Better than expected Chinese data, but peace talks stalled in Ukraine

Chinese economic activity was better than expected, but underlying sector data suggests weaker dynamics than meets the eye. Sri Lanka announced the suspension of debt service. Indian inflation surprised to the upside. Indonesian trade surplus rose further. Ukraine peace talks stalled as Europe debates embargoing energy imports from Russia. Chilean President Boric submitted a more benign pension withdrawal bill to parliament as his rejection rate soared above 50% in record time, a similar trend was observed in Peru.

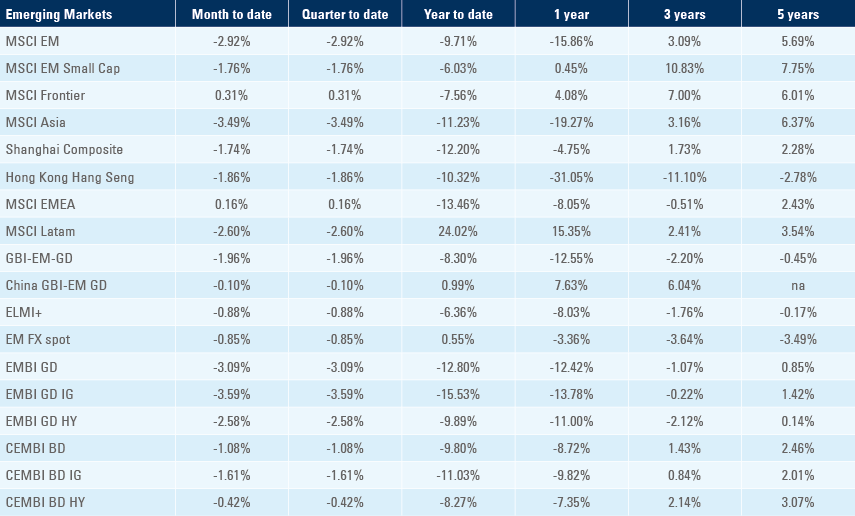

Emerging markets

China: Economic activity surprised to the upside buoyed by investment and net exports, even though underlying data across sectors suggests weaker activity than meets the eye. Higher investment numbers are a sign that countercyclical monetary and fiscal expansions are supporting the economy after the strong slowdown in the housing market during the second half of 2021. The leadership is trying to steady the supply chain around Shanghai while controlling its largest covid-19 outbreak to date. Inflation remained subdued reflecting weak domestic economic activity.

The yoy rate of real GDP growth rose 4.8% in Q1 2022 from 4.0% in Q4 2021, 60bps above consensus. Industrial production rose by 5.0% yoy and fixed asset investment increased by 9.3% yoy, both c. 100bps above consensus, but retail sales declined 3.5% yoy, or 50bps below consensus. Nevertheless, the volume of output in power generation, cement, steel products and crude steel were at yoy rates of 0.2%, -5.6%, -3.2% and -6.4%, respectively, while automobiles volumes dropped 4.9% yoy in March. Steel production is below 2021 but remained above the prior five year average for the period. The external accounts also supported the economy as the trade surplus rose to USD 47.4bn in March from USD 30.6bn in February, thanks to higher exports (14.7% yoy from 6.2% yoy) and lower imports (-1.7% yoy from +8.3% yoy) resulting from weak retail sales due to the lockdowns in Shanghai and other coastal cities. Logistical challenges have increased, with a reported record number of ships waiting to load or discharge at Shanghai port.1 Policymakers are aware of the challenges: Vice President Liu He gave a green light for key manufacturers to set up production bubbles as Chinese authorities urge banks to support logistical companies struggling with the lockdown regime.

To counter weak underlying economic activity, the People’s Bank of China (PBoC) cut its reserve requirement ratio (RRR) by 25bps with the average RRR declining to 8.1%, whilst regulators said they would encourage small and medium banks to lower their deposit rates by 10bps to preserve banks’ margins, which could also be a signal that the PBoC is preparing to cut its policy rate by another 10bps soon. In fact, banks are already accelerating lending as aggregate financing surged to RMB 4.7tn in March from RMB 1.2tn in February and new loans rose to RMB 3.1tn from RMB 1.2trn over the same period. Both numbers were much higher than the seasonal increase post Chinese New Year. In our view, China will continue to fine-tune its zero covid policy strategy to prioritise a normalisation of economic activity within the coming weeks while relying on monetary and fiscal policy easing to stabilise short-term growth and avoid deeper financial stability risks.

