Cloudy macro horizon remains as trade data from Asia remains weak and liquidity is about to drain

The G7 summit highlighted and consolidated the new geopolitical reality of a multi-polar world. In the United States (US) stocks are riding high on liquidity with artificial intelligence (AI) the most attractive narrative capturing flows. However, leading economic indicators still suggest the global economy is moving to a recession. The exception is China, where the narrative is evolving much faster than the economy itself. India announced another demonetisation with a much smaller impact than the 2016 episode. Ecuador’s President called snap parliamentary and presidential elections. Latin America data was stronger than expected. The International Monetary Fund (IMF) approved a USD 3bn lending programme to Ghana. Türkiye’s presidential election run-off this Sunday is less uncertain, but policies following the elections remain a question.

Global Macro

The strength of stock markets in the US has been notable. Beneath the surface, it’s clear that market leadership has been extremely narrow, concentrated in the top mega-cap technology stocks. One key theme across the performance has been AI, which has been mentioned across almost all companies’ results both in Emerging Markets (EM) and Developed Markets (DM). While AI is very likely to unleash a massive productivity revolution to the service sectors in the years ahead, it is unlikely to change the current economic and credit cycles, in our view.

Also in our view, US markets outperformance year-to-date has come from a combination of light tactical positioning (fast money) at the beginning of the year and more plentiful liquidity than expected. The Bank of Japan (BOJ) policy remained expansionary while the US Federal Reserve (Fed)’s balance sheet increased to bail depositors from Silicon Valley Bank, Signature Bank and First Republic Bank, and the Treasury General Account (TGA) has been drained since January when the debt ceiling was hit, effectively expanding liquidity. At the same time, fiscal policies were more expansionist that expected in Q1 2023 (i.e., Inflation Reduction Act; Cost of Living Adjustment). This allowed for this narrow relief rally in stocks despite all the well-known fundamental issues in the global manufacturing, real estate and banking sectors. Nevertheless, we are still in a range-trading environment in 2023, typical in pre-recessionary periods.

In H2 2023, the liquidity picture will change, in our view. Lifting the debt ceiling will allow the TGA to be replenished together with ongoing quantitative tightening (QT) of USD 95bn, which is likely to tighten liquidity by USD 600bn – 1.2trn. The European Central Bank (ECB) is accelerating its QT as well and its targeted longer term refinancing operation (TLTRO) repayments will tighten liquidity by another EUR 477bn on 28 June (43% of all outstanding TLTROs and 6% of the ECB balance sheet). Finally, in Japan inflation as measured by the Consumer Prices Index (CPI) rose again last week, challenging the BOJ’s yield curve control policy.

The incoming liquidity withdrawal will likely add volatility and challenge market leadership once again. The underperformance of US stocks which started in 2022 is likely to resume once liquidity tightens again, in our view. For now, keeping a cautious asset allocation but underweight US assets is the best relative stance. The time to add aggressively into EM stocks and high yield will come when the Fed is forced to U-turn.

Geopolitics

The G7 summit in Hiroshima took place a few days after the Arab League summit in Jeddah, where Syria’s leader Bashar al-Assad was welcomed to create the conditions to repatriate Arab League summit refugees in Turkey, Lebanon, and Jordan. Ukrainian President Volodymyr Zelensky took a detour to Jeddah before Hiroshima, criticising those Arab leaders who “turn a blind eye” to Russia’s invasion before lobbying the G7 for more cash and weapons. Indian President Narendra Modi took the opportunity to highlight the ineffectiveness of the United Nations (UN) to deal with problems in this new multi-polar world. Modi warned, if big institutions like the UN do not become the voice of the Global South, the UN and Security Council will become “just a talk shop”. Institutional reform to multilateral institutions is an agenda that oddly unites countries with very different strategic interest (some historical rivals) such as China, India, Brazil, Russia and South Africa alongside the Gulf countries.

