Early results show solid incumbent wins in Mexico and India. South Africa mired in coalition talks.

- ECB likely to start an intermittent cutting cycle this week.

- Biden proposed a three-stage ceasefire plan for Gaza that faces opposition from the far-right in Israel.

- Narendra Modi’s coalition may get a super-majority in India.

- Thai political risk increased again. Ecuador is reportedly close to receiving large funding.

- Claudia Sheinbaum cruising to Mexican election victory.

- Venezuela disinvited the European Union from overseeing its elections.

- South Africa’s ANC dropped to 40% of votes nationally, forcing coalition talks.

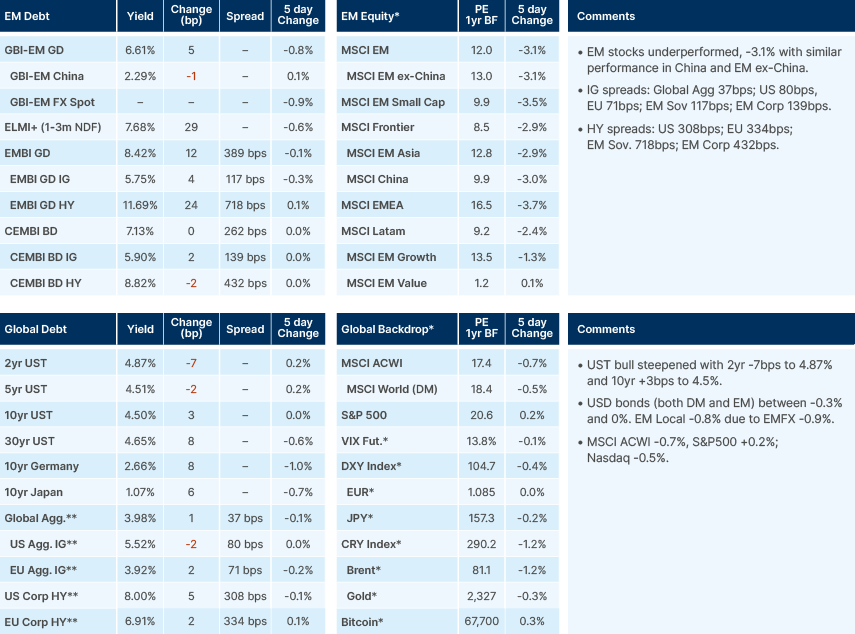

Last week performance and comments

Global Macro

EM Elections

The market reaction to the likely supermajority in India and Mexico were 180 degrees opposite. Indian assets rallied based on a narrative of policy continuity, while the MXN sold off almost 4% at some point based on Morena getting a supermajority with a new Prime Minister. The market reaction is about the nuances of policy path as much as positioning in our view. In India, there is no change of Prime Minister and the implementation path to a market-friendly reform opens. Like Mexico, India has been benefiting from manufacturing investment, albeit the government has merit in investing infrastructure and keeping a tight fiscal policy at the same time, which boosts productivity. The untold story is that the technicals are positive, in the fixed income space where Indian bonds will be included in the JP Morgan GBI EM Index with a 10% weight by Q2-2025.

On the other hand, Mexican local bonds and currency have been a darling for foreign investors, both EM dedicated and cross over. Nearshoring and the fact that Andres Manuel Lopez Obrador (AMLO) kept a tight fiscal policy during covid-19 despite some populist tendencies were the main factors buying Mexican assets. The negative narrative evolves as part of the ability of Claudia Scheinbaum to implement her own policies of becoming more subordinated to her predecessor. The risk is more acute from 1 September only until 1 October, when AMLO remains in power with a larger majority and can try to pass some of his negative changes in constitution like changes in the Supreme Court process.

Nuances apart, the positioning prior to the elections does seem to play a very large role, in our view. Supermajority means that the government has the ability of changing institutions o-in a much more straightforward manner. They increase the positive and negative tails in case they are used to thoughtful reforms or populist projects. It is very hard to make the case that the institutional environment in Mexico will deteriorate – in fact – it may improve after elections. Whereas it is hard to make the case that economic policies will change meaningfully in India, but risks always exist.

Even more interesting was the fact that South Africa, the country where the incumbent faces a proper existential threat, is much more stable, deteriorating only a little. The narrative will be expanded in the South African section, but in the end, the initial price action boiled down to positioning and price action, which themselves helped to shape the initial narrative.

