Finland and Sweden said they would like to join NATO. China’s economic data was much weaker than expected in April, but higher frequency data improved in May. Brazil’s Petrobras hiked diesel prices despite political pressures. Most Chileans said they would reject a new constitution due to distrust in the Constitutional Assembly, while Gustavo Petro’s advantage widened in Colombia. The Czech National Bank newly appointed governor Ales Michl said he expected rates to stabilise after July despite record high inflation. Hungary’s central bank governor also said it is transitioning to a more gradual phase of tightening. Ecuador received IMF approval to receive another USD 1bn under its existing programme. El Salvador sovereign credit rating was downgraded by Moody’s. Ghana’s inflation rose by 420bps to 23.6% in April. Bank Negara Malaysia hiked its policy rate by 25bps to 2.0%, while Peru and Mexico hiked 50bps to 5.0% and 7.0% respectively. Inflation rose faster than expected in India. First Quantum approved a USD 1.25bn investment in copper and nickel in Zambia.

Emerging markets

Russia-Ukraine: Finland said on Sunday it would apply to join the North Atlantic Treaty Organisation (NATO) prompting the Swedish ruling Social Democrat leader Magdalena Anderson to declare its willingness to join the alliance saying: “Europe, Sweden and the Swedish public are living a new and dangerous reality. The European security order that Sweden builds its security on is under attack… We Social Democrats think that the best thing for Sweden’s security is that we join NATO.” The only potential obstacle could come from Turkey whose President Recept Tayyip Erdogan cited Sweden and Finland support for the Kurdistan Workers Party (PKK), which Turkey, the US and EU classifies as a terrorist organisation. However, Turkey nodded favourably to the Scandinavian countries’ applications over the weekend in conversations with NATO’s Secretary Jens Stoltenberg and US secretary of state Antony Blinken.

The situation on the ground remains close to stalemate with Ukrainian troops successfully holding back Russia’s attacks in Donbass. On the one hand, a stalemate would increase the incentives for Russia to seek freezing the conflict and maintain its current territorial advances. Putin could save face with the Russian population by declaring victory after building a land bridge to Crimea and enveloping the sea of Azov. On the other hand, the main risk is Russia feeling encircled by NATO whilst unable to achieve its final objective in Ukraine (controlling Donbass and reaching Transnistria) leading to a higher propensity to use nuclear weapons – tactically or otherwise to reset the situation – as well as tightening the noose around the exports on energy, agriculture products and fertilisers, leading to higher risk of a European energy crisis and/or a global food crisis.

China: The zero covid-19 policy led to a stronger impact on the economy than expected in April as the yoy rate of retail sales plunged 11.1% (-6.6% yoy consensus and -3.5% yoy prior), industrial production dropped 2.9% yoy (+0.5% consensus +5.0% yoy prior), property investment dropped 2.7% yoy (-1.5% yoy consensus +0.7% yoy prior) and fixed asset investment rose 6.8% yoy (7.0% consensus, 9.3% yoy prior). Aggregate financing dropped to RMB 910bn (RMB 2.2trn consensus) from RMB 4.65trn as demand for credit declined due to lockdowns. On Sunday, the vice-mayor of Shanghai said malls, department stores, supermarkets, convenience stores, pharmacies and catering services will resume (offline) operations in a gradual and orderly manner as the city will promote a staged resumption of commercial business and markets as covid-19 cases dropped nationwide with only 11 provinces at risk (less than half of the previous week). Steel output rose 1.4% yoy in the first 10 days of May as subway travel in 11 major cities rose 14% in the first week of May vs. the prior week (albeit 41% below pre-pandemic levels). The PBoC also cut the lower bound of mortgage rates for first-time buyers by 20bps to 4.4%, a modest step considering the challenges faced by the sector and the overall economy. In other news, US President Joe Biden said he was weighing to cut import tariffs to fight inflation, an idea that was mentioned by US Treasury Secretary Janet Yellen a few months ago. In policy news, at a press conference on May 12, Han Wenxiu, a senior official from the Central Committee for Financial and Economic Affairs, stressed the requirement to roll out new policies when needed to support the economy.

