- Higher US CPI and jobless claims led to a steepening of the yield curve.

- China shed some more light on stimulus plans, without revealing scope of fiscal expansion, yet.

- Korean bonds will enter the FTSE WGBI and Indian bonds on the FTSE EM GBI in Q4 2025

- Indonesia’s President-elect Prabowo reappointed Sri Mulyani as Finance Minister.

- IMF ask Pakistan to remove tax incentives for industry.

- Moody’s explained reasons behind their Brazil credit rating upgrade to investors.

- AMLO’s judiciary reform to be reviewed by the Supreme Court.

- Dominican Republic outline details of long-awaited fiscal reform.

- Ghana upgraded to CCC+ by Fitch.

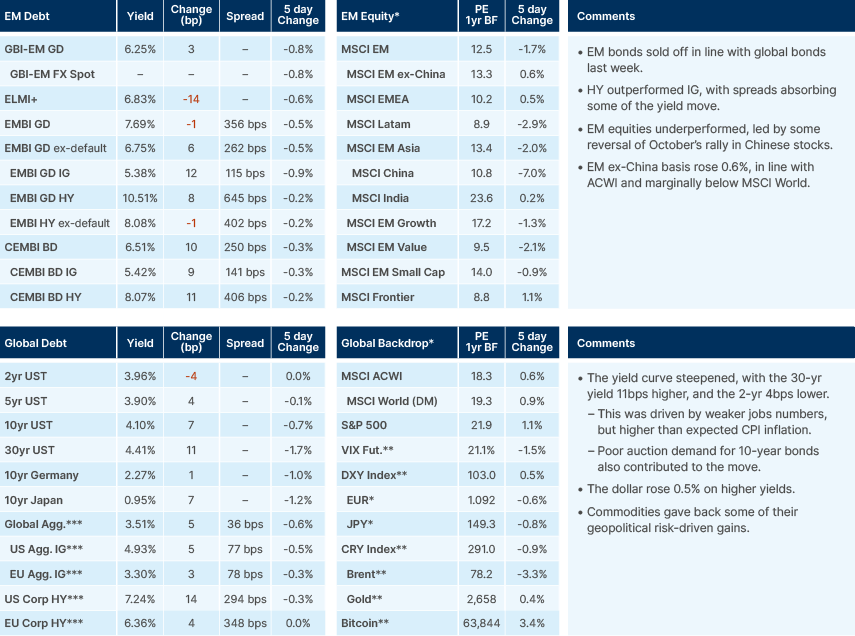

Last week performance and comments

Global Macro

There was a record influx of capital into Chinese stocks and Emerging Market (EM) equities last week, highlighting a surge in investor interest. Improving sentiment around China has a strong net positive effect on wider EM, as China holds a large weight in most EM equity indices. In China, a growing trend has seen consumers preferring to save rather than invest or spend, which has become a key concern for the country’s economic recovery. The Politburo and the People’s Bank of China (PBoC) have announced monetary and fiscal stimulus measures, but it remains unclear whether these actions will reverse this conservative consumer behaviour, particularly when the scale and focus of further fiscal stimulus efforts are still uncertain. Nevertheless, we believe the policy U-turn in Beijing is more important in the medium-term than market participants’ anxiety for details, which may be a slow drip until the US election on 5 November.

In the US, the consumer prices index (CPI) report showed inflation higher than expected, and jobless claims reached their highest point since August 2023. This sent bond yields higher, with the yield curve steepening. Both datapoints were probably warped by temporary disruptions from recent storms. These disruptions are likely to continue in the coming weeks, making it more difficult for the ‘data-dependent’ US Federal Reserve (Fed).

Geopolitics

US President Joe Biden and Israel’s Prime Minister Benjamin Netanyahu held a much-anticipated 30-minute phone call – believed to be their first contact since August – which included discussions on Israel’s intended retaliation to Iran’s missile strike last week. President Biden has said Israel must defend itself, but not by attacking Iranian nuclear sites or its oil industry.

The US expanded sanctions against Iran’s petroleum and Petrochem sectors, including measures against the ‘Ghost Fleet’ that carries Iran’s illicit oil to buyers around the world. Iran oil exports rose to 1.7m barrels of oil per day on average in 2024 since sanctions were lifted.