European Central Bank

Ahead of the European Central Bank (ECB) meeting this week, influential Executive ECB Board Member Isabel Schnabel signalled the central bank will stagger cuts (one cut, one pause). She warned: "Based on current data, a rate cut in July does not seem warranted” and “We should look very carefully at the data because there is a risk of easing prematurely.” Schnabel added that some elements of inflation "are proving persistent, especially domestic inflation, and services". While officials are satisfied with the wider slowdown in price growth, "the path back towards price stability is bumpy," she said. ECB insiders say President Christine Lagarde gave Schnabel more time to brief the Committee in lieu of Chief Economist Philip Lane.

Geopolitics

US President Joe Biden proposed a three-stage ceasefire plan for Gaza. The response from Hamas suggests they are inclined to accept, at least the first stage. However, the Israeli far-right members that secure Netanyahu’s majority firmly oppose the plan. Israel’s opposition National Unity Party, headed by war cabinet member Benny Gantz, proposed to dissolve the Knesset, positing a deadline of Saturday for the government to lay out its strategy for Gaza, among other conditions. The vote count suggests the far-right members still have the upper hand. Last week, Chinese President Xi Jinping pledged more Gaza aid and talked trade at a summit with Arab leaders.1

Commodities

OPEC+ members delivered a coherent policy at its virtual meeting last weekend, a better outcome for the group than the chaotic meeting in November 2023. OPEC+ confirmed oil output will remain unchanged through to Q3-2024, with a few nuances:

- The formal output agreement has been extended from December 2024 to December 2025.

- Voluntary cuts (on top of OPEC+) by eight members are to be maintained through Q3 2024.

- Voluntary cuts will be phased out over 15 months (from October 2024 to December 2025), conditional on market conditions.

- Saudi production to increase by 1m barrels, Russia by c. 500k barrels, UAE by c. 400k, Iraq by c. 200k, Kuwait by c. 150k, Kazakhstan by c. 70k.

- The path published by Saudi officials suggests OPEC+ output would be c. 500k barrels per day (bpd) higher by December, and about 1.8 million bpd higher by mid-2025.

- The main concession was achieved by the UAE: 300k more than original.

- The external review of production capacity has been extended to November 2024.

- There was no formal statement on the compensatory cuts for Russia, Iraq, or Kazakhstan.

Emerging Markets

EM Asia

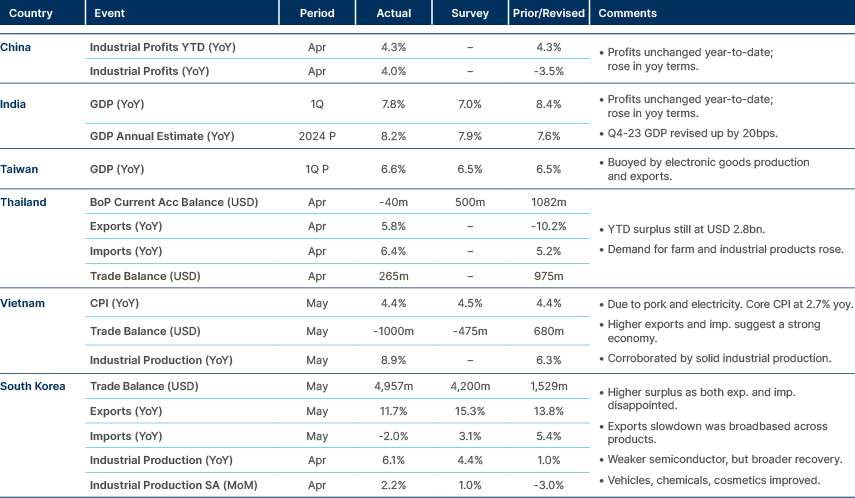

Economic Data: India’s GDP performance led by capex. Korea’s exports softened.

India: S&P Global Ratings signalled a potential upgrade for India's BBB sovereign credit rating, shifting the outlook from stable to positive. Despite upcoming election results, S&P foresees continuity in economic reforms and fiscal policies, citing strong fundamentals supporting growth. A surge in infrastructure spending and a fiscal deficit reduction have contributed to improved macroeconomic stability, potentially paving the way for a credit rating upgrade in the next 12-24 months.

