Russia annexed four Ukrainian provinces after a staged referendum, but the Ukrainian army re-takes important territories on the ground. Incumbent President Jair Bolsonaro performed better than expected in the presidential election in Brazil. China mandated state-owned banks to increase lending to the real estate sector. Tensions rose again in the Tigray region in Ethiopia. Hungary’s Orban stuck with his anti-European Union rhetoric despite the risk of losing important funding. India hiked its policy rate by 50bps to 5.9%. Lebanon discussed a mild devaluation of the official FX rate. Mexico hiked rates by 75bps to 9.25% and Thailand hiked by 50bps to 1.0%. China, Japan, and the United Kingdom announced interventions in their foreign exchange and bond markets, suggesting policymakers are very uncomfortable with the current volatility and one-sided Dollar appreciation.

Geopolitics

Russian President Vladimir Putin annexed four Ukrainian provinces (Donetsk, Luhansk, Kherson and Zaporizhzhia) after a staged referendum where supposedly more than 95% of the population voted to become part of Russia, even though Russia does not fully control any of the four regions. The Kremlin said that Donetsk and Luhansk would be incorporated according to the borders stablished by the separatist attacks in 2014, adding that they would need to discuss the borders of Zaporizhzhia and Kherson regions.1

Over the weekend, the Ukrainian army re-captured the city of Lyman in the North of Donetsk after circling the city from three directions and forcing Russian forces to retreat under severe shelling. Ukraine is also making progress in the South where they have been retaking territories West of the Dnipro River in the Kherson Oblast. Russian troops have been focusing their efforts on keeping their positions in the South to consolidate the land bridge to Crimea.

Putin asked the regime in Kyiv to return to the negotiating table to “end the war they unleashed back in 2014” and threatened to “defend our land with all the powers and means at our disposal”. Putin also blamed the “Anglo-Saxons” for blowing up the Nord Stream (NS) 1 and 2 pipelines in the Baltic Sea. The West accused Russia of blasting the pipelines after the country brought sales of gas to a halt through NS claiming it had no parts to maintain them.

At least 200k Russian people fled the country, mostly to Georgia and Kazakhstan after Putin said that 300k men would be drafted into the army. The very unpopular mobilisation caused street protests and criticism against the regime by famous personalities, the first signs that Putin is under severe pressure after territorial losses in Ukraine.2

Emerging markets

Brazil: Former President Luiz Inacio Lula da Silva received 48.4% of the votes, vs. incumbent President Jair Bolsonaro’s 43.2% share. The race was much tighter than polls had anticipated, in line with our view, as Bolsonaro galvanised the conservative votes and won decisively in the States of Sao Paulo and Rio de Janeiro.3 Nevertheless, Lula remains the favourite to win the run-off on 30 October as he gained by a landslide in the North and North East regions and remained competitive in the South East. Both candidates will focus on getting the support from Romeu Zema – the re-elected governor of Minas Gerais from Partido Novo (“New Party”). Polarisation was the key theme of the election with Bolsonarismo consolidating as a strong political movement, capturing the conservative votes. For example, Bolsonaro’s Liberal Party will have 16% of Senate seats (up from 9%) and 19% of the seats in Congress (up from 15%). At the same time, the leftist alliance led by Lula’s Workers Party got 80 seats (15.6%) in Congress, up from 68 seats (13.3%). This suggests Lula and Bolsonaro would have to come to the centre to implement any reforms, lowering the risk of populist measures. In economic news, the current account moved to a USD4.1bn deficit in July (USD3.3bn consensus) from a USD 1.3bn surplus in June, but foreign direct investment rose to USD 7.8bn (USD 4.9bn consensus) from USD 5.2bn over the same period – an overall healthy balance of payments position. CPI inflation declined 0.4% mom in September after dropping 0.7% in August, taking the yoy rate down 160bps to 8.0%, 20bps lower than consensus. PPI inflation dropped 0.95% mom in September after declining 0.70% in August, bringing the yoy rate down 34bps to 8.25%. Formal job creation increased to 279k in August from 221k in July, more than 10k above consensus. Tax collections were better than expected buoyed by the strong economic performance.

