China’s GDP growth beat expectations while US data pointed to a recession

China’s gross domestic product (GDP) growth was surprisingly positive as retail sales accelerated. Brazil showcased its unique environmental potential as its central bank Governor addressed politicians on the reasons behind not yet cutting policy rates. South African inflation printed higher than expected. Korean and Taiwanese export data remained very weak. Chile announced it will nationalise lithium exploration after existing contracts expire, and Uruguay cut policy rate by 25 basis points (bps). The gap between manufacturing and service sectors widened further in flash Purchasing Managers’ Index (PMIs) as other indicators continued to point to a recession.

Global Macro

Next week the S&P 500 earnings cycle will be key to asset prices, with 181 companies (representing 46% of market cap) reporting, including Microsoft, Google, Amazon, and Meta. The Bank of Japan meets on Friday, the first meeting chaired by Governor Kazuo Ueda. While no changes to policy direction are expected, markets will be monitoring for any changes in guidance.

Emerging Markets

China: First quarter GDP growth beat expectations at 2.2% quarter-on-quarter (qoq), up from 0.6% qoq in Q4 2022, as the year-on-year (yoy) rate rose by 160bps to 4.5%. The yoy rates of industrial production (IP), retail sales and fixed asset investments (FAI) rose by 3.9%, 10.6% and declined by 5.8%, respectively in March, with IP and FAI lower than expected and retail sales above consensus. Residential property sales rose by a yoy rate of 7.1% from 3.5%, confirming the better momentum in the real estate market, albeit new home sales lagged.

Brazil: Central Bank of Brazil Governor Roberto Campos addressed the political pressures to cut rates in a presentation in London in the presence of Leader of the Senate Rodrigo Pacheco as well as three state Governors and other Congressmen. Campos defended central bank independency and the importance of keeping inflation low for social stability as the poorer part of Brazil’s population is more exposed to inflation than companies and the wealthiest citizens, both of which can ring-fence themselves against inflation. Despite Campos’ strong technical performance, it is unlikely the political pressure will fade. At the same forum, senior economists including former Central Bank President and Finance Minister Henrique Meirelles defended tightening the current fiscal framework to make it more restrictive and clearer. As discussed, the fiscal framework is not as strong as the previous debt ceiling and while promising to cap the real increase in expenditures, it is contingent on higher revenues and higher economic growth to stabilise the ratio of debt/GDP.

Izabella Teixeira, the former Environmental Minister and the Co-President of the United Nation (UN) International Resource Panel, highlighted Brazil’s role as the world’s major environmental superpower, both in the direction of preserving natural resources and reserves, which the current government is highly focused, but also in paving the way for the energy transition by increasing its massive generation of renewable energy via solar, wind and green hydrogen. The State of Pará is Brazil’s second-largest state by territorial size with 1.25 million kilometres (slightly larger than South Africa) and is mostly taken up by the Amazon Forest. State Governor Helder Barbalho reiterated his pledge for Pará to achieve net zero emissions by 2036, sooner than Brazil’s overall target, and pledged to stop the illegal deforestation that became pervasive during the previous government. Barbalho wants to also create programmes allowing the population around the Amazon to benefit from preservation, by monetising re-forestation and other efforts via carbon credit markets and exploring natural resources from the forest (nuts, fruits, etc.) on a non-invasive and non-degrading manner. In economic news, economic activity was unchanged in January after rising 0.5% month-on-month (mom) in December 2022, bringing the yoy rate up 220bps to 3.0%. Industrial production declined 0.2% mom in February and 2.4% yoy, in line with consensus.

