The benign macroeconomic backdrop and the US Federal Reserve (Fed) inclination to ‘skip’ this month’s rate hike are music to investors’ ears. Flows into credit products and Emerging Markets (EM) bond issuance have benefitted from improved sentiment. Some say Colombia’s President Gustavo Petro is a local villain but he appears to be a market hero as the Colombian Peso outperforms. South Africa prints better than expected external and domestic data after a series of setbacks. Asia leads the disinflation cycle, and sees exports bottom out. Nigeria and Türkiye both name new central bank governors that the market can learn to love.

Global Macro

Goldilocks vs the central banks: Risk assets have performed strongly in recent weeks, and the rally has gained momentum this month, shifting the narrative from a bear market rally to a more sustainable ‘goldilocks’ scenario. The case goes as follows: inflation is falling quickly, from the Americas to Asia; the positive supply shock has further to run; and jobs are plentiful and credit markets are resilient. This narrative has delivered strong returns against the prevailing bearish sentiment, and asset price volatility has gone back to pre-Covid lows. But it feeds off the view that interest rate hikes are behind us. This assumption was tested last week, when the Bank of Canada (BoC) and the Reserve Bank of Australia (RBA) both went against market expectations and raised their monetary policy rates. It will be tested again this coming week when the four most powerful central banks: the US Federal Open Market Committee (FOMC), the European Central Bank (ECB), the Bank of Japan (BOJ) and the People’s Bank of China (PBOC) review their monetary policy. In reality, the risk of a negative surprise comes mainly from the FOMC, where the stage has been set for the so-called ‘skip’ (the idea that it will keep rates unchanged in June only to hike rates again in July, should the conditions warrant). This is an interesting idea, and the market has been practically ‘skipping’ along to that tune. It would be uncharacteristic for the Fed to stop the music without warning, but the precedent from Canada and Australia should keep investors alert to the risks. If anything, central bankers will be keen to push back against an excessive easing in financial conditions.

Colombia: President Petro’s political woes are mounting. The former Colombian ambassador Armando Benedetti was heard on tape threatening President Petro’s chief of staff with the disclosure of impropriety regarding Petro’s 2022 election campaign. Petro denied the allegation of taking illegal campaign money, but just nine months into his administration, his approval rating stands at 30% while 61% do not approve of his handling of the country (the poll was conducted in three Colombian cities: Bogotá, Barranquilla, and Cartagena). Petro has seen several of his flagship legislative reforms blocked by Congress, where he does not have a majority. His strategy of grassroots mobilisation, rallying support for his government via large-scale demonstrations, has become less and less effective. The market appears to not mind seeing Gustavo Petro unable to push through controversial reforms and has taken heart from the government’s strong fiscal performance – in line with the fiscal rule. The question is whether Petro decides to take more radical steps to achieve his reform agenda.

On the economics side, year-on-year (yoy) Consumer Price Index (CPI) inflation for May came in slightly below expectations at 12.36% (vs. 12.60% expected and 12.82% prior); core CPI yoy, however, printed above April’s level at 11.59% vs. 11.51% prior. Separately, ratings agency Moody’s affirmed Colombia’s sovereign debt rating at Baa2 with outlook remaining stable.

South Africa: Some positive economic data lifted the sombre mood in South Africa after a few quarters of disappointing economic performance. First, the current account deficit narrowed to ZAR 66.2bn (1% of gross domestic product (GDP)) in Q1 2023 from ZAR 155.3bn in Q4 2022 (2.3% GDP), which was well below market expectations, and the smallest deficit number since Q2 2011. The trade surplus notably widened substantially from ZAR 34.2bn to ZAR 103bn, due to the increased value of goods exports. Manufacturing production also surprised positively by recording a 3.4% yoy gain in April, the first annual gain in six months, and better than consensus forecasts of 2.5% yoy. This is consistent with better news regarding the impact of load shedding, which has essentially been suspended during working hours. Last week, electricity minister Kgosientsho Ramokgopa said the energy availability factor had improved to 60%, the strongest since August last year.