Emerging Markets

Asia: A broad decline in merchandise trade volumes across the region highlights the challenges facing global gross domestic product (GDP) growth. China’s economic activity data dropped again but remains one of the few locations where economic activity is still positive, and that is unlikely to change, in our view. Philippines kept policy rate unchanged as expected.

China: Economic data disappointed again. The Citibank Surprise Index plunged 77 points to 24.1 last Friday, after peaking at 155.1 on 21 April. Industrial production rose by a year-on-year (yoy) rate of 5.6% in April from 3.9% in March, but still significantly below 10.6% consensus, retail sales rose by 18.4% yoy, below consensus at 21.9%, while fixed asset investments rose 4.7% yoy, against consensus at 5.7%. Youth unemployment rate increased further to 20.4% in April, almost 4% above its 2020 peak, explaining why the country faces a confidence crisis despite the end of lockdown policies. China kept its one-year and five-year Loan Prime Rate (LPR) unchanged at 3.65% and 4.3%, respectively. But the credit channel is turning as commercial banks have recently been cutting rates on some deposits to restore their net interest rate margins. At the same time, communications from the People’s Bank of China (PBoC) suggest some banks should also cut corporate lending rates.

South Korea: Exports contracted by 15.3% in yoy terms in the first 20 days of May (-11.8% yoy in April) and -13.1% yoy after adjusting for business days, the seventh consecutive monthly decline. Semiconductor exports plunged 36.1% over the same period, as global consumers reduced spending on electronic devices after a large increase of purchases during the pandemic, partially due to work-from-home dynamics that are evolving.

India: The trade deficit narrowed to USD 15.2bn in April from USD 19.7bn in March, significantly below consensus at USD 19.6bn as exports dropped by a yoy rate of 12.7% and imports declined 14.1% yoy. Wholesale prices declined in yoy terms by 0.9% in April, down 220 basis points (bps) from March’s +1.3% yoy and 50bps below consensus. In other news, India announced a demonetisation by removing all INR 2,000 bills out of circulation with the objective to fight black market practices. Comparisons with the demonetisation of 2016 (when a large demonetisation lead to an economic slowdown) are inevitable, albeit back then the Reserve Bank of India (RBI) removed 85% of the currency in circulation, compared with only 10.6% of the INR 2,000 notes today, limiting the impact on growth and inflation.

Philippines: The central bank kept its deposit and lending rates unchanged at 5.75% and 6.25% respectively, in line with consensus. The balance of payments moved to a USD 0.15bn deficit in April after a USD 1.27bn surplus in March. Remittances from overseas workers rose to USD 2.67bn in March from USD 2.57bn in February.

Latin America: Economic activity was in general better than expected across Latin America.

Ecuador: President Guillermo Lasso invoked a constitutional provision called Muerte Cruzada, the equivalent of snap election for a new parliament and president to complete Lasso’s original term until early 2025. The National Electoral Council named 20 August as the tentative date for the legislative elections. The Pachakutik indigenous political party is questioning the constitutionality of the action since Lasso was under an impeachment process that threated to remove him from power and the initial reading is that the election tends to favour the Correistas (Movimiento Revolucion Ciudadana), the current party of opposition. The last Correista president, Lenin Moreno, was a market-friendly reformist. Moreno’s Vice President Otto Sonnenholzner said he will run again, albeit there is little visibility at this stage on whether he will have a shot. ECUA 2.5% 2035 bonds initially dropped five points to USD 33 before consolidating around USD 35 (close to the lows in October 2022 at USD 30.5; high in May 2022 at USD 64.5).

Brazil: Retail sales increased 0.8% month-on-month (mom) in March after being unchanged in February bringing the yoy rate up 210bps to 3.3% over the same period. The economic activity proxy surged to a yoy rate of 5.5% in March from 2.8% yoy in February. Petrobras announced a new pricing policy, giving more flexibility to set different price levels across different regions in the country.

