Brazilian inflation lower while the Fed hikes as if their “hair was on fire”

Economists revised Brazilian inflation lower and growth higher when former Finance Minister Henrique Meirelles gave his public support to Lula. China kept policy rates unchanged as economic data surprised to the upside. Chile reached an agreement for a new constitutional process. Colombia announced a hike to gasoline prices but looks to lower electricity prices. India’s inflation was mixed but remained relatively contained. Indonesia’s external accounts improved further. Nigeria grapples with low energy production and a currency crisis.

Geopolitics

Narendra Modi and Xi Jinping expressed concerns over Russia’s invasion of Ukraine in the Shanghai Cooperation Forum in Kazakhstan. However, the Chinese news agency Xinhua reported China and Russia will hold a new round of strategic security consultation after Russian Security Council Secretary Nikolai Patrushev met with a Chinese diplomat and said in a statement that Russia supports China’s actions in Taiwan. US President Joe Biden gave an interview for 60 minutes where he mentioned for the fourth time that the US would defend Taiwan in the event of a Chinese invasion.

Azerbaijan and Armenia reported a truce that seems to be holding after the first border clashes between the countries since 2020 led to more than 200-casualties. The Ukrainian President Volodymyr Zelenskiy demanded Russia to be held responsible for war crimes after authorities discovered mass graves after re-taking the important city of Izyum.

In other news, US Secretary of State Anthony Blinken said it is unlikely the US will reach a new nuclear deal anytime soon and said that Iran’s response was a step backward. A few days later, the Department of Energy (DoE) said it will offer 10m barrels of low-sulphur crude in November. The DoE has sold 155m barrels of crude oil of the 180m supply release originally set for a six-month period that started in May.

Emerging markets

Brazil: The median survey for 2022 CPI inflation declined 40bps to 6.0% last week and GDP growth was revised higher by 25bps to 2.65%. Economists also reduced the 2023 CPI outlook by 20bps to 5.0% and kept GDP growth unchanged at 0.5%. The volume of services increased 1.1% mom (0.6% consensus) in July from 0.8% in June, keeping the yoy rate unchanged at 6.3%. Retail sales dropped 0.8% mom in July after declining 1.4% in June, bringing the yoy rate of contraction to 5.2% (from -0.1%), but the overall economic activity index rose to 1.2% mom in July from 0.9% in June (revised from 0.6%), taking the yoy rate up by 90bps to 3.9%. In political news, the IPEC poll (former IBOPE) showed former President Luis Ignacio Lula da Silva’s vote intention rising 2% to 46%, incumbent President Jair Bolsonaro stable at 31%, Ciro Gomes at 7% and Simone Tebet at 4%. Bolsonaro’s rejection rate remained elevated at 50% and Lula at 35%. Former Central Bank Governor (under Lula) and Finance Minister (under Temer) Henrique Meirelles voiced his support for Lula in a Workers’ Party event, leading to speculation he could be his finance minister and helping to support the thesis that Lula will manage the economy orthodoxly.

China: The People’s Bank of China kept its 1-year and 5-year medium term loan prime rates unchanged at 3.65% and 4.30% respectively, in line with consensus, but injected RMB 24bn via open market operations. The yoy rate of industrial production rose 40bps to 4.2%, retail sales surged 270bps to 5.4%, fixed asset investment was up 10bps to 5.8% and property investment dropped 100bps to -7.4% in August – the first three indicators were better than consensus. Property sales declined by a yoy rate of 30.3% over the same period, but foreign direct investment remained solid at 16.4% yoy (from 17.3%) and the unemployment rate was down 10bps to 5.3%.

Chile: The President of the Senate Álvaro Elizalde said political parties found a common ground for a new constitutional process with parties agreeing on a 100% elected constitutional convention with gender parity backed by an expert commission. The new constitution will have to be approved by a mandatory vote in a new referendum. The timing on the convention and draft constitution is still to be agreed.

Colombia: Last weekend President Gustavo Petro announced increases in fuel prices aimed at reducing the accumulated deficit of the fuel stabilisation fund. This highlights Petro’s more orthodox stance to fiscal dynamics and it is positive for Colombia’s creditworthiness over the long term, albeit it will impact inflation over the short term. To compensate for higher fuel prices, Petro has announced a reduction in electricity prices by moving away from adjusting tariffs based on wholesale prices to a new index based on electricity costs, a measure that will impact utility companies. In economic news, the yoy rate of retail sales declined 950bps to 7.7% in July (consensus 12.0%) and industrial production slowed 450bps to 4.3% as the trade deficit widened to USD 490m in July from USD 333m in June due to another increase in imports.

