Equities and fixed income recovered from oversold levels. Russia takes further territory in Donbas as a peace deal remains elusive. Argentina allowed energy companies increasing production to access foreign currency. Brazil inflation was higher than expected. China and Shanghai announced several measures to support the economy as Covid cases declined. Colombia presidential election points to a more balanced run-off. Hungary declared a state of emergency and announced an extraordinary tax to strengthen its fiscal accounts. Indonesia kept current policy rates but announced increases to reserve requirements over the coming months. Nigeria opposition party appointed Atiku Abubakar as presidential candidate for the February 2023 elections. The central bank of Pakistan hiked policy rate by 150bps, and the government increased fuel prices to comply with the IMF fiscal adjustment plan. Turkey kept policy rate unchanged at 14% as the Lira tumbles.

Global macro

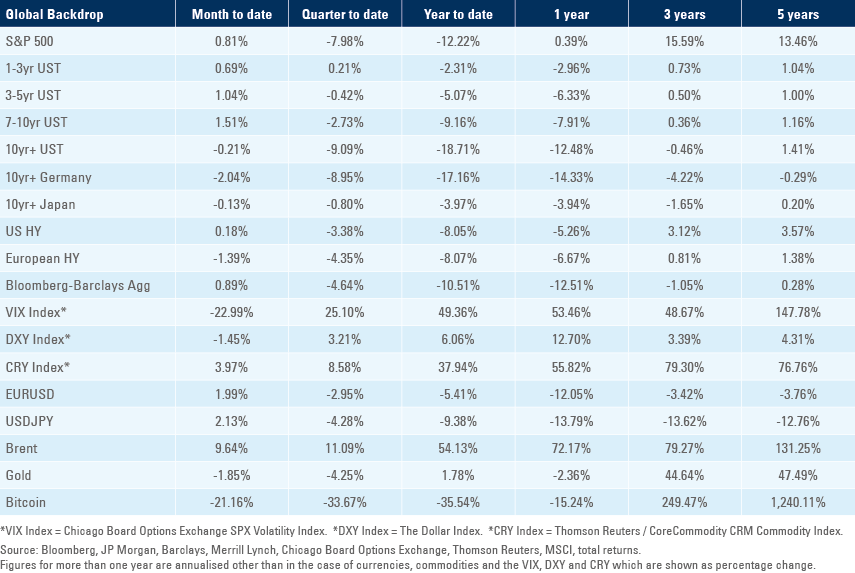

Both equities and fixed income recovered from oversold levels. The stabilisation in sentiment was anchored by the flexing of lockdown policies in Shanghai and Beijing (lowering recessionary fears) and the US Federal Reserve’s less hawkish stance allowed the 10-year US Treasury yield to decline nearly 50bps from 3.2% on 9 May. Commodity prices rose another 7.8% bringing the CRY index to the highest levels in 10-years.

Emerging markets

Russia-Ukraine: After three months of conflict, the situation on the ground remains difficult to assess. The Russian military made snail-pace progress in extending its control of Donbass (almost fully taking the State of Luhansk) and the South of Ukraine by encircling Ukrainian positions with heavy artillery. Over the weekend, a Russian official said Ukraine “shouldn’t expect to get most of its southern provinces back” and that the Sea of Azov was now “permanently closed” to Ukraine.

On the other hand, reports of large casualties and blunders makes it hard to believe the Russians will be able to hold position in large parts of Ukrainian territory, especially with the US and UK belatedly boosting the supply of heavy weaponry to Ukraine, including howitzers, as reported by Ukraine Defence Minister Oleksii Reznikov.1 2

Last week, President Volodymyr Zelenskiy warned that hundreds of thousands of lives would be lost to restore Ukraine territory militarily, whilst restating that Ukraine is not willing to give away either Crimea or Donbas. In a presentation in Davos, Henry Kissinger said Kyiv should consider trading territory for a cease-fire.