Colombia: Real GDP growth rose 1.4% quarter-on-quarter (qoq) in Q1 2023 after 0.7% qoq in Q4 2022, 40bps above consensus as the yoy rate was unchanged at 3.0%. The trade deficit widened to USD 1.08bn in March from 0.55bn in February, worse than consensus at 0.86bn. The economic activity proxy declined to a yoy rate of 1.6% in March from 3.0% in February, 30bps above consensus.

Middle East and Africa

Ghana: The IMF approved a USD 3.0bn extended fund facility (EFF) programme with a USD 0.6bn immediate disbursement and the World Bank (WB) approved a USD 1.6bn lending facility. The Ghana 8.125% initially rallied USD 3.5 to USD 41.2 before dropping back to USD 39, closing the week almost unchanged. Fading the IMF programmes (i.e., selling bonds post-announcement) have been the modus operandi of markets over the last two years, as most debt restructures are insufficient to bring the country’s debt position on a sustainable path. In the case of Ghana, a debt restructuring could act as a catalyst for higher prices, considering the IMF and WB facilities were larger than expected.

Türkiye: Foreign investors sold USD 135m worth of stocks and USD 31m of bonds post-presidential elections. The second round will take place on Sunday 28 May. The base case scenario, with some wide margin, is that Erdogan gets re-elected. The key question for next week – and month following re-election – is whether Erdogan decides to backstop the macro bleeding, allowing the TRY to depreciate and interest rates to widen. These adjustments would allow the current account deficit to tighten, lowering external funding needs and providing a better macro environment to funding the country’s external deficit, at the expense of a strong slowdown in credit and a likely economic recession. The second question is whether these adjustments would be sustained, as over the last ten years Erdogan has only allowed for temporary macro stabilisation policies before reverting to heterodox policies. The central bank reported foreign exchange (FX) reserves dropped by USD 7.6bn in the week to May 12 to USD 60.8bn. Net reserves declined by USD 4.5bn to only USD 2.3bn (excluding swaps) or negative USD 57.8bn after including FX swaps. The latest number reflects the magnitude of the challenge faced by Türkiye.

Snippets

Asia

- Indonesia: The trade surplus surged by USD 1bn to USD 3.9bn in April, significantly above consensus at USD 3.3bn as exports declined by 29.4% yoy and imports by 22.3% yoy.

- Malaysia: The trade surplus narrowed to MYR 12.9bn in April from MYR 26.7bn in March, significantly below consensus at MYR 21.2bn, as exports dropped by 17.4% yoy and imports by 11.1% yoy, both significantly below consensus.

- Taiwan: The current account surplus narrowed to USD 19bn in Q1 2023 from USD 23.4bn in Q4 2022.

- Thailand: Real GDP growth rose by a yoy rate of 2.7% in Q1 2023 from 1.4% yoy in Q4 2022, 40bps above consensus.

- Argentina: The trade deficit narrowed to USD 0.1bn in April from USD 1.1bn in March, below consensus for a USD 0.6bn surplus as imports declined by USD 0.8bn to USD 6.0bn and exports increased by 0.1bn to USD 5.9bn.

Latin America

- Chile: Real GDP growth rose 1.0% qoq in Q1 2023 from 0.2% qoq in Q4 2022 as the yoy rate declined 0.9%, an improvement from -2.3% over the previous quarter. The current account posted a USD 0.75bn surplus in Q1 2023 after a USD 5.0bn deficit in Q4 2022.

- Mexico: The central bank kept its policy rate unchanged at 11.25%, in line with consensus. Retail sales were unchanged in March after declining 0.3% mom in February, slightly below consensus.

- Peru: The unemployment rate declined by 40bps to 7.1% (below consensus at 7.4%) in the city of Lima. The economic acidity proxy improved to a yoy rate of 0.2% in March from -0.5% yoy in February but came in 110bps below consensus.

