Elections in South Africa, India, and Mexico dominate the agenda.

- FOMC minutes’ more hawkish tone led to a re-pricing of rate cut odds in September.

- Flash PMIs showed stronger service sector, booming India.

- Taiwan geopolitical ‘noise’ increased last week on the new government inauguration.

- Israel’s offensive in Rafah kept the country’s status challenged globally.

- South Korean and Taiwan exports remained strong, a positive signal for global manufacturing and EM tech earnings.

- The UAE announced USD 10bn support to Pakistan.

- India’s and Mexico’s elections unlikely to bring surprises, South Africa’s elections the most consequential in 30 years.

- Argentina’s Milei did a mini-cabinet reshuffle.

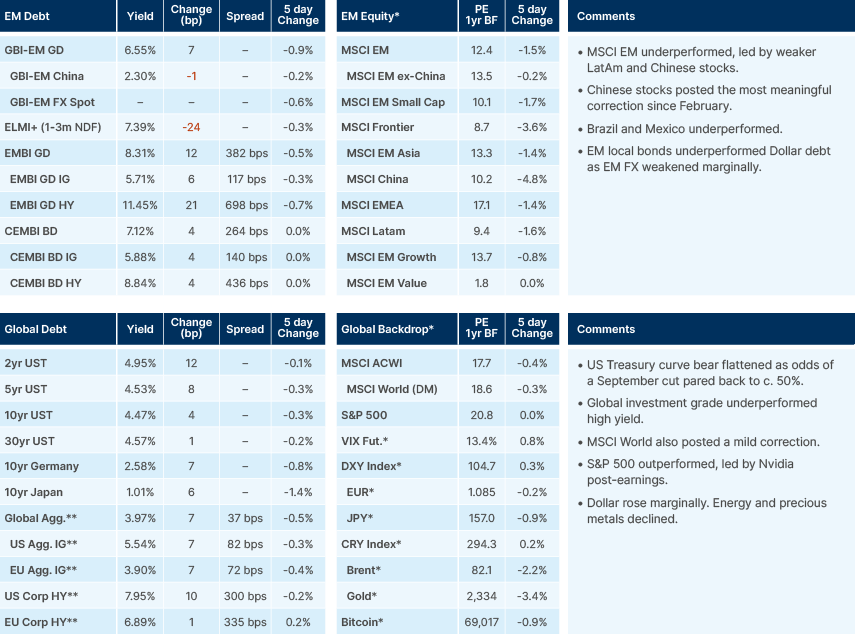

Last week performance and comments

Global Macro

Monetary Policy

US Federal Reserve (Fed) officials expressed reluctance to pursue interest rate reductions due to growing concerns about inflation. The minutes from the policy meeting of the Federal Open Market Committee (FOMC), released on Wednesday, underscored policymakers’ unease regarding the timing of easing measures. Despite inflation declining over the past year, Q1 2024 data revealed increases in both goods and services prices, sparking discussions among participants about the potential necessity of tightening policy if inflation risks materialise.

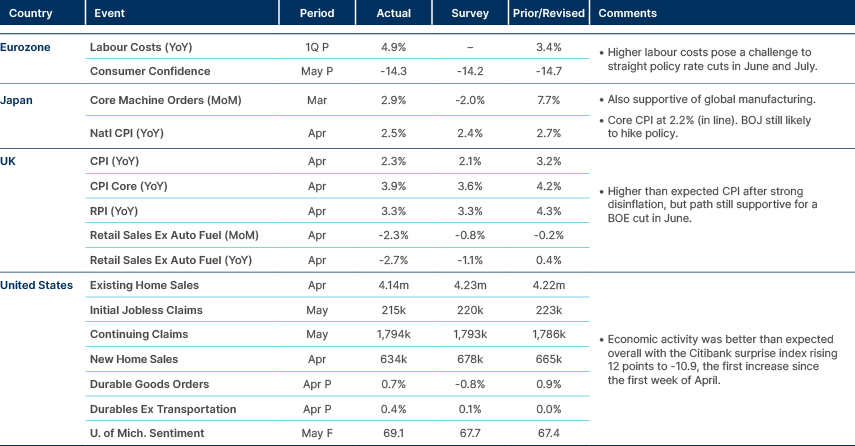

The more hawkish stance led the front end of the yield curve higher as markets pushed back the odds of a rate cut in the September meeting to around 56% at the end of last week from 92% in the first week of May. The main risk for asset prices remains an eventual steepening of the US Treasury yield curve.

