- Chinese tech stocks hot streak continues. Xi Jinping will host symposium with CEOs this week.

- Trump announced intentions to impose reciprocal tariffs on US trading partners, US CPI surprised to upside.

- Russian crude oil exports have plunged after US sanctions intensified.

- US and Russian delegations to begin talks imminently on ending Ukraine war.

- Indonesian President Prabowo Subianto doubled-down on a push to slash spending

- Brazil’s President Lula’s disapproval rate rose in January amid higher food prices and increasing pessimism about the economy

- Klaus Iohannis stepped down from his position as Romania's president instead of undergoing an impeachment vote in parliament

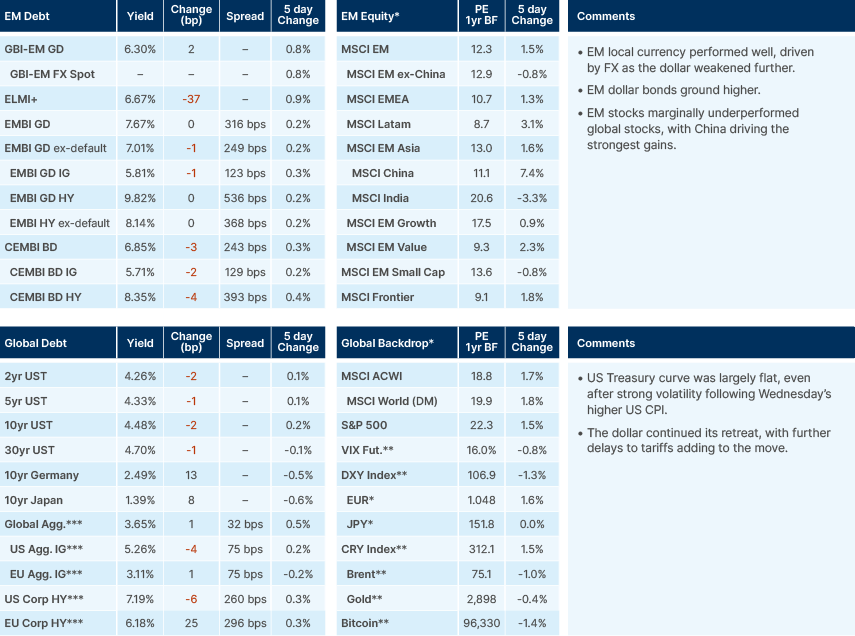

Last week performance and comments

Global Macro

Chinese tech stocks bull run

China’s tech stocks rose more than 20% in the last month, after DeepSeek’s disruptive artificial intelligence (AI) model triggered a reappraisal of China’s technological and AI capabilities. Cloud computing and tech hardware companies that stand to benefit from AI have led the rally, with Alibaba up 50% post-DeepSeek, BYD +42%, Tencent +35%, and Baidu +25%. E-commerce platforms JD.com and Meituan also posted strong gains, after better consumption data during the lunar holiday, and growing expectations of fiscal stimulus. Over recent decades, China has excelled at technology scaling, even if it lagged new product development. The leapfrogging of the Chinese auto industry with state-of-the-art electric vehicles (EVs) is a good example. DeepSeek begs the question of whether China can be the dominant player in AI applications after lagging the initial developments of the industry.

President Xi Jinping is hosting a symposium with top tech executives this week, including Jack Ma, to bolster confidence in the sector. The high-profile gathering with tech tycoons may become the main signpost of the end of the Chinese government crackdown in the technology industry that started in 2020, when Alibaba had to cancel the initial public offering (IPO) of its fintech arm Ant Group.

The outperformance of Chinese stocks, up 13.4% year-to-date (YTD), is also driving investors to reduce their large overweight in Indian stocks, which are down 6.0% YTD. Most of the underperformance in India is concentrated on the small and mid-cap companies, which are down by 18.0% and 13.1%, respectively, while large caps are down 4.2%.

US Macro data and reciprocal tariffs

On Wednesday, the US Consumer Price Index (CPI) inflation data came in hotter than expected, rising to 3.0% yoy, up from 2.8% yoy in December. The increase was primarily driven by energy prices. Month-over-month inflation was also the highest since April 2024, largely due to core services, which saw a 0.3% rise. On the same day, US Federal Reserve (Fed) Chair Jerome Powell gave a relatively hawkish speech, stating there was "absolutely no hurry" to lower interest rates. This caused a significant selloff in the 10-year US Treasury (UST), which dropped 20 basis points (bps), marking its largest daily move since last December. The following day, however, the market reacted more positively to the Producer Price Index (PPI), as key components for the Personal Consumption Expenditures (PCE), such as healthcare and airfares, were softer. This prompted an unwind of half the previous day's move, pushing the 10-year UST yield back to 4.5%. The accelerating CPI may be a blessing in disguise, in our view. We expect it is likely to prompt President Donald Trump to be more cautious with his tariff decisions in the coming months.

