It’s been exactly 30 years since then-President Nelson Mandela enabled South Africa’s transition from an apartheid white-minority government to a democratically-elected government by bringing several political parties together to form a ‘Government of National Unity’ (GNU). Mandela’s African National Congress (ANC) had governed South Africa as the majority party until national elections on 29 May this year, when it lost its majority for the first time since coming to power in 1994. The fall was severe, as the ANC’s share of the popular vote slumped from 57% in the 2019 election to just over 40%. This was surprising as pre-election polling as recently as mid-May had indicated ANC support closer to 45%.

Initial speculation mounted that the ANC would look to continue as a minority government given the inherent challenge of crafting an alliance with the main opposition centrist Democratic Alliance (DA) Party. However, on 6 June, ANC President Cyril Ramaphosa announced the formation of a new GNU. That left just 10 days for Ramaphosa to craft an agreement by the 16 June deadline, the constitutionally-mandated date by which the new Parliament would need to sit and elect a new President, Speaker and Deputy Speaker.

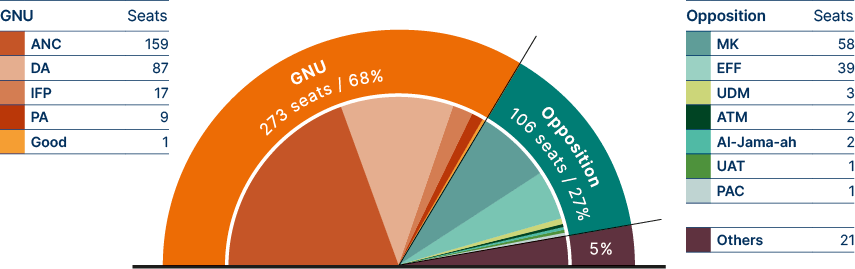

Here’s where the maths got complicated. After alleging widespread irregularities in the election, former President Jacob Zuma’s uMkhonto weSizwe (MK) Party decided to challenge in court the sitting of Parliament and to boycott Parliament’s initial meeting, but the challenge was rejected. The absence of MK’s 58 elected lawmakers from the 400-seat Parliament meant Ramaphosa needed 171 seats (the ANC’s 159 seats plus at least 12 seats from other parties) to be re-elected as President, which is, in fact, what occurred.

Fixed Income edition

Which are the largest political parties in South Africa?

The five largest political parties will hold 90% of the seats in the new Parliament. Three parties – the ANC, the DA and the Zulu-majority Inkatha Freedom Party (IFP) – together hold 65.8% of the seats in Parliament. The above-mentioned MK Party holds 14.5% of the seats, while the communist-leaning pan-Africanist Economic Freedom Fighters (EFF) hold 9.75%. An additional 13 parties are represented in Parliament.

Which parties will comprise the new GNU?

In announcing the decision to create a GNU, the ANC made clear it would “isolate those that seek to cause chaos, instability and division.” The GNU would focus on “job creation, inclusive economic growth, the high cost of living, service delivery, crime and corruption.”

In a historic move, the DA agreed on 16 June to join the GNU, with its leader, John Steenhuisen, stating, “Today, South Africa is a better country than it was yesterday. For the first time since 1994, we’ve embarked on a peaceful and democratic transfer of power to a new government that will be different from the previous one…From today, the DA will co-govern the Republic of South Africa in a spirit of unity and collaboration.”

The IKP and the right-wing Patriot Alliance have also announced their intention to join the GNU. The ANC’s Thoko Didiza was elected Speaker of Parliament and the DA’s Annelie Lotriet was elected Deputy Speaker.

Fig 1: GNU and oppositions parties in South Africa’s National Assembly

How is the market likely to react to the GNU?

South Africa retained an investment grade rating from ratings agency Moody’s until March 2020, while S&P had downgraded it to high yield territory in April 2017. The ineffective economic policies of former President Zuma’s ANC-led government and those of the first Ramaphosa administration contributed to a deterioration of South Africa’s economy by the middle part of the decade, with a notable decline in 2020 in response to the COVID-19 pandemic. Two key metrics – debt-to-GDP and the budget balance – highlight the magnitude of the deterioration. In 2014, South Africa’s debt to GDP printed at 47.0% of GDP while the budget deficit was reported at -4.3% of GDP. By 2020, the former reached 70.7% of GDP and the deficit hit -10.0% of GDP. While debt has continued to climb, reaching 72.2% of GDP in 2023, the deficit improved to -4.9% of GDP. The market is looking to the GNU to rein-in the corruption and ineffective economic policies of the prior ANC majority-led governments.