In an 80-minute phone call, the presidents of France and Germany attempted to broker a peace deal and urged their Russian counterpart to lift the blockade on the port of Odesa to allow Ukrainian grain to be exported via the Black Sea. Russia blames global grain shortages on sanctions imposed on Russia by Western countries.

Against this backdrop, the energy crisis and the risk of a food crisis continues to loom and most countries’ policies appear to be only worsening the situation. For example, last week the United Kingdom announced higher taxation on energy companies (disincentivising investment when most needed) while offering more subsidies for energy (disincentivising lower consumption) and a one-off GBP 830 payment for the poorest families at a GBP 15bn cost, probably forcing the Bank of England to hike its policy rate further than required.

In our opinion, the optimal policy to the “cost-of-living crisis” would be to provide a discount for families and companies that managed to reduce their energy consumption and a large surcharge for household and companies increasing consumption (a carrot and a stick to lower energy consumption). At the same time, the government should be incentivising more investment in energy – both fossil fuel and renewable – to reduce its external dependency.

In other news, Russia reduced the mandatory conversion of foreign currency to RUB from 80% to 50%. Despite the war and sanctions, the RUB is stronger against the Dollar year-to-date as sanctions probably disrupt the ability of the Russians to purchase foreign goods while the country still exports energy, food, metals, and fertilisers. A stronger RUB will allow for a moderation in inflation anticipated by the Russian Central Bank, which cut its policy rate by 300bps last week to 11% (vs. 8.5% pre-war). At the same time, the Ukrainian central bank sold USD 1.4bn between 23 and 27 May to support the Hryvnia, from USD 650m in the previous week, the largest intervention so far this year.

Argentina: The government announced a measure allowing oil and gas explorers to access foreign currency at official rates if they meet production targets, allowing companies to convert an amount equivalent to 20% of the incremental production for oil, and 30% of the additional output of natural gas. This is the first measure to encourage higher energy production, which can lead to more foreign direct investment and higher exports.

Brazil: CPI inflation slowed to 0.6% in the first fortnight of May from 1.7% in April, as the yoy rose 20bps to 12.2% over the same period, slightly above consensus. The diffusion index rose to 78.3%, suggesting widespread inflationary pressures. President Jair Bolsonaro sacked the CEO of Petrobras after less than one month as the government pressures the state-owned company to reduce the frequency of price increases to 100 days. Eletrobras filed a request with the securities regulator to sell 627.7m new shares and 69.8m shares owned by state development bank BNDES. If concluded, the government would own less than 50% of the company’s voting shares.

China: The State Council meeting chaired by Premier Li Keqiang announced multiple measures (33 in total) to stabilise the economy, including over RMB 140bn of tax rebate for industries; extending social insurance payment delay to the end of the year; doubling the quota of inclusive small business loan support; cutting purchase tax on passenger cars by RMB 60bn; supporting housing demand with city-specific property measures; and starting a series of energy projects. The Shanghai Government announced a plan with 40 measures to accelerate the economic recovery and revitalisation, including tax rebates for companies, allowing manufacturers to resume operations from 1 June and accelerating approvals for property projects. National covid cases declined for the 9th day to 215 last Sunday, allowing a gradual easing of restrictions in Shanghai and Beijing. Meanwhile, US Secretary of State Antony Blinken unveiled his belated US Administration Approach to China speech where he presents China as an economic rival but breaks away from the Trump administration confrontational stance.3

Colombia: A surprise turnaround in the first round of the Presidential election with Gustavo Petro getting 40.3% of the votes, but Rodolfo Hernandez achieving 28.2% of the votes, edging Federico Gutierrez who received only 23.9% of votes. Hernandez had similar vote intentions against Petro in the runoff on 19 June, but the strong momentum in favour of Hernandez puts him as a slight favourite to edge Petro, particularly considering Gutierrez and Fajardo are likely to support Hernandez (more than 70% of Gutierrez voters said they would vote against Petro in the run-off). The first-round result will support Colombian assets which were lagging fundamentals due to the risk of a leftist candidate wining in a Latin American country that was never run by the left before.4

Hungary: The central bank kept its one-week deposit rate unchanged at 6.45%, in line with consensus. Earlier in the week central bank director Barnabás Virág said he expects to slow the pace of policy rate hikes to 50bps over the next meetings and highlighted seeking a balanced fiscal account should be a priority. Average wages rose by a yoy rate of 17.5% in March, significantly above consensus at 13.9%. President Victor Orban declared a wartime state of emergency and announced a windfall tax in a video published on social media. Orban said banks, insurance companies, large distribution chains, energy and trading companies, telecommunication and airline companies would be forced to pay a large part of their excess profits to lower the fiscal deficit.