The market largely brushed off Trump’s reciprocal tariff commentary, with US stocks higher afterwards, and USTs and the dollar lower. This move was partially explained by the fact that tariffs will be delayed until at least 1 April, while Trump’s team work out the details. Despite the Friday announcement on reciprocal tariffs being billed as “the big one”, should reciprocal tariffs turn out to be the primary focus, it would be a far cry from the previously feared 10-20% universal tariffs, with up to 60% tariffs on China that Trump talked about on the campaign trail. Trump explained that he would impose reciprocal tariffs on countries that charge the US higher tariffs than those the US charges in return. He emphasised this would apply to virtually all cases, saying that there was no need for exemptions with reciprocal tariffs. He also mentioned that companies that build in America would face no tariffs. However, more problematically, Trump specified that the European Union’s 15% Value Added Tax (VAT) could also fall under the US ‘reciprocal’ scope.

Countries like Brazil, Indonesia, Thailand, Vietnam, and Türkiye, all have tariffs between 5-10% on the US, while India, Argentina and various African nations have average tariffs above 10%.

Commodities

Crude shipments from Russia's Sakhalin Island projects are being held on vessels that have been stationary for at least a week due to US sanctions. Russia's oil exports have plunged, with daily crude flows down by about 750k barrels per day, or 25% from the previous week to 2.3 million. The gross value of Moscow's exports is down by about USD 380m, or 28%, to USD 990m in the week to 9 February, the lowest since December 2022. However, rising prospects of a US-brokered conclusion to the Russia/Ukraine war is assuaging supply concerns, with Brent crude rangebound at around USD 75 in the last week.

Geopolitics

President Trump stated on Wednesday, following a conversation with Russian President Putin, that delegations would begin negotiations immediately to end the war in Ukraine. This announcement raised eyebrows among European officials who, having seemingly been sidelined from these discussions, are expected to be relied upon to finance Ukraine's reconstruction and possibly deploy troops to maintain a peace deal.

The lack of Ukrainian President Zelensky's involvement in these discussions has shocked both Ukrainian and European officials, especially considering Trump's seeming willingness to accommodate Putin's wishes. Both Trump and US Secretary of Defense Pete Hegseth have expressed the view that it is unrealistic for Ukraine to return to its pre-2015 borders or to join NATO, labelling it impractical. EU foreign policy chief Kaja Kallas questioned why the US seemed to be giving Russia what it wanted even before negotiations had truly started, with one European official calling it "extraordinary" Trump had so openly laid out his negotiating position, leaving little room for further bargaining. British Prime Minister Keir Starmer has asserted that Ukraine is on an "irreversible path" to NATO membership.

US Treasury Secretary Scott Bessent travelled to Kyiv during the week to propose a deal where the US would take ownership of half of Ukraine's rare earth minerals in exchange for continued military support. However, Zelensky rejected this offer, demanding more concrete security guarantees from the US as part of the deal.

Emerging Markets

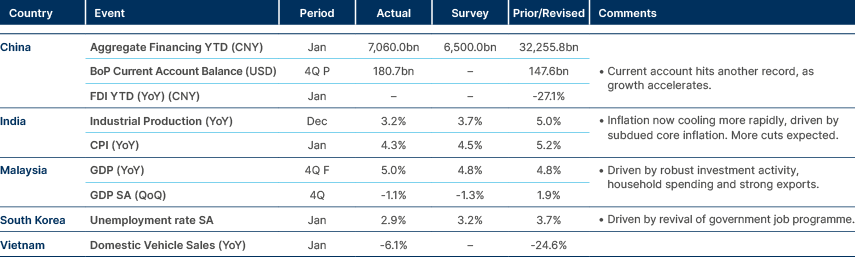

Asia

China: As mentioned, the Xi Jinping hosted symposium this week comes at a time when Chinese companies are grappling with rising trade tensions with the US, and very weak domestic consumption. Xi is expected to encourage attendees to expand their businesses both in China and overseas, especially as the Sino-US tech rivalry heats up. Tencent CEO Pony Ma is expected to attend, as are Lei Jun, the head of smartphone and EV maker Xiaomi, and Wang Xingxing, founder of robotics company Yushu Technology, according to Reuters. A Huawei executive is also expected to participate.

