Castillo removed from presidency in Peru and Kirchner condemned for corruption in Argentina

This week will be key for the performance of risk assets in December. In Peru, Pedro Castillo was ousted from his presidential seat after attempting to unlawfully dissolve parliament. In Argentina, Vice-President Cristina Fernández de Kirchner was sentenced to six years in prison and pledged not to run for any public positions in 2023. Brazilian President-elect Lula appointed worker party politicians to key positions in his future cabinet, signalling far-left policies ahead. The Korean government urged workers in key industries to stop striking as the economy slows. Colombia expects its fiscal deficit to narrow fast in 2023. Hungary remained at loggerheads with the European Union (EU) over Russia. The Chinese opted to stay indoors in several large cities despite reduced mobility restrictions. Turkey’s economy remains very imbalanced with balance of payment risks abound. Mexican economic data was better than expected.

Week ahead

Liquidity is set to deteriorate even further, from already very poor levels after the end of this week. Therefore, it is likely that the current week will be the most important for December. In terms of data, US consumer price index (CPI) inflation today will be key. The yield curve could flatten, and risk assets would sell off should inflation be above the 0.3% mom rate implied in consensus. However, risk assets could do well should inflation decline to 0.2% mom, a pace consistent with a 2.4% annualised pace of inflation, allowing the US Federal Reserve (Fed) to keep reducing its pace of hikes in Q1 2023. On Wednesday, the Federal Open Market Committee (FOMC) will hold its last meeting of the year. Its members are set to hike all policy rates by 50 basis points (bps), taking the Fed Fund rates to 4.5%. Policy makers at the European Central Bank (ECB) and Bank of England (BOE) meet on Thursday, and both are expected to hike their policy rates by a similar magnitude. Market participants will be looking for cues on the likely expected next moves in Q1-2023 as well as whether policy makers believe they are close to the end of the hiking cycle, or at least a level where they would pause hikes to see the impact in the economy, before deciding the next steps. The market prices a 5.0% terminal rate in the US and 2.85% in Europe.

Emerging markets

Peru: President Pedro Castillo tried to dissolve Congress before the third impeachment vote was held against him. The unconstitutional move was quickly disallowed by the Peruvian institutions after his entire cabinet resigned, and Castillo was arrested by the police. Following the ousting of Castillo, Congress nominated Vice-President Dina Boluarte for the vacant presidential chair. Boluarte is the sixth president in seven years, and Peru’s first woman president. She nominated a new cabinet, including Alex Contreras as Minister of Finance. Contreras is a technocrat with good credentials – he was Deputy Minister of Finance since 2021 and worked for 15 years in the Central Bank under current Governor Julio Velarde. Boluarte also said she would seek early election in April 2024, responding to large protests in the streets following Castillo’s arrest. In economic news, the central bank hiked its policy rate by 25bps to 7.5%, in line with consensus.

Argentina: An Argentine court sentenced Cristina Fernández de Kirchner to six years in jail, in one of several corruption cases where she has been indicted. The ruling was not a surprise, but is also not enforceable in the short term, as she remains immune to criminal offences while holding a public position, and can appeal to the Supreme Court after she leaves office in December 2023. The surprise was Mrs. Fernández de Kirchner's statement after the sentencing: she said she would not run for any public positions in 2023 despite being victim of “political prosecution”. If confirmed, her decision benefits the opposition Juntos por Cambio coalition. It also benefits current Finance Minister Sergio Massa, who becomes the most likely presidential candidate from the Peronist Party. In economic news, foreign exchange (FX) reserves rose for the eighth consecutive week, thanks to disbursements from multilateral institutions. Industrial production slowed to a yoy rate of 3.5% in October (from 4.3% in September), and vehicle production rose by 1k to 53.4k in November, as domestic sales increased by 2.1k to 35.2k and exports declined by 6k to 31.4k.

Brazil: President-elect Luis Inacio Lula da Silva appointed Fernando Haddad as Finance Minister. Haddad is a long-standing politician from Brazil’s Workers Party (PT). He was the former minister of education under Lula, and was mayor of the city of Sao Paulo for a term, where he kept the fiscal accounts in good shape. Lula nominated three other PT politicians to his cabinet. Rui Costa, the current governor of Bahia, was chosen to be Lula’s Chief of Staff, Flavio Dino, former governor of Maranhão state will be the Minister of Justice, and Jose Murcio will take over as Defence Minister. Lula is also said to name Aloysio Mercadante as head of the BNDES – the Brazilian development bank. He will have to change the legal provision introduced by former President Michel Temer that prohibits politicians to be appointed to key state-owned companies. In economic news, vehicle production rose by 10k to 216k in November as domestic sales increased 23k to 204k, and exports were unchanged at 43.4k vehicles. Retail sales rose 0.4% mom in October from 1.2% in September, taking the yoy rate down by 50bps to 2.7%, but 30bps better than consensus. CPI inflation rose 0.4% mom in November from 0.6% in October, bringing the yoy rate down 60bps to 5.9%, 10bps better than consensus. The Central Bank of Brazil (BCB) kept its policy rate unchanged at 13.75%, and mentioned there were important upside and downside risks for inflation in 2023:

- Upside risks: (i) a greater persistence of global inflationary pressures; (ii) the heightened uncertainty about the country's future fiscal framework and additional fiscal stimuli that support aggregate demand, partially incorporated in inflation expectations and asset prices; and (iii) an output gap tighter than the one currently adopted by the Committee in its reference scenario, especially in the labor market.

- Downside risks: (i) an additional reduction in the prices of international commodities measured in local currency; (ii) a greater than projected deceleration of global economic activity; and (iii) the continuity of tax cuts assumed to be reversed in 20231

In our view, there is a non-negligible risk of the BCB hiking its policy rate in 2023, should fiscal policy keep the debt to gross domestic product (GDP) ratio on an upward trajectory and leading to higher inflation expectations, particularly considering that social expenditures are carried out via social programmes that increase aggregate demand. On Lula’s side is the fact that Brazil is an environmental powerhouse and produces 10% of the world’s food and is self-sufficient in energy.

South Korea: The government ordered workers to go back to their positions in industries affected by strikes, including petrochemical and steel, where shipments had declined by 20% and 48% from normal levels, respectively. Prime Minister Han Duck-soo said strikes caused damages worth KRW 2.6tn. Strikes are starting to impact key industries such as automobiles, shipbuilding and semiconductors, and may hit the entire economy. In the previous week, the government issued a return-to-work order for truckers from the cement industry. In economic news, the current account surplus declined from USD 1.6bn in September to USD 0.9bn in October, as the trade balance moved from a USD 0.5bn surplus in September to a USD 1.5bn deficit in October. Exports remained weak in the first week of December, according to leading trade data.

Colombia: Finance Minister José Antonio Ocampo said the fiscal deficit should decline to 4.3% of GDP in 2023. If confirmed, this would represent a large fiscal consolidation from the FY 2022 estimate at 7.0% of GDP. CPI inflation rose 0.8% in November, 20bps above consensus and taking the yoy rate up 30bps to 12.5%. Core CPI rose by 30bps to 9.5%. The central bank expects inflation to end the year at 12.2% and decline to 7.5% and 4.2% in 2023 and 2024 respectively, remaining above-target for longer. Consumer confidence declined another 5.3 points to -24.8 in November, one standard deviation below the average since the inception of the survey in December 2000.

Hungary: The EU approved EUR 18bn of aid to Ukraine despite the veto of Hungary. Hungary’s increasingly confrontational stance with the EU risks destabilising its fiscal accounts as Europe may stop EUR 13bn of transfers to Budapest. In economic news, the yoy rate of industrial production dropped from 11.6% yoy in September to 5.1% in October, significantly below consensus. CPI inflation rose 1.8% mom in November from 2.0% in October, taking the yoy rate up 140bps to 22.5%. The trade deficit widened to EUR 1.0bn from EUR 0.75bn in September.

China: Despite significant measures to relax mobility restrictions, China’s population opted to remain indoors across many large cities like Beijing, as covid-19 cases kept increasing, leading to fears of overwhelmed hospital facilities. In economic news, aggregate financing increased to RMB 2.0trn in November from RMB 908bn in October, broadly in line with consensus. The yoy rate of the producer price index (PPI) was unchanged at -1.3% (deflation) in November, unchanged from October, while the yoy rate of CPI inflation declined 50bps to 1.6%, in line with consensus. The trade surplus narrowed to USD 69.8bn in November from USD 85.2bn in October, almost USD 10bn below consensus as exports dropped by 8.7% yoy and imports declined by 10.6% yoy, both declining faster than consensus.

Turkey: CPI inflation rose 2.9% mom in November from 3.5% in October as the yoy rate dropped 110bps to 84.3%. Core CPI dropped 150bps to 68.9% yoy over the same period. The yoy rate of PPI inflation dropped to 136% in November from 158% in October. Some corporations are struggling to purchase foreign exchange as the central bank imposed veiled capital controls to avoid a balance of payment crisis. This came amidst a large current account deficit and low confidence from locals and foreign investors in the Lyra.