Brazil: Petrobras hiked diesel prices by 8.9% to BRL 4.91 per litre (USD 0.96) a few days after President Jair Bolsonaro accused the company of pursuing too-high profits. Petrobras supplies less than 80% of refined oil products, which means international parity is necessary to avoid shortages. The gap between local and international diesel and gasoline prices was 17% and 19% respectively on 9 May, according to fuel importers association Abicom.1 In other news, the government is looking to remove import tariffs on steel and other 10 items, including food and construction products, to help cool consumer prices. Cutting import tariffs is a smart and thoughtful way to support lowering inflation and boosting the economic competitiveness.

Chile: A poll by Cadem revealed 48% of Chileans plan to reject the new constitution in the September referendum (from 33% on 28 January) while only 35% said they were in favour of it (from 56% on 28 January). The society remains divided on what do, should the current text be rejected: 38% of Chileans would prefer to call a new Constitutional Convention election, 26% would prefer an ad-hoc expert and ex-president commissions to improve the rejected text, while 24% would ask congress to propose a new constitution before a plebiscite and only 7% would approve to stick to the current constitution.2 In economic news, the trade surplus declined to USD 1.1bn in April from USD 1.3bn in March and USD 1.5bn consensus as copper exports dropped to USD 4.0bn from USD 4.9bn over the period.

Colombia: A new poll by La Gran Encuesta shows Gustavo Petro’s lead over Federico Gutierrez widening to 40% vs. 21% in the first round and to 47% vs. 34% (from 42% vs 35% in March) in an eventual run-off between the two candidates. In other news, economic activity remained strong as retail sales rose by 12.0% yoy in March rising from 4.9% in February as industrial production rose by 8.3% yoy from 7.5% yoy over the same period.

Czech Republic: CPI inflation rose by 1.8% mom in April, or 14.2% yoy from 1.7% mom (13.3% yoy) in March, twice the consensus expectations levels. Against this backdrop, President Zeman appointed Ales Michl as the new Czech National Bank governor. Zeman said the CNB is facing a ‘tough task’, but that higher rates may be starting to fuel inflation. Appointed Governor Michl said he expected rates stability after July and that inflation will return to its 2% target within two years and that hiking rates will not reduce inflation. Indeed, monetary policy is ineffective against some of the current inflationary pressure led by supply chain and commodity disruptions and wage inflation moved to negative levels, in real terms, which should constrain demand. The risk is that dovish commentary and perceived political interference in the central bank when inflation is at double-digit levels leads to a de-anchoring of expectations leading to higher wage inflation and higher pass-through from input prices, which would demand a more aggressive policy restraint to contain inflation in the future. Most CEE economies had inflation above 1% mom over the last six months while higher energy prices impact their economies. On the positive side, higher labour availability from Ukraine immigration should help to balance the labour markets over the medium term.

Hungary: Deputy Governor Virag said the National Bank of Hungary is transitioning from an ‘aggressive’ rate hike cycle to a more gradual phase of monetary tightening. CPI inflation rose to 1.6% mom in April from 1.0% mom in March (and 40bps above consensus), bringing the yoy rate to 14.2%. The trade deficit widened to USD 503m in March from USD 117m in February, a faster deterioration than consensus.

Ecuador: The International Monetary Fund agreed on the fourth and fifth reviews of the program with Ecuador, paving the way for USD 1bn disbursement before June and a final USD 700m before year-end. The IMF noted the fiscal accounts outperformed the IMF targets by USD 1bn. Petroecuador production rose back to 400kbpd as the company started the process to auction 100 oil wells aiming to increase production by 100kbpd by year-end and double production over five years.3

El Salvador: The ratings agency Moody’s downgraded El Salvador credit rating to Caa3 from Caa1 due to “increased probability of a credit event” incorporating the expectation of high material losses to investors ahead of two Eurobond redemptions in January 2023 and January 2025 (USD 800m each). El Salvador bonds trade between 36c and 48c to the USD from 2025 onwards, already reflecting significant losses after a credit event. Security Minister Gustavo Villatoro said the police arrested over 26k people (alleged gangsters) since the state of emergency on 26 March.