Leading Indicators

The S&P Global Flash Purchasing Manager’s Indices (PMIs) came in broadly stronger than consensus, with manufacturing surprising to the downside, but services to the upside. The US underperformed with its composite PMI slowed by 0.8 to 51.3, as manufacturing declined by 1.9 to 50 and services slowed by 0.4 to 51.3. The Eurozone composite PMI rose by 1.4 to 51.7, with manufacturing slowing by 0.4 to 45.7, and services improving by 1.8 to 53.3. The UK and Japan composite PMIs also outperformed, at 54.1 (from 52.8) and 52.3 (from 51.7). India remains the brightest spot, with the composite flash PMI slowing only 0.3 to 61.5, with both manufacturing and services slowing by the same magnitude to 58.8 and 60.8, respectively.

Geopolitics

China/Taiwan

Wu Cheng-wen, Taiwan's new Technology Minister, stated that semiconductor production could be remotely shut off if a conflict arises on the island.1 This preventive measure would involve remotely disabling tools embedded in the advanced lithography machines of Taiwan Semiconductor Manufacturing Co. (TSMC) supplied by ASML Holding NV. (ASML) Concerns over potential Chinese aggression have led to discussions between US, Dutch, and Taiwanese officials regarding the security of Taiwan's semiconductor production. ASML confirmed its ability to remotely disable these machines if necessary.

Nevertheless, Taiwan’s new government will face an unprecedented split as the two opposition parties with a more pro-China stance now control the parliament. The split parliament lowers the risk of a direct conflict. Furthermore, close to 60% of all Taiwanese favour the current ambiguous status quo.

Middle East

The conflict in Rafah continues to develop, as Israel’s Defence Minister Yoav Gallant announced an increase in military operations involving ground and air forces. The advance coincides with Israel announcing its intention to resume ceasefire negotiations with Hamas following public outrage sparked by a social media video depicting the abduction of female Israeli soldiers. Meanwhile, the International Criminal Court (ICC) has initiated proceedings to issue arrest warrants for Israeli leaders, including Gallant and Prime Minister Benjamin Netanyahu, as well as Hamas chiefs, on charges of war crimes. Israeli officials and the US have vehemently opposed this move, arguing it exceeds the ICC's jurisdiction.

In response to the ongoing crisis, several European nations have announced their intention to recognise a Palestinian state, signalling a growing detachment of the West to Israel's hardline policies. Ireland, Norway, and Spain have justified their recognition as a means of supporting moderate forces in the region amidst a deepening humanitarian crisis.2 Netanyahu criticised the move, calling it a "reward for terror" after 7 October, while the European Union (EU) expressed a commitment to a two-state solution and urged for a common EU position.

Emerging Markets

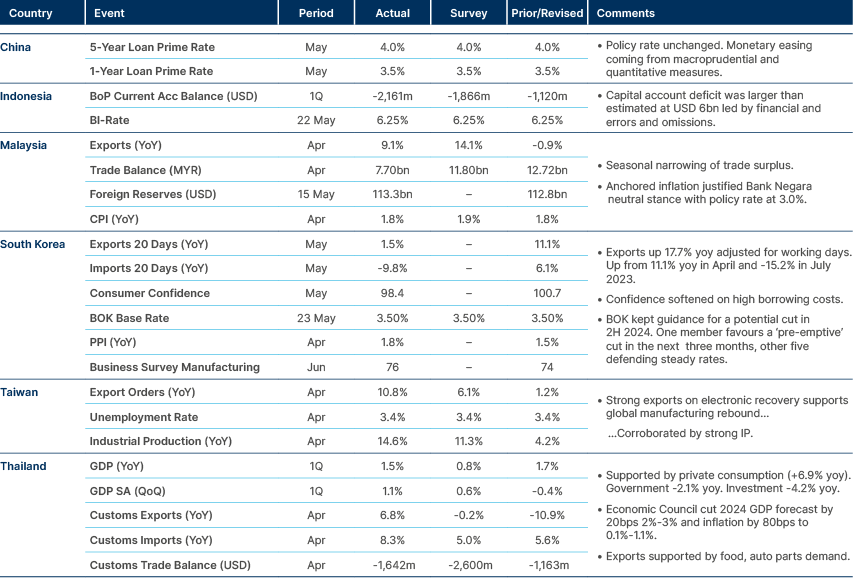

EM Asia

Economic Data: Stronger exports across Korea and Taiwan corroborate the global manufacturing rebound and are supportive to EM technology sector earnings growth.

