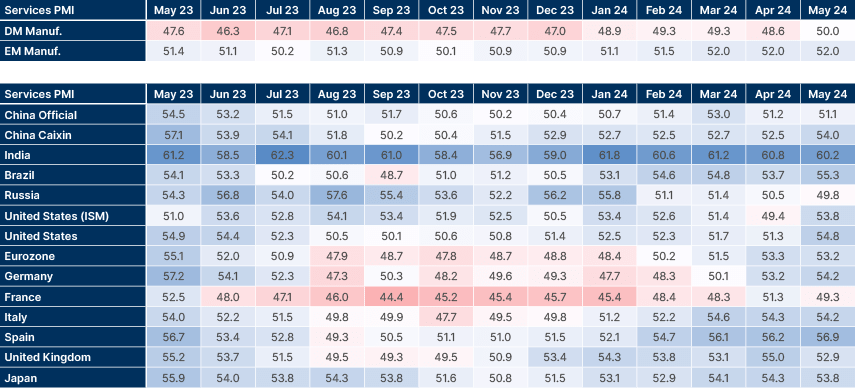

Global Macro

The European Central Bank (ECB) cut its policy rates by 25 basis points (bps), lowering the key deposit rate to 3.75%. The ECB cited a “markedly” improved inflation picture, which halved since rates peaked and halved again to 2.6% in the nine months that rates were unchanged, rendering real interest rates too elevated amidst soft economic activity. ECB President Christine Lagarde gave little indication of when the next cut would come, however, ECB guidance implies an intermittent cut cycle with a 25bps rate reduction per quarter. The ECB staff increased their inflation forecast to an average of 2.5% in 2024 and 2.2% in 2025, while GDP growth is expected to reach 0.9% in 2024 and 1.4% in 2025. The Bank of Canada (BoC) also cut its policy rate 25bps to 4.75%. BoC Governor Tiff Macklem said it was reasonable to expect further cuts, but noted it will take interest rate decisions “one meeting at a time”, allowing it to adjust its stance if inflationary pressures resurface.