Fast-forward to today. A GNU led by the ANC, the DA and the IFP is the most market-friendly outcome for South Africa. The inclusion of the DA in the government, with cabinet-level representation, is perceived as a positive step by the market. Beyond the superficial, however, market participants will look to see which cabinet positions are allocated to each participating party. The ANC is expected to retain the key Finance Ministry as well as other ‘critical’ ministries including Electricity and Transport. The ANC has indicated it would prioritise the expansion of the transmission grid and would be unlikely to give up the Electricity Ministry. The electoral outcome has initially trimmed the political risk premium that had been reflected in pre-election asset prices, while providing some volatility that has given an opportunity to trade the market.

The initial view is that the GNU will pursue fiscal consolidation, further reforms in the power sector, and promote increased participation by the private sector. Additionally, the GNU will be less likely to pursue the bailout of state-owned enterprises such as the R254 debt relief package approved in 2023 for state-owned electric company Eskom. These steps could serve to push GDP higher and in turn, reduce the fiscal deficit, which could, over the medium term, lead to a credit rating upgrade from the current Ba2/BB-/BB- level.

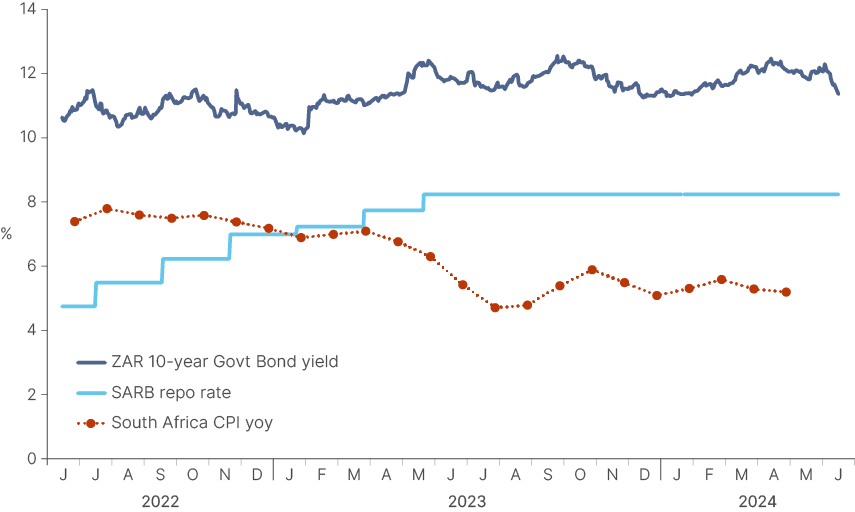

The most significant market reaction in the run-up to, and following, the election has been in local currency markets. Yields on South African government bonds, which started the year at 11.3%, widened to 12.1% by the end of May, but have since rallied significantly to 11.6% (as of the date of writing). By contrast, credit spreads on USD-denominated external debt have largely held steady, starting the year at +326 basis points (bps), widening to +347bps at the end of Q1 and returning to +326bps (as of the time of writing). Should the GNU demonstrate sufficient cohesion and pursue market-friendly policies as discussed, the risk premium in South African yields and spreads could continue to compress, potentially offering investors attractive returns, especially compared to comparably-rated sovereigns.

Fig 2: High risk premia in the South African local bond market

What are the future tests for the government?

The new GNU will face its first major test in October, when the government releases its Medium-Term Budget Policy Statement (MTBPS). This is intended to present the government’s economic outlook and to indicate how public finances will be allocated, and the focus will be on revisions to GDP growth estimates and how the new government will address public finances. Will the DA’s Steenhuisen’s view that “this…government…will be different from the previous one” be realized, and will the DA be an effective counterweight to the more extreme wing of the ANC? Another area to watch is the extent to which the GNU pushes for further progress on Operation Vulindela, a joint initiative of the Presidency and the National Treasury launched in 2021 “to accelerate the implementation of structural reforms and support economic recovery.” Its focus is on modernising the electric, water, transport and digital communications industries, but it could trigger pushback from the more radical elements of the ANC.

While initially seen as a constructive step for South Africa, it is important to see how cohesive the GNU will be as it attempts to govern the country. Given the wide range of political views represented by the various parties, the market will likely focus on the parties’ ability and willingness to cooperate, and to make progress in improving economic growth and stabilising the fiscal situation.

How is South Africa represented in Emerging Market bond indices?

South Africa is included in all major Emerging Market bond indices. In the external sovereign debt space, South Africa represents 2.64% of JPMorgan Emerging Market Bond Index – Global Diversified Index (EMBI-GD). In the corporate debt space, South African corporations represent 1.3% of the JPMorgan Corporate Emerging Market Bond Index – Broad Diversified Index (CEMBI-BD), while in the local currency sovereign debt space, South Africa represents 8.3% of the JPMorgan Global Bond Index – Global Diversified Index (GBI-EM GD).