Commodities: Brent Prices ended more than USD 3/per barrel (bbl) lower than the week before, despite the announcement of a large production cut by the OPEC+ cartel the previous weekend. Inventory data were bearish across the board with upticks in inventories in all major hubs; US stocks saw a mild fall in crude inventories, but this was overwhelmed by sizable increases across products, in gasoline and diesel notably. The US Department of Energy announced last week that contracts had been awarded for 3 million barrels of crude to begin refilling the Strategic Petroleum Reserve (SPR), as well as a second follow-on solicitation for another 3 million barrels, but this was not sufficient to support spot prices, which settled close to the SPR target price of USD 73/bbl.

Emerging Markets

EM Asia: Outside Japan, all inflation indicators in Asia have been pointing towards rapid disinflation: this was the case again in the last week with inflation prints from China, India, and Thailand notably.

China: CPI inflation edged up marginally to 0.2% yoy in May from 0.1% in April, in line with expectations. Producer Price Index (PPI) inflation dropped further, from -3.6% to -4.6%. Core inflation moderated to 0.0% month-on-month (mom) in May from 0.1% in April. China’s trade data for May came in well below expectations: exports fell 7.5% yoy in nominal terms, while imports fell 4.5%. Growth in exports to the US, the European Union (EU), Japan, and Association of South East Asian Nations (ASEAN) countries were all substantially slower in May than in April. More positively, China's trade with Arab countries rose to a record level in 2022, rising by 31% to USD 431.4bn from USD 330.3bn in 2021.

Ahead of this week’s PBOC meeting, state-owned lenders including Bank of China, Industrial & Commercial Bank of China and Bank of Communications were instructed to cut rates on a range of products, including on demand deposits by five basis points (bps), and three-year and five-year time deposits by at least 10bps. This will help lower their funding cost and could push money out of bulging deposit accounts. The market is awaiting more decisive policy stimulus in the form of cuts in the PBOC’s loan prime rate (LPR) and medium-term lending facility (MLF), but no indication has been given by officials at this stage, so any announcement from the PBOC this week would be a positive surprise.

India: The RBI left its benchmark policy repo rate at 6.5 % for the second consecutive meeting in June, to ensure inflation stays within its 2-6% target range. This was in line with market forecasts amid easing cost pressures – annual CPI inflation eased to an 18-month low of 4.7% yoy for April due to a slowdown in food prices, and fell further to 4.25% yoy for May. The consensus forecast for WPI (wholesale prices) stands at -2.50% yoy.

The RBI also kept both the standing deposit facility (SDF) rate and the marginal standing facility (MSF) at 6.25% and 6.75, respectively. It also maintained its growth forecast for the fiscal year 2024 at 6.5%.

South Korea: Korea's export reliance on China dropped below 20% in Q1, as it continued to diversify exports to other markets (down from 26.8% yoy in 2018). Q1 exports to China decreased by 29.8% yoy, while exports to markets excluding China declined by only 6.8% yoy.

There appear to be fairly clear signs that the worst is behind the Asian tech exporters. Semi-conductor exports have been picking up sequentially: on a three-month seasonally-adjusted annualised basis, Korea’s tech exports have risen from -51% in December to -2.5% in May (annualised), and Taiwan’s from -13.3% to +18.4% (annualised).

Thailand: Headline inflation fell sharply from 2.7% in April to 0.5% yoy in May (consensus 1.6%), notably due to a large drop in electricity price inflation following a one-off, one-month THB 150 subsidy to poor households that will be reversed next month. Core inflation also decreased to 1.5% from 1.7% (consensus 1.6%), suggesting demand-pull inflation pressures are subdued. The Bank of Thailand (BOT) headline inflation forecast for 2023 stands at 2.5% yoy, recently lowered from 2.9%. Inflation dynamics are improving swiftly: PPI inflation fell from -3.4% in April to -5.0% in May. This has not precluded the BOT from sounding decidedly hawkish, however.