India: The final round of general elections takes place this week, ending Saturday. Results should be unveiled by the end of the day next Tuesday. There is ample consensus that Narendra Modi’s Bharatiya Janata Party (BJP) will retain its simple majority but will fall short of a supermajority. There is also consensus that the result will mean policy continuity in India. The latest PMIs suggest economic growth remains very strong. It is hard to disagree with consensus, but election surprises could lead to larger than usual market swings, in our view, given equity market valuations and technicals.

Pakistan: The United Arab Emirates (UAE) unveiled a substantial USD 10bn investment pledge targeting "promising" economic sectors within the country. The pledge followed a meeting between UAE President Mohammed bin Zayed Al Nahyan and Pakistan Prime Minister Shebaz Sharif. The initiative aims to enhance economic development and foster cooperation between the UAE and Pakistan, a significant step forward in their bilateral relations.

South Korea: The government more than doubled the size of its chip incentive package to USD 19bn. The programme is designed to bolster the chip sector, benefiting major players like Samsung Electronics and SK Hynix, and includes KRW 17trn in financial support and tax incentives. It represents South Korea's largest single outlay of support for the chip industry, underscoring its commitment to maintaining competitiveness amid rising global competition and geopolitical tensions.

Thailand: The Constitutional Court accepted a complaint seeking the removal of Prime Minister Srettha Thavisin over his appointment of Pichit Chuenban, a lawyer who had previously spent time in prison. Nevertheless, the court did not suspend Srettha from duty, and he now has 15 days to file his defence. Pichit may have resigned to shield Srettha from the legal proceedings. These developments add to the government's challenges, including the resignation of three ministers, and pose potential hurdles to economic recovery efforts. Should Srettha be dismissed, a new government would have to be formed, which could bring Thailand’s political tensions back to the fore.

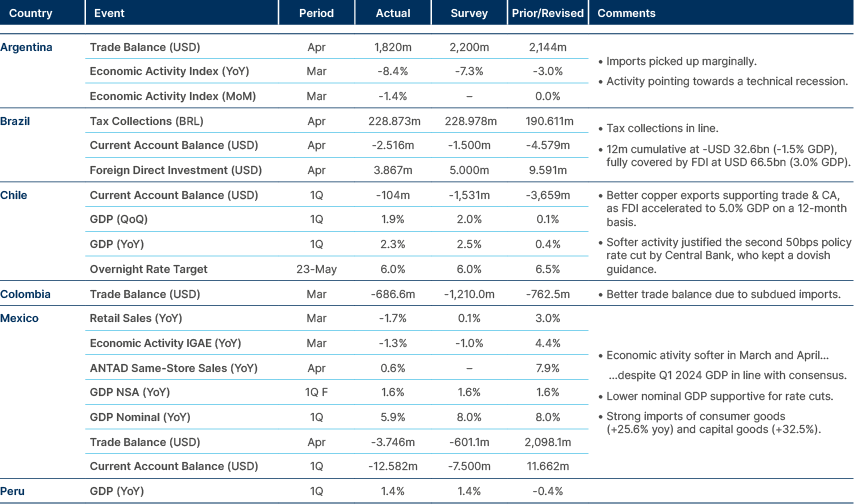

Latin America

Economic Data: External accounts remain robust across Argentina and Brazil, improved in Chile.

Argentina: JavierMilei implemented a minor cabinet reshuffle as his government struggled to approve its omnibus bill, even after accepting concessions from the opposition. Interior Minister Guillermo Francos replaced Cabinet Chief Nicolas Posse. Francos’s job is to streamline the negotiating process with Congress. The key challenge in negotiations remains Milei-Caputo tight budget discipline. According to La Nación, Federico Sturzenegger was appointed as minister, but the name of the ministry is yet to be defined. The appointment is a mere formality, in our view, as Sturzenegger has already been driving the proposed economic reforms.

Chile: The central bank cut its policy rate by 0.5% to 6.0%, totalling 5.25% of cuts since last July. Policymakers hinted at further reductions in the future after keeping the slower pace of cut for the second consecutive meeting.

Colombia: President Gustavo Petro threatened to halt payments if lawmakers reject the proposed increase in the debt ceiling, although he did not specify which payments would be affected. Congress is currently deliberating on a bill aimed at raising the country's debt ceiling by USD 17.6bn. Petro warned If congressional committees did not approve lifting the limit: “There will simply either be a ceasing of payments or I’ll have to declare an economic emergency”.3

El Salvador: Moody’s upgraded the country’s credit rating by two notches to Caa1, citing reduced credit risks and successful debt management operations. The upgrade follows an April Eurobond sale of USD 1bn and buyback that lowered amortisations through 2027, and included a bond with interest rate terms tied to future credit upgrades.