Mexico: Consumer confidence increased 0.7 points to 41.7 in November. Vehicle production was unchanged at 278.8k units in November, but exports declined 36.8k to 231.1k over the same period. CPI inflation was unchanged at 0.58% in November, but core CPI declined 18bps to 0.45%, leading to yoy rates of 7.8% and 8.5% respectively. Both were below consensus as CPI declined to deflationary level sequentially in the second half of November, pointing to weaker inflation ahead. On the other hand, nominal wages rose to a yoy rate of 8.2% in November, up from 4.5% yoy in October.

Snippets

- Chile: The central bank kept its policy rate unchanged at 11.25%, in line with consensus, as CPI inflation rose 1.0% mom in November from 0.5% mom in October, taking the yoy rate up 50bps to 13.3% (consensus 12.9% yoy). The trade surplus narrowed to USD 285m in November from USD 457m in October, better than consensus as exports rose USD 200m to USD 7.8bn and imports increased USD 400m to USD 7.5bn.

- Czech Republic: CPI inflation rose 1.2% mom in November after declining 1.4% in October, bringing the yoy rate 110bps higher to 16.2%.

- Egypt: The whole economy PMI declined 2.3 points to 45.4 in November, close to the lowest post-covid levels. CPI inflation rose 2.3% mom in November as the yoy rate rose 150bps to 18.7%. Core CPI rose 250bps to 21.5% yoy over the same period.

- India: The Reserve Bank of India increased its policy rate by 35bps to 6.25%, in line with consensus, as the committee highlighted growth downside due to international conflict and slowing demand. The yoy rate of industrial production declined to -4.0% in October from +3.1% in September and CPI inflation dropped by 100bps to 5.9% yoy in November, significantly below consensus.

- Indonesia: Consumer confidence declined 1.2 points to 119.1 in November, but remains significantly elevated.

- Malaysia: The yoy rate of industrial production declined to 4.6% in October from 10.8% in September, as manufacturing sales value dropped to 12.9% yoy from 19.5% over the same period.

- Poland: The National Bank of Poland kept its policy rate unchanged at 6.75%, in line with consensus.

- Philippines: The yoy rate of CPI inflation rose 30bps to 8.0% in November, 20bps above consensus. The unemployment rate declined 50bps to 4.5% in October.

- Romania: GDP growth was unchanged at 1.3% qoq and 4.0% yoy in Q3 2022, in line with consensus. Retail sales rose 0.5% mom and 4.2% yoy in October after declining 0.7% mom in September, but the unemployment rate increased 10bps to 5.5% in October.

- South Africa: Real GDP growth rose by 1.6% qoq in Q3 2022 after declining 0.7% qoq in Q2 2022, bringing the yoy rate up to 4.1% over the same period, significantly above the consensus at 2.8% yoy. The current account deficit narrowed to ZAR 18bn in Q3 2022 from ZAR 107bn in Q2 2022, bringing the deficit as percentage of GDP to -0.3% from -1.6% over the same period.

- Taiwan: The yoy rate of CPI inflation dropped 35bps to 2.4% in November, 15pbs below consensus as wholesale price index (WPI) inflation dropped by 190bps to 9.1%. Core CPI dropped 10bps to 2.9% over the same period. The trade surplus increased to USD 3.4bn in November from 3.0bn in October.

- Thailand: CPI inflation dropped 0.1% in November after rising 0.3% in October, bringing the yoy rate down 40bps to 5.6%. Core CPI was unchanged at 3.2% yoy.

Developed markets

United States: Initial jobless claims rose to 230k in the first week of December from 226k in the previous week, in line with consensus. Continuing claims increased to 1.67m in the last week of November from 1.61m in the previous week. The University of Michigan sentiment survey rose 2.3 points to 59.1 in December, 2.1 points better than consensus, but still at very depressed levels for the eighth consecutive month, while the one-year inflation expectation declined 30bps to 4.6% in the same survey. Factory orders rose 1.0% mom in October from 0.3% mom in September. The trade deficit widened to USD 78.2bn in October from USD 74.1bn in September. The ISM services survey increased 2.1 points to 56.5, leading to fears that the service sector will remain strong for longer, forcing the Fed to keep policy rates at elevated levels for longer to bring inflation back to its target. Fittingly, four days later PPI inflation rose 0.4% mom in November after increasing 0.1% in October (revised from 0.0%) as the yoy declined 70bps to 7.4%, some 20bps above consensus.

Europe: Retail sales dropped 1.8% mom in October (up 0.8% mom in September), posting a decline of 2.7% in yoy terms (0.0% in September), broadly in line with consensus. Final GDP growth was revised higher by 10bps to 0.3% qoq and 2.3% yoy in Q3 2022.