Latin America

Argentina: Consumer prices in Argentina rose 8.4% in April – the highest monthly increase in more than three decades. Yoy inflation reached 108.8% and is forecast to rise sharply as Argentina builds up to general elections in October. The latest end-2023 inflation forecast from a panel of local economists was raised to 148.9%, a 22-point jump from its previous forecast.

Last week the government completed a voluntary debt swap that saw it exchange 7.4trn pesos (USD 28.9bn of bonds) in local debt, with 78% participation by local creditors. The was the third swap this year, and part of a wider move to restructure debts due between June and September, just before the general election in October. The International Monetary Fund (IMF) said it "welcomes the efforts of the Argentine authorities to reduce the refinancing risks associated with domestic debt."

Brazil: Data from statistics agency IBGE showed yoy CPI inflation dropped below 4% (coming in at 3.94%) for the first time since 2020, below expectations. The S&P Global Brazil Composite Purchasing Managers’ Index (PMI) rose to 52.3 vs. 51.8 prior, while the Services PMI was somewhat lower at 54.1 vs. 54.5 prior. Earlier in the week, according to the Focus survey, upward revisions pitched the 2023 GDP growth estimate at 1.7% (from 1.3% last week), which reflected the much stronger than expected Q1 2023 GDP performance.

Chile: Cadem’s latest weekly poll showed President Gabriel Boric's approval rating rose ten percentage points to 41% and his disapproval rating declined by the same amount to 51%. For now, Boric’s approval rating surpasses that of former presidents Bachelet and Piñera in their last terms. The same poll showed 48% of Chileans would vote against a new constitution in December (vs. 46% in the previous week), while 28% said they would vote in favour (vs. 34% in the previous week). CPI inflation decreased to 8.7% yoy in May from 9.9% prior (vs. 8.9% expected) but core CPI remained sticky at 9.9% vs. 10.3% prior. The trade balance for May dropped below USD 1bn (at USD 952m) vs. USD 1.5bn expected – driven by higher imports.

Mexico: State elections were contested in Estado de Mexico and Coahuila last weekend. As expected, President Lopez Obrador’s Morena Party won a stunning victory by winning the governorship in the State of Mexico, one of the main opposition strongholds, while the opposition coalition featuring PRI, PAN and PRD, won the governorship of Coahuila. Mexico’s Foreign Minister Marcelo Ebrard announced he would leave his cabinet position this week. Many believe this move is designed to see him succeed Obrador as Morena’s official candidate in the 2024 presidential election, but he has stopped short of declaring his candidacy. Ebrard previously said he was confident he could win a nomination to represent Morena’s political project, known as the “fourth transformation”. Other possible contenders for the nomination include Mexico City Mayor Claudia Sheinbaum and Interior Minister Adan Augusto Lopez, with Sheinbaum having more cross-party appeal.

Mexico CPI inflation came in in line with expectations at 5.84% yoy (vs. 5.88% yoy expected) but importantly continues to print lower vs. 6.25% prior. CPI is declining mom at -0.22% vs. -0.02% prior but core CPI continues to increase mom at 0.32% (vs. 0.39% prior). Industrial production (not seasonally-adjusted) yoy in April disappointed with a print of 0.7% vs. 1.3% expected.

Peru: The central bank left rates unchanged at 7.75% for the fifth consecutive month, in line with consensus, while the communique following the decision remained hawkish. At 4.21%, inflation expectations for the year ahead remain above the target band of 2.0% (+/- 1pp).

Uruguay: CPI inflation yoy for May declined to 7.1% from 7.61%. Separately, ratings agency Fitch upgraded the country’s debt from BBB- to BBB.

Central Asia, Middle East, and Africa

Nigeria: Long-standing Central Bank of Nigeria (CBN) Governor Godwin Emefiele was suspended last week with “immediate effect”. Deputy Governor Folashodun Adebisi Shonubi will oversee upcoming monetary policy and exchange rate reforms. The CBN has been undertaking a gradual devaluation of the naira, according to foreign exchange (FX) daily fixing rates: the fixings have weakened by 1.5% this week. The non-deliverable forwards (NDF) market curve is pricing in a 4% devaluation in one week, 13.5% in one month and 28% in three months.

