Elections in India, South Korea and Colombia as well as Chile’s president inauguration overshadowed by geopolitics

Russia and Ukraine may negotiate a new cease-fire agreement today as both sides appear to be getting closer to a consensus. Russia increased its fiscal deficits to shore up the economy after sanctions from the West. Ukraine received further financial commitments from the US and international financial institutions. Argentina signed its 22nd deal with the IMF. Brazil’s Petrobras increased fuel prices as the government cut taxes to compensate part of the increase. Gabriel Boric was sworn in as President of Chile. China’s stock market had another volatile week as congress approved a 5.5% GDP growth target for 2022. Colombia’s presidential primaries and parliamentary elections confirmed the strong position of left-wing candidate Gustavo Petro ahead of the May 29th presidential ballot. In India, the BJP received the most votes in the key state election held in Uttar Pradesh, and the Reserve Bank of India (RBI) Deputy Governor struck a dovish tone as he downplayed second round effects of oil price inflation. South Korea’s Conservative Party candidate Yoon Seok-youl won the presidential election by a narrow margin.

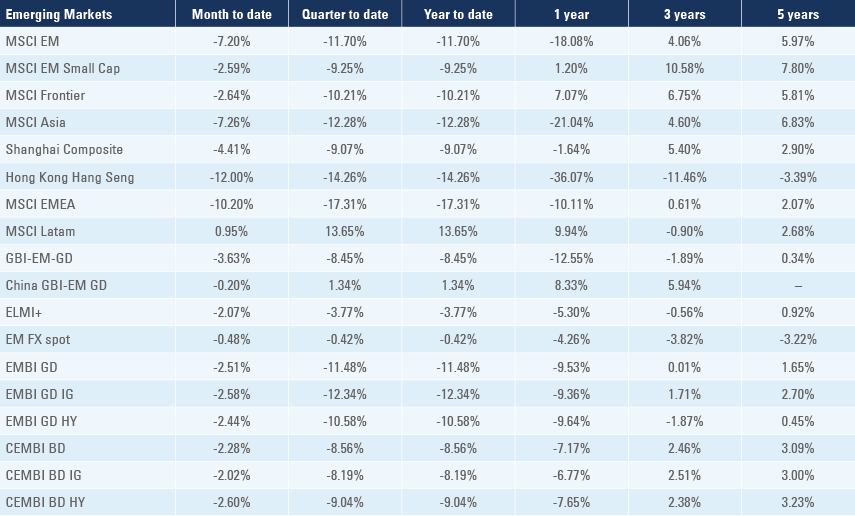

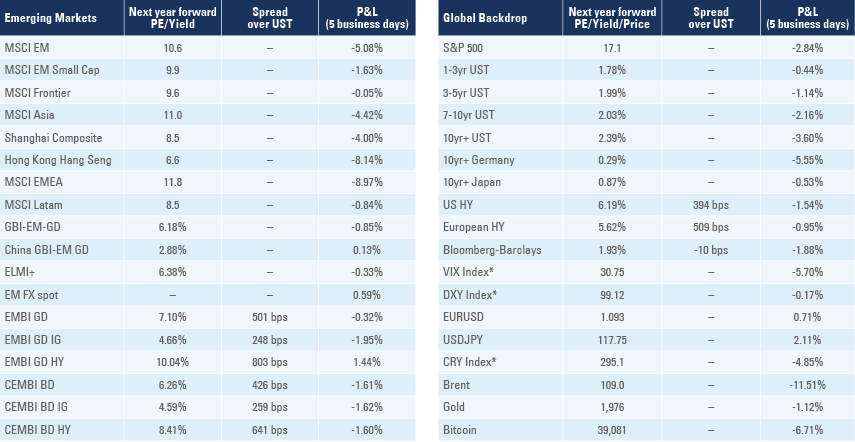

Emerging markets

Geopolitics: Different sources in the Russian press reported that Russia and Ukraine are inching closer to an agreement on a new cease-fire planned for today. According to the state-owned news agency Russia Today, the parties are working towards a “joint position of both delegations, into documents to be signed” over the next days. President Vladimir Putin said some “material positive shifts” in negotiations took place while his Ukrainian counterparty Volodymir Zelensky said that both delegations have moved from “ultimatum exchange” to "proper talks". The US National Security Adviser Jake Sullivan will meet China Politburo member Yang Jiechi in Rome to discuss the impact of the war on global security as well as to manage competition between the US and China. The French Foreign Minister Jean-Yves Le Drian said Europe was preparing another round of sanctions to ban EU imports of steel and exports of luxury products as well as expanding the list of sanctioned oligarchs and a ban on new investments in the Russia oil and gas sector. Some French companies have yet to announce any interruption in their joint ventures in Russia.