Indonesia: The central bank (BI) kept its policy rate unchanged at 3.5%, in line with consensus, but Governor Perry Warjiyo said the central bank will increase its reserve requirement ratio (RRR) from the current 5.0% to 6.0% in June, 7.5% in July and 9.0% in September, thus reducing liquidity in the financial system in a gradual manner. In total the RRR hike will absorb IDR 375trn in liquidity by year-end according to Deputy Governor Doby Budi Waluyo. Both Doby and Perry pledged to hike policy rate if there is any indication that core CPI will rise above the BI target.

Nigeria: The main opposition party People’s Democratic Party elected former Vice-President Atiku Abubakar as its presidential candidate. Atiku lost the 2019 election to current president getting 41% of national votes. The ruling All Progressives Congress party will run primaries from 6-8 of June. The Central Bank of Nigeria hiked its policy rate by 150bps to 13.0%, while consensus expected policy rate to remain unchanged flagging concerns of rampant inflation would weigh on economic recovery after CPI accelerated to 16.8% yoy in April, above the CBT target range of 6.0% to 9.0%.

Pakistan: The central bank hiked its policy rate by 150bps to 13.75%, 50bps more than consensus expectations, to bring down inflation which has been at double-digits for the past six months and hitting 13.4% yoy in April. The IMF is discussing a new loan with Pakistan in Doha, with the objective of adjusting the fiscal accounts via unpopular reduction of fuel subsidies. Finance Minister Miftah Ismail said he would “sign the agreement with the IMF in next two days and won’t come back without doing it”.

Turkey: The central bank kept its policy rate unchanged at 14.0%, in line with consensus. The TRY weakened by 9.3% month to date as the risk of a balance of payments crisis increases. External debt was stable at USD 450bn but public sector gross short foreign exchange exposure rose to USD 250bn from USD 50bn five years ago, taking public external debt to 25.3% of GDP, more than 10% GDP higher than in 2017. Net reserves excluding swaps are now at negative USD 48.8bn.

Snippets

- Egypt: The Minister of Supply said the International Islamic Trade Finance Corporation (ITFC) will lend USD 3.0bn to Egypt to finance imports of wheat and oil. Egypt signed a USD 3.0bn loan with the ITFC in 2018 and another USD 1.5bn earlier this year for similar purposes.

- Ghana: The central bank hiked its policy rate by 200bps to 19.0%, totalling 550bps since the first hike in November 2021, in line with consensus expectations.

- India: After banning exports of wheat, the government has restricted sugar exports to avoid shortages in the local market.

- Israel: The Bank of Israel hiked its policy rate by 40bps to 0.75%, slightly more than 25bps consensus.

- Ivory Coast: The yoy rate of CPI inflation dropped 50bps to 4.0%, below consensus expectations.

- Malaysia: The yoy rate of CPI inflation rose by 10bps to 2.3%, in line with consensus.

- Mexico: The yoy rate of CPI inflation dropped 0.1% in the first fortnight of May after rising 0.2% in the same period in April, taking the yoy rate of inflation down 10bps to 7.6%, in line with consensus as core CPI dropped by the same magnitude to 7.2% yoy over the same period. The yoy rate of real GDP growth rose 1.8% yoy in Q1 2022 from 1.6% in Q4 2021 while the trade balance moved to a USD 1.8bn deficit in April from a USD 0.2bn surplus in March, a much sharper deterioration than implied by the seasonal pattern.