Middle East and Africa

- Egypt: The central bank kept its deposit and lending rates unchanged at 18.25% and 19.25%, respectively. The trade deficit improved only marginally to USD 1.97bn in March after a USD 2.1bn deficit in February.

- Nigeria: The yoy rate of CPI inflation rose 20bps to 22.2% in April, broadly in line with consensus.

- Saudi Arabia: The yoy rate of CPI inflation was unchanged at 2.7% in April.

- South Africa: The unemployment rate rose 20bps to 32.9% in Q1 2023. Retail sales declined 0.7% mom in March after dropping 0.3% mom in February.

Central and Eastern Europe

- Czechia: Producer price index (PPI) inflation declined 1.2% in April after 1.0% deflation in March, bringing the yoy rate down by 380bps to 6.4%, 110bps below consensus.

- Hungary: Real GDP growth contracted 0.2% qoq in Q1 2023 (-0.9% yoy), slightly better than consensus.

- Poland: Real GDP growth increased by 3.9% qoq in Q1 2023 after contracting 2.3% qoq in Q4 2022 as the yoy rate contracted 0.2%, slightly better than -0.9% consensus. The trade surplus declined to USD 0.6bn in March from USD 1.1bn in February (revised from 2.2bn) below consensus for a USD 1.4bn surplus. Both imports and exports rose sequentially, but the former at a faster pace.

- Romania: Real GDP growth rose 0.1% qoq in Q1 2023 after 1.0% in Q4 2022, bringing the yoy rate down by 220bps to 2.3%, significantly below consensus at 4.0%.

Developed Markets

United States: The New York Fed Empire Manufacturing survey dropped 43 points to -32 in May and the Service Business activity dropped by seven points to -16.8 over the same period. Retail sales rose 0.4% mom in April, 40bps below consensus, after declining 0.7% mom in March (revised from -1.0% mom), while industrial production rose 0.5% mom in April, 50bps above consensus after 0.0% in March (revised from +0.4% mom). The housing sector remains at depressed levels. Initial jobless claims rose 242k in the week ending 13 May (251k consensus and 264k prior) and continuing claims declined to 1.80m in the previous week (1.82m consensus and 1.81m prior). Jerome Powell and Ben Bernanke were both panellists at the “wonkish” policy adviser Thomas Laubach Research Conference, where the current Fed Chair made the case for pausing the hiking cycle to assess the impact on the economy.

Eurozone: Real GDP growth rose 0.1% qoq in Q1 2023, unchanged from Q4 2022 and in line with consensus. The trade balance moved to EUR 17.0bn surplus in March from a EUR 0.2bn deficit in February. Industrial production dropped 4.1% mom in March after rising 1.5% mom in February, bringing the yoy rate down 340bps to -1.4% over the same period against consensus for +0.1% yoy. The ZEW expectation survey dropped 15 points to -9.4 in May.

Japan: The yoy rate of CPI inflation rose 30bps to3.5% in April as core CPI (ex-food and energy) rose 30bps to 4.1%, both broadly in line with consensus. PPI inflation rose 0.2% mom in April after 0.1% mom in March (consensus unchanged), taking the yoy rate down 160bps to 5.8%, 20bps above consensus. Industrial production rose 1.1% mom in March after 0.8% mom in February. GDP growth rose 0.4% qoq in Q1 2023 after being unchanged for Q4 2022.

United Kingdom: The unemployment rate rose 10bps to 3.9% in April as 136k jobs were lost in net terms over the same period, from 42k created in March. The cracking of the UK’s labour market is interesting as it often leads economic activity trends in the US.