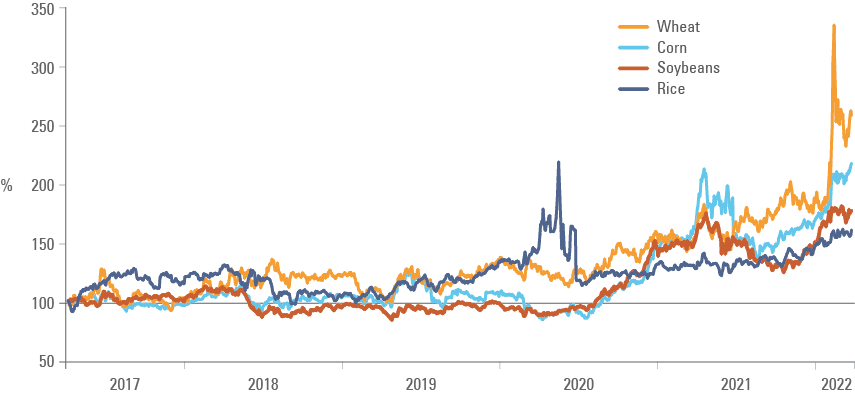

Differently than in the West, policy makers in China are not constrained by inflation as yoy rate of CPI inflation rose 60bps to only 1.5% in March while PPI inflation dropped 50bps to 8.3%. Chinese inflation remained subdued due to the impact of the reversal of animal protein inflation (pork is the largest component in the food basket) and more subdued prices for key staple foods such as rice – which remains in surplus on a global basis, in sharp contrast with wheat and corn which have a large deficit due to the war between Russia and Ukraine. Food prices are likely to go higher during the rest of the year, albeit by a slower magnitude than in the West as figure 1 highlights, the price increases in wheat and corn far outpace the inflationary pressures in rice over the past 18 months.

Figure 1: Major staple crops: 5-year price change

Sri Lanka: The government announced the suspension of external debt servicing until the completion of discussions with the International Monetary Fund (IMF) in preparation for a comprehensive debt restructuring program. The debt restructuring was on the cards since the former government of President Gotabaya Rajapaksa insisted on not pursuing fiscal consolidation and saying they would not seek support from the IMF as the fiscal deficit and debt/GDP ballooned. The government’s finances became untenable after the post-pandemic sluggish tourism recovery (a shock equivalent to 4% of GDP) and higher oil prices impacted terms of trade. The entire Eurobond curve trades between USD 42 and 48c on the USD after the default announcement, a level consistent with a hard but friendly debt restructuring intermediated by the IMF. Political risks remain after 41 ministers of Rajapaksa’s cabinet resigned and the government lost its majority in parliament. The new cabinet is now onboard in requesting IMF support and the central bank governor hiked its deposit and lending policy rates by 700bps to 13.5% and 14.5% respectively to contain inflation expectations after the LKR depreciated more than 60% since mid-March. Sri Lanka accounted for less than 0.8% of the JP Morgan EMBI GD at the beginning of the year.

India: The yoy rate of industrial production rose 1.7% in February, 100bps below consensus, from 1.5% yoy in January. The yoy rate of CPI inflation rose to 7.0% in March from 6.1% yoy in February, 60bps above consensus led by elevated food inflation. At the same time, inflationary pressures broadened as the 10% trimmed mean CPI increased to 6.1% yoy in March from 5.4% in February, while wholesale prices rose to 14.6% yoy from 13.1% yoy over the same period. Higher inflation increases the likelihood of the Reserve Bank of India increasing its policy rate over the next months. Exports expanded by a yoy rate of 19.8% in February from 25.1% yoy in January while imports growth slowed to 24.2% yoy from 36.1% yoy leading to a trade deficit of USD 18.5bn from USD 20.9bn over the same period.