China: Bloomberg reported that financial regulators told state-owned banks to lend at least RMB 600bn (c. USD 85bn) to the property sector until the end of the year, including mortgages, development loans and bond purchases.4 China will also offer personal income tax refunds to residents who buy new homes within one year of selling on old home, until end-2023. The balance of payment surplus narrowed to USD 77.5bn in Q2 2022 from USD 80.2bn in Q1 2022. The composite PMI declined 0.8 to 50.9 as the manufacturing survey improved 0.7 to 50.1, but the non-manufacturing survey dropped 2.0 to 50.6. The Caixin manufacturing PMI dropped 1.4 points to 48.1. China has been intervening to support the RMB, notably asking banks to bring the currency closer to the fixing which has been systematically stronger than market levels over the second half of September.

Ethiopia: An air strike hit a busy residential area in Adi Da’ero, a town 32 kilometres (20 miles) from the Eritrean border, killing at least 6 people and injuring dozens. The fighter jet dropping the bomb came from the direction of Eritrea according to humanitarian officials. The strike led to mobilisation in the Tigray region in Ethiopia and Eritrea after a five-month ceasefire in clashes between the Ethiopian army led by Abiy Ahmed and the Tigray People’s Liberation Front (TPLF) who rule the country from 1991 to 2018. Eritrea was effectively in war against Ethiopia during the TPLF rule but signed a peace deal when Abiy Ahmed came to power.

Hungary: Prime Minister Victor Orban said Hungary was negotiating financing arrangements with non-European partners, saying if Brussels does not release the EU funds pledged to Hungary, he would find other sources of funding. The government approved a proposal by parliament to organise a public survey on EU sanctions against Russia. In economic news the National Bank of Hungary hiked its main policy rate by 125bps to 13.0%, 25bps more than consensus, and said that this would conclude its hiking cycle even though PPI inflation rose another 4.1% mom in August, taking the yoy rate up 550bps to 43.4%.

India: The Reserve Bank of India hiked its policy rate by 50bps to 5.9%, in line with consensus. The current account deficit widened to USD 23.9bn in Q2 2022 from USD 13.4bn in Q1 2022, around USD 7bn better than consensus. Government accounts moved to INR 201bn deficit in August after a INR 11bn surplus in 2020.

Lebanon: The Finance Ministry announced that the country’s official FX exchange rate of the Lebanese pound against the US dollar would change to 15,000 from 1,500, starting in November. This is designed as a step towards the unification of the country’s multiple exchange rates, requested by the IMF. However, this depreciation is likely to be too modest to address the gap in the FX market as parallel market rates are around 39,000 pounds per dollar. The question is whether the IMF will accept the mild devaluation as a step in the right direction or reject it outright as insufficient.

Mexico: The central bank hiked its policy rate by 75bps to 9.25%, in line with consensus. The unemployment rate increased 10bps to 3.5%, a bit higher than consensus and the trade deficit narrowed by USD 0.5bn to USD 5.5bn (consensus 4.9bn) as exports rose by USD 4bn to USD 50.7bn and imports rose by USD 3.8bn to USD 56.2bn. Vehicle exports soared 42.5% yoy to USD 15.2bn in August as supply shortages of key parts such as chips eased.

Thailand: The High Court of Thailand ruled Prime Minister Prayuth Chan-Ocha had not breached a constitutional term limit, allowing him to stay in power until elections are called, before March 2023. The Bank of Thailand (BoT) hiked its policy rate by 25bps to 1.0%, in line with consensus. Thailand has relatively elevated private debt levels, but a low debt burden due to low interest rates, which justifies the BoT’s cautious approach when tightening policy. Core CPI rose meaningfully, but still at around 3.2% yoy, despite CPI at 7.9%. In other news, the current account deficit narrowed to USD 3.5bn in August from USD 4.2bn in July.

Snippets

- Chile: The unemployment rate was unchanged at 7.9%. The yoy rate of manufacturing and industrial production declined 4.0% and 5.0% respectively, below consensus of 3.3% for both indicators while retail sales declined by 13.2% yoy, broadly in line with consensus.

- Colombia: The central bank hiked its policy rate by 100bps to 10.0%, 50bps below consensus as the national unemployment rate dropped 40bps to 10.6%

- Czechia: The Czech National Bank kept its policy rate unchanged at 7.0%, in line with consensus. Consumer and business confidence dropped to -2.6 in September from +1.7 in August.

- Egypt: Tourism arrivals rose to 4.9m in 1H 2022 from 2.6m 1H 2021.

- Ghana: The government plans to engage with domestic and external investors as part of an economic program to form the basis for talks with the International Monetary Fund.

- Indonesia: The yoy rate of CPI inflation rose to 5.95% in September from 4.69% in August and core CPI rose 17bps to 3.21% over the same period, both slightly lower than consensus.