- Oman: The fiscal accounts moved to an OMR 360m surplus in Q1 2022 (c. 4% of GDP), significantly better than the OMR 750m (c. 11% of GDP) deficit in Q1 2021 as energy income rose 86% and non-oil revenues improved on higher VAT collections.

- Peru Protesters are keeping the large copper mine Las Bambas closed. President Castillo appointed another government with a new set of ministers.

- Poland: The yoy rate of retail sales rose by 33.4% in April from 22.0% yoy in March, representing a sharp 19.0% yoy increase in real terms (after discounting inflation).

- Russia: The Central Bank of Russia cut its policy rate by 300bps to 11.0% in an unscheduled meeting and said it would consider further rate cuts at the next meetings. The RUB has strengthened 24.3% year-to-date due to elevated exports of energy and low levels of imports on the back of capital controls.

- Senegal: The yoy rate of CPI inflation rose 80bps to 7.0%.

- South Africa: The yoy rate of PPI inflation rose by 120bps to 13.1% in April, more than 100bps above consensus.

- South Korea: The Bank of Korea hiked its policy rate by 25bps to 1.75%, in line with consensus and raised its inflation forecasts up to 4.5% in 2022 (from 3.1%) and 2.9% in 2023 (from 2.0%) while the yoy rate of real GDP growth was lowered to 2.7% in 2022 (from 3.0%).

- Vietnam: The ratings agency S&P upgraded Vietnam sovereign rating to BB+ with a stable outlook.

