The momentary easing in financial conditions seen in July is now behind us. Global economic challenges continue to demand a decisive response and policy-makers everywhere must make difficult choices. Europe is under pressure from high gas prices, while oil flows freely elsewhere; China cut its lending rates and stepped up to help property developers; Colombia’s tax reform will not please everyone; Egypt is revisiting its FX policy; Ghana does not wait to correct a policy mistake; Indonesia presses its advantage in nickel mining.

Geopolitics

Turkey’s President Recep Tayyip Erdogan, together with UN Secretary General Guterres, visited president Zelensky in Kyiv last week and called for a negotiated solution to the conflict, which is passing its half-year mark this week. Guterres notably called for an urgent withdrawal of military forces and equipment from the Zaporizhzhia nuclear plant, after video footage showed several military trucks parked near the plant’s reactor. However, Ukraine maintains its objective of regaining territorial integrity, including Crimea. Western military observers called the conflict a ‘standstill’, and Russia’s representative at the United Nations (UN), Gennady Gatilov, said that he did not see a path for diplomacy at present. Russia is planning a referendum in the Kherson prefecture (oblast) on 14 September, in an attempt to consolidate control over the area.

Commodities

Crude prices dropped over the week, but WTI crude prices bounced back above $90 a barrel on Friday as a sharp decline in crude inventories pushed back against recession concerns. Total nationwide US oil inventories — including Strategic Petroleum Reserve — fell by 10.5 million barrels in the week to August 12, and gasoline inventories declined by 4.6m, vs. 1.0 million expected. The drop in oil inventories was notably explained by a rapid rise in crude exports that climbed to a record 5 million barrels a day, as Europe ramps up purchases.

In Europe, natural gas prices climbed for a fifth straight week, jumping 19% last week to EUR 244/MWh (front-month contract), as it was announced that the key Nord Stream pipeline will stop for repairs for three days at the end of the month, and German economy minister Habeck warned of risks of supply cuts. Chancellor Scholz and Minister Habeck both mentioned the possibility of extending the lives of three German nuclear plants, but a Bloomberg analyst cited long ramp works and estimated this would replace only 3% of Germany’s natural gas consumption in 2023.

Emerging markets

China: The PBOC lowered its one-year medium-term lending facility rate by 10 bps to 2.75% in its operation on Aug. 15. This led to cuts to China’s LPR (Loan Prime Rate), the reference rate for commercial bank loans. In comparison to the 1Y LPR (cut by 5bps to 3.65%), the 5Y LPR was cut by 15bps to 4.30%, in a move that will help lower mortgage rates. In addition, China’s housing ministry, finance ministry and the central bank announced last Friday a package of RMB 200bn (USD 29bn) in loans to troubled real estate developers. This provided more details on a plan that had been disclosed earlier in the summer. Although his influence has waned, Premier Li continues to push for a more expansionary economic policy. In comments made on August 16th, Li acknowledged that sluggish demand is the prominent obstacle to economic recovery, and said measures should be taken to boost big-ticket item consumptions such as automobiles, and support reasonable housing demand. He also pushed his idea of leveraging public sector investment via local government special bond (LGSB), highlighting that “the outstanding amount of LGSB has not reached local governments' debt limit and therefore authorities should actively utilise the debt limit space according to law".

Colombia: High growth but narrow margins. Real GDP expanded 1.5% qoq in Q2 2022, driving the yoy growth rate to a whopping 12.6% over the previous year, which was admittedly impacted by social unrest. Sequentially, economic activity slowed to 8.5% yoy in June from 17.2% yoy in May. The trade deficit narrowed to USD 0.3bn in June from USD 1.7bn as imports slowed 0.4bn to USD 6.4bn over the same period. So far so good. The new President Gustavo Petro has ambitious plans for greater social expenditure, including an ‘anti-hunger’ plan, free education in public universities, and support for the elderly. The new Finance Minister Jose Antonio Ocampo, a respected economist, has been tasked with finding the fiscal room. His ‘tax reform’ plans are under discussion, and as proposed, the reform would result in COP25 trillion (USD 5.7bn) of additional tax revenue, or 1.7% of GDP, in 2023. The additional revenue would come from tax changes on wealthy individuals (32%), taxes on commodities exports (27%), corporate taxes (23%) and other levies (19%). The risk to the fiscal outlook is that higher taxes impacts consumption. On the positive, pension reform was not included in the reform agenda this year, and minister Ocampo did not exclude a reduction in fuel price subsidies.