Mexico: Mexicans go to the ballot next weekend to elect their first-ever woman president. Former Mexico City Mayor Claudia Sheinbaum is the frontrunner with close to 56% vote intentions, according to a poll by AS/COA released on 15 May. Sheinbaum is from the incumbent Morena Party, which benefits from the strong popularity of President Andres Manuel López Obrador (AMLO), who currently enjoys a 66% approval rating. She faces Senator Xóchitl Gálvez of the main opposition alliance that brought the three traditional parties National Action Party (PAN), the Institutional Revolutionary Party (PRI), and the Party of the Democratic Revolution (PRD) together. Gálvez has close to 34% of vote intentions, according to the same pollsters. Federal Deputy Jorge Álvarez Máynez from the Citizen's Movement (MC) is also in the race, but has only 10% of vote intentions. Some analysts expect the race to be much closer than suggested by the polls, pointing towards the possibility of tactical voting boosting Gálvez support and to ‘hidden’ Mexicans dissatisfied with AMLO. Nevertheless, both candidates have broadly similar agendas. Sheinbaum is expected to be supportive of Pemex, with the government suggesting USD 40bn of support – the equivalent of all maturing Pemex debt over the coming five years. This will put pressure on the fiscal deficit, which will increase to close to 5% of GDP this year, but mostly due to one-offs such as AMLO’s infrastructure spending. Mexico may be likely to keep benefiting from the nearshoring investment cycle. The capex cycle is not easy to spot on the external accounts, but there has been a boom in warehouse and industrial park plans built by locals to rent to foreign investors. This means the impact on the external accounts is likely to come slowly over several years in the format of service account inflows, rather than one-off chunkier foreign direct investments. The main risk to monitor is the possibility of larger fiscal expansion in an eventual future downturn.

Peru: Finance Minister Jose Arista has affirmed the government's commitment to providing ongoing financial support for the state-owned Petroleos del Peru SA (Petroperu). The assistance is deemed critical as Petroperu needs USD 2.2bn to remain operational, as indicated in a recent statement from the company's board. The support measures are expected to materialise shortly, and may include capital injections, credit extensions, and guarantees.

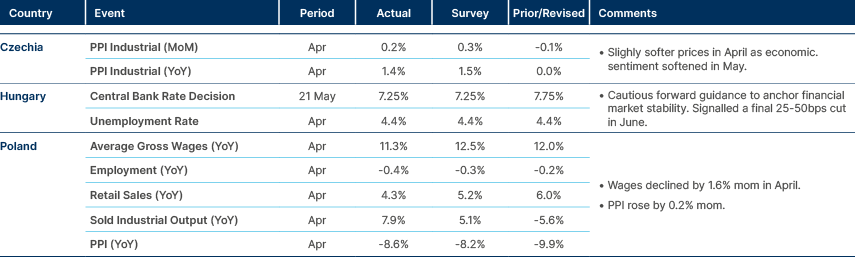

Central and Eastern Europe

Economic Data: No surprises on data as Hungary focuses on financial stability.

Central Asia, Middle East, and Africa

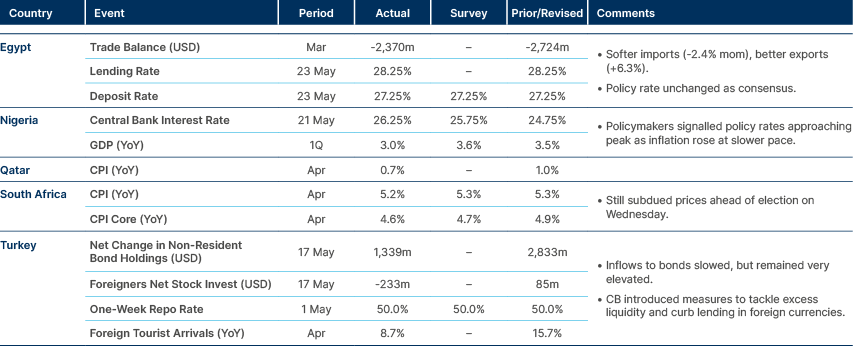

Economic Data: Nigeria approaching the end of its hiking cycle.