Ecuador: President Guillermo Lasso submitted a referendum to the Constitutional Court with eight questions – none related to economic policies. The objective is to regain control of the political agenda after conflicts with the indigenous communities. Questions include allowing the army to combat organised crime, extradition of organised crime members, reducing the number of parliamentarians and demanding political movements have minimal number of affiliates as well as water protection.

Hungary: The European Union executive recommended suspending around two-thirds of Hungary’s funding for the 2021-27 EU budget over corruption concerns. Hungary’s investment grade rating maybe at risk as the country runs large current account and fiscal budget due to the spike in energy prices after a large increase in government debt due to the covid-19 crisis.

India: The yoy rate of CPI inflation rose 30bps to 7.0% in August, 10bps above consensus, but WPI inflation dropped 150bps to 12.4%, 60bps below consensus. Industrial production slowed to a yoy rate of 2.4% in July from 4.2% in June. The trade deficit narrowed to USD 28bn in August from USD 30bn in July as imports declined by USD 4.2bn to USD 59.5bn and exports dropped by USD 2.4bn to USD 34bn.

Indonesia: The trade surplus increased to USD 5.8bn in August from USD 4.2bn in July as exports rose by USD 2.4bn to USD 27.9bn and imports increased by only USD 0.8bn to USD 21.2bn. Local auto sales improved to 97k in August from 86k in July, rising above the 10-year average for the month of August (and only lower than 2018).

Nigeria: The yoy rate of CPI inflation rose 90bps to 20.5%, in line with consensus. Nigeria’s oil production plunged to 1.13m barrels of oil per day (mbod) in August 2022 from 1.43mbod in August 2021 and 1.95mbod in August 2019. As a result of lower oil production, the country is facing a shortage of US Dollars that is impacting even airline companies from sending air ticket sales receipts abroad, prompting Gulf Countries to warn they would be ceasing to operate flights to the country. Nigeria holds presidential elections in February 2023, most likely to be disputed, between Atiku Abubakar and Bola Tinubu, two septuagenarians that are a staple in Nigerian politics over the past few decades.

Snippets

- Argentina: CPI inflation rose by 7.0% mom in August from 7.4% in July, taking the yoy rate up 750bps to 78.5%.

- Czechia: The current account deficit narrowed to EUR 1.0bn in July from EUR 2.0bn in June. The yoy rate of PPI industrial production inflation declined 160bs to 25.2% in August, 50bps below consensus.

- El Salvador: The Treasury issued a tender offer to repurchase up to USD 360m of bonds expiring in 2022 and 2023. The amount is USD 100m smaller than mentioned initially by the government as the country foreign exchange reserves remain in a very challenging situation.

- Peru: The yoy rate of economic activity declined 200bps to 1.4% in July but increased by 0.7% mom in seasonally adjusted terms. The unemployment rate rose 50bps to 7.3% in the city of Lima in August.

- Philippines: Remittances from overseas workers rose to USD 2.92bn in July from USD 2.76bn in June, another record, leading the balance of payment deficit to narrow to USD 0.6bn in August from USD 1.8bn in July.

- Poland: CPI inflation was unchanged at 0.8% mom and 16.1% yoy in August, but core CPI rose to 0.8% mom, from 0.6% in July, as the yoy rate rose 60bps to 9.9%.

- Romania: Industrial output rose 0.3% mom in July after dropping 2.4% mom in June (revised from -3.9%) and industrial sales declined 2.4% mom in July after -3.0% in June.

- Russia: The Central Bank of Russia cut its policy rate by 50bps to 7.5% - 200ps below the level prior to the Ukrainian invasion.

- Saudi Arabia: The yoy rate of CPI inflation rose 30bps to 3.0%, remaining significantly below the level of the United States due to lower energy prices.

- South Africa: Retail sales dropped 0.1% in July after declining 0.4% in June, 50bps better than consensus.

- South Korea: The unemployment rate declined another 40bps to 2.5%, significantly below the consensus for a 10bps increase.

- Uruguay: Real GDP growth rose by 4.3% qoq in Q2 2022 from 1.9% qoq in Q1 2022, significantly better than consensus and allowing the yoy rate to remain elevated at 7.7% over the period.