Indonesia: The trade surplus rose to USD 4.5bn in March from USD 3.8bn in February as exports increased by a yoy rate of 44.4% and imports 30.9% yoy due to higher commodity prices boosting the country’s terms of trade. Indonesia is set to become a key manufacturing hub for electric vehicles over the coming years, while its traditional palm oil and mining industry exports surge due to higher terms of trade.

Ukraine: Peace talks have stalled after the events in Bucha and the breakdown in humanitarian corridors in Mariupol and other Ukraine cities. Pressure on Europe to increase sanctions is on the rise as horrid battleground scenes from the war emerge and the struggle to hold Mariupol increases, as Ukrainain forces concentrate on the giant metal plant of Avovstal. The steel company Metinvest said the country has lost more than one-third of metallurgy production capacity and pledged never to operate under Russian occupation. In that regard, public opinion in favour of harder sanctions to energy purchase is likely to rise. This week the European commission will keep pushing for restrictions on purchases of oil and gas despite opposition from Hungary, Germany and Austria. International pressure is also escalating over Germany’s blocking of energy sanctions. Last week German President Steinmeier cancelled plans for a visit to Ukraine as he “wasn’t wanted in Kyiv”, but the embargo decision is likely to be postponed until the French presidential run-off this weekend.

Chile: The Boric administration submitted a much more modest pension withdrawal bill to parliament, limiting the overall redemptions from the system to USD 3-4bn from an originally estimated USD 16.8bn. The revised bill significantly reduces the potential impact on inflation, albeit still leads to undesired higher economic impulse when the economy is already overheating. The constitutional court approved the elimination of the Senate and the creation of Regional Chambers, albeit not clarifying their attributions. In other political news, President Gabriel Boric’s disapproval rate rose 30% in the first five weeks week to reach 50%, surpassing his approval rate in record time after coming to power (Sebastian Pinera 37 weeks, Michelle Bachelet 33 weeks) according to Cadem – a pollster.2 The poll highlights a similar degree of polarisation also observed in other Latin American counties, a trend, we believe, that is likely to lead to government paralysis.

Peru: Economic activity was unchanged in February after rising 1.4% mom in January, which contributed to an increase in the yoy rate by 200bps to 4.9%. Castillo’s disapproval rate is close to 80%, the highest across Latin America in line with Argentina’s Alberto Fernandez and Venezuela’s Nicolas Maduro. Congress is set to approve another pension plan withdrawal, which may lead to further dollarisation as well as higher inflationary pressures and terminal interest rates.

Snippets

Argentina: CPI inflation rose by 6.7% mom in March from 4.7% mom in February, 90bps above consensus, taking the yoy rate 2.8% higher to 55.1% over the period and the highest level in 20 years.

Brazil: The yoy rate of retail sales rose 1.3% in February, 260bps above consensus, from -1.5% yoy in January. The ratings agency Moody’s affirmed Brazil’s sovereign credit rating at Ba2 with stable outlook.

Colombia: The yoy rate of retail sales slowed to 4.9% in February from 20.9% yoy in January, 3.1% below consensus.

Czech Republic: The yoy rate of CPI inflation rose 260bps to 12.7% in March, 30bps above consensus.

Egypt: The yoy rate of CPI inflation rose 170bps to 10.5% in March.

Malaysia: The trade surplus increased to MYR 26.7bn in March from MYR 19.8bn in February, significantly above consensus after the yoy rate of export growth increased by 8.6% to 25.4% and imports rose by 11.6% to 29.9% yoy.

Mexico: Congress rejected the electricity bill submitted by President Andres Manuel Lopez Obrador that would reduce the role of the private sector in the industry. The yoy rate of industrial production declined to 2.5% in February (170bps below consensus) from 4.3% yoy in January.

Poland: The yoy rate of CPI inflation rose 10bps to 11.0%, but the mom readings remained elevated (above 3.0%). The current account deficit widened to EUR 2.9bn in February from USD 0.6bn in January as higher energy prices led to the highest level of imports over the last decade.