South Africa: The Constitutional Court disqualified former-president Jacob Zuma from parliamentary candidacy, due to his 2021 conviction. Nevertheless, the Electoral Commission noted the Constitutional Court decision and said that Zuma, as leader of the MK Party, would remain the face of the party on the ballot. This is likely to keep up the support for the MK Party, particularly in Zuma’s homeland of KwaZulu Natal, the largest electoral state in the nation. South Africans vote tomorrow with the ruling African National Congress (ANC) likely to lose the majority in parliament for the first time since Nelson Mandela came to power 30 years ago. Voters are increasingly disillusioned with ANC’s economic mismanagement and governance shortcomings, including several corruption scandals since Zuma was elected in 2009. The Economist poll-of-polls shows the ANC median vote intention at 43%, with a 41% low and 45% high between pollsters. The centre-right Democratic Alliance (DA), led by John Steenhuisen, has 20%-25%, while far-left parties, including Zuma’s MK Party and Julius Malema’s EFF party, poll around 12% each. The ANC could still govern by forming an alliance with smaller parties, particularly if it manages to reach close to 45%. Falling behind this threshold would force it to enter an alliance with either the DA (positive), or the EFF or MK Party (very negative).

Türkiye: The Central Bank of Türkiye kept its one-week repo rate at 50%, in line with consensus, and signalled the peak of the current rate cycle. Instead, it introduced measures to tackle excess liquidity and restrict lending in foreign currencies, which has significantly increased while local currency lending slowed.

Developed Markets

Economic Data: Stronger US economic data at the margin.

United Kingdom: Prime Minister Rishi Sunak announced a general election on 4 July. The early election surprised political pundits who expected elections towards the autumn, leading to speculation about the reason behind his decision.

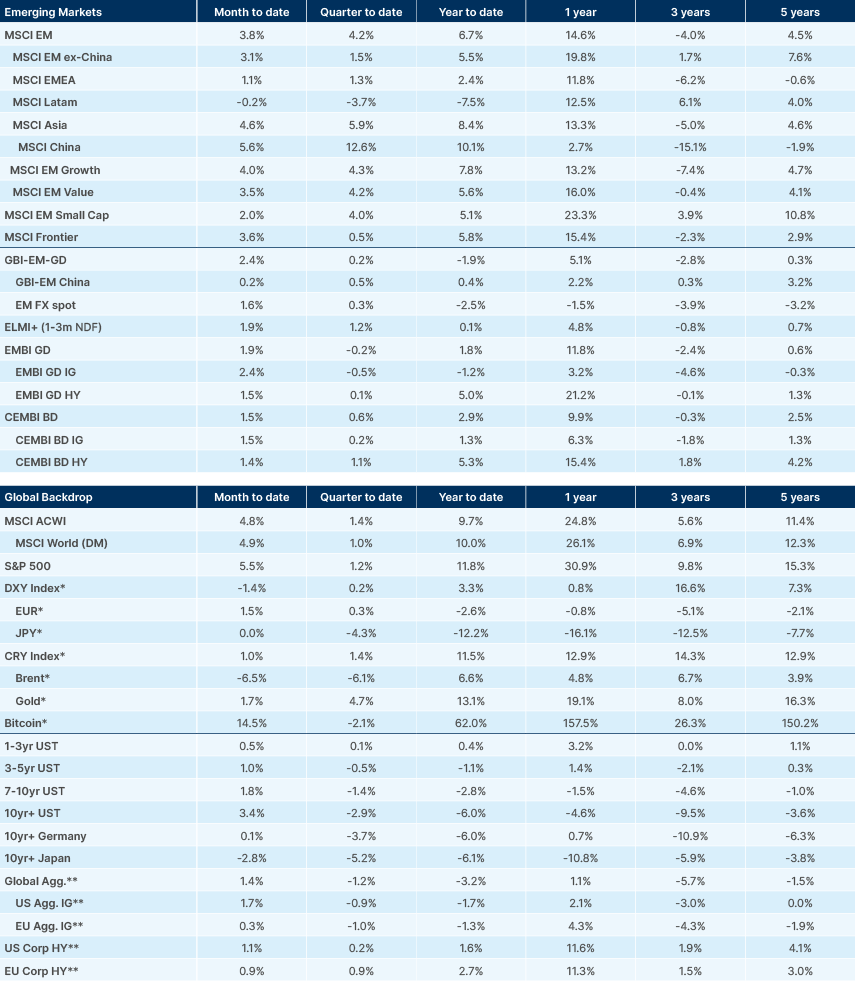

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. As at 26-May.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.techtimes.com/articles/304929/20240523/chinas-invasion-result-sudden-shutoff-chip-machines-taiwan-tech-minister.htm

2. See – https://www.bbc.co.uk/news/articles/c4nn78r3w3ko

3. See – https://x.com/petrogustavo/status/1794002496676909221