Canada: The Bank of Canada hiked its policy rate by 50bps to 4.25%, in line with consensus.

Japan: The yoy rate of PPI inflation declined 10bps to 9.3% in November, 50bps above consensus.

1. See https://www.bcb.gov.br/en/pressdetail/2456/nota

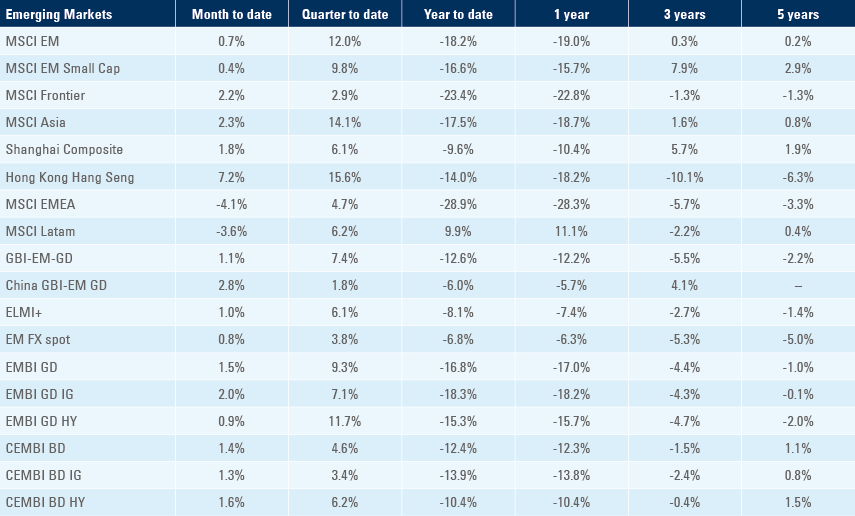

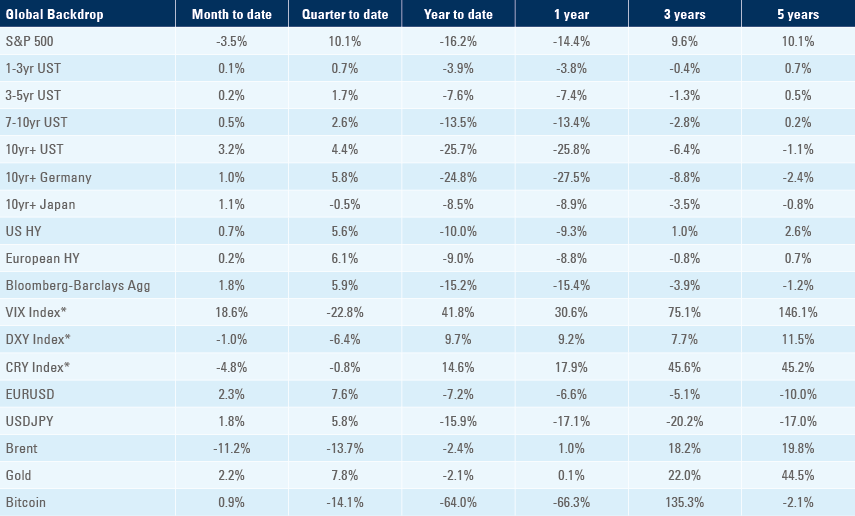

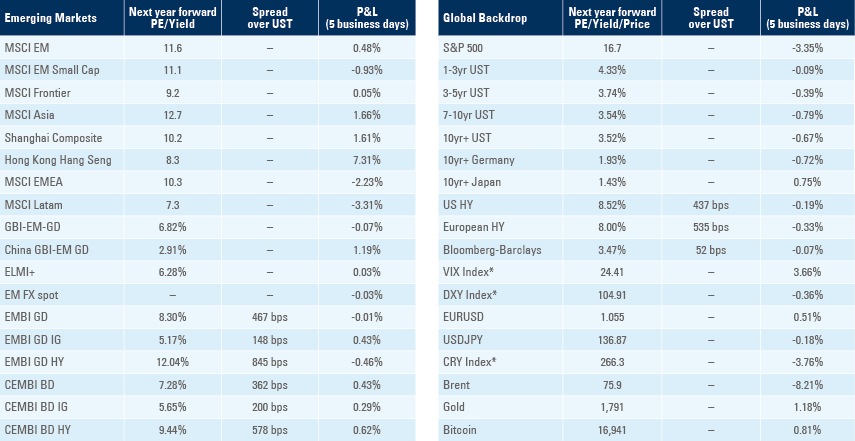

Benchmark performance