Romania: The yoy rate of CPI inflation rose 170bps to 10.2% in March, 60bps above consensus as the trade deficit widened to USD 2.5bn in February from USD 2.1bn in January and industrial output dropped by 1.0% yoy in February from a flat yoy reading in January.

Russia: The gold and foreign exchange reserves rose by USD 2.9bn to USD 609.4bn in the week ending on 8 April, the second consecutive weekly increase from the low of USD 604.4bn on 25 March.

Saudi Arabia: The yoy rate of CPI inflation rose 40bps to 2.0% in March. The longer CPI inflation diverges between the Arab countries and the US, the higher will be the incentives for countries in this region to change their USD peg system, which subordinates their monetary policy to the US, where inflation is approaching double digit levels.

South Africa: The yoy rate of retail sales dropped 0.9% in February (2.5% below consensus) from +7.7% yoy in January, as the yearly rate of growth of manufacturing production dropped to 0.2% from 2.0% yoy over the same period.

South Korea: The Bank of Korea hiked its 7-day repo policy rate by 25bps to 1.5%, in line with consensus. The unemployment rate was unchanged at 2.7% in March.

Turkey: The Central Bank of Turkey kept its policy rate unchanged at 14.0%, in line with consensus. Industrial production rebounded 4.4% mom in February after dropping 2.3% mom in January.

Zambia: Treasury Secretary Felix Nkulukusa signalled China is close to reaching an agreement on restructuring Zambia’s sovereign debt. Debt relief from China and other lenders is a key IMF condition for its USD 1.4bn staff-level agreement supporting Zambia’s USD 17.3bn foreign debt restructuring.

Global backdrop

Commodities: The CRY commodity price index surged 17.7% last week (+36% year to date) led by higher energy prices as natural gas future prices surged above USD 8 per million British thermal units (mbtu`s) on the 18 April. US natural gas inventories grew by only 15bn cubic feet in the week ending on 8 April, less than half the average increase over the past five years, leaving stockpiles around 20% lower than usual levels. The US Supreme Court also declined to hear an appeal against a lower court decision to close the 65-mile Spire pipeline running through Illinois and Missouri. Oil prices rose by 14.8% last week to USD 113 per barrel. The Libyan Prime Minister Abdul Hamid Dbeibah shut the largest oil field in the country producing 450k barrels of light crude oil per day after a standoff between the largest two rival governments. Protesters also shut down two port terminals demanding Dbeibah to hand over power to the Fathi Bashagha, who was appointed by the parliament in February after Libya failed to hold its presidential election in December.

United States: Vice Chairman Lael Brainard and NY Governor John Williams indicated they would like to announce in May the start of reducing the Fed’s balance sheet, with implementation beginning in June. The overnight interest swap (OIS) market now prices 225bps of hikes by Feb 2023 (including 50bps in May and June), but also a high likelihood of an economic slowdown and the Fed moving from hikes to cuts from 2H 2023 as the 1-month forward 2-year interest rates in 1-year’s time (1m 2y1y) declined to -0.27% from 0.69% at its peak in October 2021.

In economic news, CPI inflation rose 1.2% in March, the highest monthly increase in 17 years and 8.5% yoy, which was 10bps above consensus and the highest level in more than 40 years. The yoy rate of CPI ex-food and energy rose by 10bps to 6.5%, but PPI ex-food and energy rose by 90bps to 11.2% yoy as both indices indicate that inflationary pressures are broadening out. The University of Michigan sentiment survey bounced 6.3 to 65.7 in April but remained in a declining trend far below the previous peaks of 101.0 in Feb 2022 and 88.3 in April 2021 as well as below the 71.8 covid-19 low level in April 2020. The empire manufacturing survey rebounded more sharply from -11.8 in March to 24.6 in April. Industrial production rose 0.9% in March, 50bps above consensus and at a similar pace than in February.