Türkiye: The Turkish lira continued to weaken to a new record low of 23.5 per USD, extending the monthly loss to 13%, and bringing the total depreciation to about 18% since the runoff election on 28 May. Following the appointment of Mehmet Simsek, a former deputy prime minister known for his market-friendly policies, as the new Finance Minister, President Tayyip Erdogan appointed Hafize Gaye Erkan, a former co-CEO at First Republic Bank and a managing director at Goldman Sachs, as the Head of the Central Bank of Türkiye (CBT). These moves were seen as signalling a strong shift from unorthodox economic policies that had led to high inflation, low interest rates, a plummeting lira, and negative net FX reserves. Türkiye’s annual inflation rate eased for the seventh consecutive month to 39.6% in May, mainly due to the government's move to provide unlimited free natural gas for all households for a year, but it is still far from the CBT’s target of 22.3% for 2023. Türkiye’s current account deficit widened from USD 4.9bn in March to USD 5.4bn in April.

Egypt: Egypt’s oil ministry is working to increase oil production by 11% to 650,000 barrels per day (bpd) in the current year from 587,000 bpd in 2022 to increase foreign currency inflows. The petroleum ministry is targeting raising investments of foreign oil companies operating in the country by 35% to about USD 7.75bn during the current year.

Central and Eastern Europe

Poland: The European Court of Justice ruled the Polish government’s judicial reforms of December 2019, which involved disciplining the judiciary, was unlawful. In a separate issue, the European Commission launched an infringement procedure against Poland for the ruling party’s (PiS) launch of an investigative committee into Russian influence on Poland between 2007 and 2022, widely seen as an attack on the opposition. The central bank kept interest rates unchanged at 6.75%. The government approved an amendment to the 2023 budget which would increase the deficit ceiling by PLN 24bn from 68bn to 92bn (i.e., from 2% of GDP to 2.8% of GDP).

Czech: Industrial output fell 1.8% yoy (worse than the 0.4% growth expected), while nominal monthly wages grew 8.6% yoy (vs 7.9% prior). Headline inflation declined further to 11.1% in May, down from 12.7% in April. The print was above consensus (10.8%) but significantly below the central bank (CNB) May forecast of 11.6% yoy.

Hungary: Retail sales declined by 12.6% yoy in April, better than the 13.2% yoy decline in March, but still larger than in the previous months. In a similar trend to recent European CPI inflation figures, yoy CPI fell from 24% in April to 21.5% in May with declines led by food prices.

Developed Markets

US economic data disappoints: Economic data was slightly weaker than expected last week. First, the US ISM Services survey fell to 50.3 from 51.9, against expectations of an increase to 52.4. All four sub-indices were down mom, with the new orders index falling particularly sharply to 52.9 (down 3.2 points mom). Second, initial jobless claims for the week to 3 June jumped by 28,000 to 261,000, the largest weekly jump in initial claims since July 2021. However, continuing claims fell by another 37,000 to 1.757 million last week and now stand circa 100,000 below their April high, which is not typically seeN during economic slumps, and is a clear sign of strength in the labour market.

Ahead of this week’s June FOMC meeting, the market is pricing in A 31% chance of a 25bps hike, following by a greater chance of a rate hike at July’s meeting. The rationale for the ‘skip’ before hiking again was laid out by Fed Vice Chair nominee Philip Jefferson last week: to gain more time to observe how the US economy is handling the 500bps of rate hikes implemented so far. Jefferson was careful to argue that a skip was not a pause, which is fair enough, but one wonders how much more the Fed will know in July that they don’t know in June, so a skip would still be dovish.