- Kazakhstan: The state-owned railway and transport infrastructure company Kazakhstan Temir Zholy offered to buy back all USD 883m outstanding Eurobonds due in 2042 at par. The bond was trading at 85c before the tender offer.

- Morocco: The Central Bank of Morocco hiked its policy rate by 50bps to 2.0%, the first hike since 2008 and partially reverse the 75bps cumulative cut since 2019.

- Nigeria: The central bank hiked its policy rate by 150bps to 15.5%, 100bps more than consensus.

- Pakistan: The International Monetary Fund said it may increase the USD 1.1bn disbursement due in a few weeks to help the country deal with its twin deficits.

- Poland: CPI inflation rose to 1.6% mom in September taking the yoy rate up 110bps to 17.2%, 80bps below consensus.

- South Africa: The trade surplus narrowed to ZAR 7.2bn in August from ZAR 24.8bn in July, significantly lower than consensus. PPI inflation declined 0.5% in August after rising 2.2% in July, bringing the yoy rate down 140bps to 16.6%.

- South Korea: The yoy rate of retail sales rose to 15.4% in August from 9.7% in July, but industrial production slowed to 1.0% yoy from 1.5% over the same period. The trade deficit narrowed to USD 3.8bn in September from USD 9.5bn in August as the yoy of exports slowed 380bps to 2.8% while imports declined 960bps to 18.6%.

- Turkey: The yoy rate of CPI and PPI inflation rose to 83.5% and 151.5% respectively. The elevated and accelerated rate of PPI inflation alongside lose monetary policy is likely to keep CPI inflation unhinged.

Developed markets

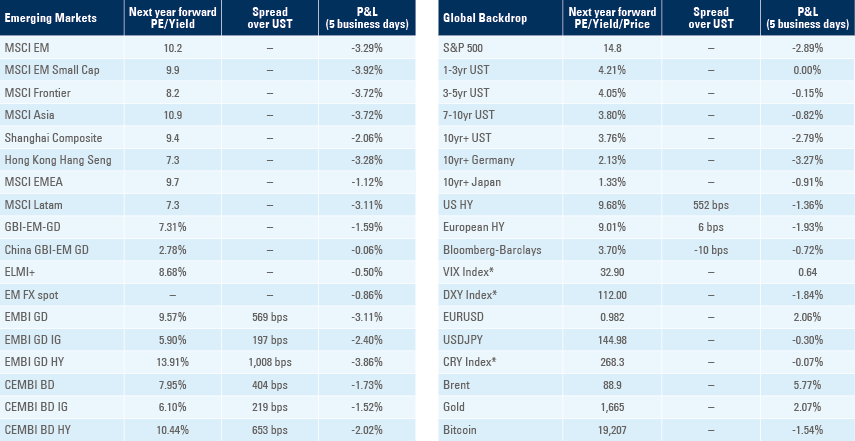

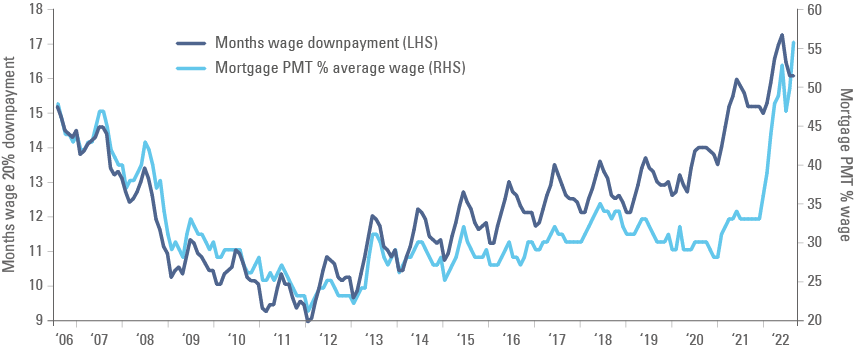

United States: Mixed signals coming from the housing market as the S&P Case-Shiller 20-city composite index dropped 0.4% mom in Sep (+0.2% consensus) from +0.2% mom prior, but new home sales rose to 685k in August from 532k in July, 185k above consensus. Pending home sales dropped 2.0% in August from -0.6% in July. Forward looking housing market indicators continues to point to significant challenges ahead. The average 30-year mortgage rate climbed to 7.06%, its highest level in 22-years and 425bps higher than the 2.81% level reached in February 2021, the lowest point in the series started in 1997. After the massive increase in mortgage rates, an American earning the average hourly earnings of USD 32.36 and working 34.5 hours per week would have to spend 56% of their disposable income before taxes, insurance and running costs, to service a mortgage considering a 20% down payment (equivalent to 16-months of salary) to buy an existing house at the nationwide average price. The previous peak was 47% in 2007 as per figure 1. This suggests home sales will decline to the lowest levels since 2008 as per figure 2:

Figure 1: US House affordability measured by months of average US wage for a 20% mortgage down payment and % of wage allocated to serve the mortgage debt of the average house price

Figure 2: Pending home sales vs percentage of average wage dedicated to serve the debt of an average house

In other economic news, durable goods orders declined 0.2% mom in August after rising 0.2% in July while consumer confidence recovered to 108.0 in September from 103.2 in August (104.5 consensus). The core PCE deflator rose by 0.6% mom in August taking the yoy rate 20bps higher to 4.9%. Personal income rose 0.3% mom (unchanged) in August and personal spending increased by 0.4% mom (from -0.2% in July). Jobless claims dropped to 193k in the week ending on 24 September from 209k in the previous week.

The Chicago PMI dropped 6.5 points to 45.7 in September, significantly below consensus at 51.8. The University of Michigan sentiment survey dropped 0.9 to 58.6, mostly driven by poor expectations of future activity. Inflation expectations for 1-year and 5-10 years dropped 10bps to 4.7% and 2.7% respectively.

The President of the Federal Reserve Bank of St. Louis James Bullard said the credibility of the inflation target regime was under threat, adding that more increases are needed to achieve its target as policy has just recently moved to restrictive territory.

Europe: Most European Central Bank policymakers pledged to keep rising policy rates with the pace of tightening driven by data, according to Vice Governor Luis Guindos. The ECB is likely to have to tighten policy further in the face of expansionist fiscal policies. Last week, the German government announced a EUR 200bn special fund to contain the price of energy, which adds to the EUR 100bn special fund to modernise its army and a EUR 60bn fund against climate change. The three funds combined adds up to EUR 360bn. The German Finance Ministry said 26 special funds outside the regular budget in 2020, suggesting untransparent budget allocations are increasing when compared it to Germany's regular budget of EUR 496 billion for 2022.5

In economic news, Eurozone economic confidence dropped by 3.6 points to 93.7 – close to 1 standard deviation below its average of 99.9 since 1985, but still far away from the lows of 71.6 in January 1993, 68.6 in March 2009 and 60.9 in March 2020.6 The measure stands in sharp contrast with consumer confidence which sits at -28.8 – the lowest level since the beginning of the series. The yoy rate of CPI inflation rose 90bps to 10.0% in September, and core CPI rose 50bps to 4.8% - the highest level since the creation of the single currency as German’s EU harmonised CPI rose 210bps to 10.9%. PPI widened to 50.5% yoy in Italy, 29.5% yoy in France and The Eurozone unemployment rate was unchanged at 6.6%.

United Kingdom: The Bank of England intervened in the UK Gilt market after yields jumped from 3.5% on the 22 September to 5.14% on 28 September. Defined Benefit pension plans were the culprit to the disorderly price action as their levered liability-driven investment pools suffered margin calls, triggering asset sales across Gilts and other asset markets.7 The BOE intervention was based on sound principle of maintaining financial stability. The BOE intervention is very different than quantitative easing, in our view.8 In political news, a poll by YouGov showed the Labour Party ahead by 33% over the Conservative Party. The Chancellor of the Exchequer changed his mind in cutting the 45% top tax rate after the wild moves in Sterling and UK Gilts led to dissatisfaction amongst population and Conservative party members.

Japan: The Ministry of Finance said they spent JPY 2.8trn (c. USD20bn) in foreign exchange interventions in September.