Exit poll projections suggest the governing National Democratic Alliance (NDA) coalition will win between 316 and 400 seats. On average, NDA is expected to win 365 seats, 12 more than in the 2019 elections. Parliament has 545 seats (simple majority 273 seats, supermajority with 364). Nomura estimates the incumbent Bharatiya Janata Party (BJP) should get 305-320 seats, above the current 303 seats gained in the 2019 elections. The main opposition coalition I.N.D.I.A. bloc, led by the Congress Party, is projected to win 146 seats.

Thailand: Former Prime Minister Thaksin Shinawatra was indicted for Royal Insult in an interview he gave to a foreign media company in 2015. He was also charged with violating a computer crime law. Thaksin will appear in court on 18 June in a high-profile case against the charges. At the same time, Prime Minister Srettha Thavisin was accused by Thaksin of violating the lese-majeste law (criminalising perceived insults to the royal family) by causing fake news to circulate on social media after an interview in Seoul. The recent legal cases against Prime Minister Srettha and former Prime Minister Thaksin bring political uncertainties that are likely to slow economic reforms, including the THB 500bn digital wallet handout (THB 10k to c. 50m people) to stimulate the economy. In the short term, this is likely to reduce fiscal spending over the next quarters and also lower inflationary pressures.2 However, over the medium term, political instability reflecting broad tensions between political factions could be destabilising for the economy and postpone investments.

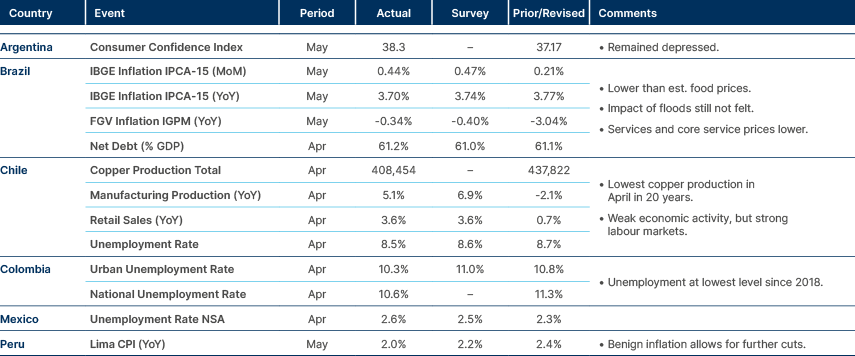

Latin America

Economic Data: Low inflation and unemployment across the region.

Argentina: President Javier Milei’s Libertarian Party managed to get a quorum in the Senate to push a vote on its omnibus bill next week. The bill suffered several modifications, so will have to be ratified again by the Lower House.

Ecuador: A Bloomberg article quoting Minister Finance Juan Carlos Vega suggested the possibility of the country receiving over USD 8bn in multilateral funding on top of the USD 4bn from the International Monetary Fund (IMF) programme. The article did not specify over which period the USD 8bn would be received. If it is over the four-year duration of the IMF programme (meaning USD 2bn per year on average), the amount is reasonable and there could be some space to exceed it. We met the Minister of Finance last week in Quito, and at least for 2024, he expects c. USD 4.0-4.5bn in multilateral funding, which is in line with our expectations. We should get the details next week after the approval of the programme from the IMF board on 31 May, but in principle, we expect c. USD 1.5bn from the IMF and c. USD 3bn from other multilaterals in 2024.

Mexico: Claudia Sheinbaum from the incumbent Morena Party claimed won the presidential elections with 58%-60% of votes, according to preliminary results. Some pundits argue that Sheinbaum will remain subordinate to current President Andrés Manuel López Obrador (AMLO), but her own track record and the history of Latin America suggest a lower likelihood of subordination to her predecessor. If the results are confirmed, Sheinbaum will have a supermajority (more than two-thirds) in the Lower House of Congress and fall just short of one in the Senate, increasing her ability to pass constitutional reforms. The key risk lies in the Morena Party winning a supermajority and Sheinbaum losing popularity fast, and becoming subordinated to AMLO, which raises the possibility of populist policies. This is more of a ‘tail risk’, in our view. Sheinbaum is an experienced politician, serving as Head of Government in Mexico City from 2018 to 2023, with her own strong ideas. It is possible that Morena will fail to achieve a supermajority in the Senate and that Sheinbaum could prove to be a more skilled technocrat than pundits fear.