South Africa: Consumer Price Index (CPI) inflation rose 1.0% mom in March from 0.7% mom in February, bringing the yoy rate up 10bps to 7.1%, or 20bps above consensus. Core CPI was unchanged at 0.8% mom and 5.2% yoy. Retail sales declined only 0.1% mom in February after rising 1.5% mom in January, significantly better than consensus at -1.0%

South Korea: April’s first 20 days of exports improved versus March, but still declined by 11.0% yoy on a business day-adjusted basis. Exports of chips declined 39.3% yoy, exports to China dropped 26.8% yoy while exports to the US rose 1.4% yoy. Imports declined to a lesser extent, bringing the trade deficit for the first 20 days to USD 4.1bn. The yoy rate of Producer Price Index (PPI) inflation dropped 150bps to 3.3% in March.

Taiwan: Export orders dropped by a yoy rate of 25.7% in March from 18.3% in February, worse than expected.

Chile: President Gabriel Boric said he would nationalise Chile’s lithium industry, respecting existing assets owned by the private sector, but thereafter the state would take over. There are two listed companies exploring lithium in Chile: SQM and Albermale, the first has a contract to explore lithium until 2030 and the latter until 2043.

Uruguay: The central bank cut its policy rate by 25bps to 11.25%, defying consensus expectations for unchanged policy. In the previous week, CPI inflation dropped to 0.9% mom in March after 1.0% mom in February, and the yoy rate dropped 20bps to 7.3%, down from 10.0% in September 2022.

Argentina: The trade balance moved to a USD 1.1bn deficit in March after a USD 0.2bn surplus in February as imports rose USD 1.7bn to USD 6.8bn, while exports increased by USD 0.5bn to USD 5.7bn. President Alberto Fernández announced he will not run for re-election after the parallel ARS rate depreciated to 450 vs. official foreign exchange (FX) at 220. The central bank was forced to sell some bonds it bought on the secondary market, a worrying sign that the institution may be close to running out of FX reserves.

Snippets

- Colombia: The yoy rate of economic activity index slowed to 3.0% in February from 5.9% in January, slightly better than consensus.

- Czechia: PPI inflation dropped 1.0% mom in March after registering a 0.3% mom deflation in February, bringing the yoy rate down 580bps to 10.2%.

- Ecuador: President Guillermo Lasso vowed to dissolve the National Assembly and call early elections to avoid impeachment.

- India: The yoy rate of the Wholesale Price Index declined 250bps to 1.3% in March, 25bps below consensus.

- Indonesia: Bank Indonesia kept its policy rate unchanged at 5.75%, in line with consensus, as headline CPI inflation moved below the ceiling of its target band, while core CPI was slightly below the centre of its target band.

- Malaysia: The yoy rate of CPI inflation dropped 30bps to 3.4%, 20bps below consensus, and the trade surplus improved to MYR 27.7bn in March from MYR 19.6bn in February, significantly above consensus.

- Mexico: Retail sales declined 0.3% mom in February after rising 1.7% mom in January bringing the yoy rate down 190bps to 3.4%.

- Philippines: Overseas cash remittances declined to USD 2.6bn in February from USD 2.8bn in January, bringing the yoy growth rate down 110bps to 2.4%.

- Poland: Core CPI inflation rose 1.3% in March, unchanged from February as the yoy rate rose 30bps to 12.3%.