China is conducting major military drills across the Taiwan Strait, involving army, navy, and rocket forces. The drills will simulate a blockade of the island and control of key ports and areas. Taiwan called the drills “irrational and provocative”, while China said the drills are a “stern warning to the separatist acts of Taiwan independent forces”.

Emerging Markets

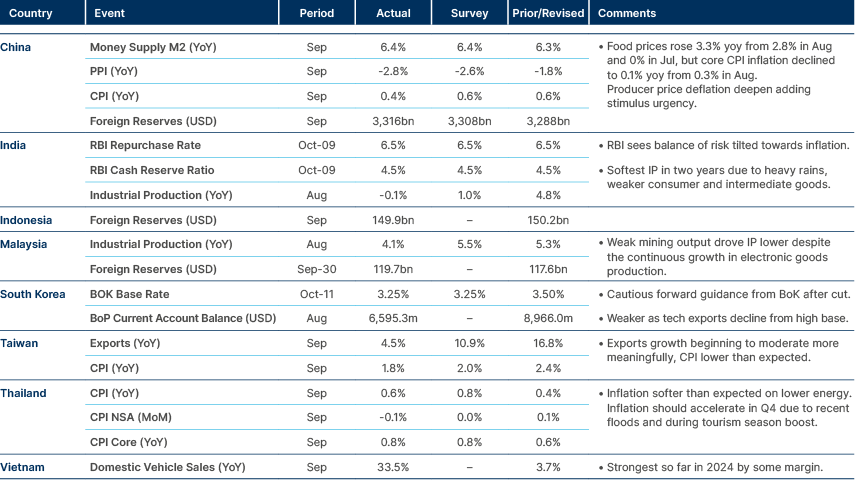

Asia

Deflation in Chinese producer prices, India holds rates, Korea cuts by 25 basis points (bps).

China

The Ministry of Finance (MoF) outlined the fiscal stimulus package that needs to be discussed and approved by the National People’s Congress (NPC) in late October. As expected, the emphasis on risks was clear with local debt refinancing, bank recapitalisation and backstopping the real estate market in focus. There was no direct support announced for consumption and second-child families, which is disappointing, but those may still be discussed by legislators. The MoF allowed local governments to tap RMB 400bn of unused bond quota carried from previous years, thus not requiring NPC approval. Last week, Vice Premier He Lifeng stressed the importance of the property market, calling it the “wind vane” of the macro economy. He urged to extend more loans to housing projects on the “whitelist” and significantly expand the coverage of the “whitelist” programme, as he vowed to work hard to ensure delivery of homes. He also urged the increase and better use of the PBoC relending programme to purchase unsold homes to be used as affordable housing.

Last week, the MSCI China index declined by 8.2%, a healthy correction after a 39% rally from 11 September to 7 October. We continue to see more upside than downside to Chinese stocks due to attractive valuations, a real catalyst to backstop prices as the PBoC is allowing non-financial corporates to borrow at relending rates (2.25%) to buy back their stocks, and the U-turn on the willingness to backstop macroeconomic risks (local government and real estate) and stimulate the economy, if necessary.

India

Government bonds also to be included in FTSE EMGBI from September 2025 but will only result in USD3-4bn of inflows.

Indonesia

Reuters reported Finance Minister Sri Mulyani Indrawati was one of the incumbents attending at meeting by President-elect Prabowo Subianto to chose his cabinet ahead of his inauguration later this week.

Pakistan

The International Monetary Fund (IMF) directed Pakistan to cease the establishment of industrial zones offering investment incentives like tax breaks and subsidies. This move aims to create a more equitable investment landscape and protect the country’s tax base. The decision may significantly impact Pakistan’s efforts to attract Chinese industries, particularly as Prime Minister Shehbaz Sharif is actively trying to encourage Chinese companies to relocate to Pakistan as part of a broader initiative to gain momentum for projects under the Belt and Road Initiative. The directive is expected to have immediate consequences, particularly for a new export processing zone planned at Pakistan Steel Mills in Karachi, which could face challenges due to the lack of incentives.