Venezuela: The government withdrew its invitation to the European Union (EU) to monitor the presidential elections scheduled for 28 July. The decision could increase concerns over the transparency and credibility of the electoral outcome. Nevertheless, it also suggests the government seems to be willing to keep opposition candidate Edmundo González in the race until the election date rather than trying to disqualify him. The size of the opposition advantage poses a risk the government is making a calculus mistake, relying on its institutional controls, the obstacles it could impose to the opposition and its own mobilisation capacity to narrow the gap and try to win the election.

Central and Eastern Europe

Economic Data: Revisions point to softer economic activity in Eastern Europe/

Central Asia, Middle East, and Africa

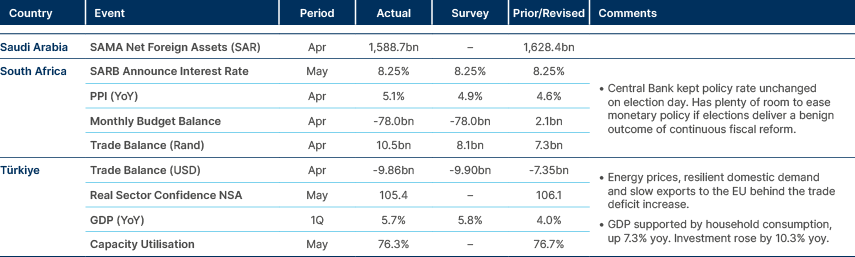

Economic Data: Türkiye’s GDP supported by household consumption and investment.

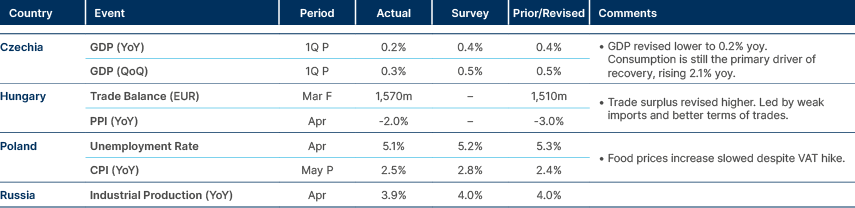

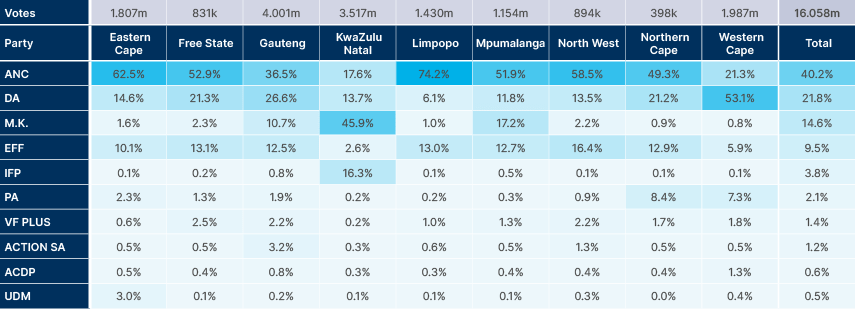

South Africa: The African National Congress (ANC) Party received only 40.2% (6.5m) of valid votes, down from 57% in 2019. The centre-right Democratic Alliance (DA) Party received 21.8% (3.5m) up 1% from 2019, and former president Jacob Zuma’s newly-created uMkhonto we Sizwe (MK) Party received 14.6% (2.3m) and the Economic Freedom Fighters (EFF) harnessed 9.5% (1.5m) of national votes.

On a regional basis, the DA Party retained its majority in the West Cape (Cape Town) with 53.1% of votes and had an expressive vote in Gauteng (Johannesburg) but failed to gain traction in the rest of the country, as per Fig. 1. The MK Party’s massive debut is mostly related to KZK (Durban). It is fair to say the ANC would have retained its majority had it received 90% of the votes from the MK Party in KZN and Mpumalanga.