Developed markets

United States: CPI inflation surprised to the upside at 0.3% mom (-0.1% consensus) and 8.3% yoy. The higher inflation number was a rude awakening to markets, leading Harvard economist Larry Summers to call for the Fed to hike rates by 100bps to 3.5% in September to boost its credibility, leading to a sharp sell-off in US Treasury yield and equity markets. The reality is that the Fed needs to destroy aggregate demand in order to lower service prices and rents. By increasing interest rates, the Fed incentivises savings and disincentivises consumption. Another two powerful transmission channels are incomes (wage) and wealth. When people feel rich and comfortable about their jobs, they will consume more. That was the main channel in which quantitative easing (QE) operated. On the other hand, if asset prices are declining because of quantitative tightening (QT) and people that are afraid to losing their jobs they are likely to increase savings.

The labour market remains extremely tight. Jobless claims remains at very low level at 213k in the week ending on 10 September from 218k in the previous week and continuing claims were unchanged at 1.4m in the week of the 3 September. On the wealth channel, data from the Board of Governors of the Federal reserve system showed that US net worth dropped USD 6.1trn in Q2 2022 when the S&P was down 16.5%, the largest drop since the sell-off in 2020. However, net worth remains USD 27trn (110% of GDP) above pre-pandemic levels, sitting at USD 143.8trn (578% of GDP).1

Furthermore, there is ample empirical evidence that monetary policy impacts the economy with a large lag, ranging from ten to twenty months in EM and twenty-five to fifty months in DM according to a study by the Czech National Bank.2 Despite the uncertainty associated with such long lags, our sense is that the Fed is hiking rates as if “their hair was on fire”, which, in our opinion, is very risky since we have no idea of the impact of an increase in Fed Fund rates from 0% to 4% in such a short period of time, particularly considering the large amount of debt accumulated by government adding up to a non-negligible debt pile from households and corporates. The Fed impatience suggests the damage to income and wealth maybe larger than in previous cycles and, alas, even a very hawkish Fed may not be able to reduce inflation this decade as Volcker did in the 1980s.

Central Bankers emulating Paul Volcker appear to have forgotten that Volcker came in very different political-economic circumstances. He hiked policy rates to twenty percent while commodity prices were declining after more than one decade of elevated prices that spurred significant investments in energy, while debt had been eroded by a long period of negative real interest rates resulting from the cumulative.

PPI inflation dropped 0.1% mom in August from -0.4% in July, bringing the yoy rate down 110bps to 8.7%, but the ex-food and energy PPI declined by only 40bps to 7.3%. Retail sales rose 0.3% mom in August from -0.4% in July (revised from 0.0%). Leading indicators were mixed as the Philadelphia Fed Business sentiment dropped to -9.9 in September from +6.2 in August, but the empire manufacturing improved sharply to -1.5 in September from -31.3 in August. The 3m moving average remained at levels achieved only in 2020, 2015, 2008 and 2001.

The yield on two-year US Treasury widened 19bps to 3.95%, the highest level since 2008, as the market prices in a 17% likelihood of a 100bps hike at Wednesday’s FOMC meeting. Yields on 10-year and 30-year UST widened by only 7 and 2bps to 3.48% and 3.51% as the yield curve (10-yr vs 2-yr) hit the flattest level since 2000. The real interest rates on 10-year inflation-linked bonds rose 17bps to 1.13%, the highest level since 2008.

Europe: The Euro Area ZEW survey showed bankers’ expectations for economic activity deteriorating further to -60.7 in September from -54.9 in August as the German ZEW survey current situation dropped 12.9 points to -60.5 (consensus -52.1) and expectations dropped 6.6 points to -61.9. The Euro Area industrial production dropped 2.3% mom in July after rising 1.1% in June (revised from +0.7%) and the trade deficit widened to EUR 40.3bn from EUR 32.2bn over the same period. Labour costs rose by a yoy rate of 4.0% in Q2 2022 from 4.2% in Q1 2022 (revised from 3.2%), the fastest pace since Q1 2008. In other news, the President of the European Commission Ursula Von der Leyen said the EU is seeking to raise more than EUR 140bn to cushion the population against higher energy prices.

United Kingdom: The yoy rate of CPI inflation rose 0.5% mom in August after increasing by 0.6% in July, bringing the yoy rate down 20bps to 9.9%, but core CPI rose 10bps to 6.3% yoy.