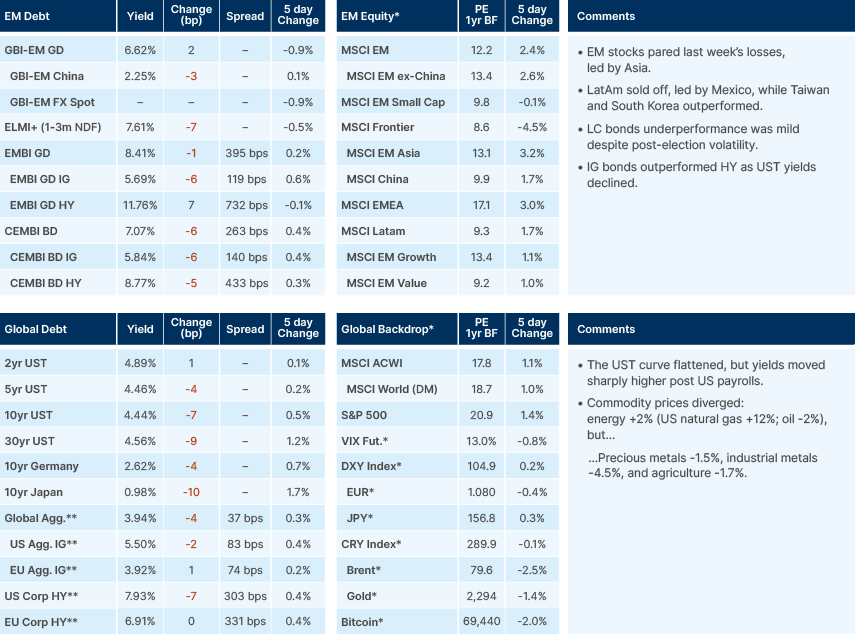

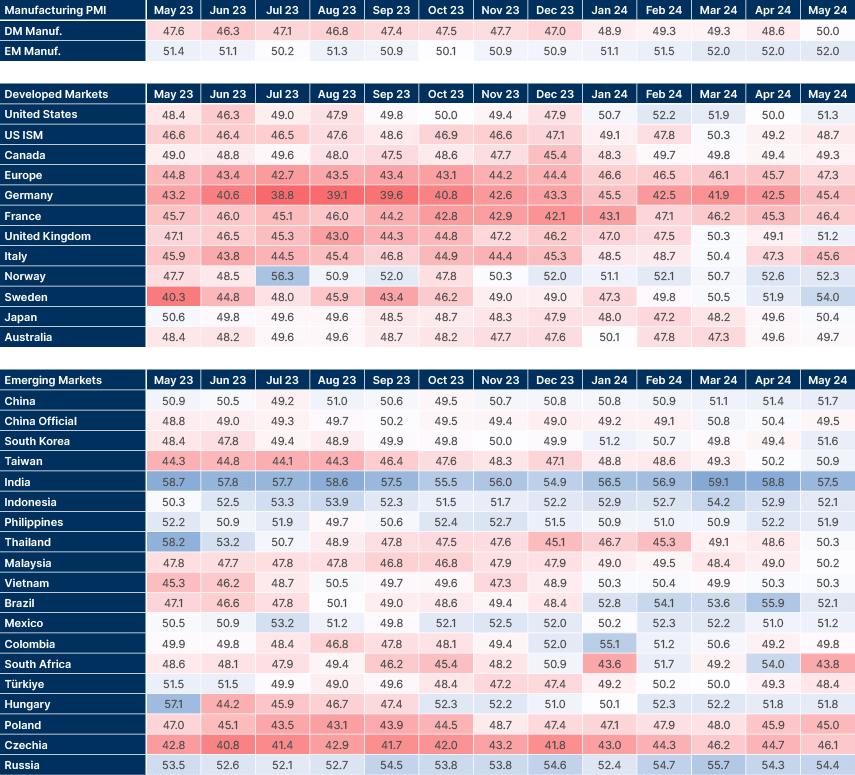

Fig 1. Purchasing Managers’ Index (PMIs)

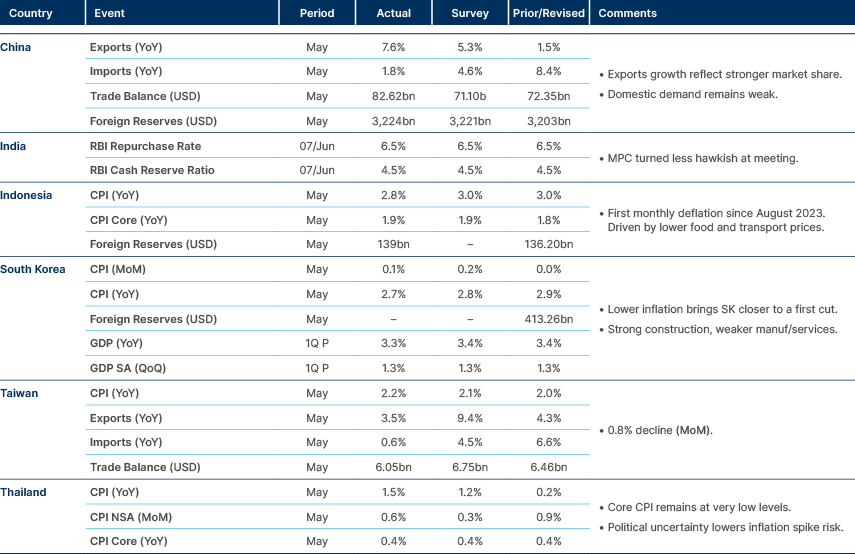

The manufacturing PMIs improved marginally with Developed Markets (DM) increasing, led by the US, Europe, and the UK, as per Fig. 1. Nevertheless, the ISM Manufacturing survey (another diffusion index survey more concentrated in larger corporations, but with a longer track record), deteriorated to below 50 as the new orders to inventory ratio dropped below 1.0. New orders/Inventories dropped below 1.0 for the first time since May 2023. The services PMI improved as well, led by the Eurozone.

The Emerging Market (EM) manufacturing and services PMIs were unchanged as the technology-heavy countries (China, Korea, Taiwan, and Malaysia) improved while South Africa, Brazil, India, and Indonesia declined. In China, the Official PMI – also more concentrated in larger corporations – declined slightly below 50. Overall, not only do EM PMIs remain above the level of DMs’, but their deviation versus the long-term average remains much more positive. The EM services PMI was unchanged, with China and Brazil improving while India, and Russia deteriorated marginally.