Russia: The government announced a RUB 1trn (USD 9bn or 0.7% of GDP) fiscal stimulus in order to support the economy after Western sanctions, with half of the amount for social spending, including unemployment benefit. The Russian government has been running fiscal surpluses for years and has a significant ability to support the economy. The current account surplus rose to a record USD 20bn in February, the highest on record for the month due to the spike in commodity prices. Deputy PM Alexander Novak said oil loadings in March remain normal, but there are issues selling spot cargoes for April. Russian oil and condensate production remained stable at 11.1m barrels per day from 1st to 8th March. A number of major oil and gas companies like BP, Shell and ExxonMobil decided to cut ties with their Russian partners, selling their participation in capital and carbon-intensive upstream assets to Russian national oil companies. In other news, Finance Minister Anton Siluanov said c. USD 300bn of the USD 640bn of Russia’s foreign reserves were frozen, of which USD 100bn (16.4%) in USD and 32.2% in EUR. He added he would hope Russia’s partnership with China would allow Russia to access the 13.1% of its reserves in RMB. In other economic news, the yoy rate of CPI inflation rose 0.5% to 9.2%, in line with consensus.

Ukraine: The World Bank approved a USD 0.7bn emergency budget support, the IMF is working on a USD 1.4bn Rapid Financing Instrument lending and the US Congress approved a package including USD 14bn of support to Ukraine. The country had USD 30bn in foreign exchange reserves in February and pledged to keep serving its debt obligations despite the devastating Russian attack on its territory. The West is not directly committed in the Ukrainian conflict, but is willing to provide large amounts of financial support, just like in 2014, when Russia annexed Crimea and started the conflict in Donbass.

Argentina: The lower house of congress approved the USD 45bn agreement with the International Monetary Fund (IMF) as 202 out of 252 parliamentarians voted in favour of programme. The opposition provided more than half of the votes and the only 37 congress members voting against the bill were from the radical-left member of the ruling coalition led by Vice President Cristina Fernandez de Kirchner.

Brazil: The state-owned oil company Petrobras announced a 25% increase in diesel and 20% hike in gasoline prices, significantly narrowing the gap from local products to international prices. The following day the Brazilian parliament cut taxes on oil products, compensating 2/3rds of the fuel price hike, according to Finance Minister Paulo Guedes. We believe the government strategy is sub-optimal as price hikes would naturally support lower demand. In our view a temporary subsidy to the most impacted sector (truck drivers) would be a preferable solution. Nevertheless, this combination may be better than if Petrobras were forced to keep prices low as it could force private sector refined products out of the market, potentially creating a local supply shock. It also reduces the risk of social unrest, including a new round of truck drivers’ strike. The yoy rate of CPI inflation rose 0.2% to 10.5% in February, in line with consensus. A total of 155k formal jobs were created in January, in line with consensus, after 282k jobs were lost in December.

Chile: Gabriel Boric was sworn as the next President of Chile. A young 36 years-old president with his political origins in the student protests of 2011, Boric pledged to boost economic growth and help to redistribute income and wealth. At the same time, the debate over the new constitution is intensifying at the Constitutional Assembly. Last week the vice president of the convention Gaspar Dominguez said the more radical (leftist) members of the convention need to go “back to the drawing board” if they want some of their proposals to go through after the plenary rejected almost all of the 40 measures suggested by the environmental group – including a ban on private ownership of natural resources. The text for a new constitution is expected to be put to a referendum vote later this year. In economic news, the yoy rate of CPI inflation rose 0.1% to 7.8% (consensus 8.2%).

China: Chinese stock markets were under pressure after the US Security and Exchange Commission (SEC) issued a provisional list of five Chinese companies that will have to de-list from US exchanges in up to three years1. The China Securities Regulatory Commission (CSRC) said this was a normal step under the US Holding Foreign Companies Accountable Act (HFCAA): "We respect overseas regulators' efforts to strengthen supervision over accounting firms to improve the quality of the financial information of listed companies but firmly oppose the wrong practice of some forces politicising securities regulation". The HFCAA has already led to an acceleration of Chinese companies listing in Hong Kong. There was also speculation that Chinese stocks were being sold by Russian institutions and high net worth individuals.