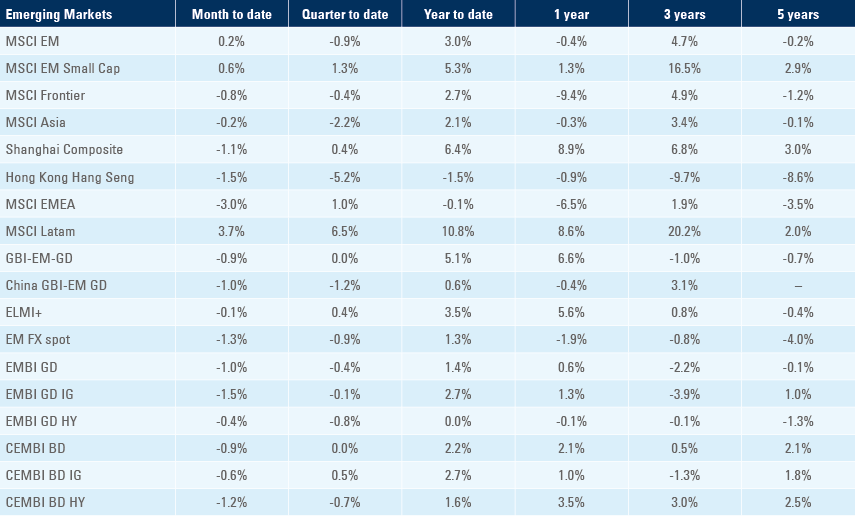

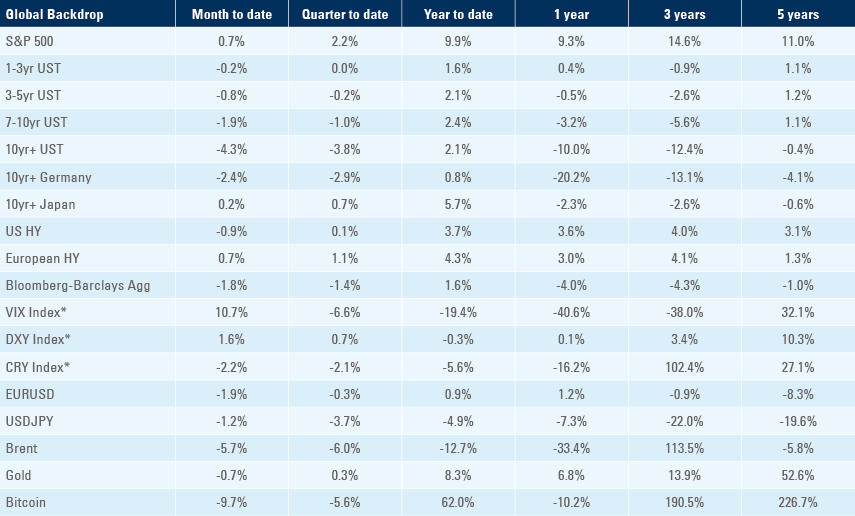

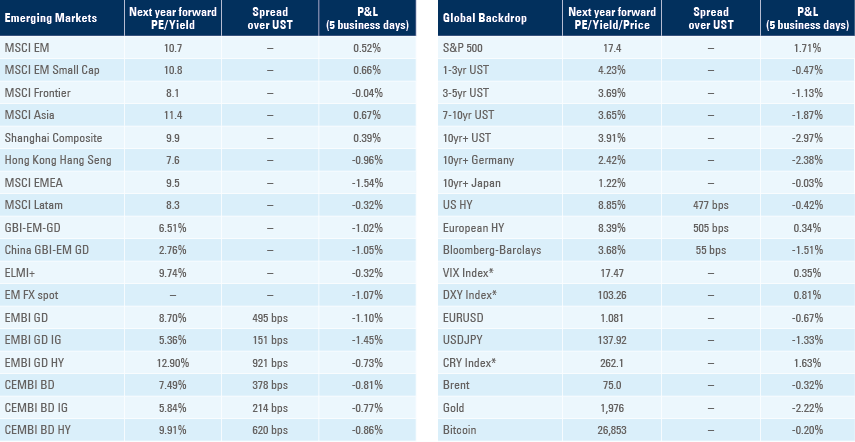

Benchmark performance