South Korea

Government bonds are to be included in FTSE WGBI, effective November 2025. Korean bond swap spreads tightened, and the curve flattened slightly on the news. The expected inflow is USD 50-70bn which is equivalent to 2.2% of the WGBI. The outstanding balance of Korean Government bonds is USD 710bn.

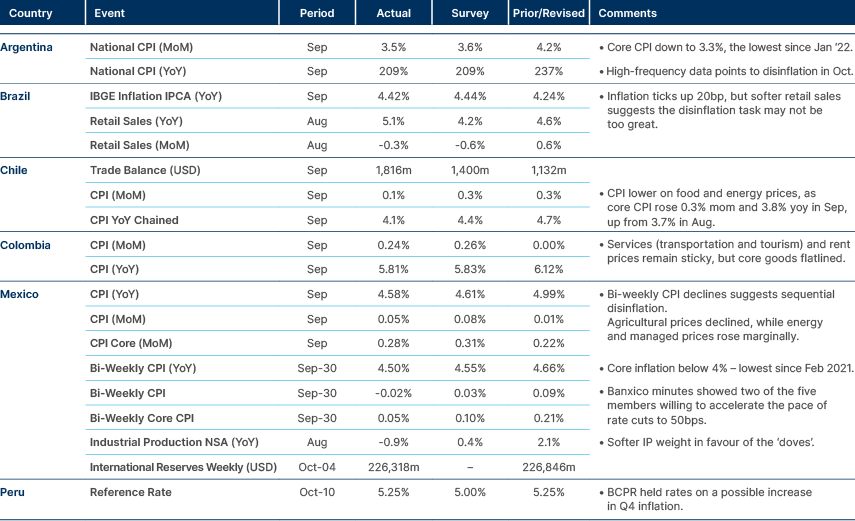

Latin America

Benign inflation data across the board.

Brazil

Moody’s explained, in an investor call organised by Barclays, why it upgraded Brazil from Ba2 to Ba1 with a positive outlook. The key reason behind the upgrade was the better growth environment and significant structural reforms approved since 2015. Despite the risk premium in Brazilian assets at similar levels to 2015, fundamentals are much better today, according to Moody’s. There is no political crisis, or massive contingent liabilities. Moody’s expects Brazil structural gross domestic product (GDP) growth to have shifted to 2.5%, from below 1.0% pre-reforms. Brazil’s nominal deficit is high, but the primary deficit is manageable. Interest to revenue is now at around 15% and is likely to revert to its mean of 12%. Locals are negative, and assuming a ‘no reform’ scenario driving primary deficit to 2% of GDP, which is very different to what the government is signalling. Moody’s sees debt/GDP stabilising at 82% of GDP, with a slow improvement to a primary surplus by 2028. It highlights that Brazil could move into a virtuous cycle with some structural reforms on the spending side, like healthcare, education, and social security de-indexations.

Ecuador

The government mandated a 50% reduction in electricity usage for certain industrial firms due to the worst drought experienced in 60 years, which has severely impacted the hydroelectric power supply. The decision sparked a backlash from business associations, which argued the move is causing economic losses, and was implemented without prior consultation with the industry. One of the key sectors affected is shrimp aquaculture, which may face a USD 75m monthly decrease in exports due to the reduced power supply.

Mexico

The Supreme Court is preparing to review a proposed judicial overhaul from former President Andrés Manuel López Obrador, which permitted the election of judges by popular vote. Critics, including the US and various stakeholders, warn this reform jeopardises judicial independence and democratic oversight.

Consequently, the Supreme Court has accepted four requests to assess the effects on the separation of powers. There is a (slim) possibility of annulment if legislative processes are deemed to have been violated during the process of its approval. However, President Claudia Sheinbaum insisted the overhaul will proceed, while president of the Senate Gerardo Fernández Noroña said the Supreme Court doesn’t have the right to review acts of Congress, and that the reform will be implemented.