Indonesia: Indonesian President Prabowo Subianto doubled-down on a push to slash spending and reallocate funds to his signature social programmes, criticising opposition from “little kings” over concerns the cuts could prove a drag on Southeast Asia’s largest economy. Prabowo hopes to free nearly USD 19bn from the cuts to fund campaign promises, including free lunches for more than 82 million schoolchildren and pregnant women nationwide. Delivering on that alone would require USD 28bn a year.

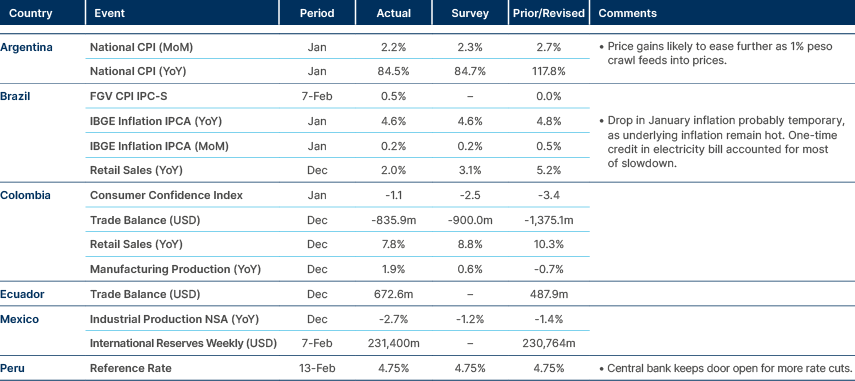

Latin America

Argentina: Argentine President Javier Milei promoted a cryptocurrency called Libra, directing followers to a site claiming to support small businesses in Argentina. The token’s value surged past USD 4bn before collapsing, causing investors to lose money and sparking an internal government probe. Crypto entrepreneur Hayden Davis, who helped launch Libra, saw its market value skyrocket before it crashed. Davis later admitted to holding some profits despite the token’s collapse. The scandal has likely embarrassed Milei ahead of a key US trip, raising concerns about his judgment and erratic decision-making.

Brazil: President Lula’s disapproval rate rose to 51% in January amid rising food prices and increasing pessimism about the economy, according to a survey conducted with 3,125 people by pollster Latam Pulse. The approval rate for his government fell to 38%, and his personal approval rating is 46%, a tie with potential future election opponent, Sao Paulo Governor Tarcísio de Freitas. A poll by the more traditional pollster Datafolha was released on Friday, showing Lula’s approval rate down to 24% from 35% in the prior poll two months ago. His rejection rate rose to 41% from 34% over the same period. Importantly, Lula’s approval rate dropped further to 33%, from 49%, in the Northeast. This represents a historical break as the Labour Party received most votes across in the Northeast since it first came to power in 2002.1

Central and Eastern Europe

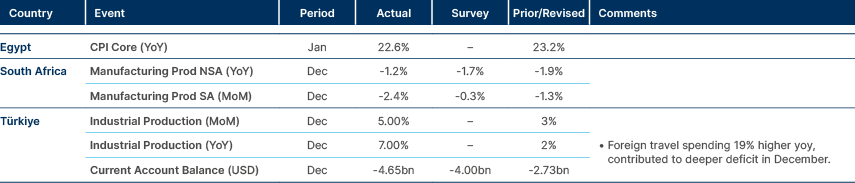

Romania: Klaus Iohannis stepped down from his position as Romania's president instead of undergoing an impeachment vote in parliament. He had remained in office after November's presidential election was annulled by the courts, following allegations of Russian interference. The election had been won by Calin Georgescu, a far-right critic of NATO. The annulment of the election results has angered the right-wing opposition. A new election will take place in May, but it remains unclear whether Mr. Georgescu will be permitted to run.

Central Asia, Middle East, and Africa

Democratic Republic of Congo: Fighting resumed in the eastern region of the Democratic Republic of Congo, despite appeals from African leaders for a truce between the M23 rebel group, supported by Rwanda, and Congolese troops. After seizing Goma, M23 is now moving towards Bukavu, a major city located 200km (125 miles) to the south.

Developed Markets

United States: President Trump signed an Executive Order rolling back enforcement of a law that bars US companies from bribing foreign officials, arguing that the restriction puts American firms at a disadvantage. The act bars a company or person with US links to pay money or offer gifts to foreign officials to win business overseas. Trump weighed in trying to scrap the law during his first term. “US companies are harmed by FCPA overenforcement because they are prohibited from engaging in practices common among international competitors, creating an uneven playing field,” the White House fact sheet said.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://especiais.gazetadopovo.com.br/eleicoes/2018/resultados/resultados-eleicoes-presidenciais-desde-1989