Ghana: The yoy rate of CPI inflation rose 420bps to 23.6% in April with food and fuel driving most of the rise. Finance Minister Ken Ofori-Atta repeated the government is committed not to seek assistance from the IMF and argued the economy is heading to the right direction. He also suggested the Bank of Ghana shouldn’t respond to supply shocks on food and energy, which is not helpful for credibility, particularly when inflation is running above 20% yoy, which is significantly above its peers, suggesting inflation is not purely due to supply shocks.

Malaysia: Bank Negara Malaysia hiked policy rate by 25bps to 2.0% (consensus unchanged), indicating ongoing strength of the domestic economy and less need for highly accommodative conditions, which suggests further hikes are afoot. The yoy rate of industrial production rose 5.1% in March from 4.0% yoy in February as manufacturing growth accelerated to 6.9% yoy led by electronics metals and food products. Real GDP growth accelerated to 5.0% in Q1 2022 from 3.6% yoy in Q4 2021, 1.0% above consensus while the current account surplus narrowed to MYR 3.0bn from MYR 15.3bn over the same period.

Mexico: The central bank hiked its policy rates by 50bps to 7%, as was widely expected. Vehicle production slowed to 251k in April from 306k in March as exports dropped to 241k vehicles from 263k over the same period, both in line with the seasonal pattern over the last 10 years. In other news, CPI inflation rose by 0.5% mom in April from 1.0% mom in March, leading to 20bps increase in the yoy rate to 7.7% as core CPI rose by 40bps to 7.2%, broadly in line with consensus as the bi-weekly CPI data showed inflation slowing in sequential terms.

India: The yoy rate of CPI inflation rose by 80bps to 7.8% in April, 40bps above consensus as food prices surprised to the upside and energy prices remained elevated. Reserve Bank of India has sold USD in the spot and future markets to avoid market disruptions amidst stronger USD bid. The RBI was purchasing USD in April when the INR was at stronger levels. In other news, the trade deficit widened to USD 20.1bn in April from USD 18.5bn in March, in line with consensus as both exports and imports expanded more than 30% over 2021.

Peru: The central bank hiked its policy rate by 50pbs to 5.0%, in line with consensus and pledged to deliver additional changes to the monetary policy stance if needed to bring inflation back to the 1-3% tolerance band. Core CPI excluding food and energy rose 30bps to 3.8%. Last week policymakers approved another USD 8bn pension withdrawal, or 23% from the system, which is driving local assets lower (pent up selling pressure) and adding inflationary pressures.

Sri Lanka: Mahinda Rajapaksa, the brother of President Gotabaya Rajapaksa, resigned as prime minister on Monday amid protests over his mismanagement of the economy. The IMF needs a stable government to negotiate a programme and would prefer to have a broad coalition across political parties running a technocrat government to make sure whoever is in power will comply with the economic adjustment agreed by the fund.

Zambia: First Quantum Mineral (FQM), approved a USD 1.25bn project to expand the Kansanshi copper mine citing renewed confidence in the country’s investment climate following the election of President Hakainde Hichilema last August. The country aims to increase copper production to 3m metric tons per year by next decade, from 0.8m metric tons in 2021. Chile and Peru are the largest copper producing countries in the world with 5.6m and 2.3m metric tons output in 2021. FQM also approved USD 0.1bn to invest in a nickel project which starts producing in 2023.4

Snippets

- Argentina: Vice President Cristina Kirchner criticised economic policies in a political rally in the Province of Chaco, saying she picked Alberto Fernandez to run as president just as the IMF oversight mission landed in Buenos Aires. CPI inflation rose 6.0% mom in April or 58.0% yoy, above consensus at 5.6% mom.