Dominican Republic

The government announced a long-awaited fiscal reform, expected to boost revenue by 1.5% of GDP, though this falls short of the earlier anticipated increase of 2-2.5%. Key revenue gains will come from eliminating value-added tax (VAT) exemptions and enforcing the 18% VAT more broadly. Additionally, there will be higher income taxes for businesses and individuals, based on income brackets, as well as new taxes on property, and alcoholic and sugary drinks.

Spending reforms include a 21% increase to a social assistance programme from USD 27 to USD 33 monthly, which focuses on subsidising food consumption for the poorest 10% of the population. This will require an additional USD 83m annually in social aid. The public sector minimum wage will also increase from USD 167 to USD 250 a month. This reform process has taken nearly three years to finalise, and no significant market reaction is expected, as the Dominican Republic remains a stable investment environment.

Panama

The government proposed a USD 26bn budget for 2025, representing a 15% decrease compared with 2024, with a fiscal deficit of 3% of GDP. Panama's fiscal deficit through June 2024 stood at 4% of GDP. The budget forecasts nominal economic growth of 5% and inflation of 2% for 2025.

Central and Eastern Europe

Inflation under control in Czech Republic, Hungary, Romania.

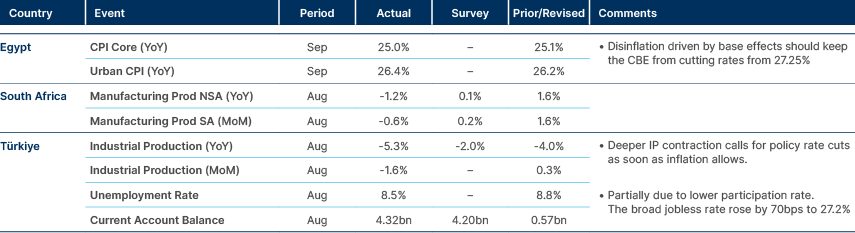

Central Asia, Middle East, and Africa

Industry slowing in Turkey.

Ghana

Fitch Ratings upgraded Ghana’s sovereign long-term local-currency rating to CCC+ while affirming the long-term foreign-currency rating at RD (Restricted Default). It also assigned CCC+ ratings to new US dollar-denominated bonds issued on 9 October as part of Ghana's Eurobond restructuring, while affirming the CC rating on US dollar bonds partially guaranteed by the International Development Association. The CCC+ rating reflects Ghana’s anticipated credit profile after the restructuring, characterised by declining debt levels, supported by ongoing fiscal consolidation efforts, but still facing elevated liquidity risks.

Ethiopia

Ethiopia’s Finance Minister Ahmed Shide indicated bondholders will need to accept "some haircut" as part of the country’s debt restructuring process. The government plans to meet with bondholders during this month’s IMF and World Bank meetings to discuss the restructuring terms. The Finance Minister said he also expects foreign direct investment (FDI) to double over the next two to three years, increasing from USD 3bn in 2023. In the last quarter, FDI was 12% higher than the previous year.

Developed Markets

Higher inflation and weaker labour markets in the US, likely due to hurricanes.

United States

The Biden administration is preparing to launch a new initiative aimed at providing fresh financing to developing nations experiencing cash shortages, with the goal of preventing potential debt crises. This proposal, named the Pathway for Sustainable Growth, will be officially announced by US Treasury Under Secretary Jay Shambaugh. The programme will involve collaboration between the IMF and the World Bank, as well as both sovereign and private creditors, to support countries in managing financial difficulties before reaching the point of needing debt restructuring.

The initiative is designed to assist countries facing temporary financial challenges by offering significant financing tied to reform measures, while also ensuring the sustainability of their debt levels. By focusing on early intervention, the programme will seek to provide relief and avoid deeper financial crises in participating nations.

Bank stocks hit their highest level since before the collapse of Silicon Valley Bank as better-than-expected profits from JPMorgan Chase and Wells Fargo boosted hopes of an economic ‘soft landing’ in the country. Quarterly earnings fell at both banks year over year, by 2% for JP Morgan and 11% at Wells Fargo. However, analysts forecast JPMorgan would report quarterly net income of USD 12.1bn and Wells USD 4.5bn. JPMorgan’s shares rose 4.4% in New York on Friday, while Wells gained 5.6%.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.