Canada in hawkish move: The BoC ended its ‘pause’ and increased the overnight rate by 25bps to 4.75%. The market was only assigning a 50% probability to a rate hike. The BoC has now moved to a ‘data dependent’ stance, looking at excess demand, inflation expectations, wage growth and corporate pricing. It kept its quantitative tightening policy unchanged. Expectations are for another hike to 5.0% in July.

Australia surprise rate hike: The RBA defied consensus expectations again, hiking its cash rate by 25bp to 4.1%. The market was only assigning a 25% probability to a hike. The decision and statement offered further evidence the RBA is still concerned about upside risks to inflation, and the market is pricing in another hike for at least one of the next three RBA meetings.

Eurozone in technical recession: The Q1 Eurozone GDP print was revised down from 0.3% quarter-on-quarter (qoq) annualised to -0.4%. At the country level, this revision was largely linked to Germany, which was revised down by 1.5% to -1.3%, and Ireland now down 17.3%. Ireland’s data, as ever, creates distortions, but there is no mistaking the slowdown in European growth, which has now recorded a technical recession last winter (two consecutive quarters of negative growth).

Japan records strong Q1 growth: Japan’s second set of preliminary estimates of Q1 2023 GDP was released on 8 June. The revised real GDP growth figure is +2.7% qoq annualised, above the consensus forecast of +1.9%, indicating that the Japanese economy grew strongly in Q1 2023.