- Costa Rica: President Rodrigo Chaves eliminated vaccine and mask mandates after his inauguration on Sunday while pledging to improve business conditions by “letting the private sector work in peace, without unnecessary bureaucracy and absurd regulation”.

- Egypt: The yoy rate of CPI inflation rose to 13.1% in April from 10.5% yoy in March led by a sharp increase in food prices and pressures from the 15% devaluation on EGP in March while core CPI rose by 180bps to 11.9% yoy. The ministry of finance reported the intention to issue RMB bonds in China.

- Indonesia: The yoy rate of real GDP growth was unchanged at 5.0% in Q1 2022, in line with consensus as CPI inflation rose to 3.5% yoy in April from 2.6% yoy in March and core CPI rose by 20bps to 2.6% yoy in April. The unemployment rate declined to 5.8% in February 2022 from 6.5% in August 2021.

- Philippines: Ferdinand Marcos Jr. and Sara Duterte both won a landslide victory in presidential and vice-presidential elections last Monday.

- South Korea: Former prosecutor Yoon Suk Yeol took office as president last Monday.

- Taiwan: The trade surplus improved to USD 4.9bn in April from USD 4.7bn in March as the yoy rate of exports slowed to 18.8% (from 21.3%) and imports rose to 26.7% (from 20.3%) over the same period.

- Turkey: The unemployment rate rose to 11.5% in March from 11.1% in February (revised from 10.7%), a level. Industrial production declined 1.8% mom in March from +4.4% mom in February

Global backdrop

United States: Economic activity deteriorated again as the Citibank surprise index declined 7.5 to 12.8 on the 13 May over the previous week. CPI inflation declined to 0.3% mom (consensus 0.2% mom) in April from 1.2% mom in March bringing the yoy rate down 20bps to 8.3% , but CPI ex-food and energy rose to 0.6% mom from 0.3% over the same period, leading to 30bps decline in the yoy rate to 6.2% (consensus 6.0%). The University of Michigan sentiment dropped to 59.1 in May from 65.2 in April (64.0 consensus), the lowest level since 2009.

Most of the Federal Reserve’s (Fed) board speakers endorsed 50bps hikes pace with Atlanta’s Raphael Bostic expecting another 2-3 hikes of 50bps before assessing the situation. The hawkish Cleveland President Loreta Mester said the Fed does not rule out 75bps “forever”. Vice Chairman Lael Brainard noted large price movements and margin calls in commodities markets as the Financial Stability Report warned of worsening liquidity conditions across key financial markets due to rising risks stating, “the risk of a sudden deterioration appears higher than normal”. The Nasdaq dropped more than 30% from its peak – the sharpest decline since 2008 except for the covid-19 crisis. However, in 2020 the Fed was fast to add one of the largest monetary stimuli due to the pandemic, whilst today the economy is at full employment and inflation significantly above the Fed’s 2% target. In our view the Fed is likely to pare down its hawkish tone as the economy slowdown already signalled by the University of Michigan and other surveys becomes more evident.

Europe: The European Central Bank Vice-President de Guindos noted that inflation and fragmentation (yield of peripheral countries widening vs. core) should be handled ‘separately’ which might be a hint to an ‘anti-fragmentation’ strategy. De Guindos’ comments should be considered against a background where the ECB is likely to hike policy rate to positive levels for the first time in 10 years, which would be very supportive for the EUR, in our view.