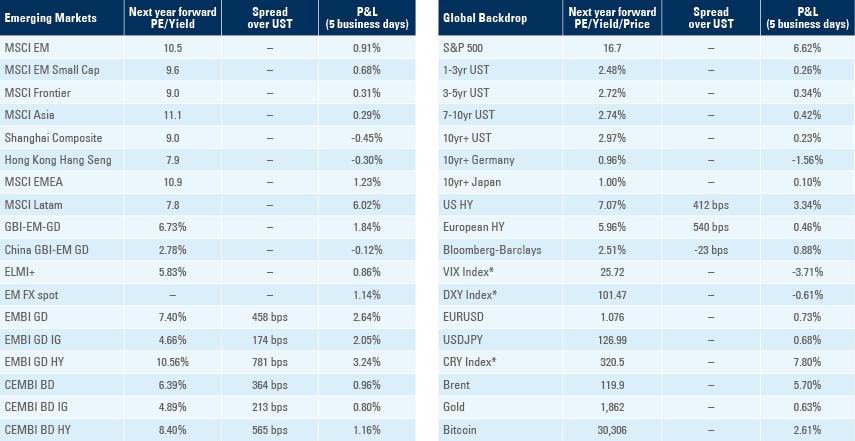

Global backdrop

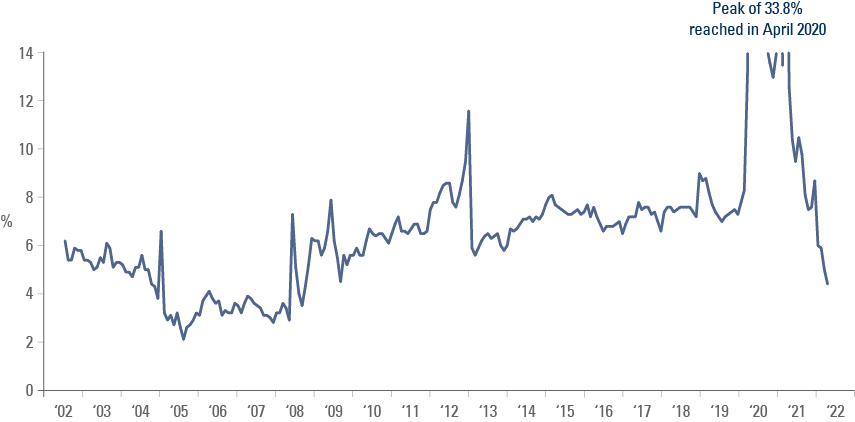

United States: The FOMC minutes signalled 50bps hike is the base case for the next two meetings with a fourth 50bps in September possible should inflation remain pressured. The influential (but non-voter) Director Raphael Bostic signalled a pause in September is the preferred policy choice. The committee revised inflation forecasts higher for the second half of 2022 and 2023 due to further supply chain disruptions, higher import prices and wage pressures. Economic data softened further with the Citibank Surprise Index declining another 20 to -39.9, from +68.5 on 15 April. Durable goods orders slowed to 0.4% mom in April from 0.6% mom in March. Mortgage applications declined 16% yoy as refinancing applications declined 75% as buyers feel the pinch of higher rates with new home sales declining to 591k in April from 709k in March (revised from 763k). The PCE deflator rose 0.2% mom in April and 6.3% yoy, in line with consensus, while personal income rose 0.4% mom (0.1% below consensus) and personal spending rose 0.9% mom (0.8% consensus and 1.4% prior). High inflation and consumption dragged personal savings rate to 4.4% of disposable personal income (from 5.0% in March), the lowest level since 2008.

Figure 1: US Personal Saving as a % of Disposable Personal Income

Europe: The European Central Bank (ECB) Governor Christine Lagarde mentioned she expects to hike policy rates for the first time since 2009 in July and exit negative interest rate policy (NIRP) by September as well as reduce asset purchasing programme by September. Director Villeroy said hiking policy rate by 50bps is “not consensus” in the institution. Exiting NIRP would be a game changer, in our view, and remains far from being priced. The IFO business climate rose 1.1 to 93.0 in Germany, above consensus.

New Zealand: The Reserve Bank of New Zealand hiked its policy rate by 50bps to 2.0%, in line with consensus and said more hikes are likely soon, suggesting another 50bps hike in the next meeting in July is now the base case.

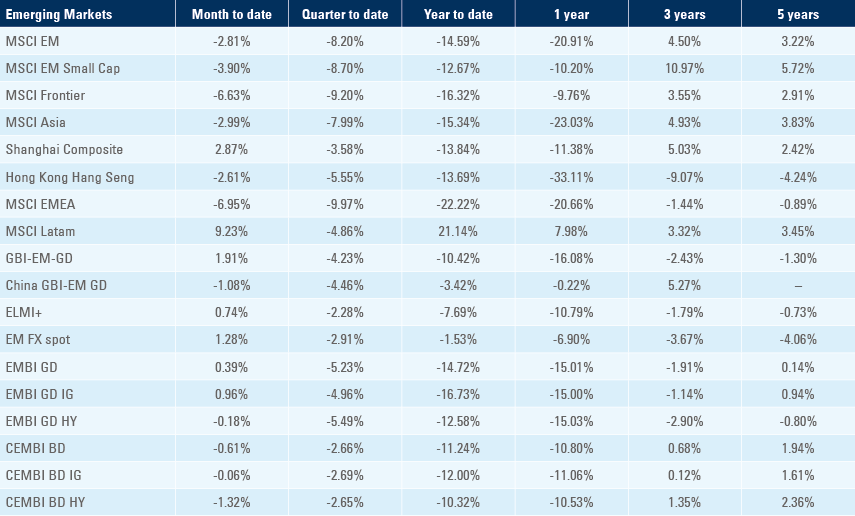

Benchmark performance

1. See https://twitter.com/KofmanMichael/status/1529475216606478336

2. See (in Ukrainian) https://www.mil.gov.ua/news/2022/05/28/na-peredovij-vzhe-uspishno-praczyuyut-tri-vidi-155-mm-artilerii-%E2%80%93-gaubiczya-m777-gaubiczya-fh70-sau-caesar-v-ukrainu-nadijshli-sau-m109-%E2%80%93-oleksij-reznikov/

3. See https://www.state.gov/the-administrations-approach-to-the-peoples-republic-of-china/

4. See https://elpais.com/america-colombia/elecciones-presidenciales/2022-05-29/elecciones-presidenciales-en-colombia-2022-en-vivo.html