In other news, the National People’s Congress (NPC) set the 2022 growth target at 5.5%, down marginally from 6.0% in 2021, but above consensus expectations from 4.5% to 5.5%, and pledged to set up a financial stability fund and adopt measures to keep house prices stable. The overall budget deficit declined from RMB 8.5trn in 2020 and RMB 7.2trn in 2021 to RMB 7.0 in 2022, but military spending will rise by 7.1%, the fastest pace in three years. The NPC pledged to implement RMB 2.5trn of tax cuts with the priority of supporting small and micro companies that absorbs 85% of urban employment.

The NPC did not provide a hard target for energy use as focus turns to financial stability. In economic news, the yoy rate of CPI inflation was unchanged at 0.9% in February, in line with consensus. Aggregate financing declined to RMB 1.2trn in February (consensus RMB 2.2trn) from RMB 6.2trn in January, lowering the yoy rate of growth to 10.2% in February from 10.5% yoy in January. Weaker demand for SOE loans and property sector led to the bulk of slowdown. The trade surplus improved to USD 116bn in February from USD 97bn in January as the yoy rate of import and export growth declined to 16%.

Colombia: Presidential primaries and Parliamentary elections were disputed in Colombia. In the presidential primaries, 61-year old ex-Bogota mayor and senator Gustavo Petro convincingly won the nomination for the left-wing Pacto Historico coalition and confirmed his front-runner status ahead of the May 29th presidential election. The centrist Sergio Fajardo, a former mayor of Bogota and right-wing Federico Gutierrez, a former mayor of Medellin also won their parties’ nominations and will take part in the six-way tie in May. In the lower house, the centre-left Partido Liberal Colombiano won the largest vote share, gaining 32 seats. The left-wing Pacto Historico and the right-wing Partido Conservador Colombiano won 25 seats each in the lower house but did better in the upper house, gaining 16 seats each.

India: The Bharatiya Janata Party (BJP) is set to remain in power, as expected, but took more seats than expected in the important states of Uttar Pradesh and Uttarakhand and had a substantial lead in Manipur and Goa. The opposition Aam Adbmi Party (AAP) looks likely to win a decisive victory in Punjab, breaking the polarisation between BJP and Congress Party and potentially positioning itself as a credible anti-establishment party for future elections. The RBI Deputy Governor Michael Patra said he is more worried about GDP growth than inflationary pressures as GDP is expected to rise only around 2% above pre-pandemic levels in 2021/2022 fiscal year. Food inflation is likely to remain contained by supply management and record production and excise duty cuts on oil products have smoothed price pressures. Importantly, Patra sees little second round effects on wages and rentals and low pricing power among corporates justifying a careful policy stance in the face of the exogenous supply shock. Indeed, Wholesale Price Index rose 0.1% to 13.1% yoy in February, a relatively subdued print considering the magnitude of increase in commodity prices. In economic news, seasonally-adjusted industrial production rose 1.8% mom in January after rising 0.7% in December.

South Korea: The opposition candidate for the Conservative Party Yoon Seok-youl won the presidential election last Wednesday with 48.5% of the votes, less than 1% ahead of incumbent Democratic Parity Lee Jae-myung. The new President will put more emphasis on nuclear power (from renewables) as part of the decarbonisation effort. Yoon pledged to resume the construction of Shin-hanul reactors 3 and 4, which were scrapped by the previous administration, and extend the lifetime of existing nuclear reactors upon safety review. The objective is to raise nuclear as a share of the South Korean energy matrix to 30-35% in 2030, from 29% today, while fossil fuels will decline to 40% of the total by the end of his term in 2027, from 62% today. In economic news, business-days adjusted exports rose at a yoy rate of 32.6% in the first 10 days of March from 14.2% yoy in February while imports rose 33.0% yoy from 22.1% yoy over the same period.

Snippets

Egypt: The yoy rate of CPI inflation rose 1.5% to 8.8% in February due to a 17.6% yoy increase in food prices (from 12.4% yoy in January).

Hungary: The yoy rate of CPI inflation rose 0.4% to 8.3% in February, against consensus expectations of 8.1% yoy.

Malaysia: Industrial production dropped 1.4% mom in January after declining 0.4% in December, mostly due to lingering effects from severe flooding impacting manufacturing.

Mexico: The yoy rate of CPI inflation rose by 0.2% to 7.3% in February, in line with consensus.