Geopolitics

Centre and far-right parties had strong gains in the European Union (EU) parliamentary elections, roughly in line with polls. The far right is expected to increase its share of seats from c.17% to c.25%. The main consequence of these results was French President Emmanuel Macron dissolved parliament after a big defeat to the far-right National Rally (RN) Party. Early elections for the remainder of the current term (until 2027) will take place on 30 June and 7 July.

Macron’s political calculation is multifaceted. In France, each of the 577 seats in the National Assembly is appointed by a simple majority hurdle, over two rounds if necessary. Furthermore, the turnout for the European Congress was 52% in France (up from 50% in 2020) and is much lower than national French elections at 72%, which was the lowest since 1969. Thus, both the voting system and population behaviour tend to favour centrist parties and positions. Another element justifying the move was the fact that the far left has been struggling to coalesce around a single narrative/coalition, presenting an opportunity for Macron to outperform in relation to the current polls, which gives his Renaissance coalition only 15%, vs 33% for Le Pen’s RN. The final calculus may be more structural. If Le Pen comes to power now, she will have a shorter mandate until the next general election in 2027. With France’s fiscal deficit close to 6% of GDP, and one of the largest debt/GDP levels of OECD countries, Le Pen would struggle to implement her populist reforms that include tax cuts for several groups.

In other geopolitical news, last week, Macron said that France will send Mirage fighter jets to Ukraine and train pilots to fly them by the end of the year. This comes after NATO allies – including Belgium, Norway, Denmark, and Holland – committed to sending 80 F-16 fighters to Ukraine. Russia has accused Ukraine of using US-supplied weapons to shell civilian targets and being responsible for the deaths of women and children. The accusation follows statements by several countries’ leaders, including Germany and the US, to green-light Ukraine to use Western-supplied weapons to strike military targets inside Russia. Russia has been threatening to escalate the calibre of weapons in the war against Ukraine. In an interview, President Vladimir Putin denied Russia would be willing to escalate the conflict to a NATO country. Two Russian ships stopping in Cuba on the way to Venezuela also raised concerns about any attempt by Russia to use the far-left regimes in Latin America as a means of direct or indirect retaliation against Washington’s more explicit support to Ukraine.

Commodities

Saudi Aramco lowered its July Arab light crude oil price for Asian buyers by 50 cents to USD 2.40 per barrel. This underscores a soft demand outlook in the region that constitutes the bulk of the company’s exports. Prices for other crude oil grades sold to Asia were also cut by a similar margin.

Emerging Markets

EM Asia

Economic Data: Consumer price index (CPI) inflation declining across Asia, driven by soft domestic consumer demand.

India: Equities initially rallied after exit polls suggested a landslide victory for Narendra Modi’s Bharatiya Janata Party (BJP), particularly stocks from infrastructure companies associated with the government. However, election results on Tuesday showed a different story, as Modi’s party lost its parliamentary majority gained in 2019. The BJP gained only 234 seats, down from 303 seats in 2019, and needed the support of smaller parties within its National Democratic Alliance (NDA) to get to 291 seats, which is just marginally above the 272-majority mark and down from 349 seats in 2019. The opposition I.N.D.I.A. bloc, led by the Indian National Congress, performed better than expected, particularly in the poorer parts of Northern and Central India, winning 229 seats, 100 seats more than in 2019, while the leading opposition party Congress led by Rahul Ghandi took 99 seats (from 52 in 2019). The Nifty 50 index of large cap companies sold off 7% on the news, but has recouped most of its losses, as the multiple smaller parties from BJP’s NDA unanimously elected Modi.

Despite the smaller majority, it is likely the direction of travel of the government will be little changed. There is some chance of more social spending at the lower end of the population, which would be a welcome development if done in a gradual and sensible manner. Importantly, we do not believe investments in infrastructure will be significantly scaled back. There is a case to be made that the results were positive for India in the long term. Most of the structural reforms implemented by Modi took place during this first mandate when he had to rely on a coalition. It also lowers tensions between ethnic groups, including reforms that would be seen as favouring one group (Hindus) over the others. On the other hand, Modi will have to rely in particular on two parties in the NDA coalition that have in the past criticised the government, a less stable foundation. we done see this as an issue in the short to medium term, but the government not finishing its five-year mandate is a risk that must now be considered and monitored.