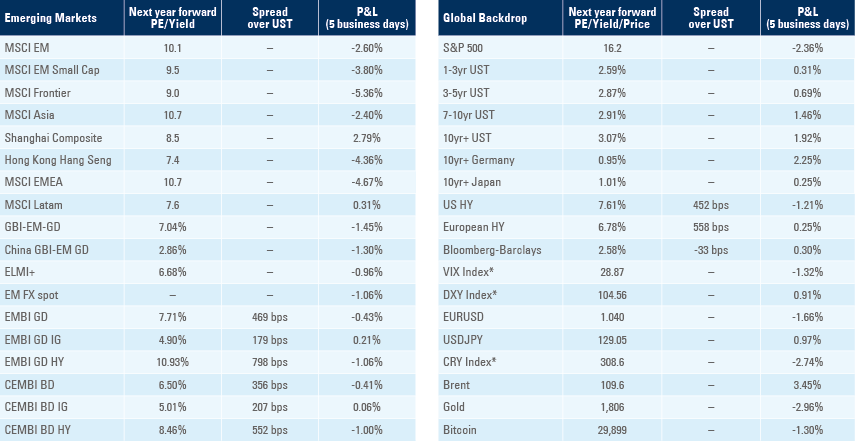

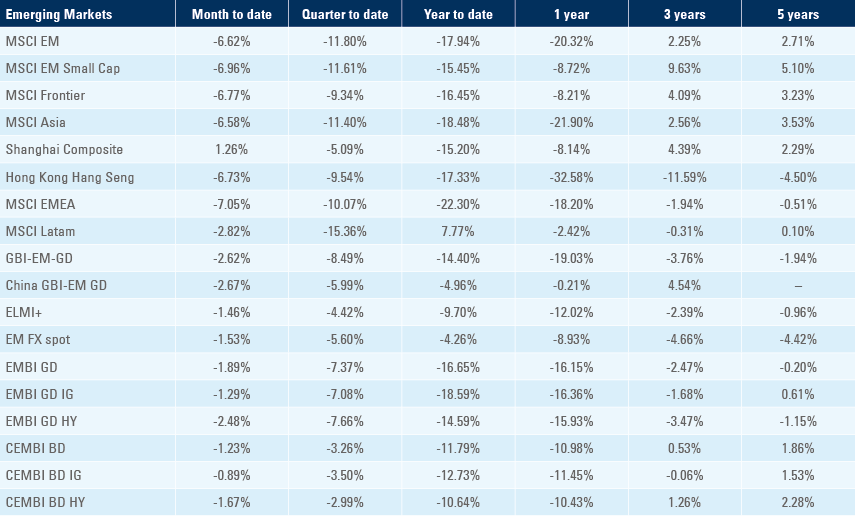

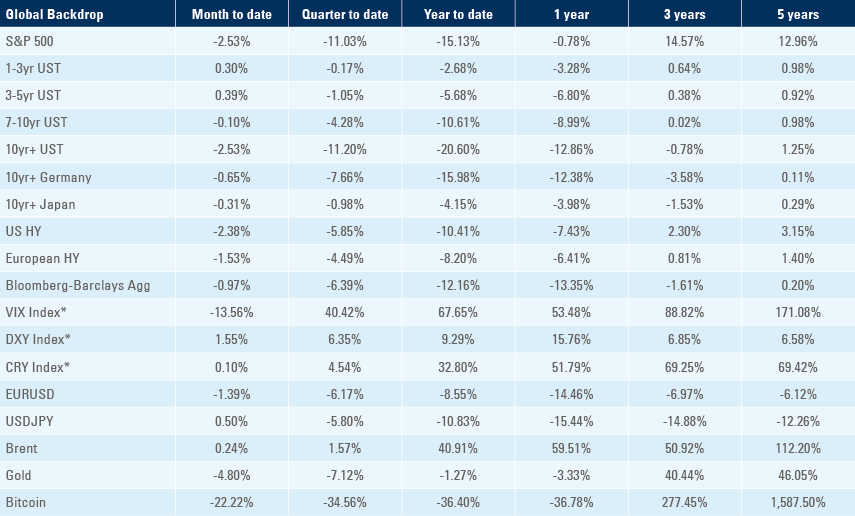

Benchmark performance

1. See https://abicom.com.br/categoria/ppi/

2. See https://cadem.cl/plaza-publica/

3. See See https://www.imf.org/en/News/Articles/2022/05/11/pr22148-ecuador-imf-staff-and-the-ecuadorian-authorities-reach-staff-level-agreement

4. See https://www.lusakatimes.com/2022/05/09/first-quantum-minerals-approves-1-25-bln-mine-expansion-in-zambia/