This Week’s events

Monday, 12 June

- Czech Rep. CPI (May, % yoy) cons.11.0

- India CPI (May, % yoy) cons. 4.4

Tuesday, 13 June

- Germany CPI (May, final, % mom/yoy) -0.1/6.1

- Germany HICP (May, final, % mom/yoy) -0.2/6.3

- Germany ZEW survey expectations (Jun, index) -14.0

- Germany ZEW survey current situation (Jun, index) -40.0

- US CPI (May, % mom/yoy) 0.2/4.1

- US CPI ex food and energy (May, % mom/yoy) 0.4/5.3

Wednesday, 14 June

- UK Monthly GDP (Apr, % mom/3M-3M) 0.2/-

- UK Industrial production (Apr, % mom/yoy) -0.4/-

- Eurozone Industrial production (Apr, * % mom/yoy) 1.2/0.9

- US PPI final demand (May, % mom/yoy) -0.1/1.5

- Argentina National CPI (May, % mom/yoy) 8.4/108.8 8.2/115.1 -/-

- FOMC rate decision (%) 5.25%

Thursday, 15 June

- Japan Trade balance (May, JPYbn) -1300.0

- China Industrial production (May, % yoy) 3.5

- China Retail sales (May, % yoy) 3.7

- China Fixed assets ex rural – ytd (May, % yoy) 4.4

- France HICP (May, final, % mom/yoy) -0.1/6.0

- France CPI (May, final, % mom/yoy) -0.1/5.1

- Poland CPI (May, final, % yoy) 13.0

- US Retail sales advance (May, % mom) 0.0

- US Retail sales ex auto (May, % mom) - 0.1

- US IP (May % mom) 0.1

- Russia Real GDP (Q1, 2nd rel, % yoy) -1.9

- ECB Refi rate / deposit rate (%) 4.25% / 3.50%

Friday, 16 June

- Eurozone HICP (May, final, % yoy) 6.1

- Eurozone Core HICP (May, final, % yoy) 5.3

- Brazil Economic activity (Apr, % mom/yoy) 0.1/1.5

- US University of Michigan sentiment (Jun, flash, index) 60.0

- BOJ policy rate / 10yr target: -0.10% / 0.00%

During the week

- China Aggregate financing (May, RMBbn) 1900.0

- China New yuan loans (May, RMBbn) 1550.0

- China M2 (May, % yoy) 12.0

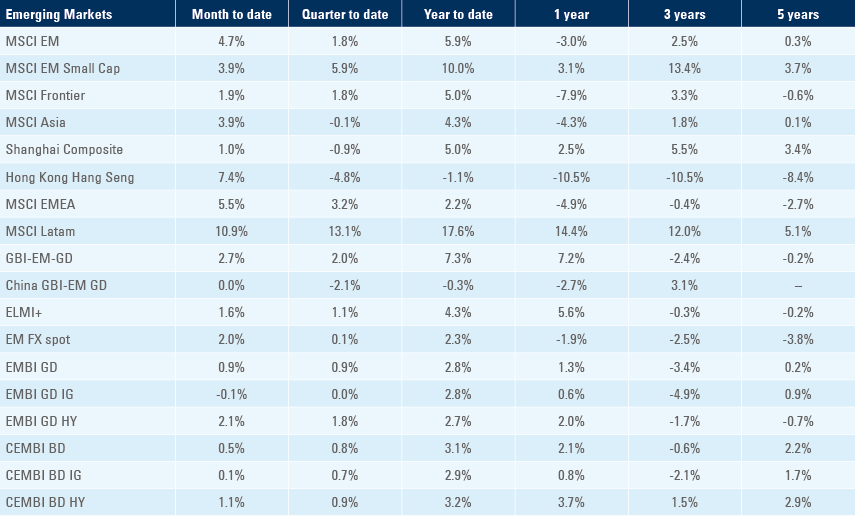

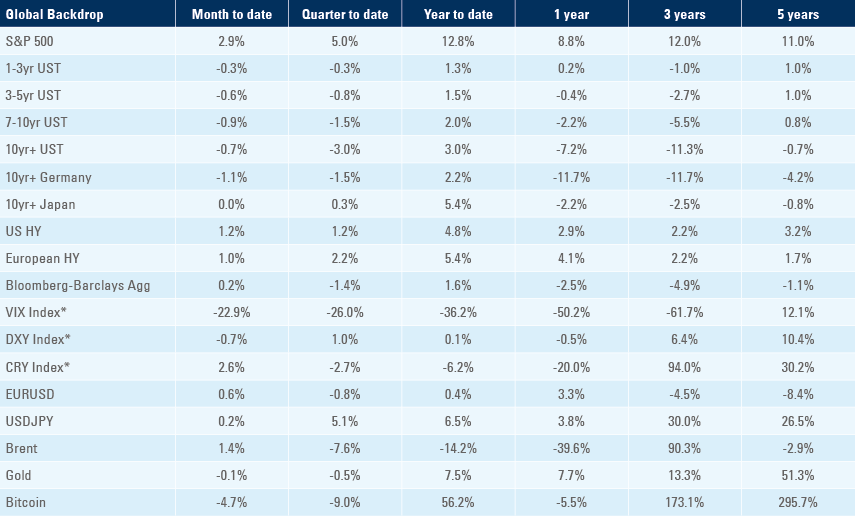

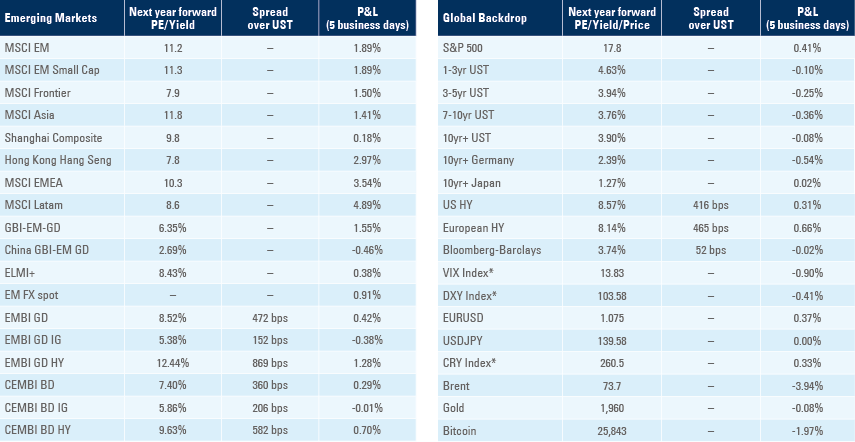

Benchmark performance