Against this backdrop, the Reserve Bank of India (RBI) kept its policy rate unchanged at 6.5%, but two out of the six participants voted for a 25bps cut. Governor Shaktikanta Das emphasised the RBI’s primary focus on the domestic growth-inflation mix in deciding policy, relegating the role of US monetary policy. With inflation on a declining trend, it is likely the RBI will have room to cut policy rates over the next meetings. The more dovish bias (two votes for a cut) comes against the background that Indian government bonds will start to be included in the local currency bond benchmark by JP Morgan. Index inclusion will take place over 10 months until India reaches 10% of the Index by Q2 2025.

Latin America

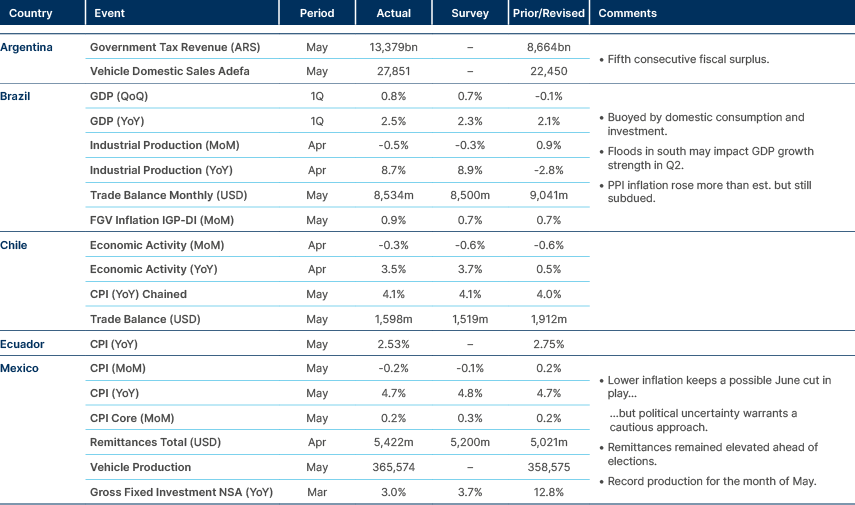

Economic Data: Encouraging data for Brazil and Mexico in Q1, but risks tilted to the downside.

Ecuador: An International Monetary Fund (IMF) programme targets a major fiscal overhaul aimed at improving the primary balance of the non-financial public sector.

- Moving from a 2.7% GDP deficit in 2023 to a balance in 2025, and to a surplus of about 2% of GDP in the medium term.

- Measures include a 3% VAT increase from 12% to 15%, expected to yield a net increase of USD 2.2bn in non-oil revenue in 2024.

- A plan must be prepared to further mobilise non-oil fiscal revenues by rationalising tax expenditures and replacing transitory revenue measures with high quality solutions. The plan will be required for the first review in mid November 2024.

Mexico: Claudia Sheinbaum’s landslide victory on Monday caused a sharp increase in volatility on the Peso. The Morena Party won by a margin of more than 30% over Xochtil Galvez and the National Action Party. The leftist coalition will hold 183 of 372 seats in the lower house of Congress, and 83 of 128 seats in the Senate, just shy of the 85 needed for a ‘supermajority.’ This would have allowed them to change the constitution unopposed, however, this unprecedented consolidation of power for the Morena party still raises the likelihood that changes to Mexico’s constitution will be actualised.

Outgoing president Andrés Manuel López Obrador (AMLO) had proposed 20 changes to the constitution during this mandate but did not have the political capital to pass them. Constitutional changes require two-thirds of both houses of Congress and a simple majority across all states to be implemented. Most of AMLO’s constitutional reforms are seen as weakening the institutions in Mexico, which explains why the MXN sold off sharply after AMLO mentioned his intention to approve changes in the judiciary system last week, which would effectively reduce checks and balances on state power, transferring more authority to the executive branch. AMLO will be in office until 1 October, while the newly-elected Congress comes to power on 1 September, giving him one month to implement his changes. Having said that, this is a very complex political process. Not only two-thirds of both chambers need to approve, requiring the Morena Party to gain four votes from the opposition in the Senate, but the legislature chamber of all states needs to ratify the changes with a simple majority. Morena does not have a majority across several states. Another mitigating factor is the United States, Mexico, and Canada Free Trade Agreement.