Fig. 1: % Votes by Region: 10 largest Parties

The National Assembly must meet within 14 days to elect a President, a House Speaker, and a Chairperson of the National Council of Provinces (Upper House).3 There are two paths from here. If Cyril Ramaphosa remains as party leader, he will likely favour an alliance with the DA Party, as he was leading the anti-corruption campaign that drove out Zuma and former ANC Secretary General Ace Magashule, making it highly unlikely, in our view, that Ramaphosa will opt for an alliance with Zuma’s MK Party or the far-left EFF. This is the base case, in our view, as Ramaphosa enjoys more credibility with the average voter than the ANC. An alliance between ANC, the DA, and the centre-right Inkatha Freedom Party (IFP) would give the parties a working majority in all states, except for KZN, where the three parties would control 47.6% of seats.

On the other hand, Ramaphosa's replacement could lead to another big split in the party and would also open the way for an alliance with either the left-wing MK Party or the further left-wing EFF. An alliance with the ANC and EFF is more likely than the MK Party. However, the poor performance of the EFF in KZN makes it less valuable, with only 12.5% of seats in Gauteng and 2.6% in KZN. Furthermore, its far-left ideas are incompatible with the ANC's politics.

An alliance with the DA Party is being discussed in two formats. The ANC may run a minority government with DA support to pass legislation, with the latter party taking the House Speaker position to control legislation. This would likely render the government (and South African assets) more unstable. However, the DA Party may agree to become a full partner in the government in the name of national stability, giving the government close to two-thirds of the seats after adding 3.8% of the IFP Party and possibly 2.1% of the Patriotic Alliance (PA) Party. In this scenario, the DA Party and the centre-right smaller parties would have nearly as many votes as the ANC, and the reform agenda may accelerate and improve in terms of quality.

In the author’s view, the DA Party will be wise to be part of the government and take the opportunity to implement structural reforms. It is very hard to see it winning more than one-quarter of the national votes given its apartheid history and the country’s demographics. The complicated coalition talks in KZN and Gauteng will also bring the ANC closer to the DA.

Türkiye: Finance Minister Mehmet Şimşek said the Treasury will borrow more than necessary to drain liquidity out of the system. Simsek also mentioned that net foreign exchange (FX) reserves “will be positive soon”. Net reserves stand at USD 33.8bn as of 28 May, and swap-adjusted net reserves are negative at only USD -4.8bn.

Zambia: Debt exchange approved by 95% of bondholders.

Developed Markets

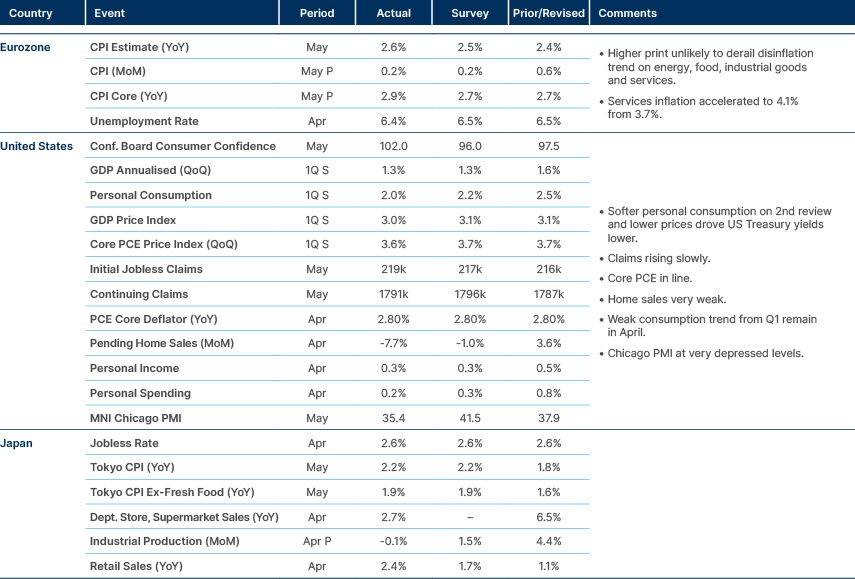

Developed Markets: Europe increase in inflation unlikely to derail the disinflation trend. US GDP revised lower based on softer consumption.

United States: Donald Trump was convicted of concealing the source of cash for the USD 130k payment to silence Stormy Daniels ahead of the 2016 US presidential election. Sentencing is scheduled for 11 July, just days ahead of the Republican National Convention on 15 July. Trump faces up to four years in prison, albeit it is highly unlikely he will face jail time given he is a first-time offender. Trump can still appeal, which is likely to postpone the sentencing.