Egypt: Change is in the air. President El-Sisi reshuffled the cabinet, replacing 13 ministers, and the Central Bank Governor Tarek Amer tendered his resignation. The intention of the reshuffle seems to be to improve the government’s efficiency. Egypt was very close to reaching a deal with the International Monetary Fund, but the agreement was held back due to disagreements on EGP management, as the Fund has been pushing for a more flexible exchange rate. The Egyptian pound has been under pressure as traders bet on a one-off devaluation. The central bank has been holding the spot exchange rate stable but the forward market is pricing a high probability of a 25-30% depreciation in the pound in the coming months, and there is a real sense that policy changes are required urgently, alongside progress in discussion with the IMF. The trade data for June illustrated the pressures on the country’s external balance: the trade deficit rose to USD 3.2bn, from USD 2.6bn the prior month. Imports rose by 6.2% over the same period last year, and exports rose by a more modest 3.8% yoy but were down sequentially. Acting Central Bank governor Hassan Abdullah, a former commercial bank executive, chaired the central bank’s monetary policy committee last week under heightened scrutiny, and decided to keep the policy rate unchanged at 11.25%, against expectations of a rate hike.

Ghana: It is never too late to fix a policy mistake. Just one week after agreeing to leave the policy rate unchanged, the Bank of Ghana convened an emergency meeting to hike its policy rate by 300bps to 22.0%, citing worrying currency weakness and inflation. CPI rose 200bps to 31.7% yoy, and PPI inflation rose 250bps to 41.2% in July.

India: A balanced view. The central bank (RBI) minutes released last week shed some light on the decision to hike the repo rate by 50bps to 5.4% at the start of the month. The minutes confirmed domestic growth momentum remains strong and more rate hikes are likely on the way, but also acknowledged that the global economic environment is deteriorating, and that the decline in commodity prices in recent months may improve the inflation outlook. The yoy rate of wholesale prices inflation slowed to 13.9% in July from 15.2% in June.

Indonesia: Leveraging natural resources. Indonesia is the world’s largest miner of nickel, with 760k tons per annum (around 20% of global production) and has c. 72 million tons of nickel ore reserves, or 52% of the world's known reserves. Nickel is a key component of the cathodes used in electric vehicle (EV) batteries, and it has been good business for Indonesia. Earlier this month, Tesla and Indonesia signed a USD 5 billion contract to supply the company with processed nickel supplies for use in lithium ion batteries for five years. The nickel would need to be refined in Indonesia before it can be exported. Now, in order to increase the value-add generated by the sector, President Jokowi is pressing his advantage and he has been pushing electric vehicle manufacturers to set up car manufacturing in the country. In a headline grabbing interview last week, Jokowi alluded to the possibility of taxing nickel exports to encourage domestic manufacturing. The Indonesian government's recent ban on coal exports is a challenge for the nation's miners, as local selling prices are capped at USD70/t while the international price for Indonesian coal has reached USD 322/t. Indonesian coal miners are still planning to expand production despite earnings threats, as the EU's ban on Russian coal leads to more intense competition among Asia's miners. In other news, Indonesia’s current account surplus widened to 1.1% of GDP (USD 3.9bn) in Q2 from 0.1% in Q1 as the surge in commodity prices boosted the goods trade balance.

Kenya: Another miss for Odinga. William Ruto of the UDA party won the presidential election by the electoral council, according to the electoral council, beating long-standing opposition leader and four-time presidential candidate Raila Odinga by a slim margin (50.5% vs. 48.9%). Although Odinga had received the support of his long-time rival president Uhuru Kenyatta, many old Kenyatta supporters preferred to vote for change. The election was quite peaceful, but Odinga rejected the result and has decided to put the matter to the Supreme Court. If the results are annulled, as was the case in 2017, a fresh election must be held within 60 days of the ruling.

Snippets

- Argentina: Finance Minister Massa is moving forward with subsidy cuts on utility bills in a bid to comply with its $44 billion programme with the International Monetary Fund despite the political costs. Officials rolled out the details of the subsidy squeeze: subsidies will either be cut gradually, or capped for medium income households, and they will be maintained for the more needy. The economic team estimates that the plan will save the public purse c. 0.5% of GDP on a full-year basis, which is a modest dent in total energy subsidies amounting to close to 3% GDP.