Sheinbaum’s position was unclear. She stated she favoured AMLO’s reforms, but they need debate. Aside from worries of democratic backsliding, market participants are concerned about how these constitutional changes will impact Sheinbaum’s target of bringing the fiscal deficit down to more manageable levels (6% of GDP to 3% of GDP), especially considering the ongoing cost of supporting Pemex. Overall, it is likely Sheinbaum will want to have her own independent pro-growth mandate, significantly mitigating the constitutional reform risks.

Central and Eastern Europe

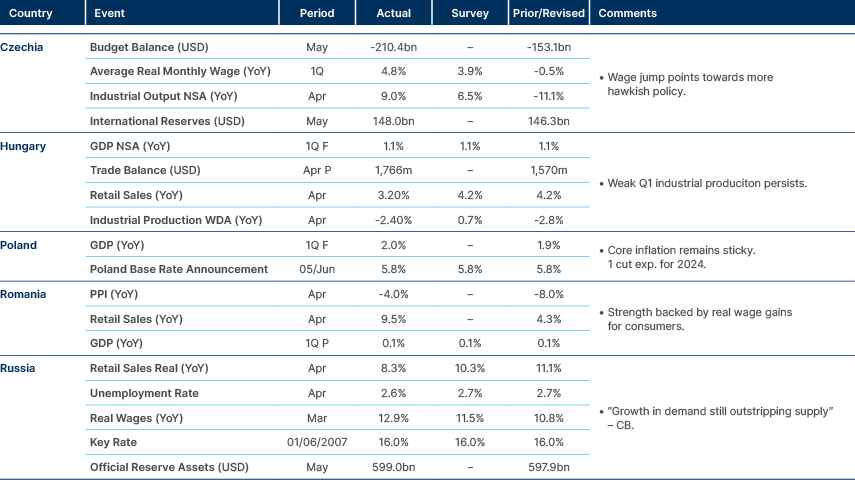

Economic Data: Real wage gains in Czechia and Romania, while Poland and Russia stay restrictive.

Türkiye: Net reserves after excluding currency swaps turned positive (USD 6.2bn) at the end of May for the first time since March 2020. Since the local elections in March, reserves have risen by USD 67.5bn on a net basis, driven by a USD 30bn rise in reserves and a USD 37.4bn decline in swap liabilities. This reversal has been underpinned by strong foreign investment inflows into government debt, and the de-dollarisation of domestic deposits. The inflows from locals and foreign investors are ultimately motivated by the structural reforms that are likely to bring inflation down significantly, boosting macroeconomic stability and the environment for long-term investments in the country.

Ukraine: A staff-level agreement was reached on the fourth review of Ukraine's four-year extended fund facility (EFF), with an expected disbursement of USD 2.2bn following board approval in the coming weeks. The EFF amounts to USD 15.6bn and was approved in March 2023, with USD 5.4bn disbursed so far as part of a larger USD 122bn international support package.

In its statement, the IMF said economic activity is expected to slow in the second half of 2024, due to recent large-scale attacks on the energy sector. Inflation is also expected to increase moderately in the second half of the year.

Georgia: China won a bid to build a deep-sea port in Georgia’s Anaklia Port. This will be the first Chinese-built and operated port on the Black Sea coast, strengthening Tbilisi and Beijing’s growing relationship and bringing China’s influence closer to Europe.

South Africa: Coalition talks began early this week in South Africa. The African National Congress (ANC) members said that a Unified National Government was their preferred course of action at this stage, including both the centre-right Democratic Alliance (DA) Party and the far-left Economic Freedom Fighters (EFF). Given their contrasting ideologies, a government involving both the DA and the EFF is difficult to imagine, especially since the DA has explicitly said it would never work with the EFF. However, according to sources within the ANC, the EFF will not propose extreme policies if they join the government, and so far, has appear to have been reasonable in its proposals to the ANC. The scenario of a minority ANC government with support from the DA for specific matters increased in likelihood, an outcome that is likely to favour market-friendly legislation, albeit remaining more politically unstable than a formal coalition. The new parliament must vote to elect a new president early next week.