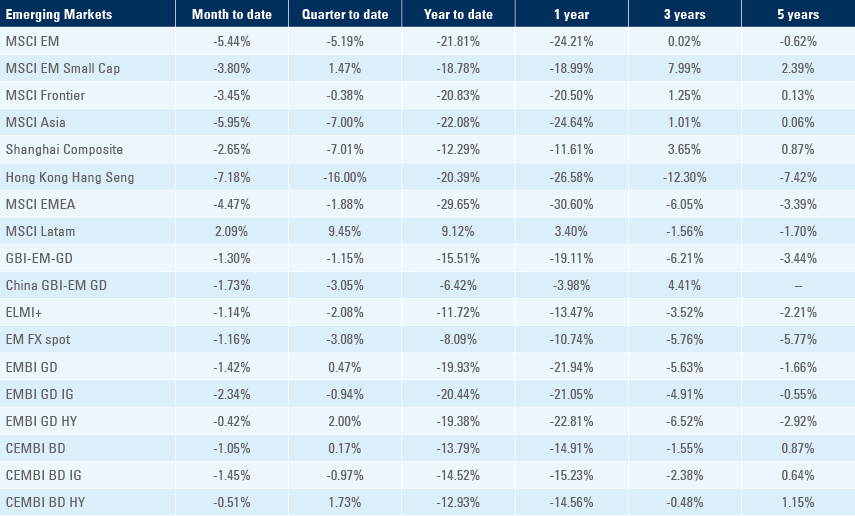

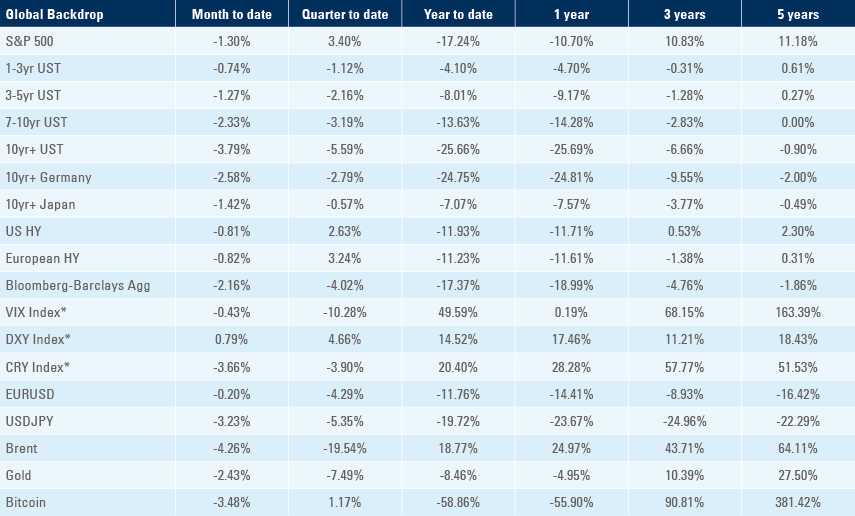

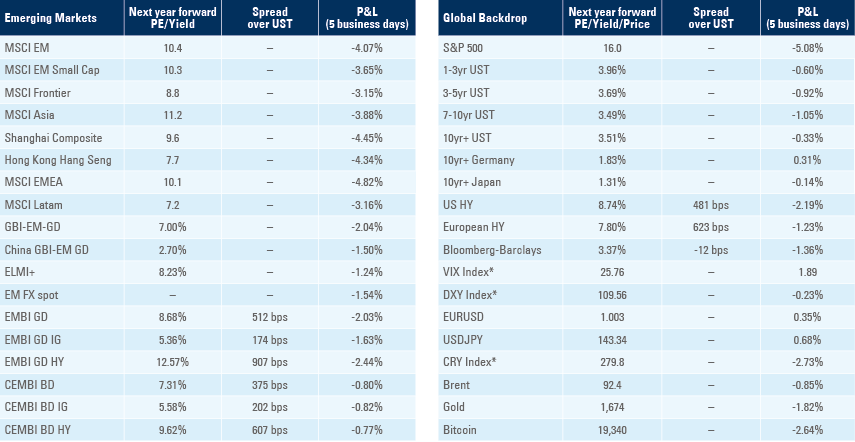

Benchmark performance