- Brazil: Prices fell by 0.69% mom in the first half of August (IGP10 index), vs. -0.59% expected, helped by the wholesale prices component, which turned negative mom. The monthly activity indicator for June rose to 0.7% mom from -0.3% the previous month. The yoy increase was slightly lower at 3.1% due to base effects.

- Chile: Real GDP growth was unchanged in Q2 2022, below expectations of 0.3% qoq, after contracting 0.8% qoq in Q1 2022. Despite the sluggish growth trajectory coming from weak consumption, the current account deficit widened by USD1bn to USD 6.6bn in Q2.

- According to a Pulso Ciudadano opinion survey, 45.8% of respondents plan to vote against the proposed Constitution charter on 4 September, up from 44.3% the week prior. Just 32.9% said they will back the Constitution, down from 33.9% before.

- Czechia: The yoy rate of PPI inflation dropped 170bps to 26.8% in July.

- Malaysia: The trade surplus narrowed to MYR 15.5bn in July from MYR 21.9bn in June, MYR 2.0bn consensus. Exports slowed down by 8.2% mom due to lower demand from US and China while imports dropped by 4.5%.

- Namibia: The central bank hiked its policy rate by 75bps to 5.5%, in line with consensus.

- Nigeria: The yoy rate of CPI inflation rose 100bps to 19.6% in July, 20bps above consensus.

- Pakistan: Pakistan’s former Prime Minister, Imran Khan, was charged under the country’s antiterrorism act on Sunday, in a drastic escalation of the tense power struggle between the country’s current government and its former leader that threatens to set off a fresh round of public unrest. The charges came a day after Mr. Khan gave a speech condemning the recent arrest of one of his top aides, Shahbaz Gill, who was imprisoned earlier this month for making comments on a talk show calling for military officers to defy orders from the ‘top brass’. The police report said that Imran Khan’s comments amounted to an illegal attempt to intimidate the country’s judiciary and police force.

- Peru: President Castillo disapproval rate declined to 69% in August. As many as 59% of the people polled in a survey poll are in favour of an impeachment. Congress can try to impeach Castillo for moral incapacity or high treason in a process that could last from two weeks to more than one month.

- Philippines: The central bank hiked its policy rate by 50bps to 3.75%, in line with consensus, taking policy rate back to pre-covid levels.

- Russia: The producer price index (PPI) declined 2.2% mom in July after a 4.1% drop in June (-1.0% mom consensus), bringing the yoy rate of PPI inflation down by 520bps to 6.1% over the same period.

- Turkey: The central bank unexpectedly cut its policy rate by 100bps to 13.0%, citing moderating economic activity. This will not improve the domestic macro imbalances, which saw the yoy rate of CPI inflation reach 80% in July. The external balance is expected to remain under pressure despite tourism booking soaring back to 2019 levels.

- Uruguay: The central bank hiked its policy rate by 50bps to 10.25%, in line with consensus as the yoy rate of CPI inflation increased 30bps to 9.6% in July. The statement mentioned the committee is looking to deliver similar hikes in upcoming meetings to bring policy to contractionary territory.

- Zambia: The Bank of Zambia kept its policy rate unchanged at 9.0%

Developed markets

United States: The minutes of the Federal Open Market Committee (FOMC) showed a committee willing to keep increasing interest rates, but at a slower pace due to risks to economic activity and the slowdown in underlying inflationary pressures on a sequential basis. Overall, it corroborates our view that we have passed peak hawkishness and that the FOMC is likely to slow rate increases to 50bps increments in September and possibly less in November, particularly if disinflationary pressures remain in place in Q4 2022. FOMC members Daly and Bullard said further 50-75bps hikes will be considered in September and both members pushed back against rate cuts next year – now priced to start in June. Among the data releases, existing home sales fell hard (-5.9% mom), and retail sales also disappointed with a flat reading mom for July.

Europe: the ECB’s Isabel Schnabel emphasised inflationary pressures and the risk of de-anchoring inflation expectations demand further monetary policy tightening, suggesting at least one more 50bps rate hike over the coming meetings. The seasonally adjusted trade deficit widened to EUR 30.8bn in June from EUR 27.2bn in May as extremely elevated energy prices keep pressure on Europe’s external accounts. At the same time, GDP growth expanded by 0.6% qoq in Q2 2022, the same pace as Q1 2022 and 10bps lower than consensus. The ZEW expectations survey declined another 3.8 points to -54.9.

Canada: CPI inflation slowed to 0.1% mom in July from 0.7% in June, bringing the yoy down 50bps to 7.6% while core CPI remained elevated at 5.5% yoy in July.