Zambia: Bondholders holding 96.25% of Zambia’s Eurobond principal approved its exchange offer, paving the way for a comprehensive debt restructuring under the G-20 common framework architecture. The overall restructuring is estimated to cut about USD 900m from Zambia’s debt and spread its future payments over a much longer timeframe. The new bonds have a mechanism where coupon payment increases should Zambian exports perform well in the coming years. Official creditors will reschedule USD 6.3bn of loans. Last week, the IMF announced a staff-level agreement on the third review of Zambia’s extended credit facility, increasing funding by nearly USD 400m. The new package will help mitigate the impact of the drought on the economy. Fiscal consolidation and inflationary pressures remain concerns. Beyond the short-term challenges, Zambia’s long-term economic performance has a positive bias. The country is rich in copper and other minerals important for energy transition, and its market-friendly president Hakainde Hichilema ended the cycle of increasing taxes and other hurdles for mining companies.

Developed Markets

Data: ECB cuts for first time in five years, mixed employment data in US clouds picture.

US: While still on a declining trend on a six-month moving average basis, stronger non-farm payrolls data lowered market participants’ expectations of rate cuts this year. The last Federal Reserve (Fed) dot plot in March showed the median Fed voter forecasting three rate cuts this year. However, markets are now betting the central bank will only lower rates once or twice.

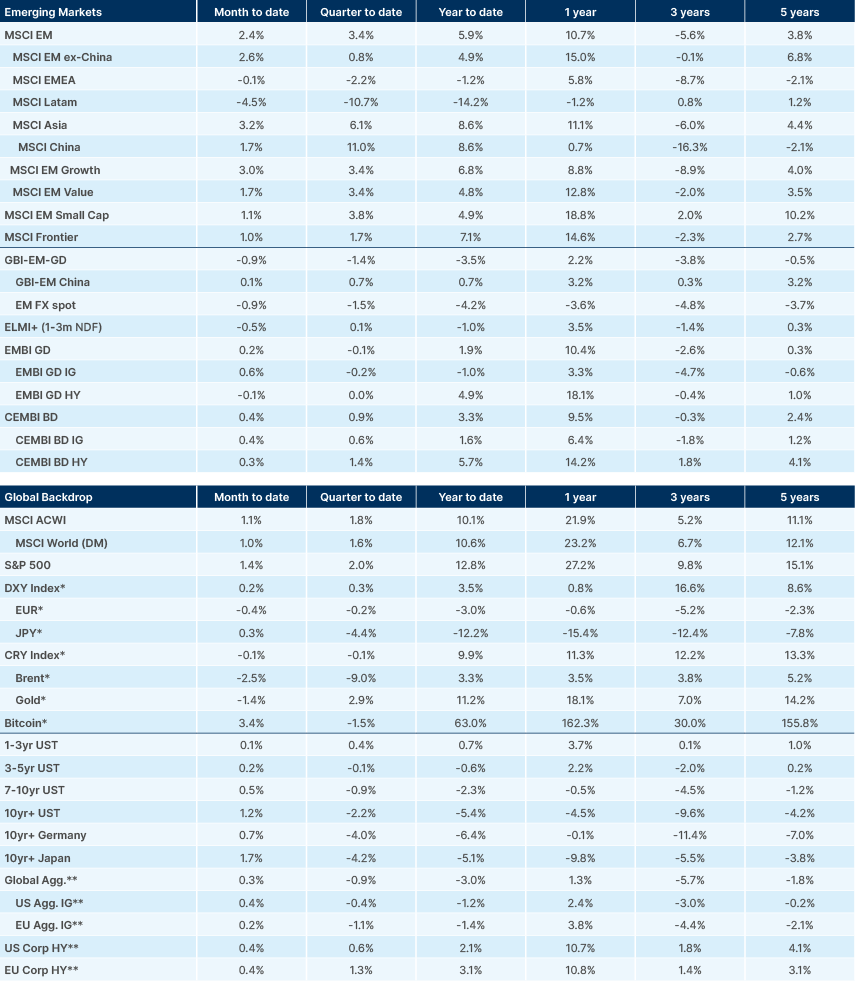

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.