Peru: The Central Bank of Peru hiked its policy rate by 50bps to 4.0%, in line with consensus, as CPI inflation rose to a yoy rate of 6.2% and core CPI to 3.3%

Poland: The National Bank of Poland hiked its policy rate by 75bps to 3.5% (consensus 3.25%) as Governor Glapinski raised the 2022 CPI forecast from between 9.3% to 12.2% against 5.1% to 6.5% in its previous forecasts. The 2023 forecast was increased to 7.0% to 11.0% against 2.7% to 4.6% previously.

Romania: The yoy rate of real GDP growth rose 2.4% in Q4 2021 from 2.2% yoy in Q3 2021.

South Africa: The current account surplus narrowed to 1.9% of GDP in Q4 2021 from 3.5% in Q3 2021, totalling 3.7% of GDP in 2021 from 2.0% in 2020. The yoy rate of real GDP growth slowed to 1.7% in Q4 2021 from 2.9% yoy in Q3 2021.

Taiwan: The yoy rate of CPI inflation declined to 2.4% in February from 2.8% in January, 30bps below consensus, but PPI inflation rose 0.5% to 11.5% yoy (90bps above consensus). The yoy rates of export and import growth accelerated to 35% in February as the trade surplus rose to USD 5.8bn from USD 4.9bn in the previous month.

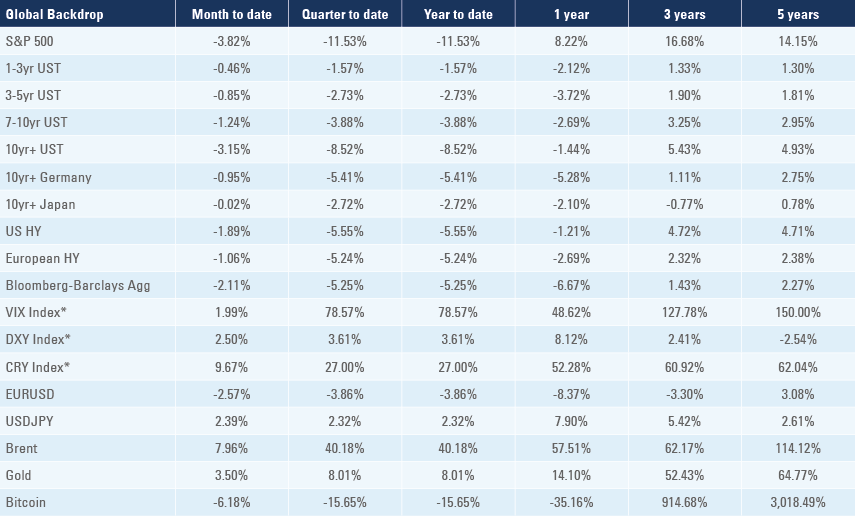

Global backdrop

United States (US): Economic data was consistent with the stagflationary trend, which is becoming very entrenched as a result of the Ukrainian War. The yoy rate of CPI inflation rose by 0.4% to 7.9% in February and core CPI rose by 0.4% to 6.4% yoy. Both were in line with consensus, but hit their highest levels since 1982. Real average hourly earnings declined by a yoy rate of 2.6% in February from -1.8% in January as credit card data from Bank of America shows spending slowing significantly, particularly in apparel. The University of Michigan survey showed one-year inflation expectations rising 0.5% to 5.4% as consumer sentiment declined 2.8 points to 59.7. The trade deficit widened to USD 89.7bn in January from USD 82.0bn in December. Market participants expect the Fed to hike its policy rate by 25bps in its 16th March meeting.

Europe: The European Central Bank (ECB) decided to stop PEPP purchases at the end of March and reduce APP purchases from EUR 40bn in April to EUR 30bn in May and EUR 20bn in June, showing the authority is uncomfortable with the pace of increase in inflation, opening the door for an earlier hike in policy rates than previously signalled. The market currently prices the ECB first 25bps hike between September and October. German industrial production rose 2.7% in January from 1.1% in December

Commodities: The London Metals Exchange (LME) cancelled several transactions and closed the Nickel market after Tsingshan Holding Group, a key nickel producer, and other brokers suffered a significant cash flow disruption after nickel prices soared 250% in two days. JP Morgan and China Construction Bank bailed the firm out by offering a large undisclosed loan. However, nickel trading in the exchange is still not re-established. The LME set specific criteria to re-opening the Nickel market, including netting off long and short positions prior to the reopening, but traders with a short position are unwilling to settle contracts after a major price increase and LME inventories of LME grade nickel are low, which means the price may go higher still2. This is the first major impact of the liquidity shock as a result of the sanctions imposed in Russia.