United Kingdom: The yoy rate of CPI inflation rose 70bps to 10.1% in July, 30bps above consensus and the highest level since 1982.

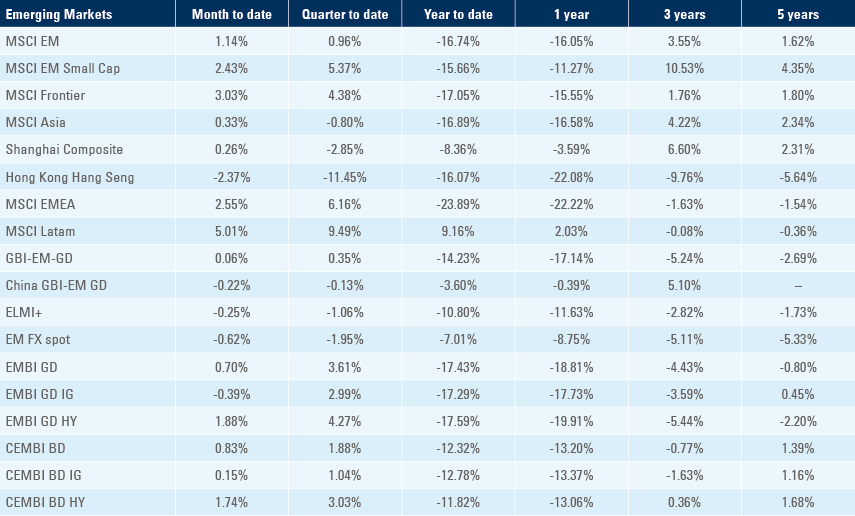

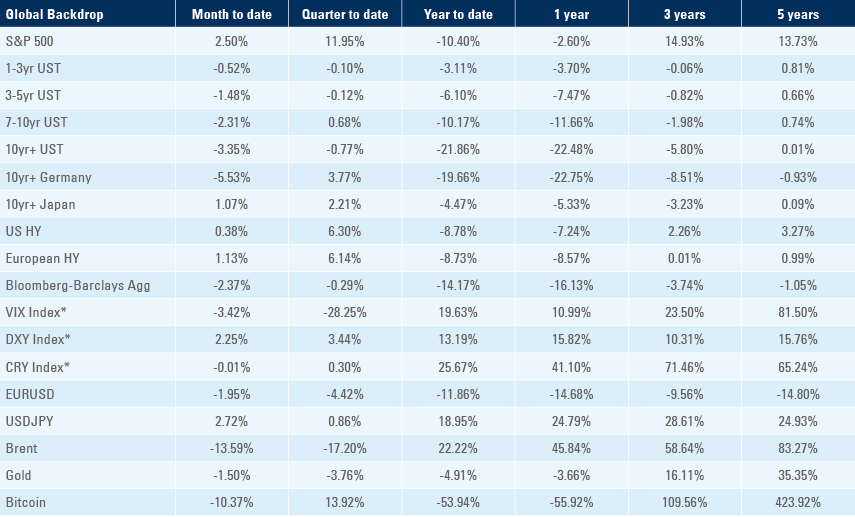

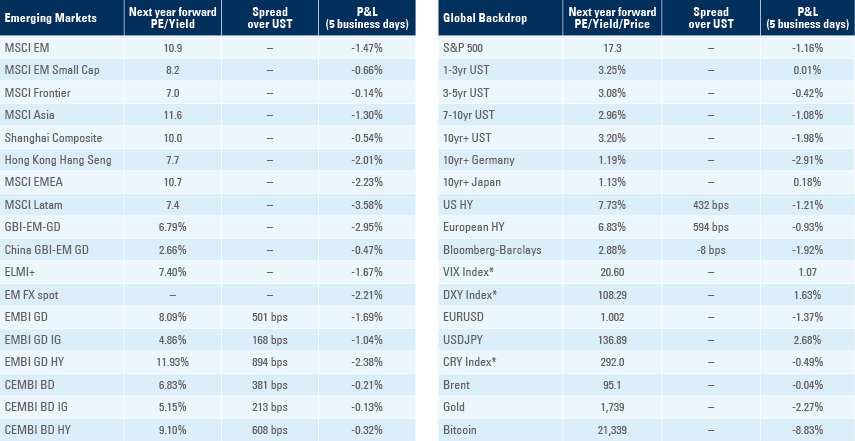

Benchmark performance