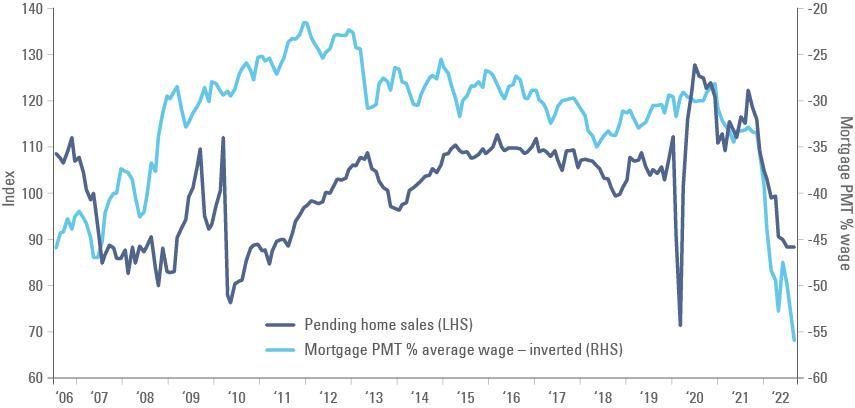

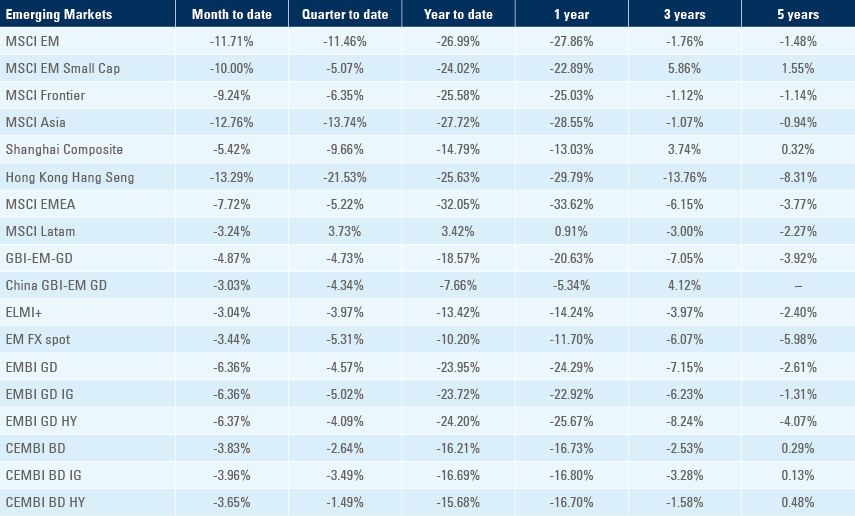

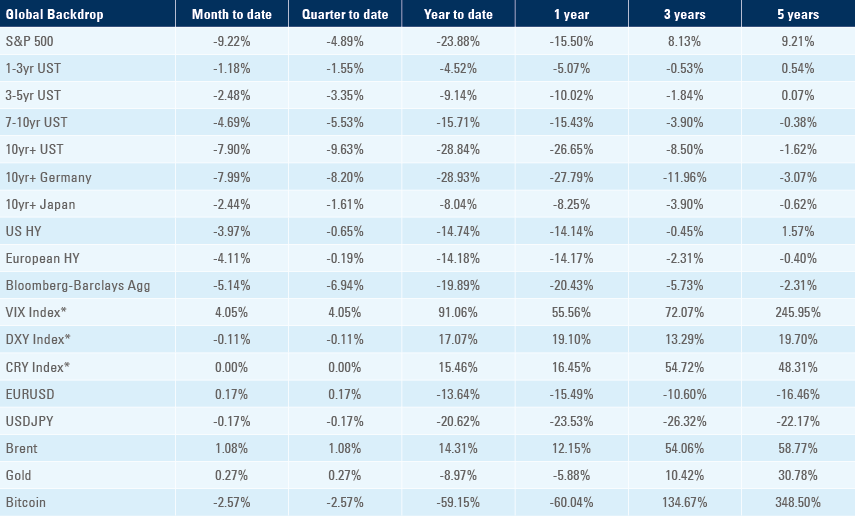

Benchmark performance

1. See https://www.washingtonpost.com/world/2022/09/30/map-ukraine-regions-annexation-russia/

2. See https://twitter.com/R82938886/status/1574865224108220423?s=20&t=Uzi3eMl8KxRZJMPb8_h2oQ

3. See https://infograficos.oglobo.globo.com/politica/eleicoes-2022/mapa-votacao-municipios-e-estados-do-brasil.html#/presidente?desempenho=geral

4. See https://www.bloomberg.com/news/articles/2022-10-02/watch-chinese-property-stocks-as-banks-urged-to-offer-funding

5. See https://www.politico.eu/article/german-audit-court-slams-scholz-200-billion-gas-price-cap-debt/

6. See The economic confidence index is composed of: industrial confidence indicator (40%), the service confidence indicator (30%), the consumer confidence indicator (20%), the construction confidence indicator (5%), and the retail trade confidence indicator (5%).

7. See https://www.ft.com/content/57137862-0fee-4e1c-b5d9-8cb20fc2315b

8. See https://www.ft.com/content/038b30c3-f550-4cc0-93ed-9154021d6ee2