Europe: The ECB kept its deposit and refinancing policy rates unchanged at -0.5% to 0.0% respectively, in line with consensus. The statement following the meeting reinforced the expectations for asset purchases to end in Q3 2022 as rate hikes to positive levels this year remain on the table. The latest round of opinion polls shows incumbent President Emmanuel Macron leading far-right candidate Marine Le Pen by more than 8% (Ipsos poll has Macron leading by 12%) as the candidates prepare for a debate tomorrow ahead of the 24 April run-off.

Japan: The JPY depreciated to around 128 per USD, a 10% drop year-to-date as the Bank of Japan insists on defending the ceiling level for 10-year government bonds at 0.25%. The JPY is the weakest currency across major countries, leading to even higher energy prices in JPY terms, while doing little to support the current account, which moved to a deficit due to the negative terms of trade shock. Finance Minister Shunichi Suzuki’s “rapid weakening” comment suggests authorities are uncomfortable with the pace of depreciation. The Bank of Japan yield targets matters for US Treasury and global bond markets. JPY weakness is mostly a symptom of BoJ YCC capping 10yr at 0.25%, which is also leading to low FX-hedge UST yields, removing demand from US bonds.

United Kingdom: The yoy rate of CPI inflation rose 0.8% to 7.0% in March, while core CPI inflation rose 50bps to 5.7%, both reaching the highest level since 1992.

Canada: The Bank of Canada hiked its policy rate by 50bps to 1.0% but issued a more hawkish statement than expected, signalling a terminal rate above 3.0% at the end of 2023.

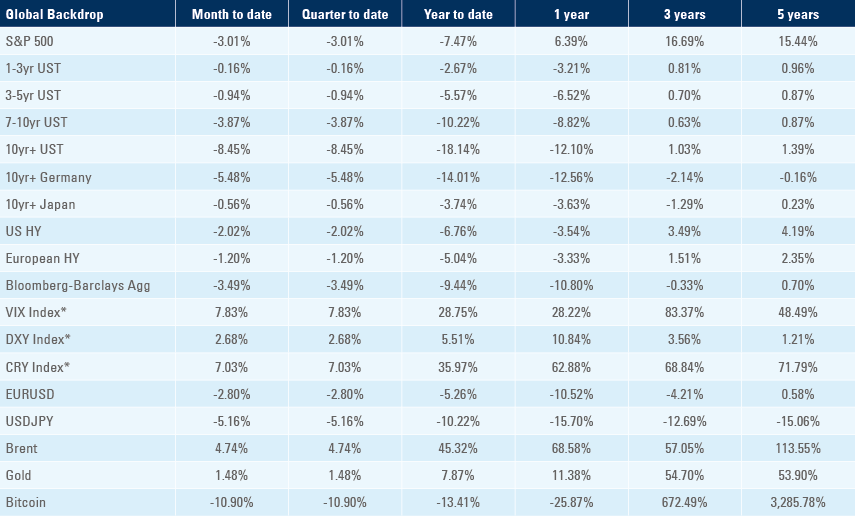

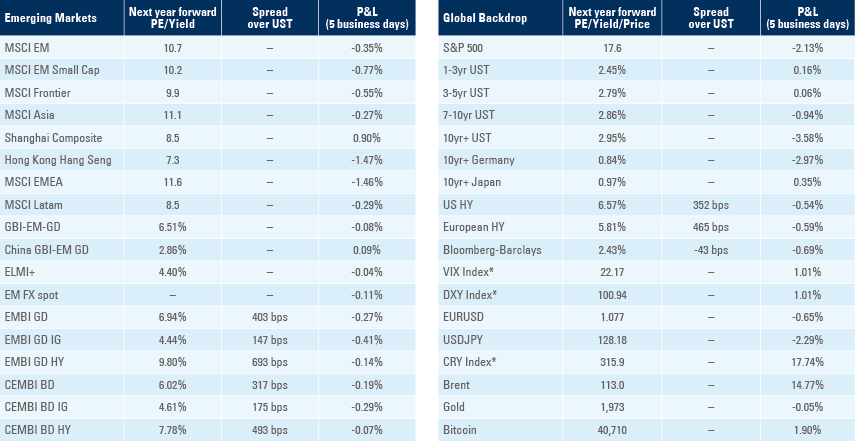

Benchmark performance