The outcome only matters if he loses votes in America’s six swing states – more specifically, the 6% of undecided voters in the swing states. Polls suggest 11% of independent voters said a guilty verdict would make them less likely to vote for Trump. As expected, the former president attacked the process, saying: “This was a rigged, disgraceful trial” in the hallway outside the courtroom. Trump added: “The real verdict is going to be November 5th by the people. And they know what happened here”.

A forecast model by US political website The Hill gives Trump 56% odds of winning with 295 electoral votes vs. 243 for Biden, based on the electoral votes below:4

- Safe votes: 122 vs. DEM 159

- Likely votes: GOP 113 vs. DEM 67

- Likely + Safe: GOP 235 vs. DEM 226

- Swing states: GOP 56 vs. DEM 17

- GOP: higher odds in Georgia, Arizona, Wisconsin, and Pennsylvania

- DEM: better chance of taking Nevada and Michigan, and with lower margin

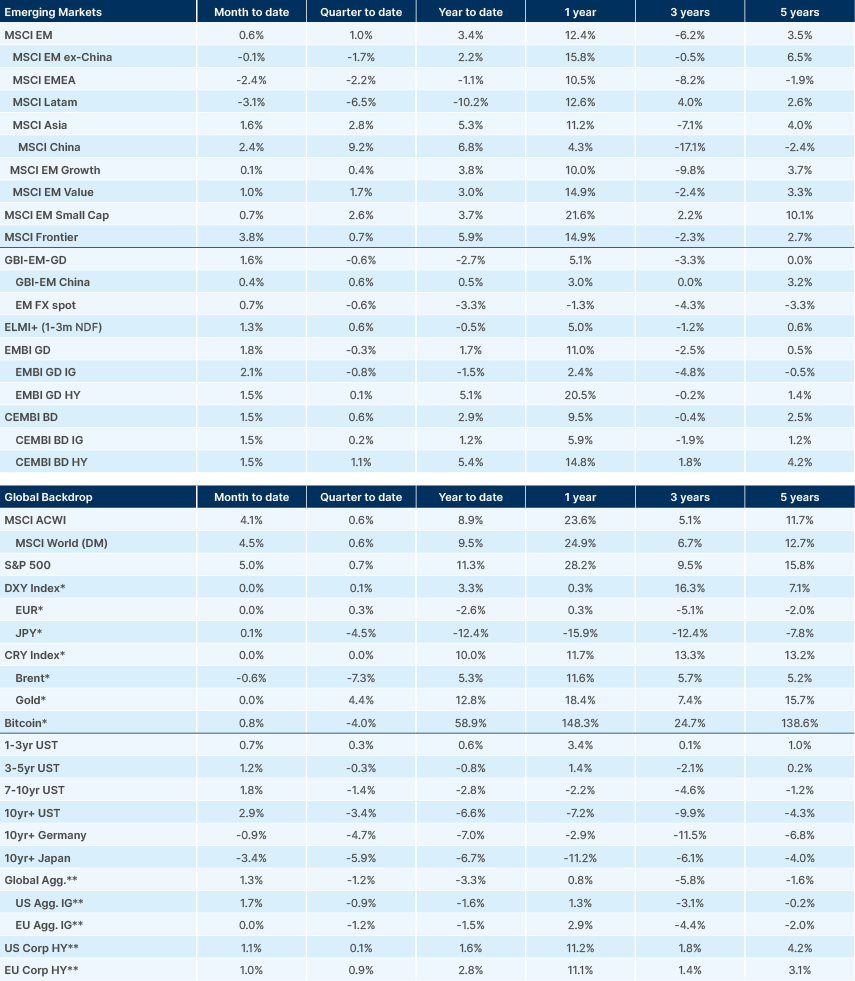

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://apnews.com/article/china-arab-forum-israel-hamas-war-de6b7249bb6aa2125aed9b671dc0fd03

2. See – https://www.bangkokpost.com/business/general/2802986/political-turmoil-could-put-handout-at-risk-say-analysts

3. See – https://docs.google.com/document/d/1NBMFZimaDFCA6dEGkGFi0jCVQY_notXf/preview?pli=1 and https://en.wikipedia.org/wiki/Democratic_Alliance_(South_Africa)

4. See – https://elections2024.thehill.com/forecast/2024/president/