Developed Markets

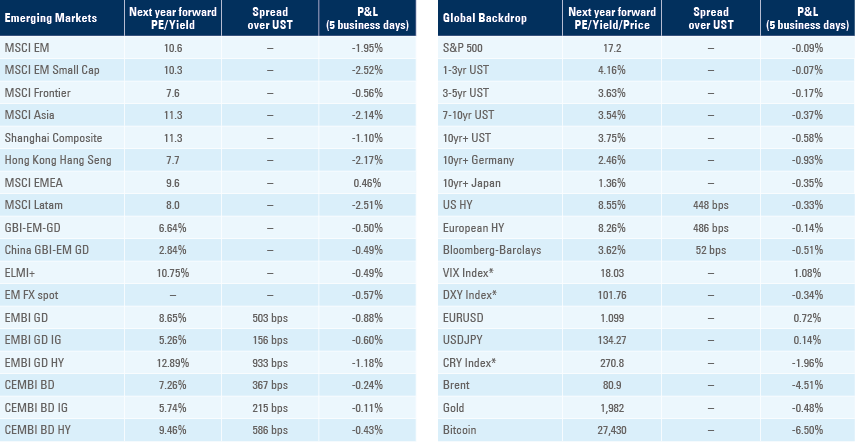

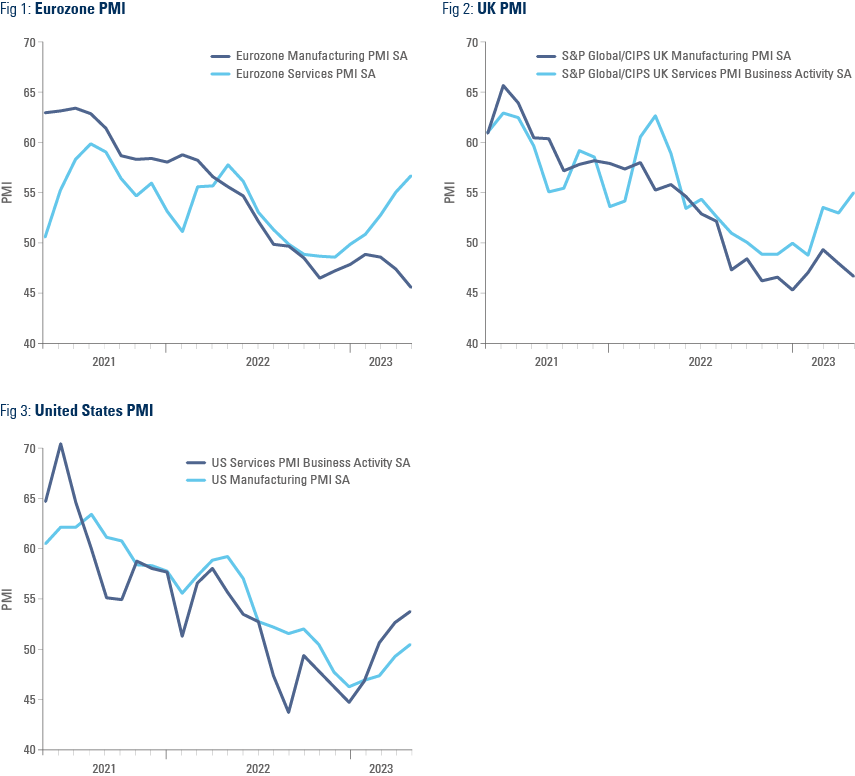

Mind the gap: The gap between the services and manufacturing sector PMIs widened further in the Eurozone and UK, where manufacturing declined to 45.5 and 46.6, respectively, but the service sector improved to 56.6 and 54.9, respectively. In the US, manufacturing and services PMI was surprisingly positive, with the first rising 1.2 points to 50.4 and the latter rising 1.1 point to 53.7, as shown on Figures 1 to 3. Overall, the charts still point towards a recessionary trend in manufacturing, which is a better leading indicator to the economy than the service sector. This is also not a good mix for inflation, which tends to have a heavier weight of services on their core components.

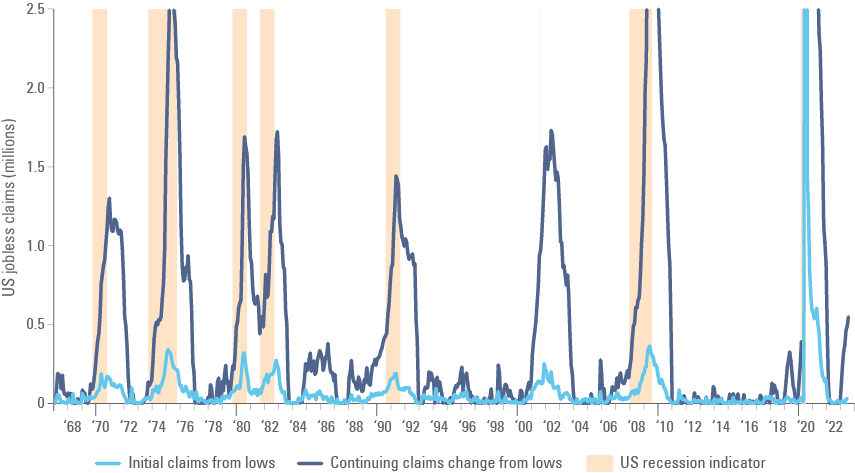

United States: Housing data was soft and labour market data softened further last week. The National Association of Home Builders (NAHB) housing market index increased +1 to 45 (in line with consensus) and away from the low of 30 in December 2022. Rates on 30-year mortgages declining from 7.2% in October 2022 to 6.4% in Jan 2023 appear to have led the rebound, but since then, 30-year mortgage rate sold off to 6.9%, driven by wider spreads. The Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey declined 8.8% as the index oscillated at the lowest levels since 1996. Housing starts was unchanged at 1.4m, while building permits declined 0.8% mom to 1.4m in March. The Philadelphia Federal Reserve (Fed) Survey of Business Activity declined another eight points to -31.3 in April. Jobless claims rose 5k to 245k in the week ending 15 April, and continuing claims rose by 60k to 1,865k in the previous week, rising 550k from the lowest level in September 2022. Claims have never risen by this magnitude without the US economy entering a recession, as per Figure 4. Continuing claims usually leads initial jobless claims, as it calculates the net between jobs gained and destroyed, so if initial claims is above jobs created, continuing claims will rise.

Figure 4: Changing in continuing claims and initial jobless claims vs. US recessions

United Kingdom: CPI inflation declined 30bps to 10.1% in March, 30bps above consensus.

Canada: CPI inflation rose 0.5% mom in March from 0.4% in February, but the yoy rate declined 90bps to 4.3% due to base effects, while the main core indices were between 4.4% and 4.6%.

Eurozone: The German ZEW Indicator of Economic Sentiment dropped nine points to 4.1 in April, significantly below 15.6 expected by consensus analysts. The European ZEW survey declined 3.6 points to 6.4 in April. The Eurozone currency account surplus increased to EUR 24.3bn in February from EUR 18.6bn in January, and the yoy rate of CPI inflation declined by 160bps to 6.9% while core CPI was unchanged at 5.7%.

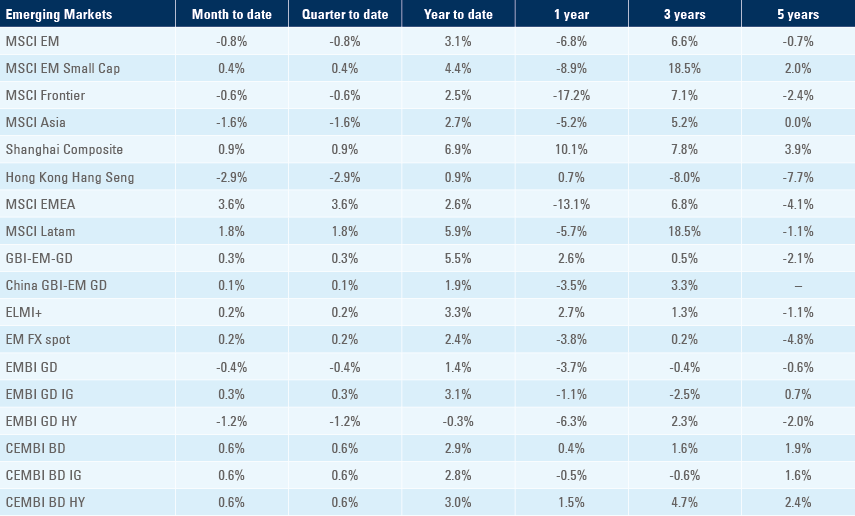

Benchmark performance